- Home

- »

- Medical Devices

- »

-

Dental Veneers Market Size & Share Analysis Report, 2030GVR Report cover

![Dental Veneers Market Size, Share & Trends Report]()

Dental Veneers Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Porcelain Veneers, Composite Veneers), By End-use (Hospitals, Dental Clinics), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-958-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Veneers Market Summary

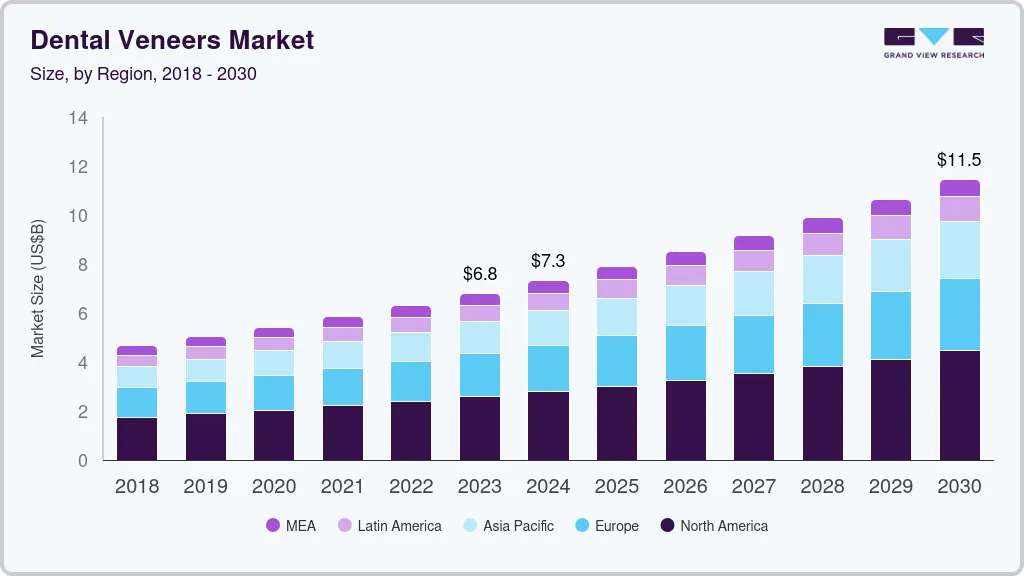

The global dental veneers market size was valued at USD 6.7 billion in 2023 and is projected to reach USD 11.45 billion by 2030, growing at a CAGR of 7.7% from 2024 to 2030. The rapidly increasing demand for cosmetic procedures in dentistry is driving awareness about the products such as dental veneers.

Key Market Trends & Insights

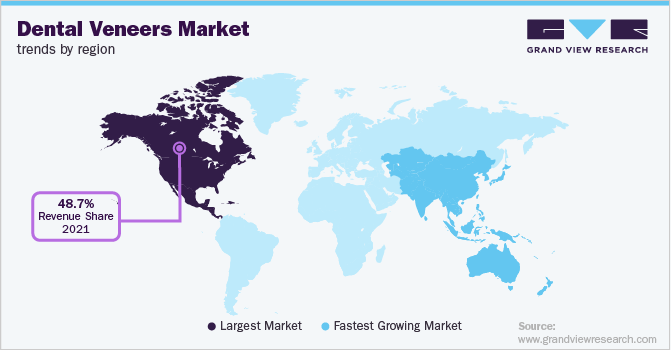

- North America dominated the market and accounted for revenue share of 48.7% in 2021 due to the growth of the geriatric American population.

- Based on product type, the porcelain veneers segment dominated the market and accounted for a revenue share of 60.0% in 2021.

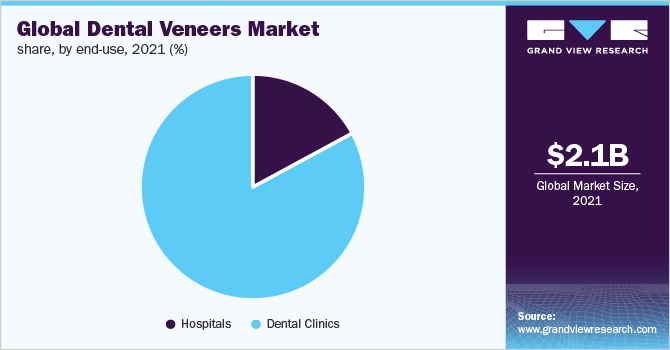

- Based on end-use, the dental clinics segment held the largest market share of 83.3% in terms of revenue in 2021.

