- Home

- »

- Plastics, Polymers & Resins

- »

-

Cut Flower Packaging Market Size, Industry Report, 2033GVR Report cover

![Cut Flower Packaging Market Size, Share & Trends Report]()

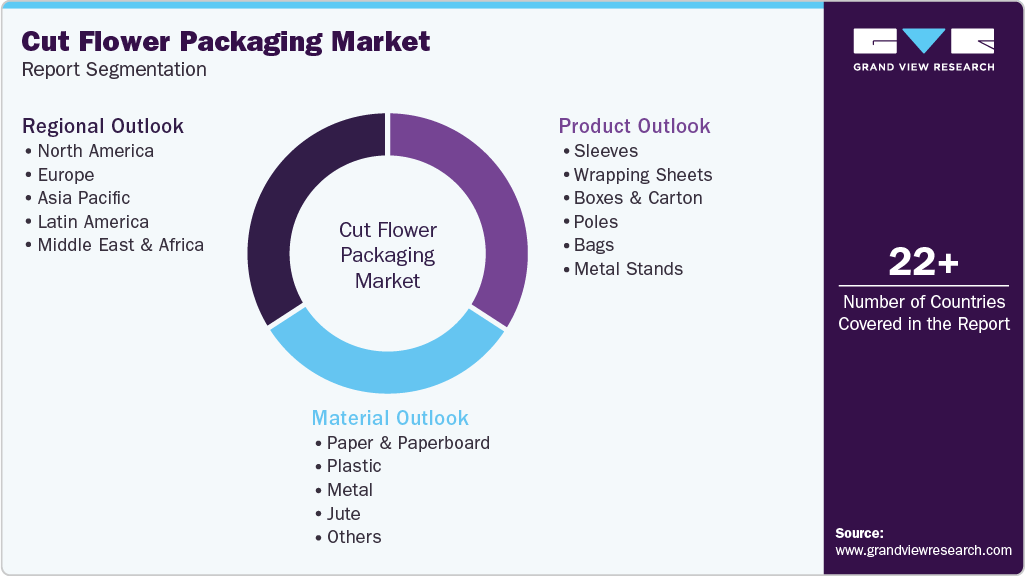

Cut Flower Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Paper & Paperboard, Plastic, Metal, Jute), By Product (Sleeves, Wrapping Sheets, Boxes & Carton, Poles, Bags, Metal Stands), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-810-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cut Flower Packaging Market Summary

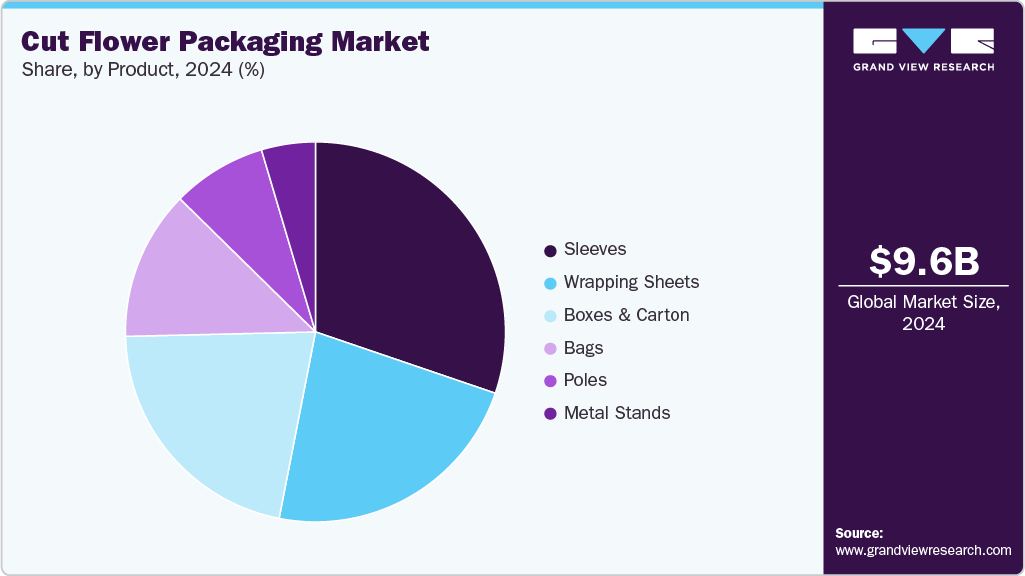

The global cut flower packaging market size was estimated at USD 9.59 billion in 2024 and is projected to reach USD 17.81 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. The global cut flower packaging industry is driven by the growing demand for fresh flowers across retail and e-commerce channels, supported by expanding floriculture trade worldwide.

