- Home

- »

- Advanced Interior Materials

- »

-

Deburring Machine Market Size, Share, Industry Report 2030GVR Report cover

![Deburring Machine Market Size, Share & Trends Report]()

Deburring Machine Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Vibratory Deburring, Barrel Tumbling, Thermal Deburring), By End-use (Automotive, Aerospace & Defense), By Operation Mode, By Deburring Media, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-602-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Deburring Machine Market Summary

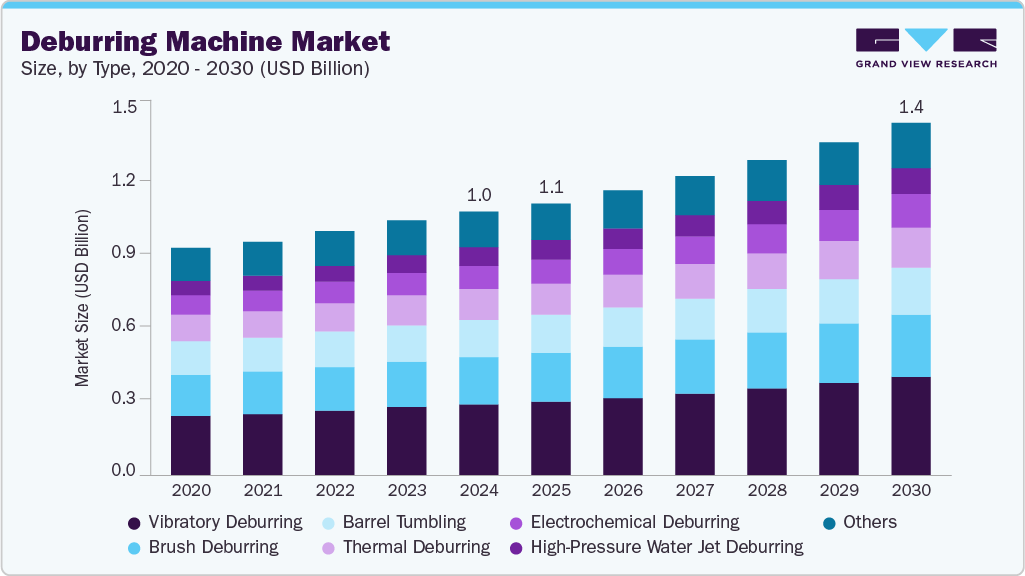

The global deburring machine market size was estimated at USD 1,023.6 million in 2024 and is projected to reach USD 1,365.8 million by 2030, growing at a CAGR of 5.3% from 2025 to 2030. Market growth is primarily driven by the rising demand for precision engineering and the expansion of high-performance manufacturing.

