- Home

- »

- Network Security

- »

-

Cyber-physical Systems Market Size, Industry Report, 2030GVR Report cover

![Cyber-physical Systems Market Size, Share, & Trends Report]()

Cyber-physical Systems Market (2025 - 2030) Size, Share, & Trends Analysis Report By Component (Hardware, Software, Services), By Type (Open-loop, Closed-loop), By Security (Embedded Security, Robotic Security), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-586-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cyber-physical Systems Market Trends

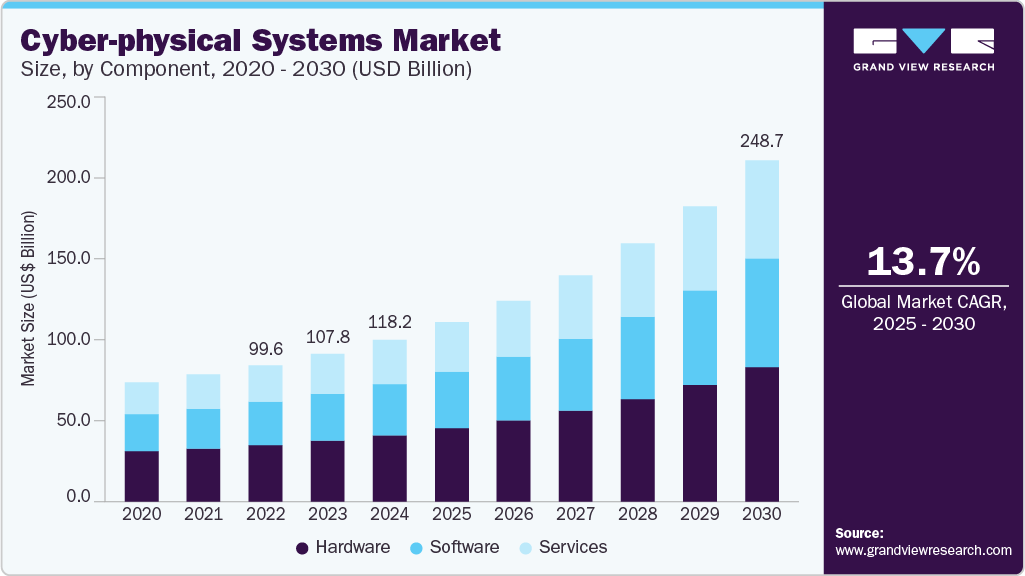

The global cyber-physical systems market size was estimated at USD 118.20 billion in 2024 and is anticipated to grow at a CAGR of 13.7% from 2025 to 2030 The growing adoption of Industry 4.0 is driving the CPS market.

Key Highlights:

