- Home

- »

- Pharmaceuticals

- »

-

Diabetes Management Supplements Market Report, 2033GVR Report cover

![Diabetes Management Supplements Market Size, Share & Trends Report]()

Diabetes Management Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Type, By Ingredients, By Formulation (Capsule, Softgels, Powder), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-739-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Diabetes Management Supplements Market Summary

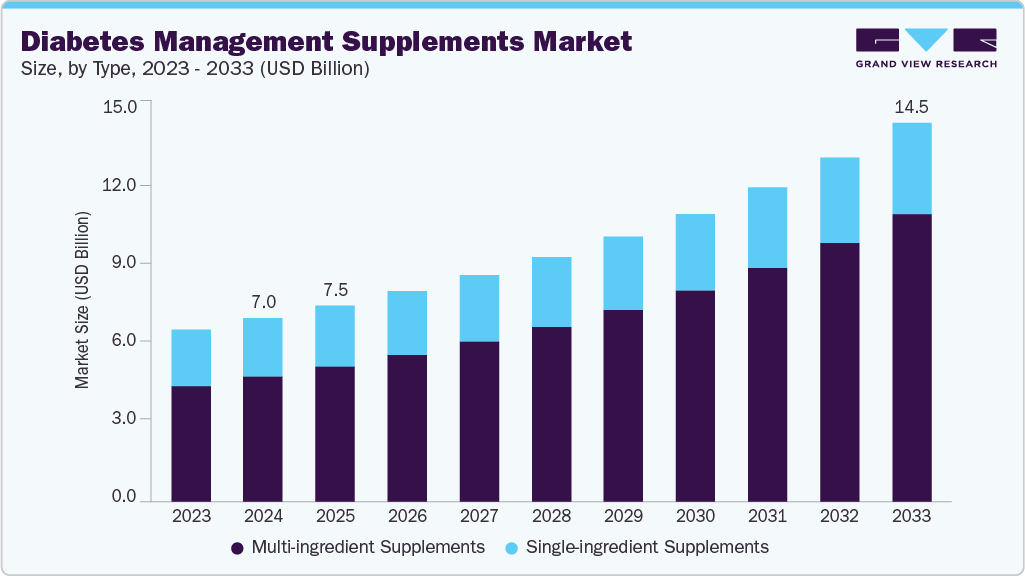

The global diabetes management supplements market size was valued at USD 7.04 billion in 2024 and is projected to reach USD 14.52 billion by 2033, expanding at a CAGR of 8.56% from 2025 to 2033. The market growth is driven by the rising prevalence of diabetes worldwide, increasing awareness about preventive healthcare, and growing adoption of nutritional supplements as an adjunct to conventional diabetes management.

