- Home

- »

- Automotive & Transportation

- »

-

Digital Freight Brokerage Market Size, Industry Report, 2030GVR Report cover

![Digital Freight Brokerage Market Size, Share & Trends Report]()

Digital Freight Brokerage Market (2025 - 2030) Size, Share & Trends Analysis Report By Transportation Mode (Road Freight, Rail Freight), By Service Type, By Customer Type, By End-user Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-540-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Freight Brokerage Market Summary

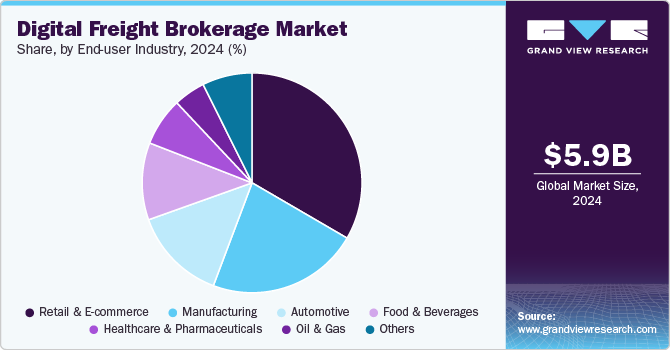

The global digital freight brokerage market size was estimated at USD 5.87 billion in 2024 and is projected to reach USD 24.36 billion by 2030, growing at a CAGR of 27.3% from 2025 to 2030. Today, traditional freight brokerage faces several challenges, such as a lack of real-time tracking, unpredictable pricing fluctuations, inefficiencies due to manual processes, and capacity constraints.

Key Market Trends & Insights

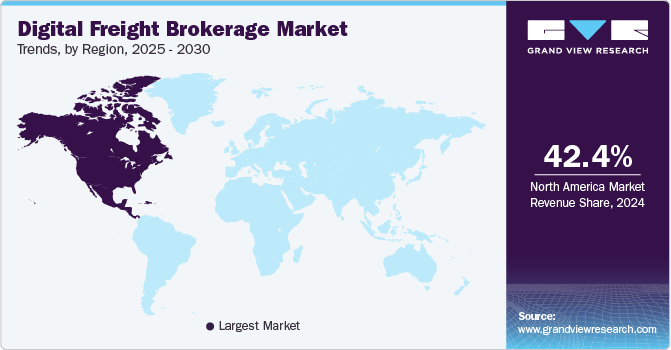

- North America dominated the digital freight brokerage market with the largest market revenue share of 42.4% in 2024.

- Based on transportation mode, the road freight segment led the market with the largest revenue share of 74.7% in 2024.

- Based on service type, the full-truckload (FTL) brokerage segment accounted for the market with the largest revenue share in 2024.

- Based on customer type, the business-to-business (B2B) segment accounted for the largest market share in 2024.

- Based on end user industry, the retail & e-commerce segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.87 Billion

- 2030 Projected Market Size: USD 24.36 Billion

- CAGR (2025-2030): 27.3%

- North America: Largest market in 2024

To overcome such challenges, companies are focusing on digital freight brokerage solutions by leveraging automation, AI, and real-time data analytics. Digital freight brokerage is a freight brokerage model that uses technology, often online platforms or apps, to connect shippers with carriers, automating processes such as tendering, booking, and shipment execution, and aiming for more efficient and real-time freight matching. This modern approach is widely used across industries such as retail, manufacturing, and e-commerce, where fast and efficient logistics are crucial.

Growth in cross-border & intermodal freight transport is a key driver of the digital freight brokerage industry. As global trade expands, businesses face challenges such as customs delays, inefficient coordination between transport modes, and high costs associated with cross-border freight. Digital freight brokerage platforms offer real-time tracking, automated customs documentation, and AI-powered route optimization, enabling seamless transitions between different modes of transport. Major companies are increasingly focusing on expanding intermodal and cross-border capabilities to enhance supply chain resilience. For instance, in November 2024, Schneider National, Inc. (U.S.) launched a new intermodal service between the Southeast U.S. and Mexico in collaboration with CSX (U.S.) and CPKC (Canada). This service eliminates border delays common in trucking, ensuring faster, more secure freight movement, which aligns with the benefits provided by digital freight brokerage solutions.

