- Home

- »

- Next Generation Technologies

- »

-

Data Fabric Market Size And Share, Industry Report, 2033GVR Report cover

![Data Fabric Market Size, Share & Trends Report]()

Data Fabric Market (2025 - 2033) Size, Share & Trends Analysis Report By Component, By Deployment, By Type, By Enterprise Size, By Business Applications, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-976-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Fabric Market Summary

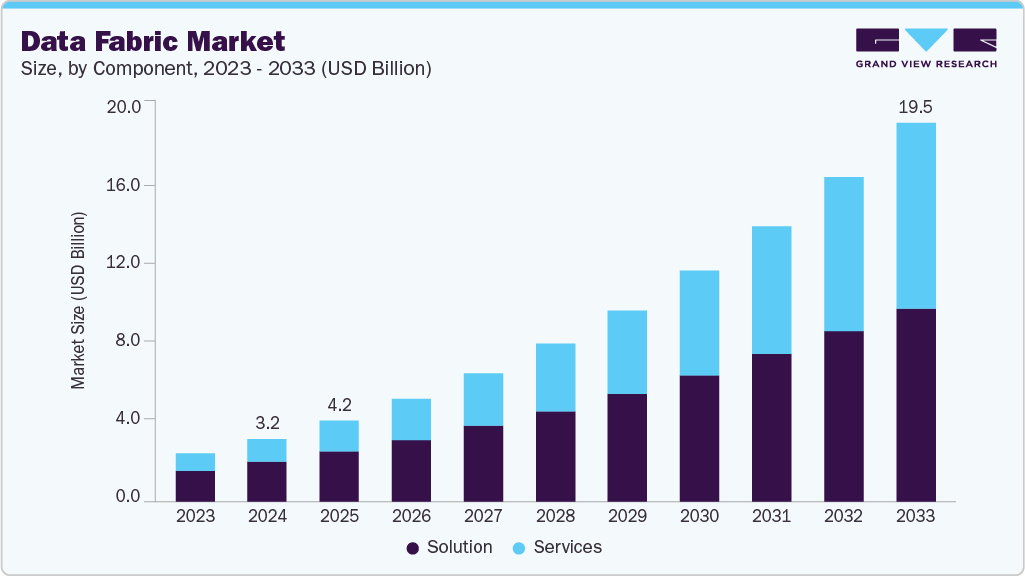

The global data fabric market size was estimated at USD 3.25 billion in 2024 and is projected to reach USD 19.54 billion by 2033, growing at a CAGR of 21.3% from 2025 to 2033. The growth in the increasing volume of enterprise data and IoT devices, the rising adoption of edge computing and 5G technologies, the growing demand for data governance and compliance solutions, and the expanding digital transformation initiatives across industries.

Key Market Trends & Insights

- North America dominated the global data fabric market, accounting for the largest revenue share of over 44% in 2024.

- The data fabric market in the U.S. led the North America market and held the largest revenue share in 2024.

- By component, the solution segment led the market, holding the largest revenue share of over 63% in 2024.

- By type, the disk-based data fabric segment held the dominant position in the market and accounted for the leading revenue share of over 74% in 2024.

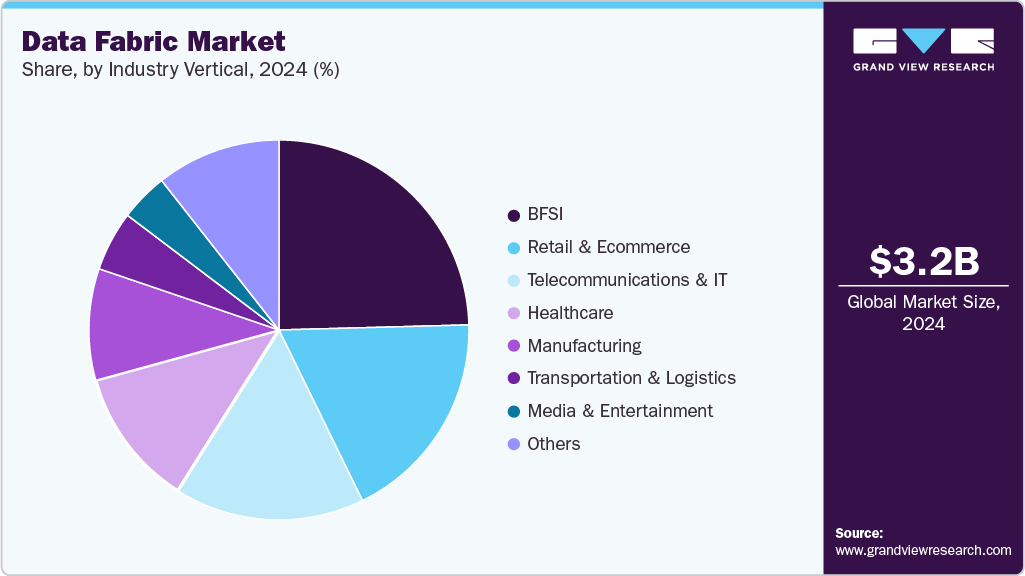

- By industry vertical, the BFSI segment is expected to grow at the fastest CAGR of over 23% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 3.25 Billion

