- Home

- »

- Medical Devices

- »

-

CT And MRI Contrast Agents Market, Industry Report, 2030GVR Report cover

![CT And MRI Contrast Agents Market Size, Share & Trends Report]()

CT And MRI Contrast Agents Market (2025 - 2030) Size, Share & Trends Analysis Report By Modality (MRI, X-ray/ Computed Tomography), By Product (Gadolinium-based, Iodinated), By Route Of Administration, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-537-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

CT And MRI Contrast Agents Market Trends

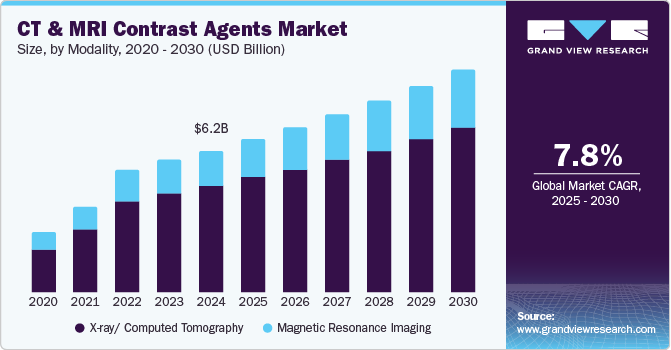

The global CT and MRI contrast agents market size was estimated at USD 6.22 billion in 2024 and is anticipated to grow at a CAGR of 7.81% from 2025 to 2030. The increasing demand for iodinated contrast media, the rising burden of chronic disorders, and the rising focus of government bodies on improving diagnostic infrastructure are anticipated to support the market growth. Several government authorities are undertaking initiatives to increase access to medical imaging such as CT and MRI.

For instance, in March 2024, data published by the UK government revealed that the Community Diagnostic Centre (CDC) program has provided over 7 million diagnostic tests, checks, and scans across England since its launch in July 2021. This initiative is supported by an investment of USD 2.45 billion, marking the most significant financial commitment to CT and MRI capacity in the history of the NHS. Around 155 centres are operational in England, and the government is focused on opening 160 centres by March 2025. This growing focus on expanding diagnostic facilities is expected to drive market growth.

The increasing prevalence of chronic conditions, such as cardiovascular and neurological disorders, is expected to drive the demand for CT and MRI contrast agents. These agents are crucial in neurological imaging as they enhance the visibility of brain structures and abnormalities. Similarly, in cardiac imaging, these agents aid in diagnosing and assessing heart disease. According to a study published by ScienceDirect in January 2023, approximately 50% of CT scans and 40% of MRI scans utilize iodine or gadolinium-based contrast agents to improve image contrast and enhance diagnostics. This figure rises to 60% for neurological examinations. As a result, the growing prevalence of chronic disorders is expected to increase the demand for CT and MRI contrast agents in the coming years.

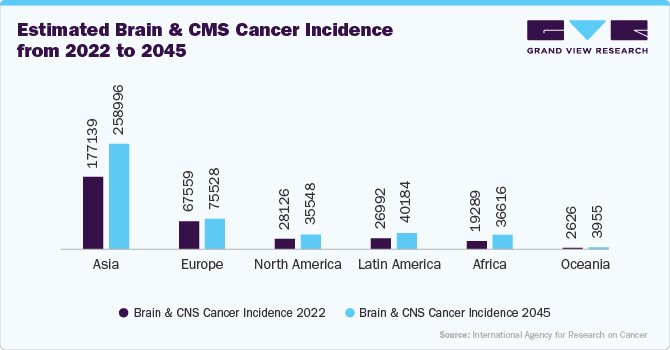

The below graph and table highlight the increasing incidence of brain tumors across the globe. It shows that the majority of individuals with brain and CNS cancer are in Asia. Around 2,58,996 new brain and CNS cancer cases are anticipated in Asia in 2045. Thus, the growing incidence of neurological conditions such as brain tumors across various regions such as Asia, Europe, Oceania, North America, and Africa is anticipated to boost the demand for CT and MRI contrast agents.

