- Home

- »

- Clothing, Footwear & Accessories

- »

-

Cycling Helmets Market Size, Share & Growth Report, 2030GVR Report cover

![Cycling Helmets Market Size, Share & Trends Report]()

Cycling Helmets Market (2025 - 2030) Size, Share & Trends Analysis Report By Category (Conventional Helmet, Smart Helmet), By Distribution Channel (Specialty & Sports Shops, Department & Discount Stores), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-452-4

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cycling Helmets Market Summary

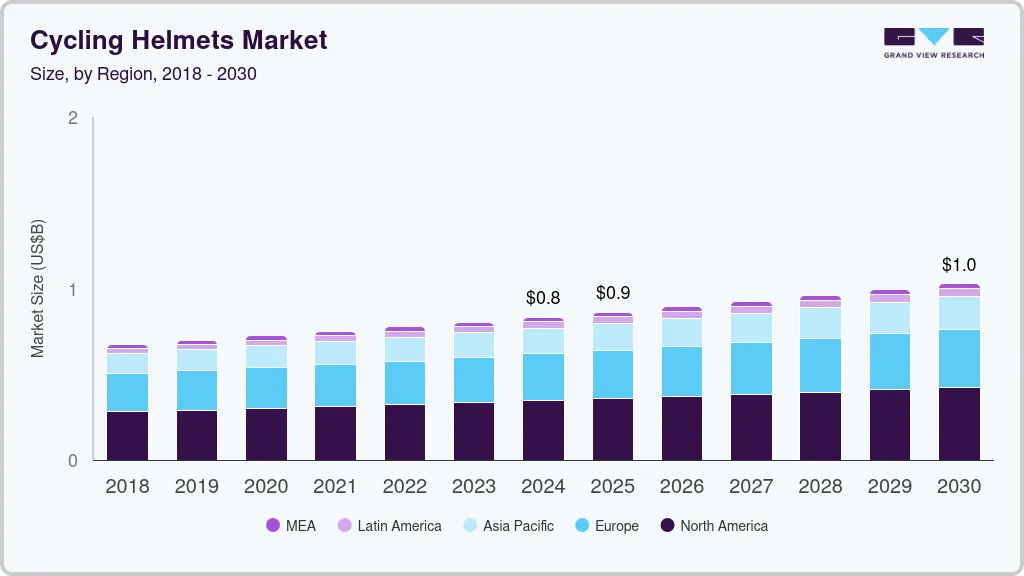

The global cycling helmets market size was estimated at USD 832.5 million in 2024 and is projected to reach USD 1.02 billion by 2030, growing at a CAGR of 3.6% from 2025 to 2030. The growing interest in cycling for fitness, recreation, and as an eco-friendly mode of transportation is fueling the demand for cycling helmets.

Key Market Trends & Insights

- North America dominated the global cycling helmets market with the largest revenue share of over 41.45% in 2024.

- By category, the conventional helmets segment led the market with the largest revenue share of 70.87% in 2024.

- By distribution channel, the online segment is expected to grow at the fastest CAGR of 3.9% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 832.5 Million

- 2030 Projected Market Size: USD 1.02 Billion

- CAGR (2025-2030): 3.6%

- North America: Largest market in 2024

This is particularly notable in urban areas where cycling is encouraged as a means to reduce traffic congestion and pollution. Increasing awareness about the importance of safety while cycling is a primary driver. Governments and cycling associations globally are promoting the use of helmets, often through regulations that mandate helmet usage. Innovations in helmet materials and design, such as the integration of MIPS (Multi-directional Impact Protection System) technology, which reduces rotational forces during impacts, are driving consumer interest. Lightweight and well-ventilated helmets are also increasingly popular.Nowadays, there is a growing trend toward eco-friendly helmets made from recycled or biodegradable materials. Consumers are becoming more environmentally conscious, and this is influencing their purchasing decisions. Personalized helmets with custom colors, designs, and fit are gaining popularity. Advanced 3D scanning and printing technologies allow for helmets tailored to individual head shapes, enhancing comfort and protection.

Cycling helmets equipped with integrated technology, such as Bluetooth connectivity, built-in cameras, and lights, are becoming more prevalent. These smart helmets appeal to tech-savvy cyclists who value safety, communication, and convenience. Moreover, cyclists prioritize helmets that offer a comfortable fit, lightweight design, and proper ventilation. Helmets with adjustable straps and multiple-size options are highly preferred.