Key Market Trends & Insights

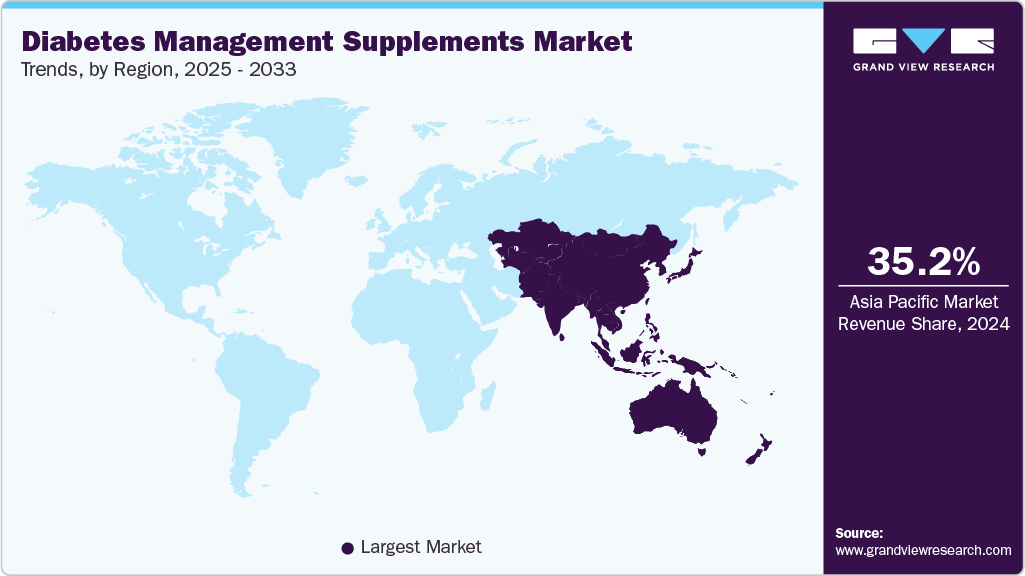

- The Asia Pacific diabetes management supplements market held the largest share of 35.16% of the global market in 2024.

- The diabetes management supplements industry in the China is expected to grow significantly over the forecast period.

- By type, the multi-ingredient supplements segment held the highest market share in 2024.

- Based on ingredients, the herbal extracts & botanicals segment held the highest market share of 37.56% in 2024.

- By formulation, the capsules segment held the highest market share of 38.26% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.04 Billion

- 2033 Projected Market Size: USD 14.52 Billion

- CAGR (2025-2033): 8.56%

- Asia Pacific: Largest market in 2024

Factors such as lifestyle changes, rising obesity rates, and aging populations are further contributing to higher demand for supplements to control blood sugar levels, improve insulin sensitivity, and support overall metabolic health. Moreover, innovations in formulation, expanding distribution channels including e-commerce, and greater consumer inclination toward natural and herbal supplements are expected to create significant opportunities for manufacturers over the forecast period.

Rising global prevalence of diabetes and prediabetes

One of the main drivers behind the demand in the diabetes management supplements market is the increasing global prevalence of diabetes and prediabetes. The rising burden of these conditions, caused by sedentary lifestyles, poor eating habits, and growing obesity rates, has led to a surge in patients needing long-term management options. According to global health organizations, diabetes cases are steadily rising across both developed and developing regions, making it a major public health challenge of our time. For example, data from the International Diabetes Federation shows that about 589 million adults aged 20 to 79 are currently living with diabetes. With millions more at risk of complications like cardiovascular disease, neuropathy, and kidney problems, the demand for supportive and supplementary approaches to traditional treatments has become increasingly urgent.

As a result, diabetes management supplements are increasingly being recognized as an effective adjunct to prescribed medications, helping individuals maintain blood glucose levels, improve insulin sensitivity, and reduce the risk of secondary complications. These supplements, often enriched with essential vitamins, minerals, antioxidants, and herbal extracts, offer additional metabolic support and contribute to overall well-being. The expanding diabetic and prediabetic population not only ensures a steady consumer base but also compels healthcare providers and policymakers to recommend holistic management practices, thereby driving the sustained growth of the diabetes management supplements market.

Increased awareness of nutritional interventions

Another key driver of the diabetes management supplements market is the growing awareness of nutritional interventions in diabetes management. Patients and healthcare professionals increasingly recognize the importance of dietary supplements in maintaining healthy blood glucose levels and preventing complications associated with diabetes. Ingredients such as chromium, magnesium, alpha-lipoic acid, omega-3 fatty acids, and herbal extracts like bitter melon and fenugreek have gained popularity for their ability to support insulin function, regulate metabolism, and provide antioxidant benefits. The shift toward nutrition-based solutions improves health outcomes and encourages patients to adopt supplements as part of their daily self-care regimen.

Moreover, rising educational initiatives, awareness campaigns by healthcare organizations, and wider dissemination of scientific research highlighting the benefits of micronutrients and plant-based formulations have amplified consumer acceptance of supplements. With individuals seeking natural, non-invasive, and long-term approaches to managing chronic conditions, nutritional interventions are positioned as an effective adjunct to traditional diabetes therapies. This trend is reshaping consumer purchasing behavior, boosting demand for specialized diabetes management supplements, and creating opportunities for manufacturers to innovate and launch evidence-backed, clinically tested products in the global marketplace.

