- Home

- »

- Next Generation Technologies

- »

-

Data Broker Market Size And Share, Industry Report, 2033GVR Report cover

![Data Broker Market Size, Share & Trends Report]()

Data Broker Market (2025 - 2033) Size, Share & Trends Analysis Report By Data Category (Consumer Data, Business Data, Health Data, Financial Data, Location Data), By Data Type, By Pricing, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-670-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Broker Market Summary

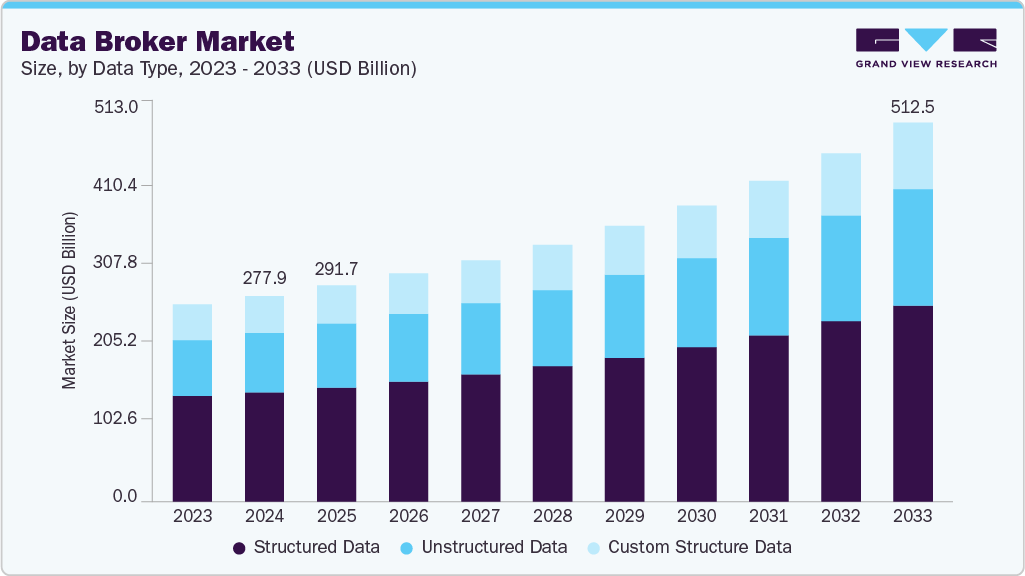

The global data broker market size was estimated at USD 277.97 billion in 2024 and is projected to reach USD 512.45 billion by 2033, growing at a CAGR of 7.3% from 2025 to 2033. A key trend shaping the global data broker market is the convergence of big data analytics, AI, and real-time data monetization models across diverse industry verticals.

Key Market Trends & Insights

- North America held a 41.2% revenue share of the global data broker market in 2024.

- The U.S. market is fueled by its highly developed third-party data licensing ecosystem and early enterprise adoption of cloud-native data marketplaces.

- By data category, consumer data segment held the largest revenue share of 35.1% in 2024.

- By pricing, the subscription segment held the largest revenue share in 2024.

- By data type, the structured data segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 277.97 Billion

- 2033 Projected Market Size: USD 512.45 Billion

- CAGR (2025-2033): 7.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Organizations are moving from static demographic datasets to dynamic data streams that capture intent, location, transactions, and sentiment in near real time. In addition, with the rise of programmatic advertising, fraud detection, and personalized engagement, businesses demand continuously updated datasets that reflect real-world changes in consumer behavior. Data brokers are integrating AI-driven tools for automatic categorization, enrichment, and normalization of disparate data sources, transforming raw data into actionable intelligence. For instance, companies in the BFSI and retail sectors are leveraging brokered data streams to score leads, personalize offers, and preempt credit and fraud risks, enabling faster, more accurate decision-making.

Moreover, the market is also witnessing evolution in the types of data being collected, with a strong pivot toward unstructured and custom-structured data. While structured data such as emails, contact information, and financial records continue to dominate core offerings, unstructured data like social media activity, voice transcripts, geolocation trails, and purchase intent signals are being processed using natural language processing (NLP) and machine learning. This shift is fueling growth in sectors like healthcare and telecom, where customized datasets enable predictive analytics, network optimization, and patient risk stratification.

