- Home

- »

- Clothing, Footwear & Accessories

- »

-

Diabetic Footwear Market Size, Share & Growth Report 2030GVR Report cover

![Diabetic Footwear Market Size, Share & Trends Report]()

Diabetic Footwear Market Size, Share & Trends Analysis Report By Product (Slippers, Sandals, Shoes), By Distribution Channel (Online, Offline), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-833-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2025

- Industry: Consumer Goods

Diabetic Footwear Market Size & Trends

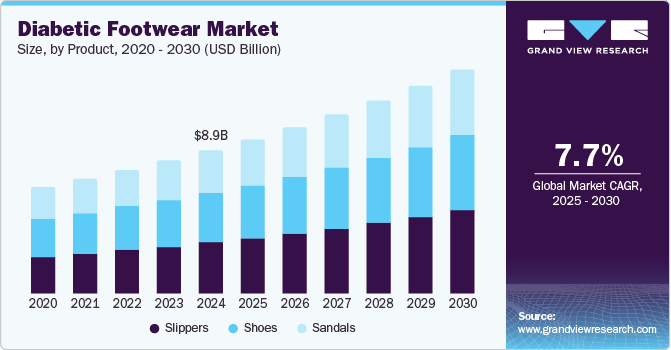

The global diabetic footwear market size was valued at USD 8.96 billion in 2024 and is projected to grow at a CAGR of 7.7% from 2025 to 2030. Diabetic footwear is designed to help prevent the risk of nerve damage and poor blood flow in diabetic patients. It offers comfort and support for individuals with specific foot conditions, helping prevent complications associated with diabetes.

The increase in diabetes cases plays an important role in the heightened demand for specialized footwear. According to the prediction published by the International Diabetes Federation, the number of people suffering from diabetes is expected to reach 783 million by 2045 from an estimated 643 million in 2030. Moreover, the awareness of diabetes-related foot issues is growing, making patients turn to various preventive measures, including diabetic footwear.

Material and technological advancements have resulted in more comfortable and efficient designs, making diabetic footwear attractive to a wider audience. Furthermore, preventive healthcare is important in motivating individuals to take proactive steps in managing their diabetes, including investing in appropriate footwear. The growth of e-commerce platforms has also provided consumers with access to a diverse selection of diabetic footwear, which helps them compare and buy the product. Additionally, dedicated online diabetic footwear platforms such as Healthy Feet Store and Happy Walk are actively contributing to the growth of the diabetic footwear market.

Product Insights

The slipper segment dominated the market with a 36.0% revenue share in 2024, owing to the increasing consumer demand for health and wellness products that prioritize comfort and foot care. Diabetic slippers are designed with advanced material and cushioning, offering comfortable and practical solutions for diabetic patients. Their functionality makes them comfortable and convenient for consumers seeking to prioritize foot health. For instance, the Dr. Comfort Cozy diabetic slippers by Dr. Comfort are specifically designed for individuals with diabetes and other foot health concerns.

The sandal segment is expected to grow at a significant CAGR during the forecast period due to continuous innovation in product offerings. Diabetic sandals offer comfort and protection with characteristics such as non-binding straps, adjustable straps, and cushioned soles. These footwear help prevent complications such as blisters, ulcers, and fungal infections for those with diabetic complications. Moreover, brands such as Aetrex and Orthofeet offer sandals that focus on style and functionality, making them suitable for both indoor and outdoor use.

Distribution Channel Insights

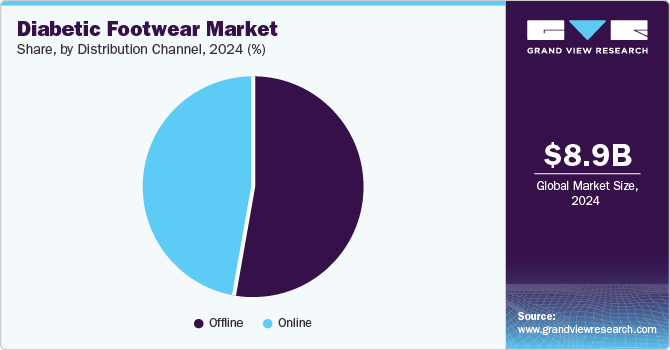

Offline distribution channels registered the highest market revenue share in 2024. The growth of physical retail spaces driven by urbanization and increased healthcare investment in developing nations contributes to the growth of offline distribution channels. Local pharmacies and medical supply outlets offer personalized solutions for foot health, making it more convenient for their customers. For instance, pharmacy outlets and drug stores such as Walgreens and CVS offer a diverse collection of diabetic footwear, allowing their customers to try the footwear to find fit and comfort.

The online segment is expected to grow at the fastest CAGR during the forecast period. The global use of the internet and smartphones accelerates the transition to online purchasing. Additionally, the growth of online shopping platforms is more convenient and allows shoppers to explore and compare a variety of diabetic footwear effortlessly without visiting physical stores. Furthermore, platforms such as Shoemed and Vonwellx have simplified the shopping experience for consumers looking for diabetic footwear, offering benefits such as pay-on delivery, free deliveries, returns & exchanges, and discounted offers, attracting a wider audience group.