Region

Brain and CNS Cancer Incidence 2022

Estimated Brain and CNS Cancer Incidence 2045

Asia

1,77,139

2,58,996

Europe

67,559

75,528

North America

28,126

35,548

Latin America

26,992

40,184

Africa

19,289

36,616

Oceania

2,626

3,955

Source: International Agency for Research on Cancer

In addition, the increasing demand for iodinated contrast media is projected to propel the market growth. In 2022, the U.S. FDA reported the shortage of iodinated contrast media. In addition, in August 2023, a study led by University of Missouri School of Medicine neurologist Dr. Adnan Qureshi found that the iodinated contrast dye shortage had a significant impact on the assessment of stroke patients at hospitals across the U.S. This shortage resulted in a decline in CT procedures. This shortage, coupled with the rising prevalence of infectious diseases, has prompted manufacturers to enhance production capacities.

For instance, GE Healthcare invested USD 80 million in November 2022 to expand iodinated contrast media production at its site in Norway, aiming to meet global demand. Iohexol and iodixanol APIs are crucial in GE’s iodinated contrast media, used in over 100 million patient doses annually-equivalent to three procedures every second. With investments and new production lines, the production capacity is anticipated to increase by 30 million doses per year by 2025, highlighting the growing demand for these essential molecules.

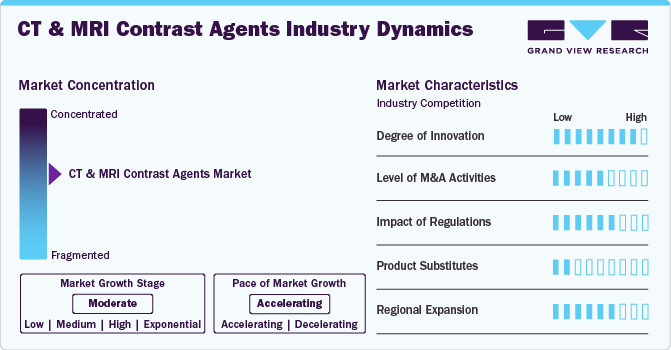

Market Concentration & Characteristics

The CT and MRI contrast agents industry is in a moderate growth stage, driven by the rising prevalence of chronic disorders, growing production capacities, and increasing healthcare investments.

The CT and MRI contrast agents market is experiencing a significant surge in innovation. Key developments include enhanced formulations for safer and more effective agents, using nanotechnology for more precise imaging, and introducing biodegradable agents that minimize environmental impact. For instance, in April 2023, GE HealthCare launched Pixxoscan (gadobutrol), a gadolinium-based MRI contrast agent featuring eco-friendly +PLUSPAK plastic packaging that reduces costs, minimizes environmental impact, and enhances safety.

Regulations are crucial in the CT and MRI contrast agents market, ensuring patient safety and quality standards. Regulatory bodies such as the U.S. FDA, the European Union, and other regional authorities regulate clinical trials and marketing authorization for CT and MRI contrast agents. For instance, in June 2023, the FDA approved the iodine-based contrast agent iopromide injection (Ultravist) for intravenous and intraarterial contrast-enhanced mammography. Ultravist is also used in CT procedures. Such approvals are anticipated to drive the CT and MRI contrast agents industry over the forecast period.

Companies in the CT and MRI contrast agents industry are introducing innovative substitute products. For instance, in October 2024, GE Healthcare announced the completion of its Phase I clinical development for a manganese-based macrocyclic MRI contrast agent. If authorized, this agent could act as an alternative to gadolinium-based contrast agents and mitigate the environmental impact of gadolinium excreted by patients.

The industry is undergoing considerable regional growth as major players aim to enhance their global presence. For instance, in October 2022, GE Healthcare’s Pharmaceutical Diagnostics division announced a long-term agreement with Chilean mining company Sociedad Quimica y Minera de Chile S.A. (SQM), to ensure a stable supply of iodine, a crucial component for contrast media used in X-ray and CT procedures worldwide.

Modality Insights

The x-ray/ computed tomography segment accounted for the largest revenue share in 2024. The segment's growth can be attributed to the availability of various contrast agents, such as iohexol, iodixanol, and ioversol, which are used in CT scans to enhance visibility and help in disease diagnosis. In addition, a large volume of CT scans supports the segment growth. For instance, according to the data published by the Diagnostic Imaging Dataset Annual Statistical Release 2022/23, in England, about 7.1 million CT scans were performed in 2022/2023, showcasing a 5.5% increase from the previous year.

