- Home

- »

- Healthcare IT

- »

-

De-identified Health Data Market Size, Industry Report, 2033GVR Report cover

![De-identified Health Data Market Size, Share & Trends Report]()

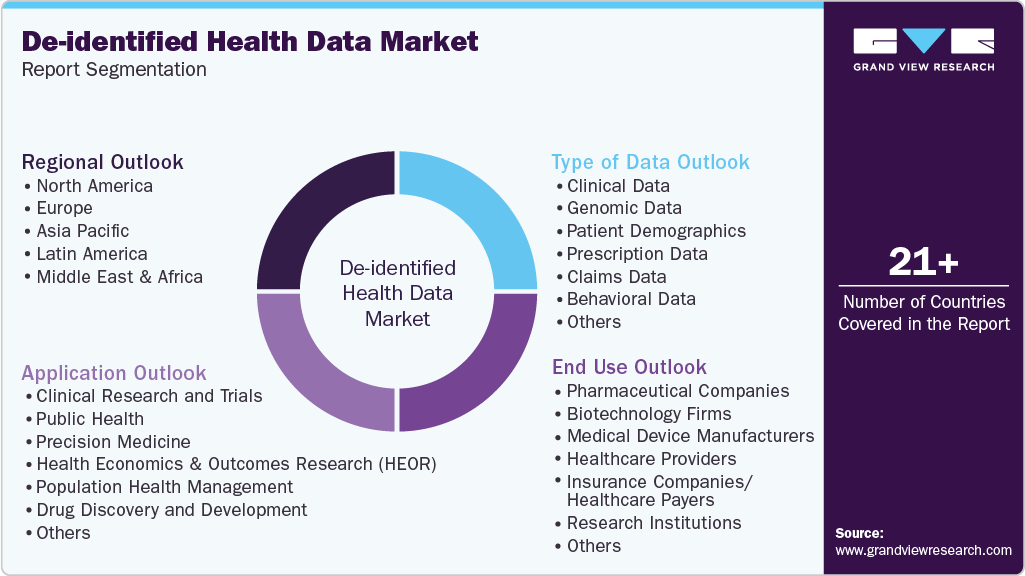

De-identified Health Data Market (2026 - 2033) Size, Share & Trends Analysis Report By Type of Data (Genomic Data, Prescription Data, Claims Data, Pharmacogenomic Data, Clinical Data), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-481-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

De-identified Health Data Market Summary

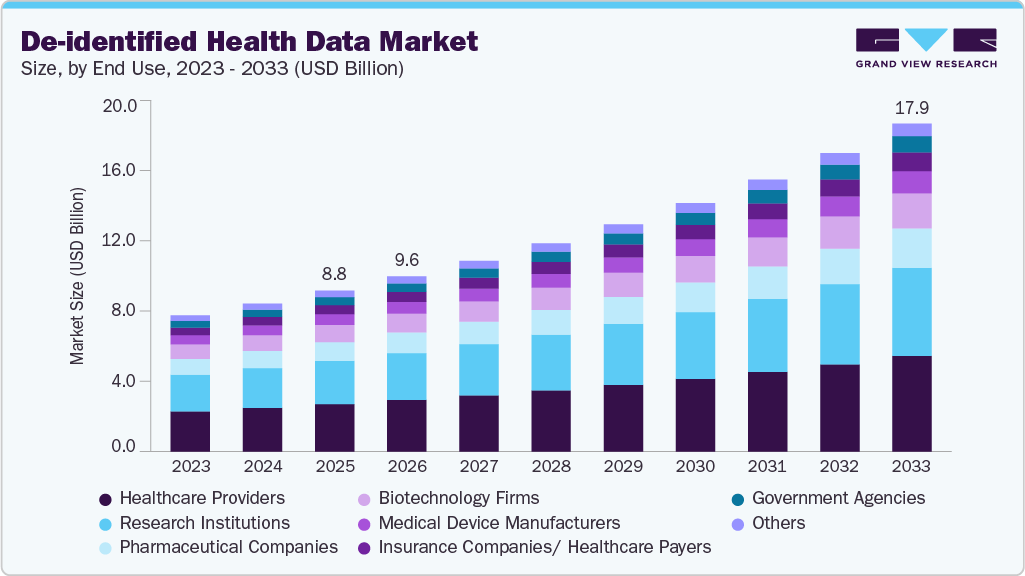

The global de-identified health data market size was estimated at USD 8.80 billion in 2025 and is projected to reach USD 17.93 billion by 2033, growing at a CAGR of 9.37% from 2026 to 2033. The market is driven by the increasing integration of data analytics in healthcare, which supports large-scale studies and predictive modeling without breaching patient confidentiality.