Key Market Trends & Insights

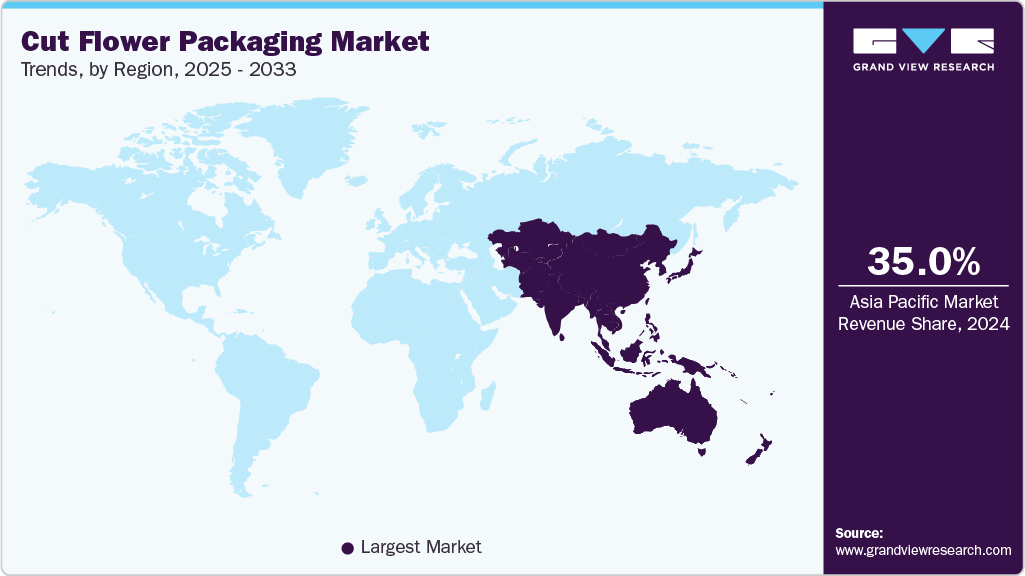

- Asia Pacific dominated the cut flower packaging industry with the largest revenue share of over 35.0% in 2024.

- The cut flower packaging industry in the U.S. is expected to grow at a substantial CAGR of 6.8% from 2025 to 2033.

- By material, the jute segment is expected to grow at a considerable CAGR of 7.7% from 2025 to 2033 in terms of revenue.

- By product, the boxes & carton segment is expected to grow at a considerable CAGR of 7.8% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 9.59 Billion

- 2033 Projected Market Size: USD 17.81 Billion

- CAGR (2025-2033): 7.2%

- Asia Pacific: Largest market in 2024

In addition, rising consumer preference for sustainable and visually appealing packaging solutions enhances market growth. Flowers are central to celebrations such as weddings, anniversaries, birthdays, and corporate events, fueling steady demand for protective and aesthetic packaging solutions. The expansion of the event management and wedding industries, particularly in regions such as the Asia Pacific and North America, has amplified this need. For instance, according to the Government of India, India's wedding industry stands as the world's second-largest, hosting around 10.0 million weddings annually and commanding an estimated market size of USD 130.0 billion per year, positioning it as the fourth-largest industry in the country. This outlook drives bulk demand for cut flowers and decorative floral packaging. Similarly, florists and retailers in Western countries rely heavily on customized packaging, such as sleeves, wraps, and boxes, to enhance visual appeal and maintain freshness during transportation and display.The rapid expansion of online flower delivery services has significantly influenced the market. E-commerce players such as 1-800-Flowers, Interflora, and Bloom & Wild are investing in innovative, durable, and temperature-resistant packaging to ensure safe delivery of delicate flowers to consumers’ doorsteps. Packaging solutions now incorporate moisture-retaining materials, ventilation features, and corrugated protective inserts to prevent damage and dehydration during shipping. The convenience of ordering flowers online, combined with last-mile delivery optimization, has increased the global circulation of packaged flowers, driving demand for lightweight, recyclable, and cost-effective packaging formats suitable for courier transport.