Key Market Trends & Insights

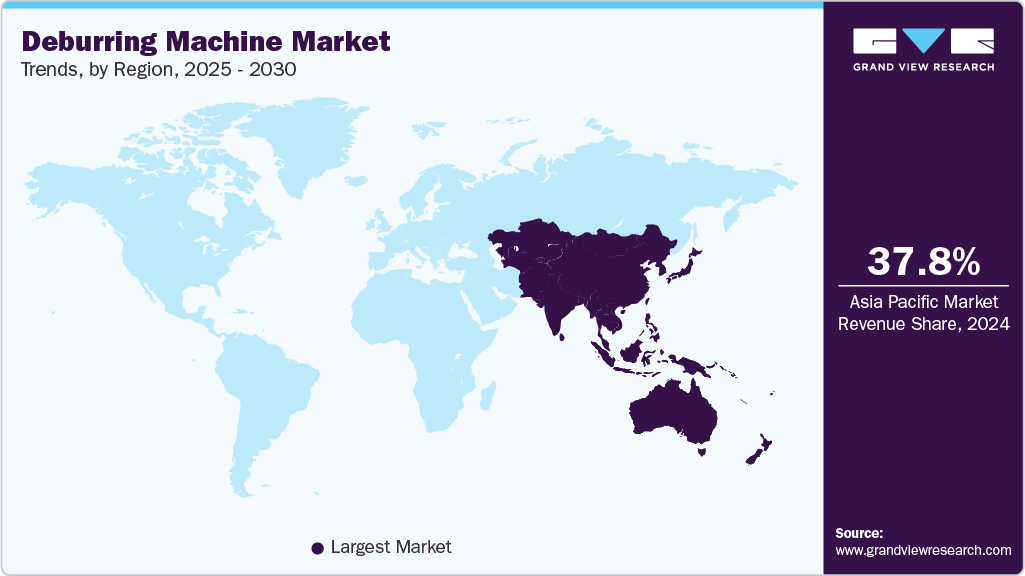

- Asia Pacific dominated the global deburring machine market with a revenue share of 37.8% in 2024.

- The U.S. deburring machine market accounted for the largest share of 78.1% in North America in 2024.

- By type, the vibratory deburring segment led the market with the revenue share of 26.8% in 2024.

- By operation mode, the automatic deburring segment led the market with a revenue share of 54.8% in 2024.

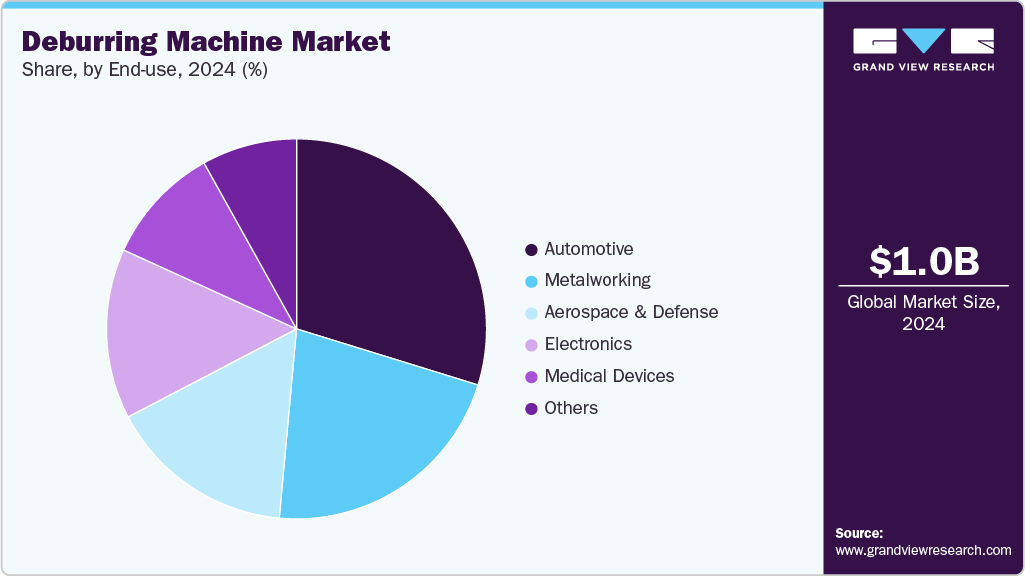

- By end-use, the automotive segment led the market with a revenue share of 29.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,023.6 Million

- 2030 Projected Market Size: USD 1,365.8 Million

- CAGR (2025-2030): 5.3%

- Asia Pacific: Largest market in 2024

The automotive and aerospace sectors, in particular, are major contributors due to their stringent safety and performance requirements. Technological advancements play a pivotal role in propelling the market growth forward. The integration of automation and robotics, including AI-powered controls and IoT connectivity, enhances the precision and efficiency of deburring processes. These innovations enable real-time monitoring, predictive maintenance, and adaptive adjustments, reducing downtime and improving overall productivity.

Furthermore, the increasing emphasis on regulatory compliance and quality standards across industries, such as aerospace and medical devices, necessitates the adoption of advanced deburring technologies to ensure consistent and high-quality finishes.