The rise of e-commerce and on-demand deliveries is a significant driver of the digital freight brokerage industry. The rapid growth of e-commerce is driving demand for faster, more flexible, and cost-effective shipping solutions. Digital freight brokerage platforms enable instant carrier sourcing, reduce transit times, and improve delivery efficiency. According to The Census Bureau of the Department of Commerce, total e-commerce sales for 2024 were estimated at USD 1,192.6 billion, reflecting an 8.1% increase from 2023, while total retail sales grew by only 2.8%. This rapid e-commerce expansion has heightened the increasing reliance on advanced freight solutions to handle growing shipment volumes efficiently.

Regulatory complexities and trade policies are essential for security and trade standardization. However, it creates operational hurdles for freight companies, requiring them to invest in compliance management and digital solutions to streamline processes and minimize disruptions. Compliance with different countries’ transportation laws, customs regulations, and environmental mandates can lead to delays, fines, and increased operational costs. For instance, United States-Mexico-Canada Agreement (USMCA) regulations impose stricter labor laws, regional content requirements, and customs enforcement, directly affecting cross-border freight operations. In addition, The FMCSA (Federal Motor Carrier Safety Administration) mandates the use of Electronic Logging Devices (ELDs), which limits driving hours, requiring carriers to adhere to strict compliance measures, which increases operational costs and reduces driver flexibility.

Fluctuations in freight demand and excess carrier capacity present significant challenges for logistics and transportation companies. When demand is low, there are more available trucks than shipments, leading to intense competition among carriers and driving freight rates down. This reduces profitability and forces some carriers to operate at a loss or exit the market entirely. Conversely, when demand spikes, there may not be enough carrier capacity to meet shipping needs, causing delays and higher transportation costs for shippers. This volatility disrupts market stability and affects platform reliability, as inconsistent pricing and availability can deter both shippers and carriers. In addition, digital freight platforms rely on large volumes of transactions for profitability, and unpredictable demand cycles can make revenue growth inconsistent.

Transportation Mode Insights

Based on transportation mode, the road freight segment led the market with the largest revenue share of 74.7% in 2024. Road freight refers to the transportation of goods via trucks and other vehicles on highways and road networks. Road freight is used for short- and long-haul shipments, last-mile deliveries, and cross-border trade. The segment growth is mainly attributed to the rise of e-commerce, growing cross-border trade, and technological advancements in digital freight platforms for optimizing route efficiency. Major players in the market, including Schneider National, Inc. and J.B. Hunt Transport Services, Inc., are expanding intermodal and dedicated trucking services to enhance efficiency. Also, digital freight brokerages such as Uber Freight (a subsidiary of Uber Technologies, Inc.) are leveraging AI-driven load matching to maximize truck utilization and reduce empty miles.

The air freight segment is expected to grow at a significant CAGR during the forecast period. Air freight brokerage involves connecting shippers with airlines or freight forwarders to facilitate the movement of goods by air, offering services such as negotiating rates, handling paperwork, and ensuring compliance with regulations. The expansion of cross-border e-commerce,increasing global trade, rising demand for time-sensitive shipments, such as pharmaceuticals, perishables, and high-value goods, and increasing technological advancements in cargo tracking, fuel efficiency, and automated handling systems are expected to support the segment's growth.

