- Home

- »

- Clinical Diagnostics

- »

-

Diagnostic Enzymes Market Size, Industry Report, 2033GVR Report cover

![Diagnostic Enzymes Market Size, Share & Trends Report]()

Diagnostic Enzymes Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Taq Polymerase, MMLV RT, HIV RT), By Application (Diabetes, Oncology, Cardiology), By Product, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-003-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Diagnostic Enzymes Market Summary

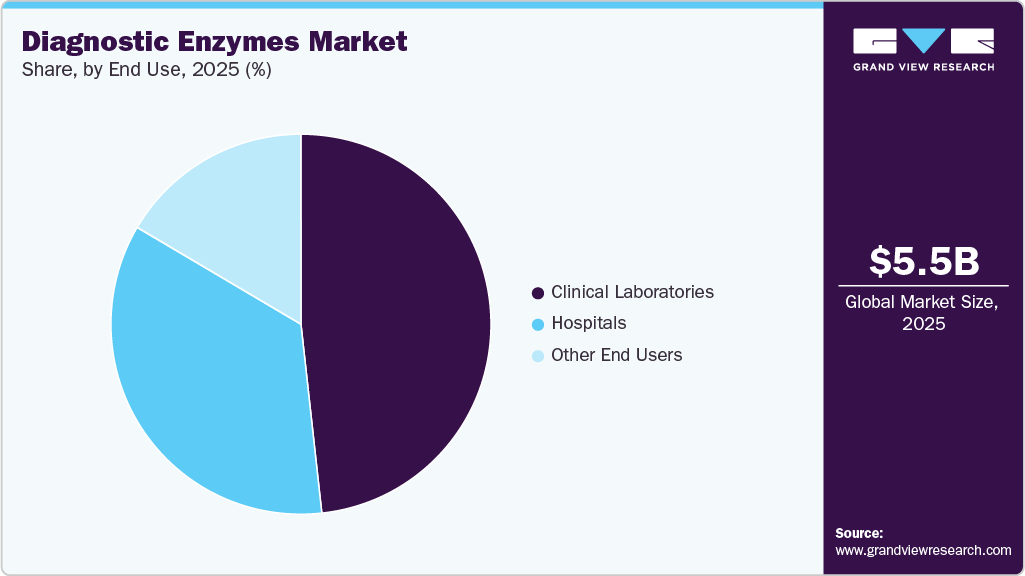

The global diagnostic enzymes market size was estimated at USD 5.48 billion in 2025 and is projected to reach USD 9.75 billion by 2033, growing at a CAGR of 7.60% from 2026 to 2033. This growth highlights the growing demand for faster and more reliable healthcare solutions as the world faces an increase in cases of infectious diseases and chronic conditions.

Key Market Trends & Insights

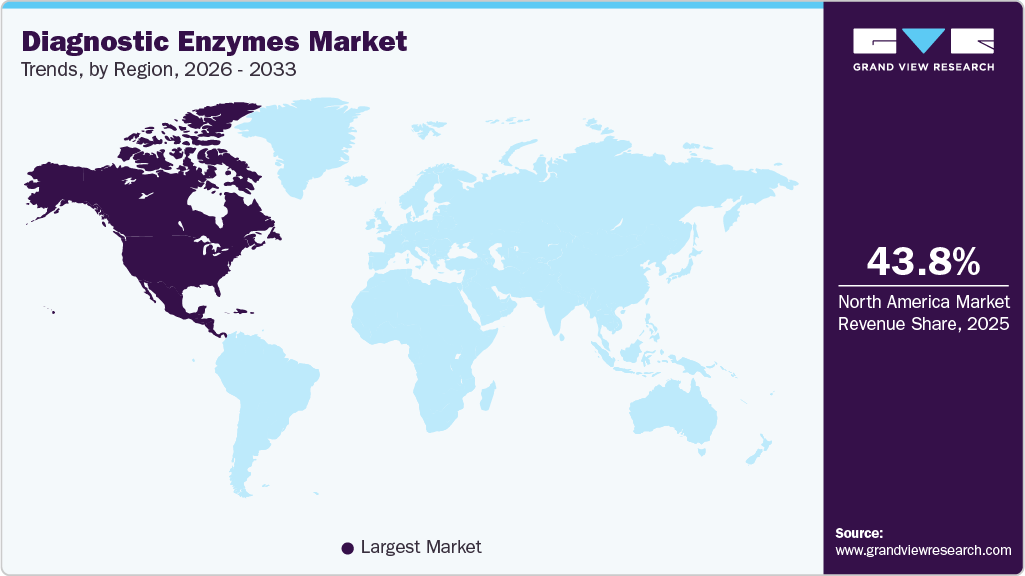

- North America dominated the global diagnostic enzymes market with the largest revenue share of 43.79% in 2025.