Key Market Trends & Insights

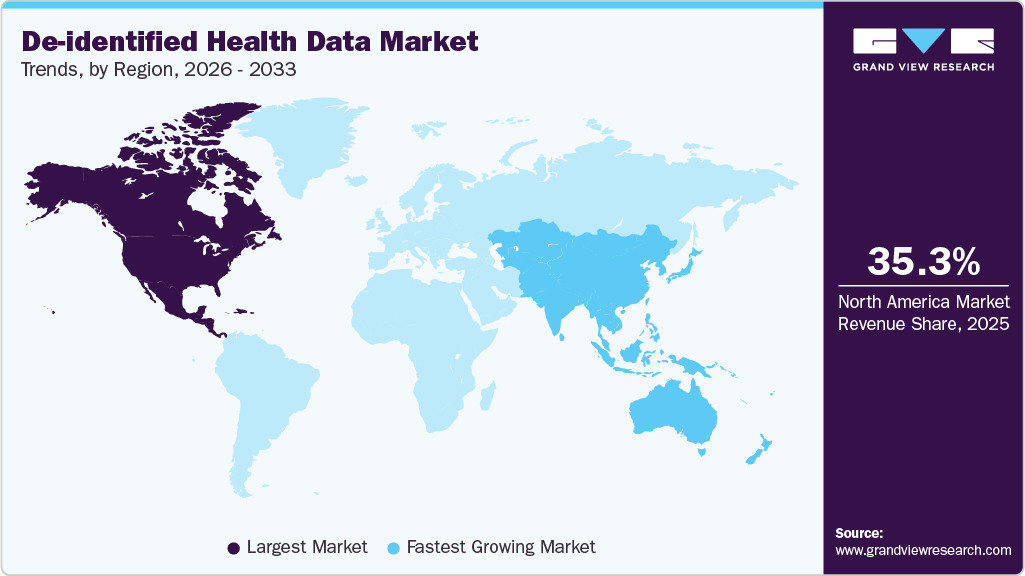

- The North America de-identified health data market dominated with a revenue share of over 35.3% in 2025.

- By type of data, the clinical data dominated with the largest share of 17.00% in 2025.

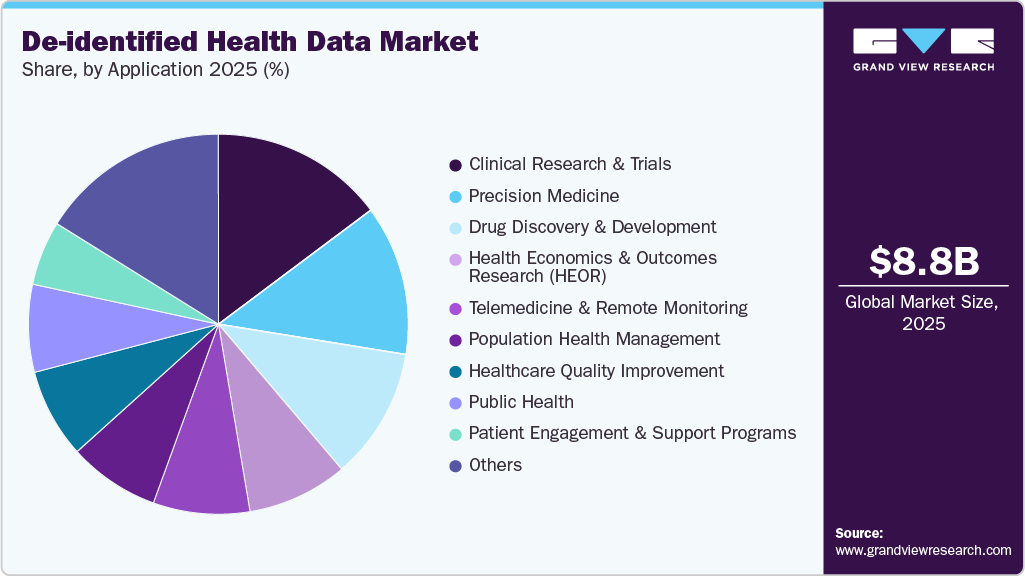

- Based on application, the clinical research and trials segment accounted for the largest revenue share in 2025.