Service Type Insights

Based on service type, the full-truckload (FTL) brokerage segment accounted for the market with the largest revenue share in 2024. FTL shipping means a single shipment occupies the entire capacity of a truck or trailer. FTL freight brokerage involves connecting shippers with carriers to transport goods that fill an entire truck, offering direct delivery and potentially faster transit times compared to less-than-truckload (LTL) shipping. It is widely used in industries requiring bulk transportation, including retail & e-commerce, automotive, and manufacturing. The segment growth is mainly driven by increasing demand for faster delivery, increased adoption of digital freight platforms, and growth in long-haul shipments. Major companies including C.H. Robinson Worldwide, Inc. and Total Quality Logistics, LLC are investing in AI-powered freight matching, while other players are focusing on enhancing their dedicated FTL services to improve efficiency.

The refrigerated freight (temp-controlled) segment is expected to grow at a significant CAGR during the forecast period. The increasing demand for perishable goods, including fresh produce, dairy, meat, poultry, and seafood and rise in pharmaceutical shipments, especially temperature-sensitive vaccines and biologics is expected to support the segment growth. Stringent government regulations regarding food and drug safety further push the adoption of reliable refrigerated transportation.

Customer Type Insights

Based on customer type, the business-to-business (B2B) segment accounted for the largest market share in 2024. B2B freight refers to the transportation of goods and products between businesses, wholesalers, manufacturers, and distributors. It mainly focused on large-scale, high-volume shipments. For instance, shipments of raw materials to factories, finished goods to warehouses, or equipment to other businesses.It is essential in industries such as manufacturing, automotive, and industrial goods. B2B shipping can be more complex due to factors including specialized handling, compliance with international regulations, and specific delivery windows. The segment is driven by globalization, supply chain digitalization, and the need for efficient logistics networks.

The business-to-consumer (B2C) segment is expected to grow at a significant CAGR during the forecast period. The rapid expansion of e-commerce platforms, fueled by digitalization and changing consumer shopping preferences,increased smartphone penetration and digital payment solutions, advancements in last-mile delivery is expected to support the segment growth. Also, the growing demand for personalized shopping experiences, coupled with convenient return policies, further strengthens the growth of the B2C logistics segment.

End-user Industry Insights

Based on end user industry, the retail & e-commerce segment accounted for the largest market share in 2024. The surge in online retail and e-commerce has created a high demand for efficient and flexible logistics solutions, making digital freight brokerage a valuable tool for these industries. The retail & e-commerce segment includes freight services that support online and brick-and-mortar retail supply chains. The segment growth is driven by increasing online shopping trends, rapid last-mile delivery demand, and increasing warehouse automation. Companies such as Uber Freight (a subsidiary of Uber Technologies, Inc.) are enhancing logistics networks with predictive analytics and AI-based routing, while traditional players like Schneider National, Inc. are investing in intermodal solutions to meet evolving retail logistics needs.

The healthcare & pharmaceuticals segment is expected to grow at a significant CAGR during the forecast period. The increasing government strict regulatory compliance for the transportation of temperature-sensitive drugs and medical equipment increasing demand for biopharmaceuticals, including vaccines and biologics, is expected to support the segment growth. Also, the rising chronic diseases and aging populations are increasing the need for frequent and safe medical shipments.

Regional Insights

North America dominated the digital freight brokerage market with the largest market revenue share of 42.4% in 2024. The North America market is being driven by high e-commerce adoption, shortage of trucking capacity, advanced AI-based logistics solutions, advanced logistics infrastructure, increasing cross-border trade with Canada and Mexico, and strong digital freight penetration. The U.S. dominates the market with companies such as C.H. Robinson Worldwide, Inc. and Uber Freight (Uber Technologies, Inc.), which are leveraging AI-driven freight matching and automation. Canada is seeing growth in digital brokerage with companies, including Loadlink Technologies, focusing on enhancing freight visibility and optimizing load management.