The MRI segment is expected to experience the fastest CAGR of 8.78% from 2025 to 2030. This growth is primarily driven by the rising incidence of chronic disorders and the increasing availability of contrast agents used in MRI diagnostics. For example, in October 2022, Fresenius Kabi launched Gadoterate Meglumine Injection, USP, a new contrast agent for MRI. This injection is a gadolinium-based contrast agent (GBCA). The GBCAs are utilized in 30-45% of the approximately 40 million MRI procedures conducted annually in the U.S.

Product Insights

The iodinated contrast agents segment dominated the CT and MRI contrast agents industry in 2024. These agents incorporate iodine, significantly boosting radiodensity and facilitating superior visualization of vascular structures and organs. The rising demand for CT procedures due to the increasing prevalence of chronic disorders is anticipated to boost the iodinated contrast agents segment growth in the coming years.

The gadolinium contrast agents segment is expected to experience the fastest CAGR from 2025 to 2030. The rising incidence of chronic disorders such as cancer and the increasing approvals for gadolinium-based contrast agents primarily drive this growth. For instance, in October 2023, the European Commission granted Guerbet the marketing authorization for Elucirem (Gadopiclenol). Such approvals are anticipated to propel the segment growth in the coming years.

Some of the gadolinium-based contrast agents, along with their manufacturers, are mentioned in the table below:

Company Name

Product/Component Name

Guerbet

Elucirem (gadopiclenol)

Bracco Diagnostics Inc.

Vueway (gadopiclenol)

Guerbet

Artirem (Gadoteric acid)

Bayer

Gadavist / Gadovist

Bayer

Eovist / Primovist

GE HealthCare

Clariscan (gadoterate meglumine)

GE HealthCare

Omniscan (Gadodiamide)

Bracco Diagnostics Inc.

ProHance (Gadoteridol)

Source: Grand View Research Analysis

Application Insights

The neurological disorders segment accounted for the largest revenue share in 2024. The segment's growth can be attributed to the rising prevalence of neurological disorders and the growing availability of various contrast agents that can be used in neurological disorders such as brain tumors and multiple sclerosis, among others. Several studies have recommended the use of contrast agents during neurological disease diagnosis. For instance, according to a study published by the National Library of Medicine in September 2023, the use of gadolinium-based contrast agents (GBCA) are recommended in diagnosing individuals suspected of having multiple sclerosis. Thus, such recommendations are anticipated to drive the segment growth over the forecast period.

The cardiovascular disorders segment is anticipated to grow the fastest from 2025 to 2030. This growth is anticipated to be driven by the rising incidence of cardiac disorders. According to the data published by the CDC in October 2024, around About 1 in 20 adults aged 20 and older have CAD. MRI and CT contrast imaging are used to diagnose various cardiac diseases, including coronary artery disease (CAD), assessing the heart's structure and function, and detecting conditions like heart failure, aortic aneurysms, and cardiac tumors. Thus, the wide utility of contrast agents in cardiac imaging is anticipated to drive the segment growth.

Route Of Administration Insights

The intravenous segment led the market with a revenue share in 2024. This growth can be attributed to the numerous advantages of intravenous contrast administration and the wide availability of various intravenous contrasts, including ProHance, Elucirem, Eovist, Optiray, and Visipaque. A study published by PubMed Central in March 2024 highlights that, unlike oral contrast, which does not significantly enhance patient management, intravenous iodine contrast media offers clinical benefits without introducing substantial artifacts in imaging or affecting quantification. These advantages over other administration routes are anticipated to drive the growth of the intravenous segment further.

The oral route segment is expected to experience significant growth from 2025 to 2030. Oral contrast agents are crucial in gastrointestinal imaging, providing several significant benefits. They enhance the visualization of the digestive tract, allowing for better delineation of structures and identifying abnormalities such as tumors and blockages. Generally, they are safe and well-tolerated, and these agents have fewer adverse effects compared to intravenous alternatives, making them suitable for a broader range of patients. In addition, their cost-effectiveness and ease of administration, requiring only that patients drink the solution, help reduce overall imaging expenses. As a result, these advantages are anticipated to drive segment growth in the coming years.

End-use Insights

The hospital segment accounted for the largest market share at 58.98% in 2024. This growth can be attributed to the increasing launches of contrast agents and the rising adoption of these agents by hospitals. For instance, in February 2023, Bracco revealed that the gadolinium-based contrast agent (GBCA) VUEWAY is available for use in hospitals and clinics. In addition, the growing investments in advancing medical imaging in hospital settings are supporting the segment growth.