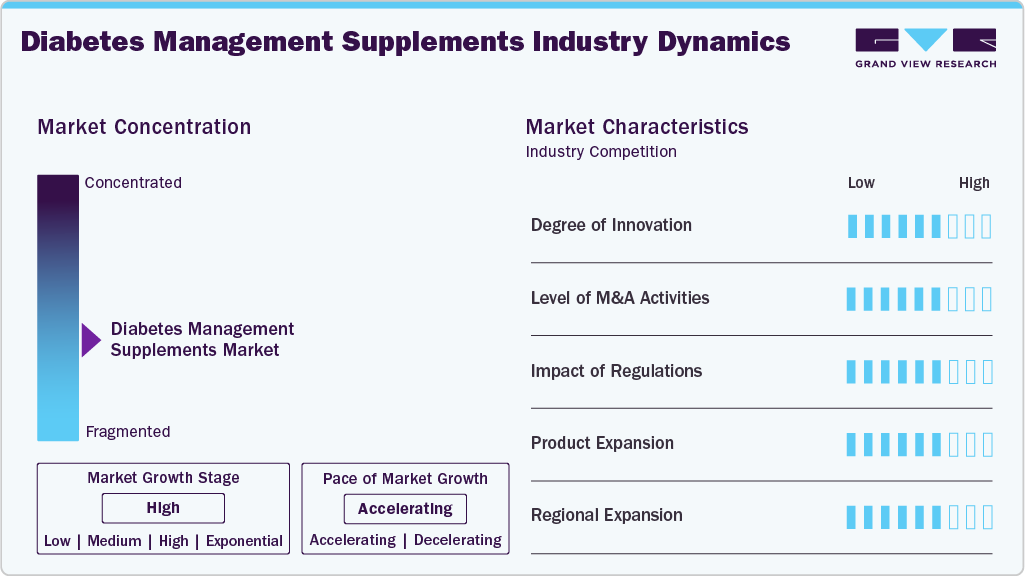

Market Concentration & Characteristics

The diabetes management supplements industry exhibits a moderate to high level of innovation, with companies increasingly focusing on evidence-backed formulations that combine herbal extracts and clinically proven ingredients such as chromium, alpha-lipoic acid, and omega-3 fatty acids. Innovation is also visible in developing clean-label, plant-based products and diverse delivery formats, including gummies, powders, and functional beverages, to improve convenience and consumer appeal, alongside integrating personalized nutrition and digital health tools, further shaping product differentiation.

The diabetes management supplements industry reflects moderate M&A activities, primarily driven by companies aiming to expand their product portfolios, strengthen distribution networks, and enter high-growth regions. Nutraceutical and dietary supplement manufacturers are increasingly pursuing acquisitions of niche players specializing in herbal or plant-based diabetes solutions to diversify offerings and capture the growing consumer preference for natural products. Moreover, strategic partnerships with biotech firms and research-driven organizations are helping established players integrate clinically validated formulations into their product lines. While M&A intensity is not as aggressive as in the pharmaceutical or biotech sectors, consolidation is gradually rising as companies seek competitive advantages, scale operations, and respond to evolving consumer demand for innovative, high-quality diabetes management supplements.

Regulations play a crucial role in the diabetes management supplements industry by shaping product quality, labeling, and marketing. While frameworks like the FDA’s DSHEA in the U.S. allow quicker product launches, stricter rules from bodies like the European EFSA demand stronger scientific validation. Emerging markets are also tightening standards to ensure safety and transparency. Although compliance increases costs and may slow innovation, clear regulations enhance consumer trust and support sustainable market growth.

Product expansion in the diabetes management supplements industry is driven by rising consumer demand for diverse and convenient solutions to manage blood sugar and overall metabolic health. Companies are broadening their portfolios with new formulations, such as herbal blends, micronutrient-enriched products, and clinically validated ingredient combinations. They are also introducing innovative delivery formats like gummies, powders, functional drinks, and ready-to-consume snacks. This expansion caters to varying consumer preferences and helps brands differentiate themselves in a highly competitive space.

