- Home

- »

- Network Security

- »

-

Patch Management Market Size, Share, Growth Report, 2030GVR Report cover

![Patch Management Market Size, Share & Trends Report]()

Patch Management Market (2023 - 2030) Size, Share & Trends Analysis Report By Solution (Software, Services), By Deployment, By Enterprise Size (Small & Medium-sized Enterprises, Large Enterprises), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-089-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Patch Management Market Summary

The global patch management market size was valued at USD 660.3 million in 2022 and is projected to reach USD 1.45 billion by 2030, growing at a CAGR of 10.4% from 2023 to 2030. The growth can be attributed to the increasing deployment of third party-applications, growing demand for secure software, increasing awareness about cyber security among users, and growing demand for Development, Security, and Operations (DevSecOps).

Key Market Trends & Insights

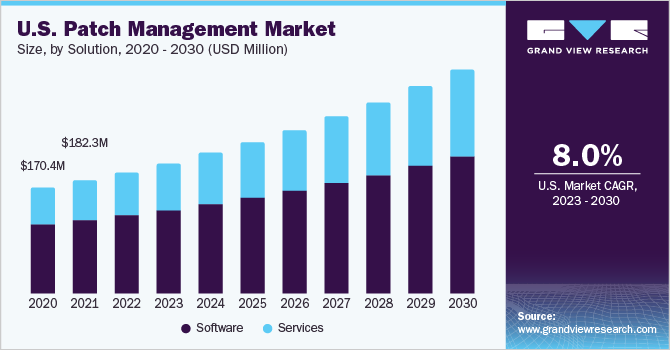

- North America held the major share of 37.70% of the market in 2022.

- Asia Pacific is anticipated to emerge as the fastest-developing regional market and is expected to grow at a CAGR of 13.0% during the forecast period.

- By solution, the software segment accounted for the largest market share of 64.17% in 2022.

- By deployment, the on-premise segment is anticipated to grow at a CAGR of 8.8% during the forecast period.

- By enterprise size, the large enterprise segment accounted for the largest market share of 53.10% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 660.3 Million

- 2030 Projected Market Size: USD 1.45 Billion

- CAGR (2023-2030): 10.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Organizations use several DevOps software and tools, such as TrendMicro Cloud One, ScriptRunner, and NinjaOne, to ensure a smooth collaboration between the development and operations teams of an enterprise to automate the development, testing, deployment, and operations of software, creating a positive outlook for the market.To manage this process, IT and security teams must be able to see the entire network infrastructure and have fine-grained control over it. This emphasizes the significance of standardizing and automating the transfer and deployment of programs in diverse settings throughout their lifecycle in a delivery pipeline, which creates a substantial opportunity for patch management solution providers.

The possibility of data breaches and cyber-attacks has increased with the rise of remote working. This has become a significant problem for data security as the devices can be stolen, misplaced, or hacked, potentially compromising important corporate data. Patch management solutions can assist alleviate these issues by including security features such as real-time behavioral analysis of events and historical visibility of memory, discs, and devices.

Additionally, patch management enables the user to automatically correlate vulnerabilities with patches and associated configuration modifications, reducing remedial response time. It maps vulnerabilities to fixes rapidly and effectively, and it generates ready-to-deploy jobs that may be delivered and scheduled automatically. These factors would further supplement the growth of the patch management industry during the forecast period.

Security is critical in today's complicated Internet of Things (IoT) ecosystem. The proliferation of connected devices generates a large amount of data, which is being used to enable the development of new business models such as Products-as-a-Service (PaaS) or automated real-time decision-making. Because of the IoT ecosystem's rapid proliferation, hackers now have access to new attack vectors such as data and identity theft, IP theft, data fabrication, device manipulation, and network manipulation.

To counteract these threats, cybersecurity firms and service providers are working on security solutions that will assist organizations in automating their IT security. Such systems provide automatic threat detection, allowing IT organizations to cut the time and effort required to follow harmful activity. These systems provide real-time monitoring and identification of new threats while also responding autonomously. These factors would further supplement the growth of the market during the forecast period.

However, complexity is one of the key challenges to the growth of the market for patch management. Patch management solutions can be complex to implement and manage and require significant IT expertise. This can be a challenge for small businesses that may need more resources or expertise to manage these solutions. To overcome these challenges, several patch management vendors are focusing on developing user-friendly and intuitive interfaces that make it easier for organizations to manage their devices and applications.

