- Home

- »

- Medical Devices

- »

-

Dermatology CRO Market Size, Share, Industry Report, 2033GVR Report cover

![Dermatology CRO Market Size, Share & Trends Report]()

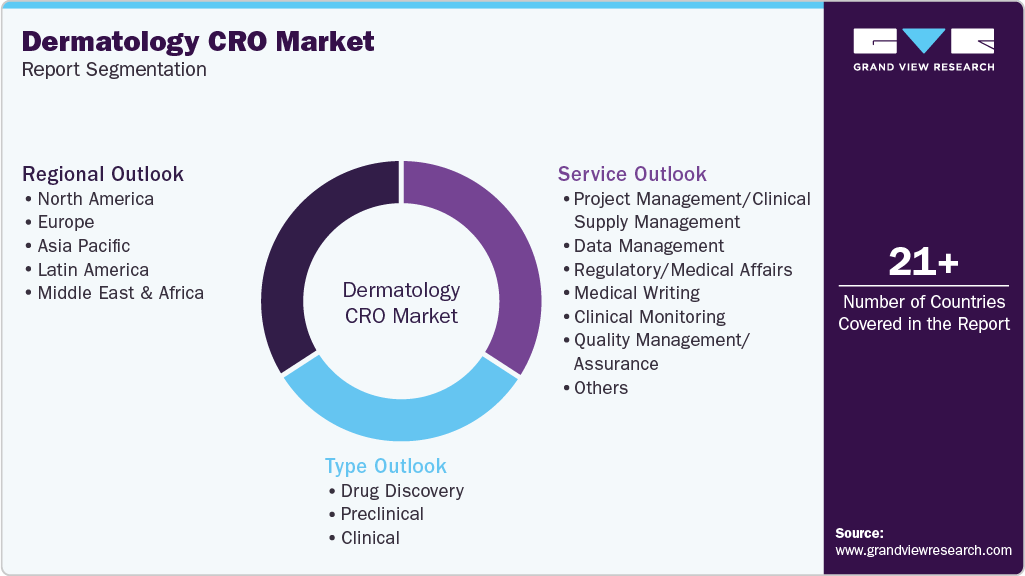

Dermatology CRO Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Drug Discovery, Preclinical, Clinical), By Service (Clinical Monitoring, Project Management/Clinical Supply Management, Data Management), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-635-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dermatology CRO Market Summary

