- Home

- »

- Next Generation Technologies

- »

-

Digital Immune System Market Size & Share Report, 2030GVR Report cover

![Digital Immune System Market Size, Share & Trend Report]()

Digital Immune System Market (2023 - 2030) Size, Share & Trend Analysis Report By Component (Solution, Services), By Deployment (On-premises, Cloud), By Security Type, By Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-127-1

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global digital immune system market size was estimated at USD 25.30 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 12.7% from 2023 to 2030. The capability of Digital Immune System (DIS) to optimize customer experience by preventing security risks is increasing its demand among organizations. The organization that is focused on investing in DIS experiences higher-end user experience due to high application uptimes. As organizations work in various delivery modes such as public cloud, private cloud, multi-cloud, and others, it is vital to revamp security for them, which drives market growth.

DIS is a combination of technologies for software design, operation, and analytics used to mitigate business risk. A robust DIS protects services and applications from anomalies, such as the effects of security issues or software bugs, which makes applications more resilient so that they recover quickly from failures. The application failures may include security vulnerabilities, user experience problems, compatibility problems, and others. As a result, DIS produces a superior user experience and customer experience by blending technologies and practices to enhance the resilience of services, systems, and products.

The growing theft of cyberattacks worldwide is one of the major factors accentuating the market growth. According to the statistics provided by AAG, a software company, cyber-attacks increased globally by 125% through 2021, and this increased cyber-attack volume threatened individuals and businesses in 2022. As a result, businesses demanded a digital immune system that leverages machine learning, threat intelligence, leverage automation, and others to detect and mitigate cyber threats. According to the statistics provided by Cardiff University, 80% of UK businesses considered investment in cybersecurity a high priority to overcome cyberattacks.

IoT attacks have increased at a significantly faster rate in recent days. AO Kaspersky Lab, a cybersecurity company, found that in the first half of 2021, 1.5 billion attacks were witnessed against IoT devices. In addition, SonicWall Capture Labs reported an 87% increase in IoT malware in 2022 as compared to 2021. This is creating the need for DIS to secure IoT devices from external threats.

DIS has been providing significant benefits in terms of cybersecurity but has potential challenges and drawbacks associated with its implementation and use. The cost of implementing a DIS depends on several factors, including the complexity and size of an organization, the specific process and technologies used to implement it, and the level of support required. The initial cost for implementing digital immune system is significant as it involves purchasing new software and hardware, as well as includes investment in employee training and process development. However, the ongoing cost of running DIS is lower as compared to its initial cost.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic has created an extraordinary push for employees and businesses to change the way they work or communicate. Companies were forced to rapidly digitalize their business modes, adopt remote working environments, and others during the pandemic. This created opportunities for the digital immune system among businesses to efficiently prevent cyber-attacks. Thus, the increasing number of businesses that require cybersecurity services amid COVID-19 accentuated the market growth.

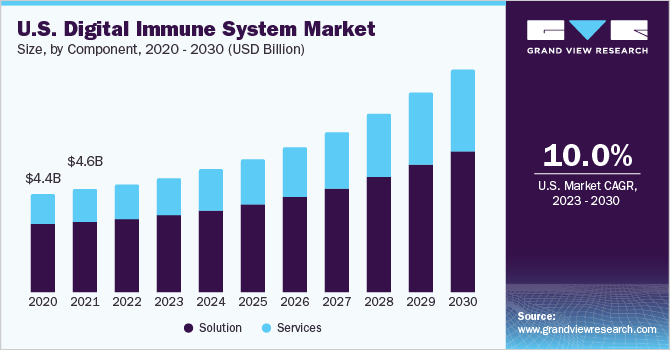

Component Insights

In terms of component, the solution segment dominated the market in 2022 with a revenue share of more than 68.0%. The adoption of digital immune system solutions can be surrounded by the improved visibility and automated capabilities that digital immune technologies provide for thwarting and identifying threats. The major factors accentuating the segment growth are the evolving cybersecurity, increasing sophistication of cyber threats, and technological advancements. As organizations invest to seek effective and proactive ways to protect their digital assets and data from these thefts, these factors contribute to the segment growth.

