- Home

- »

- Communications Infrastructure

- »

-

Crowdsourced Testing Market Size, Industry Report, 2030GVR Report cover

![Crowdsourced Testing Market Size, Share & Trends Report]()

Crowdsourced Testing Market (2025 - 2030) Size, Share & Trends Analysis Report by Component (Platform, Services), By Testing Type (Usability Testing, Functional Testing), By Application, By Organization Size, By Industry (BFSI, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-085-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Crowdsourced Testing Market Summary

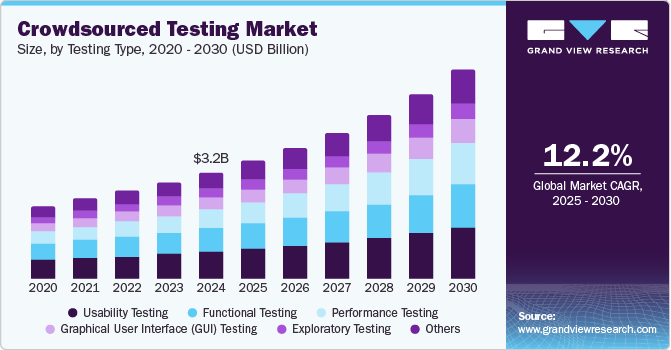

The global crowdsourced testing market size was expected to reach USD 3.18 billion in 2024 and is projected to reach USD 6.25 billion by 2030, growing at a CAGR of 12.2% from 2025 to 2030. The increasing need for cost-effective and flexible Quality Assurance (QA) practices drives the growth of the crowdsourced testing market.

Key Market Trends & Insights

- North America crowdsourced testing market dominated the overall market in 2024, with a market share of 31.1%.

- Asia Pacific crowdsourced testing market is expected to grow at the fastest CAGR of 13.6% over the forecast period.

- Based on component, the platform segment dominated the overall market, gaining a market share of 70.2% in 2024.

- Based on testing type, the usability testing segment dominated the overall market, gaining a market share of 25.1% in 2024.

- Based on application, the mobile applications segment has dominated the market, gaining a market share of 41.9% in 2024 and witnessing the fastest CAGR of 13.4% during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3.18 Billion

- 2030 Projected Market Size: USD 6.25 Billion

- CAGR (2025-2030): 12.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Crowdsourced testing is a software testing type that uses testers available throughout the day and in different locations. It has a better possibility of finding a bug as there are many testers, and the tests are conducted under various conditions, such as connectivity, user locations, and devices. Crowdsourced testing offers benefits such as lower test costs and is a customer-centric testing method as the testing is done by actual users worldwide.

Crowdsourced testing platforms have been adopted rapidly in North America, a region with many crowdsourced testing companies and developed technological infrastructure. The region has high internet and smartphone penetration, driving North America's crowdsourced testing market growth. The market is fragmented, with many market players present in the market. The market players and new entrants are adopting strategies such as product launches and expansion to gain a competitive edge.

COVID-19 Impact on the Crowdsourced Testing Market

The COVID-19 pandemic had a positive impact on the crowdsourced testing market. Companies adopted the Work-From-Home (WFH) model due to government regulations for social distancing and travel restrictions. Many companies struggled to transition from in-office to a remote working model. Companies suffered from a lack of remote infrastructure to move their in-house Quality Assurance (QA) teams to remote working scenarios. Many organizations’ QA teams could not operate efficiently due to a lack of proper remote infrastructure, aiding the market growth.

The COVID-19 pandemic accelerated digitization, with more people adopting mobile applications for various use cases, including digital payment and online shopping. It also positively impacted mobile application development as businesses shifted to online channels to meet customer expectations. Healthcare, entertainment, and video calling applications saw increased adoption due to the COVID-19 pandemic. Crowdsourced testing offers benefits such as a faster test life cycle process, reduced costs, and availability of remote testers, contributing to the market’s growth due to the COVID-19 pandemic.