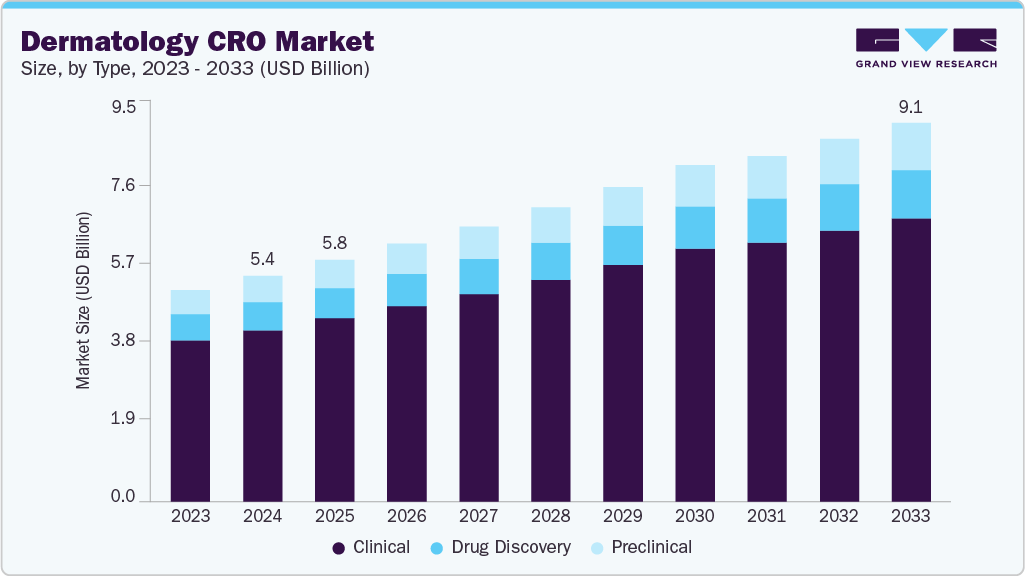

The global dermatology CRO market size was estimated at USD 5.42 billion in 2024 and is projected to reach USD 9.09 billion by 2033, growing at a CAGR of 5.80% from 2025 to 2033. The dermatology contract research organization (CRO) market is experiencing robust growth, primarily driven by the rising prevalence of chronic skin conditions such as psoriasis, eczema, acne, and skin cancers across the globe.

Key Market Trends & Insights

- Asia Pacific dermatology CRO market held the largest share of 43.93% of the global market in 2024.

- The dermatology CRO in the U.S. is expected to grow significantly over the forecast period.

- Based on type, the clinical segment held the highest revenue share in 2024

- Based on service, the clinical monitoring segment held the highest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.42 Billion

- 2033 Projected Market Size: USD 9.09 Billion

- CAGR (2025-2033): 5.80%

- Asia Pacific: Largest market in 2024

Besides, growing interest of dermatological companies and increasing awareness of dermatological health, coupled with the expansion of the biopharmaceutical pipeline for innovative topical and systemic therapies is further driving the demand for specialized clinical research services. In addition, factors such as growing investments in dermatology R&D, the rising adoption of personalized medicine, and enhanced patient participation facilitated by digital tools are expected to support the market growth.Moreover, the emerging trends such as decentralized clinical trials, tele dermatology, and AI-powered skin imaging are reshaping the dermatology clinical trial landscape, improving patient access and data accuracy. The increased use of wearable skin sensors and advanced imaging technologies is further enhancing real-time monitoring and endpoint assessment. Overall, the market scenario is favorable due to rising government initiatives supporting dermatology research, expanding applications in cosmetic dermatology, and increased clinical trial activity in emerging regions like Asia-Pacific and Latin America.

Furthermore, the CROs are taking strategic initiatives such as expanding their geographic presence, forming partnerships with technology providers, and investing in integrated digital platforms to offer comprehensive dermatology trial solutions. In addition, technology advancements, including AI and machine learning for lesion analysis, decentralized trial platforms, and the integration of real-world data, enable CROs to enhance trial efficiency, patient engagement, and data quality, strengthening their competitive position in this dynamic market.

Opportunity Analysis

The dermatology CRO market is expected to witness significant market opportunities driven by rising dermatological disorders, increased investment in R&D for skin therapies, and a surge in demand for cosmetic dermatological procedures. Besides, the pipeline for clinical candidates is increasingly addressing conditions such as psoriasis, eczema, acne, and rare skin diseases. This further expands the need for biopharma sponsors to turn towards CROs with specialized expertise in dermatology.

Moreover, growth opportunities are emerging in early-phase clinical studies, the integration of imaging-based endpoints, and the adoption of decentralized trial models that enhance patient recruitment and retention rates. Furthermore, the innovations in AI-assisted lesion analysis and wearable diagnostic technologies are further improving the accuracy and efficiency of clinical trials. Furthermore, emerging markets offer cost advantages and access to diverse patient populations, further a rapidly evolving and specialized clinical research landscape. This has led CROs to prioritize strategic partnerships, therapeutic specialization, and comprehensive integrated service offerings, further offering new growth opportunities in the market.

Impact of U.S. Tariffs on the Global Dermatology CRO Market

The effects of U.S. tariffs on the dermatology CRO market have been limited; however, some impacts are noticeable in specific areas. Besides, most dermatology CROs are increasingly concentrating on clinical trials and related services, which are less directly influenced by tariffs than manufacturing sectors. Thus, tariffs on imported medical equipment, laboratory supplies, and technology such as imaging devices and diagnostic tools used in dermatology trials have marginally raised operational costs, prompting some CROs to revisit their procurement strategies or postpone equipment upgrades.

