- Home

- »

- Alcohol & Tobacco

- »

-

Denmark CBD Pouches Market Size, Industry Report, 2033GVR Report cover

![Denmark CBD Pouches Market Size, Share & Trends Report]()

Denmark CBD Pouches Market (2025 - 2033) Size, Share & Trends Analysis Report By Content (Up to 10 mg, 10 mg -20 mg), By Type (Flavored, Unflavored), By Distribution Channel (Offline, Online), Segment Forecasts

- Report ID: GVR-4-68040-684-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Denmark CBD Pouches Market Summary

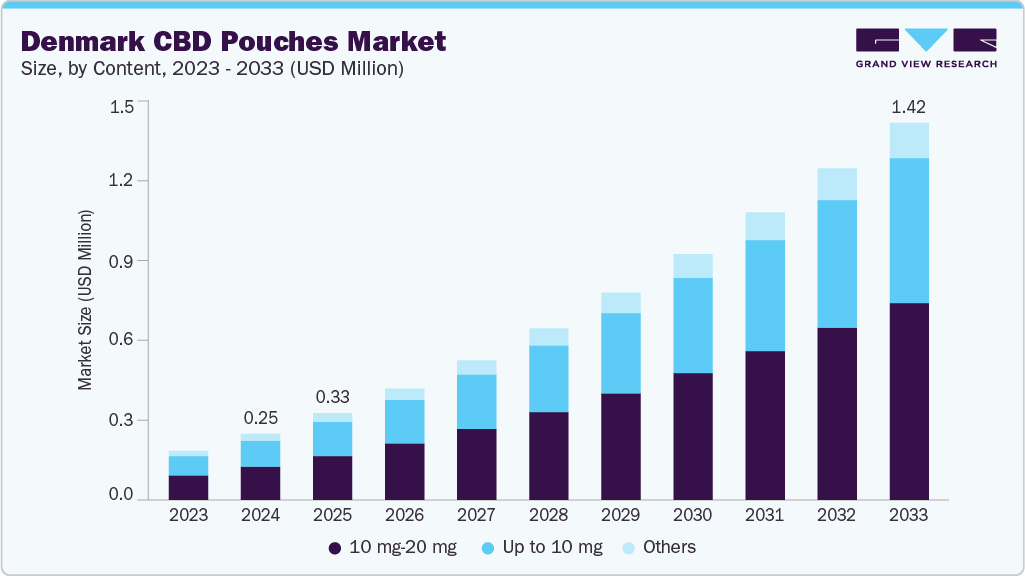

The Denmark CBD pouches market size was estimated at USD 0.25 million in 2024 and is expected to reach USD 1.42 million by 2033, growing at a CAGR of 20.1 % from 2025 to 2033. The market is expanding due to rising consumer demand for discreet, smokeless CBD formats and growing interest in natural wellness products.

Key Market Trends & Insights

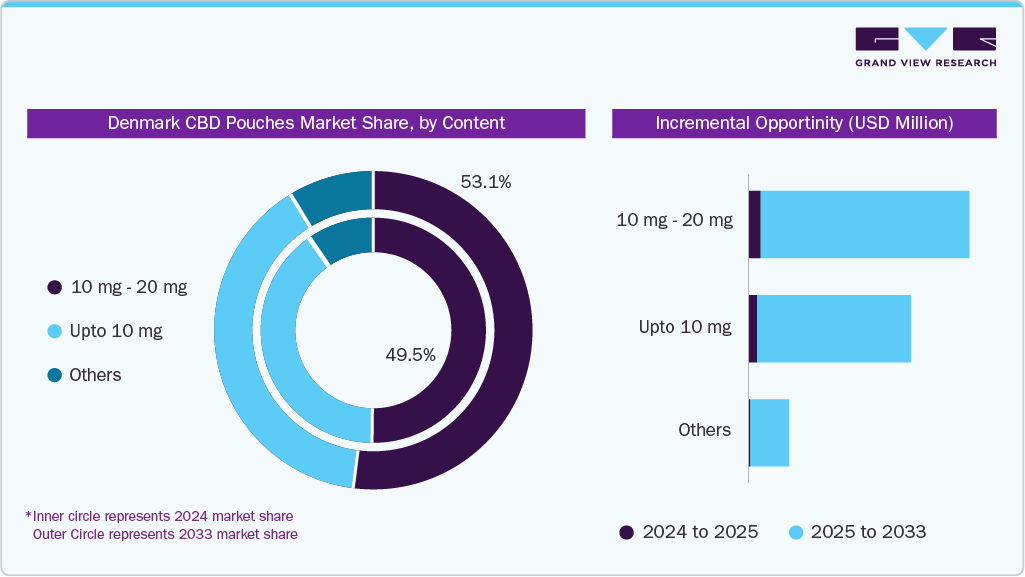

- By content, 10 mg -20 mg CBD pouches led the market and accounted for a share of 49.49% in 2024.

