- Home

- »

- Clinical Diagnostics

- »

-

STD Diagnostics Market Size, Share & Growth Report, 2030GVR Report cover

![STD Diagnostics Market Size, Share & Trends Report]()

STD Diagnostics Market Size, Share & Trends Analysis Report By Product (Instruments and Services, Consumables), By Application (HIV Testing, HSV Testing, Chlamydia Testing), By Technology, By Location Of Testing, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-686-8

- Number of Report Pages: 156

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

STD Diagnostics Market Size & Trends

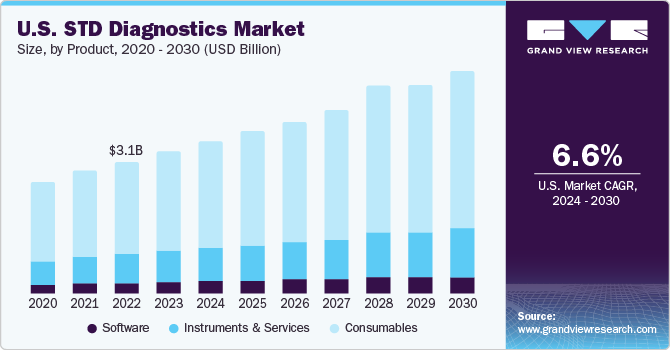

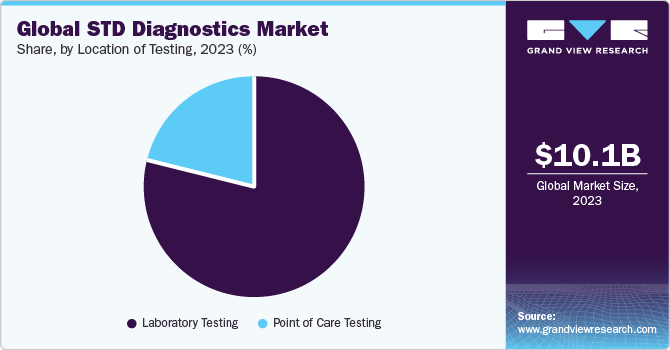

The global STD diagnostics market size was estimated at USD 10.06 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.18% from 2024 to 2030. The market for Sexually Transmitted Disease (STD) diagnostics is primarily influenced by advancements in diagnostic technology and increased government efforts to promote early detection and treatment. The growing burden of STDs serves as a key driver for the industry. Additionally, the growth can also be attributed to rapid technological advancements, and high R&D investments by key players to introduce novel & innovative products such as genetic biomarkers for antibiotic-resistant strains of bacteria, multiplex Point-of-Care (PoC), & self-testing products in the market.

Technological advancements related to accuracy, portability, and cost-effectiveness are expected to drive the Sexually Transmitted Disease (STD) diagnostics market over the forecast period. Key players are expanding their test portfolios, by investing in R&D to develop diagnostic kits that can identify emerging diseases or by entering into agreements with other kit manufacturing companies. For instance, in June 2023, Linear Diagnostics, a UK-based company, a spinout from the University of Birmingham, secured funding to create a STI rapid test. The company received support from the National Institute for Health and Care Research (NIHR) in the UK. The funding aims to facilitate the development of a 20-minute test for diagnosing gonorrhoea and Chlamydia, addressing the need for faster and more accessible STI diagnostics.

In the ever-evolving landscape of STD diagnostics, key trends point towards integrating advanced technologies, contributing significantly to the industry's growth. The introduction of sophisticated tools, such as multiplex PCR products and next-generation HIV testing kits, stands out as a pivotal development. Companies such as Seegene, with products like Anyplex, Allplex, and Seeplex, have been crucial in expanding diagnostic capabilities. For instance, the Allplex STI/BV Panel Assay can distinguish among 28 different causative agents in a single test, showcasing the substantial progress made in diagnostic precision. This technological advancement not only broadens the spectrum of detectable sexually transmitted infections but also facilitates more accurate and targeted treatments.