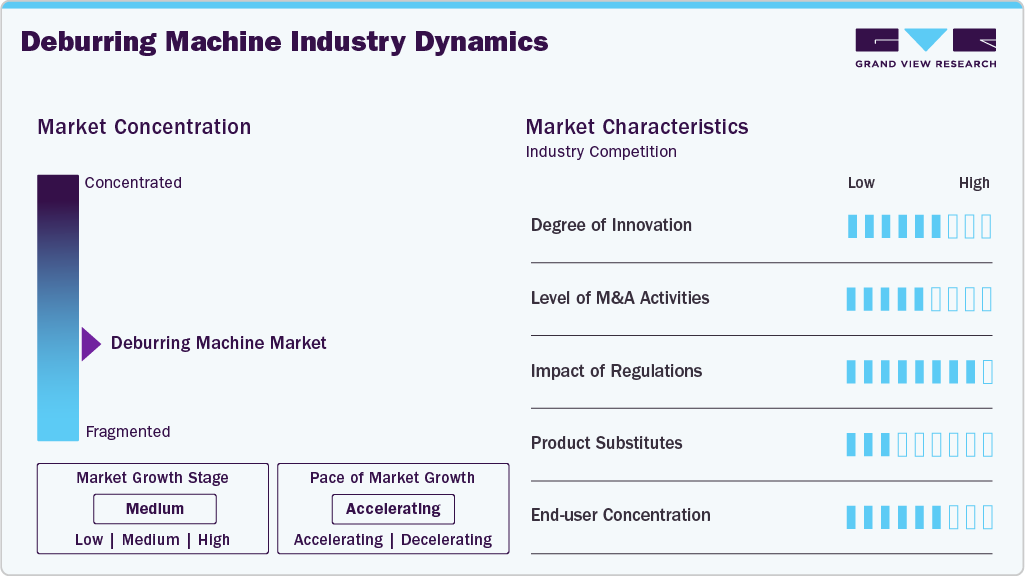

Market Concentration & Characteristics

The global deburring machine industry is moderately fragmented, with a mix of established multinational players and numerous regional manufacturers. While key players such as ATI Industrial Automation and Maschinenbau Silberhorn hold significant market shares, no single company dominates the entire landscape. This fragmentation is driven by varied application requirements across industries and regions, allowing smaller firms to compete through niche solutions or specialized technologies.

The deburring machine industry is undergoing significant innovation, driven by advancements in automation and artificial intelligence. Robotic arms equipped with AI algorithms and vision systems are increasingly integrated into deburring machines, enabling precise and adaptive finishing of complex parts. In addition, eco-friendly deburring techniques, such as water-based and cryogenic methods, are gaining traction as industries seek sustainable manufacturing solutions.

The deburring machine industry has witnessed notable mergers and acquisitions, reflecting the industry's consolidation and the pursuit of technological advancements. For instance, Dürr Ecoclean GmbH acquired Cleaning & Surface Processing (CSP) in 2020, enhancing its capabilities in surface treatment and deburring solutions. Such strategic moves enable companies to expand their product portfolios and strengthen their market positions.

Regulatory standards play a crucial role in shaping the deburring machine industry, particularly in industries like aerospace, automotive, and medical devices. Stringent quality requirements necessitate the use of precise deburring machines to ensure component safety and functionality. Compliance with these regulations drives the adoption of advanced deburring technologies that meet the highest industry standards.

Drivers, Opportunities & Restraints

The global deburring machine industry is driven by the increasing demand for precision manufacturing across various industries, including automotive, aerospace, and electronics. Advancements in automation and robotics, such as AI-powered deburring systems, enhance efficiency and accuracy, reducing manual labor and operational costs. In addition, the adoption of Industry 4.0 practices and smart manufacturing initiatives further accelerates the integration of advanced deburring technologies into production lines.

Emerging economies, particularly in Asia-Pacific, present significant growth opportunities for the deburring machine industry due to rapid industrialization and increased manufacturing activities. The rising demand for lightweight materials, especially in the automotive and aerospace sectors, necessitates advanced deburring solutions capable of handling complex geometries. Furthermore, the shift towards electric vehicles (EVs) and the emphasis on sustainable manufacturing practices create avenues for developing energy-efficient and environmentally friendly deburring technologies.