For instance, in June 2023, NinjaOne, a security service provider, announced the expansion in NinjaOne patch management, which delivers automated patching solutions and services to maintain business activities and operations and keep organizations secure from vulnerabilities. The technology will streamline the entire patch management process, allowing companies to identify and address vulnerabilities, as well as minimize security risks, with the help of automated capabilities. As a result, while complexity is a significant impediment to the endpoint detection and response patch management industry, significant efforts are being made to make these solutions more accessible and controllable for organizations of all sizes.

Patch management services are being adopted across a variety of industries and sectors due to organizations’ strong desire for installing appropriate cyber security solutions based on organizational structure. Since companies manage a large number of resources, massive data volumes, and network connectivity across billions of devices, they can be a potential target for cybercriminals. Several organizations are subscribing to cyber security services as part of their efforts to build a robust security structure for mitigating cyberattacks.

Consulting and support services are particularly gaining traction in end-use industries as these services allow companies to focus on their workflows. Furthermore, hardware-as-a-service and security-as-a-service are the recent trends among large organizations. Companies, such as Microsoft Corporation, Qualys, and SolarWinds, offer these services to both small and large enterprises and state and local governments to help them in deploying a modern security infrastructure while reducing operational costs. Thus, the growing demand for such services across industries is expected to contribute to the growth of the patch management industry.

Solution Insights

The software segment accounted for the largest market share of 64.17% in 2022. Several organizations are engaged in adopting patch management solutions, which have capabilities in detecting vulnerabilities that can initiate a potential attack. The vulnerability management framework helps organizations in evaluating, treating, and identifying vulnerabilities in software and systems and plan security tactics to mitigate threats and minimize the attack surface.

For instance, in December 2022, Balbix, a cybersecurity solution provider, updated the MITRE ATT&CK framework with additional features and capabilities for mapping software vulnerabilities and endpoint security controls. The new functionalities allow businesses to assess unmitigated cyber risks and prioritize vulnerabilities for remedy. Furthermore, Balbix uses advanced analytics to connect common vulnerabilities and exposures (CVEs) to the MITRE ATT&CK framework’s tactics, techniques, and procedures. As a result, it is creating new revenue opportunities for vulnerability management vendors, which bodes well for segment growth.

The services segment is anticipated to grow at a CAGR of 11.3% during the forecast period. The growth of the segment can be attributed to the increased adoption of professional services, increasing demand for IT security services to monitor and manage security solutions, and increasing demand for consultation services and maintenance aid upgradation services from organizations.

Patch management services are quite extensive and provide expert and personalized counsel, assisting clients in identifying risks, implementing solutions, and securely securing endpoint devices against any future threats. Patch management companies also examine existing IT infrastructure and advise enterprises on how to adopt patch management systems, either on-premises or in the cloud. They also offer a mix of managed services, training, and support to businesses to ensure effective device management and secure business data shared over endpoints.

Deployment Insights

The cloud-based segment accounted for a revenue share of 54.00% in 2022. Even as cloud computing evolves, cloud-based platforms remain vulnerable to criminality and data breaches. Cloud patch management solution uses cloud-empowered tools to manage and apply Operating System (OS), third-party patches, and software updates to endpoints. The majority of endpoint management solutions require hardware for each location, which requires constant versioning maintenance as patch management vendors are releasing new features and bug fixes.

For instance, in January 2023, Action 1 Corporation, a patch management solution provider, launched a free cloud-native patch management tool for IT teams, to help them identify and proactively mitigate the risks. With the help of the cloud solution, the company allows IT teams with automated scripting proficiencies to identify and eliminate threats and chances to leverage possibly weak or reused passwords to break into organizations’ critical systems by directly working with vulnerable users. These benefits provided by cloud patch management solutions would further drive the growth of the segment during the forecast period.

The on-premise segment is anticipated to grow at a CAGR of 8.8% during the forecast period. On-premise patch management solutions are used by enterprises to patch internal servers and on-premises devices automatically. As large enterprises have vital business information databases, they choose complete ownership of solutions and upgrades. However, when the workforce grows and the shift to remote work occurs, IT professionals using on-premise patching tools and solutions frequently fail to protect endpoints effectively and efficiently due to a lack of visibility into software assets.