- The diagnostic enzymes industry in the U.S. accounted for the largest market revenue share in North America in 2025.

- Based on product, the clinical segment led the market with the largest revenue share of 69.55% in 2025.

- Based on application, the infectious disease segment led the market with the largest revenue share of 35.63% in 2025.

- Based on end use, the clinical laboratories segment led the market with the largest revenue share of 51.30% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.48 Billion

- 2033 Projected Market Size: USD 9.75 Billion

- CAGR (2026-2033): 7.60%

- North America: Largest Market in 2025

Diagnostic enzymes are at the heart of this progress, they help doctors detect and measure vital biomarkers that uncover infections, metabolic disorders, and other health issues. Thanks to advances in diagnostic technologies and greater patient awareness, these enzymes are playing an increasingly important role in spotting diseases early and guiding timely treatment. By making diagnoses faster and more precise, they not only improve individual patient outcomes but also contribute to stronger public health worldwide.Enzymes are extensively used in disease diagnosis due to their remarkable biocatalytic properties. For example, enzymes such as glucose oxidase (GOx) and glucose dehydrogenase play a crucial role in diagnosing diabetes by measuring glucose levels in the body. They are vital for the metabolic functions of various organisms, including plants, microorganisms, animals, and humans.

Abnormal enzyme activity can lead to various metabolic disorders, making components of enzyme metabolism significant markers for disease diagnostics. Key players are focusing on collaborations to launch new products in the market. For instance, in July 2023, the global joint marketing agreement was formed between INOVIQ and Promega. This collaboration enables the co-marketing of INOVIQ’s EXO-NET exosome capture technology and Promega’s nucleic acid purification systems, aiming to provide comprehensive exosome solutions on a global scale.

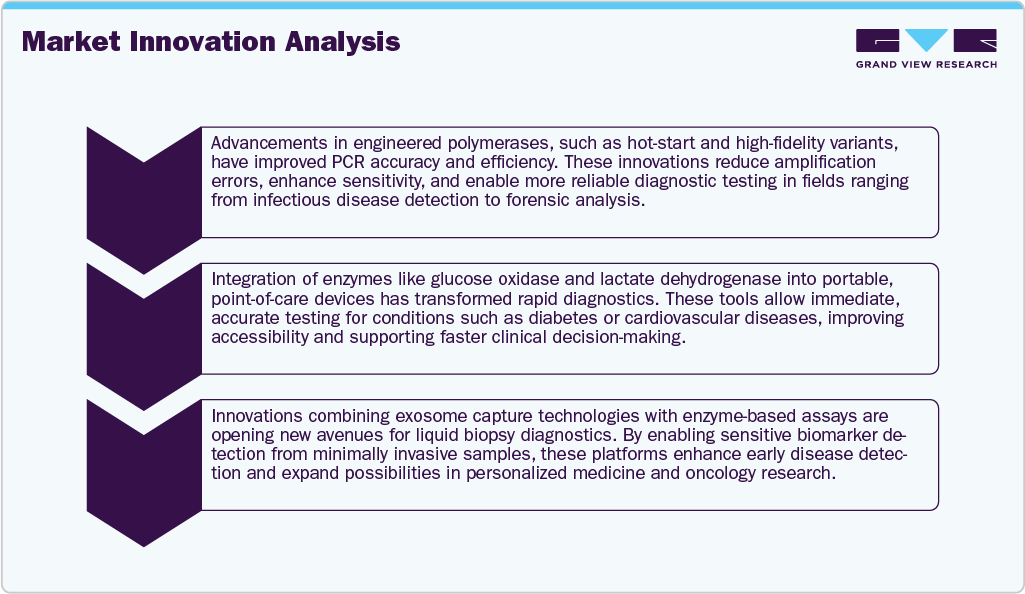

The diagnostic enzyme industry is experiencing growth driven by ongoing innovations in diagnostic technologies. Advances in technology have resulted in more efficient and sensitive tests that rely on enzymes for accurate results. For instance, nuclease enzymes are increasingly employed in DNA sequencing and amplification techniques for applications such as detecting infectious diseases.