U.S. Digital Freight Brokerage Market Trends

The digital freight brokerage market in the U.S. held a dominant position in 2024. The digital freight brokerage industry in the U.S. is witnessing significant transformation, driven by strong e-commerce expansion, supply chain digitalization, autonomous trucking innovations, regulatory changes, and a growing push for sustainability. Major players in the country are investing in AI-powered platforms to streamline freight matching and reduce operational inefficiencies. The ongoing FMCSA electronic logging device (ELD) mandates are pushing carriers to adopt real-time tracking solutions.

Asia Pacific Digital Freight Brokerage Market Trends

The digital freight brokerage market in Asia Pacific held a significant share in 2024. The digital freight brokerage industry in the Asia Pacific region is witnessing significant transformation, driven by rapid urbanization, booming e-commerce, government-backed smart logistics policies, infrastructure investments, and the rise of digital payment systems. China leads the region, with Full Truck Alliance (FTA) using AI-driven freight matching to reduce empty miles. In Japan, companies such as Yamato Transport Company, Ltd. and Sagawa Express Co., Ltd. are integrating blockchain-based tracking solutions for freight security.

The China digital freight brokerage market held a substantial market share in 2024. The China market is experiencing rapid growth, driven by government-backed smart logistics initiatives, high e-commerce penetration, AI-based logistics automation, 5G adoption, and large-scale infrastructure projects. The government’s Made in China 2025 policy is also supporting the adoption of digital freight solutions to improve supply chain efficiency.

The digital freight brokerage market in Japan held a significant share in 2024. The Japan market is influenced by aging truck driver shortages, automation in logistics, rising e-commerce, government-backed digitalization, and sustainability goals. The Japanese Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) is pushing for digital freight platforms to address workforce shortages. Companies are also focusing on hydrogen-powered trucks, with Toyota Motor Corporation partnering with logistics firms to develop low-emission freight solutions.

Europe Digital Freight Brokerage Market Trends

The digital freight brokerage market in Europe was identified as a lucrative region in 2024. The European market is witnessing significant transformation, driven by increasing government stringent environmental regulations, cross-border trade facilitation, and increasing demand for real-time freight visibility. The rise of online shopping has also fueled the need for efficient last-mile delivery, with digital freight platforms optimizing routing and cost-effectiveness. DHL Freight (Deutsche Post AG) and A.P. Møller - Mærsk A/S are investing in intermodal digital freight solutions to optimize cross-border logistics. Meanwhile, automated pricing tools and freight visibility technologies are enhancing supply chain efficiency across the region.

The German digital freight brokerage market is being shaped by its advanced logistics infrastructure, strong manufacturing exports, government-backed digitalization programs, and increasing demand for automated supply chain solutions. As the largest economy in Europe, Germany plays a critical role in freight movement across the region. Companies in the country, such as DB Schenker (Schenker AG), are focusing on enhancing their digital freight capabilities to optimize road and rail transport.

Key Digital Freight Brokerage Company Insights

Some of the key players operating in the market include C.H. Robinson Worldwide, Inc., Total Quality Logistics, LLC, RXO, Inc., WWEX Group, and Landstar System Holdings, Inc.

-

Founded in 1905, headquartered in Minnesota, U.S., C.H. Robinson is a third-party logistics (3PL) provider globally, providing brokerage and warehousing, freight transportation, and transportation management. It offers truckload, less than truckload, air freight, intermodal, and ocean transportation. The company operates a vast digital freight network that connects shippers and carriers across multiple transportation modes, including road, air, ocean, and intermodal freight.

-

Founded in 1997, headquartered in Ohio, U.S.; Total Quality Logistics, LLC (TQL) is a leading freight brokerage firm, that specializes in full-truckload (FTL), less-than-truckload (LTL), and intermodal shipping services. It operates a large carrier network and provides real-time tracking and load-matching services through its proprietary digital freight platform.

Key Digital Freight Brokerage Companies:

The following are the leading companies in the digital freight brokerage market. These companies collectively hold the largest market share and dictate industry trends.

- C.H. Robinson Worldwide, Inc.