Component Insights

In terms of component, the market is classified into platform and services. The platform segment dominated the overall market, gaining a market share of 70.2% in 2024. It is expected to grow at a CAGR of 11.8% throughout the forecast period. Crowdsourcing companies provide organizations access to vetted crowd testers where they can manage test activities, create quality tests, and execute them through the crowdsourced testing platform. The wide availability of crowdsourced testing platforms with feature-based pricing options is driving the growth of the platforms segment. Moreover, some platforms offer integration of the company’s tech stacks with their platform, improving productivity. For instance, Global App Testing (Spa Worldwide Limited)’s platform can integrate with Atlassian’s Jira or GitHub, Inc.’s GitHub, among others.

The services segment is anticipated to grow at the fastest CAGR of 13.0% throughout the forecast period. Services include test management, test plan creation, support, and consulting services. This is a managed crowdsourced testing approach, as the customer doesn’t interact directly with crowd testers, and a dedicated resource provides insights. Services save the organization test management time and improve the development life cycle, driving segment growth.

Testing Type Insights

In terms of testing type, the market is classified into exploratory, Graphical User Interface (GUI), usability, functional, performance, and other testing types. The usability testing segment dominated the overall market, gaining a market share of 25.1% in 2024. It is expected to grow at a CAGR of 11.6% throughout the forecast period. It determines issues or bugs in an application, and real-life users do the testing. Crowdsourced testing involves testing an application by crowd testers located at remote locations. Testing done by many crowd testers helps determine the bugs in an application quickly and helps companies determine if the application needs revision. Moreover, many crowdsourced companies offer usability testing functionalities. Hence, the benefits and availability of usability testing are driving the segment's growth.

The performance testing segment is expected to grow at the fastest CAGR of 14.1% during the forecast period. It helps determine how efficiently an application can handle the growing number of transactions, users, and data volumes. It helps companies avoid unexpected failures and ensure applications can handle growing demand. The need to ensure efficient and responsive applications even when there are many users is driving the segment growth. Cigniti and StarDust (Computer Task Group, Inc.) are market players offering performance testing solutions.

Application Insights

In terms of application, the market is classified into mobile applications, web applications, and native desktop applications. The mobile applications segment has dominated the market, gaining a market share of 41.9% in 2024 and witnessing the fastest CAGR of 13.4% during the forecast period. Growing internet and smartphone penetration worldwide, especially across developing nations, is driving the growth of this segment. Consumers are increasingly using mobile applications for various tasks, such as digital payment, online shopping, and digital media consumption, among others. Moreover, mobile applications are platform specific and are more complex than web applications in terms of functionality and features. Hence, crowdsourcing platforms are being used to improve the overall functionality of mobile applications across platforms and devices.

The web applications segment is anticipated to witness a CAGR of 11.7% throughout the forecast period. Web applications are comparatively less complex than mobile applications as they are not platform specific. However, the need to ensure the smooth functioning of web applications and improve customer experience is driving the growth of this segment. Market players such as Testbirds B.V. and Ubertesters Inc. offer website testing solutions.

Organization Size Insights

In terms of organization size, the market is classified into Small and Medium Sized Enterprises (SMEs) and large size enterprises. The large size enterprises segment held the maximum share in the market, with a share of 62.4% in 2024 and is expected to witness a CAGR of 11.4% throughout the forecast period. Large size enterprises might find it difficult to test every application and feature across countries and devices with in-house Quality Assurance (QA) teams. Moreover, the in-house Quality Assurance (QA) teams may miss out on application bugs that crowd testers would identify as they would not have any bias. The need to identify and fix maximum bugs in an application and improve application scalability are driving large enterprises' adoption of crowdsourced testing.

The Small and Medium Sized Enterprises (SMEs) segment is anticipated to grow at the fastest CAGR of 13.4% throughout the forecast period. Small and Medium Sized Enterprises (SMEs) are increasingly adopting or looking to adopt digital technologies to improve business processes and operations affected by the COVID-19 pandemic. According to the World Economic Forum’s 2021 survey, there was a rise in interest in using digital technologies among Small and Medium Sized Enterprises (SMEs) in 2021 compared to 2019. This will likely lead to growth in application development by Small and Medium Sized Enterprises (SMEs). The need for cost-effective software test methods is driving the growth of this segment.