Data brokers are increasingly offering hybrid pricing models such as subscription plus pay-per-use, alongside API-driven delivery platforms to provide clients with modular, real-time access to tailored datasets. For instance, in June 2025, the U.S. Consumer Financial Protection Bureau (CFPB) announced new oversight measures targeting data brokers under the Fair Credit Reporting Act, following investigations into how location and health-related data were being bundled and sold without explicit user consent, prompting brokers to enhance transparency, data sourcing disclosures, and opt-out mechanisms.

Data Category Insights

Consumer data segment accounted for the largest revenue share of 35.1% in 2024, driven by the surging demand for personalized marketing and real-time customer profiling across industries such as retail, BFSI, and media. Consumer data encompassing demographics, lifestyle attributes, purchase history, and online behavior offers insights that fuel advertising campaigns, customer segmentation, and lead scoring. Unlike business or location data, consumer datasets are frequently updated, highly scalable, and monetized across both B2B and B2C models, making them the most commercially asset class within the data broker ecosystem. Additionally, the growth of digital platforms, loyalty programs, and mobile applications has amplified the availability of actionable consumer insights. For instance, in May 2021, Acxiom launched its Real‑Time Solutions Suite, a cloud‑native marketing platform that enables advertisers to capture and unify real‑time consumer interactions across devices and channels, enhancing data accuracy, personalization, and speed while maintaining robust privacy controls. Consequently, the increasing shift toward precision marketing and omnichannel engagement is driving the growth of consumer data segment in the global data broker market.

Health data segment is expected to register the fastest CAGR during the forecast period, driven by the rapid digitization of medical records, increasing adoption of predictive analytics, and growing investments in value-based care and telehealth services. Additionally, the demand for structured health data, including electronic health records (EHRs), insurance claims, genetic profiles, and remote patient monitoring is accelerating as healthcare providers seek to improve clinical outcomes, reduce costs, and personalize treatment. Moreover, governments across major countries are implementing strategic initiatives to enable the responsible utilization of health data for research, innovation, and public health improvement. For instance, in April 2025, the UK government announced plans for a National Health Data Service to centralize and securely monetize NHS records for research and innovation, highlighting the expanding commercial viability of compliant, consent-based health data platforms. Consequently, this confluence of digital infrastructure, policy momentum, and commercial opportunity is fueling the robust growth of the health data segment within the data broker market.

Data Type Insights

The structured data segment accounted for the largest market share in 2024, due to its high usability, seamless integration with enterprise systems, and compliance-ready structure. Structured datasets such as demographics, financial records, and transaction logs are the backbone of data monetization strategies across BFSI, retail, and telecom sectors. Additionally, the increasing adoption of automation, API-based data delivery, and real-time analytics solutions is further driving demand for structured data, especially among enterprises seeking scalable and regulatory-compliant data sources. For instance, in April 2025, Experian announced the expansion of its structured data APIs and cloud-native delivery systems, enabling businesses to integrate real-time consumer insights directly into credit, fraud, and marketing platforms. Subsequently, the above-mentioned factors are contributing significantly in driving the growth of structured data segments in the global data broker market.

The unstructured data segment is expected to grow at the fastest CAGR over the forecast period, driven by the growth of digital content across social media, emails, audio-visual media, IoT sensors, and user-generated platforms. Organizations are leveraging natural language processing (NLP), machine learning, and AI-powered analytics to extract value from unstructured datasets, enabling better insights into customer sentiment, behavior, and intent. This is particularly relevant in industries like healthcare, media, and retail, where decision-making relies heavily on contextual and behavioral signals. Moreover, the rise of large language models (LLMs), voice-based interfaces, and real-time monitoring tools is accelerating enterprise investment in unstructured data processing capabilities. For instance, in June 2025, IBM launched watsonx.data lakehouse platform with native support for unstructured data, enabling enterprises to manage, query, and analyze diverse content types such as PDFs, emails, and images within a single AI-optimized architecture. Therefore, the factors above are contributing significantly to the accelerated adoption and robust growth of the unstructured data segment within the global data broker market.

