- Home

- »

- Communications Infrastructure

- »

-

Data Center Rack Market Size, Share & Growth Report, 2030GVR Report cover

![Data Center Rack Market Size, Share & Trends Report]()

Data Center Rack Market (2024 - 2030) Size, Share & Trends Analysis Report By Rack (Open Frame Rack, Cabinet, Others), By Height, By Width (19 Inch, 23 Inch), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-329-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Rack Market Summary

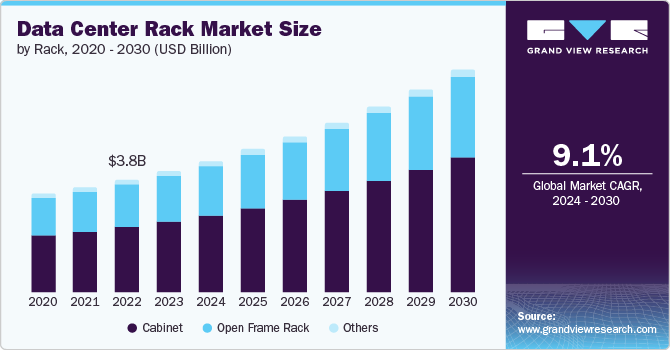

The global data center rack market size was estimated at USD 4,133.0 million in 2023 and is projected to reach USD 7,574.3 million by 2030, growing at a CAGR of 9.1% from 2024 to 2030. The data center rack market is driven by several key factors, reflecting the increasing demand for efficient and scalable data storage solutions.

Key Market Trends & Insights

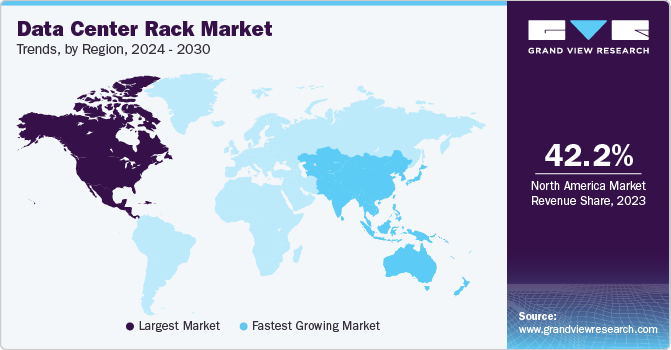

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Argentina is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, cabinet accounted for a revenue of USD 2,408.8 million in 2023.

- Cabinet is the most lucrative rack type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 4,133.0 Million

- 2030 Projected Market Size: USD 7,574.3 Million

- CAGR (2024-2030): 9.1%

- North America: Largest market in 2023

One of the primary drivers is the exponential growth in data generation across industries, necessitating enhanced data storage, management, and processing capabilities.

The proliferation of cloud computing and the rise of hyper-scale data centers are significantly boosting the need for advanced data center infrastructure, including high-capacity racks. Furthermore, the rapid adoption of Internet of Things (IoT) devices and edge computing is compelling organizations to deploy data centers closer to the data source, thus increasing the demand for flexible and modular rack solutions.

Technological advancements, such as high-density servers and advanced cooling technologies, propel market growth by optimizing space and energy efficiency within data centers. Additionally, stringent data security and compliance regulations are prompting enterprises to invest in robust data center infrastructure to ensure data integrity and security. The ongoing digital transformation across various sectors and the increasing penetration of artificial intelligence and big data analytics further underscores the critical need for scalable and resilient data center rack solutions, thereby driving market expansion.

High-density servers and advanced cooling technologies significantly propel the growth of the data center rack market by optimizing space utilization and energy efficiency within data centers. High-density servers, which offer greater processing power within a smaller physical footprint, enable data centers to maximize their computational capabilities without the need for extensive physical expansion. This increased density necessitates robust and flexible rack solutions capable of accommodating the higher power and cooling requirements associated with such servers.