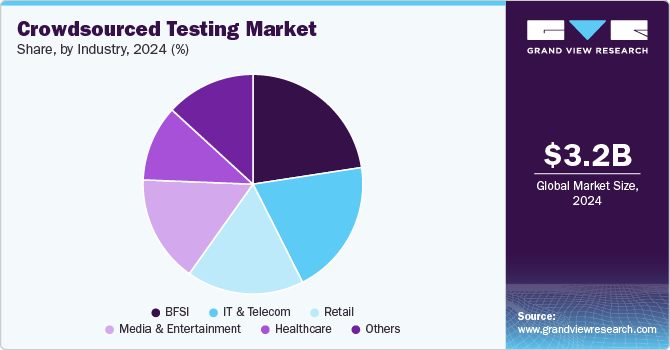

Industry Insights

In terms of industry, the market is classified into Banking, Financial Services, and Insurance (BFSI), retail, IT & telecom, media & entertainment, healthcare, and native desktop others. The BFSI segment has dominated the overall crowdsourced market, gaining a market share of 22.6% in 2024 and witnessing a CAGR of 12.4% during the forecast period. The growing digitization of banking platforms and applications to improve customer experience is driving the growth of the BFSI segment. Mobile banking is witnessing growth in adoption as customers increasingly use mobile applications for applications such as instant payment and investments.

The retail segment is anticipated to witness the fastest CAGR of 14.1% throughout the forecast period. The growth in e-commerce sales worldwide, accelerated by the COVID-19 pandemic, is driving the growth of this segment. E-commerce websites and applications must load quickly and provide an easy navigation path in addition to efficient checkout and payment processes. Many crowdsourcing companies, such as Testlio, Bugcrowd, and Applause App Quality, Inc., serve the retail sector.

Regional Insights

North America crowdsourced testing market dominated the overall market in 2024, with a market share of 31.1%. It is expected to grow at a CAGR of 12.3% throughout the forecast period. North America has prominent market players such as U.S.-based Testlio, Test IO (EPAM Systems, Inc.), and Ubertesters Inc. Moreover, developed technological infrastructure is aiding the growth of the region. High mobile app development, computer software Research & Development (R&D), and a favorable cloud ecosystem is aiding the growth of application development in the region. This is aiding the adoption of crowdsourcing test platforms in the region.

U.S. Crowdsourced Testing Market

The U.S. crowdsourced testing market is expected to grow at a significant CAGR from 2025 to 2030. The U.S. market is the most mature and largest in the world, driven by the presence of numerous tech giants and a strong startup ecosystem. The country's emphasis on innovation and early adoption of new technologies, coupled with the increasing complexity of software applications, is fueling the demand for crowdsourced testing services. This demand is further driven by the need for faster time-to-market, cost-effectiveness, and access to a diverse pool of testers with specialized skills.

The crowdsourced testing industry in Canada is expected to grow at a significant CAGR from 2025 to 2030. The Canadian market is poised for significant growth due to the increasing adoption of digital technologies across various industries. The country's strong focus on research and development, coupled with a robust IT infrastructure, is creating a favorable environment for the growth of crowdsourced testing. In addition, the presence of a highly skilled workforce and a strong emphasis on quality assurance are further driving the demand for crowdsourced testing services.

Asia Pacific Crowdsourced Testing Market

Asia Pacific crowdsourced testing market is expected to grow at the fastest CAGR of 13.6%. Asia Pacific has a developing technology infrastructure and rising internet & smartphone penetration. This, along with the region’s huge population, is aiding the growth in mobile application usage for various applications, including online shopping and mobile banking services. Hence, the demand for efficient applications across devices and platforms for various sectors is likely to grow to meet the customer demand in the region. Crowdsourced testing can improve the overall test lifecycle and the overall customer experience.

The India crowdsourced testing market is expected to grow at a significant CAGR from 2025 to 2030. India's large pool of skilled IT professionals, coupled with a cost-effective labor market, makes it an attractive destination for global companies seeking crowdsourced testing services. The country's growing startup ecosystem and increasing digital adoption are further driving the demand for quality assurance and testing services. Furthermore, the government's initiatives to promote the IT industry and the increasing availability of high-speed internet are creating a conducive environment for the growth of crowdsourced testing.