To overcome these challenges, organizations are implementing on-premise patch management solutions to gain complete control over their endpoints and infrastructure, allowing them to tailor the solution to their specific needs and requirements. This organizational preference for safeguarding the confidentiality of internal data is likely to enhance demand for on-premise implementation during the projection period.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share of 53.10% in 2022. Large enterprises are increasingly using patch management solutions to monitor systems for threats and vulnerabilities and adopting patching applications and systems. They offer multiple benefits to large-scale enterprises, such as increased productivity, improved security, and cost savings. They provide end-to-end visibility into the activities performed on servers, desktops, and laptops.

While providing important company information to employees via mobile devices has various advantages, such as increased workforce productivity, it also exposes businesses to business security threats, such as data breaches and data theft. Furthermore, the rise of Bring Your Own Device (BYOD) concepts complicates IT departments' ability to govern their employees' workplaces on personal mobile devices using tight protocols and standards. During the projection period, these factors would supplement the demand for patch management systems for large companies.

The Small & Medium Enterprises (SMEs) segment is expected to grow at the highest CAGR of 11.1% during the forecast period. With the increased adoption of mobile and web-based applications for business operations, SMEs are deploying patch management solutions to identify security gaps and mitigate risks. SMEs are increasingly becoming aware of the benefits of threat detection and response systems.

Furthermore, the sophistication of hacking attempts and the increase in cyber threats are also contributing to the demand for patch management solutions for SMEs. These systems collect and report information about such dangerous behaviors to the security administrator. They are becoming an important aspect of infrastructure security because they can prevent attackers or hackers from acquiring information on client networks.

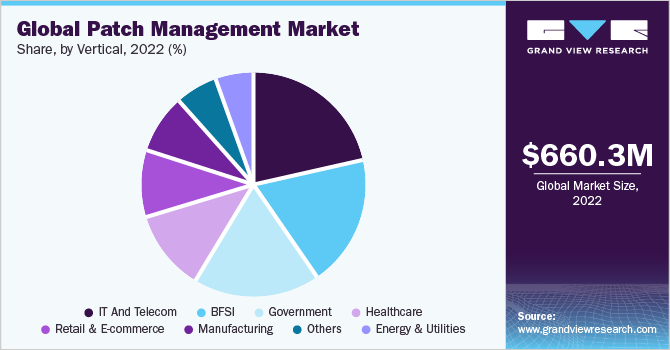

Vertical Insights

The IT & telecom segment accounted for the largest market share of 21.59% in 2022. The growing use of endpoint devices, coupled with the growing number of connections on private unsecured networks, led to an increase in the frequency of cyber-attacks. As such, IT & telecom companies started focusing on developing and implementing in-house patch management solutions.

This, in turn, kept the market afloat during the pandemic while also contributing to segment growth. IT and telecom companies store the personal information of users, such as their names, addresses, and financial information, due to which they become a compelling target for cyber attackers. To protect sensitive data and avoid data losses, telecom companies are expected to increase their spending on patch management solutions. Furthermore, an increase in the complexity of the regulatory environment across the world is making it vital for telecom companies to stay abreast of the changing regulatory compliances, thus accelerating segment growth.

The healthcare segment is anticipated to grow at a CAGR of 13.3% during the forecast period. The segment’s growth can be attributed to the rising adoption of cloud-based solutions, connected devices, and smartphones. With the increasing integration of IoT-enabled medical devices, Electronic Health Records (EHRs), and other advanced healthcare technologies, the healthcare ecosystem has become increasingly connected in recent years.

This, coupled with the increasing data breaches in the industry, is contributing to the segment growth. Patchworx, an enterprise patch management solution provider, created Patch Management as a Service system for the healthcare sector to keep all medical information, data, and records secure through software patching. The solution is designed to monitor, track, and download reports to ensure that hardware and software are working correctly. These factors and developments would further create the demand for patch management solutions in the healthcare industry during the forecast period.

Regional Insights

North America held the major share of 37.70% of the market in 2022. The regional patch management industry can be attributed to the increasing number of Small & Medium Enterprises (SMEs) and the establishment of major IT hubs and the growing adoption of security and vulnerability assessment and management tools by organizations in the region are driving the need for putting more effective cyber security measures in place.