Regional expansion in the diabetes management supplements industry is driven by growing demand beyond mature markets like North America and Europe. High-growth opportunities are emerging in Asia-Pacific, fueled by urbanization and rising incomes, as well as in the Middle East, Latin America, and Africa, supported by healthcare investments and expanding e-commerce. Tailoring products to local needs and meeting diverse regulations are helping companies strengthen their global presence.

Type Insights

The multi-ingredient supplements segment dominated the market in 2024 and is expected to grow fastest throughout the forecast period, owing to their ability to provide comprehensive nutritional support for blood sugar management and overall metabolic health. These formulations combine vitamins, minerals, herbal extracts, and functional ingredients, catering to consumers seeking a holistic approach to diabetes care. Rising consumer preference for convenient, all-in-one solutions, coupled with increasing awareness of the synergistic benefits of multi-ingredient products, is further driving adoption.

The single-ingredient supplements segment is expected to grow significantly during the forecast period, driven by their targeted approach in managing specific nutritional deficiencies and supporting blood sugar regulation. Consumers seeking personalized or condition-specific supplementation often prefer single-ingredient products, such as chromium, magnesium, alpha-lipoic acid, or vitamin D, to address metabolic needs. Rising awareness of individual nutrient benefits, along with scientific validation and clinical research, is further encouraging adoption. Moreover, the ease of combining single-ingredient supplements with other therapies or formulations allows for flexible, customizable diabetes management, positioning this segment as a key contributor to market growth.

Ingredients Insights

The herbal extracts & botanicals segment dominated the market in 2024 with a share of 37.56%, owing to the growing consumer preference for natural and plant-based solutions in diabetes management. Ingredients such as bitter melon, fenugreek, cinnamon, and gymnema sylvestre are widely recognized for their potential to support blood glucose regulation and improve insulin sensitivity. Increasing awareness of the benefits of traditional remedies, coupled with a rising demand for clean-label and minimally processed products, is driving the segment growth

The probiotics segment is expected to grow at the fastest CAGR during the forecast period, driven by the growing recognition of gut health in diabetes management and the role of probiotics in improving glucose metabolism and insulin sensitivity. Increasing consumer awareness of the link between gut microbiota and metabolic disorders fuels demand for probiotic supplements as an adjunct to conventional therapies. The segment’s strong scientific backing and potential for personalized nutrition solutions position probiotics as a key growth driver in the global diabetes management supplements market.

Formulation Insights

The capsules segment dominated the market with a share of 38.26% in 2024, driven by convenience, precise dosing, and ease of consumption. Capsules allow for effective delivery of vitamins, minerals, herbal extracts, and multi-ingredient formulations, making them highly popular among consumers managing diabetes. Rising preference for ready-to-use, portable, and shelf-stable supplement forms and strong availability through retail pharmacies and e-commerce platforms further fuel adoption. Moreover, advancements in encapsulation technology enhance bioavailability and preserve ingredient efficacy reinforce the dominance of capsules in the global diabetes management supplements market.

The softgels segment is projected to grow at a significant CAGR, driven by their aster absorption and higher bioavailability than other forms. In diabetes management supplements, they are widely used to encapsulate omega-3s, herbal extracts, and fat-soluble vitamins that aid in blood sugar management. Their ability to mask unpleasant tastes and improve patient compliance further supports segment growth.