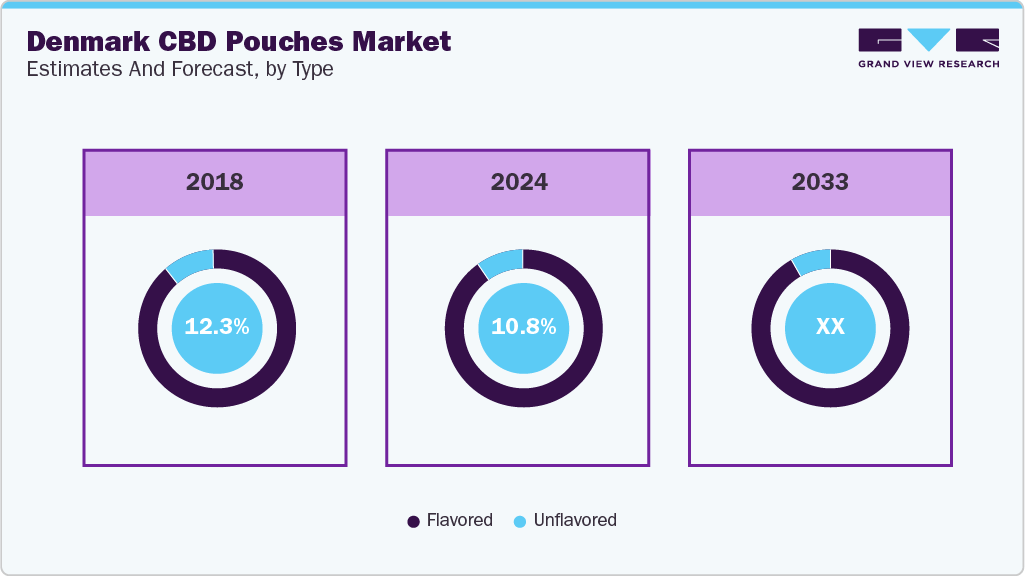

- By type, flavored CBD pouches dominated the market in Denmark, with a share of 89.18% in 2024.

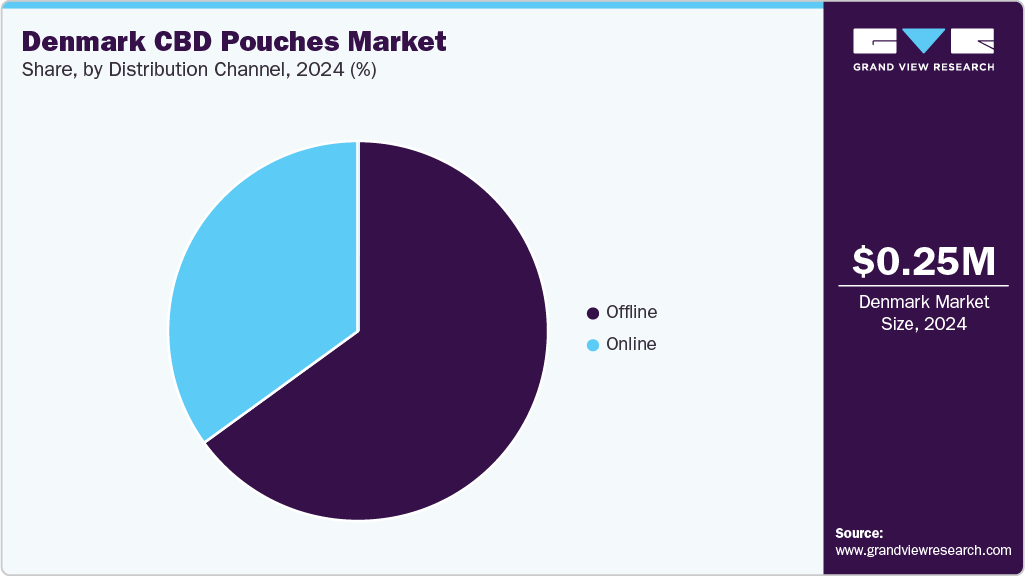

- By distribution channel, the offline sales held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 0.25 Million