- 2033 Projected Market Size: USD 19.54 Billion

- CAGR (2025-2033): 21.3%

- North America: Largest market in 2024

The increasing demand for real-time analytics and edge computing is pushing enterprises to adopt data fabric solutions that process and analyze data instantly. Businesses are leveraging these technologies to make faster, more informed decisions in sectors like manufacturing, healthcare, and logistics. Data fabric architectures enable data processing closer to the source, reducing latency and improving response times. This capability is crucial for mission-critical applications that rely on immediate data insights. As a result, real-time analytics within data fabrics is becoming a key differentiator for operational efficiency and competitiveness.The growing demand for enhanced data security is pushing organizations to adopt data fabrics built on zero-trust principles. With the rise of cyber threats and data breaches, enterprises are prioritizing secure, identity-driven, and policy-based access control mechanisms within their data infrastructure. Data fabric solutions are now embedding advanced encryption, tokenization, and continuous monitoring to safeguard sensitive data. These capabilities ensure compliance with global regulations while reducing vulnerabilities across distributed environments. As a result, security-driven data fabrics are becoming indispensable for organizations operating in high-risk and regulated sectors.

The demand for automated orchestration of data pipelines is reshaping how enterprises handle large-scale data movement and transformation. Manual data integration and monitoring are becoming unsustainable as organizations manage billions of data records across hybrid environments. Data fabric solutions are now embedding workflow automation, intelligent scheduling, and adaptive error handling to streamline pipeline management. This shift reduces operational overhead, minimizes downtime, and enhances data delivery efficiency. As data complexity increases, automated pipeline orchestration stands out as a critical driver of productivity and reliability.

Component Insights

The solution segment significantly contributed to market growth in 2024, accounting for over 63% of global revenue, driven by the growing demand for unified data management and seamless integration across hybrid and multi-cloud environments. Enterprises are increasingly deploying data fabric solutions to improve data accessibility, enhance decision-making, and eliminate information silos. The surge in AI and machine learning adoption has further accelerated the need for automated data integration, metadata management, and intelligent governance features. Organizations are also prioritizing real-time analytics and data virtualization to gain faster insights from distributed sources. This strong momentum underscores the solution segment’s central role in enabling operational agility and supporting data-driven transformation across industries.

The services segment is expected to grow at the fastest CAGR during the forecast period, propelled by the increasing demand for consulting, deployment, and integration support to manage complex data fabric implementations. Enterprises are seeking expert guidance to align data strategies with business goals and ensure smooth adoption of advanced data fabric platforms. The growing need for training, maintenance, and managed services is further driving market expansion as organizations look to optimize performance and minimize downtime. Service providers are also focusing on customizing solutions to meet industry-specific requirements and compliance standards. This growing reliance on professional and managed services is strengthening the segment’s role in enabling scalable, efficient, and high-performing data fabric operations.

Deployment Insights

The on-premises segment accounted for the significant market revenue share in 2024, owing to the growing preference among enterprises for greater control over data security, privacy, and compliance. Organizations operating in highly regulated industries such as banking, healthcare, and government continue to rely on on-premises deployments to safeguard sensitive information and meet stringent data protection requirements. The need for low-latency data processing and seamless integration with legacy infrastructure further supports the adoption of on-premises data fabric solutions. Many enterprises are also prioritizing hybrid deployment models that combine on-premises reliability with selective cloud scalability. This trend underscores the enduring significance of on-premises architectures in ensuring secure, efficient, and compliant data operations.

The cloud segment is expected to grow at the fastest CAGR over the forecast period, driven by the increasing demand for scalable, flexible, and cost-efficient data management solutions. Enterprises are rapidly shifting toward cloud-based data fabrics to enable real-time data access, faster deployment, and improved collaboration across distributed environments. The rising adoption of hybrid and multi-cloud strategies is further accelerating the need for cloud-integrated platforms that ensure seamless connectivity and unified governance. Vendors are continuously enhancing their offerings with AI-enabled automation, self-service capabilities, and advanced analytics to meet the evolving needs of the enterprise. This growing preference for cloud deployment underscores its role in driving agility, innovation, and digital transformation across the global data fabric industry.

