- Home

- »

- Medical Devices

- »

-

Croatia Hearing Aid Retailers Market, Industry Report, 2030GVR Report cover

![Croatia Hearing Aid Retailers Market Size, Share & Trends Report]()

Croatia Hearing Aid Retailers Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (In-the-Ear Hearing Aids, Receiver-In-the-Ear Hearing Aids), By Technology (Digital, Analog), And Segment Forecasts

- Report ID: GVR-4-68040-563-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Croatia Hearing Aid Retailers Market Trends

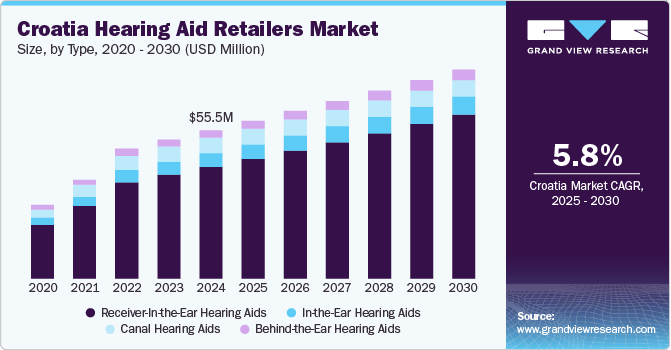

The Croatia hearing aid retailers market size was estimated at USD 55.51 million in 2024 and is projected to grow at a CAGR of 5.78% from 2025 to 2030. The increasing prevalence of hear loss among the aging population, and increased awareness of the importance of hearing health are primarily driving market growth. As life expectancy increases, more individuals are entering older age groups where hearing impairment is more common.

A 2024 report by the European Hearing Instrument Manufacturers Association (EHIMA) estimates that 15.1% of Croatia's population self-reported some degree of hearing loss in 2022. This figure is among the highest in Europe and includes individuals with mild to severe hearing difficulties, regardless of official disability status.

Furthermore, there is a growing customer preference for advanced medical technology driving market growth. As the demand for sophisticated medical devices rises, hearing aids are increasingly viewed as essential health products rather than consumer electronics. This shift encourages retailers to enhance their offerings by stocking more advanced models incorporating cutting-edge features such as Bluetooth connectivity, noise cancellation, and artificial intelligence capabilities. Rising healthcare costs may enhance access to insurance and subsidies for hearing aids, boosting retail sales. The aging population's increasing experience with hearing loss emphasizes the need for effective solutions. Retailers should adjust strategies to target this demographic and offer personalized services, including fittings and aftercare support.

The increasing government deficit and fiscal policy in the country are leading to a growing demand in the market. As government spending rises, particularly on social assistance programs, disposable income for certain segments of the population may improve. This change could lead to a higher demand for healthcare-related products, such as hearing aids, as more individuals become financially able to seek treatment for hear impairments. Moreover, strong revenue growth from indirect taxes indicates robust consumer spending, which could benefit retailers in the hearing aid sector. With favorable economic conditions and an increase in purchasing power due to rising employment and wages, sales volumes for these devices are likely to grow.