The diagnostic imaging centers segment is expected to experience significant growth in the coming years. This growth is primarily driven by the increasing number of diagnostic imaging centers being established in various countries. For instance, in February 2025, a subsidiary of the Malaysian conglomerate Sunway Group, Sunway Equity Holdings, partnered with Singapore-based AsiaMedic to launch a new medical diagnostics imaging center in Singapore. This new facility offers a comprehensive range of diagnostic imaging services, including CT and MRI. The rising number of diagnostic imaging centers is anticipated to boost the demand for CT and MRI contrast agents in the years ahead..

Regional Insights

North America dominated the global market revenue for CT and MRI contrast agents in 2024. This was driven by the high prevalence of chronic disorders and a robust healthcare infrastructure. The region benefits from significant investments in research and development, which foster continuous innovation in CT and MRI contrast agents. For example, according to data published by the Radiology Society of North America in January 2023, the 2022 Kuo York Chynn Neuroradiology Research Award was presented to the University of Connecticut School of Medicine to study a new MRI contrast agent. This new agent uses a lower gadolinium concentration than existing options but may provide equivalent or superior diagnostic results.

U.S. CT And MRI Contrast Agents Market Trends

The U.S. dominated the North American CT and MRI contrast agents’ market in 2024, owing to its advanced healthcare system and high volume of CT and MRI examinations conducted in the U.S. Moreover, the presence of key industry players such as Guerbet, Bracco, GE Healthcare, and Bayer is anticipated to support the country's market growth. Moreover, the increasing number of clinical trials in the U.S. for CT and MRI contrast agents is anticipated to support the segment growth in the coming years.

Clinical Trials for CT and MRI Contrast Media in the U.S.

Study Name

Intervention/ Treatment

Conditions

Enrollment

Sponsor

Study Completion

Evaluation of a Targeted Magnetic Resonance Imaging Contrast Agent in Prostate Cancer Patients

Gadolinium (Gd) and peptide based MRI contrast agent (MT218)

MRI Scan

12

Songqi Gao, Molecular Theranostics LLC

2025-12

Assessing How Normal Variations in CT Scanning Affects Its Interpretation

Diagnostic Test: CT scan

Colorectal Cancer Metastatic

169

Memorial Sloan Kettering Cancer Center

2025-01-27

Contrast-Enhanced CT and MRI in Diagnosing and Staging Liver Cancer Using UNOS Policy (ACRIN6690)

Drug: iodinated contrast dye

Drug: motexafin gadolinium

Other: Eovist-enhanced MRI

Liver Cancer

20

American College of Radiology Imaging Network

2023-12

Dual Energy CT Decreased IV Contrast Dose Imaging for TAVR

Combination Product: Iodinated Contrast Agent (Omnipaque)

Device: Dual Energy CT

Transcatheter Aortic Valve Replacement

164

University of Maryland, Baltimore

2026-03-01

Source: ClinicalTrials.gov

Europe CT And MRI Contrast Agents Market Trends

The European CT and MRI contrast agents’ market is expected to grow at a significant CAGR over the forecast period, driven by the rising marketing authorizations from European countries such as the UK and Austria, among others, for CT and MRI contrast agents and the increasing adoption of advanced medical technologies. For instance, in April 2023, GE Healthcare expanded its offering by launching gadobutrol (Pixxoscan, a contrast agent that can be used in MRI imaging. The Pixxoscan has been examined using a regulatory decentralized procedure (DCP) with marketing approval in Austria. It was introduced to several European countries in 2023. Thus, such launches and approvals are anticipated to support the regional CT and MRI contrast agents market growth.

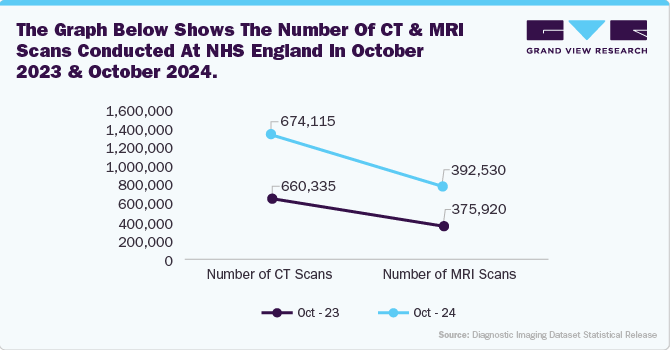

The UK CT and MRI contrast agents market is expected to grow during the forecast period. The UK is a significant contributor to the Europe market, with a growing demand for advanced CT and MRI contrast agents driven by the high prevalence of chronic disorders. In addition, the demand for medical imaging is continuously growing in the UK. According to the data published by the Diagnostic Imaging Dataset Statistical Release in February 2025, 48.5 million imaging tests were reported in England from November 2023 to October 2024, of which 0.67 million were CT scans and 0.39 million were MRIs.