Sustainability has become a defining trend in the cut flower packaging industry. Growing environmental awareness and regulations restricting single-use plastics have pushed manufacturers toward biodegradable, compostable, and recyclable materials. Brands are increasingly adopting paper-based wraps, plant-based films, and water-soluble coatings to replace conventional plastic packaging. For instance, European packaging suppliers have introduced compostable cellophane made from wood pulp and starch-based bioplastics to meet the EU’s circular economy goals. These eco-conscious initiatives not only help brands comply with environmental policies but also enhance their market appeal among eco-aware consumers, particularly in premium floral retail segments.

Innovations in packaging technology are further driving the growth of the cut flower packaging industry. Advanced materials that offer better breathability, humidity control, and ethylene absorption are increasingly being used to extend the shelf life of flowers during storage and transportation. Modified atmosphere packaging (MAP), anti-fog films, and moisture control sachets help maintain optimal conditions for flower freshness. For example, Dutch exporters, the largest players in the global flower trade, utilize temperature-controlled corrugated boxes with integrated hydration systems to preserve blooms during long-haul shipments. Such technological progress enables suppliers to reduce waste, enhance product quality, and cater to international markets, reinforcing the industry’s global expansion.

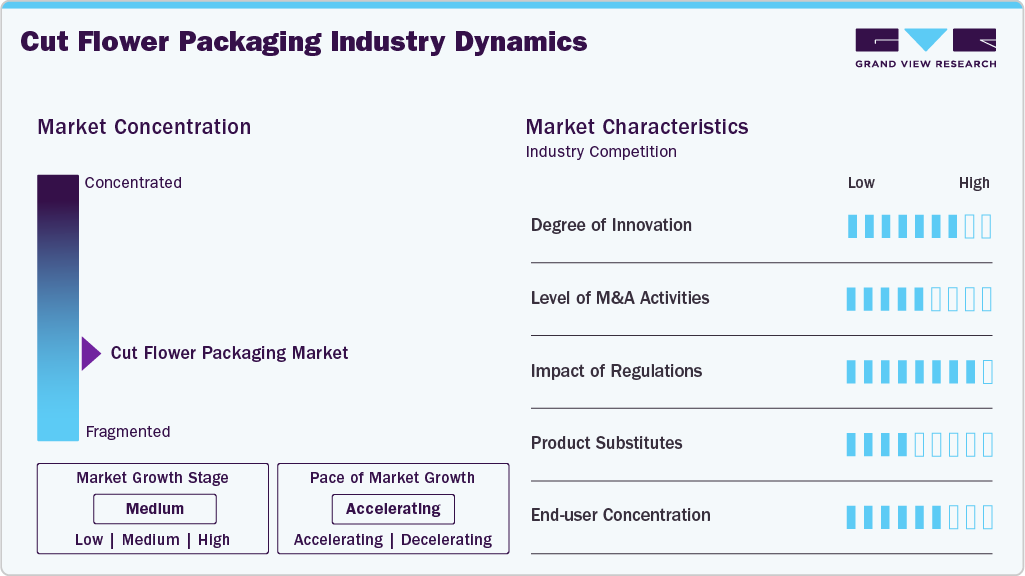

Market Concentration & Characteristics

The cut flower packaging industry operates within a highly time-sensitive value chain due to the perishable nature of flowers. Packaging solutions must ensure preservation of freshness, color, and fragrance from harvest to final sale. This drives demand for materials and designs that provide temperature regulation, moisture retention, and protection against mechanical damage.