Concurrently, advanced cooling technologies, such as liquid cooling and in-row cooling systems, address the thermal management challenges posed by high-density server deployments. These cooling solutions enhance the efficiency and reliability of data center operations by effectively dissipating heat, thereby preventing overheating and reducing energy consumption. By integrating these advanced technologies, data centers can achieve higher performance levels while maintaining operational efficiency, ultimately driving the demand for sophisticated data center rack systems that support these innovations.

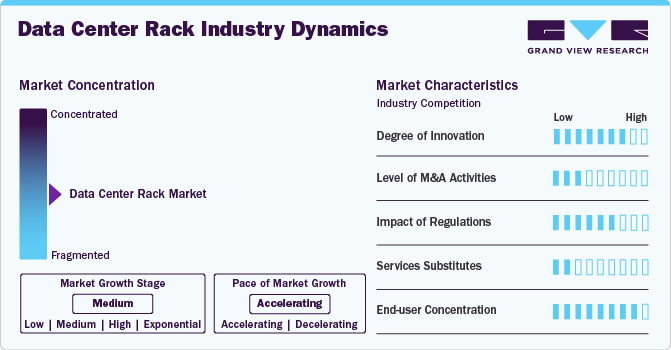

Market Concentration & Characteristics

The data center rack market can be characterized by the presence of several market players. These market players range from well-established industry giants to more specialized providers catering to specific custom racks or sizes. Furthermore, data center racks come in various types and sizes, including open frame racks, cabinets, and wall mounted racks. This caters to the diverse needs of different businesses and further contributes to the fragmented nature of the market.

Governments worldwide are imposing regulations aimed at reducing the environmental impact of data centers. This includes energy efficiency standards like the Energy Star program run by the U.S. Department of Energy and U.S. Environmental Protection Agency. Directives such as the European Union’s Ecodesign Directive, which sets requirements for energy-using products.

To facilitate efficient cooling, modern rack cabinets come equipped with integrated fans that improve air circulation, are compatible with liquid cooling systems to handle high-density setups, and incorporate airflow management tools like brush strips, grommets, and strategic cable organization to avoid blockages. In terms of cable management, these racks feature vertical and horizontal channels for neat cable arrangement and versatile entry points for easy access. Regarding security, the design includes lockable doors and panels to deter unauthorized access, with the option for electronic controls for advanced security, alongside features aimed at detecting and signaling any security breaches.

The fragmented nature of the data center rack market is prompting market players to focus on developing data center racks customized according to consumers' requirements to improve their brand positioning in untapped markets.

The data center rack market players face competition from various companies across different sectors. This includes established data center infrastructure providers, networking and telecommunications equipment manufacturers, IT hardware manufacturers, specialized rack manufacturers, emerging technology companies, and providers of alternative solutions.

Rack Insights

Cabinet rack held the largest market share of around 58% in 2023. Several key factors drive the growth of cloud-based data center rack. Cabinet racks are increasingly used in data centers because they provide secure, organized, and modular solutions for housing critical IT equipment. The rising demand for data storage and processing capabilities, spurred by the exponential growth in data generation plays a significant role.

Furthermore, the widespread adoption of cloud computing, necessitates the deployment of high-density servers that require advanced cabinet solutions to optimize space and power usage. Enhanced security features of cabinet racks, including lockable doors and advanced access control systems, are essential for safeguarding sensitive data and complying with stringent data protection regulations.

The open frame segment is expected to register a CAGR of 8.4% from 2024 to 2030. Open frame racks are favored for their superior airflow and cooling efficiency, critical in managing the heat generated by high-density server deployments. Without the encumbrance of side panels or doors, these racks allow unrestricted airflow, facilitating effective cooling and reducing the risk of equipment overheating. Additionally, open frame racks provide easier access to equipment for maintenance and upgrades, significantly enhancing operational efficiency and reducing downtime. This accessibility is particularly beneficial in dynamic data center environments requiring frequent adjustments and scaling.

