- Home

- »

- Pharmaceuticals

- »

-

Dementia Treatment Market Size And Share Report, 2030GVR Report cover

![Dementia Treatment Market Size, Share & Trends Report]()

Dementia Treatment Market Size, Share & Trends Analysis Report By Indication (Alzheimer’s Disease Dementia, Vascular Dementia), By Drug Class, By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-258-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Dementia Treatment Market Size & Trends

The global dementia treatment market size was estimated at USD 17.06 billion in 2023 and is projected to grow at a CAGR of 7.68% from 2024 to 2030. The market growth is attributed to the high disease prevalence, rising geriatric population, introduction of novel therapeutic products, and increasing R&D activities in the market. For instance, according to the NCBI, in 2023, in the U.S., around 6.7 million people aged 65 years and above had Alzheimer’s disease dementia and it is estimated to reach around 13.8 million by 2060. Moreover, increasing supportive government initiatives and growing awareness programs to educate people about the disease are further anticipated to drive market growth. The increasing prevalence of dementia is one of the major factors driving market growth.

According to the WHO data published in March 2023, more than 55 million people suffer from dementia worldwide and it is predicted to reach 78 million and 139 million by 2030 and 2050, respectively. Moreover, around 10 million new cases of the disease are reported every year. The prevalence of the disease is comparatively higher in developing economies, such as China, India, and Brazil. The introduction and development of novel therapeutic products for different types of dementia is expected to support the growth. In November 2023, Eisai Co., Ltd. announced the launch of Leqembi in the U.S. market and the company aimed that the drug would be prescribed to 10,000 patients by the end of March 2024. Leqembi received approval from the U.S. FDA in July 2023.

Similarly, in September 2022, Corium, Inc. announced the availability of Adlarity (donepezil transdermal system) for prescription in the U.S. for the treatment of mild, moderate, or severe dementia related to Alzheimer's disease. In March 2022, the U.S. FDA approved Adlarity for the treatment of Alzheimer's disease dementia. Favorable initiatives are being undertaken by government and non-government bodies to improve the overall healthcare services for patients and spread awareness among people. In December 2023, the U.S. Department of Health & Human Services (HHS) released a roadmap of strategies to support research activities, increase treatment rates, improve health services to support dementia patients, and encourage action to reduce risk factors associated with the disease.

Moreover, government bodies are providing financial aid to accelerate clinical research to develop novel drugs for the targeted disease. For instance, in November 2023, the National Institutes of Health announced a funding opportunity for the development of novel therapeutic drugs for Alzheimer’s disease and related dementia. The funding will be provided to support phase 1 and 2 clinical trials to accelerate the evaluation of promising drug candidates. The presence of strong pipeline candidates under clinical trials for dementia is expected to boost market expansion. As of January 2023, there were 36 drugs in phase-3, 87 drugs in phase-2, and 31 drugs in phase-1 clinical trials.

Increasing R&D activities to develop novel biological and other drug classes are anticipated to fuel market growth. Clinical studies related to anti-amyloid antibodies show promising results in clinical trials. For instance, lecanemab and donanemab drug candidates showed cognitive decline by 27% at 18 months of treatment and about 35% at 18 months of treatment, respectively. Moreover, amyloid clearance was observed in 68% of participants in the phase-3 trial of lecanemab and 80% in the donanemab phase-3 trial.

Market Concentration & Characteristics

The degree of innovation is high in the market characterized by a growing level of R&D. Market players are involved in the development of novel biological drugs, disease-modifying therapies, and transdermal patches. According to the report published by the Alzheimer's Association in May 2023, disease-modifying therapies are the most common investigational drugs accounting for 79% of drugs in clinical trials

Key players are involved in mergers & acquisitions to strengthen their market position. This strategy enables companies to expand their product portfolio and expertise in the market. For instance, in November 2023, Merck & Co., Inc. acquired Caraway Therapeutics, Inc.for a total potential consideration of up to USD 610 million. Caraway Therapeutics is involved in the development of treatment for neurodegenerative diseases including Parkinson’s disease and Lewy body dementia

The regulatory framework for drug approvals has always been one of the major restraining factors in the pharmaceutical and biotechnology industries. The approval process for neurodegenerative diseases is very complex and stringent in target markets that have a high potential to grow due to the availability of a large patient pool and high unmet medical needs

The level of substitution is low for the market due to the unavailability of alternative remedies for disease management. However, the adoption of natural therapy methods, such as a healthy diet, proper sleep, supplements, and exercising the mind, may improve overall disease management

