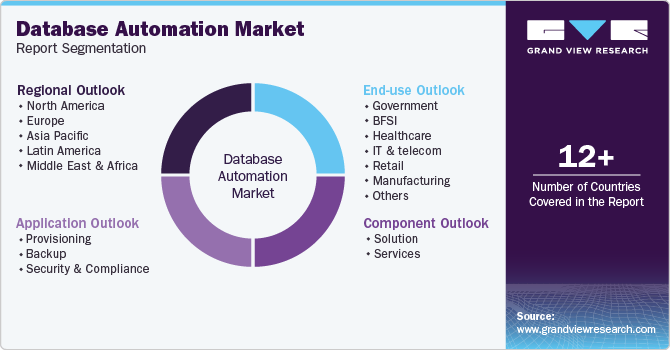

Database Automation Market Size, Share & Trends Analysis Report By Component (Solution, Service), By Application (Provisioning, Backup, Security And Compliance), By End-use (Government, BFSI, Healthcare, Retail), By Region, And Segment Forecasts 2025 - 2030

- Report ID: GVR-4-68040-568-8

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Database Automation Market Size & Trends

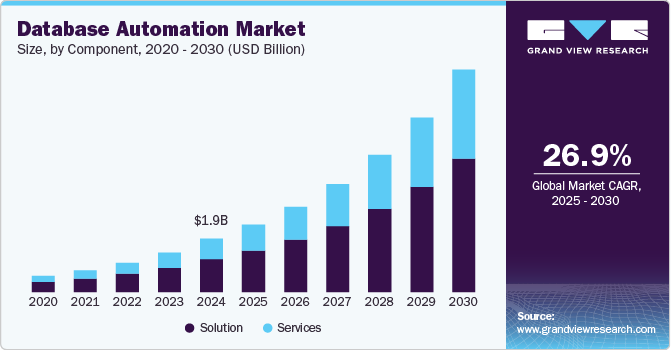

The global database automation market size was estimated at USD 1,934.0 million in 2024 and is projected to grow at a CAGR of 26.9% from 2025 to 2030. Enterprises are actively upgrading their core IT infrastructure to remain competitive and efficient. This modernization effort is increasing the need for database automation tools that streamline migration processes. Organizations are also seeking automated systems that ensure regulatory compliance with minimal manual oversight.

Simplified database maintenance is becoming a priority as enterprises aim to reduce operational complexity. In September 2024, Oracle Corporation and Amazon Web Services, Inc. announced a strategic partnership to launch Oracle Database@AWS. This collaboration enables customers to access Oracle Exadata Database and Oracle Autonomous Database Service directly within AWS, simplifying the migration and deployment of enterprise workloads to the cloud while enhancing agility, flexibility, and security.

Demand for AI-powered automation is increasing as enterprises prioritize systems that can understand context and support decision-making. AI agents are evolving to require deeper memory structures such as context retrieval and semantic understanding. This shift is driving the need for intelligent data platforms that can manage fast, complex, and dynamic data interactions. Real-time data processing is becoming essential to ensure efficient and responsive automation workflows. Data infrastructure providers that support advanced AI integration are gaining more relevance in enterprise automation strategies. Companies are integrating AI with automation to improve efficiency and decision-making using real-time data platforms. For instance, in April 2025, UiPath, a U.S.-based software company, and Redis are expanding their collaboration to support agentic automation by integrating Redis’ real-time data and memory capabilities into UiPath’s on-premises automation solutions. This collaboration enables smarter, faster AI agents through Redis-powered features such as semantic caching, routing, and vector search, enhancing UiPath’s Agent Builder and overall automation performance.

As businesses increasingly adopt cloud solutions, there is a notable rise in demand for cloud-native database automation tools. Hybrid solutions are becoming more prevalent, allowing seamless integration between on-premise and cloud databases. These tools offer businesses greater flexibility, enabling them to manage their databases more efficiently across multiple environments. Cloud-native automation streamlines tasks such as provisioning, scaling, and performance monitoring. Hybrid models provide the advantage of data portability, ensuring businesses can easily move workloads between environments. The growing demand for scalability drives the development of more robust database automation platforms. This shift enables businesses to reduce operational costs while maintaining optimal performance. Businesses benefit from improved agility, adapting quickly to changing needs or workloads. The cloud transition offers long-term operational benefits, contributing to more sustainable growth.