Better reimbursement facilities overcome the high pricing issue to some extent in developed regions such as the U.S. and Europe. According to the World Health Organization (WHO), about 50% of healthcare financing in low-income countries comes from out-of-pocket payments, compared to ~14% in high-income countries and ~30% in middle-income countries. When payments from public health insurance, general government expenditure, and prepaid private insurance are combined, approximately 38% of healthcare financing in low-income countries is combined in funding pools, which allow the risks of healthcare costs to be shared across population groups, as compared to 80% in high-income countries and approximately 60% in middle-income countries.

Market Dynamics

The emphasis on diversified diagnostic capabilities is a clear reflection of the industry's commitment to enhancing healthcare outcomes and addressing the complexities associated with the diagnosis of STIs. As these advancements become more widely adopted, the STD diagnostics market is poised for further growth, driven by a commitment to effective and comprehensive diagnostic solutions.

Governments of developed economies are undertaking initiatives to promote early diagnosis of STDs. The Sexually Transmitted Infections National Strategic Plan is a groundbreaking, first-of-its-kind five-year plan aimed at reversing the recent rapid growth in STIs in the U.S. The STI Plan establishes a vision as well as objectives, goals, and methods for dealing with STI crisis. Indicators with measurable targets are also included to track progress. The STI Plan focuses on gonorrhea, chlamydia, syphilis, and HPV, which have the highest morbidity rates, the most persistent & pervasive STI inequities, and the biggest impact on the health of the people, according to the U.S. national data. This national plan focuses on increasing awareness about STIs and expanding high-quality affordable screening, diagnosis, and treatment of these STIs.

However, the number of government initiatives is increasing for containing the STD epidemic in various regions. These initiatives include regular vaccination coverage for hepatitis A, hepatitis B, human papillomavirus, and herpes zoster virus, among others. According to the CDC's January 2023 data, the HPV vaccine can aid in the prevention of 32,100 cases of cancer every year. In the U.S., vaccination coverage for herpes zoster among adults aged 50 & above and adults aged 60 & above was 24.1% and 34.5%, respectively.Similarly, the vaccination coverage of HBV was around 67% in 2018, which is below the Healthy People 2020 target of 90%, but still acts as a restraining factor for market growth. HPV vaccination increased from 2.1% in 2011 to 26.3% in 2018 among men and 20.7% in 2010 to 52.8% in 2018 among women aged 19-26.

Product Insights

The consumables segment dominated the market in 2023 with a revenue share of 69.9% and is anticipated to grow at the fastest CAGR over the forecast period owing to increased demand for consumables coupled with the introduction of innovative solutions. Increase in product approvals for addressing high demand for diagnosis of STDs may contribute to the growth of respective consumables in the market. For instance, in May 2022, Abbott’s Alinity m STI Assay received FDA clearance. It is a multiplex test that can detect and differentiate four common STDs simultaneously—Neisseria gonorrhoeae (NG), Chlamydia trachomatis (CT), Mycoplasma genitalium (MG), and Trichomonas vaginalis (TV). In addition, companies such as Ortho-Clinical Diagnostics, Inc. recently received approval for VITROS Immunodiagnostic HIV Combo Reagent Pack.

Furthermore, in the realm of STD diagnostics, the market is witnessing notable trends that may shape its trajectory. One significant factor driving this evolution is the increasing product approvals, a response to the escalating demand for effective STD diagnosis. For instance, Abbott's Alinity m STI Assay, which secured FDA clearance in May 2022. This multiplex test stands out by its capability to concurrently detect and differentiate four prevalent STDs—Chlamydia trachomatis (CT), Neisseria gonorrhoeae (NG), Mycoplasma genitalium (MG), and Trichomonas vaginalis (TV). This development not only reflects a commitment to addressing the pressing need for improved diagnostic tools but also signals potential growth in the consumption of related consumables. As diagnostic technologies advance and gain regulatory approval, the market is poised for expansion, driven by a shared goal of enhancing the efficiency and accuracy of STD diagnosis.