In addition, increasing patient awareness of preventive healthcare and early disease detection has driven up the demand for enzyme-based diagnostic tests. Patients are becoming increasingly proactive in monitoring their health, leading to a rise in the utilization of enzyme diagnostics for conditions such as cardiovascular diseases, diabetes, and cancer. This shift toward proactive healthcare management is further propelling the growth of the diagnostic enzyme industry.

The diagnostics enzyme industry is being shaped not only by innovation but also by regulatory decisions that guide the industry's operations. A clear example was the FDA’s emergency approvals during the COVID-19 pandemic, which expedited the use of RT-PCR and enzyme-linked immunosorbent assays to detect SARS-CoV-2 and helped bring reliable testing to the public more quickly. Alongside this regulatory framework, companies are also expanding their capabilities to meet rising global demand.

For instance, in October 2024, Takara Bio (Europe) expanded its Gothenburg location by constructing a specialized enzyme-manufacturing facility that can process approximately 600,000 PCR and qPCR reactions each week, thereby increasing its ability to generate diagnostic-quality enzymes. This investment not only increases production capacity but also ensures that Takara can continue to support the growing demand for diagnostic enzymes, which play a vital role in healthcare and disease detection.

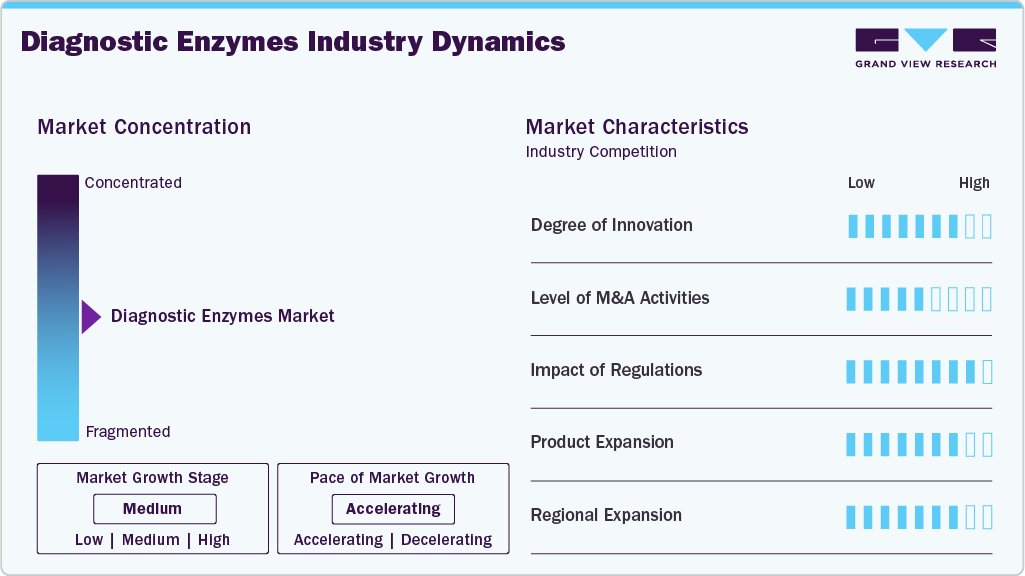

Market Concentration & Characteristics

The diagnostics enzyme industry is characterized by continuous innovation, with companies refining enzymes to deliver higher sensitivity, greater stability, and faster results. Breakthroughs such as high-fidelity polymerases and enzyme-linked biosensors are enhancing assay precision. These innovations are directly supporting earlier disease detection, more accurate monitoring, and improved patient outcomes across a wide range of therapeutic areas. For instance, in September 2024, Promega Corporation introduced a new variant of polymerase designed to minimize stutter artifacts in forensic DNA analysis, highlighting ongoing enhancements in enzyme functionality.

Moreover, in February 2024, New England Biolabs ( NEB) unveiled updated enzyme kits that optimized cDNA synthesis and molecular diagnostics workflows, further contributing to gradual innovation. These advancements indicate that the demand for quick and dependable testing continues to propel enhancements, even though the market remains largely dependent on established enzyme categories, which tempers the overall intensity of innovation.