The crowdsourced testing market in Japan is expected to grow at a significant CAGR from 2025 to 2030. Japan's focus on quality and reliability, coupled with a strong emphasis on innovation, is driving the adoption of crowdsourced testing services. The country's mature IT industry and the increasing complexity of software applications are creating a demand for efficient and cost-effective testing solutions. In addition, the growing awareness of the benefits of crowdsourced testing, such as faster time-to-market and improved software quality, is further driving the demand for these services.

The China crowdsourced testing market is expected to grow at a significant CAGR from 2025 to 2030. China's rapid digital transformation and the increasing number of internet users are driving the demand for high-quality software applications. The country's large pool of skilled IT professionals and the government's support for the development of the IT industry are creating a favorable environment for the growth of crowdsourced testing. Furthermore, the increasing adoption of mobile devices and the growing popularity of e-commerce are creating new opportunities for crowdsourced testing providers.

Europe Crowdsourced Testing Market

The crowdsourced testing market in Europe is expected to grow at a significant CAGR from 2025 to 2030. Europe's diverse market, with a strong focus on data privacy and security, is driving the demand for robust testing solutions. The increasing adoption of cloud-based technologies and the growing number of startups are creating opportunities for crowdsourced testing providers. In addition, the increasing awareness of the benefits of crowdsourced testing, such as cost-effectiveness and improved software quality, is driving the demand for these services.

The crowdsourced testing industry in Germany is expected to grow at a significant CAGR from 2025 to 2030. Germany's strong emphasis on quality and engineering excellence is driving the adoption of crowdsourced testing services. The country's large automotive and manufacturing industries, which rely heavily on software-driven systems, are creating a significant demand for testing services. In addition, the increasing complexity of software applications and the need for faster time-to-market are driving the demand for efficient and cost-effective testing solutions.

Key Crowdsourced Testing Company Insights

The Crowdsourced Testing market is highly competitive, with a multitude of players vying for market share. Some prominent players in the market include Cigniti, Testlio, Digivante Limited, Global App Testing (Spa Worldwide Limited), Test IO (EPAM Systems, Inc.), Applause App Quality, Inc., Ubertesters Inc., Crowdsprint, Testbirds B.V., Userfeel Ltd, THE Β FAMILY AB., StarDust (Computer Task Group, Inc.), Bugcrowd, Rainforest QA, Inc., msg systems ag, and Mob4Hire, among others. Key players in this space include established software testing companies, specialized crowdsourced testing platforms, and emerging startups. These companies compete on various factors, including pricing, quality of service, global reach, and the diversity and expertise of their tester communities.

Established software testing companies often leverage their existing client relationships and brand reputation to offer crowdsourced testing as an additional service. Specialized crowdsourced testing platforms, on the other hand, focus solely on providing crowdsourced testing services and often offer advanced features and tools to facilitate efficient testing processes. Emerging startups bring innovation and agility to the market, often focusing on niche segments or offering unique testing methodologies.

Some of the key companies operating in the Crowdsourced Testing market include Testbirds B.V., Cigniti, and Testlio, among others.

-

Testbirds B.V. has carved a niche for itself in the crowdsourced testing market by offering a comprehensive platform that combines the power of human testers with advanced AI-powered tools. This unique approach enables efficient and effective testing of complex software applications. The company's strong focus on quality assurance, combined with its global network of skilled testers, allows it to deliver high-quality testing services to clients across various industries.

-

Cigniti is a leading provider of independent software testing and quality engineering services. The company's competitive advantage lies in its deep domain expertise, strong industry partnerships, and a robust global delivery model. Cigniti's comprehensive suite of testing services, including functional testing, performance testing, security testing, and mobile testing, enables it to address the diverse testing needs of its clients.

-

Testlio is a cloud-based software testing platform that empowers organizations to deliver high-quality software faster. The company's proprietary platform leverages a global network of expert testers to provide on-demand testing services. Testlio's competitive advantage lies in its ability to rapidly scale testing efforts, its focus on automation, and its commitment to delivering exceptional customer service.

Bugcrowd and Rainforest QA, Inc. are some of the emerging companies in the target market.

-

Bugcrowd leverages a global network of security researchers to identify and report vulnerabilities in software applications and infrastructure. This crowdsourced approach enables organizations to quickly discover and address security risks before they can be exploited by malicious actors. Bugcrowd's platform provides a streamlined process for managing vulnerability reports, prioritizing issues, and rewarding researchers.

