- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Digestive Enzyme Supplements Market Size Report, 2030GVR Report cover

![Digestive Enzyme Supplements Market Size, Share & Trends Report]()

Digestive Enzyme Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Origin, By Application (Additional Supplements, Medical & Infant Nutrition, Sports Nutrition), By Nature, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-758-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digestive Enzyme Supplements Market Summary

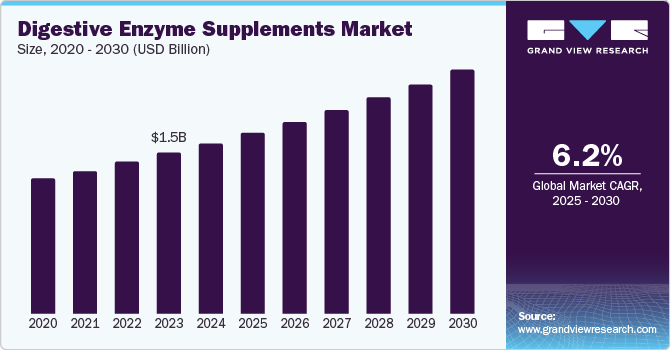

The global digestive enzyme supplements market size was valued at USD 1.48 billion in 2024 and is projected to reach USD 2.12 billion by 2030, growing at a CAGR of 6.2% from 2025 to 2030. The growth of this market is primarily influenced by factors such as growing health consciousness among consumers, the large presence of an aging population, changes in dietary preferences, and increased awareness regarding the role of gut health in overall well-being.

Key Market Trends & Insights

- North America dominated the global digestive enzyme supplements industry in 2024.

- The U.S. held the largest revenue share of the regional industry for digestive enzyme supplements in 2024.

- Based on origin, the animal-based digestive enzyme supplements segment will dominate the global industry in 2024.

- Based on application, the additional supplements segment dominated the global digestive enzyme supplements industry in 2024.

- Based on nature, the conventional nature segment held a significant revenue share of the global digestive enzyme supplements industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.48 Billion

- 2030 Projected Market Size: USD 2.12 Billion

- CAGR (2025-2030): 6.2%

- North America: Largest Market in 2024

- Asia Pacific: Fastest growing market

Digestive enzyme supplements are widely used to treat gastrointestinal health problems and other disorders impacted by digestive deficiencies. Customers have preferred some of the digestive enzyme supplements key market participants offer to improve treatments associated with dietary ailments such as lactose intolerance, exocrine pancreatic insufficiency, and cystic fibrosis.

A series of significant advancements in therapeutics also contribute to this market's growth. Novel formulations associated with plant-based enzymes are considered noteworthy developments for the future of the global digestive enzyme supplements industry. Growing emphasis on research and development and increasing investments by businesses and governments are also expected to add growth opportunities for this market during the forecast period.

Origin Insights

The animal-based digestive enzyme supplements segment will dominate the global industry in 2024. Unhealthy lifestyles, awareness regarding gut health and overall well-being, and increasing healthcare spending are adding to the growth of this segment. Animal-based products are largely preferred when treating critical disorders such as pancreatic cancer and pancreatitis. These products are characterized by animal-based enzymes, naturally occurring proteins that have been part of the human diet for a long time.

The plant-based digestive enzyme supplements segment is expected to experience moderate growth over the forecast period. Growth in this segment is mainly driven by factors such as increasing awareness regarding cruelty-free sourcing processes and bans imposed by multiple governments on animal killings to develop consumer products. Growing demand for natural and organic products and trends such as veganism are adding to the growth of this segment.

Application Insights

The additional supplements segment dominated the global digestive enzyme supplements industry in 2024. This is attributed to factors such as changing lifestyles, growing health consciousness among consumers, increasing demand from urban consumers, and more. An increasing number of adults focusing on aspects such as weight management and other well-being requirements is adding to the growth of this segment.

The sports nutrition applications segment is anticipated to experience growth during the forecast period. Benefits provided by digestive enzyme supplements, such as enhanced nutrient absorption, improved muscle strength, faster post-workout recoveries, and more, are primarily driving the growing adoption. Specific enzymes such as protease, amylase, lipase, lactase, and others are extensively used in formulations.

Nature Insights

The conventional nature segment held a significant revenue share of the global digestive enzyme supplements industry in 2024. Users prefer conventional products characterized by animal-based enzymes and tested formulations during treatment. The existing customer base, ease of availability and accessibility, and growing utilization of sports nutrition are adding to the growth opportunities for this segment.

The organic nature segment is anticipated to experience substantial growth during the forecast period. This is attributed to the increasing demand for organic and naturally sourced products, growing inclination towards trends such as veganism, and rising bans on animal killings in various regional markets. Government encouragement and responses from customers who are highly aware of products' sustainability and environmental impact are projected to generate greater demand for this segment over the next few years.

Regional Insights

North America dominated the global digestive enzyme supplements industry in 2024. This market is primarily driven by increasing demand from health-conscious urban consumers, growing utilization in the medical treatment associated with dietary ailments, and rising use in sports nutrition. The presence of multiple manufacturers in the region also contributes to the growth. Effective distribution strategies implemented by the key market participants and ease of accessibility through online portals are anticipated to fuel growth during the forecast period.

