- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Denmark Dietary Supplements Market, Industry Report 2030GVR Report cover

![Denmark Dietary Supplements Market Size, Share & Trends Report]()

Denmark Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamins, Botanicals, Minerals), By Form, By Type, By Application, By End Use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-622-9

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

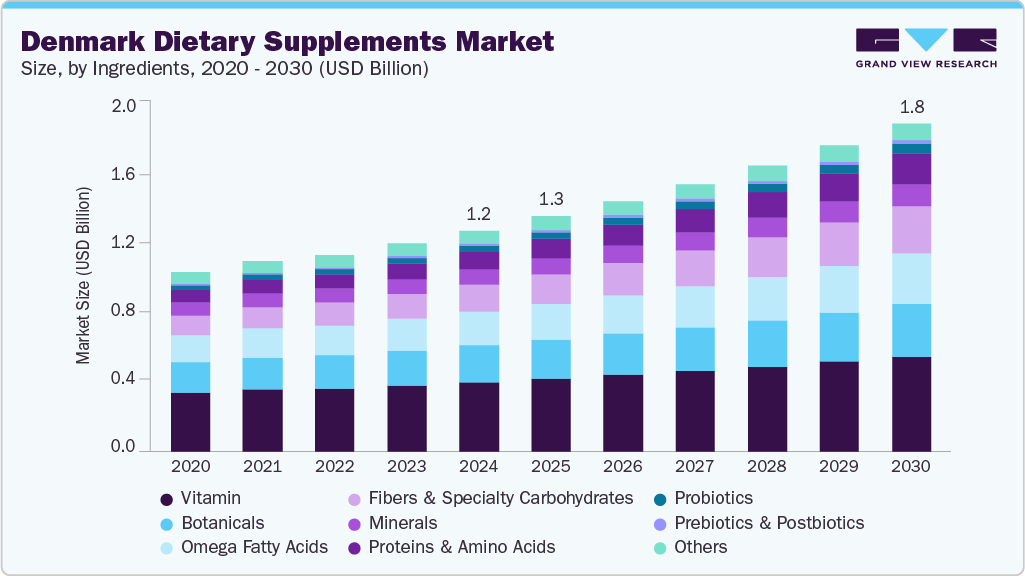

The Denmark dietary supplements market size was estimated at USD 1.23 billion in 2024 and is projected to grow at a CAGR of 6.9% from 2025 to 2030. Increasing health consciousness among consumers has led to a higher demand for supplements that support overall well-being. People are becoming more proactive in managing their health, particularly with the rise in chronic diseases, aging populations, and lifestyle-related health concerns. This trend has fueled interest in vitamins, minerals, probiotics, and herbal supplements to boost immunity, digestion, and mental health.

Government initiatives and favorable regulations have further contributed to market expansion. Danish authorities promote awareness of nutrition and wellness, encouraging consumers to adopt preventive healthcare measures. In July 2024, the Ministry of Food, Agriculture, and Fisheries (Denmark) published guidelines aimed at retailers, importers, and manufacturers to provide an understanding of the legislation related to food supplements.

Rising disposable income and changing dietary habits are also significant drivers. As individuals have more spending power, they are willing to invest in high quality, premium supplements. Moreover, busy lifestyles and convenience-oriented consumption patterns have led to an increased preference for supplements over traditional sources of nutrients.

The influence of e-commerce and digital marketing has reshaped consumer purchasing behaviors. Online platforms provide easy access to various dietary supplements, enabling informed purchasing decisions through detailed product descriptions, reviews, and expert recommendations. The convenience of subscription-based models and direct-to-consumer brands has further accelerated market penetration.

Consumer Insights

Denmark is undergoing significant demographic changes, with an aging population and a shrinking workforce. In 2025, the total population was 6,002,515, with 15.56% young people, 63.32% working-age people, and 21.12% elderly people. The population growth rate stood at 0.42%, the sex ratio was 0.99 (with 1.02 for the working-age group), and the dependency ratio was 57.9%. In Denmark, dietary supplements are consumed by various age groups, with adults and seniors (55+) being key end users. The 55+ population particularly relies on supplements to support bone health, cognitive function, heart health, and immunity, addressing age-related deficiencies.

Women in Denmark commonly use supplements such as calcium and vitamin D for bone health, iron for pregnancy and general well-being, multivitamins for overall health, and collagen for beauty benefits. Their higher consumption stems from increasing health awareness, preventive healthcare practices, and targeted marketing. Men primarily focus on muscle-building and performance-enhancing supplements, including protein powders and creatine. Influencer marketing and digital health platforms further drive female supplement use, as women often engage more in health-related research and prefer products with natural ingredients and scientific validation.