The graph below shows the number of CT and MRI scans conducted at NHS England in October 2023 and October 2024.

Month

Number of CT Scans

Number of MRI Scans

Oct-23

660,335

375,920

Oct-24

674,115

392,530

Source:Diagnostic Imaging Dataset Statistical Release

Thus, as mentioned in the above graph, the demand for CT and MRI scans is rapidly increasing, which is further anticipated to boost the demand for contrast agents used in these modalities.

The Germany CT and MRI contrast agents market is experiencing significant growth, driven by the advanced healthcare infrastructure and a strong emphasis on research and development. The increasing prevalence of chronic diseases boosts demand for imaging technologies. In addition, a growing aging population and rising awareness of early diagnostics further fuel market growth. According to the data published by the Statistisches Bundesamt (Destatis) in March 2023, the number of people needing long-term care in Germany will increase by 37% by 2055 just because the population is aging.

The graph above illustrates the increasing prevalence of the older population, which is expected to drive market growth. Contrast agents are commonly utilized in the diagnosis of chronic diseases, and this demographic is at a higher risk of developing such conditions.

Asia Pacific CT And MRI Contrast Agents Market Trends

The Asia Pacific CT and MRI contrast agents industry is expected to experience the fastest growth from 2025 to 2030. This growth is largely driven by the increasing prevalence of chronic disorders and rising healthcare expenditures. Countries like China and India are seeing rapid advancements in healthcare infrastructure, which in turn is boosting the adoption of CT and MRI contrast agents.

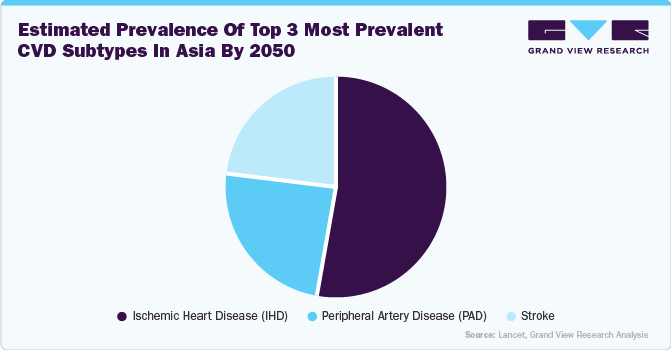

Additionally, the rising prevalence of cardiovascular diseases (CVDs), such as strokes and peripheral artery diseases, is anticipated to further propel market growth in the coming years. According to a study published by the Lancet in August 2024, the crude prevalence of CVDs in Asia is projected to reach 729.5 million by 2050, marking a 109.0% increase from 2025.

The graph above emphasizes the rising prevalence of cardiovascular diseases (CVDs) in the Asian region in the coming years. The use of contrast agents enhances the visualization and identification of cardiac conditions during imaging procedures, which is expected to significantly contribute to market growth.

China CT and MRI contrast agents market is expected to grow over the forecast period. China is a key player in the Asia Pacific market, with significant growth anticipated over the forecast period. The China CT and MRI contrast agents’ market is witnessing considerable growth. The market is expanding significantly due to the rising prevalence of chronic disorders, including cancer, cardiac diseases, and neurological conditions. According to data from the National Library of Medicine published in June 2023, around 330 million people in China are estimated to be affected by cardiovascular disease (CVD). This high prevalence is expected to drive market growth in the years ahead.

Latin America CT And MRI Contrast Agents Market Trends

The Latin America CT and MRI contrast agents industry is experiencing steady growth, driven by an increasing prevalence of chronic diseases, rising healthcare expenditures, and advancements in imaging technology. In addition, growing awareness of early diagnosis and improvements in healthcare infrastructure are further fuelling demand for contrast agents in diagnostic procedures across the region.