Height Insights

The 42 U segment accounted for the largest market share of around 63.0% in 2023. The 42 U rack size emerged as the industry standard mainly because it perfectly aligns capacity, efficiency, and the use of physical space. This standardization primarily responds to the escalating needs for high-density server spaces, necessitating durable and expandable infrastructure to support expanding computational demands. The 42U rack accommodates numerous servers and networking devices by offering substantial vertical storage, optimizing data center space, and improving overall operational effectiveness.

The above 42 U segment is expected to register the highest CAGR from 2024 to 2030. As data generation and storage requirements continue escalating, organizations are increasingly seeking higher-capacity racks that can accommodate more equipment without requiring physical expansion of data center facilities. The 45U and 48U racks provide the additional vertical space needed to house high-density servers, networking equipment, and storage solutions, thereby maximizing the utilization of available floor space. Moreover, these taller racks enhance operational efficiency by reducing the number of aisles and optimizing airflow management, which is crucial for maintaining optimal cooling and energy efficiency.

Width Insights

The 19 inch segment accounted for the largest market share of around 71.0% in 2023. The 19 inch width has become the industry benchmark for rack-mounted equipment due to its compatibility with various IT and telecommunications hardware, including servers, storage devices, networking equipment, and power management systems. This universal compatibility facilitates easier integration and deployment of different equipment types, ensuring that data centers can maintain operational flexibility and scalability. Moreover, the 19 inch width is preferred for its space efficiency, allowing data centers to maximize their available floor space while accommodating high equipment density.

The 23 inch segment is expected to register the highest CAGR from 2024 to 2030. The 23 inch racks offer enhanced space and cable management capabilities, accommodating larger and more complex equipment configurations. This increased width allows for better airflow and cooling efficiency, addressing the escalating thermal management challenges associated with high-density computing environments.

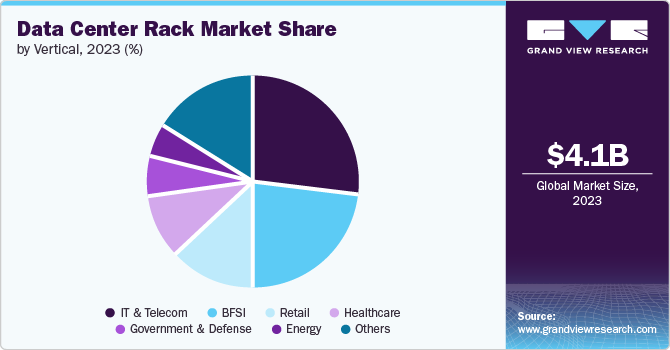

Vertical Insights

Based on vertical,IT & telecom segment accounted for the largest market share of around 27.0% in 2023. In the IT sector, the exponential growth of data generated by various applications, including cloud computing, big data analytics, and artificial intelligence, necessitates robust and scalable data storage and processing solutions. Data center racks provide the essential infrastructure to house high-density servers and storage devices efficiently, facilitating the seamless management and processing of large volumes of data.

Their standardized design ensures compatibility with a wide range of IT equipment, enabling easy integration and scalability as organizations expand their data center capacities. In the telecom sector, the rapid deployment of 5G networks and the increasing proliferation of Internet of Things (IoT) devices significantly boost the demand for advanced data center infrastructure.

The healthcare segment is expected to grow significantly over the forecast period. This growth is fueled by the increasing digitization of healthcare records, the adoption of advanced medical technologies, and the integration of innovative data analytics tools. Electronic health records (EHRs), telemedicine, wearable health devices, and AI-powered diagnostics generate vast amounts of data that require substantial storage and processing capabilities. Data center racks are essential for housing the high-density servers and networking equipment necessary to manage this influx of data efficiently and securely.