- By end use, healthcare providers dominated the market with the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 8.80 Billion

- 2033 Projected Market Size: USD 17.93 Billion

- CAGR (2026-2033): 9.37%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Regulatory frameworks such as GDPR and HIPAA further incentivize using de-identified data for compliance. Advancements in AI and machine learning amplify the need for extensive, privacy-compliant datasets to improve diagnostic and therapeutic methods. In addition, the surge in data from wearable devices, sensors, and electronic health records (EHRs) has expanded the scope for de-identified data in secondary applications.

De-identified health data is essential for clinical research as it allows researchers to analyze large datasets while protecting patient privacy. This data identifies trends, evaluates treatment effectiveness, and supports population health studies without compromising individual identities. By leveraging de-identified data, researchers can enhance the quality of their findings and facilitate advancements in medical knowledge and practice.

For instance, in April 2023, Philips and the MIT Institute for Medical Engineering and Science (IMES) collaborated to develop an enhanced critical care dataset to advance clinical research and AI applications in healthcare. This dataset includes de-identified data from ICU patients and integrates comprehensive clinical information to support researchers and educators in gaining insights into critical care and improving patient outcomes. The initiative fosters innovation in AI-driven healthcare solutions, contributing to more accurate diagnostics and personalized treatments.

Furthermore, de-identification facilitates collaboration and innovation within the healthcare sector by enabling secure patient data sharing across various healthcare systems, thereby advancing diagnostic and treatment technologies. Moreover, it provides critical data necessary for training AI systems, enhancing the accuracy and relevance of medical imaging for disease detection and analysis. This approach protects patient privacy and drives improvements in healthcare outcomes.

For instance, in December 2023, nference, Inc., a software company focused on transforming healthcare data for research, partnered with Emory Healthcare, Georgia's largest academic health system, to enhance access to diverse, aggregated, de-identified data. This initiative aims to accelerate research efforts, improve disease diagnosis, and facilitate the development of new treatments. The collaboration reflects a mutual commitment to advancing medical knowledge, promoting innovation, and enhancing the health and well-being of individuals and communities globally.

“This collaboration with nference allows us to join a federated data network of leading institutions that will enable ground-breaking research. Together, we can work to improve lives and provide hope, tackling some of the most critical health care challenges of our time while delivering comprehensive, data-driven insights.”

- Joe Depa, chief data and analytics officer at Emory Healthcare and Emory University

Market Concentration & Characteristics

The degree of innovation in the de-identified health data industry is high. Innovation in the industry is driven by advancements in data analytics, artificial intelligence (AI), and machine learning (ML), which enhance the extraction of insights while preserving patient privacy.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance,in June 2021, Datavant and Ciox Health announced their merger, creating the largest neutral and secure health data ecosystem in the U.S. This merger aims to enhance the interoperability of healthcare data, facilitating the secure sharing of de-identified patient datasets across various healthcare entities. The combined entity will focus on advancing healthcare insights and improving patient outcomes while maintaining compliance with privacy regulations.

Regulations governing the market for de-identified health data focus on ensuring patient privacy and data security. Key frameworks include the Health Insurance Portability and Accountability Act (HIPAA), which establishes guidelines for de-identifying health data to prevent patient identification. In addition, Europe's General Data Protection Regulation (GDPR) imposes stringent requirements on data handling and consent, influencing global practices. Organizations must adhere to these regulations while leveraging de-identified data for research, analytics, and other applications to ensure compliance and protect individual privacy.

Geographic expansion significantly drives the de-identified health data industry by increasing market penetration and revenue, enabling access to diverse data sources, and fostering regulatory compliance and standardization.