The concentration of end-users is expected to be moderate. Increasing regular visits to neurologists & psychiatrists and a growing patient base in nursing homes to provide care for dementia patients are projected to increase the end-user concentration

Indication Insights

The Alzheimer’s disease (AD) dementia segment led the global market with a share of 60.11% in 2023 and is expected to maintain its dominance over the forecast period. The largest share of this segment can be attributed to the high number of disease cases associated with AD, high treatment rates, and increased awareness among people. According to the WHO, Alzheimer’s disease is the most common form of the disease, which contributes to 60 - 70% of all dementia cases. Moreover, increasing approval of novel therapeutic drugs for the treatment is expected to drive segment growth.

For instance, in September 2023, Eisai Co., Ltd. received market approval from the Ministry of Health, Labour and Welfare for lecanemab to treat dementia due to AD in Japan. The Lewy body dementia (LBD) segment is anticipated to grow at the fastest CAGR from 2024 to 2030 owing to the increasing cases and severity of this health condition. It is more rapid than other types of dementia and patients can experience more symptoms and sudden decline. According to the Lewy Body Society, LBD accounts for 15% of all types of disease forms and it is expected to increase in the coming years.

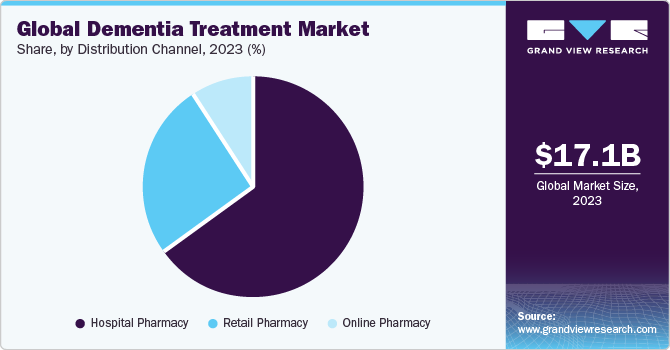

Distribution Channel Insights

The hospital pharmacy segment led the market with a share of 64.59% in 2023. The increasing hospitalization rate due to dementia among the geriatric population is supporting the segment's growth. According to the Alzheimer’s Association Report 2023, there were 518 hospitalizations per 1,000 Medicare beneficiaries aged 65 years and older having Alzheimer’s or other types of dementia as compared to only 234 hospitalizations per 1,000 Medicare beneficiaries without these conditions.

The online segment is expected to grow at the fastest CAGR from 2024 to 2030. Increased user base of internet & smartphone, ease of ordering medications through an e-commerce platform, and increasing e-commerce services offering medicinal products globally are expected to fuel segment growth in the coming years. Moreover, increasing adoption of telemedicine to manage mental health is further anticipated to support segment growth in the coming years.

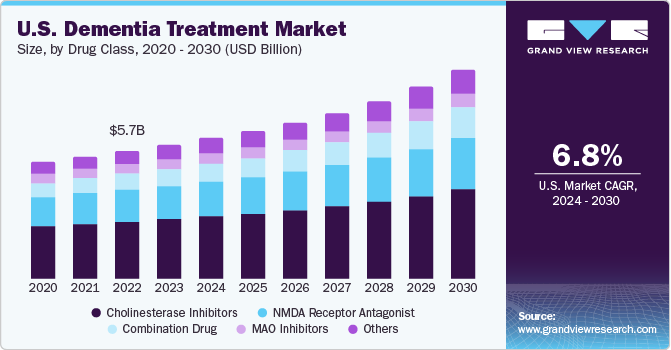

Drug Class Insights

The cholinesterase inhibitors segment led the market with a share of 44.44% in 2023. High prescription rates of donepezil, rivastigmine, and galantamine and better results are some of the key factors supporting market growth. Moreover, the increasing adoption of transdermal cholinesterase inhibitors and their high safety & effectiveness are further supporting market growth. For instance, in September 2023, Corium, LLC published data stating that Adlarity (donepezil transdermal system) showed positive results in terms of skin tolerability and adhesion in a placebo-controlled trial.

However, the combination drugs segment is projected to grow at the fastest CAGR from 2024 to 2030. The segment growth can be attributed to the increasing adoption of combination therapy due to its better results, and increasing introduction of novel combination drugs by key players. For instance, in April 2022, NovaMedica developed and registered a combination of donepezil and memantine molecules under the brand name Mioreol in the Russian and European markets. Increasing approval of cholinesterase inhibitors and NMDA receptor antagonist combinations across the globe is boosting segment growth.