Regional Insights

North America data center rack marketheld the largest share of 42.20% in terms of revenue in 2023. Several key factors are driving the data center rack market in North America. Foremost among these is the rapid digital transformation across various industries, including technology, finance, healthcare, and retail, which generates an increasing demand for data storage and processing capabilities.

The proliferation of cloud computing, big data analytics, and the Internet of Things (IoT) further contributes to the need for advanced data center infrastructure. The region's continued investment in technological advancements and innovation also plays a crucial role, as emerging technologies like artificial intelligence and edge computing require significant computational power and efficient data management.

U.S. Data Center Rack Market Trends

The data center rack market of the U.S. is experiencing significant growth at a CAGR of 9.3% from 2024 to 2030. In the U.S., the data center rack market is driven by the proliferation of cloud computing services, the expansion of data-driven enterprises, and the adoption of advanced technologies such as AI and IoT. The country's robust IT infrastructure and the presence of leading technology companies further stimulate the demand for efficient and scalable data center solutions.

The growing investments in building new data centers in the U.S. also propel the market growth. For instance, as part of its plan to invest USD 13 billion in the construction of new data centers and offices across more than a dozen states in the U.S. in 2024, Google announced an additional USD 600 million investment in March 2024 to expand its data center in Pryor, Oklahoma. The Pryor site plays a crucial role in the company's global network of data centers, which supports Google searches, email services, photo storage, and maps.

Asia Pacific Data Center Rack Market Trends

Asia Pacific data center rack market is growing significantly at a CAGR of 9.9% from 2024 to 2030. The Asia Pacific region is witnessing rapid data center rack market growth due to the increasing digital transformation across various industries, particularly in emerging economies. The region's expanding internet user base, coupled with the rising adoption of cloud services and big data analytics, is fueling the demand for data center infrastructure. Investments in smart city projects and the expanding e-commerce sector also contribute to the market's expansion.

The data center rack market of China is growing significantly at a CAGR of 9.7% from 2024 to 2030. China's data center rack market is propelled by the country's significant investments in digital infrastructure and the rapid growth of its tech industry. The widespread adoption of 5G technology, AI, and IoT applications generates substantial data, necessitating advanced data center solutions. Government initiatives promoting digital economy development, development of digital infrastructure, and stringent data protection regulations further drive the market.

For instance, Shanghai, a Chinese megacity, plans to develop a USD 30 billion high-tech infrastructure cluster by 2026, with investors playing a pivotal role. This initiative, which includes extensive upgrades to 5G networks and computing capabilities, is expected to significantly enhance Shanghai's internet speeds and cellphone coverage.

India data center rack market is growing significantly at a CAGR of 11.5% from 2024 to 2030. The data center rack market in India is driven by the increasing digitalization of businesses, the growth of cloud computing services, and the government's push towards a Digital India initiative. The proliferation of internet services and the surge in data consumption, mainly due to the rise of online platforms and e-commerce, necessitate robust data center infrastructure. Additionally, favorable policies and incentives for data center investments support market growth.

The data center rack market of Japan is growing significantly at a CAGR of around 8.9% from 2024 to 2030. Japan's data center rack market is influenced by the country's advanced technological landscape and the adoption of cutting-edge innovations such as AI, robotics, and IoT. Finance, healthcare, and manufacturing sectors drive the demand for high-performance computing and data storage solutions.

Europe Data Center Rack Market Trends

Europe data center rack market is growing significantly at a CAGR of 8.0% from 2024 to 2030. The data center rack market in Europe is expanding due to the region's strong emphasis on data privacy and security, exemplified by the General Data Protection Regulation (GDPR). The increasing adoption of cloud services, big data analytics, and digital transformation initiatives across various industries are significant drivers. Additionally, the push for sustainable and energy-efficient data centers aligns with Europe's commitment to reducing carbon emissions, further fueling market growth.