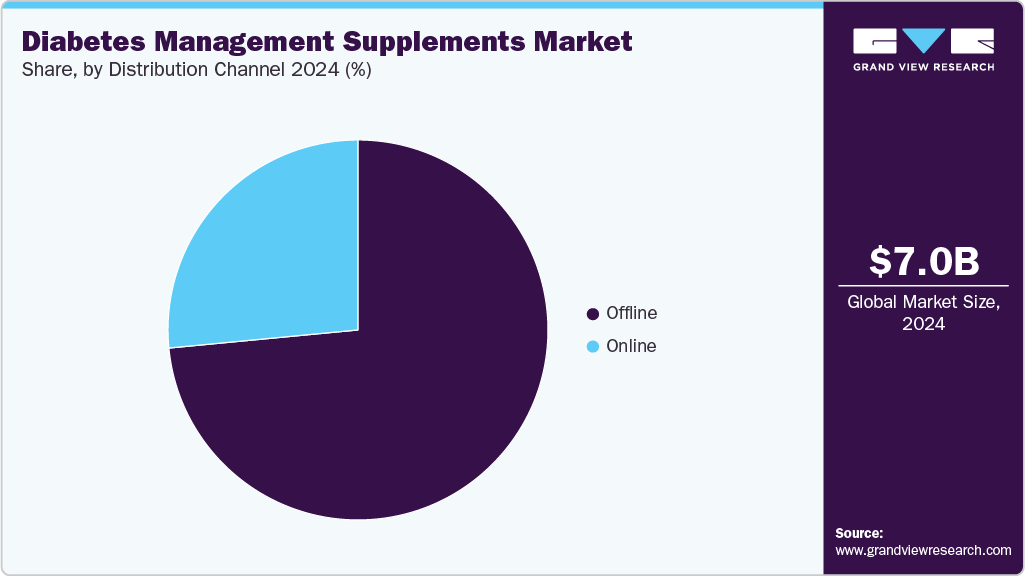

Distribution Channel Insights

The offline segment captured the largest market share in 2024, driven by the established presence of retail pharmacies, health stores, and supermarkets, which remain preferred channels for purchasing diabetes management supplements. Consumers often rely on in-store interactions for guidance, product verification, and trust-building, particularly for herbal and clinically validated formulations. The convenience of immediate product availability, promotional activities, and brand visibility in offline channels continues to support strong adoption.

The online segment is projected to grow at the fastest CAGR during the forecast period, driven by the increasing adoption of e-commerce platforms and digital health solutions. Consumers are turning to online channels for convenience, wider product selection, competitive pricing, and doorstep delivery of diabetes management supplements. Rising smartphone penetration, subscription-based models, and targeted digital marketing campaigns further accelerate the segment growth.

Regional Insights

The North America diabetes management supplements market is growing significantly, supported by the high prevalence of diabetes and prediabetes, rising consumer awareness about preventive healthcare, and the availability of clinically backed supplement formulations. A well-established nutraceutical industry and strong distribution networks across retail pharmacies, specialty stores, and e-commerce platforms are boosting accessibility. Additionally, increasing healthcare expenditure, growing preference for clean-label and plant-based supplements, and continuous product innovation by leading players drive steady market expansion, making North America one of the most attractive regions for diabetes management supplements.

U.S. Diabetes Management Supplements Market Trends

The U.S. diabetes management supplements market is highly competitive, driven by global nutraceutical firms, regional players, and startups offering diverse formulations. Rising demand for clean-label, plant-based, and clinically validated products pushes companies to prioritize innovation and quality. Expanding retail and e-commerce channels, ongoing R&D, new product launches, and strategic partnerships intensify competition in this dynamic market.

Europe Diabetes Management Supplements Market Trends

The Europe diabetes management supplements industry is witnessing steady growth, supported by the rising prevalence of diabetes, greater emphasis on preventive healthcare, and strong consumer preference for natural and plant-based products. According to the International Diabetes Federation, diabetes prevalence in the European Region is projected to rise from 9.8% in 2024 to nearly 10% higher by 2050, with the number of people living with diabetes estimated at 66 million in 2024. Well-established nutraceutical regulations, particularly those enforced by the European Food Safety Authority (EFSA), further drive demand for clinically validated supplements, strengthening consumer trust and product credibility. Moreover, expanding retail and online distribution channels and increasing research and product innovation investments continue to accelerate market adoption across the region.

The UK diabetes management supplements industry is expanding, supported by a rising diabetic population, increasing lifestyle-related health concerns, and strong consumer interest in dietary interventions for blood sugar management. The country’s well-developed healthcare infrastructure and widespread use of digital health platforms promote greater awareness and adoption of supplements alongside conventional treatments. Moreover, the UK’s dynamic startup ecosystem, coupled with high demand for personalized nutrition and subscription-based supplement services, fosters innovation and creates new growth opportunities in the market.