Mergers and acquisitions continue to be a driving force behind market growth. Larger corporations leverage acquisitions to strengthen their product portfolios, while smaller firms gain the scale and reach needed to compete globally. These deals provide access to proprietary technologies, expand commercial pipelines, and facilitate the integration of new capabilities, ensuring responsiveness to evolving diagnostic demands worldwide.

Regulation continues to shape the pace and direction of the diagnostics enzyme industry. Emergency authorizations during the COVID-19 pandemic demonstrated the flexibility of oversight in speeding up the availability of vital diagnostic tools. At the same time, rigorous quality and safety requirements ensure that enzyme-based products remain reliable, safeguarding patient trust and maintaining the highest clinical standards across healthcare systems.

The diagnostics enzyme industry is also being driven by ongoing product diversification. Companies are launching specialized enzymes designed for PCR, sequencing, and biomarker analysis, supported by improved formulations and diagnostic kits. These advancements enhance efficiency and accuracy in testing, enabling firms to meet evolving clinical needs and maintain a competitive position in both healthcare and research environments.

Geographic expansion plays an increasingly important role in shaping the market landscape. Global firms are investing in facilities, partnerships, and tailored product offerings across Asia-Pacific, Europe, and developing markets. Such efforts enhance access to diagnostics, align solutions with local healthcare priorities, and reinforce the worldwide adoption of enzyme-driven technologies in modern clinical practice.

Type Insights

The glucose oxidase/dehydrogenase segment led the market with the largest revenue share of 9.26% in 2025. Glucose oxidase (GOx) remains in high demand due to its central role in glucose monitoring and its expanding applications in biomedical research. As a key enzyme in diabetes care, GOx enables accurate blood glucose measurement-an essential step for patients managing their condition. With diabetes cases rising globally, the need for dependable glucose detection methods has fueled the adoption of GOx-based biosensors. Beyond diabetes, GOx is also finding new applications in cancer diagnostics, where its glucose-oxidizing ability is being utilized to detect specific biomarkers, thereby broadening its clinical value for researchers and healthcare providers alike.

The lactate dehydrogenase (LDH) segment is anticipated to experience at the fastest CAGR during the forecast period. This trend is supported by the increasing use of molecular diagnostic devices in diabetes management and by LDH’s importance in understanding metabolic processes. Found in nearly all tissues, LDH levels in plasma and serum reflect both normal cellular turnover and tissue damage. As a result, LDH has become a valuable marker for diagnosing cancers, monitoring conditions associated with cell injury, and evaluating disease severity. Its ability to indicate tissue damage makes it particularly useful in clinical evaluations. Growing recognition of LDH’s role in treatment monitoring is also strengthening its position in personalized medicine. As healthcare moves toward more precise and patient-centered approaches, demand for LDH testing is set to rise, driving further growth in this segment.

Application Insights

The infectious diseases segment led the market with the largest revenue share of 35.63% in 2025. The widespread application of PCR technology has significantly advanced the early identification and treatment of infectious diseases. This technology allows for the precise and sensitive detection of organisms that are typically difficult to identify. Conditions such as atypical pneumonia, tuberculosis, streptococcal pharyngitis, ulcerative urogenital infections, and various chronic illnesses can now be diagnosed effectively using PCR methods. As per the WHO, in 2024, an estimated 10.7 million people globally fell ill with TB, including 1.2 million children, 3.7 million women, and 5.8 million men. Notably, the expression of the DNA polymerase gene from Thermus thermophilus Escherichia coli facilitates efficient reverse transcriptase activity, enabling the one-step detection of cellular mRNA expression, which enhances diagnostic accuracy.

The oncology segment is expected to grow at the fastest CAGR of 9.46% over the forecast period. This anticipated growth can be largely attributed to initiatives like the U.S. government's Cancer Moonshot, launched in February 2022, which aims to improve cancer screening rates and identify previously undetected cases, particularly those overlooked during the COVID-19 pandemic. The initiative's ambitious goal is to reduce cancer mortality by 50% over the next 25 years through early detection and timely treatment, further driving demand for enzymes for the diagnostic drugs market.