Type Insights

The disk-based data fabric segment accounted for the significant market revenue share in 2024, driven by the increasing demand for reliable, high-capacity, and cost-effective storage solutions for large-scale data environments. Enterprises continue to favor disk-based architectures due to their ability to efficiently manage both structured and unstructured data while maintaining consistent performance. The growing volume of enterprise data generated from IoT devices, analytics platforms, and transactional systems has further boosted adoption. Organizations are leveraging disk-based data fabrics to ensure data durability, scalability, and ease of integration with existing infrastructure. This sustained reliance on disk-based systems highlights their importance in supporting stable and efficient data management operations across industries.

The in-memory data fabric segment is expected to grow at the fastest CAGR during the forecast period, fueled by the increasing demand for real-time data processing and low-latency analytics. Enterprises are adopting in-memory architectures to accelerate decision-making by enabling instant access to critical data across applications and business functions. The surge in AI, machine learning, and IoT-driven workloads is further driving the need for high-speed data fabrics that can handle complex computations in real time. Organizations are leveraging in-memory solutions to enhance performance in areas such as fraud detection, predictive analytics, and dynamic pricing. This growing shift toward faster, more responsive data architectures positions the in-memory segment as a key driver of innovation and agility in the data fabric industry.

Enterprise Size Insights

The large enterprises segment accounted for the significant market revenue share in 2024, driven by the increasing adoption of data fabric solutions to manage massive and complex data volumes across global operations. These organizations are prioritizing scalable and integrated data architectures to enhance decision-making, improve operational efficiency, and maintain a competitive advantage. The increasing focus on digital transformation, AI-driven analytics, and regulatory compliance has further accelerated the deployment of data fabrics among large enterprises. Many are investing in advanced automation, governance, and security capabilities to ensure seamless data access and control across departments. This growing reliance on data fabric technologies underscores their critical role in enabling enterprise-wide data unification and strategic insight generation.

The small and medium enterprises segment is expected to grow at the fastest CAGR over the forecast period, propelled by the increasing need for affordable, scalable, and easy-to-deploy data management solutions. SMEs are rapidly adopting cloud-based data fabric platforms to simplify integration, improve agility, and enhance decision-making without incurring heavy infrastructure investments. The growing availability of subscription-based and modular data fabric offerings is enabling smaller organizations to access enterprise-grade capabilities at lower costs. These solutions enable SMEs to streamline data workflows, enhance customer insights, and accelerate digital transformation initiatives. As a result, the rising focus on flexibility, efficiency, and cost optimization is fueling strong growth in the SME adoption of data fabric technologies.

Business Applications Insights

The fraud detection and security management segment accounted for the significant market revenue share in 2024, driven by the increasing need to safeguard sensitive enterprise data and digital transactions from sophisticated cyber threats. Organizations across various sectors, such as banking, e-commerce, and healthcare, are leveraging data fabric solutions to detect anomalies, monitor suspicious activities, and prevent data breaches in real time. The integration of AI and machine learning within data fabrics enhances threat detection accuracy and enables predictive security analytics. Enterprises are also focusing on unified data visibility and compliance management to strengthen risk mitigation strategies. This heightened emphasis on proactive security and fraud prevention continues to position the segment as a vital driver of data fabric industry growth.

The governance, risk, and compliance management segment is expected to grow at the significant CAGR over the forecast period, propelled by the increasing enforcement of data protection regulations and the growing need for transparent and accountable data practices. Enterprises are adopting data fabric solutions to establish centralized governance frameworks that ensure data integrity, traceability, and regulatory compliance across diverse environments. The increasing complexity of global regulations, such as GDPR, CCPA, and HIPAA, is driving organizations to invest in automated compliance monitoring and policy enforcement capabilities. Data fabric platforms equipped with lineage tracking, audit trails, and access control are helping enterprises minimize risks and maintain operational transparency. This strong focus on regulatory alignment and risk reduction is positioning the governance, risk, and compliance segment as a key growth catalyst in the data fabric industry.