In addition, the CROs engaged in global clinical trials, particularly those obtaining materials or services from China or other countries affected by tariffs, may experience increased costs or longer timelines. Also, some dermatology sponsors have relocated portions of their trial operations to countries with fewer trade barriers to better manage expenses and timelines. Moreover, U.S.-based CROs have experienced increased interest from domestic biopharma firms seeking to reduce reliance on overseas suppliers. At the same time, the overall influence of tariffs is limited. Thus, it motivated CROs to enhance supply chain resilience, diversify sourcing options, and invest in more localized trial infrastructure to maintain competitiveness and adaptability in a changing global trade landscape.

Technological Advancements

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the landscape of dermatology CROs by improving the precision, efficiency, and patient-centered approach of clinical trials. AI-driven skin imaging and diagnostics facilitate automated, real-time evaluations of skin lesions, leading to more consistent assessments of treatment responses and disease progression. When paired with high-resolution digital photography and 3D imaging, CROs can gather comprehensive and objective visual data regarding lesion size, pigmentation, and texture changes. Moreover, the integration of wearable skin sensors and smart patches enables continuous monitoring of crucial biomarkers, including hydration, pH, and inflammation, which supports non-invasive, real-world data collection. This reduces the burden on patients and enhances compliance.

Decentralized trial platforms (DCTs) further promote accessibility and participant retention by incorporating tele dermatology, remote monitoring, and digital engagement tools, which are particularly beneficial in long-term or aesthetic dermatology studies. In addition, machine learning algorithms optimize trial designs by analyzing historical data to identify potential recruitment obstacles, refine inclusion criteria, and select the most suitable trial sites. Thus, these innovations enhance trial quality, speed up timelines, and lower costs in dermatology-focused clinical research.