- Total Quality Logistics, LLC

- Coyote Logistics, LLC (a subsidiary of RXO, Inc.)

- WWEX Group

- Landstar System Holdings, Inc.

- Mode Global

- Echo Global Logistics, Inc.

- Schneider National, Inc.

- Uber Freight (a subsidiary of Uber Technologies, Inc.)

- J.B. Hunt Transport Services, Inc.

Recent Developments

-

In November 2024, Uber Freight (a subsidiary of Uber Technologies, Inc.) launched a program called broker access, that allow brokers to efficiently book and implement loads on Uber Freight’s carrier platform while remaining the sole broker on the load. The program helps automate and digitize broker operations with an accessible self-serve portal.

-

In July 2024, Freight Technologies, Inc. introduced Waavely, a platform that simplifies ocean freight booking and management for companies shipping containers between North America and global ports. It features 24/7 tracking with an interactive map for real-time shipment monitoring.

-

In February 2023, Echo Global Logistics, Inc. (Echo) introduced EchoInsure+, a comprehensive cargo insurance product exclusively for its clients. Developed in partnership with Falvey, EchoInsure+ provides top-tier protection for LTL shipments, accessible through EchoShip, Echo’s online shipping platform, and Echo representatives.

Digital Freight Brokerage Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.29 billion

Revenue forecast in 2030

USD 24.36 billion

Growth rate

CAGR of 27.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Transportation mode, service type, customer type, end-user industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; Poland; China; India; Japan; Australia; South Korea; Brazil; UAE.; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

C.H. Robinson Worldwide, Inc.; Total Quality Logistics, LLC; Coyote Logistics, LLC (a subsidiary of RXO, Inc.); WWEX Group; Landstar System Holdings, Inc.; Mode Global; Echo Global Logistics, Inc.; Schneider National, Inc.; Uber Freight (a subsidiary of Uber Technologies, Inc.); J.B. Hunt Transport Services, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Freight Brokerage Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital freight brokerage market report based on transportation mode, service type, customer type, end-user industry, and region:

-

Transportation Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Road Freight

-

Rail Freight

-

Air Freight

-

Ocean Freight

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Full-truckload (FTL) Brokerage

-

Less-than-Truckload (LTL) Brokerage

-

Intermodal Brokerage

-

Expedited Freight

-

Refrigerated Freight (Temp-Controlled)

-

Cross-border Freight Brokerage

-

Other Services Type

-

-

Customer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Business-to-Business (B2B)

-

Business-to-Consumer (B2C)

-

-

End-User Industry Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail & E-commerce

-

Manufacturing

-

Automotive

-

Food & Beverages

-

Healthcare & Pharmaceuticals

-

Oil & Gas

-

Other End-user Industries

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Italy

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital freight brokerage market size was estimated at USD 5.87 billion in 2024 and is expected to reach USD 7.29 billion in 2025.

b. The global digital freight brokerage market is expected to grow at a compound annual growth rate of 27.3% from 2025 to 2030 to reach USD 24.36 billion by 2030.

b. North America dominated the digital freight brokerage market with a share of 42.4% in 2024. The digital freight brokerage market in North America is being driven by high e-commerce adoption, shortage of trucking capacity, advanced AI-based logistics solutions, advanced logistics infrastructure, increasing cross-border trade with Canada and Mexico, and strong digital freight penetration.

b. Some key players operating in the digital freight brokerage market include C.H. Robinson Worldwide, Inc., Total Quality Logistics, LLC, Coyote Logistics, LLC (a subsidiary of RXO, Inc.), WWEX Group, Landstar System Holdings, Inc., Mode Global, Echo Global Logistics, Inc., Schneider National, Inc., Uber Freight (a subsidiary of Uber Technologies, Inc.), J.B. Hunt Transport Services, Inc.

b. Key factors that are driving the market growth include increasing adoption of AI and automation in logistics and growing demand for on-demand and transparent freight solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.