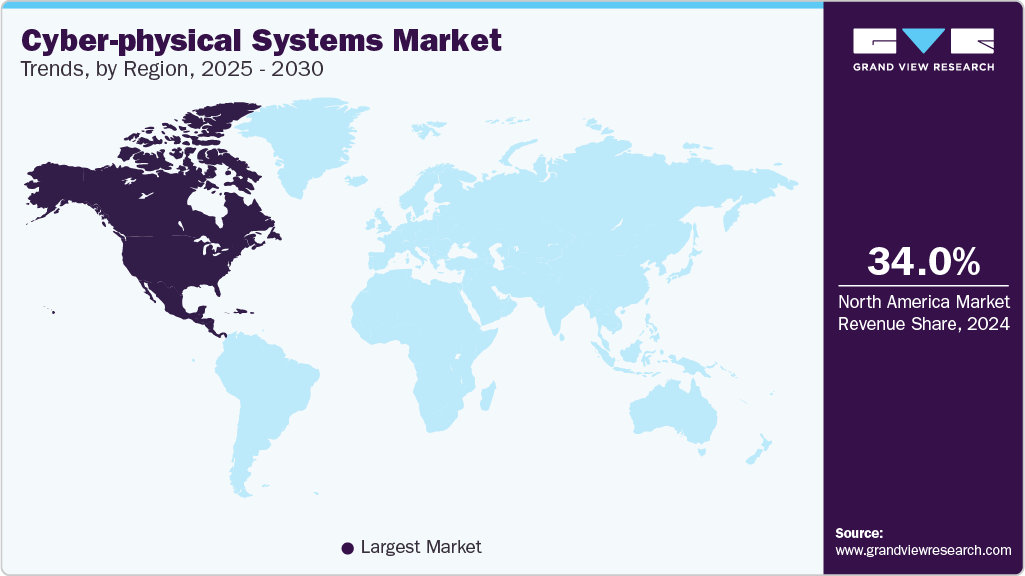

- North America held the major share of over 34.0% of the cyber-physical systems industry in 2024

- The cyber-physical systems (CPS) market in the U.S. is projected to grow during the forecast period

- By Component, the hardware segment accounted for the largest market share of over 41.0% in 2024

- By type, the closed-loop segment dominated the market and accounted for a revenue share of over 69.0% in 2024

- By security, the Internet of Things (IoT) security segment dominated the market and accounted for a revenue share of over 31.0% in 2024 in the cyber-physical systems industry

As manufacturing and industrial sectors increasingly embrace automation, data exchange, and smart technologies, Cyber-physical systems (CPS) plays a central role in enabling real-time coordination between physical equipment and digital systems. These systems integrate sensors, embedded software, and networking capabilities to monitor and control physical processes with a high degree of accuracy and autonomy.

The demand for smart factories, predictive maintenance, and autonomous production lines significantly boosts the deployment of CPS across industrial landscapes. The rise of smart infrastructure and smart city initiatives around the world is driving the CPS market. Governments and municipalities invest in connected systems to enhance urban mobility, energy management, water distribution, and public safety. Cyber-physical systems enable this interconnectivity by linking digital intelligence with the physical infrastructure. For example, CPS can help optimize traffic flow, detect energy wastage in real-time, or automate emergency response systems, improving operational efficiency and quality of life in urban settings.

The increasing importance of precision and automation in sectors like healthcare and agriculture also fuels the CPS market growth. In healthcare, CPS enables advanced medical devices such as robotic surgery systems, smart prosthetics, and remote patient monitoring tools that require high accuracy and seamless software and hardware integration. In agriculture, CPS supports precision farming through sensor-based soil monitoring, automated irrigation systems, and drone-assisted crop management. These capabilities help reduce waste, improve resource utilization, and increase overall productivity, prompting further investment in CPS solutions.

The rapid development of 5G and edge computing infrastructure is another crucial factor accelerating the adoption of cyber-physical systems. These technologies offer the low latency and high bandwidth necessary for CPS to function efficiently in real-time applications, particularly in environments where time-sensitive data exchange is critical, such as autonomous vehicles or robotic manufacturing cells. With the expansion of these next-gen networks, CPS applications are becoming more robust, scalable, and suitable for mission-critical operations.

Furthermore, the growth of artificial intelligence (AI) and machine learning (ML) technologies is amplifying the value of CPS. These intelligent systems can analyze data from physical processes in real-time and make autonomous decisions that optimize performance, reduce downtime, or adapt to changing conditions. Integrating AI into CPS transforms them from reactive to proactive systems, expanding their application in everything from logistics and environmental monitoring to aerospace and autonomous systems. This convergence of AI and CPS creates a powerful ecosystem that drives innovation and demand across industries.

Component Insights

The hardware segment accounted for the largest market share of over 41.0% in 2024. The increasing demand for advanced sensors, actuators, embedded systems, and connectivity devices drives segment growth. These hardware components form the backbone of CPS, enabling the seamless interaction between digital algorithms and physical processes. The growing complexity and scale of industrial automation systems, smart cities, autonomous vehicles, and intelligent healthcare devices propel the need for high-performance and reliable hardware. As industries aim for real-time monitoring, precision control, and predictive maintenance, the demand for robust and efficient hardware infrastructure is becoming more critical.