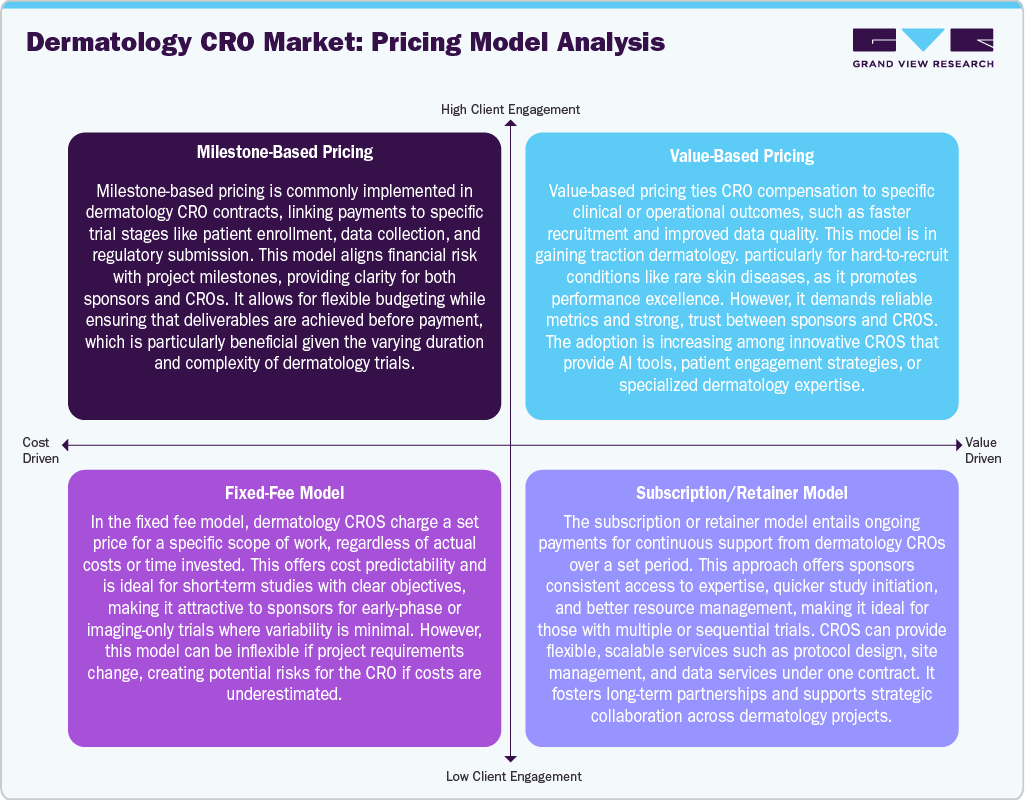

Pricing Model Analysis

In the dermatology CRO market, pricing models are customized to align with the complexity, duration, and goals of each trial. A widely used approach is milestone-based pricing, where payments are linked to key phases of the trial, such as enrollment, data lock, or regulatory submission. This model ensures accountability and aligns financial expenditures with project progress. Fixed-fee models provide cost predictability for well-defined, short-term studies, particularly in early-phase dermatology trials or imaging assessments.

While these models facilitate budgeting, they carry risks if there are changes in project scope. Besides, rising interest in value-based pricing ties payments to outcomes such as quicker recruitment or enhanced data quality. This approach incentivizes performance and is particularly effective for complex or rare dermatological conditions, though it necessitates robust performance tracking. In addition, subscription or retainer-based models foster long-term partnerships by offering flexible and ongoing access to CRO resources across multiple projects. This is especially advantageous for sponsors with growing dermatology pipelines, enabling faster trial initiation and strategic collaboration with specialized CRO expertise.

Market Concentration & Characteristics

The dermatology CRO market growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

Dermatology CROs are innovating with AI-enabled skin imaging, 3D lesion mapping, wearable sensors, and decentralized trial platforms. These advancements improve data accuracy, facilitate remote monitoring, and streamline faster, patient-focused clinical trials for complex dermatological and aesthetic conditions.

Evolving FDA and EMA regulations for topical drugs, generics, and biologics in dermatology are impacting trial design and endpoint selection. CROs must adjust to stricter demands for data quality, bioequivalence, and safety, leading to increased demand for regulatory consulting and standardized clinical methodologies tailored to dermatology.

Mergers and acquisitions in the dermatology CRO sector are rising, with larger CROs acquiring niche firms to enhance their therapeutic expertise, site networks, and digital capabilities. These strategic deals aim to provide integrated dermatology trial services and access to specialized investigator communities.

CROs are expanding their services to encompass early-phase trials, post-marketing studies, and real-world evidence, specifically in dermatology. This growth includes offerings such as imaging analysis, tele dermatology, patient recruitment platforms, and biomarker development, providing comprehensive support for clinical trials involving skin-related drugs, devices, and aesthetic innovations.

Dermatology CROs are expanding their presence in the Asia-Pacific and Latin America to access treatment-naïve populations, achieve cost efficiencies, and accelerate patient enrollment. These areas enhance their clinical infrastructure and regulatory alignment, supporting global dermatology studies focused on inflammatory, infectious, and pigmentary skin conditions.

Type Insights

The clinical segment held the largest revenue share in the global market, accounting for 75.95% in 2024. The high segment growth is due to dermatologic drug development's growing complexity and increased outsourcing by pharma and biotech companies. Rising prevalence of chronic skin conditions such as psoriasis, acne, atopic dermatitis, and skin cancers drives continuous R&D, accelerating demand for clinical trial outsourcing services. CROs play a crucial role in managing diverse patient recruitment, navigating complex regulatory landscapes, and delivering specialized services such as dermatopathology, digital imaging, and patient-reported outcome tracking.