Type of Data Insights

Clinical data dominated the type of data segment, with the largest market share of approximately 17.0% in 2025. The segment's dominance is attributed to its crucial role in research, treatment development, and the optimization of patient care. The extensive availability of clinical data enables the identification of treatment outcomes and patient demographics, which are essential for advancing personalized medicine. For instance, in March 2024, Tempus announced the contribution of de-identified tumor profiles' data, including limited clinical information from over 3,000 cancer diagnoses, to the National Cancer Institute (NCI). This marks a unique addition to NCI's planned Data Enclave and aims to support the advancement of cancer research by enhancing insights from individual cancer cases. This initiative aligns with NCI's mission to improve cancer outcomes through data-driven research.

The behavioral data segment is expected to grow at the fastest CAGR during the forecast period. The growth is attributed to driven by rising demand for de-identified insights on patient lifestyle, adherence, and health-seeking behaviors to support risk prediction, outcome modeling, and population-level behavioral analysis while maintaining data privacy.

Application Insights

Clinical research and trials dominated the application segment, accounting for the largest revenue share in 2025. The segment’s largest share is attributed to the increasing reliance on de-identified real-world clinical and imaging data for patient cohort identification, protocol optimization, and trial feasibility assessments. In addition, the expanding scale of global clinical research activity continues to drive the demand for compliant, privacy-preserving datasets, particularly to support decentralized, adaptive, and multi-site clinical trials under stringent data protection regulations. For instance, as of January 2026, ClinicalTrials.gov had 564,447 registered studies.

Percentage of recruiting studies by location (as of January 2026)

Location

Number of Recruiting Studies and Percentage of Total

U.S. only

19,473 (30%)

Non-U.S. only

42,286 (65%)

Both U.S. and non-U.S.

3,077 (5%)

Not provided

0 (0%)

The drug discovery and development segment is expected to grow at the fastest CAGR during the forecast period. The growth is attributed to the increasing reliance on real-world evidence (RWE) to accelerate drug development. De-identified data enables researchers to analyze diverse patient populations, predict drug responses, and identify potential safety concerns early in the development process. For instance, in July 2023, nference and Vanderbilt University Medical Center (VUMC) entered into an agreement to enhance real-world evidence (RWE) generation for complex diseases. The collaboration integrates VUMC’s extensive longitudinal, multi-modal data with nference’s AI-driven federated platform. This partnership aims to advance scientific insights, benefiting drug discovery and patient care by leveraging real-world data for more effective healthcare solutions.

End Use Insights

Healthcare providers dominated the end use segment, with the largest share in 2025. The segment leads the market owing to its crucial role in clinical decision-making, treatment optimization, and improving patient outcomes. Providers rely on de-identified data for research, population health management, and quality improvement initiatives, enabling them to analyze trends without breaching patient privacy. In addition, regulatory requirements for data privacy and the need for evidence-based care further drive the demand for de-identified data to enhance operational efficiency and support clinical advancements.

The pharmaceutical companies’ segment is expected to grow at the fastest CAGR over the forecast period. The growth is attributed to its essential role in drug development, clinical trials, and precision medicine. Pharmaceutical firms are increasingly relying on de-identified data to analyze patient populations, assess drug safety and efficacy, and optimize trial designs without compromising patient privacy. Hence, market players undertake several strategic initiatives to capitalize on the advantages of de-identified health datasets. For instance, in July 2024, QuantHealth partnered with OMNY Health to leverage OMNY’s vast de-identified health data network. This collaboration aims to enhance clinical trial design, evidence-based practices, and medical research.

Regional Insights

The North America de-identified health data industry dominated with a revenue share of over 35.3% in 2025. The region has an advanced healthcare infrastructure and significant technological investment, particularly in data analytics and AI. Moreover, stringent regulatory frameworks such as HIPAA enhance the focus on data privacy, encouraging the use of de-identified data for research while ensuring compliance. Furthermore, the presence of leading pharmaceutical and biotech companies accelerates the demand for high-quality data to support clinical trials and drug development. The strong emphasis on innovation and research further strengthens North America's leading position in this sector.