Pricing Insights

The subscription segment dominated the market in 2024 by pricing model in the global data broker market, reflecting a strong preference for ongoing access to curated datasets essential for strategic decision-making. Subscription-based offerings simplify budgeting with fixed costs while ensuring clients receive continual updates, critical for marketers, risk managers, and compliance teams. In response, data brokers have enhanced their platforms with self-service portals and API integrations that deliver real-time feeds and customizable subscription tiers. For instance, in June 2025, Reklaim expanded its Reklaim Protect privacy subscription service to include automatic opt‑outs from California’s data broker registry and major advertising platforms. Consequently, the shift toward durable relationships, cloud‑enabled delivery, and full‑lifecycle data management is driving the growth of subscriptionsegment in the global data broker market.

The pay‑per‑use segment is expected to register the fastest growth during the forecast period, driven by the rising need for flexible, consumption‑based access to precise data without long‑term commitments. This model is increasingly preferred by project‑based teams, fintech, and performance marketers who seek targeted, short‑term datasetssuch as location analytics, purchase intent signals, or market segment samplesfor specific campaigns or trials. The proliferation of cloud‑based data marketplaces makes it seamless for consumers to query and retrieve micro‑segments of data as and when needed, ensuring cost-efficiency and customization. In conclusion, the aforementioned factors are predicted to register the fastest CAGR by pricing segment in the global data broker market.

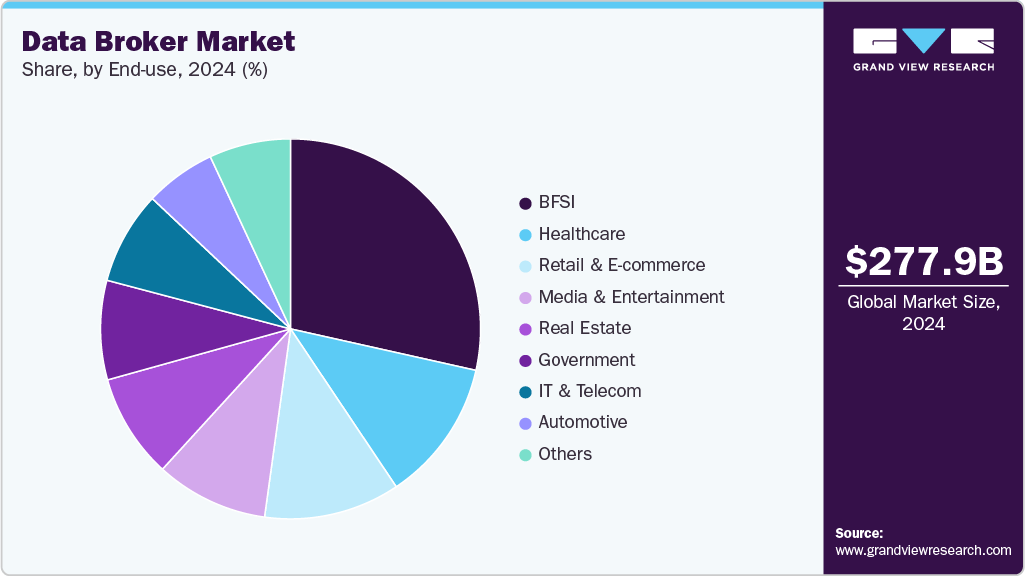

End-use Insights

The BFSI segment accounted for the largest market share in the global data broker market, driven by the sector’s dependence on structured, high-quality data for credit risk assessment, fraud detection, regulatory compliance, and personalized financial services. Banks, insurers, and fintech integrate brokered data such as income records, credit histories, and employment verification into automated decision systems to streamline underwriting, improve customer onboarding, and meet stringent KYC/AML requirements. Additionally, the growing reliance on API-based and real-time data access is further embedding data brokers into core financial workflows. For instance, in August 2024, Equifax partnered with Workday to integrate its employment and income verification service, The Work Number, with Workday Payroll, allowing financial institutions and government agencies to access real-time verification data securely and efficiently. This development highlights that brokered data is being operationalized across the BFSI ecosystem, reinforcing the segment’s dominant role in driving demand and revenue within the global data broker market.