Product Insights

The clinical enzyme segment led the market with the largest revenue share of 69.55% in 2025, primarly due to the increasing application of enzymes in clinical chemistry. These enzymes play a crucial role in analyzing bodily fluids, which is essential for detecting and managing various health conditions. Even minor changes in plasma, serum, or blood levels can signal serious health issues, necessitating rapid, accurate, and sensitive analytical methods in clinical settings. The selectivity and speed of enzyme reactions are crucial in these diagnostic processes, enabling the precise detection of specific substrates while effectively eliminating interfering substances. Enzymes are also used to measure cofactors, inhibitors, and activators, making them ideal candidates as labels in immunoassays.

The molecular segment is projected to experience at the fastest CAGR during the forecast period, driven by the increasing use of enzymes in molecular diagnostics. Enzymes play a crucial role in various techniques, including PCR assays and next-generation sequencing (NGS). PCR, a widely adopted method in molecular biology, finds applications in diagnostics, sequencing, forensics, and cloning. Other enzyme-based assays, such as Isothermal Nucleic Acid Amplification Technology (INAAT) and Transcription-Mediated Amplification (TMA), enable the rapid detection of specific nucleic acid sequences without the need for traditional thermal cycling, effectively addressing some limitations associated with conventional methods. All of these factors effectively also drive the IVD diagnostic molecule raw enzymes market

End Use Insights

The clinical laboratories segment led the market with the largest revenue share of 51.30% in 2025. This dominance is supported by several key factors, including the rising adoption of point-of-care testing and the growing demand for molecular diagnostic solutions. The shift toward personalized medicine is also driving greater reliance on clinical laboratories, as tailored testing becomes essential for guiding treatment decisions. In addition, advancements in technologies such as next-generation sequencing and digital PCR are expanding the capabilities of laboratories, enabling faster, more precise, and comprehensive diagnostic services. Together, these developments are reinforcing the central role of clinical laboratories in modern healthcare and fueling the segment’s continued growth.

The other end-use segment is anticipated to grow at the fastest CAGR 8.38% of over the forecast period. As more individuals seek convenient and accessible healthcare solutions, home testing kits utilizing diagnostic enzymes enable users to perform tests for various conditions, including diabetes and infections, in the comfort of their own homes. The increasing emphasis on preventive care and early disease detection further fuels this demand, as consumers become more proactive about monitoring their health. In addition, advancements in enzyme technology and the growing availability of user-friendly testing kits are making these products more appealing to consumers.

Regional Insights

North America dominated the global diagnostic enzymes market with the largest revenue share of 43.79% in 2025. The surge in demand for enzymes was significantly influenced by the U.S. Food and Drug Administration's (FDA) approval of emergency use authorizations for COVID-19 laboratory-developed diagnostics. During this period, enzyme-linked immunosorbent assays (ELISA) and reverse transcription polymerase chain reaction (RT-PCR) tests became the primary methods for detecting SARS-CoV-2 under these emergency authorizations.

U.S. Diagnostic Enzymes Market Trends

The diagnostic enzymes market in the U.S. accounted for the largest market revenue share in North America in 2025, driven by the increasing adoption of enzyme-based diagnostic tests, advancements in diagnostic technologies, the rise in chronic and infectious diseases, growing demand for point-of-care testing, the utilization of artificial intelligence and machine learning, and the expanding need for enzyme-based diagnostic tests in clinical chemistry. For instance, in October 2023, Thermo Fisher Scientific introduced Gibco CTS Detachable Dynabeads, an innovative platform featuring an active-release mechanism for efficient cell isolation and purification in cell therapy manufacturing. The detachable Dynabeads enable easy cell release, facilitating scalable and high-quality cell therapy production.

Europe Diagnostic Enzymes Market Trends

The diagnostic enzymes market in Europe is experiencing significant growth owing to the increasing emphasis on preventive healthcare and early disease detection, driven by a rising awareness of health issues and the need for timely interventions. This trend is particularly evident in the growing prevalence of chronic diseases, which has heightened the demand for effective diagnostic solutions.

The UK diagnostic enzymes market is experiencing significant growth, driven by several factors. One major factor is the increasing adoption of enzyme-based diagnostic tests, driven by technological innovations. Another factor is the rising burden of chronic and infectious diseases, which has led to a greater demand for accurate and efficient diagnostic tools. According to the data by the National Library of Medicine, Infectious diseases represent a major public health challenge globally, contributing to significant health disparities. In the UK, contagious diseases account for 7% of deaths and 4% of lost life years. The economic burden of infectious diseases in the UK is estimated to be around USD 38 billion annually, highlighting the substantial impact on the country's healthcare system and economy.