Industry Vertical Insights

The BFSI segment accounted for the largest market revenue share in 2024, fueled by the growing need for real-time data integration, fraud detection, and regulatory compliance management. Financial institutions are increasingly leveraging data fabric solutions to unify siloed data from multiple sources, enabling faster and more accurate decision-making. The adoption of AI-driven data governance and analytics frameworks is enabling banks and insurers to enhance operational efficiency and deliver personalized customer experiences. Rising incidences of cyber threats and the need for secure, compliant data environments are further driving investments in advanced data fabric architectures. Moreover, the shift toward open banking and digital financial ecosystems continues to accelerate the BFSI sector’s reliance on intelligent, connected data infrastructure.

The retail & ecommerce segment is expected to grow at the significant CAGR over the forecast period, driven by the increasing adoption of data fabric solutions to enhance customer experience and optimize supply chain operations. Retailers are leveraging real-time data integration and analytics to gain actionable insights into consumer behavior, inventory management, and pricing strategies. The rapid expansion of omnichannel retail and personalized marketing is amplifying the need for unified data architectures that connect online and offline customer touchpoints. Data fabric platforms are also enabling seamless integration of AI and automation to improve product recommendations and demand forecasting. Furthermore, the surge in digital transactions and e-commerce platforms is compelling for enterprises to invest in secure, scalable, and agile data infrastructure to maintain a competitive advantage.

Regional Insights

The North America data fabric industry is anticipated to hold a revenue share of over 44% in 2024, driven by the widespread adoption of advanced analytics and AI-driven data integration platforms. Growing investments in hybrid cloud infrastructure and enterprise digital transformation initiatives are further accelerating market expansion. The region benefits from strong participation by leading vendors such as IBM, Informatica, and Cloudera, who are enhancing data interoperability across complex IT environments. Increasing focus on real-time data governance and regulatory compliance continues to position North America as a major hub for data fabric innovation.

U.S. Data Fabric Market Trends

The U.S. data fabric industry is expected to grow significantly in 2024, fueled by increasing enterprise demand for unified data management across hybrid and multi-cloud ecosystems. Rapid advancements in AI, machine learning, and automation are driving organizations to adopt scalable data fabric solutions for improved decision-making. Major tech companies and hyperscalers are actively investing in cloud-native data fabric architectures to strengthen data accessibility and operational agility. Additionally, the rise of data-intensive industries such as BFSI, healthcare, and retail is amplifying the demand for secure and intelligent data connectivity.

Europe Data Fabric Market Trends

The data fabric industry in Europe is expected to grow significantly over the forecast period, supported by the rising adoption of digital transformation and cloud modernization initiatives. European enterprises are increasingly prioritizing data sovereignty and governance frameworks to comply with GDPR and other regional data protection laws. The integration of AI-driven analytics and automation tools within data fabric platforms is enhancing operational efficiency across sectors. Furthermore, growing collaborations between cloud providers and enterprise software vendors are accelerating the deployment of data fabric solutions across the continent.

Asia Pacific Data Fabric Market Trends

The data fabric industry in Asia Pacific is anticipated to register the fastest CAGR of over 24% during the forecast period, driven by rapid digitization and growing cloud adoption across emerging economies. Expanding investments in AI, big data analytics, and IoT are boosting the need for unified and scalable data architectures. Countries such as China, Japan, and India are leading the shift toward intelligent data integration to enhance enterprise productivity and innovation. The proliferation of data-intensive industries and government-led smart infrastructure initiatives further solidifies the Asia Pacific’s position as the fastest-growing regional market.

Key Data Fabric Company Insights

Some key companies in the data fabric industry are IBM, SAP, Oracle, Informatica Inc., and Cloudera Inc.

-

SAP’s Data Fabric offerings are built around its Business Technology Platform (BTP), which seamlessly integrates data across SAP and non-SAP systems. The company enables enterprises to create a unified data layer that supports analytics, AI, and business intelligence. SAP’s strength lies in its ability to connect operational and analytical data to deliver contextual insights in real time. With its focus on enterprise digital transformation, SAP is expanding Data Fabric capabilities through partnerships with Snowflake, Google Cloud, and AWS.

-

Oracle delivers Data Fabric capabilities through its Oracle Cloud Infrastructure (OCI) and Oracle Data Management suite, offering an integrated platform for data integration, governance, and analytics. The company’s data fabric approach emphasizes autonomous data management using AI and machine learning. Oracle’s strong cloud ecosystem and advanced database technologies enable unified access to structured and unstructured data. Its commitment to hybrid and multi-cloud interoperability positions it as a leading enterprise data solutions provider.

Key Data Fabric Companies:

The following are the leading companies in the data fabric market. These companies collectively hold the largest Market share and dictate industry trends.

- Atlan Pte. Ltd

- IBM

- Oracle

- Talend

- SAP

- Informatica Inc.