The Germany diabetes management supplements market is growing, supported by the country’s strong tradition of herbal medicine, high consumer trust in natural remedies, and widespread adoption of evidence-based nutraceuticals. Demand is further driven by an aging population with rising susceptibility to metabolic disorders, along with increasing interest in preventive self-care solutions. Germany’s robust research base and integration of supplements within pharmacies and health stores provide a mature distribution framework.

Asia Pacific Diabetes Management Supplements Market Trends

Asia Pacific is dominating the market in 2024 with the largest share of 35.16% and expected to witness the fastest growth in the diabetes management supplements market, registering a CAGR of 9.20% during the forecast period. This growth is driven by the rising prevalence of diabetes, rapid urbanization, changing dietary habits, and increasing health awareness among consumers. Expanding middle-class populations with higher disposable incomes and the growing popularity of herbal and traditional medicine-based supplements further fuel demand.

The China diabetes management supplements industry is growing rapidly, driven by shifting consumer lifestyles, increasing awareness of preventive nutrition, and rising demand for premium, science-backed formulations. The country’s strong e-commerce ecosystem and digital health platforms are accelerating access to supplements, particularly among younger, tech-savvy consumers. For instance, in July 2025, US-based Nature’s Sunshine announced plans to acquire Fosun Industrial’s 20% stake in China joint ventures, securing full ownership after Fosun Pharma’s shareholding fell below 5%. This move highlights growing international investment and confidence in China’s nutraceutical market, positioning the country as a strategic hub for global diabetes supplement expansion.

The Japan diabetes management supplements market is growing, driven by the country’s aging population, high prevalence of type 2 diabetes, and strong consumer inclination toward functional foods and nutraceuticals. In April 2023, a Japanese cohort study (JACC) published in the Journal of Nutritional Science highlighted that higher low-carbohydrate diet scores, particularly those emphasizing vegetable-based nutrition, were associated with a reduced risk of type 2 diabetes, underscoring the role of dietary interventions in prevention strategies. Rising health consciousness and Japan’s cultural emphasis on balanced nutrition and preventive care are further fueling demand for supplements that blend traditional Japanese ingredients with modern scientific research.

Middle East & Africa Diabetes Management Supplements Market Trends

The Middle East and Africa (MEA) diabetes management supplements industry is emerging, driven by a sharp rise in diabetes cases linked to changing diets, sedentary lifestyles, and increasing obesity rates. Countries such as Saudi Arabia, the UAE, and South Africa are witnessing heightened demand as consumers become more proactive in managing blood sugar levels through dietary support. Multinational nutraceutical companies are strengthening their footprint via joint ventures and localized product offerings, while local players are leveraging traditional herbal ingredients to appeal to regional preferences. With growing investments in healthcare awareness campaigns and digital distribution channels, MEA is gradually shaping into a promising growth market for diabetes management supplements.

The Kuwait diabetes management supplements market is emerging, driven by a high diabetes burden and rising consumer focus on preventive nutrition. Growing demand for natural and herbal products, wider availability through pharmacies and online channels, and supportive healthcare initiatives are creating opportunities for both local and international players.