Despite the market's growth prospects, high initial investment costs for advanced deburring machines, particularly those incorporating robotics and AI, pose challenges for small and medium-sized enterprises (SMEs). The complexity of integrating these sophisticated systems into existing production lines can lead to operational disruptions and increased downtime. In addition, the need for skilled personnel to operate and maintain advanced deburring equipment adds to the operational costs, potentially hindering widespread adoption.

Type Insights

The vibratory deburring segment led the market with the largest revenue share of 26.8% in 2024, due to its versatility, cost-effectiveness, and ability to handle a wide range of part sizes and materials. It is widely used in high-volume industries such as automotive and metalworking, offering consistent surface finishing and efficient batch processing. Its low maintenance and scalability make it a preferred choice for mass production settings.

The high-pressure water jet deburring segment is anticipated to grow at the fastest CAGR of 6.8% during the forecast period, driven by increasing demand for precision and eco-friendly solutions. It is particularly effective for delicate or complex components where mechanical deburring could cause damage. With rising environmental regulations and the need for non-abrasive methods, this clean, residue-free process is gaining traction in industries like aerospace, medical devices, and electronics.

Operation Mode Insights

The automatic deburring segment led the market with the largest revenue share of 54.8% in 2024, owing to its efficiency, consistency, and integration with smart manufacturing systems. These systems are ideal for high-volume production environments, particularly in the automotive and electronics sectors, where precision and speed are critical. Their ability to reduce labor costs and minimize human error has made them the top choice for large-scale manufacturers.

The semi-automatic deburring machines segment is anticipated to witness at the fastest CAGR of 5.0% during the forecast period, especially among small and mid-sized enterprises (SMEs). These machines offer a balance between manual flexibility and automated efficiency, making them cost-effective for varied production volumes. As more manufacturers aim to modernize without fully automating, this segment is gaining traction in both emerging and developed markets.

Deburring Media Insights

The ceramic media segment led the market with the largest revenue share of 37.9% in 2024. Ceramic deburring media leads the market due to its durability, versatility, and effectiveness in heavy-duty material removal. It is widely used in automotive, aerospace, and metal fabrication industries for its ability to handle hard metals and deliver high-quality finishes. Its long service life and efficiency in aggressive deburring processes make it the most relied-upon media type.

The steel deburring media segment is anticipated to grow at the fastest CAGR of 6.0% during the forecast period, due to its high durability, aggressive cutting action, and suitability for heavy-duty applications. It is increasingly used in industries like automotive and metal fabrication where rapid material removal and robust performance are essential. As manufacturers seek long-lasting, cost-efficient solutions for tough metal parts, the demand for steel media continues to rise.

End-use Insights

The automotive segment led the market with the largest revenue share of 29.8% in 2024 due to its large-scale production needs and stringent quality requirements. Deburring is critical for engine parts, transmission components, and braking systems to ensure safety and performance. The growing trend toward electric vehicles has further increased the demand for precision deburring in battery housings and lightweight metal parts.

The aerospace & defense segment is experiencing at the fastest CAGR of 5.9% during the forecast period, due to the industry's strict tolerance, safety, and surface quality requirements. Components like turbine blades, structural parts, and precision fasteners demand burr-free finishes to ensure performance and reliability. With increased global investment in aircraft manufacturing and defense systems, the need for advanced and automated deburring solutions is expanding rapidly.

Regional Insights

The North America deburring machine market is anticipated to grow at a significant CAGR of 5.6% during the forecast period, driven by mature automotive and aerospace industries, especially in the U.S. and Canada. High levels of automation, adoption of Industry 4.0 technologies, and strict quality standards have fueled demand for advanced deburring solutions. The region consistently invests in robotic and AI-integrated systems, sustaining its dominance in the market.

U.S. Deburring Machine Market Trends

The deburring machine market in the U.S. accounted for the largest revenue share of 78.1% in North America in 2024, driven by its advanced manufacturing infrastructure and high adoption of automation. Strong demand from the automotive, aerospace, and medical device industries fuels consistent investment in robotic and precision deburring solutions. The presence of major industry players and continued focus on quality and efficiency sustain its leadership.