The services segment is anticipated to grow at the highest CAGR during the forecast period. The increasing importance of cybersecurity in CPS is fueling demand for specialized services. CPSs are highly susceptible to cyber threats due to their tight integration of digital and physical elements, making them targets for attacks that could disrupt essential services or cause physical damage. As a result, there is a rising demand for cybersecurity assessments, vulnerability management, and continuous monitoring services tailored to CPS environments. Service providers offering secure implementation, compliance management, and incident response are becoming critical partners in the lifecycle of CPS solutions.

Type Insights

The closed-loop segment dominated the market and accounted for a revenue share of over 69.0% in 2024. The rising adoption of autonomous systems significantly contributes to the demand for closed-loop CPS. In applications such as self-driving cars, drones, and robotics, closed-loop feedback is essential for real-time navigation, obstacle avoidance, and decision-making. These systems must constantly monitor their surroundings and respond to changing conditions instantly, which closed-loop architecture supports far better than open-loop alternatives. The growing investments in autonomous technologies, especially in transportation and defense, propel the need for robust closed-loop CPS infrastructure.

The open-loop segment is expected to register a CAGR of 12.5% from 2025 to 2030. The increasing use of programmable logic controllers (PLCs) and embedded systems in various sectors supports the expansion of open-loop CPS. These systems are often employed in routine control operations, such as lighting systems, heating and ventilation, and machinery actuation, where real-time feedback is unnecessary. The continued innovation in embedded technologies and the development of low-power, high-efficiency computing components make open-loop CPS more reliable and accessible for a wide range of applications.

Security Insights

The Internet of Things (IoT) security segment dominated the market and accounted for a revenue share of over 31.0% in 2024 in the cyber-physical systems industry. The growing number of cyber threats targeting operational technology (OT) environments drives the segment's growth. High-profile incidents involving compromised industrial control systems (ICS) have highlighted the vulnerabilities that exist at the intersection of IT and OT. As CPS relies heavily on real-time data exchange and control between networked devices, any breach in IoT security can lead to disastrous consequences, such as equipment failure, production downtime, or even physical harm. This has prompted regulatory bodies and industry stakeholders to prioritize developing and deploying advanced IoT security frameworks within CPS environments.

The industrial control systems (ICS) security segment is expected to register the highest CAGR from 2025 to 2030. The growing use of connected devices and automation technologies within industrial settings further contributes to the need for advanced ICS security. Smart sensors, programmable logic controllers (PLCs), and SCADA (Supervisory Control and Data Acquisition) systems enable real-time decision-making in CPS. However, these components are often susceptible to malware, ransomware, and insider attacks. Ensuring the confidentiality, integrity, and availability of data and control commands within these systems is critical to maintaining safe and efficient industrial operations. This necessity is spurring the adoption of ICS-specific cybersecurity platforms that offer continuous monitoring, threat intelligence, and secure communications.