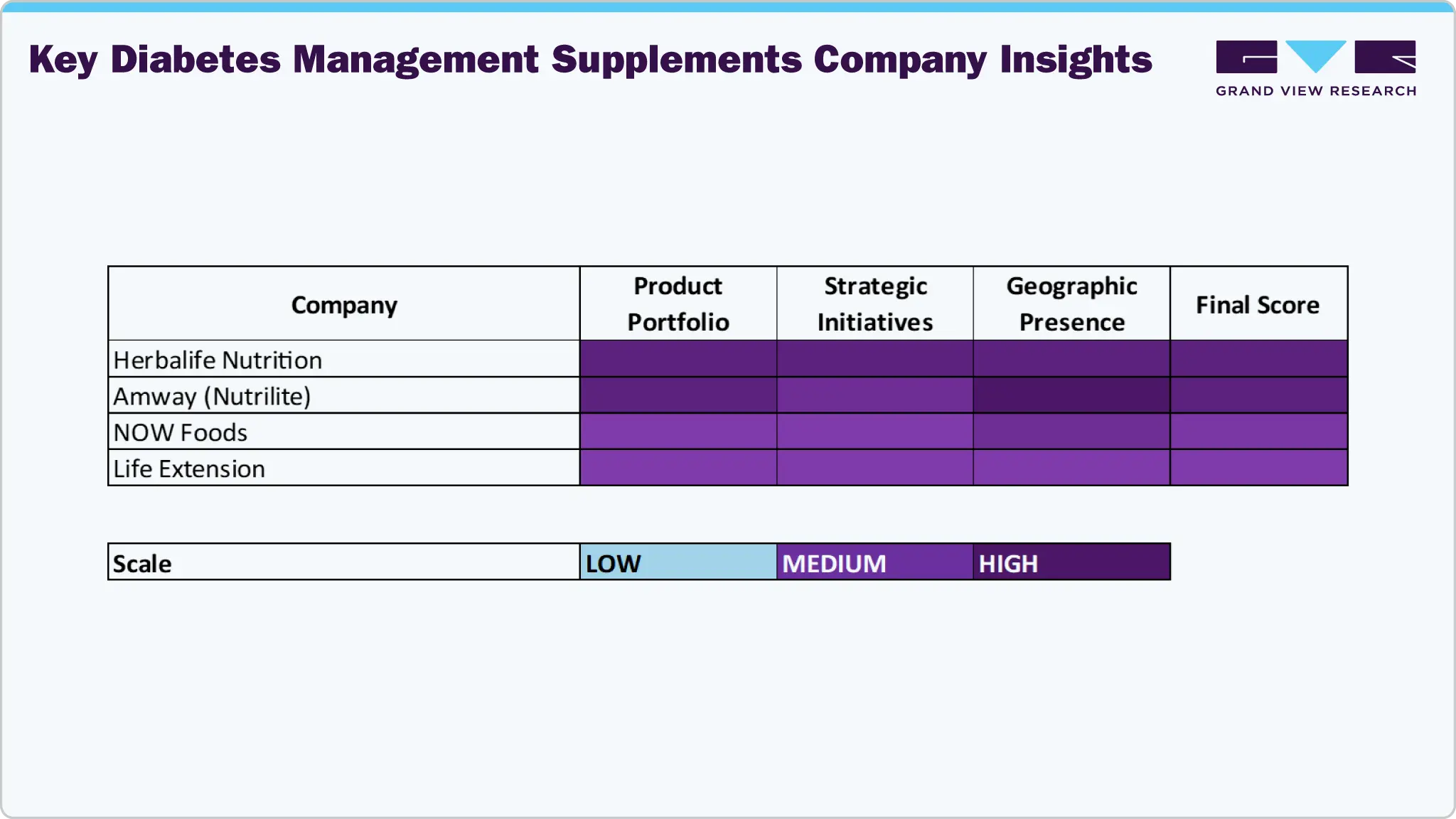

Key Diabetes Management Supplements Company Insights

The diabetes supplement industry is characterized by a mix of established global players and emerging innovators who maintain leadership through robust product portfolios, strategic collaborations, and continuous investment in research and development. Companies such as Herbalife Nutrition, Amway (Nutrilite), Nature’s Bounty (Nestlé Health Science), and Nature’s Way Products, LLC hold significant market share thanks to their trusted brand presence, comprehensive product offerings, and extensive distribution networks across multiple regions.

Firms like NOW Foods, Swanson Health Products, Glanbia plc, Vegatot, Glucose Health, Inc., and Life Extension are expanding their footprint by introducing specialized blood sugar management supplements, herbal formulations, and personalized wellness solutions that cater to the growing needs of diabetic patients, health-conscious consumers, and medical practitioners. Their focus on innovation, ingredient transparency, and efficacy-driven formulations enables them to tap into evolving consumer demands for safe and natural glucose-support supplements.