Application Insights

The HIV segment dominated the market with a share of 32.0% in 2023, owing to high testing rate, increased product approvals, such as fourth-generation HIV tests & self-testing kits, and significant R&D initiatives relevant to novel products. The CDC in March 2023 announced the launch of a project, Together TakeMeHome (TTMH), to distribute up to 1 million HIV self-tests over 5 years. These tests can be ordered by people aged 17 years and older in the U.S. including Puerto Rico via an online portal. The test is developed by CDC in partnership with Building Healthy Online Communities (BHOC), OraSure Technologies, Emory University, Signal Group, and NASTAD.

The HPV testing segment is expected to grow at a significant CAGR during the forecast period. Traditionally, the Pap smear has been the primary screening method for cervical cancer. However, there has been a shift towards HPV testing as a more sensitive and reliable method for detecting high-risk HPV strains that are associated with the development of cervical cancer. New product launches specifically by reputed organizations such as UNICEF play an important role in creating awareness for cervical cancer. In January 2023, UNICEF launched a new cervical cancer toolkit, a comprehensive tool including an HPV DNA-based diagnostic tool, a preventive HPV vaccine, and a treatment pool. The launch of this kit will benefit the most for women in lower-income countries.

Technology Insights

The immunoassay segment dominated the market in 2023 with a revenue share of 44.6% owing to higher testing rates for Sexually Transmitted Disease (STD) diagnostics. Moreover, the approval of new immunoassay products for the diagnosis of sexually transmitted diseases may impel market growth. For instance, in August 2020, DiaSorin, Inc. received 510 (k) approval from the U.S. FDA for introducing LIAISON XL MUREX anti-HBe, which is used for the diagnosis of HBV infection.

The molecular diagnostics segment is expected to exhibit the fastest growth rate of over the forecast period. An increase in use of high-throughput PCR technology to detect Sexually Transmitted Diseases (STDs) is expected to drive the NAAT segment. Advantages such as cost-effectiveness and user-friendliness of this technology and the accuracy offered are estimated to increase the adoption of this technology. Most of the urine tests for STDs are performed using NAATs owing to their high sensitivity. In June 2021, Bio-Rad Laboratories, Inc. entered into a partnership with Seegene, Inc. for the development and commercialization of multiplex PCR-based products for the diagnosis of infectious diseases. Such strategic initiatives may enable market players to introduce innovative products in the STD diagnostics industry.

Location of Testing Insights

The laboratory testing segment dominated the market with a share of 78.5% in 2023driven by high market penetration rate and procedure volumes. Presence of extensive ancillary support with respect to manpower and infrastructure is also a key driver. Many healthcare institutions are working with laboratories to integrate different tests. Public health laboratories serve an important role in performing high-quality testing for STDs and associated antimicrobial resistance. According to a Public Health England report, the total number of STI tests conducted at Sexual Health Services (SHS) and community-based settings for diagnosing chlamydia, gonorrhea, first episode genital warts, and first episode genital herpes were found to be 161.67, 57.08, 27.47, and 20.53 (in thousands), respectively, in 2020.

The point-of-care testing segment is estimated to witness the fastest growth over the forecast period. There is an increasing interest in development of such products owing to shorter turnaround time that enables healthcare providers to make treatment decisions promptly at clinicians’ offices. Therefore, various companies are designing assays & molecular diagnostic platforms for POC or near-patient testing. For instance, digene HC2 CT-GC Dual ID DNA Test, digene HC2 GC-ID DNA Test for the diagnosis of Neisseria gonorrhoeae and Chlamydia trachomatis by QIAGEN and ResistancePlus MG FleXible for diagnosing Mycoplasma genitalium with macrolide-resistance detection by Danaher Corporation (Cepheid) are among such products.