Market Size & Forecast

- 2023 Market Size: USD 6.7 Billion

- 2030 Projected Market Size: USD 11.45 Billion

- CAGR (2024-2030): 7.7%

- North America: Largest Market in 2021

- Asia Pacific: Fastest growing market

The rising occurrence of dental ailments, growing demand for restorative dental procedures, emerging dental tourism worldwide, and growing expendable income in developing countries are some of the key driving factors contributing to market growth. The dental care sector was significantly impacted at the beginning of the COVID-19 pandemic owing to the government-imposed social distancing guidelines.

The American Dental Association (ADA) proposed a guideline to postpone elective dental procedures. As per the ADA, the procedures that needed to be postponed included oral examinations, routine cleaning, cosmetic dental procedures, radiography, and other orthodontic treatments. According to the ADA’s Health Policy Institute (HPI), dental services were at a halt due to the pandemic. The rapid rise in demand for cosmetic procedures in dentistry had a significant impact on the demand for dental procedures for aesthetic reasons. The traditional treatment option focuses on the use of surgical skills to help patients with their dental/oral needs.

The widespread explosion of extreme makeovers in the media channels gives the impression that the dental communities are in full support of this new era of cosmetic dental procedures. The simultaneous applications of the aesthetic aspect of dentistry along with the technical skills allow dental specialists to attain aesthetically functional results. The market's development is expected to be restrained by the hefty premium of dental imaging techniques, the paucity of insurance coverage for cosmetic operations, and the greater risks and difficulties involved with orthodontic and dental bridge procedures.

Moreover, the availability of innovative biomaterials and techniques has resulted in the development of newer approaches to managing dental disorders. The technologically advanced techniques are respectful of soft oral tissues. Cosmetic dentistry has transformed patient perspectives toward dental care. Cosmetic procedures such as dental veneers are gaining more demand, as patients are realizing that they are painless with satisfactory results. The quest for a better facial appearance has become equal to cosmetic intervention. Hence, the demand for cosmetic dentistry is growing at a rapid rate.

Product Type Insights

The porcelain veneers segment dominated the market and accounted for a revenue share of 60.0% in 2021. The porcelain veneers are placed on teeth as strong caps to improve the appearance of teeth. They are costlier than the other type of veneers. However, they can last up to a longer life span. Therefore, porcelain is mostly preferred for its durability. Porcelain veneers are usually the thin, strong cap on the front surface as well as on the sides of the teeth to improve the appearance. Porcelain veneers are mostly crafted from amalgamated ceramic which gives a natural appearance to the teeth.

During the forecast period, the composite veneers segment is expected to witness the fastest CAGR of 9.2% from 2022 to 2030. On the basis of crafting, these veneers are further divided into three different kinds, i.e., direct, indirect, and fabricated veneers. These are crafted from amalgamated resin materials and are attached to the front surface of the tooth. Direct composite veneers are crafted during the surgeries by surgeons and fixed directly onto the teeth, however, indirect composite veneers are created in dental laboratories. As indirect composite veneers are created in laboratories, lab assistants can use more rigid plastic to make it much more long-lasting than usual, and thus it looks and feels more like porcelain veneers. Artificial intelligence integration into aesthetic dentistry has also altered the way treatments are delivered by supporting real-time imprints to be completed quickly and easily. Due to the reduction in turnaround time, patients can now view and obtain their desired veneers.

End-use Insights

Based on end-use, the dental clinics segment held the largest market share of 83.3% in terms of revenue in 2021. The number of independent solo dental clinics or practices is increasing worldwide. The maximum number of patients prefer vising independent dentist clinics for consulting than dental hospitals. Consulting independent clinics are expected to grow in the coming years as they are cost-efficient with advanced dental equipment and specialists are easily available with the less waiting time.

The number of dental clinics is growing across the world and this is expected to continue in the coming years due to the cost-efficiency, technologically advanced options, and availability of specialists.