The Mexico deburring machine market is anticipated to grow at the fastest CAGR during the forecast period, driven by rapid growth in automotive, electronics, and metal component manufacturing. As global companies shift production to Mexico for cost efficiency, the demand for high-quality surface finishing technologies is accelerating. This has led to increased adoption of semi-automatic and entry-level automated deburring systems.

Europe Deburring Machine Market Trends

The deburring machine market in Europe shows steady growth, backed by strong industrial bases in Germany, France, and Italy. The region emphasizes high-precision manufacturing, particularly in the automotive and aerospace sectors. With a growing focus on environmental compliance, technologies like hydrogen-based CO₂-free thermal deburring are gaining momentum, especially among eco-conscious manufacturers.

The Germany deburring machine market accounted for the largest market revenue share in Europe in 2024, due to its strong manufacturing base, particularly in the automotive, aerospace, and precision engineering sectors. The country emphasizes high-quality production standards, driving consistent demand for advanced and automated deburring technologies. German companies also lead in the development and adoption of eco-efficient systems, such as hydrogen-based thermal deburring.

The deburring machine market in the UK is anticipated to grow at the fastest CAGR during the forecast period, driven by the expansion of high-precision industries like aerospace, defense, and medical devices. UK manufacturers are increasingly adopting advanced deburring technologies to meet strict quality and safety standards, particularly for export-driven production.

Asia Pacific Deburring Machine Market Trends

Asia Pacific dominated the deburring machine market with the largest revenue share of 37.8% in 2024, fueled by rapid industrialization in China, India, Japan, and South Korea. The booming automotive, electronics, and metal processing industries demand scalable and cost-effective deburring solutions. Government initiatives to boost manufacturing and exports further propel the adoption of both manual and automated machines.

The deburring machine market in China accounted for the largest revenue share in Asia Pacific in 2024,owing to its vast manufacturing ecosystem across the automotive, electronics, and metalworking industries. The country’s focus on large-scale production and continuous upgrade of manufacturing technologies fuels high demand for automated and precision deburring solutions. Government initiatives supporting smart factories and Industry 4.0 adoption further strengthen China’s leadership in this market.

TheIndia deburring machine marketis propelled by rapid industrialization and expansion in the automotive, electronics, and metal fabrication sectors. Increasing foreign direct investment and government policies promoting “Make in India” have accelerated the adoption of modern manufacturing equipment, including semi-automatic and automatic deburring machines.

Latin America Deburring Machine Market Trends

The deburring machine market in Latin America is anticipated to grow at a steady CAGR during the forecast period, driven by industrial hubs in Brazil and Argentina. The region’s automotive and metalworking sectors drive the demand, with a rising interest in semi-automatic solutions due to cost efficiency. However, slow technological adoption and limited automation infrastructure constrain faster market expansion.

The Brazil deburring machine market is driven by its robust automotive and metalworking industries. Increasing industrial modernization and growing demand for high-quality surface finishing are encouraging adoption of semi-automatic and automated deburring solutions. Despite economic fluctuations, Brazil’s focus on improving manufacturing efficiency and meeting international quality standards supports steady market growth. Investments in infrastructure and technology upgrades are expected to further boost demand for advanced deburring systems

Middle East & Africa Deburring Machine Market Trends

The deburring machine market in Middle East and Africa is in the early stages of growth, with increasing interest in industrial automation and component manufacturing. Countries like the UAE and South Africa are investing in aerospace and defense sectors, which is gradually increasing demand for precision deburring. Growth is promising but currently limited by infrastructure and skilled labor shortages.

The UAE deburring machine market is driven by its growing aerospace, defense, and metal fabrication industries. The country’s focus on industrial diversification and investment in advanced manufacturing technologies drives demand for automated and precision deburring solutions.

Key Deburring Machine Company Insights

Some of the key players operating in the market include ATI Industrial Automation, Inc., BENSELER, and Sugino Corp.