The healthcare segment is expected to register the fastest growth during the forecast period, driven by the widespread digitization of patient records, expanding utilization of AI-driven diagnostics, and growing demand for real-world evidence in clinical and therapeutic innovation. In addition, Healthtech platforms, hospitals, pharmaceuticals, and insurers increasingly rely on brokered health datasets ranging from EHRs, insurance claims, and genomic profiles to wearable device outputs to improve care outcomes, personalize treatments, and support regulatory compliance. Moreover, the trend is further fueled by supportive policy frameworks. For instance, in January 2025, the EU Council formally adopted the European Health Data Space (EHDS) regulation, establishing a secure, cross-border infrastructure for sharing electronic health data for research and public-health planning, while maintaining strict privacy and consent controls. Consequently, the strengthening of digital infrastructure, regulatory endorsement, and heightened clinical and commercial appetite are positioning healthcare as the fastest-growing vertical in the data broker market.

Regional Insights

North America data broker market accounted for the largest market share of 41.2% in 2024, primarily due to the region's expansive ecosystem of data-driven enterprises and widespread integration of brokered data across sectors such as financial services, healthcare, retail, and advertising. Additionally, American companies are at the forefront of leveraging structured and unstructured data for advanced applications including AI model training, real-time marketing, and automated credit decisioning. Moreover, the region is also home to several major data brokers including Oracle Data Cloud, Acxiom, CoreLogic, and Experian North America who provide tailored, industry-specific datasets through cloud-based platforms and self-service APIs. Furthermore, the presence of large advertising technology networks and privacy-resilient data monetization models enables continued expansion of consumer and behavioral data applications. Regulatory developments such as California's CPRA and ongoing federal discussions around data transparency have further incentivized firms to invest in compliant data partnerships, reinforcing North America’s dominant role in shaping the commercial data economy.

U.S. Data Broker Market Trends

The U.S. data broker industry is fueled by its highly developed third-party data licensing ecosystem and early enterprise adoption of cloud-native data marketplaces. U.S. organizations increasingly source data directly through integrated platforms such as Snowflake Marketplace, AWS Data Exchange, and Microsoft Azure Data Share, enabling seamless access to brokered datasets for use in machine learning pipelines, customer intelligence, and ESG risk analysis. Additionally, the proliferation of digital identity resolution technologies has further expanded the demand for granular consumer and household-level data. Moreover, sectors such as real estate and healthcare in the U.S. are leveraging brokered data not just for marketing, but for location intelligence, social determinants of health, and predictive modeling. With government agencies like the FTC increasing scrutiny on opaque data practices, many U.S. brokers have pivoted toward transparency-first models, emphasizing source traceability, data provenance, and dynamic consent, positioning the U.S. at the center of both innovation and responsible data commerce.

Europe Data Broker Market Trends

Data broker industry in Europe is anticipated to register significant growth from 2025 to 2033, owing to strong regulatory framework, growing demand for sovereign data infrastructure, and increasing adoption of ethical data monetization practices. European organizations are leveraging brokered data across sectors such as finance, automotive, and public health, but with stricter compliance requirements under the General Data Protection Regulation (GDPR), which mandates transparency, consent, and data minimization. As a result, many data brokers in the region are shifting toward privacy-preserving technologies like differential privacy, synthetic data, and federated learning to remain compliant while meeting enterprise data needs. Furthermore, the rollout of the European Health Data Space (EHDS) and initiatives under the EU Data Governance Act are enabling more structured and secure sharing of public and private sector data, especially for cross-border research and innovation. Countries like Germany, France, and the Netherlands are witnessing strong demand for localized, domain-specific datasets through EU-based cloud marketplaces and consent-first platforms, positioning Europe as a growing but compliance-centric region within the global data broker landscape.

The UK data broker market is undergoing a period of scrutiny and transformation, driven by significant regulatory and national-security developments. The government’s March–May 2025 call for evidence on data brokers marks a proactive effort by the Department for Science, Innovation & Technology to examine potential security risks, especially the sale of sensitive datasets that could be exploited by hostile actors, prompting industry-wide reviews of data governance and risk protocols. Meanwhile, regulatory enforcement is being stepped up: The Information Commissioner’s Office (ICO) has issued enforcement actions against major credit reference agencies like Experian for inadequate transparency and profiling practices, signaling tougher oversight of data brokerage operations.Consequently, these dynamics are compelling UK brokers to embrace privacy-first platforms, enhanced provenance tracking, and security-first architectures, making the UK market one of the most regulation-focused and ethically driven segments in the global data brokerage landscape.