Furthermore, the growing preference for cloud patch management solutions, especially among the SMEs in the region, to boost business efficiency, cost-efficiency, and flexibility, is also driving the adoption of patch management solutions. Due to the high adoption of these solutions and services, as well as the presence of patch management providers in the region, the United States is likely to hold the greatest share of the market throughout this period.

For instance, in May 2022, New Relic, a U.S.-based vulnerability and security management company, launched New Relic Vulnerability Management platform, that would enable enterprises to identify and addresses security risks quicker and precisely. Additionally, it enables team members of software and security teams to aggregate native and third-party security signals across the entire software stack. Moreover, with the help of mappings and correlations, engineers can track, monitor, debug, and secure the entire software stack more efficiently and reduce overall risks. These factors would further drive the growth the patch management solutions in the region during the forecast period.

Asia Pacific is anticipated to emerge as the fastest-developing regional market and is expected to grow at a CAGR of 13.0% during the forecast period. The Bring Your Own Device (BYOD) movement has accelerated in Asia Pacific, and expanding government activities to support cybersecurity compliances to safeguard data from attacks have resulted in a need for patch management solutions.

Numerous organizations in the region prefer patch management solutions with built-in vulnerability detection capabilities. Organizations in emerging economies are increasingly adopting vulnerability management solutions, recognizing the importance of vulnerability management frameworks in evaluating, treating, and identifying vulnerabilities in software and systems and, as a result, planning security tactics to mitigate threats and minimize the attack surface.

Key Companies & Market Share Insights

The key players include Microsoft Corporation; IBM; Broadcom, Inc.; VMware; Qualys; Automox; and Kaseya Limited to broaden their product offering, companies utilize a variety of inorganic growth tactics, such as regular mergers acquisitions, and partnerships. In November 2021, IBM Corporation announced the acquisition of ReaQta, an endpoint security solutions provider. This acquisition is expected to expand IBM Corporation’s cybersecurity threat detection and response capabilities by streamlining its strategy to deliver security solutions with an open approach across data, diverse tools, and hybrid cloud environments. Some prominent players in the global patch management market include:

-

Microsoft Corporation

-

Broadcom, Inc.

-

IBM

-

VMware

-

Qualys

-

Solar Winds

-

ConnectWise, LLC.

-

Avast Software

-

Automox

-

Kaseya Limited

-

Freshworks

-

NinjaOne

-

Pulseway

-

Heimdal

-

SysAid

Patch Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 723.7 million

Revenue forecast in 2030

USD 1.45 billion

Growth rate

CAGR of 10.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Segments covered

Solution, deployment, enterprise size, vertical, region

Key companies profiled

Microsoft Corporation; Broadcom, Inc.; IBM; VMware; Qualys; SolarWinds; ConnectWise LLC.; Avast Software.; Automox; Kaseya Limited; Freshworks; NinjaOne; Pulseway; Heimdal; SysAid

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Patch Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global patch management market report based on solution, deployment, enterprise size, vertical, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Medium-sized Enterprises

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT and Telecom

-

Retail & E-commerce

-

Healthcare

-

Manufacturing

-

Government

-

Energy & Utilities

-

Others (Media & Entertainment, Transportation & Logistics, Aerospace & Defense)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global patch management market was valued at USD 660.3 million in 2022 and is expected to reach USD 723.7 million in 2023.

b. The global patch management market is expected to grow at a compound annual growth rate is 10.4% from 2023 to 2030 to reach USD 1.45 billion by 2030.

b. The software segment accounted for a market share of 64.17% in 2022. Several organizations are engaged in adopting patch management solutions, which have capabilities in detecting vulnerabilities that can initiate a potential attack. The vulnerability management framework helps organizations in evaluating, treating, and identifying vulnerabilities in software and systems and plan security tactics to mitigate threats and minimize attack surface.

b. Some key players operating in the patch management market include Microsoft Corporation, Broadcom, Inc., IBM, VMware, Qualys, Solar Winds, ConnectWise, LLC., Avast Software, Automox, Kaseya Limited, Freshworks, NinjaOne, Pulseway, Heimdal, and SysAid

b. The market growth can be attributed to the increasing deployment of third party-applications, growing demand for secure software, increasing awareness about cyber security among users, and growing demand for Development, Security, and Operations (DevSecOps).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.