-

ATI Industrial Automation is a U.S.-based company known for its advanced robotic accessories and end-of-arm tooling solutions. It specializes in products such as robotic tool changers, force/torque sensors, and material removal tools, designed to enhance automation system performance. ATI serves a wide range of industries, including automotive, aerospace, and electronics, offering high-precision and customizable solutions.

-

BENSELER is a German company that focuses on surface finishing and deburring services for industrial components. It offers specialized solutions such as coating, thermal deburring, and electrochemical metalworking, catering mainly to the automotive and engineering sectors. The company is known for its technical expertise and high standards in component finishing.

Key Deburring Machine Companies:

The following are the leading companies in the deburring machine market. These companies collectively hold the largest market share and dictate industry trends.

- ATI Industrial Automation, Inc.

- BENSELER

- Sugino Corp.

- Kadia Production

- Georg Kesel GmbH & Co. KG

- EMAG Systems GmbH

- PROCECO

- Maschinenbau Silberhorn

- SBS Ecoclean Group

- Loeser GmbH

- SEMA Technology Group

- AXIOME

- RSA Cutting Technologies Ltd

- Bertsche Engineering Corporation

- Abtex LLC

Recent Developments

-

In May 2024, BENSELER has introduced a CO₂-free thermal deburring (TEM) process using hydrogen, eliminating methane and enabling eco-friendly burr removal. This innovative method allows automotive and component manufacturers to enhance their carbon footprint while effectively deburring delicate aluminum, zinc, and steel parts in a single step.

-

In December 2024, PROCECO launched the ProClean 4000, a high-pressure water jet deburring system that utilizes advanced nozzle technology to effectively remove burrs from intricate parts without causing damage. This system is particularly advantageous for the electronics and aerospace industries, where component integrity is paramount.

Deburring Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,054.3 million

Revenue forecast in 2030

USD 1,365.8 million

Growth rate

CAGR of 5.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, operation mode, deburring media, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

ATI Industrial Automation, Inc.; BENSELER; Sugino Corp.; Kadia Production; Georg Kesel GmbH & Co. KG; EMAG Systems GmbH; PROCECO; Maschinenbau Silberhorn; SBS Ecoclean Group; Loeser GmbH; SEMA Technology Group; AXIOME; RSA Cutting Technologies Ltd; Bertsche Engineering Corporation; Abtex LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Deburring Machine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global deburring machine market report based on type, operation mode, deburring media, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Vibratory Deburring

-

Barrel Tumbling

-

Brush Deburring

-

Thermal Deburring

-

Electrochemical Deburring

-

High-Pressure Water Jet Deburring

-

Others

-

-

Operation Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Semi-automatic

-

Manual

-

-

Deburring Media Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceramic

-

Steel

-

Plastic

-

Organic Compounds

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Electronics

-

Medical Devices

-

Metalworking

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global deburring machine market size was estimated at USD 1,023.6 million in 2024 and is expected to be USD 1,054.3 million in 2025.

b. The global deburring machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2030 to reach USD 1,365.8 million by 2030.

b. Asia Pacific is the dominating region and accounted for the share of 37.8% in the global deburring machine market, fueled by rapid industrialization in China, India, Japan, and South Korea. The booming automotive, electronics, and metal processing industries demand scalable and cost-effective deburring solutions.

b. Some of the key players operating in the global deburring machine market include ATI Industrial Automation, Inc.; BENSELER; Sugino Corp.; Kadia Typeion; Georg Kesel GmbH & Co. KG; EMAG Systems GmbH; PROCECO; Maschinenbau Silberhorn; SBS Ecoclean Group; Loeser GmbH; SEMA Technology Group; AXIOME; RSA Cutting Technologies Ltd; Bertsche Engineering Corporation; Abtex LLC.

b. Key factors driving the global deburring machine market include the growing demand for high-precision components across industries like automotive, aerospace, and electronics, increased automation in manufacturing processes, and the rising adoption of Industry 4.0 technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.