Data broker market in Germany is characterized by strong demand for structured and industrial-grade data, particularly across manufacturing, automotive, and insurance sectors, where real-time analytics and IoT integration are driving commercial adoption. However, the market is also under intense regulatory scrutiny, especially following a 2024 investigation by Netzpolitik.org and Bayerischer Rundfunk that exposed the sale of billions of mobile location pings including sensitive movement data linked to military personnel raising national security and privacy concerns. This has led to increased enforcement of the Federal Data Protection Act (BDSG) and mounting pressure on brokers to adopt consent-driven, GDPR-compliant practices. In response, companies are investing in anonymization technologies, secure data provenance tracking, and transparent sourcing to retain market relevance. As a result, while Germany’s data broker market is poised for growth through domain-specific innovation and digital infrastructure, it remains one of the most privacy-regulated and compliance-sensitive landscapes in Europe.

Asia Pacific Data Broker Market Trends

Asia Pacific is expected to register the fastest CAGR of 8.2% from 2025 to 2033, driven by its rapid digital transformation, e-commerce expansion, and surging demand for data-driven decision-making across industries. Countries such as China, India, Japan, and South Korea are accelerating digital infrastructure development including hyperscale data centers, 5G rollout, and smart city initiatives which is increasing data generation and consumption. Additionally, the rise of cloud-based data marketplaces is enabling businesses to procure and analyze brokered datasets such as transaction feeds, geo-location logs, and social sentiment data with unprecedented flexibility.Meanwhile, major firms are investing in localized API-accessible data services catered to regional needs like retail analytics and supply chain optimization. Consequently, this dynamic ecosystem fueled by infrastructure investment, regulatory openness, and tailored data platforms is positioning Asia Pacific as the fastest-growing and most opportunity-rich data broker market globally.

Japan data broker market is experiencing substantial growth, fueled by the increasing adoption of alternative data across sectors such as financial services, e-commerce, and mobility. Japanese companies are leveraging diverse data sources including geolocation intelligence, transaction records, and social media analytics to enhance decision-making, improve customer segmentation, and drive product innovation. In addition, the country’s advanced digital infrastructure, combined with its focus on automation, AI integration, and smart city initiatives, is creating strong demand for brokered datasets that support real-time insights. Moreover, growing collaboration between government agencies, telecom providers, and private data platforms is promoting more structured, ethical, and value-driven use of data. With rising investments in data marketplace platforms and heightened interest in compliance-focused monetization strategies, Japan is emerging as a leading regional hub for scalable and secure data brokerage solutions.

Data broker market in China is driven by both rapid commercial innovation and rigorous state control. The proliferation of government-backed data exchanges such as the Shanghai and Guiyang platforms enables vast volumes of structured and AI-training data to circulate, supported by a thriving ecosystem of annotators and alternative data services. In addition, major domestic players like Wind Information and Shanghai DZH cater to financial, manufacturing, and smart city use cases, leveraging geo-transactional and real-time data feeds. Moreover, China’s comprehensive legal framework comprising the PIPL, Data Security Law, Cybersecurity Law, and the forthcoming Network Data Security Regulations imposes strict controls on personal data usage, classification, and cross-border flows. Furthermore, Chinese authorities have pledged a crackdown on illegal “black and grey” data markets, particularly those trading sensitive surveillance and location-based information. Therefore, these dynamics converge to shape a market that balances explosive growth in domain-specific and AI training datasets with regulatory oversight and evolving compliance controls.

India data broker market is in a nascent but fast-evolving stage, driven by a surge in digital platforms, e-commerce expansion, and growing demand for personalized consumer insights in sectors like advertising, fintech, and retail. Although direct personal data monetization remains limited, many enterprises play indirect brokerage roles by managing marketing campaigns and handling consent-based data aggregation. Also, the sweeping Digital Personal Data Protection Act, 2023 (DPDP Act) and forthcoming regulations along with intermediary guidelines are prompting companies to invest heavily in consent-management platforms, AI-driven anonymization tools, and localization-compliant data handling solutions, especially given requirements such as data localization by the RBI for payments. At the same time, emerging models like financial account aggregators (FIPs) are gaining traction, facilitating structured data sharing for credit underwriting but also highlighting challenges around consent literacy and infrastructure readiness.