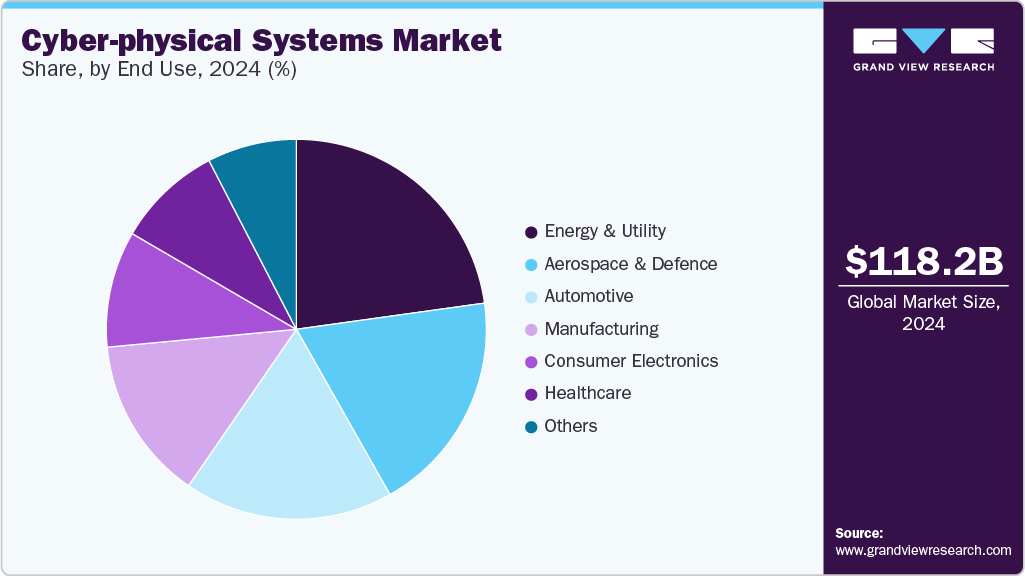

End Use Insights

The energy and utility segment accounted for the largest market share of over 22.0% in 2024 in the cyber-physical systems industry. The increasing digitalization and automation of power generation, transmission, and distribution processes drive market growth. As the energy sector shifts towards smarter grids and renewable energy integration, CPS technologies become indispensable for real-time monitoring, control, and optimization of complex infrastructure. These systems enable enhanced operational efficiency, reduce downtime, and improve resource management, driving the adoption of CPS in this segment. The need to balance energy demand and supply dynamically while integrating distributed energy resources makes CPS solutions essential for modern energy utilities.

The healthcare segment is anticipated to register the highest CAGR during the forecast period. The rising focus on personalized and remote patient care drives the segment's growth. CPS technologies support telemedicine, wearable health monitors, and home-based medical devices, facilitating continuous patient monitoring and timely interventions outside traditional clinical settings. This capability improves patient outcomes and reduces hospital stays and healthcare costs. The growing prevalence of chronic diseases and aging populations worldwide further amplifies the need for advanced CPS-enabled healthcare solutions that provide scalable and patient-centric care models.

Regional Insights

North America held the major share of over 34.0% of the cyber-physical systems industry in 2024. The increasing adoption of digital twins, artificial intelligence, and machine learning within CPS frameworks in North America is driving market growth. These technologies enhance predictive maintenance, real-time monitoring, and system optimization, helping industries reduce downtime and costs while boosting productivity. The region’s focus on sustainability and energy efficiency also promotes using CPS in managing smart grids and renewable energy sources, aligning with environmental goals and regulatory pressures. Altogether, these drivers position North America as a powerhouse in advancing the market globally.

U.S. Cyber-physical Systems Market Trends

The cyber-physical systems (CPS) market in the U.S. is projected to grow during the forecast period. The proliferation of IoT devices and the push for smart city initiatives in the U.S. are major catalysts for the CPS market. Integrating CPS in smart grids, intelligent transportation systems, and building automation supports better resource management, energy efficiency, and urban sustainability. The widespread adoption of AI and machine learning within CPS frameworks also drives market growth by enabling advanced predictive analytics and autonomous operations, thus fostering innovation across the healthcare, energy, and logistics industries.

Europe Cyber-physical Systems Market Trends

The cyber-physical systems (CPS) market in Europe is expected to grow at a CAGR of 13.9% from 2025 to 2030. The increasing concerns about cybersecurity across critical infrastructure and industrial systems also propel the CPS market in Europe. With frequent cyber threats targeting utilities, transportation networks, and manufacturing plants, there is an urgent need for secure and resilient systems that protect both physical assets and digital networks. CPS integrates robust cybersecurity measures, enabling safer and more reliable operations, which is critical for regulatory compliance and risk management in highly regulated European markets.