-

Rainforest QA, Inc. offers a cloud-based testing platform that combines human testers with automated testing tools to provide comprehensive testing coverage. The platform's AI-powered features enable efficient test case generation, execution, and analysis. By leveraging a global network of skilled testers, Rainforest QA can quickly scale testing efforts to meet the needs of organizations of all sizes.

Key Crowdsourced Testing Companies:

The following are the leading companies in the crowdsourced testing market. These companies collectively hold the largest market share and dictate industry trends.

- Cigniti

- Testlio

- Digivante Limited

- Global App Testing (Spa Worldwide Limited)

- Test IO (EPAM Systems, Inc.)

- Applause App Quality, Inc.

- Ubertesters Inc.

- Crowdsprint

- Testbirds B.V.

- Userfeel Ltd

- THE Β FAMILY AB

- StarDust (Computer Task Group, Inc.)

- Bugcrowd, Rainforest QA, Inc.

- msg systems ag

- Mob4Hire

Recent Developments

-

In June 2024, YouTube integrated a new feature where viewers can add short notes to videos to provide additional context. These notes could explain if a clip is a parody, outdated, or real news. This is currently an experiment limited to mobile users in the US watching English language videos. YouTube will assess the accuracy of the notes before making them widely available.

-

In March 2023, OpenAI has introduced Evals, a software framework designed to crowdsource the testing of its AI models. By making Evals open-source, OpenAI aims to encourage users to report shortcomings in its models, such as GPT-4, and contribute to their improvement. This approach allows for a more comprehensive evaluation of the models' capabilities and limitations, leading to more robust and reliable AI systems. Evals enables users to create and run benchmarks, compare model performance across different datasets, and even implement custom evaluation logic. By fostering collaboration and community involvement, OpenAI hopes to accelerate the development of AI models and address potential issues more effectively.

Crowdsourced Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.52 billion

Revenue forecast in 2030

USD 6.25 billion

Growth rate

CAGR of 12.2% from 2025 To 2030

Historic year

2017 - 2023

Base year for estimation

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 To 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, testing type, application, organization size, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); U.A.E.; South Africa

Key companies profiled

Cigniti, Testlio, Digivante Limited, Global App Testing (Spa Worldwide Limited), Test IO (EPAM Systems, Inc.), Applause App Quality, Inc., Ubertesters Inc., Crowdsprint, Testbirds B.V., Userfeel Ltd, THE Β FAMILY AB., StarDust (Computer Task Group, Inc.), Bugcrowd, Rainforest QA, Inc., msg systems ag, and Mob4Hire

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Crowdsourced Testing Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global crowdsourced testing market based on component, testing type, application, organization size, industry, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Platform

-

Services

-

-

Testing Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Exploratory Testing

-

Graphical User Interface (GUI) Testing

-

Usability Testing

-

Functional Testing

-

Performance Testing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Mobile Applications

-

Web Applications

-

Native Desktop Applications

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small And Medium Sized Enterprises (SMEs)

-

Large Size Enterprises

-

-

Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Retail

-

IT & Telecom

-

Media & Entertainment

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

U.A.E.

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global crowdsourced testing market size was estimated at USD 3.18 billion in 2024 and is expected to reach USD 3.52 billion in 2025.

b. The global crowdsourced testing market is expected to grow at a compound annual growth rate of 12.2% from 2025 to 2030 to reach USD 6.25 billion by 2030.

b. North America dominated the crowdsourced testing market with a share of 31.1% in 2024. This is attributable to developed technology infrastructure and the presence of crowdsourced testing companies.

b. Some key players operating in the crowdsourced testing market include Cigniti, Testlio, Digivante Limited, Global App Testing (Spa Worldwide Limited), Test IO (EPAM Systems, Inc.), Applause App Quality, Inc., Ubertesters Inc., Crowdsprint, Testbirds B.V., Userfeel Ltd, THE Β FAMILY AB., StarDust (Computer Task Group, Inc.), Bugcrowd, Rainforest QA, Inc., msg systems ag, and Mob4Hire.

b. Key factors driving the crowdsourced testing market growth include increasing digital transformation and the need for flexible Quality Assurance (QA) practices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.