The shift toward biologics, targeted therapies, and decentralized trial models enhances CRO value. Sponsors, especially small and mid-sized firms, increasingly rely on CROs to reduce costs and accelerate timelines. Moreover, the expanding focus on aesthetic dermatology and cosmeceuticals broadens the scope of clinical trials. CROs with dermatology-specific expertise, global site networks, and advanced data capabilities are particularly well-positioned, making the clinical segment the most critical revenue contributor in the dermatology CRO market.

On the other hand, the preclinical segment is expected to witness the highest CAGR over the forecast period. Preclinical dermatology CROs are essential in the initial skin-related drug and cosmetic development phases. They offer specialized services such as in vitro testing, toxicology, pharmacokinetics, and disease modeling. They also conduct studies on skin irritation, sensitization, and penetration using human and animal skin models to assess safety and efficacy. They also provide biomarker discovery, histopathology, and formulation screening for dermatologic products. Continuous advancements, such as 3D skin equivalents and organ-on-chip technologies, enhance the predictive accuracy of human skin responses while reducing animal testing. Their expertise facilitates quicker decisions and regulatory submissions, helping sponsors optimize dermatology candidates early in development, speeding up the transition from lab research to clinical evaluation for safer and more effective dermatology therapeutics.

Services Insights

The clinical monitoring segment accounted for the largest revenue share in 2024. Clinical monitoring services offered by dermatology CROs are vital for maintaining the quality, safety, and compliance of dermatology clinical trials. These CROs oversee site activities, verify data accuracy, and ensure adherence to protocols and regulatory requirements tailored to skin-related studies. Monitoring involves regular site visits, source data verification, and patient safety assessments, with particular attention to specialized endpoints such as lesion evaluation and photographic documentation.

Dermatology CROs employ digital tools like remote monitoring and electronic data capture systems to improve oversight efficiency. Their expertise in addressing dermatology-specific challenges, such as variability in skin assessments and managing diverse patient populations, ensures reliable and high-quality data collection. Effective clinical monitoring accelerates trial timelines, mitigates risks, and facilitates regulatory approvals, making it an essential element of successful drug and device development in dermatology.

On the other hand, the regulatory/medical affairs segment is expected to witness the highest growth rate over the forecast period. Regulatory and medical affairs services provided by dermatology CROs are crucial for guiding skin-related clinical trials from development to approval. These services encompass regulatory strategy development, submission support, and compliance management specifically for dermatology products, including topical drugs, biologics, and medical devices.

CROs help sponsors navigate the complex regulatory landscapes established by agencies like the U.S. FDA and EMA, ensuring that trial designs adhere to safety and efficacy standards. Medical affairs teams contribute through scientific communication, medical writing, and stakeholder engagement to support trial outcomes and post-marketing efforts. Their expertise in dermatology-specific guidelines, labeling requirements, and safety reporting minimizes regulatory risks.

Regional Insights

The Asia Pacific dermatology CRO market held the largest revenue share of 43.93% in 2024. The regional growth is primarily attributed to increasing prevalence of skin diseases, improved healthcare infrastructure, and rising investments in pharmaceutical R&D. Countries such as China, Japan, India, and South Korea are becoming attractive destinations for clinical research due to their large treatment-naïve populations and cost efficiencies. The adoption of decentralized trials is enhancing patient recruitment and improving data quality. Regulatory harmonization and government support are further promoting the growth of clinical research in the region. In addition, the growing awareness of dermatologic health and the expanding cosmetic dermatology markets are accelerating market momentum. This region presents significant opportunities for CROs to support global dermatology trials.

China Dermatology CRO Market Trends

The dermatology CRO market in China is driven by a substantial patient population, an increasing prevalence of skin diseases, and heightened spending on pharmaceutical R&D. The government's emphasis on clinical research reforms and the introduction of streamlined regulatory pathways expedite trial approvals. CROs are utilizing AI-driven skin imaging, tele dermatology, and decentralized trial models to enhance efficiency and boost patient engagement. In addition, cost advantages and an expanding healthcare infrastructure are attracting global sponsors. The rise in both therapeutic and cosmetic dermatology trials is further boosting market demand. With its evolving regulatory environment and the adoption of advanced technologies, China is positioning itself as a significant player in the Asia Pacific dermatology CRO market.