Germany cyber-physical systems industry is expected to grow significantly during the forecast period. Germany’s strong automotive sector contributes considerably to the CPS market growth. The development of autonomous and connected vehicles relies heavily on CPS for integrating sensors, communication networks, and control systems. German automotive manufacturers and suppliers are investing in CPS to enhance vehicle safety, performance, and efficiency, reinforcing the demand for sophisticated cyber-physical solutions.

Asia Pacific Cyber-physical Systems Market Trends

The cyber-physical systems (CPS) market in Asia Pacific is expected to register the highest CAGR of 15.5% from 2025 to 2030. Urbanization and infrastructure development in the region also play a crucial role in boosting CPS adoption. Governments are focused on developing smart cities that leverage CPS technologies to optimize traffic management, energy consumption, and public safety. These smart city projects create significant opportunities for CPS solutions to be deployed in transportation systems, energy grids, and public utilities, helping to improve resource management and reduce operational costs. The increasing emphasis on sustainable development further accelerates the deployment of CPS for environmental monitoring and energy-efficient infrastructure.

China cyber-physical systems industry is projected to grow during the forecast period. Government policies promoting research and development play a crucial role in advancing CPS technologies in China. Collaborative efforts between academia, industry leaders, and technology startups foster innovation and accelerate the commercialization of CPS applications across various sectors such as healthcare, energy, manufacturing, and transportation. This robust ecosystem of support continues to drive the dynamic market growth.

Key Cyber-physical Systems Company Insights

Some key companies operating in the market include Rockwell Automation and Honeywell International Inc., among others are some of the leading market participants.

-

Rockwell Automation is a global company specializing in industrial automation and digital transformation. It plays a pivotal role by integrating physical processes with digital technologies to create intelligent systems capable of real-time monitoring, predictive maintenance, and advanced security. The company's collaboration with Cisco has led to the development of the Converged Plantwide Ethernet (CPwE) architecture, which provides a secure and scalable network foundation for industrial operations.

-

Honeywell International Inc. is a multinational conglomerate with a diverse portfolio spanning aerospace, building technologies, industrial automation, and energy and sustainability solutions. Honeywell's commitment to cybersecurity within CPS is evident through its suite of operational technology (OT) cybersecurity solutions. Products like Honeywell Forge Cybersecurity+ and Cyber Insights provide organizations with the tools to identify, prioritize, and mitigate cyber risks in their OT environments.

Yokogawa Electric Corporation and Emerson Electric Co. are some of the emerging market participants.

-

Yokogawa Electric Corporation is a Japanese multinational specializing in industrial automation and control systems. Yokogawa offers diverse products and services, including distributed control systems (DCS), safety instrumented systems (SIS), process control systems, and advanced measurement instruments. Through its OpreX brand, Yokogawa offers comprehensive solutions encompassing the entire plant lifecycle, from design and construction to operation and maintenance. Key components of this ecosystem include the CENTUM VP DCS, Exaquantum plant information management system, and Collaborative Information Server (CI Server), all of which facilitate real-time data acquisition, analysis, and decision-making.

-

Emerson Electric Co. is a global company specializing in industrial automation and digital transformation. Emerson's Plantweb Digital Ecosystem exemplifies this trend, integrating advanced sensing technologies, analytics software, and IoT solutions to optimize manufacturing processes. In addition, combining AI and machine learning into CPS enables predictive maintenance and adaptive control, further boosting system efficiency.

Key Cyber-physical Systems Companies:

The following are the leading companies in the cyber-physical systems market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Honeywell International Inc.

- Siemens AG

- Schneider Electric

- Rockwell Automation

- General Electric Company

- Hitachi, Ltd.

- Toshiba Corporation

- Robert Bosch GmbH

- Cisco Systems, Inc.

- Emerson Electric Co.