The data center rack market of the UK is growing significantly at a CAGR of 8.2% from 2024 to 2030. The United Kingdom's data center rack market is driven by the country's robust digital economy and the growing demand for cloud services and data analytics. The financial services sector generates significant data processing and storage needs, necessitating advanced data center infrastructure. According to UK Finance, the number of annual transactions made with contactless payment cards reached 13.1bn in 2021, up 36.0% from 2020.

Germany data center rack market is growing significantly at a CAGR of 8.5% from 2024 to 2030. Germany's data center rack market is driven by the country's strong industrial base and the rapid adoption of Industry 4.0 technologies. The increasing use of cloud computing, IoT, and AI in manufacturing and other sectors drives demand for scalable and secure data center solutions. Moreover, Germany's commitment to energy-efficient technologies supports the growth of the data center rack market.

The data center rack market of France is growing significantly at a CAGR of 8.7% from 2024 to 2030. In France, the data center rack market is driven by the digital transformation of businesses and the growing adoption of cloud services and big data analytics. The development of new data centers is expected to propel market growth. For instance, in May 2024, Microsoft announced a plan to invest EUR 4 billion (USD 4.31 billion) in data center infrastructure in France. For the first time, Microsoft will purchase renewable energy through power purchase agreements (PPAs) in the country. A new data center will be constructed near Mulhouse in the Grand Est region of eastern France, and the company's existing facilities in Paris and Marseille will be expanded.

Middle East & Africa Data Center Rack Market Trends

Middle East & Africa data center rack market is growing significantly at a CAGR of 9.3% from 2024 to 2030. The data center rack market in the Middle East and Africa is driven by the region's digital transformation initiatives and increasing adoption of cloud services. Governments and enterprises invest heavily in IT infrastructure to support the growing demand for digital services, e-commerce, and smart city projects.

Additionally, the proliferation of mobile and internet users and the rise of data-intensive applications and IoT necessitates robust and scalable data center solutions. The need for enhanced data security and compliance with regional regulations further contributes to the demand for advanced data center racks.

The data center rack market of Saudi Arabia is growing significantly at a CAGR of 9.9% from 2024 to 2030. The data center rack market in Saudi Arabia is propelled by the government's ambitious Vision 2030 plan, which aims to diversify the economy and promote digital transformation. Significant investments in smart city projects, such as NEOM and the Red Sea Project, drive the demand for cutting-edge data center infrastructure.

Key Data Center Rack Company Insights

Some of the key players operating in the market include Schneider Electric and Vertiv Group Corp., among others.

-

Schneider Electric is a global energy management and automation company that provides innovative solutions for data center infrastructure, including data center racks. The company's racks are designed to offer robust, scalable, and efficient support for critical IT equipment. These solutions ensure optimal cooling, power distribution, and cable management, which is essential for maintaining modern data centers' performance and reliability.

-

Vertiv Group Corp. offers a comprehensive range of solutions tailored to meet the evolving needs of modern data centers worldwide. As a global provider of critical infrastructure technologies and services, Vertiv specializes in designing and manufacturing data center racks that optimize space, enhance cooling efficiency, and ensure reliable performance.

AMCO Enclosures and Chatsworth Products are some of the emerging market participants in the data center rack market.

-

AMCO Enclosures specializes in designing and manufacturing robust racks and enclosures that provide structural integrity and optimal airflow management, which are essential for maintaining equipment performance and reliability. Their products are known for their durability and customization options, catering to diverse industry needs.

-

Chatsworth Products (CPI) is recognized for its innovative approach to data center infrastructure solutions, including a wide range of racks, cabinets, and cable management systems. CPI's products emphasize efficiency, scalability, and sustainability, addressing the evolving requirements of data centers worldwide. Their solutions integrate advanced thermal management technologies and support for high-density deployments, ensuring optimal performance and energy efficiency.

Key Data Center Rack Companies:

The following are the leading companies in the data center rack market. These companies collectively hold the largest market share and dictate industry trends.