The market is characterized by strong seasonality and event-based demand spikes. Major occasions such as Valentine’s Day, Mother’s Day, Christmas, and wedding seasons significantly influence production and packaging volumes. During these peak periods, packaging suppliers experience surge in orders for custom-printed wraps, decorative sleeves, and branded boxes. For instance, florists in North America and Europe witness up to a 40% rise in packaging demand around Valentine’s Day alone. This cyclical nature requires manufacturers to maintain flexible production capacities, efficient inventory management, and quick response systems to meet fluctuating demand.

Material Insights

The paper & paperboard segment recorded the largest market revenue share of over 45.0% in 2024.Paper and paperboard are among the most widely used materials in cut flower packaging due to their eco-friendliness, biodegradability, and ease of customization. They are commonly used in wrapping papers, corrugated boxes, and decorative sleeves that provide aesthetic appeal and sufficient protection during transportation. Kraft paper and coated paperboard are preferred for their strength and printability, allowing florists and retailers to add branding, color, and patterns. Government regulations promoting paper-based alternatives, such as the EU Single-Use Plastics Directive, have further boosted adoption.

Jute segment is expected to grow at the fastest CAGR of 7.7% during the forecast period. Jute, a natural fiber derived from plants, is increasingly used in cut flower packaging as part of the industry’s shift toward sustainable materials. It is commonly utilized in jute wraps, baskets, and bouquet holders, providing a rustic and natural look. Jute packaging enhances breathability, preventing flowers from rotting while maintaining an organic appeal suitable for eco-conscious customers. Its biodegradability and compostability make it a favored alternative in regions emphasizing environmental responsibility, such as Europe and North America.

Product Insights

The sleeves segment recorded the largest market share of over 30.0% in 2024.Sleeves are one of the most commonly used packaging formats for cut flowers, typically made from materials such as BOPP (biaxially oriented polypropylene), polyethylene, or biodegradable films. These conical or cylindrical wraps protect flowers during handling and transit while enhancing shelf presentation in retail environments. Sleeves are available in transparent, tinted, or printed designs, enabling branding and aesthetic customization. They are widely used by supermarkets, floral retailers, and e-commerce platforms for bouquet packaging.

The boxes & carton segment is projected to grow at the fastest CAGR of 7.7% during the forecast period. Boxes and cartons are rigid or semi-rigid packaging formats used for long-distance flower transportation and e-commerce delivery. The adoption of boxes and cartons is driven by the expansion of global flower exports and the rapid growth of online floral delivery services. The increasing use of corrugated packaging with integrated moisture control and insulation technologies supports long-haul preservation.

Regional Insights

Asia Pacific cut flower packaging industry dominated the market and accounted for the largest revenue share of over 35.0% in 2024 and is witnessing strong growth as it is expected to grow at the fastest CAGR of 7.7% during the forecast period. This positive outlook is due to its robust cut flower production base and rapidly expanding retail and export networks. Countries such as China, India, Japan, and Malaysia are major producers of flowers such as chrysanthemums, orchids, and lilies, driving continuous demand for protective and decorative packaging materials. The region’s growing middle-class population and rising disposable income have boosted domestic consumption of flowers for gifting, weddings, and festivals, necessitating high-quality sleeves, wraps, and cartons.

China cut flower packaging industry’s growing focus on eco-friendly and innovative packaging is further accelerating market expansion. The government’s “Green Packaging Standard” and circular economy initiatives have led manufacturers to invest in biodegradable films and recyclable paper-based packaging for the floral industry. In addition, the rise of e-commerce-driven floral delivery platforms such as FlowerPlus and Roseonly has amplified the demand for aesthetically designed and protective packaging formats. These developments, coupled with China’s cost-efficient production capabilities, position the country as both a manufacturing powerhouse and a trendsetter in the global cut flower packaging landscape.