Ingredients Insights

Vitamins dominated the market and accounted for a share of 31.3% in 2024, owing to the rising prevalence of lifestyle-related health conditions, such as deficiencies and immune disorders, which have further contributed to the demand for vitamin supplements. Additionally, the aging population, which requires higher nutritional support, has played a key role in market expansion. Moreover, digital health platforms and influencer marketing strategies have influenced consumer preferences, particularly among younger demographics, further boosting vitamin sales across Denmark.

The proteins & amino acids segment is expected to experience the fastest CAGR from 2025 to 2030. With rising awareness of protein’s role in maintaining muscle mass, especially among aging populations, demand for high-quality protein supplements continues to expand. Additionally, digital health platforms and influencer marketing have contributed to the surge in protein consumption, particularly among younger consumers seeking athletic performance and wellness benefits. In November 2024, Arla Foods Ingredients launched Lacprodan DI-3092, a whey protein hydrolysate. It comes with minimal bitterness, thereby overcoming the challenge in medical nutrition.

Form Insights

Tablets dominated the market and accounted for a share of 31.4% in 2024, owing to their ease of consumption, precise dosing, and longer shelf life compared to other supplement formats. Consumers favor tablets due to their affordability, convenience, and availability, making them a widely accessible choice. Additionally, advancements in formulation technologies have improved tablet efficiency, enhancing bioavailability and absorption rates. Healthcare professionals often recommend tablets for standardized dosages, boosting their credibility among consumers.

The powders segment is expected to experience the fastest CAGR of 8.3% from 2025 to 2030. Powder supplements offer versatility, allowing users to mix them into drinks, smoothies, and meals, enhancing convenience. The rising trend of sports nutrition and active lifestyles has fueled demand for protein powders, amino acids, and performance-enhancing blends. Additionally, advancements in formulations, including plant-based and organic powders, appeal to health-conscious consumers seeking clean-label options. E-commerce growth and influencer-driven marketing further contribute to the segment’s rapid expansion, making powders a preferred choice for younger and fitness-focused demographics.

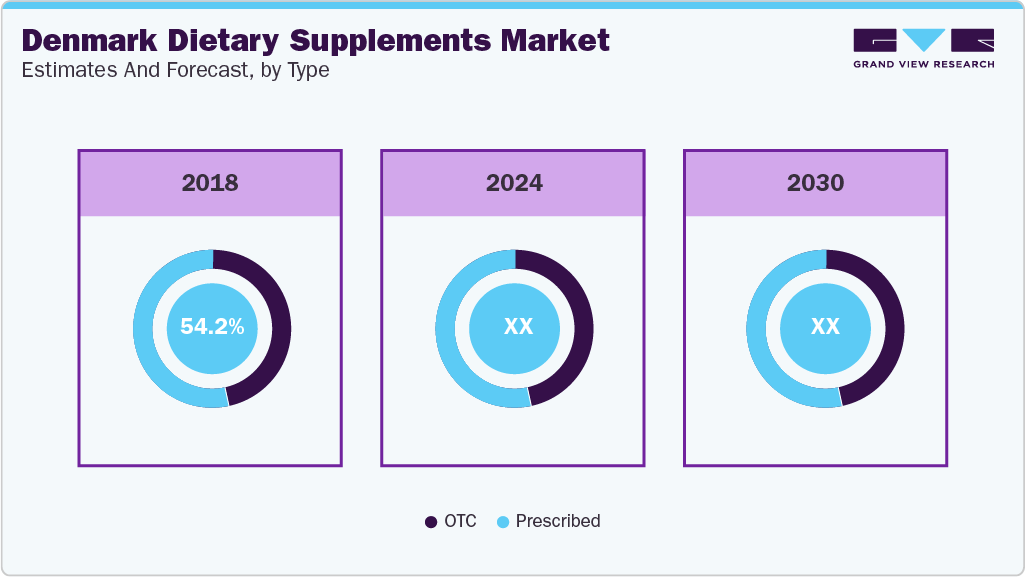

Type Insights

Prescribed supplements dominated the market and accounted for a share of 55.4% in 2024, owing to rising healthcare awareness and physician recommendations for managing chronic conditions, deficiencies, and overall wellness. Consumers increasingly rely on medical guidance for supplement intake, ensuring safe and effective usage. Additionally, an aging population and higher incidence of lifestyle-related diseases have driven demand for doctor-prescribed vitamins, minerals, and therapeutic formulations.

The OTC segment is expected to experience a significant CAGR from 2025 to 2030. With rising health awareness, individuals are opting for easily accessible, non-prescription supplements to address nutritional deficiencies, immunity support, and overall wellness. The expansion of e-commerce platforms has further fueled market penetration, allowing consumers to conveniently purchase OTC supplements with detailed product insights and expert recommendations.