U.S. De-identified Health Data Market Trends

The de-identified health data industry in the U.S. is driven by its extensive healthcare system and significant investment in health information technology. For instance, in June 2024, the U.S. Department of Health and Human Services awarded USD 56 million to enhance health centers' technology for improved care quality. The funding supports the modernization of UDS reporting, enabling streamlined processes and reducing the time spent on chart audits. The initiative aligns with Health Level 7 (HL7) FHIR API standards, facilitating the efficient exchange of health data. All data collected through this initiative will be de-identified and secured in compliance with the HHS Safe Harbor Method for patient data de-identification, ensuring adherence to HIPAA regulations.

Europe De-identified Health Data Market Trends

The de-identified health data industry in Europe is expected to be driven by its stringent regulatory framework, which emphasizes data privacy and protection, such as the GDPR. This regulatory environment fosters a culture of data sharing while ensuring compliance with privacy standards. Furthermore, advanced healthcare systems and extensive research institutions enhance the demand for de-identified data to support clinical studies and public health initiatives. The growing focus on personalized medicine and digital health solutions further drives the adoption of de-identified data across the region.

The UK de-identified health data industry is expected to be driven by significant government initiatives to advance health data research. For instance, in July 2024, the UK government secured nearly USD 67.62 million (£ 50 million) to support the UK Biobank, a leading health research resource, following new backing from the pharmaceutical industry. This funding will enhance the biobank's capabilities in storing and analyzing de-identified health data, facilitating advancements in medical research. The initiative aims to facilitate innovations in treatment and disease prevention, strengthening the UK's position in health data research.

The de-identified health data industry in Germany held a significant market share in 2024. This is owing to its advanced healthcare system and commitment to data protection regulations, particularly under GDPR. The country's advanced research infrastructure and numerous healthcare institutions facilitate collecting and utilizing de-identified data for clinical studies. Moreover, Germany's emphasis on innovation in healthcare technology supports integrating de-identified data in research and public health initiatives.

Asia Pacific De-identified Health Data Market Trends

The de-identified health data industry in the Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The growth is attributed to rapid advancements in healthcare infrastructure and technology. Increasing investments in health IT and data analytics and a growing demand for personalized medicine are driving this growth. Moreover, the rising awareness of data privacy regulations is prompting organizations to adopt de-identified data solutions for compliance purposes. The region's expanding pharmaceutical and biotech sectors further contribute to the demand for comprehensive health data for research and clinical applications.

The Japan de-identified health data industry held a significant market share in 2024. The growth is attributed to several initiatives industry players undertake to advance Japan’s healthcare. For instance, in June 2024, SoftBank Group formed a joint venture named "SB TEMPUS" with Tempus to enhance healthcare in Japan by applying medical data and AI. The venture aims to offer precision medicine services by leveraging Tempus's extensive expertise and technology, including one of the industry's largest collections of de-identified molecular, clinical, and imaging data. Tempus's connections to approximately 50% of U.S. oncologists will support the initiative's objectives.

The de-identified health data industry in India is expected to be driven by the growing awareness and use of de-identified data solutions. For instance, in July 2024, Miimansa AI published research highlighting innovative methods for de-identifying clinical discharge summaries in India using Large Language Models (LLMs). This study addresses the growing demand for effective data de-identification techniques in response to the increasing digitization of healthcare. The research enhances de-identification efficacy by employing LLMs to create synthetic clinical reports while safeguarding patient privacy and maintaining data utility.

Key De-identified Health Data Company Insights

The growing number of collaborations, partnerships, and mergers & acquisitions among industry players is enabling them to gain a competitive edge in the market. For instance, in September 2024, ICON plc partnered with IBM and announced advancements in clinical trial processes through de-identified health data, which enhances patient recruitment and optimizes study design. The initiative aims to improve trial efficiency and accelerate drug development by leveraging vast datasets while ensuring patient privacy. The emphasis on de-identified data enables researchers to gain insights without compromising individual privacy, thereby transforming clinical trial methodologies.

Key De-identified Health Data Companies:

The following are the leading companies in the de-identified health data market. These companies collectively hold the largest market share and dictate industry trends.

- IQVIA

- Oracle (Cerner Corporation)

- Optum, Inc. (UnitedHealth Group)"

- ICON plc

- Veradigm LLC (Formerly known as Allscripts)

- IBM

- Flatiron Health (F. Hoffmann-La Roche Ltd)

- Premier, Inc.