Middle East & Africa CT And MRI Contrast Agents Market Trends

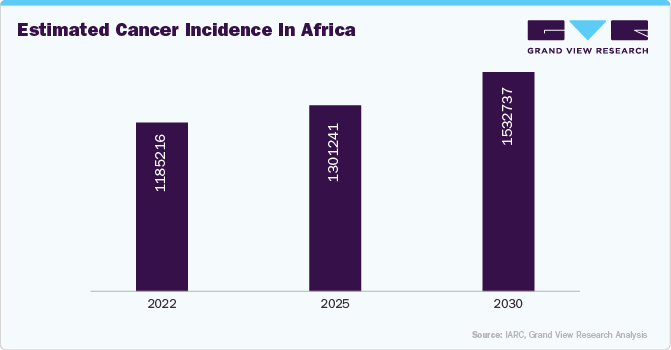

The Middle East & Africa CT and MRI contrast agents industry is growing, driven by the rising incidence of chronic diseases, including cancer and cardiovascular conditions. Increased healthcare investments, advancements in medical imaging technologies, and a growing emphasis on early diagnosis contribute to market growth. Additionally, expanding healthcare infrastructure and initiatives to improve patient access to diagnostic services further enhance demand for contrast agents in the region.

Key CT And MRI Contrast Agents Company Insights

Key players operating in the CT and MRI contrast agents industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products. Strategies such as expansion activities, product approvals, and partnerships are playing key roles in propelling market growth.

Key CT And MRI Contrast Agents Companies:

The following are the leading companies in the CT and MRI contrast agents market. These companies collectively hold the largest market share and dictate industry trends.

- Bracco Diagnostics Inc.

- Guerbet

- GE HealthCare

- Bayer

- Fresenius Kabi USA, LLC

Recent Developments

-

In January 2025, Bayer reported positive results from the pivotal Phase III QUANTI studies, which evaluated the efficacy and safety of gadoquatrane, an investigational GBCA intended for MRI. These favourable clinical studies are expected to contribute to market growth.

-

In November 2024, Bracco Diagnostics Inc., announced that its latest FDA-approved MRI agent, VUEWAY (gadopiclenol) injection, has reached one million patient administrations across more than 480 customer sites.

-

In October 2024, GE HealthCare announced the results of its Phase I clinical trial for manganese-based macrocyclic magnetic resonance imaging (MRI) contrast agent.

CT And MRI Contrast Agents Market Scope

Report Attribute

Details

Market size value in 2025

USD 6.71 billion

Revenue forecast in 2030

USD 9.77 billion

Growth rate

CAGR of 7.81% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, modality, application, route of administration, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Key companies profiled

Bracco Diagnostics Inc.; Guerbet; GE HealthCare; Bayer; Fresenius Kabi USA, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global CT And MRI Contrast Agents Market Report Segmentation

This report forecasts revenue & volume growth of the CT and MRI Contrast Agents market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agrochemicals market report based on product, modality, application, route of administration, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gadolinium-based Contrast Media

-

Iodinated Contrast Media

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Magnetic Resonance Imaging

-

Elucirem/ Vueway

-

Dotarem

-

ProHance

-

MultiHance

-

Gadovist

-

Eovist / Primovist

-

Clariscan

-

Other Generics

-

-

X-ray/ Computed Tomography

-

Optiray

-

ISOVUE

-

Ultravist

-

Omnipaque

-

Visipaque

-

Other Generics

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Disorders

-

Neurological Disorders

-

Gastrointestinal Disorders

-

Cancer

-

Nephrological Disorders

-

Musculoskeletal Disorders

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous

-

Oral Route

-

Rectal Route

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global CT and MRI contrast agents market size was estimated at USD 6.22 billion in 2024 and is expected to reach USD 6.71 billion in 2025.

b. The global CT and MRI contrast agents market is expected to grow at a compound annual growth rate of 7.81% from 2025 to 2030, reaching USD 9.77 billion in 2030.

b. The x-ray/computed tomography segment dominated the modality segment of the global CT and MRI contrast agents market, with a share of 75.60% in 2024. This dominance is attributable to the availability of various contrast agents, such as iohexol, iodixanol, and ioversol, which are used in CT scans to enhance visibility and help diagnose disease.

b. Some key players operating in the global CT and MRI contrast agents market include Bracco Diagnostics Inc., Guerbet, GE HealthCare, Bayer, and Fresenius Kabi USA, LLC.

b. Key factors driving the global CT and MRI contrast agents market growth include the increasing demand for iodinated contrast media, the rising burden of chronic disorders, and the rising focus of government bodies on improving diagnostic infrastructure

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.