Leading organizations continue to dominate the landscape by integrating advanced scientific research with holistic wellness approaches and strategic growth initiatives. These companies have solidified their position in the diabetes supplement market by addressing the increasing demand for natural, clinically supported, and preventive solutions that support healthy blood sugar levels, weight management, and overall metabolic health. As awareness of diabetes management and preventive care rises globally, the market trajectory will increasingly reflect commitments to product quality, accessibility, and sustainable sourcing practices.

The diabetes supplement market is experiencing a dynamic convergence of established expertise and innovative entrants. Strategic partnerships, product line expansion, and evidence-based ingredient innovations drive intensified competition. Companies that successfully blend scientific rigor, consumer-centric solutions, and regulatory compliance are positioned to deliver sustained growth in this rapidly evolving sector.

Key Diabetes Management Supplements Companies:

The following are the leading companies in the diabetes management supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Herbalife Nutrition

- Amway (Nutrilite)

- Nature’s Bounty (Nestlé Health Science)

- Nature’s Way Products, LLC

- NOW Foods

- Swanson Health Products

- Glanbia plc

- Vegatot

- Glucose Health, Inc.

- Life Extension

Recent Developments

-

In February 2022, Vestige launched pre-Gluco Health capsules, a supplement formulated with botanical extracts and micronutrients to support glucose metabolism, improve insulin sensitivity, and help prevent progression from pre-diabetes to diabetes.

-

In March 2023, Nestlé Health Science launched the Opt2Win program in India, targeting obesity management, a key risk factor for type 2 diabetes, thereby supporting the diabetes supplement market through nutritional interventions and patient-focused weight management.

Diabetes Management Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.53 billion

Revenue forecast in 2033

USD 14.52 billion

Growth rate

CAGR of 8.56% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, ingredients, formulation, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Herbalife Nutrition; Amway (Nutrilite); Nature’s Bounty (Nestlé Health Science); Nature’s Way Products, LLC; NOW Foods; Swanson Health Products; Glanbia plc;

Vegatot; Glucose Health, Inc.; Life Extension

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Diabetes Management Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the global diabetes management supplements market on the basis of type, ingredients, formulation, distribution channel, and region

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Multi-ingredient Supplements

-

Single-ingredient Supplements

-

-

Ingredients Outlook (Revenue, USD Million, 2021 - 2033)

-

Herbal Extracts & Botanicals

-

Vitamins & Minerals

-

Amino Acids & Antioxidants

-

Omega-3 Fatty Acids

-

Probiotics

-

Others

-

-

Formulation Outlook (Revenue, USD Million, 2021 - 2033)

-

Capsules

-

Tablets

-

Softgels

-

Powders

-

Liquids

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Pharmacies & Drug Stores

-

Hypermarkets/Supermarkets

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The diabetes management supplements market size was estimated at USD 7.04 billion in 2024 and is expected to reach USD 7.53 billion in 2025.

b. The diabetes management supplements market is expected to grow at a compound annual growth rate of 8.56% from 2025 to 2033 to reach USD 14.52 billion by 2033.

b. The herbal extracts & botanicals segment dominated the diabetes management supplements market with a share of 37.56% in 2024. This is driven by strong consumer preference for natural ingredients like cinnamon, fenugreek, and bitter melon, which are widely recognized for supporting blood sugar management.

b. Some key players operating in the diabetes management supplements market include Herbalife Nutrition; Amway (Nutrilite); Nature’s Bounty (Nestlé Health Science); Nature’s Way Products, LLC; NOW Foods; Swanson Health Products; Glanbia plc; Vegatot; Glucose Health, Inc.; Life Extension.

b. Key factors driving the growth of the diabetes management supplements market include rising diabetes prevalence worldwide, increasing awareness of preventive healthcare, growing preference for natural and multi-ingredient formulations, expansion of e-commerce channels, and continuous product innovations by supplement manufacturers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.