The dermatology CRO market in Japanis driven by a growing pharmaceutical industry, an aging population, and the increasing prevalence of skin disorders. Regulatory support and stringent quality standards ensure robust clinical trial conduct. CROs are focusing on advanced imaging, biomarker analysis, and decentralized trials to improve patient recruitment and data accuracy. Growth in biologics and personalized dermatology therapies is fueling demand. Japan’s strong healthcare infrastructure and experienced clinical sites attract both domestic and international sponsors. The integration of digital technologies and real-world data collection further supports market growth.

The dermatology CRO market in India witnessed substantial growth due to its large treatment-naïve population, cost-effective clinical trial sites, and expanding healthcare infrastructure. The increasing incidence of skin diseases and rising investment in pharmaceutical R&D are boosting the demand for specialized dermatology trials. CROs are integrating AI-based imaging and decentralized trial models to improve patient access and data quality. Regulatory reforms are streamlining trial approvals and attracting global sponsors. Besides, the country's diverse patient demographics and scalable clinical capabilities make it a key emerging market for dermatology clinical research in the Asia Pacific region.

Europe Dermatology CRO Market Trends

The Europe dermatology CRO market is expected to grow significantly, attributed to the rising prevalence of skin diseases and strong pharmaceutical R&D across countries such as Germany, the UK, and France. Besides, the rising focus on regulatory frameworks and advanced clinical trial infrastructure further supports market growth. Increasing use of digital technologies, decentralized trials, and AI-powered imaging improves patient recruitment and data quality. In addition, the expansion into emerging Eastern European markets offers cost advantages, and diverse populations are expected to drive the market growth over the estimated time period. Furthermore, growing focus on rare dermatologic conditions and aesthetic therapies further propels the market growth potential.

The dermatology CRO market in Germany held the highest share in 2024. Strong pharmaceutical R&D, advanced clinical infrastructure, and a supportive regulatory environment drive the country's growth. There is significant focus on chronic skin conditions and novel biologics. Besides, the adoption of AI imaging, tele dermatology, and decentralized trial models enhances clinical trial efficiency for dermatology CRO. In addition, the country as a pharmaceutical hub attracts global sponsors seeking high-quality data and regulatory compliance, further boosting the market growth. Moreover, growing interest in aesthetic dermatology and rare skin diseases is anticipated to contribute to the market.

The UK dermatology CRO market is driven by increasing clinical trial activity in inflammatory and rare skin diseases. A well-established regulatory framework and advanced healthcare system facilitate high-quality dermatology research. Collaborations between pharma sponsors and specialized CROs are driving innovation. In addition, the country’s diverse patient pool and strategic location strengthen its position as a key dermatology clinical research hub across Europe.

North America Dermatology CRO Market Trends

The North America region is expected to grow significantly over the forecast period. Significant investments in R&D, an advanced healthcare infrastructure, and a robust pipeline of innovative therapies in dermatology drive the market. The U.S. leads the market in the region, showcasing extensive clinical trial activity and solid regulatory backing for new biologics and topical medications. Besides, Canada is experiencing steady growth due to increased research initiatives and collaborations in dermatology. In addition, trends propelling the market growth are the rising number of decentralized trials, the use of AI in imaging, and the application of personalized medicine. Moreover, the increasing prevalence of chronic skin diseases and the rising interest in cosmetic dermatology further drive the market growth. Furthermore, strong partnerships between CROs and pharmaceutical companies, along with the growing adoption of digital technologies, is anticipated to boost the market over the estimated time period.