The diagnostic enzymes market in Germany is experiencing steady growth, driven by rising demand for advanced molecular diagnostics, point-of-care testing, and personalized medicine solutions. The increasing prevalence of chronic and infectious diseases, coupled with an aging population, is fueling the need for reliable enzyme-based assays such as polymerases, kinases, oxidases, and dehydrogenases. Strong investments in biotechnology and healthcare infrastructure, along with supportive government initiatives, are further accelerating adoption. For instance, in October 2024, BRAIN-Biocatalysts Life Science Solutions launched an initiative that integrates BRAIN Biotech’s innovative enzyme discovery platform MetXtra with Biocatalysts’ large-scale fermentation capabilities of 10,000L. This partnership tackles intellectual property issues and the challenges of scaling up, providing comprehensive enzyme solutions from discovery to production.

Asia Pacific Diagnostic Enzymes Market Trends

The diagnostic enzymes marketin theAsia Pacific is anticipated to grow at the fastest CAGR during the forecast period,driven by various factors that reflect the region's diverse healthcare landscape. One of the primary drivers is the increasing prevalence of chronic diseases and infectious conditions, leading to a heightened demand for effective and timely diagnostic solutions.

The China diagnostic enzymes market is growing, driven by the trend of personalized medicine in China. As healthcare providers move towards tailored treatment approaches, there is a rising need for precise diagnostic tests that can guide individualized therapies. Enzyme-based tests play a crucial role in this shift by providing accurate insights into patient conditions.

The diagnostic enzymes market in Japan is experiencing strong and steady growth, driven by the country’s advanced healthcare system and increasing emphasis on precision medicine. As Japan faces an aging population and a rise in chronic illnesses, there is an increasing demand for reliable diagnostic tools that utilize enzymes such as polymerases, oxidases, and dehydrogenases. Hospitals, research institutes, and diagnostic labs are adopting enzyme-based assays to improve accuracy, speed, and patient outcomes.

Latin America Diagnostic Enzymes Market Trends

The diagnostic enzymes marketinLatin America is experiencing significant growth,owing to increasing investments in the pharmaceutical and biotechnology sectors, particularly in countries like Brazil, Mexico, and Argentina. Regulatory support and initiatives aimed at enhancing diagnostic capabilities are also playing a crucial role in the market's growth. Many Latin American countries are implementing policies to streamline the approval process for new diagnostic tests, making it easier for companies to introduce innovative products to the market.

Middle East and Africa Diagnostic Enzymes Market Trends

The diagnostic enzymes market in the Middle East and Africa is experiencing gradual expansion, driven by growing awareness of early disease detection, rising healthcare investments, and an increasing burden of chronic and infectious diseases. Countries across the region are strengthening their laboratory infrastructure and adopting modern enzyme-based diagnostic tools, such as polymerases, oxidases, and dehydrogenases, to improve accuracy and efficiency.

The Saudi Arabia diagnostic enzymes marketis expanding due to increased healthcare investment and improved infrastructure. The government has prioritized enhancing healthcare services as part of its Vision 2033 initiative, which aims to improve the quality of life for citizens and residents. This includes upgrading laboratory facilities and integrating advanced diagnostic technologies into clinical practice, facilitating the adoption of innovative enzyme-based diagnostic tests.

Key Diagnostic Enzymes Company Insights

The competitive scenario in the diagnostic enzymes industry is intense, with key players including Takara Bio, Inc., Promega Corporation, Enzo Life Sciences, Inc., Merck KGaA, Thermo Fisher Scientific, Inc., Creative Enzyme, F. Hoffmann-La Roche Ltd., Solis BioDyne, Ambliqon A/S, and Yashraj Biotechnology Ltd. The key players operating in the market are focusing on partnerships, strategic collaborations, and geographical expansion in emerging and economically favorable regions.

Key Diagnostic Enzymes Companies:

The following are the leading companies in the diagnostic enzymes market. These companies collectively hold the largest market share and dictate industry trends.

- Takara Bio, Inc.