- AMCO Enclosures

- Belden Inc.

- Chatsworth Products

- Cisco Systems, Inc.

- Dell Inc.

- Eaton

- Fujitsu

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Legrand

- nVent

- Panduit Corp.

- Rittal GmbH & Co. KG

- Schneider Electric

- Vertiv Group Corp.

Recent Developments

-

In March 2024, Eaton announced the North American launch of an innovative modular data center solution designed to swiftly address the growing demands for edge computing, machine learning, and AI. The SmartRack modular data centers from Eaton can be deployed within days in various settings, including colocation or enterprise data centers, warehouses, and manufacturing facilities. Eaton’s SmartRack modular data centers integrate cooling systems, IT racks, and service enclosures to deliver a performance-optimized solution for critical IT equipment, supporting up to 150 kW of equipment load.

-

In April 2022, Rittal GmbH & Co. KG, a global manufacturer and provider of system solutions for industrial and IT enclosures, has announced a U.S. partnership with TD SYNNEX, a global distributor and solutions aggregator for the IT ecosystem. Through this partnership, Rittal will distribute IT rack enclosures, solutions, and accessories to information technology (IT) customers via TD SYNNEX.

-

In August 2022, Vertiv Group Corp. unveiled the Vertiv MegaMod Plus and Vertiv MegaMod, turnkey prefabricated modular (PFM) data center solutions across Europe, the Middle East, and Africa (EMEA). These high-quality prefabricated modules can be deployed in expandable units of 0.5 or 1 megawatt and support IT loads of up to 2 megawatts or more.

Data Center Rack Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.48 billion

Revenue forecast in 2030

USD 7.57 billion

Growth rate

CAGR of 9.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Rack, height, width, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

AMCO Enclosures; Belden Inc.; Chatsworth Products; Cisco Systems, Inc.; Dell Inc.; Eaton; Fujitsu; Hewlett Packard Enterprise Development LP; International Business Machines Corporation; Legrand; nVent; Panduit Corp.; Rittal GmbH & Co. KG; Schneider Electric; Vertiv Group Corp.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Rack Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global data center rack market report based on rack, height, width, vertical, and region:

-

Rack Outlook (Revenue; USD Billion; 2018 - 2030)

-

Open Frame Rack

-

Cabinet

-

Others

-

-

Height Outlook (Revenue; USD Billion; 2018 - 2030)

-

Below 42 U

-

42 U

-

Above 42 U

-

-

Width Outlook (Revenue; USD Billion; 2018 - 2030)

-

19 Inch

-

23 Inch

-

Others

-

-

Vertical Outlook (Revenue; USD Billion; 2018 - 2030)

-

BFSI

-

Government & Defense

-

Healthcare

-

IT & Telecom

-

Energy

-

Retail

-

Others

-

-

Regional Outlook (Revenue; USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center rack market size was estimated at USD 4.13 billion in 2023 and is expected to reach USD 4.48 billion in 2024

b. The global data center rack market is expected to grow at a compound annual growth rate of 9.1% from 2024 to 2030 to reach USD 7.57 billion by 2030

b. North America dominated the data center rack market with a market share of 42.2% in 2023. Several key factors are driving the data center rack market in North America. Foremost among these is the rapid digital transformation across various industries, including technology, finance, healthcare, and retail, which generates an increasing demand for data storage and processing capabilities.

b. Some key players operating in the data center rack market include AMCO Enclosures, Belden Inc., Chatsworth Products, Cisco Systems, Inc., Dell Inc., Eaton, Fujitsu, Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Legrand, nVent, Panduit Corp., Rittal GmbH & Co. KG, Schneider Electric, and Vertiv Group Corp.

b. The data center rack market is driven by several key factors, reflecting the increasing demand for efficient and scalable data storage solutions. One of the primary drivers is the exponential growth in data generation across industries, necessitating enhanced data storage, management, and processing capabilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.