The dermatology CRO market in the U.S.held the largest share in 2024. The market is driven by vigorous clinical trial activity in several areas such as psoriasis, eczema, acne, and rare skin disorders. Besides, the market is supported by advanced regulatory frameworks and substantial R&D budgets. Also, the rising prevalence of skin diseases and a greater emphasis on personalized therapies contribute to increasing demand for services. Strong collaborations between pharmaceutical sponsors and specialized CROs, combined with ongoing technological innovation, is expected to support the market growth.

The Canada dermatology CRO marketis driven by growing investments in dermatology research and favorable regulatory policies. The market benefits from high-quality clinical infrastructure and increasing collaborations between biotech companies and CROs. There is rising interest in trials targeting chronic skin conditions and cosmetic dermatology. Adoption of digital tools such as AI imaging and telemedicine enhances trial efficiency and patient engagement. Moreover, the diverse patient population and cost-effective clinical sites are attracting more global dermatology trials, further supporting the market growth. These factors are expected to enhance market growth in Canada during the projected period.

Latin America Dermatology CRO Market Trends

The dermatology CRO market in Latin America is experiencing significant growth driven by increasing clinical trial activity, improving healthcare infrastructure, and cost advantages are shaping the landscape for clinical research. Besides, the present diverse patient populations with a high prevalence of skin diseases make the region an attractive location for trials. The adoption of digital technologies and decentralized trials is enhancing recruitment and the quality of data collected. Furthermore, regulatory agencies align with international standards, facilitating smoother trial approvals.

The dermatology CRO marketin Brazil is driven by the high prevalence of skin diseases and increasing investments in pharmaceutical R&D. A large and diverse patient pool in the country, along with competitive costs that attract international sponsors to conduct clinical trials. In addition, regulatory reforms are making trial approvals more streamlined and align with global standards. Besides, the growing demand in both cosmetic and therapeutic dermatology further boosts clinical research in the region. Moreover, with an improving healthcare infrastructure and robust investigator networks, the country is positioning itself as a key hub for dermatology clinical trials in Latin America. This is expected to boost market growth during the forecast period.

Middle East & Africa Dermatology CRO Market Trends

The dermatology CRO market in the MEA region is anticipated to grow at the highest CAGR over the forecast period. The high growth potential is driven by rising burden of skin diseases and heightened awareness of clinical trials. Middle Eastern countries such as South Africa, Saudi Arabia, the UAE, and Kuwait are emerging markets in the dermatology CRO landscape. The growing development of healthcare infrastructure and robust regulatory frameworks is a critical factor driving regional market growth. Moreover, the favorable investment climates and diverse patient populations are anticipated to support the market growth. The incorporation of digital tools is improving patient recruitment and the overall efficiency of trials. Furthermore, the increasing demand for dermatology therapeutics and cosmetic procedures, along with supportive government initiatives, is anticipated to support market growth.

The dermatology CRO marketin South Africa is driven by the increasing incidence of skin diseases, coupled with enhancements in clinical trial infrastructure. Besides, the country benefits from favorable regulatory reforms and a diverse patient demographic, making it an attractive destination for global sponsors. Several service providers in South Africa are embracing digital technologies and decentralized trial methodologies to improve patient recruitment and data quality. The growing interest in both therapeutic and cosmetic dermatology trials further establishes South Africa as a key emerging market within the Middle East & Africa region.

Key Dermatology CRO Company Insights

The key players operating across the market are adopting several strategic initiatives such as service launches, mergers & acquisitions, partnerships & agreements, and expansions to gain a competitive edge in the market. For instance, in August 2024, Lindus Health introduced a comprehensive dermatology-focused CRO and technology platform. The new ‘All-in-One Dermatology CRO' is designed to support clinical trials across numerous dermatologic conditions such as acne, eczema, atopic dermatitis, skin cancers, and others. The offering combines clinical trial management with digital tools to streamline study execution and improve patient engagement.

Key Dermatology CRO Companies:

The following are the leading companies in the dermatology CRO market. These companies collectively hold the largest market share and dictate industry trends.