- Promega Corporation

- Enzo Life Sciences, Inc.

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Creative Enzyme

- F. Hoffmann-La Roche Ltd.

- Solis BioDyne.

- Ambliqon A/S.

- Yashraj Biotechnology Ltd.

Recent Developments

-

In September 2025, Promega announced a strategic partnership with Watchmaker Genomics to license a newly engineered reverse transcriptase. Optimized for improved accuracy and sensitivity in RNA analysis, the enzyme will strengthen Promega’s ability to produce both catalog and custom solutions for clinical, applied, and pharmaceutical molecular applications. This collaboration marks the start of a broader alliance between the two companies, as they work together to develop next-generation enzyme technologies that meet the advancing demands of molecular diagnostics and life science research.

-

In September 2024, Promega introduced a newly engineered polymerase designed to reduce stutter in forensic DNA analysis significantly. By minimizing stutter artifacts, the enzyme significantly simplifies the interpretation of mixed DNA samples, enabling forensic scientists to generate more accurate profiles from multiple contributors. This breakthrough marks the first enzyme specifically developed to address one of the most persistent challenges in DNA forensics.

-

In June 2025, Enzo Biochem, Inc. announced that it had entered into a definitive Agreement and Plan of Merger with Battery Ventures, a global technology-focused investment firm. Under the agreement, Battery, through its newly formed entity Bethpage Parent, Inc., will acquire Enzo for $0.70 per share in cash, valuing the transaction at approximately $37 million. This acquisition could impact the distribution and availability of Enzo’s enzyme assay kits, such as those for alkaline phosphatase, lactate dehydrogenase, and glucose oxidase, as well as its broader diagnostics portfolio.

Diagnostic Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5.84 billion

Revenue forecast in 2033

USD 9.75 billion

Growth rate

CAGR of 7.60% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Takara Bio, Inc.; Promega Corporation; Enzo Life Sciences, Inc.; Merck KGaA; Thermo Fisher Scientific, Inc.; Creative Enzyme; F. Hoffmann-La Roche Ltd.; Solis BioDyne; Ambliqon A/S.; Yashraj Biotechnology Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diagnostic Enzymes Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global diagnostic enzymes market report based on the product, application, end use and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Taq Polymerase

-

MMLV RT

-

HIV RT

-

Hot start Taq Polymerase

-

UNG

-

RNase Inhibitors

-

Bst Polymerase

-

PCR Master Mix

-

Lyophilized Polymerase

-

T7 RNA Polymerase

-

Cas9 Enzyme

-

Acid Phosphatase

-

Alanine Aminotransferase

-

Alkaline phosphatase

-

Amylase

-

Angiotensin Converting Enzyme

-

Aspartate Aminotransferase

-

Cholinesterase

-

Creatinine Kinase

-

Gamma Glutamyl Transferase

-

Lactate Dehydrogenase

-

Renin

-

Glucose Oxidase/Glucose Dehydrogenase

-

Urease

-

Lactate Oxidase

-

Horseradish Peroxide

-

Glutamate Oxidase

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Diabetes

-

Oncology

-

Cardiology

-

Infectious Diseases

-

Nephrology

-

Autoimmune Diseases

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Molecular Enzymes

-

Clinical Enzymes

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Clinical Laboratories

-

Other End Users

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global diagnostic enzymes market is expected to grow at a compound annual growth rate of 7.60% from 2026 to 2033 to reach USD 9.75 billion by 2033.

b. North America dominated the diagnostic enzymes market with a share of 43.79% in 2025. This is attributable to the high demand for enzymes and the increasing prevalence of infectious disorders in the region requiring enzymes for diagnostic applications

b. Some key players operating in the diagnostic enzymes market include Takara Bio, Inc., Promega Corporation, Enzo Life Sciences, Inc., Merck KGaA, Thermo Fisher Scientific, Inc., Creative Enzyme, F. Hoffmann-La Roche Ltd., Solis BioDyne., and Ambliqon A/S.

b. Key factors that are driving the market growth include the rising demand for enzymes in diagnostics with wide applications in pathology. Moreover, advancements in diagnostic techniques for viral infection are anticipated to propel the market growth.

b. The global diagnostic enzymes market size was estimated at USD 5.48 billion in 2025 and is expected to reach USD 5.84 billion in 2026.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.