Component Insights

In terms of component, solution segment dominates the database automation market is anticipated to hold 61.5% in 2024. This dominance is driven by the increasing demand for comprehensive, end-to-end automation tools. These solutions streamline database management, significantly reducing manual intervention and improving operational efficiency. They enhance scalability, security, and performance, allowing businesses to adapt to growing data needs without compromising quality. As cloud adoption grows, the need for scalable and flexible database management solutions continues to rise, driving the demand for advanced automation tools. With businesses focusing on reducing operational costs and improving time-to-market, solutions will continue to lead the database automation market.

The services segment in the database automation market is experiencing significant growth. As businesses adopt more complex automation solutions, the demand for professional services rises. These services include consulting, integration, and support, helping companies to optimize their database operations. Managed services, in particular, are growing as organizations seek experts to handle their database needs. The need for ongoing maintenance and troubleshooting also drives the expansion of this segment. Services enable businesses to leverage the capabilities of database automation solutions fully.

Application Insights

The Provisioning segment accounted for the largest market revenue share in 2024. They automate database creation, configuration, and scaling across environments. This reduces time spent on manual setup and minimizes errors during deployment. Organizations benefit from faster rollout of applications and improved consistency in database environments. The efficiency gains help teams focus on strategic initiatives rather than repetitive tasks. As businesses demand rapid delivery pipelines, provisioning tools have become essential components of database automation. These tools enable seamless scaling as companies grow, supporting their evolving infrastructure needs.

Security and Compliance offerings are experiencing robust growth in the database automation market. These tools automate vulnerability assessments, patch management, and audit logging processes. They help ensure databases meet regulatory requirements and maintain data integrity under evolving standards. Automated security workflows reduce the risk of breaches and simplify audit compliance reporting. Companies investing in digital transformation are prioritizing these solutions to protect sensitive information. Continued focus on data privacy and cyber threats will further expand this category. As regulations become more stringent, the demand for automated compliance solutions will likely intensify.

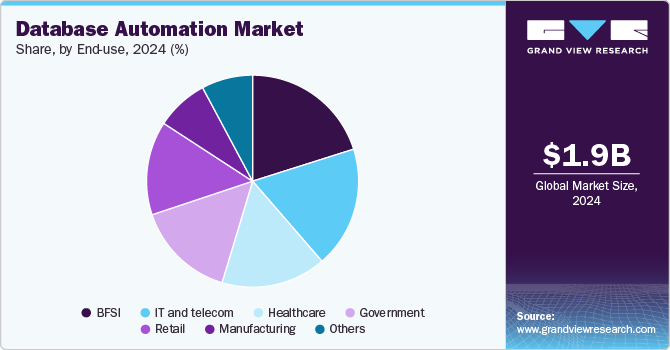

End-use Insights

The BFSI segment generated the highest market revenue in 2024. BFSI dominates the database automation market, accounting for the largest revenue share. Financial institutions use automation to handle transaction volumes and complex data workflows. Tools automate provisioning, backup, and disaster recovery, ensuring high availability. Automated compliance and encryption processes help meet stringent regulatory standards. Efficiency gains from these solutions reduce operational costs and minimize human errors. Continued digital transformation initiatives within BFSI will sustain demand for advanced automation capabilities. The need for enhanced security and real-time data processing further propels the growth of automation in the BFSI sector.

IT and telecom industries are experiencing rapid growth in the database automation market. These sectors require scalable, high-performance databases to support large-scale networks and customer data platforms. Automation tools streamline network database configuration, performance tuning, and capacity planning. Automated monitoring and alerting enhance uptime and reduce mean time to incident resolution. The drive to manage growing data traffic and deliver new services fuels adoption of these solutions. As 5G deployments and cloud-native architectures expand, demand for database automation will continue to rise. Integrating AI-driven automation solutions will further enhance operational efficiency in these industries.

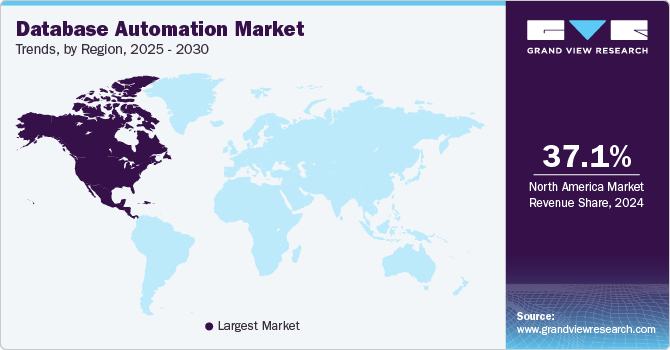

Regional Insights

North America dominated the market and accounted for 37.1% of the share in 2024. Database automation uptake is growing steadily in Canada and Mexico as firms seek to modernize legacy systems. Local service providers are offering hybrid solutions that bridge on-prem databases and regional cloud platforms. Automating provisioning and patching helps these businesses cut costs and boost reliability. Rising regulatory requirements around data residency are driving demand for built-in compliance features. Cross-border enterprises appreciate tools that simplify multi-jurisdictional data management.