- 2033 Projected Market Size: USD 1.42 Million

- CAGR (2025-2033): 20.1%

Supportive EU-wide trends and improved product availability are also encouraging trial and adoption. The growing demand for CBD pouches in Denmark is driven by a confluence of evolving consumer wellness preferences, regulatory shifts, and functional innovation in cannabinoid delivery systems. As Danish consumers increasingly seek natural, plant-based alternatives for stress management, sleep support, and cognitive enhancement, CBD pouches offer a discreet, non-combustible format aligned with modern health values. Their portability, precise dosing, and smoke-free administration appeal to both wellness-oriented users and individuals avoiding traditional inhalable or edible products.The demand for CBD pouches in Denmark is growing as consumers increasingly seek alternative wellness options that match modern health and lifestyle preferences. Unlike traditional cannabis products, CBD pouches provide a smoke-free, discreet, and controlled way to consume, making them appealing to users looking for stress relief, sleep aid, or mental clarity without THC's psychoactive effects. This format especially appeals to health-focused individuals, working professionals, and first-time users who might hesitate to use oils or vaporizers but prefer convenient, pre-dosed delivery methods.

Regulatory clarity, although still developing, has played an important role in legitimizing CBD products in Denmark. While recreational cannabis remains illegal, non-psychoactive CBD-especially when derived from hemp and meeting EU THC limits-has gained traction in wellness and health product categories. Growing availability through cross-border e-commerce, specialty stores, and wellness retailers is making CBD pouches more accessible, especially to urban consumers. Additionally, Denmark’s involvement in broader EU efforts to destigmatize cannabinoids and promote functional wellness is indirectly enhancing local confidence in trying new formats like pouches.

Innovation from Scandinavian and European brands continues to drive market growth. Companies offering flavored, water-soluble, and clean-label pouches are increasingly meeting consumer demands for transparency, taste, and efficacy. As trust in third-party testing and quality assurance grows, consumers are more willing to incorporate CBD pouches into daily routines. The discreet nature of this format also fits well with Danish cultural norms that favor moderation and privacy, making it a culturally suitable delivery method for both therapeutic and lifestyle uses.

Consumer Insights for Denmark CBD Pouches Market

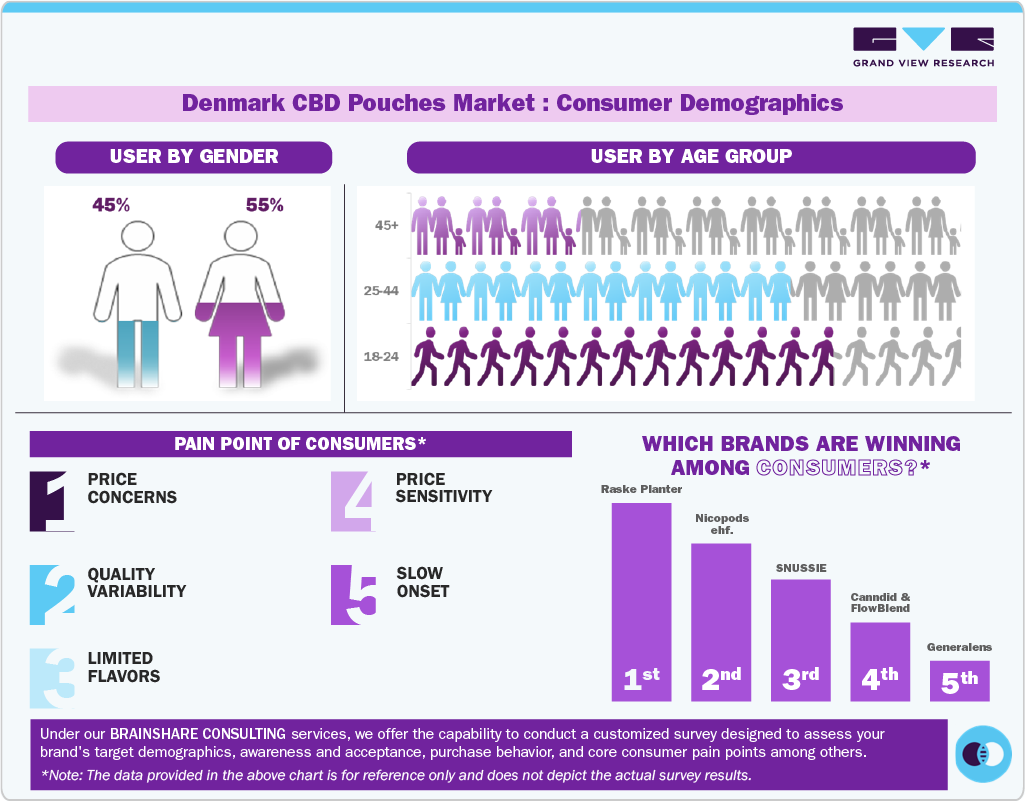

In Denmark, CBD pouch use shows slight gender differences-women often choose pouches for wellness and stress relief, while men prefer functional benefits like focus or recovery. The discreet, smokeless design appeals to both, especially among health-conscious users.