Application Insights

Immunity dominated the market and accounted for a share of 14.4% in 2024. This dominance is driven by increasing consumer awareness of preventive healthcare, with a growing emphasis on strengthening immune function against seasonal illnesses and chronic conditions. The aging population and rising concerns over lifestyle-related immunity decline fueled demand for immune-boosting supplements, particularly those containing vitamins C and D, zinc, and probiotics. Additionally, the shift toward natural and science-backed formulations has reinforced consumer confidence.

The prenatal health segment is expected to experience the fastest CAGR from 2025 to 2030, driven by increasing awareness of maternal nutrition and fetal development. Expectant mothers are emphasizing essential nutrients such as folic acid, iron, calcium, and omega-3 fatty acids, which support pregnancy health and reduce the risk of complications. The rise in healthcare initiatives promoting prenatal wellness, physician recommendations, and government-supported awareness campaigns has contributed to this surge in demand.

End Use Insights

Adults dominated the market and accounted for a share of 62.2% in 2024, owing to growing health awareness among adults seeking preventive healthcare solutions to address lifestyle-related concerns such as stress, nutritional deficiencies, and chronic conditions. The increasing aging population has further boosted demand for supplements supporting bone health, immunity, and cognitive function. Additionally, busy lifestyles and convenience-oriented consumption patterns have fueled reliance on multivitamins and functional supplements. The expansion of digital health platforms, influencer-driven marketing, and personalized nutrition offerings has strengthened consumer engagement, reinforcing the adult segment’s market leadership in Denmark.

The infants segment is expected to experience fastest CAGR during the forecast period. Dietary supplements play a vital role in infants' early life stage growth. They are considered suitable for infants because of the rich nutrients in their formulations and the availability of products in various forms, including liquid and powder. Supplements help parents address nutritional gaps while ensuring that food specially formulated for the infant stage is provided.

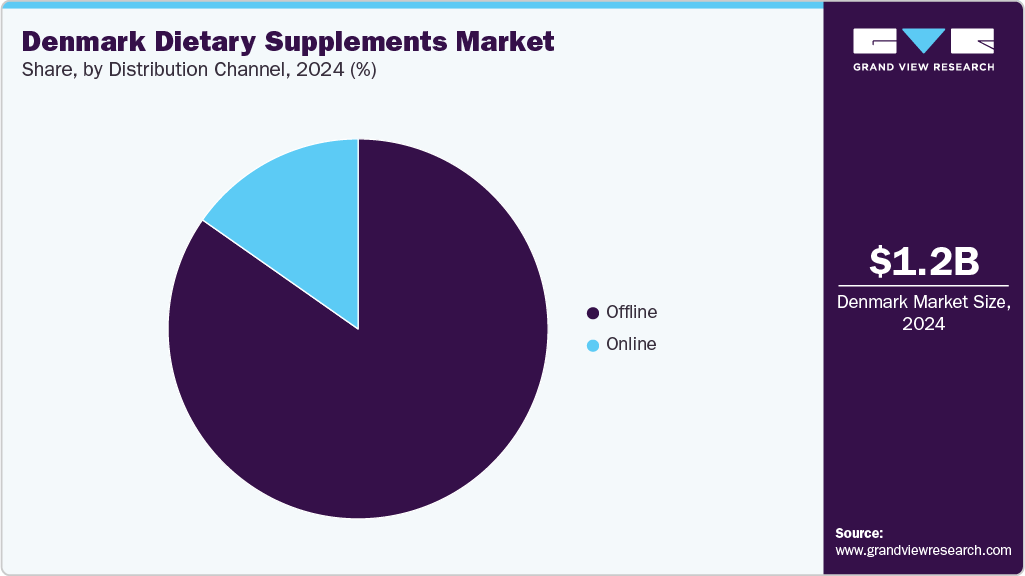

Distribution Channel Insights

Offline dominated the market and accounted for 84.7% in 2024. This dominance is driven by consumer preference for direct interaction, expert guidance, and trust in brick-and-mortar pharmacies, health stores, and supermarkets. Many consumers rely on healthcare professionals’ recommendations and prefer physical retail experiences for product verification and consultation. Additionally, Denmark’s strong pharmacy network and well-established retail chains continue to support offline sales. While e-commerce is growing, the demand for in-store purchases, personalized advice, and immediate product availability remains a key factor in maintaining offline market leadership.

The online channel is expected to experience the fastest CAGR from 2025 to 2030. The rise of e-commerce platforms and direct-to-consumer brands has expanded product availability, offering a wide range of supplements with detailed descriptions, expert recommendations, and customer reviews. Additionally, the growth of subscription-based models and influencer marketing has strengthened consumer engagement, making online purchasing more appealing. Advancements in AI-driven health assessments and personalized nutrition plans further enhance the digital shopping experience, fueling the rapid expansion of the online segment.