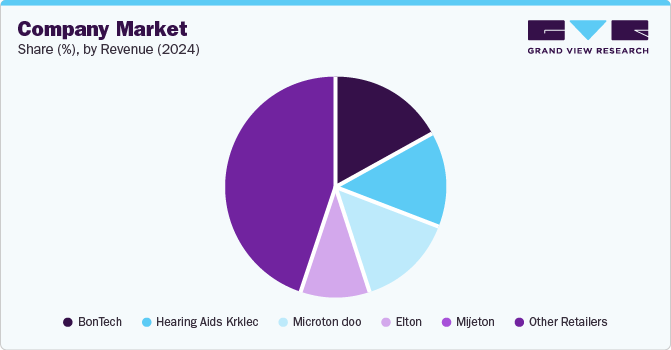

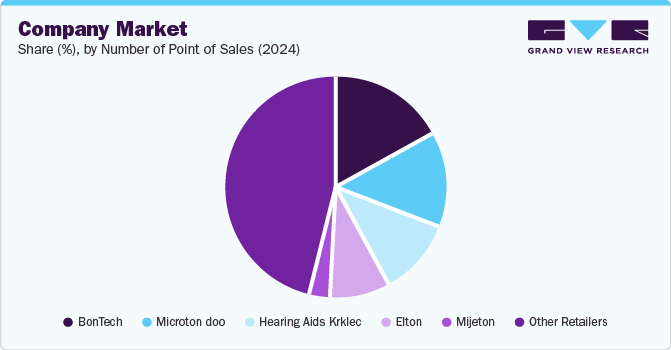

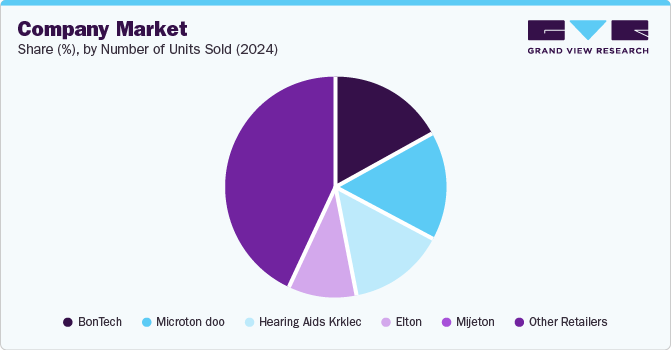

In 2024, the market is driven by key factors such as revenue performance, extensive distribution networks, and high unit sales, which reflect both financial strength and consumer demand.

Pricing Analysis

Pricing Analysis

Pricing Elasticity Insights

Low-End Segment: Heavy commoditization with limited differentiation, price sensitivity remains high.

Low-End: Highly elastic, with elderly and price-sensitive consumers relying on government subsidies.

Mid-Range Segment: Enhanced connectivity and batteries offered with rechargeable options.

Mid-Range: Moderately elastic, with value-added technological features that balance prices.

High-End Segment: Premiumization driven by integration of advanced features such as AI-driven noise cancellation and IoT integration.

High-End: Inelastic demand with tech-savvy consumers prioritizing innovation and quality over cost.

Revenue Streams and Business Models in Croatia

Emerging Models

Description

Subscription Model

Decreased disposable income in Croatia is impacting sales of premium devices, pushing customers toward cheaper alternatives. Companies can address this by offering products and maintenance services through a subscription model, making them more affordable and accessible. This approach also fosters continuous customer engagement with regular updates and maintenance, ultimately lowering service costs over time.

Buying Group Model

A buying group consists of individuals within an organization who contribute to purchasing decisions, representing various roles. This model enhances revenue share and operational efficiency by pooling resources in advertising, logistics, and technology. It leads to better supplier negotiations, fosters collaboration and knowledge sharing, and helps companies reach new customer bases more effectively.

In-house Insurance Model

Croatia's mid-level GDP per capita results in moderate purchasing power, making premium devices niche products aimed at higher-income urban consumers. Subsidies and insurance reimbursements are key to promoting hearing aid adoption. Competitor BonTech offers insurance for accidental damage, theft, and extended warranties. Companies can capitalize on this by providing extended warranties or comprehensive insurance plans that cover repairs, loss, and theft.

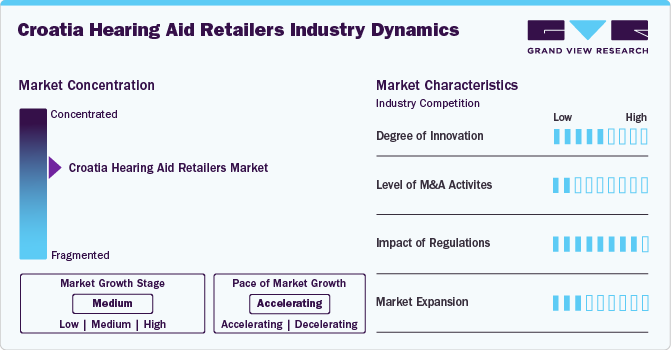

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including degree of innovation, level of mergers & acquisitions, impact of regulation, and expansion. The degree of innovation is medium, the level of merger & acquisition activities is low, the impact of regulations is high, and the expansion is medium.

The market exhibits a moderate degree of innovation, driven by increasing consumer demand for advanced auditory solutions, rising awareness of hear health, and a strong focus on digital transformation. For instance, BonTech, a leading Croatian provider, utilizes 3D printing technology to create custom-fit hearing aids and ear molds tailored to individual anatomies in Croatia, where custom devices and personalized solutions are in demand. This innovation enhances comfort, performance, and precision, ensuring an optimal fit for users.

The merger and acquisition activity level in the market is currently low, reflecting a broader trend observed in many emerging markets. The hearing aids sector in Croatia is characterized by a relatively small number of players, which is expected to hinder significant consolidation efforts typically seen in more mature markets. However, there is potential for growth as hear health awareness increases and the aging population expands.

Regulatory developments, particularly the implementation of the Medical Device Regulation (MDR) and EU recognition procedures for professional qualifications, have significantly influenced Croatia’s market. Moreover, there is enhanced post-market surveillance, with rigorous inspections and detailed reporting to HALMED, ensuring continuous safety monitoring.

Several companies are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Companies such as Neuroth Group are actively expanding their operations across Southeastern Europe. In the past four years, the number of Neuroth locations in Slovenia, Croatia, Serbia, and Bosnia has almost doubled - by the end of 2023, there will be over 40.