- Intel Corporation

- IBM Corporation

- Microsoft Corporation

- Yokogawa Electric Corporation

- Claroty

Recent Developments

-

In January 2025, Dragos Inc. partnered with Yokogawa Electric Corporation, marking a significant milestone in Yokogawa’s global mission to secure industrial environments. This collaboration strengthens Yokogawa Electric Corporation’s ability to deliver comprehensive cybersecurity solutions worldwide, allowing customers to concentrate on their core operations while their critical assets remain protected. Dragos and Yokogawa are dedicated to advancing industrial cybersecurity, helping organizations create resilient and secure operational environments.

-

In March 2024, Claroty announced it had raised USD 100 million in strategic growth funding. This capital will be used to expand Claroty’s platform to protect cyber-physical systems (CPS) across major sectors such as the public sector and highly regulated critical infrastructure industries. The funds will also support growth in emerging markets throughout the Americas, EMEA, and Asia-Pacific regions, drive research and development in core and related technologies like secure remote access, and strengthen new and existing strategic partnerships.

-

In March 2024, Nozomi Networks Inc. partnered with Yokogawa Electric Corporation to address the increasing global demand for managed security services and solutions specifically designed for process manufacturers' OT and IoT cybersecurity needs. Under Yokogawa’s OpreX Managed Services, customers worldwide can access Nozomi Networks’ advanced OT and IoT visibility, network monitoring, and threat detection solutions. Furthermore, Yokogawa will offer Nozomi Networks’ standalone solutions for customers who wish to manage their security programs independently.

-

In November 2023, Claroty announced an expansion of its partnership with Rockwell Automation by integrating its SaaS-powered industrial cybersecurity platform, Claroty xDome, into Rockwell Automation's global services portfolio. Furthermore, Rockwell Automation customers can access Claroty's cloud-based and on-premise OT security solutions. This partnership enhancement underscores Rockwell's leadership in OT security by providing its customers with a cloud OT security solution. This move places Rockwell at the forefront of secure digital transformation, reinforcing the company's commitment to innovation and cybersecurity.

Cyber-physical Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 131.08 billion

Revenue forecast in 2030

USD 248.78 billion

Growth rate

CAGR of 13.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, type, security, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexic; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

ABB; Honeywell International Inc.; Siemens AG; Schneider Electric; Rockwell Automation; General Electric Company; Hitachi, Ltd.; Toshiba Corporation; Robert Bosch GmbH; Cisco Systems, Inc.; Emerson Electric Co.; Intel Corporation; IBM Corporation; Microsoft Corporation; Yokogawa Electric Corporation; Claroty

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cyber-physical Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cyber-physical systems market report based on component, type, security, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Open-Loop

-

Closed-Loop

-

-

Security Outlook (Revenue, USD Billion, 2018 - 2030)

-

Embedded Security

-

Industrial Control Systems (ICS) Security

-

Robotic Security

-

Internet of Things (IoT) Security

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace and Defence

-

Automotive

-

Energy and Utility

-

Healthcare

-

Manufacturing

-

Consumer Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cyber-physical systems market size was estimated at USD 118.20 billion in 2024 and is expected to reach USD 131.08 billion in 2025.

b. The global cyber-physical systems market is expected to grow at a compound annual growth rate of 13.7% from 2025 to 2030 to reach USD 248.78 billion by 2030.

b. The closed-loop segment dominated the market and accounted for a revenue share of over 69.0% in 2024 in the cyber-physical systems market. The rising adoption of autonomous systems significantly contributes to the demand for closed-loop CPS market.

b. Some key players operating in the market include ABB, Honeywell International Inc., Siemens AG, Schneider Electric, Rockwell Automation, General Electric Company, Hitachi, Ltd., Toshiba Corporation, Robert Bosch GmbH, Cisco Systems, Inc., Emerson Electric Co., Intel Corporation, IBM Corporation, Microsoft Corporation, Yokogawa Electric Corporation, Claroty

b. Factors such the adoption of the growing adoption of Industry 4.0, the rise of smart infrastructure and smart city initiatives around the world, and the increasing importance of precision and automation in sectors like healthcare and agriculture are anticipated to accelerate the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.