North America Cut Flower Packaging Market Trends

North America cut flower packaging industry’sgrowth is attributed to the high consumption of ornamental flowers and widespread adoption of premium floral packaging solutions. The U.S. and Canada represent major markets for imported flowers from Latin America, especially Colombia and Ecuador, which require protective corrugated boxes, sleeves, and temperature-controlled packaging during transit. The region’s well-developed retail infrastructure, led by supermarket chains such as Walmart, Costco, and Kroger, fuels demand for standardized, attractive, and sustainable flower packaging formats. Moreover, gifting culture during holidays such as Valentine’s Day, Mother’s Day, and Thanksgiving drives seasonal spikes in packaging demand.

U.S. Cut Flower Packaging Market Trends

The U.S. cut flower packaging industrystands as the largest consumer of cut flowers in North America, making it a critical driver of the regional packaging market. The strong e-commerce ecosystem and increasing preference for doorstep flower deliveries have pushed packaging companies to develop solutions that ensure freshness, minimize mechanical damage, and enhance presentation. Retail giants such as Whole Foods and Trader Joe’s also promote flowers as impulse-buy items, boosting the use of visually appealing sleeves and wraps.

Europe Cut Flower Packaging Market Trends

Europe cut flower packaging industryplays a central role in the global market, driven by its large-scale import, distribution, and consumption of flowers. Netherlands, Germany, and UK act as key hubs for flower trading and logistics, importing massive volumes from Africa and Latin America. These countries require specialized transport packaging solutions such as ventilated boxes, moisture-retaining wraps, and recyclable sleeves to preserve freshness throughout the supply chain. Europe’s strong floral gifting tradition and presence of advanced retail networks, including florists and supermarket chains, contribute to steady demand for premium and decorative packaging formats.

Key Cut Flower Packaging Company Insights

The competitive environment of the global cut flower packaging industry is highly fragmented, characterized by the presence of both multinational packaging corporations and specialized regional suppliers catering to local floriculture hubs. Key players compete based on product innovation, material sustainability, cost efficiency, and design aesthetics to enhance shelf appeal and extend flower freshness during transport.

Strategic collaborations between packaging manufacturers and large flower exporters, especially in regions such as the Netherlands, Colombia, Kenya, and Ethiopia, are intensifying competition through customized and value-added solutions such as anti-fog films, moisture retention liners, and temperature-resistant materials. Furthermore, digital supply chain integration and automation in packaging processes are becoming major differentiators, driving consolidation and M&A activities among leading firms seeking global market reach and operational scalability.

-

In November 2025, Koen Pack Americas launched its Ecologic line, a sustainable floral packaging range made from grass paper and post-consumer recycled plastics, aiming to reduce environmental impact while maintaining quality and visual appeal. This initiative reinforces Koen Pack’s commitment to sustainability, innovation, and reliable supply across the floral industry.

-

In October 2025, DS Smith partnered with Queen Flowers to create a recyclable fibre-based bouquet box made from corrugated cardboard. Designed for easy assembly and material efficiency, it maintains flower freshness, reduces transport weight, and is fully recyclable, supporting both branding and sustainability goals.

Key Cut Flower Packaging Companies:

The following are the leading companies in the cut flower packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Smurfit Westrock

- Stora Enso

- DS Smith

- Mondi

- UFlex Limited

- PakFactory

- Tycoon Packaging

- A·ROO Company

- Smart Packaging Solutions

- Nature-Pack

- Packman Packaging

- Flamingo Holland Inc.

- GleePackaging

Cut Flower Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.23 billion

Revenue forecast in 2033

USD 17.81 billion

Growth Rate

CAGR of 7.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, region

States scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia, UAE

Key companies profiled

Smurfit Westrock; Stora Enso; DS Smith; Mondi; UFlex Limited; PakFactory; Tycoon Packaging; A·ROO Company; Smart Packaging Solutions; Nature-Pack; Packman Packaging; Flamingo Holland Inc.; GleePackaging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cut Flower Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cut flower packaging market report based on material, product, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Paper & Paperboard

-

Plastic

-

Metal

-

Jute

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Sleeves

-

Wrapping Sheets

-

Boxes & Carton

-

Poles

-

Bags

-

Metal Stands

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.