U.S. Digestive Enzyme Supplements Market Trends

The U.S. held the largest revenue share of the regional industry for digestive enzyme supplements in 2024. Trends related to consumer health products, increasing inclination among working professionals and other individuals towards managing improved physical strength, and ease of availability are some of the key growth driving factors for this market. Increased research and development activities initiated by businesses and government agencies working in the healthcare domain are adding to the growth experienced by this market.

Europe Digestive Enzyme Supplements Market Trends

Europe was identified as one of the key global digestive enzyme supplements industry regions in 2024. Health and fitness trends in the region, growing awareness regarding the role of enzyme supplements in enhanced well-being, ease of accessibility driven by effective offline distribution, and increased digital footprint of the companies are some of the growing driving factors for this market.

The UK digestive enzyme supplements market held a significant revenue share of the regional industry in 2024. This market is mainly driven by factors such as increasing consciousness among urban consumers regarding the role of gut health in overall well-being and the rising availability of plant-based and microbial-source-based products in the market.

Asia Pacific Digestive Enzyme Supplements Market Trends

The Asia Pacific digestive enzyme supplements industry is projected to experience the fastest growth over the forecast period. This is attributed to factors such as increased spending on consumer healthcare products in the region and the presence of highly populated countries such as China and India. Increasing awareness among consumers, recommendations by healthcare practitioners, and significant growth in the availability of products manufactured by global brands are adding to the growth.

China held the largest revenue share of the regional market in 2024. This market is primarily driven by factors such as enhanced focus of global brands on the Asia Pacific market, increasing consciousness regarding gut health, and ease of availability. Growing research and development activities in the healthcare and chemical industries in the domestic market are expected to generate more growth opportunities for this market.

Key Digestive Enzyme Supplements Company Insights

Some of the key companies in the global digestive enzyme supplements market are Enzymes, Inc.; Amano Enzyme Inc.; Enzymedica; Klaire Laboratories; National Enzyme Company; Advanced Enzyme Technologies; Metagenics; and others. To address growing demand and competition, key market participants have embraced innovative strategies, increased focus on research and development, collaborations, and improved distribution.

-

Enzymes, Inc., a company specializing in enzyme nutrition, offers a diverse portfolio of innovation-based products such as Genuine N•Zimes, Ness, PreEnzol, Vert•Zimes, Wellzymes, Apple PrePectin, PHysioProtease, ProteaseCW, ProteaseGL, and others. The company shares detailed information regarding formulations to improve customer experience, enhance collaborations with health practitioners, innovate, etc., to strengthen its positioning.

-

Metagenics offers a product portfolio characterized by offerings related to multiple domains, including cardiometabolic health, gastrointestinal health, immune health, general wellness, children’s health, neurological health, stress management, muscle, bone, and joint health, sports nutrition, weight management, and others. Its offerings feature enzymes, medical foods, ketogenic products, multivitamins, omega-3, probiotics, and more.

Key Digestive Enzyme Supplements Companies:

The following are the leading companies in the digestive enzyme supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Enzymes, Inc.

- Amano Enzyme Inc.

- Enzymedica

- Klaire Laboratories

- National Enzyme Company

- Advanced Enzyme Technologies

- Metagenics

- Danone

- Vox Nutrition

- Integrative Therapeutics

- Klaire Laboratories

Recent Developments

-

In March 2024, Pure Encapsulations, one of the industry participants in vitamins, minerals, and supplements products, announced the launch of its products in Super Supplements stores and The Vitamin Shoppe. The step was driven by its commitment to enhance the availability of products through the physical marketplace. This includes the availability of products such as O.N.E. Multivitamin, Digestive Enzyme Ultra, Berberine UltraSorb, and others.

Digestive Enzyme Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.57 billion

Revenue forecast in 2030

USD 2.12 billion

Growth Rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Origin, application, nature, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, India, Japan, Australia, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Enzymes, Inc.; Amano Enzyme Inc.; Enzymedica; Klaire Laboratories; National Enzyme Company; Advanced Enzyme Technologies; Metagenics; Danone; Integrative Therapeutics; Vox Nutrition; Klaire Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digestive Enzyme Supplements Market Report Segmentation

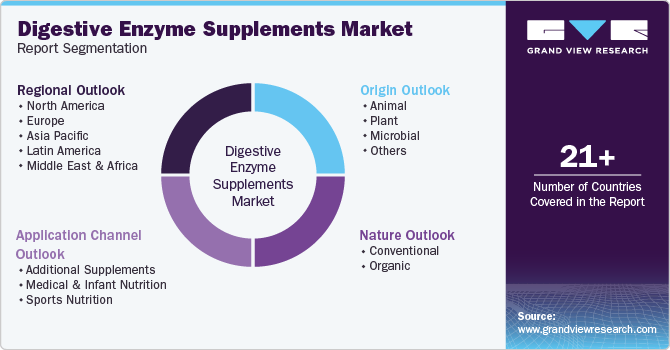

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global digestive enzyme supplements industry report based on origin, application, nature, and region.

-

Origin Outlook (Revenue, USD Billion, 2018 - 2030)

-

Animal

-

Plant

-

Microbial

-

Others

-

-

Application Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Additional Supplements

-

Medical & Infant Nutrition

-

Sports Nutrition

-

-

Nature Outlook (Revenue, USD Billion, 2018 - 2030)

-

Conventional

-

Organic

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.