- Shaip

- Komodo Health, Inc.

- Evidation Health, Inc.

- Medidata

- Clarify Health Solutions

- Satori Cyber Ltd.

Recent Developments

-

In September 2024, ICON announced a collaboration with Intel to utilize de-identified data from its clinical research platform alongside Intel's AI technology. This partnership enhances patient recruitment and streamlines clinical trial processes by deriving insights from de-identified patient data. The initiative aims to advance precision medicine and improve efficiencies in drug development and outcomes by integrating ICON's clinical trial expertise with Intel's AI capabilities.

-

In February 2024, Veradigm published its first Veradigm Insights Report: Cardiovascular Conditions in 2024, analyzing de-identified real-world data from 53 million cardiovascular patients. The report assesses the prevalence of cardiovascular disease (CVD) and related conditions across all U.S. states, with demographic breakdowns based on age, ethnicity, and sex.

De-identified Health Data Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 9.58 billion

Revenue forecast in 2033

USD 17.93 billion

Growth rate

CAGR of 9.37% from 2026 to 2033

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type of data, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

IQVIA; Oracle (Cerner Corporation); Optum, Inc. (UnitedHealth Group); ICON plc; Veradigm LLC (Formerly known as Allscripts); IBM; Flatiron Health (F. Hoffmann-La Roche Ltd); Premier, Inc.; Shaip; Komodo Health, Inc.; Evidation Health, Inc.; Medidata; Clarify Health Solutions; Satori Cyber Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global De-identified Health Data Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 - 2033. For this report, Grand View Research has segmented the global de-identified health data market report based on type of data, application, end use, and region:

-

Type of Data Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical Data

-

Genomic Data

-

Patient Demographics

-

Prescription Data

-

Claims Data

-

Behavioral Data

-

Wearable and Sensor Data

-

Survey and Patient-Reported Data

-

Imaging Data

-

Laboratory Data

-

Hospital and Provider Data

-

Social Determinants of Health (SDoH) Data

-

Pharmacogenomic Data

-

Biometric Data

-

Operational and Financial Data

-

Epidemiological Data

-

Healthcare Utilization Data

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical Research and Trials

-

Public Health

-

Precision Medicine

-

Health Economics and Outcomes Research (HEOR)

-

Population Health Management

-

Drug Discovery and Development

-

Healthcare Quality Improvement

-

Insurance Underwriting and Risk Assessment

-

Market Access and Commercial Strategy

-

Business Intelligence and Operational Efficiency

-

Telemedicine and Remote Monitoring

-

Patient Engagement and Support Programs

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical Companies

-

Biotechnology Firms

-

Medical Device Manufacturers

-

Healthcare Providers

-

Insurance Companies/ Healthcare Payers

-

Research Institutions

-

Government Agencies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global de-identified health data market size was estimated at USD 8.80 billion in 2025 and is expected to reach USD 9.58 billion in 2026.

b. The global de-identified health data market is expected to grow at a compound annual growth rate of 9.37% from 2026 to 2033 to reach USD 17.93 billion by 2033.

b. North America dominated the global de-identified health data market with a share of 35.3% in 2025. This is attributable to the presence of leading pharmaceutical and biotech companies, advanced healthcare infrastructure and significant technological investment, particularly in data analytics and AI. In addition, stringent regulatory frameworks such as HIPAA enhance the focus on data privacy, encouraging the use of de-identified data for research while ensuring compliance.

b. Some key players operating in the global de-identified health data market include IQVIA; Oracle (Cerner Corporation); Merative (Truven Health Analytics); Optum, Inc. (UnitedHealth Group); ICON plc; Veradigm LLC (Formerly known as Allscripts); IBM; Flatiron Health (F. Hoffmann-La Roche Ltd); Premier, Inc.; Shaip; Komodo Health, Inc.; Evidation Health, Inc.; Medidata; Clarify Health Solutions; and Satori Cyber Ltd.

b. Key factors that are driving the market growth include rising demand for healthcare data, growth in AI and Machine Learning, growing adoption of healthcare analytics (data-driven decision-making), and growth in Real-World Data (RWD) and Real-World Evidence (RWE).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.