Younger adults (18-29) are early adopters, attracted to innovation and convenience. The 25-44 age group is the main user base, incorporating CBD into their daily wellness routines. Older adults (45+) tend to adopt more slowly but are increasingly interested in sleep and pain relief without inhalation.

Consumers face several pain points: high prices, unclear regulations, inconsistent product quality, limited flavors, and restricted offline access. These barriers make first-time users cautious and slow broader market growth.

Brands gaining traction include Nicopods, SNUSSIE, Canndid, and FlowBlend-favored for clean-label formulations, discreet formats, and better availability online. Trust, transparency, and ease of use are driving brand preference.

Content Insights

CBD pouches with 10 - 20 mg content accounted for a revenue share of 49.49% in 2024 in Denmark. CBD pouches in this range are the preferred format because of their moderate and effective dose, providing a balance between noticeable effects and tolerability. This strength is especially popular among wellness users seeking daily relief from stress or discomfort. Brands like SNUSSIE and Nicopods target this segment with clear labeling and Scandinavian-style clean formulations that appeal to Danish consumers.

The CBD pouches with up to 10 mg content are expected to grow at a CAGR of 19.8% from 2025 to 2033. The up to 10 mg pouch segment is rapidly expanding in Denmark as new users and health-conscious adults prefer low-dose products for microdosing throughout the day. These lighter formulations are perfect for easing into CBD use and are often available in mild mint or citrus flavors. Brands such as Canndid offer low-dose options aimed at focus or calming benefits, which are becoming more popular among younger professionals.

Type Insights

The flavored CBD pouches segment led the market, making up 89.18% of it in 2024. Flavored CBD pouches are especially popular in Denmark because they help mask the earthy taste of hemp and provide a more enjoyable, lifestyle-friendly experience. Flavors like berry, eucalyptus, and menthol are favored by users seeking both functional benefits and a pleasant mouthfeel. Nicopods ehf. and FlowBlend have taken advantage of this trend by launching Nordic-inspired flavors that appeal to local taste preferences.

The unflavored CBD pouches market is the fastest-growing segment, expected to expand at a CAGR of 17.1% from 2025 to 2033. Unflavored CBD pouches are increasing steadily as Danish consumers become more label-conscious and look for minimalist, additive-free products. Wellness and therapeutic users who prefer a natural hemp experience without sweeteners or artificial flavorings drive this growth. Some smaller domestic or EU brands target this niche by marketing “pure” or “raw” CBD products for more experienced users.

Distribution Channel Insights

The sales of CBD pouches through offline channels are rapidly growing, making up about 65.98% in 2024. Offline stores are the main sales route in Denmark, mainly because consumers prefer buying from physical health stores, pharmacies, or specialty shops where they can verify product authenticity. In-person retail also offers reassurance, especially for new users. Shops in cities like Copenhagen and Aarhus are increasing shelf space for pouches, boosted by wellness product bundles.

Sales of CBD pouches through online channels are the fastest-growing segment, expected to grow at a CAGR of 20.8% from 2025 to 2033. Despite dominant offline sales, online sales of CBD pouches are expanding most rapidly in Denmark, driven by convenience, a wider selection, and easier access to niche or imported brands. Platforms offering transparent lab reports and subscription services, such as those operated by brands like Canndid and FlowBlend, are gaining popularity, especially among tech-savvy and younger consumers seeking flexibility and delivery convenience.