Regional Insights

The North American diabetic footwear market secured the dominant market revenue share of 33.5% in 2024. The number of diabetes cases in the region is rising, leading to a growing need for specialized footwear that effectively handles foot complications associated with diabetes. Additionally, government initiatives that support diabetic foot care, such as reimbursement programs through Medicare in the U.S., motivate patients to invest in specialized footwear that can help avert serious complications. These factors contribute to North America's position in the diabetic footwear market, highlighting the critical role of specialized footwear in effectively managing diabetes-related health issues.

U.S. Diabetic Footwear Market Trends

The diabetic footwear market in the U.S. is expanding due to awareness of foot health among patients. The need for specialized footwear to prevent complications associated with diabetes is growing. The aging population contributes to this growth, as older adults are more susceptible to diabetes and related foot issues. In addition, technological advancement here plays a significant role, with innovations such as 3D printing and materials enhancing the customization and comfort of these products. Moreover, brands like Podartis Srl and DARCO are enhancing their distribution network to improve access to specialized footwear.

Europe Diabetic Footwear Market Trends

The diabetic footwear market in Europe is seeing a rise primarily due to an increase in cases of diabetes. In countries such as Germany and the UK, people prioritize specialized footwear to prevent complications such as ulcers and nerve damage caused by diabetes. Innovative initiatives, such as the EU-funded project 'Special Shoes Movement,' have supported the development of advanced footwear and insoles specifically designed for diabetic patients. Additionally, these advancements seek to address the challenges faced by individuals with diabetes while enhancing the overall footwear industry through sustainable production methods and innovative design principles.

Asia Pacific Diabetic Footwear Market Trends

The Asia Pacific (APAC) diabetic footwear market is seeing significant growth, driven by rising awareness about diabetic foot care and rising diabetes rates in countries such as China and India. Urbanization in India has led to a surge in healthcare product purchases, including specialized footwear for people with diabetes. For instance, the Diabetic Foot Education Program (DFEP) in India is a nationwide initiative aimed at providing knowledge regarding the prevention of diabetic foot complications and essential foot-care education. The program seeks to improve healthcare quality for diabetic foot patients across India. Similarly, The Chinese government has initiated health promotion efforts in this age of urbanization, boosting demand for diabetic footwear.

Key Diabetic Footwear Company Insights

The diabetic footwear market is becoming increasingly competitive, featuring several key players that have made significant strides recently. Notable companies in the sector include Orthofeet, Inc., Dr. Comfort, and others.

-

Orthofeet Inc. is a key player with a significant presence in the diabetic footwear market. Continuous innovation in its technology helps, and its success is attributable to the development of therapeutic footwear specifically designed for individuals concerned about their foot health. Orthofeet offers a wide variety of products, including orthopedic shoes and sandals, which have gained widespread adoption across countries such as the U.S. and Canada.

-

Drew Shoe Corporation is a prominent player in the diabetic shoe market; its product line combines health benefits with fashion. Drew Shoe is known for providing footwear that offers depth, and orthopedic support, which helps it win over a considerable market segment in the U.S. This approach of merging medical requirements with consumers’ desire for style has effectively helped the company to make its strong position in the industry.

Key Diabetic Footwear Companies:

The following are the leading companies in the diabetic footwear market. These companies collectively hold the largest market share and dictate industry trends.

- Podartis Srl

- Etonic Worldwide LLC

- DARCO International Inc.

- Apex Foot Health Industries LLC

- Dr. Comfort LLC

- Advance Diabetic Solution

- Drew Shoe Corporation

- Aetrex Worldwide Inc.

- Dr. Zen Products, Inc.

- Orthofeet Inc.

Recent Developments

-

In November 2023, Aetrex launched a new personalized footwear recommendation platform, Fit Starter, developed in partnership with Heeluxe. This innovative platform enhances shoe fitting services for retailers, aiming to decrease product returns and boost customer satisfaction.

-

In November 2023, the custom-fit footwear brand Fyous secured USD 1.75 million investment from Innovate UK to develop custom footwear for people with diabetes, addressing the high incidence of foot injuries and amputations among this population. The company's proprietary polymorphic moulding technology enables rapid production of well-fitting shoes tailored to individual patients. This innovation aims to significantly reduce the risk of foot ulceration and related complications, ultimately benefiting patients and reducing costs for the NHS.

-

In February 2022, The American Diabetes Association (ADA) partnered with Dr. Comfort to enhance initiatives to prevent and manage foot complications related to diabetes. This collaboration highlights the significance of education and access to quality diabetic footwear, fostering patient awareness. It also promotes market growth by encouraging the use of specialized footwear.

Diabetic Footwear Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.66 billion

Revenue forecast in 2030

USD 13.98 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Mexico, Canada, U.K., France, Germany, Italy, Spain, India, China, Japan, UAE, Saudi Arabia, South Africa, Brazil

Key companies profiled

Podartis Srl; Aetrex Worldwide; Dr. Zen Products, Inc.; Orthofeet, Inc.; DARCO International, Inc.; Etonic Worldwide LLC; Apex Foot Health Industries LLC; Dr. Comfort LLC; Advance Diabetic Solution; Drew Shoe Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diabetic Footwear Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global diabetic footwear market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Shoes

-

Sandals

-

Slippers

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."