Route of Administration Insights

The oral route of administration led the market with a share of 54.69% in 2023 and is projected to retain its dominance over the projected years. High market penetration of oral drugs, such as memantine, donepezil, rivastigmine, galantamine, and others, a large number of pharmaceutical companies offering these oral drugs, and increasing approval of oral drugs are the key factors driving the segment expansion. For instance, in May 2023, the U.S. FDA granted supplemental approval for Rexulti (brexpiprazole) oral tablet to manage agitation associated with dementia.

The injectable drugs segment is expected to experience the fastest CAGR from 2024 to 2030. Increasing R&D activities to develop novel biological therapeutics, approval of injectable drugs, and improved results in treating dementia are some major factors anticipated to drive segment growth. For instance, in July 2021, Biogen and Eisai Co., Ltd. received the U.S. FDA approval for Aduhelm injection for the treatment of dementia related to Alzheimer’s disease. Moreover, in January 2023, Eisai Co., Ltd. received the U.S. FDA accelerated approval for Leqembi for the treatment of Alzheimer's disease. The increasing introduction of novel injectable drugs is expected to propel the segment growth significantly.

Regional Insights

The North America dementia treatment market accounted for the largest share of 37.92% in 2023 and is expected to be the dominant regional market throughout the forecast period. High disease prevalence, presence of key pharmaceutical companies involved in the marketing & development of novel dementia drugs, and favorable government initiatives are some of the key factors supporting market growth. For instance, in June 2023, Health Canada announced the initiation of the approval process for lecanemab in the country. Moreover, according to the Alzheimer's Association of Canada, around 747,000 people suffer from the disease in the country.

U.S. Dementia Treatment Market Trends

The dementia treatment market in the U.S. is expected to grow at a lucrative rate over the forecast period due to a strong presence of key players, better reimbursement policies, improved healthcare infrastructure, and favorable initiatives undertaken by government & non-government bodies to improve the healthcare services for dementia patients. For instance, in October 2023, U.S.-based CuraSen Therapeutics announced the initiation of a human clinical trial with a new neurodegenerative disease drug, CST-3056 in the 4th quarter of 2024. The company has received funding of USD 5.8 million from the Alzheimer’s Drug Discovery Foundation.

Europe Dementia Treatment Market Trends

The Europe dementia treatment market was identified as a lucrative regional market. The growth can be attributed to factors, such as a high prevalence of dementia, introduction of novel therapeutic products, and a surge in R&D activities to develop novel drugs to manage mental health. For instance, in January 2023, Eisai Co., Ltd. and Biogen announced that the European Medicines Agency (EMA) accepted a marketing authorization application for lecanemab indicated for AD and mild AD dementia.

The dementia treatment market in the UK is expected to grow significantly over the forecast period due to the presence of local pharmaceutical & biopharmaceutical companies, well-established healthcare infrastructure, high disposable income, and rising awareness about early detection of mental health.

The France dementia treatment market is expected to grow over the forecast period attributed to the increasing patient base and introduction of novel drugs for different types of dementia

The dementia treatment market in Germany is expected to grow considerably in the future due to the rising number of initiatives being undertaken by the government to reduce the overall disease burden in the country. Moreover, the prevalence of diseases is higher in Germany compared to other European countries.

Asia Pacific Dementia Treatment Market Trends

The Asia Pacific dementia treatment market is anticipated to witness the fastest CAGR from 2024 to 2030. The presence of a large target population, high unmet clinical needs, and developing healthcare is anticipated to provide high growth potential for the regional market. Developing countries, such as China and India, have a large patient base with high unmet medical needs that create market opportunities for key players in the region. According to the NIH data published in April 2023, dementia prevalence in India is around 7.4% among people aged above 60 years. Moreover, it is expected that more than 75% of Alzheimer’s disease and related dementias to occur in low- and middle-income countries by 2050.

The dementia treatment market in China is expected to grow significantly due to the large target patient base, increasing approval of novel therapeutic drugs, and increasing favorable initiatives undertaken by key governments to control dementia.

The Japan dementia treatment market is expected to grow over the forecast period due to the presence of strong pharmaceutical companies, well-established healthcare systems, and increasing adoption of novel biological drugs and other therapies to treat the disease.

Latin America Dementia Treatment Market Trends

The dementia treatment market in Latin America was identified as a lucrative region. An increasing disease prevalence coupled with high unmet medical needs and increasing adoption of novel & effective treatment options for disease management are some of the key factors driving the regional market.