Manufacturers are exploring new materials like graphene and carbon fiber to create helmets that are lighter yet stronger. These materials also improve the overall comfort and reduce the helmet's weight without compromising safety. Collaborations with professional cyclists, cycling teams, and events are common strategies to enhance brand visibility and credibility. Sponsoring major cycling tours or local events helps in reaching a broader audience.

Many manufacturers engage in educational campaigns that promote cycling safety and the importance of helmet use. These campaigns often include demonstrations, safety clinics, and collaborations with schools or cycling clubs. Some brands are enhancing the retail experience by offering virtual try-ons, in-store fittings, and interactive displays that showcase the technology behind their products.

Manufacturers are integrating MIPS with other technologies, such as RECCO reflectors (used for rescue operations) and SPIN (Shearing Pads Inside) systems, which offer similar rotational protection through innovative padding designs.

Category Insights

Conventional cycling helmets accounted for a share of 70.87% of the global revenue in 2024. Conventional helmets are generally more affordable compared to helmets with advanced technologies or smart features. This makes them accessible to a larger segment of consumers, including casual cyclists and those new to the sport. These helmets are widely available in a variety of retail outlets, including sporting goods stores, department stores, and online platforms. Their widespread distribution ensures they are easily accessible to consumers around the world.

The smart cycling helmet segment is expected to grow at a CAGR of 4.0% from 2025 to 2030. Smart helmets can integrate with smartphones and cycling apps, offering features like GPS navigation, fitness tracking, and real-time communication. This adds value to the cycling experience, particularly for those who use cycling as part of their fitness routine or commute. Many smart helmets come equipped with integrated LED lights, making cyclists more visible on the road, especially in low-light conditions. Some models also include turn signals, further enhancing safety during urban commuting.

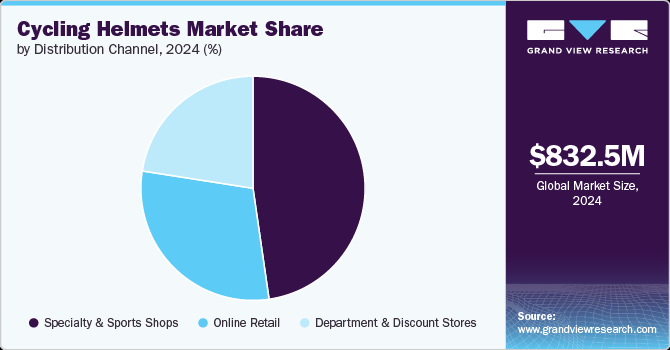

Distribution Channel Insights

The sales of cycling helmets through specialty & sports shops accounted for a revenue share of 47.70% in 2024. These stores typically carry a wide range of helmets and have in-depth knowledge about the technical aspects of each model. This expertise allows them to explain the benefits of different helmet technologies, such as MIPS (Multi-directional Impact Protection System) or advanced ventilation systems, which can be a decisive factor for many buyers. Specialty and sports shops often carry a curated selection of high-quality helmets, including premium brands that may not be available in general retail outlets. This focus on quality attracts discerning customers who are looking for the best products on the market.

The sales of cycling helmets through online segment is expected to grow at a CAGR of 3.9% from 2025 to 2030. Many helmet manufacturers are adopting direct-to-consumer sales models through their websites, cutting out intermediaries and offering products at lower prices. This trend is gaining traction, particularly among consumers looking for the best value. Some online retailers are incorporating AR technology that allows customers to virtually try on helmets, helping them find the right fit without needing to visit a physical store. These innovations improve the online shopping experience and reduce the hesitation associated with purchasing helmets online.

Regional Insights

North America cycling helmets market captured a revenue share of over 41.45% in the market. There is a strong emphasis on safety in North America, with various campaigns and regulations promoting the use of helmets while cycling. Many states and municipalities have laws mandating helmet use, especially for children, which drives sales. Cycling is becoming more popular for both recreation and commuting in North America, particularly in urban areas. This rise in cycling participation is fueling demand for helmets.

U.S. Cycling Helmets Market Trends

The cycling helmets market in the U.S. is projected to grow at a significant CAGR from 2025 to 2030. Investments in cycling infrastructure, such as bike lanes and bike-sharing programs, are encouraging more people to cycle, which in turn boosts the market for cycling helmets. The market is seeing an influx of technologically advanced helmets, including smart helmets with features like Bluetooth connectivity, integrated lights, and crash detection systems. These innovations cater to the tech-savvy consumer base in the U.S.