U.S. Database Automation Market Trends

The U.S. market leads in adoption of AI-driven database automation, with many organizations piloting self-healing capabilities. Major cloud providers are bundling native automation services, making it easier for companies to spin up and manage databases. Given the complex regulatory landscape, security and compliance features are a top priority. Integration with DevOps pipelines is widespread, enabling rapid deployment and continuous updates.

Europe Database Automation Market Trends

European firms are prioritizing data sovereignty, leading to increased use of automated compliance workflows. Hybrid and multi-cloud database automation platforms are popular, as they support GDPR requirements. The market sees steady growth in managed services, given the shortage of in-house cloud database experts.

Asia Pacific Database Automation Market Trends

In APAC, emerging economies such as India and Southeast Asia are racing to adopt cloud-native database automation. Service providers are tailoring offerings to support multilingual and region-specific compliance needs. Automated performance tuning is in high demand to handle spikes in e-commerce and digital services. Many governments are investing in smart-city databases, further fueling the market.

Key Database Automation Company Insights

Some of the key companies in the Database Automation industry include Amazon Web Services, Inc., Elasticsearch B.V., IBM Corporation, Microsoft, MongoDB, Inc. and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

IBM Corporation introduced enhancements to its Db2 for z/OS Developer Extension, including support for external SQL and Java stored procedures, a notebook interface for efficient SQL development, and advanced catalog filtering features. Moreover, IBM's automation roadmap emphasizes the integration of generative AI to unify business objectives with IT operations, aiming to streamline complex tasks and improve decision-making processes.

-

Microsoft's Power Automate platform saw the introduction of AI flows, enabling users to create automation workflows using natural language descriptions. Furthermore, Azure Database for MySQL was enhanced with support for MySQL 9.1, offering advanced JSON handling, performance improvements, and security enhancements to facilitate more efficient and scalable applications.

Key Database Automation Companies:

The following are the leading companies in the database automation market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Elasticsearch B.V.

- IBM Corporation

- Microsoft

- MongoDB, Inc.

- Oracle Corporation

- Pegasystems Inc.

- SAP SE

- ServiceNow, Inc.

- UiPath Inc.

Recent Developments

-

In September 2024, Oracle Corporation is partnering with Amazon Web Services, Inc., Google Cloud, and Microsoft Azure to run Oracle Database services on OCI directly within their data centers, offering unified management, billing, and low-latency multi-cloud connectivity. Customers can procure through each provider’s marketplace using existing commitments and BYOL licenses while integrating with services such as EC2, AWS Analytics, Vertex AI, and Azure data tools.

-

In November 2023, IBM Corporation teamed up with Amazon Web Services to bring Amazon RDS for Db2 into general availability. This fully managed cloud service simplifies provisioning, scaling, backup, and recovery for Db2 workloads-especially those powering AI applications across hybrid environments.

Database Automation Market Report Scope

|

Report Attribute |

Details |

|

Market Application value in 2025 |

USD 2,443.0 million |

|

Revenue forecast in 2030 |

USD 8,040.6 million |

|

Growth rate |

CAGR of 26.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segment scope |

Component, application, end-use, region |

|

Region scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Amazon Web Services, Inc. Elasticsearch B.V., IBM Corporation, Microsoft, MongoDB, Inc., Oracle Corporation, Pegasystems Inc., SAP SE, ServiceNow, Inc., UiPath Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Database Automation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global database automation market report based on component, application, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Provisioning

-

Backup

-

Security and Compliance

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government

-

BFSI

-

Healthcare

-

IT and telecom

-

Retail

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global database automation market size was estimated at USD 1,934.0 million in 2024 and is expected to reach USD 2,443.0 million in 2025.

b. The global database automation market is expected to grow at a compound annual growth rate of 26.9% from 2025 to 2030 to reach USD 8,040.6 million by 2030.

b. North America dominated the database automation market with a share of 37.1% in 2024. This is attributable to widespread cloud adoption, strong presence of tech companies, and increasing demand for automated data management solutions.

b. Some key players operating in the database automation market include Amazon Web Services, Inc. Elasticsearch B.V., IBM Corporation, Microsoft, MongoDB, Inc., Oracle Corporation, Pegasystems Inc., SAP SE, ServiceNow, Inc., and UiPath Inc.

b. Key factors driving the market growth include the growing need for real-time data processing, rising adoption of cloud-based services, and increasing demand for reducing manual database management tasks.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."