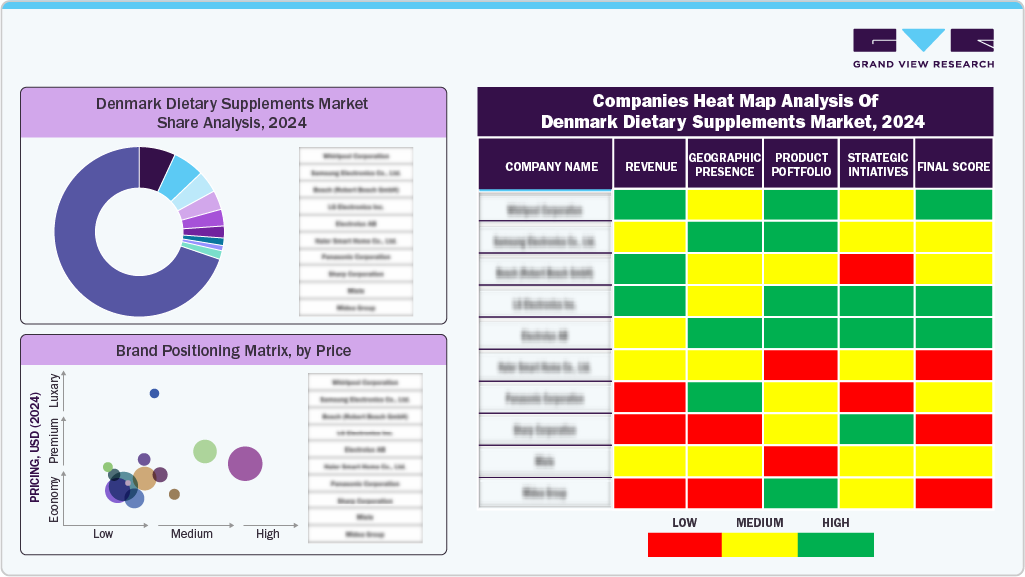

Key Denmark Dietary Supplements Market Company Insights

Some key companies operating in the Denmark dietary supplements market include Glanbia PLC, Herbalife International of America, Inc., Nestlé, Amway Corp., and others.

-

Glanbia PLC is a nutrition company specializing in the development and marketing of various products and ingredients, including lifestyle nutrition products, functional ingredients, supplements, and others. It also provides performance nutrition solutions.

-

Prozis offers an extensive portfolio of sports nutrition solutions featuring proteins, energy drinks, diet foods, vitamins, minerals, and more. Some of the key categories of its portfolio are healthy food, sports nutrition, health and weight management, and cosmetics and personal care.

Key Denmark Dietary Supplements Companies:

- Glanbia PLC

- Herbalife International of America, Inc.

- Nestlé

- Amway Corp.

- Bayer AG

- Prozis

- New Nordic Ltd.

Recent Developments

-

In June 2024, Probi launched its probiotic supplements at Matas, Denmark’s leading health retailer, expanding access to scientifically backed lactic acid bacteria products.

Denmark Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.23 billion

Revenue forecast in 2030

USD 1.83 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, form, type, application, end use, distribution channel, and country

Key companies profiled

Glanbia PLC; Herbalife International of America, Inc.; Nestlé; Amway Corp.; Bayer AG; Prozis; New Nordic Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Denmark Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Denmark dietary supplements market report based on ingredients, form, type, application, end use, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Frequently Asked Questions About This Report

b. The Denmark dietary supplements market is projected to grow at a compound annual growth rate (CAGR) of 6.9% from 2025 to 2030.

b. The Denmark dietary supplements market is projected to grow at a compound annual growth rate (CAGR) of 6.9% from 2025 to 2030.

b. Vitamins dominated the market and accounted for a share of 31.3% in 2024, owing to the rising prevalence of lifestyle-related health conditions, such as deficiencies and immune disorders, which have further contributed to the demand for vitamin supplements. Additionally, the aging population, which requires higher nutritional support, has played a key role in market expansion. Moreover, digital health platforms and influencer marketing strategies have influenced consumer preferences, particularly among younger demographics, further boosting vitamin sales across Denmark.

b. Some prominent players in the Denmark dietary supplements market include Glanbia PLC; Herbalife International of America, Inc.; Nestlé; Amway Corp.; Bayer AG; Prozis; New Nordic Ltd.

b. Increasing health consciousness among consumers has led to a higher demand for supplements that support overall well-being. People are becoming more proactive in managing their health, particularly with the rise in chronic diseases, aging populations, and lifestyle-related health concerns. This trend has fueled interest in vitamins, minerals, probiotics, and herbal supplements to boost immunity, digestion, and mental health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.