Europe Cycling Helmets Market Trends

The cycling helmets market in Europe is expected to grow at a CAGR of 3.6% from 2025 to 2030. European cities, especially in countries like the Netherlands, Denmark, and Germany, are seeing a significant increase in cycling as a mode of transport. The focus on sustainable urban mobility has led to the development of extensive cycling infrastructure, making cycling safer and more accessible. This urban cycling boom is driving demand for helmets. The rising awareness of health and fitness across Europe has led more people to take up cycling for exercise and recreation. This trend is particularly strong in countries like the UK, France, and Italy, where cycling for leisure is growing in popularity.

Asia Pacific Cycling Helmets Market Trends

The cycling helmets market in Asia Pacific is expected to witness a CAGR of 4.2% from 2025 to 2030. The popularity of cycling as a recreational activity and competitive sport is on the rise, especially in countries like Japan, South Korea, and Australia. This has led to a greater emphasis on safety gear, including helmets, among both amateur and professional cyclists. Various governments in the Asia Pacific region are promoting cycling as a healthy and sustainable mode of transport alongside campaigns to increase awareness of cycling safety. These initiatives are encouraging helmet usage, especially in urban areas.

Key Cycling Helmets Company Insights

The market is characterized by a diverse range of companies, spanning from small startups to large multinational firms, each employing various strategies to gain a competitive edge and capture market share. To stay ahead in this competitive landscape, companies are diversifying their product offerings to cater to a broad spectrum of customer needs.

This diversification includes expanding size ranges to be more inclusive, offering cycling helmets tailored to specific activities or body types, and incorporating advanced materials and technology for enhanced comfort and performance. Additionally, many companies are focusing on sustainability by using eco-friendly materials and ethical manufacturing practices, appealing to environmentally conscious consumers.

Key Cycling Helmets Companies:

The following are the leading companies in the cycling helmets market. These companies collectively hold the largest market share and dictate industry trends.

- Vista Outdoor Operations LLC

- Dorel Sports

- KASK S.p.a.

- Trek Bicycle Corporation

- Uvex Sports

- Orbea

- Specialized Bicycle Components, Inc.

- MET-Helmets

- SCOTT Sports SA.

- Limar Srl

Recent Developments

-

In August 2024, VAN RYSEL introduced a new lineup of road cycling helmets, featuring three distinct models tailored to meet the needs of cyclists at every level, from enthusiasts to professionals: the RCR, the FCR, and the XCR.

-

In January 2024, the Danish Road Safety Council has launched a campaign to highlight the importance of wearing a helmet. In the campaign, Rådet for Sikker Trafik illustrates a Viking needing a helmet for safe horseback riding. A character in the campaign remarks, “You can go looting and pillaging as much as you like, but you must wear a helmet.”

Cycling Helmets Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 862.4 million

Revenue forecast in 2030

USD 1.02 billion

Growth rate

CAGR of 3.6% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Vista Outdoor Operations LLC; Dorel Sports; KASK S.p.a.; Trek Bicycle Corporation; Uvex Sports; Orbea; Specialized Bicycle Components, Inc., Inc.; MET-Helmets; SCOTT Sports SA.; Limar Srl

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Cycling Helmets Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cycling helmets market report based on category, distribution channel, and region:

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional Helmet

-

Smart Helmet

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online retail

-

Specialty & sports shops

-

Department & discount stores

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cycling helmet market size was estimated at USD 803.7 million in 2023 and is expected to reach USD 832.5 million in 2024.

b. The global cycling helmet market is expected to grow at a compounded growth rate of 3.6% from 2024 to 2030 to reach USD 1.02 billion by 2030.

b. The conventional cycling helmet segment dominated the cycling helmet market with a share of 70.97% in 2023. Conventional helmets are generally more affordable compared to helmets with advanced technologies or smart features. This makes them accessible to a larger segment of consumers, including casual cyclists and those new to the sport.

b. Some key players operating in the cycling helmet market include Vista Outdoor Operations LLC; Dorel Sports; KASK S.p.a.; Trek Bicycle Corporation; Uvex Sports; and Orbea

b. Key factors that are driving the market growth include the growing interest in cycling for fitness, recreation, and as an eco-friendly mode of transportation. Moreover, innovations in helmet materials and design, such as the integration of MIPS (Multi-directional Impact Protection System) technology, which reduces rotational forces during impacts, are driving consumer interest.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.