Regional Insights

North America held a market share of 37.1% in 2023 and is expected to maintain its dominance over the forecast period. This dominance can be attributed to the high testing rates, technological advancements, proactive government measures, improvements in healthcare infrastructure, and the presence of major players. Reimbursement policies and favorable government initiatives are likely to drive market growth. The New Technology Add-on Payment (NTAP) program has been introduced by the CMS to reduce financial losses for hospitals. An increase in the number of partnerships between in-vitro diagnostic companies and non-profit organizations for spreading awareness about STDs is creating lucrative growth opportunities in the STD diagnostics industry.

Asia Pacific is estimated to witness the fastest growth rate over the forecast period. The high growth rate can be attributed to the rising disease burden of STIs and increasing testing rates. In the report released by The Institute for New Era Strategy in August 2023, it was noted that in 2020, approximately 641,000 individuals in Japan were diagnosed with HCV. Among them, over 530,000 were under the age of 80, and 157,000 were under the age of 60. These findings emphasize the significance of addressing the situation in the STD diagnostic market to ensure effective healthcare responses.

Key Companies & Market Share Insights

Key players are focusing on gaining market approvals for innovative products for the diagnosis of various STDs, regional & product expansions, and collaborations to maintain their share in the market.

-

In February 2023, Mylab introduced a series of rapid tests designed for the STD diagnostic. These tests are simple to use, can be stored at room temperature, and are suitable for use at point-of-care facilities in places with limited resources. Moreover, they find utility in blood banks for efficiently identifying transfusion-transmissible infections (TTIs) among blood donors, contributing to the reduction of transmission.

-

In January 2023, Molbio Diagnostics launched the Truenat HSV 1/2 test for herpes simplex virus. With the ability to provide results within an hour, this product significantly boosts the company's STD diagnostic portfolio.

Key STD Diagnostics Companies:

- BD

- F. Hoffmann-La Roche Ltd

- Hologic Inc.

- Abbott

- Cepheid (Danaher)

- Qiagen

- OraSure Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Thermo Fisher Scientific, Inc.

- Seegene Inc.

- DiaSorin S.p.A

STD Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.79 billion

Revenue forecast in 2030

USD 16.36 billion

Growth rate

CAGR of 7.18% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, technology, application, location of testing, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway;China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina;South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BD; F. Hoffmann-La Roche Ltd.; Hologic, Inc.; bioMérieux SA; Abbott; Cepheid (Danaher Corporation); Qiagen; Seegene Inc; Thermo Fisher Scientific Inc.; DiaSorin S.p.A; OraSure Technologies Inc.; Bio-Rad Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global STD Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global STD diagnostics market report based on product, technology, application, location of testing, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments and Services

-

Consumables

-

Software

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

CT/NG testing

-

Syphilis testing

-

PCR testing

-

Non-PCR testing

-

Gonorrhea testing

-

HSV testing

-

PCR testing

-

Non-PCR testing

-

HPV testing

-

HIV testing

-

Ureaplasma & Mycoplasma testing

-

Trichomonas

-

VZV testing

-

PCR testing

-

Non-PCR testing

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassay

-

Molecular Diagnostics

-

Other

-

-

Location of Testing Outlook (Revenue, USD Million, 2018 - 2030)

-

Laboratory Testing

-

Commercial/Private labs

-

Public Health Labs

-

-

Point of Care Testing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Argentina

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global STD diagnostics market size was estimated at USD 10.06 billion in 2023 and is expected to reach USD 10.79 million in 2024.

b. The global STD diagnostics market is expected to witness a compound annual growth rate of 7.18% from 2024 to 2030 to reach USD 16.36 million in 2030.

b. Based on product, the consumables segment held the largest share of 69.92% in 2023, owing to the increased demand for consumables, increasing product approvals, and the introduction of innovative solutions.

b. Some key players operating in the STD diagnostics market BD; F. Hoffmann-La Roche Ltd.; Hologic, Inc.; bioMérieux SA; Abbott; Danaher Corporation; Qiagen; Seegene Inc; Thermo Fisher Scientific Inc.; DiaSorin S.p.A.; and others.

b. Key factors driving the STD diagnostics market growth include rising incidence of STDs, growing government policies to promote early diagnostics, increasing patient awareness, and technological advancement in STD diagnostics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."