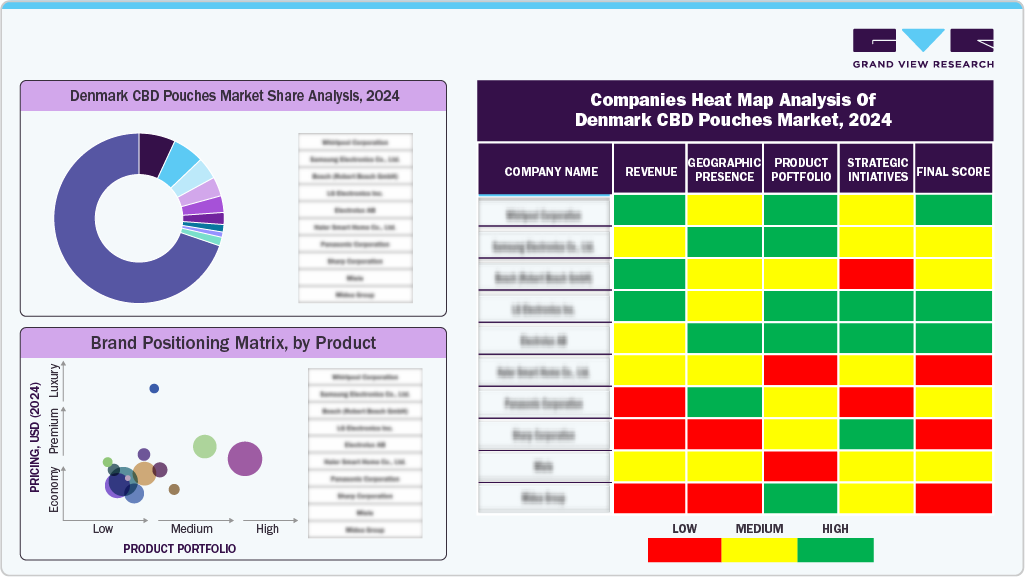

Key Denmark CBD Pouches Company Insights

The Denmark CBD pouches market is becoming more competitive as both established brands and new entrants focus on product innovation, quality improvements, and competitive pricing. Leading manufacturers are actively expanding their presence across both offline retail and online platforms to increase accessibility and reach more consumers. Additionally, companies are investing in advanced delivery technologies to enhance the bioavailability and effectiveness of CBD. The entry of major tobacco companies is further reshaping the landscape, bringing substantial resources, extensive distribution networks, and regulatory expertise to the sector. As consumer demand for discreet, smoke-free CBD formats grows and regulatory clarity continues to improve, the market is set for sustained growth in the coming years.

Key Denmark CBD Pouches Companies:

- Nicopods ehf.

- SNUSSIE

- Canndid

- FlowBlend

- Chill.com

- V&YOU

- The Snus Brothers

- CBD Pouches Nordic

- Cannadips Europe

- Generalens

Recent Developments

-

In February 2023, Cannadips Europe, a SpectrumLeaf brand renowned for its premium CBD snus products tailored for the European market, partnered with Haypp Group to develop the revolutionary Cannadips Terpene Pouch Collection, featured on Haypp’s online platform snusbolaget.se. The pouches leverage the unique qualities of plant-derived terpenes, condensed into convenient pouches. Free from tobacco, nicotine, CBD, and THC, these pouches offer an ideal solution for snus enthusiasts seeking a healthier option.

-

In January 2023, Cannadips Europe partnered with Snushus AG to introduce all-natural CBD snus pouches. This collaboration aims to expand the availability of Cannadips' CBD products within the European market. The partnership signifies a strategic move to capitalize on the growing demand for CBD-infused products in Europe, providing consumers with a new option for CBD consumption.

Denmark CBD Pouches Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 0.33 million

Revenue forecast in 2033

USD 1.42 million

Growth rate

CAGR of 20.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Content, type, distribution channel

Key companies profiled

Nicopods ehf.; SNUSSIE; Canndid; FlowBlend; Chill.com; V&YOU; The Snus Brothers; CBD Pouches Nordic; Cannadips Europe; Generalens

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Denmark CBD Pouches Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the Denmark CBD pouches market by content, type, and distribution channel.

- Content Market Outlook (Revenue, USD Million, 2021 - 2033)

-

Up to 10 mg

-

10 mg -20 mg

-

Others

-

-

Type Market Outlook (Revenue, USD Million, 2021 - 2033)

-

Flavored

-

Unflavored

-

-

Distribution Channel Market Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

- Online

-

Frequently Asked Questions About This Report

b. The Denmark CBD Pouches market size was estimated at USD 0.25 million in 2024 and is expected to reach USD 0.33 million in 2025.

b. The Denmark CBD Pouches market is expected to grow at a compound annual growth rate (CAGR) of 20.1 % from 2025 to 2033 to reach USD 1.42 million by 2033.

b. CBD pouches with 10 mg -20 mg content accounted for a revenue share of 49.49% in 2024 in Denmark. CBD pouches with 10–20 mg content are the preferred format due to their moderate and effective dose, offering a balance between noticeable effect and tolerability.

b. Some key players operating in the Denmark CBD Pouches market include Nicopods ehf., SNUSSIE, Canndid, FlowBlend, Chill.com, V&YOU, The Snus Brothers, CBD Pouches Nordic, Cannadips Europe, Generalens.

b. The growth of the market is primarily driven by a rising consumer demand for discreet, smokeless CBD formats and growing interest in natural wellness products. Supportive EU-wide trends and improved product availability are also encouraging trial and adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.