Type Insights

Based on type, the receiver-in-the-ear hearing aids segment led the market with the largest revenue share of 75.32% in 2024 and is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is attributed to the growing consumer demand for discreet, high-performing, and technologically sophisticated devices. RITE models, which differentiate the receiver from the microphone and amplifier, provide a more natural auditory experience and a more compact design than traditional behind-the-ear (BTE) models.

The behind-the-ear hearing aids segment is expected to grow at a significant CAGR over the forecast period. Continuous innovation in BTE devices, such as improved sound quality, noise reduction features, Bluetooth connectivity, and rechargeable batteries, is driving segmental growth. Moreover, increasing product launches and approvals will drive the market growth.

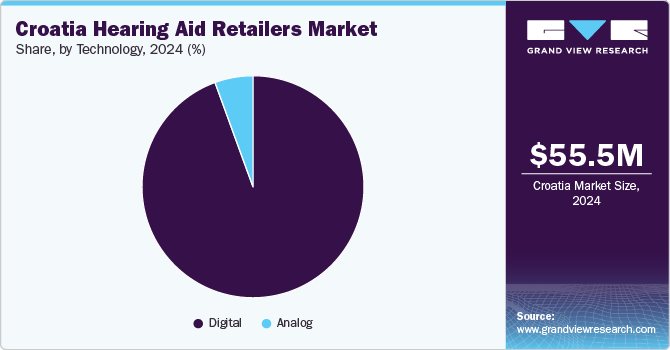

Technology Insights

Based on technology, the digital segment led the market with the largest revenue share of 94.02% in 2024 and is projected to grow at the fastest CAGR over the forecast period. The digital sector is witnessing notable expansion, fueled by technological innovations and a growing need for high-quality, customizable solutions. Digital hearing aids, which transform sound into a digital signal for processing, provide enhanced sound clarity and feature advanced options like Bluetooth connectivity and mobile app remote control. Moreover, these devices are programmed and adjusted remotely by audiologists, making them particularly attractive to the tech-savvy younger generation that prioritizes convenience and efficiency in their healthcare.

The analog segment is expected to grow at a significant CAGR over the forecast period, driven by cost-effectiveness and simplicity. Analog hearing aids tend to be more budget-friendly compared to digital models, making them a great option for consumers with basic hearing requirements or those seeking cost-effective solutions. In addition, their lower maintenance costs and easy-to-use features make them particularly appealing for older individuals or anyone with mild to moderate hearing loss. Moreover, increasing awareness of hearing loss and its effects on health and well-being contributes to growth in this segment.

Key Companies & Market Share Insights

The market is highly consolidated, dominated by three major national chains: Neuroth, Microton doo, and BonTech.The remaining market share is fragmented, consisting of independent audiologists and smaller retail groups. Key players are adopting growth strategies to enhance their market presence, including collaborations and mergers & acquisitions.

Key Companies In Croatia Hearing Aid Retailers Market:

- Neuroth

- Microton doo

- BonTech

- Hearing aids Krklec

- Elton

- Mijeton

Recent Developments

-

In February 2023, The Neuroth Group announced its plan to expand its operations across Southeastern Europe. The expansion strategy includes the addition of new hearing centers in Bosnia and further plans to open facilities in neighboring countries such as Serbia and Croatia. This approach reflects Neuroth's commitment to providing accessible hearing solutions across the region, catering to an increasing demand for high-quality audio logical services.

Croatia Hearing Aid Retailers Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 59.08 million

Revenue forecast in 2030

USD 78.25 million

Growth rate

CAGR of 5.78% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology

Country scope

Croatia

Key companies profiled

Neuroth; Microton doo; BonTech; Hearing aids Krklec; Elton; Mijeton

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Croatia Hearing Aid Retailers Market Report Segmentation

This report forecasts revenue growth, country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Croatia hearing aid retailers market report based on type, and technology:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In-The-Ear Hearing Aids

-

Receiver-In-The-Ear Hearing Aids

-

Behind-The-Ear Hearing Aids

-

Canal Hearing Aids

-

-

Technology Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital

-

Analog

-

Frequently Asked Questions About This Report

b. The Croatia hearing aid retailers market size was valued at USD 55.51 million in 2024 and is expected to reach USD 59.08 million in 2025.

b. The Croatia hearing aid retailers market is expected to grow at a compound annual growth rate of 5.78% from 2025 to 2030, reaching USD 78.25 million by 2030.

b. The receiver-in-the-ear hearing aids segment held the largest revenue share of 75.32% in 2024. The growth of this segment is primarily driven by the growing consumer demand for discreet, high-performance, and technologically advanced devices.

b. Some key players operating in the Croatia hearing aid retailers market include Neuroth, Microton doo, BonTech, Hearing aids Krklec, Elton, Mijeton

b. The market's growth is significantly driven by the increasing prevalence of hear loss among the aging population, and increased awareness of the importance of hearing health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.