Regional Insights

North America dominated the market and accounted for revenue share of 48.7% in 2021 due to the growth of the geriatric American population. As per the American Academy of Cosmetic Dentistry (AACD) study, the age group of 40-49 represents 26.88 % of aesthetic patients, succeeding the 50+ group with 25.09 %. The demand for aesthetic dentistry is reportedly driven by the fact that 71% of patients are female. The region's popularity of aesthetic dental care is very high due to the advanced technology used by dental professionals. The market is expanding significantly due to the reduced treatment time. According to the 2018 Canadian Community Health Survey (CCHS), approximately 75% of Canadians consult a dentist annually.

On the other hand, in the Asia Pacific, the market is anticipated to witness the fastest CAGR of 9.6% during the forecast period. Owing to the increasing medical tourism, growing awareness related to dental health, and rising R&D activities, Asia Pacific dental veneers market is likely to have rapid growth. The infrastructure of medical care in Asia pacific is developing with the availability of advanced medical equipment. The demand for dental veneers is anticipated to grow relatively quickly in revenue growth during the predicted period due to rising costs for services, an increase in the prevalence of dental infections, an increase in discretionary cash flow, and growing public awareness of dental issues in South Asia. Thus, developing countries such as India and China are projected to grow in the coming years.

Key Companies & Market Share Insights

The key companies are undertaking various initiatives to strengthen their market position. Many firms are focusing on the launch of new products. In addition, mergers, acquisitions, partnerships, and collaborations among the companies are the common strategies being adopted by the market players. For instance, a partnership between 3Shape, a Denmark-based developer and assembler of 3D scanning monitor and CAD/CAM software products, and Dentsply Sirona, a manufacturer of dental goods and technologies, was announced in June 2021.

The engagement between the SureSmile Clear Aligners of Dentsply Sirona and the 3Shape TRIOS intraoral scanner is the primary objective of this partnership's initial stage. To build and retain a position in the market, the players majorly focus on attracting as many new customers as possible. The market trends are gradually improving. The promising development regarding the COVID-19 vaccinations reduced the uncertainty. Some of the prominent players in the dental veneers market include:

-

Glidewell Laboratories

-

Coltene

-

Dentsply Sirona

-

DenMat

-

Ultradent Products, Inc.

-

Planmeca Oy

Dental Veneers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.32 billion

Revenue forecast in 2030

USD 11.45 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, U.K., Germany, France, Italy, Spain, Japan, China, India, Brazil, Mexico, South Africa

Key Companies profiled

DenMat, Ultradent Products, Dentsply Sirona, Glidewell Laboratories, Coltene, Planmeca OY

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

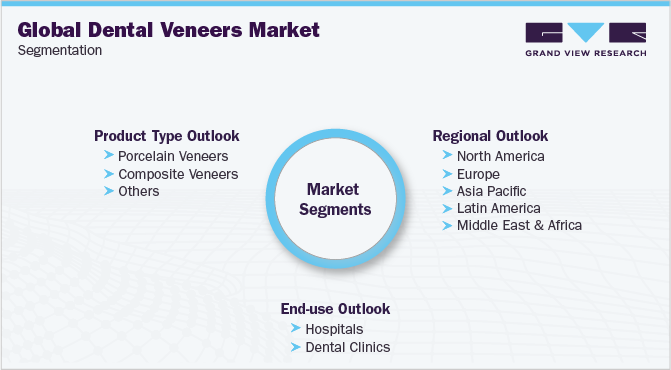

Global Dental Veneers Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global dental veneers market report based on product type, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Porcelain Veneers

-

Composite Veneers

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Hospitals

-

Dental Clinics

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dental veneers market size was estimated at USD 2.1 billion in 2021 and is expected to reach USD 2.3 billion in 2022.

b. The global dental veneers market is expected to grow at a compound annual growth rate of 8.3% from 2022 to 2030 to reach USD 4.3 billion by 2030.

b. The porcelain veneers segment dominated the U.S dental veneers market with a share of 59.5% in 2021. This is attributed to rising cosmetic procedures in dentistry which is significantly affecting the demand for dental procedures for aesthetic reasons.

b. Some key players in the dental veneers market consist of DenMat, Ultradent Products, Dentsply Sirona, Glidewell Laboratories, Coltene, Planmeca OY.

b. Key factors driving the dental veneers market growth include rising demand for aesthetic beauty, and increasing dental technologies and equipment for dental-related issues worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.