- Cloudera Inc.

- TIBCO Software Inc.

- Amazon Web Services, Inc.

- data.world, Inc.

Recent Developments

-

In November 2025, SAP partnered with Snowflake to integrate SAP’s Business Data Cloud with Snowflake’s AI Data Cloud, creating a unified business data fabric for enterprises. The collaboration introduces the SAP Snowflake solution extension, enabling seamless and secure data sharing between SAP and Snowflake environments without duplication. This integration allows organizations to unify SAP and non-SAP data in real time, enhancing analytics, AI-driven insights, and data governance. Scheduled for general availability in early 2026, the initiative marks a major step toward enabling intelligent, scalable, and cost-efficient enterprise data management.

-

In May 2025, Teradata announced a strategic collaboration with ServiceNow to integrate Teradata’s hybrid, multi-cloud analytics platform with ServiceNow’s Workflow Data Fabric. The partnership enables organizations to power AI agents and autonomous workflows using real-time, governed enterprise data. Through a zero-copy data connector, the integration allows secure access to data without replication, enhancing efficiency and data integrity. Scheduled for release in the second half of 2025, this collaboration aims to accelerate intelligent, AI-driven decision-making and workflow automation across enterprise environments.

-

In April 2025, Kinaxis partnered with Databricks to accelerate AI-powered supply chain orchestration. The collaboration integrates the Kinaxis Maestro platform with the Databricks Data Intelligence Platform, enabling unified data management, governance, and advanced analytics across supply chain networks. This partnership allows organizations to merge diverse data sources from procurement and inventory to external signals like weather and market trends into a single, intelligent data fabric. Together, Kinaxis and Databricks aim to enhance real-time decision-making, resilience, and agility across global supply chain operations.

-

In March 2025, Hewlett Packard Enterprise (HPE) unveiled a new intelligent unified data layer to power the emerging agentic AI era. The solution integrates HPE’s high-performance data fabric and storage systems, including Alletra Storage MP X10000, with the NVIDIA AI Data Platform to deliver AI-ready, governed data across hybrid and multi-vendor environments. It enables seamless data access from edge to cloud through HPE GreenLake, while embedding governance, orchestration, and intelligence into enterprise data pipelines. Expected to launch in Summer 2025, the initiative underscores HPE’s commitment to simplifying data infrastructure and accelerating enterprise-scale AI innovation.

Data Fabric Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.18 billion

Revenue forecast in 2033

USD 19.54 billion

Growth rate

CAGR of 21.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, type, enterprise size, business applications, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Atlan Pte. Ltd; IBM; Oracle; Talend; SAP; Informatica Inc.; Cloudera Inc.; TIBCO Software Inc.; Amazon Web Services Inc.; data.world Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Fabric Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global data fabric market report based on component, deployment, type, enterprise size, business applications, industry vertical, and region.

-

Component Outlook (Revenue, USD Million, 2021-2033)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2021-2033)

-

On-Premises

-

Cloud

-

-

Type Outlook (Revenue, USD Million, 2021-2033)

-

Disk-based Data Fabric

-

In-memory Data Fabric

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021-2033)

-

Small and Medium Enterprises

-

Large Enterprises

-

-

Business Applications Outlook (Revenue, USD Million, 2021-2033)

-

Fraud Detection and Security Management

-

Governance, Risk and Compliance Management

-

Customer Experience Management

-

Sales and Marketing Management

-

Business Process Management

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2021-2033)

-

BFSI

-

Telecommunications & IT

-

Retail & Ecommerce

-

Healthcare

-

Manufacturing

-

Transportation & Logistics

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021-2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global data fabric market size was estimated at USD 3.25 billion in 2024 and is expected to reach USD 4.18 billion in 2025.

b. The global data fabric market is projected to grow at a compound annual growth rate (CAGR) of 21.3% from 2025 to 2033, reaching a value of USD 19.54 billion by 2033.

b. North America dominated the data fabric market, accounting for a share of over 44% in 2024, driven by rapid cloud adoption, growing enterprise demand for real-time data integration, and strong investments in AI-enabled data management platforms.

b. Some key players operating in the data fabric market include Atlan Pte. Ltd, IBM, Oracle, Talend, SAP, Informatica Inc., Cloudera Inc., TIBCO Software Inc., Amazon Web Services Inc., and data.world Inc.

b. Key factors driving market growth include the rising demand for real-time data integration across hybrid environments, the increasing adoption of AI and advanced analytics, the growing need for unified data governance and security, and the rapid migration of enterprises to cloud-native architectures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.