- IQVIA Inc.

- Labcorp Drug Development

- Thermo Fisher Scientific Inc. (PPD)

- Parexel International Corp.

- Parexel International Corp.

- Charles River Laboratories

- ICON, Plc

- Syneos Health

- Pharmaron

- Aragen Life Sciences Ltd.

- Wuxi AppTec

- Medpace

- CTI Clinical Trial & Consulting

- Bioskin

- Proinnovera GmbH

- Biorasi, LLC

Recent Developments

-

In March 2025, Jeeva Clinical Trials launches its CRO Partnership Program. This initiative invites innovative CROs to utilize Jeeva’s unified Clinical Trial Management System (CTMS), which enables real-time collaboration, AI-supported trial oversight, and streamlined site-sponsor communication. The program is aimed at supporting specialized CROs in fields such as dermatology, obesity, oncology, and rare diseases by offering advanced digital tools that improve trial speed, regulatory compliance, patient engagement, and overall cost-effectiveness.

-

In March 2023, LEO Pharma mentioned a strategic partnership with ICON plc to enhance the scalability and efficiency of its clinical trial operations. The collaboration supported LEO Pharma’s goal of developing a highly effective, patient-focused, and cost-efficient clinical portfolio execution model. This alliance strengthened the company’s ability to deliver innovative dermatology treatments through streamlined and optimized trial processes.

Dermatology CRO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.79 billion

Revenue forecast in 2033

USD 9.09 billion

Growth rate

CAGR of 5.80% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

IQVIA Inc.; Labcorp Drug Development; Thermo Fisher Scientific Inc. (PPD); Parexel International Corp.; Charles River Laboratories; Icon, Plc; Syneos Health; Pharmaron; Aragen Life Sciences Ltd.; Wuxi AppTec; MEDPACE; CTI Clinical Trial & Consulting; Bioskin; Proinnovera GmbH; Biorasi, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dermatology CRO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global dermatology CRO market report based on type, service, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug Discovery

-

Target Validation

-

Lead Identification

-

Lead optimization

-

-

Preclinical

-

Clinical

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Project Management/Clinical Supply Management

-

Data Management

-

Regulatory/Medical Affairs

-

Medical Writing

-

Clinical Monitoring

-

Quality Management/ Assurance

-

Bio-statistics

-

Investigator Payments

-

Laboratory

-

Patient and Site Recruitment

-

Technology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Argentina

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dermatology CRO market size was estimated at USD 5.42 billion in 2024 and is expected to reach USD 5.79 billion in 2025.

b. The global dermatology CRO market is expected to grow at a compound annual growth rate (CAGR) of 5.80% from 2025 to 2033 to reach USD 9.09 billion by 2033.

b. The clinical segment dominated the market in 2024, with a market share of 75.95%. This segment is driven by a rising need for quality, safety, and compliance in dermatology clinical trials. CROs in the clinical segment oversee site activities, verify data accuracy, and ensure adherence to protocols and regulatory requirements specific to skin-related studies, further contributing to market growth.

b. Some key players operating in the dermatology CRO market include IQVIA Inc., Labcorp Drug Development, Pharmaceutical Product Development, LLC (PPD) (Thermo Fisher Scientific Inc.), Parexel International Corp., Charles River Laboratories, Icon, Plc, Medidata, Syneos Health, Pharmaron, Aragen Life Sciences Ltd., Wuxi AppTec, MEDPACE, CTI Clinical Trial & Consulting, Bioskin, Proinnovera GmbH, Biorasi, LLC, Javara, and TFS among others.

b. Key factors driving the dermatology CRO market growth are the rising prevalence of chronic skin conditions such as psoriasis, eczema, acne, and skin cancers across the globe. Besides, growing interest in dermatological companies and increasing awareness of dermatological health, coupled with expanding the biopharmaceutical pipeline for innovative topical and systemic therapies, is further fueling the demand for specialized clinical research services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.