The Brazil dementia treatment market is expected to grow at a lucrative pace over the forecast period due to the high prevalence of different types of dementia and a number of favorable initiatives undertaken by the government and market players. Moreover, Brazil held the largest share of the Latin America regional market.

MEA Dementia Treatment Market Trends

The dementia treatment market in MEA is driven by the high disease prevalence coupled with increasing unmet medical needs, aided by improvements in healthcare infrastructure.

The Saudi Arabia dementia treatment market is expected to grow over the forecast period owing to the improvement in healthcare infrastructure, increasing patient base due to a rise in the geriatric population, and adoption of novel therapies.

Key Dementia Treatment Company Insights

Some of the leading players operating in the market include Eisai Co., Ltd. Lilly,Daiichi Sankyo Company, Ltd., andBiogen. Key companies are adopting different strategies, such as new product development, collaboration, and partnership, to increase their industry footprint. For instance, Eisai and Biogen collaborated to develop and commercialize AD treatment; and, later, the companies introduced aducanumab and lecanemab to manage dementia.

Sage Therapeutics, Inc.,H. Lundbeck A/S, Corium, LLC, and NovaMedica are some of the emerging participants in the dementia market. These companies focus on achieving funding support from government bodies and healthcare organizations to support their research activities related to the development of novel treatments for dementia.

Key Dementia Treatment Companies:

The following are the leading companies in the dementia treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Eisai Co., Ltd.

- Lilly

- Novartis AG

- Daiichi Sankyo Company, Ltd.

- AbbVie Inc.

- H. Lundbeck A/S

- Biogen

- Cipla Inc.

- Sun Pharmaceutical Industries Ltd.

- Viatris Inc.

Recent Developments

-

In January 2024, Eisai Co., Ltd. and Biogen received approval for Leqembi for the treatment of mild cognitive impairment due to AD and mild AD dementia

-

In May 2023, Lilly announced the positive results of a phase-3 clinical study demonstrated that donanemab significantly slowed cognitive and functional decline in Alzheimer's disease patients at early stage

-

In May 2023, Eisai Co., Ltd. applied for market approval of lecanemab in the UK and the regulatory decision is expected to be released in 2024

-

In August 2022, Lilly commenced a large clinical phase-3 study of remternetug to evaluate the effectiveness and safety of the drug in people having mild AD. The study is expected to be completed in 2025

-

In April 2022, Sage Therapeutics, Inc. announced the results of phase-2 clinical study SAGE-718 showed that the drug is well-tolerated and associated with improvement on multiple tests to improve memory in patients with mild dementia due to Alzheimer’s disease

Dementia Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.03 billion

Revenue forecast in 2030

USD 28.11 billion

Growth rate

CAGR of 7.68% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Indication, drug class, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Eisai Co., Ltd., Lilly, Novartis AG, DAIICHI SANKYO COMPANY, LIMITED, AbbVie Inc., H. Lundbeck A/S, Biogen, Cipla Inc., Sun Pharmaceutical Industries Ltd., Viatris Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dementia Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the dementia treatment market report based on indication, drug class, route of administration, distribution channel, and region:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Alzheimer’s Disease Dementia

-

Vascular Dementia

-

Lewy Body Dementia

-

Frontotemporal Dementia (FTD)

-

Parkinson Disease Dementia

-

Others

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Cholinesterase Inhibitors

-

NMDA Receptor Antagonist

-

MAO Inhibitors

-

Combination Drug

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Transdermal Patch

-

Injectable

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global dementia treatment market size was estimated at USD 17.06 billion in 2023 and is expected to reach USD 18.03 billion in 2024.

b. The global dementia treatment market is expected to grow at a compound annual growth rate of 7.68% from 2024 to 2030 to reach USD 28.11 billion by 2030.

b. Alzheimer’s disease dementia segment led the global market with a share of 60.11% in 2023 and is expected to maintain its dominance over the forecast period. High share of the segment can be attributed to the high number of disease cases associated with Alzheimer’s disease (AD), increasing treatment rate, and increasing awareness among people

b. Some key players operating in the dementia treatment market include Eisai Co., Ltd., Lilly, Novartis AG, DAIICHI SANKYO COMPANY, LIMITED, AbbVie Inc., H. Lundbeck A/S, Biogen, Cipla Inc., Sun Pharmaceutical Industries Ltd., Viatris Inc.

b. Key factors that are driving the market growth include increasing prevalence of dementia coupled with growing geriatric population, introduction of novel therapeutic products, and increasing research & development activities in the market

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."