Key Data Broker Company Insights

Key players operating in the data broker industry are Acxiom LLC, Experian PLC, CoreLogic, Inc., Equifax Inc. and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2025, Acxiom partnered with LoopMe to introduce a survey-based custom audience solution, combining LoopMe’s mobile survey tech with Acxiom’s identity and marketing data. This initiative gives advertisers the ability to generate bespoke "high intent" segments in real time for targeted campaigns across DSPs.

-

In February 2025, LiveRamp introduced Cross‑Media Intelligence within its Data Collaboration Platform, enabling marketers to obtain deduplicated reporting across channels-from linear TV and CTV to digitalquickly and at scale. The upgrade offers up to 6× broader data coverage and delivers insights up to 4× faster, underscoring LiveRamp’s push toward seamless, identity-driven campaign optimization across media ecosystems.

-

In October 2024, LiveRamp announced partnerships with AI leaders Perplexity and Chalice, integrating authenticated marketing and custom audience activation within AI-powered search and social platform environments. The move reflects a strategic pivot to infuse machine learning insights directly into its RampID-driven data infrastructure.

Key Data Broker Companies:

The following are the leading companies in the data broker market. These companies collectively hold the largest market share and dictate industry trends.

- Acxiom LLC

- Experian PLC

- CoreLogic, Inc.

- Equifax Inc.

- Oracle America, Inc.

- Nielsen Holdings plc

- RELX PLC (LexisNexis Risk Solutions)

- LiveRamp Holdings, Inc.

- Epsilon Data Management, LLC

- Dun & Bradstreet, Inc.

- Intelius LLC

- TowerData, Inc.

- FullContact, Inc.

- Thomson Reuters Corporation

- TruthFinder LLC

Data Broker Market Report Scope

Report Attribute

Details

Market size in 2025

USD 291.65 billion

Revenue forecast in 2033

USD 512.45 billion

Growth rate

CAGR of 7.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report Pricing

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Data category, data type, pricing, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Acxiom LLC; Experian PLC; CoreLogic, Inc.; Equifax Inc.; Oracle America, Inc.; Nielsen Holdings plc; RELX PLC (LexisNexis Risk Solutions); LiveRamp Holdings Inc.; Epsilon Data Management, LLC; Dun & Bradstreet, Inc.; Intelius LLC; TowerData, Inc.; FullContact, Inc.; Thomson Reuters Corporation; TruthFinder LLC

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Broker Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global data broker market report based on data category, data type, pricing, end-use, and region.

-

Data Category Outlook (Revenue, USD Billion, 2021 - 2033)

-

Consumer Data

-

Business Data

-

Health Data

-

Financial Data

-

Location Data

-

-

Data Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Structured Data

-

Unstructured Data

-

Custom Structure Data

-

-

Pricing Outlook (Revenue, USD Billion, 2021 - 2033)

-

Subscription

-

Pay-per-Use

-

Hybrid

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

Retail & E-commerce

-

Healthcare

-

Media & Entertainment

-

IT & Telecom

-

Government

-

Automotive

-

Real Estate

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data broker market size was estimated at USD 277.97 billion in 2024 and is expected to reach USD 291.65 billion in 2025.

b. The global data broker market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2033 to reach USD 512.45 billion by 2033.

b. Consumer data segment accounted for the largest revenue share of 35.1% in 2024, driven by the surging demand for personalized marketing and real-time customer profiling across industries such as retail, BFSI, and media. Consumer data encompassing demographics, lifestyle attributes, purchase history, and online behavior offers insights that fuel advertising campaigns, customer segmentation, and lead scoring.

b. Some of the key companies operating in the data broker market include Acxiom LLC, Experian PLC, CoreLogic, Inc., Equifax Inc., Oracle America, Inc., Nielsen Holdings plc, RELX PLC (LexisNexis Risk Solutions), LiveRamp Holdings, Inc., Epsilon Data Management, LLC, Dun & Bradstreet, Inc., Intelius LLC, TowerData, Inc., FullContact, Inc., Thomson Reuters Corporation, TruthFinder LLC and Others

b. Organizations are moving from static demographic datasets to dynamic data streams that capture intent, location, transactions, and sentiment in near real time. Additionally, with the rise of programmatic advertising, fraud detection, and personalized engagement, businesses demand continuously updated datasets that reflect real-world changes in consumer behavior.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.