The services segment is anticipated to register the fastest CAGR of 14.8% over the forecast period. Services such as managed services, training, education, and others play a vital role in the seamless operations of the digital immune system. Under the training and education services, digital immune systems regarding awareness and training are offered to employees. This helps the organization to keep their employees up to date about the latest thefts and technologies.

Deployment Insights

The on-premises segment dominated the market in 2022 with a revenue share of over 61.0%. The on-premises refers to the digital immune system components that are installed within an organization's network location. These components include security appliances, firewalls, antivirus software, and others that are installed on the organization's premises. It helps the organizations to have greater control over the system, enhance compliance and security, and ability to identify potential thefts.

The cloud segment is expected to witness significant growth over the forecast period. The benefits offered by cloud-based DIS, such as scalability, cost efficiency, and rapid deployment, among others, are some of the major factors expected to drive the segment growth. Cloud-based solutions are capable of easily scaling to the growing security-related needs of organizations. The cloud-based DIS offers threat intelligence solutions that enable organizations to benefit from emerging cyber threats.

Security Type Insights

In terms of security type, the network security segment dominated the market in 2022 with a revenue share of more than 26.0%. Network security is in demand as it enables organizations to prevent unauthorized access to their network. It helps them in analyzing outgoing and incoming network traffic and suspicious activities. Evolving trends such as machine learning, endpoint detection and response, and other trends are expected to create opportunities for segment growth.

The cloud security segment is projected to witness the fastest CAGR over the forecast period. Cloud security is the essential component of DIS as organizations increasingly rely on cloud infrastructure to process, store, and access their data. Cloud security DIS combines various practices, technologies, and services to protect cloud-based data and assets from cyber threats. This security type offers continuous monitoring, identity and access management, and others to the organizations.

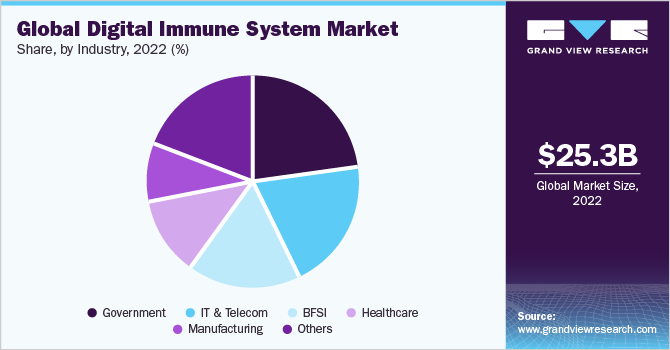

Industry Insights

In terms of industry, the government segment dominated the market in 2022 with a revenue share of more than 22.0%. The segment growth can be attributed to an increase in government investment in cybersecurity in Europe and the U.S. The main purpose of these countries to invest in DIS is national defense concerns. This is because cyberattacks not only cause infrastructure and financial inconvenience but also lead to fatalities indirectly and directly.

The healthcare segment is expected to witness steady growth over the forecast period. The healthcare industry is adopting DIS due to several factors that make it a high-priority sector for cybersecurity, such as the sensitivity of health data, the rise of cyberattacks, adoption of health IT, among others. The healthcare industry is expected to be compliant with various regulatory norms, such as HIPAA in the U.S. and General Data Protection regulation in Europe. Failure to meet these regulations can lead to severe data loss.

Regional Insights

In terms of region, North America dominated the market in 2022 with a revenue share of over 29.0%. The region's growth can attributed to the presence of a large number of players in the region. At the same time, advanced technological infrastructure in the U.S. that includes robust network connectivity drives market growth. At the same time, a high level of awareness of cybersecurity-related benefits among organizations is also one of the major factors driving the market growth in the region.

Asia Pacific is anticipated to grow at the fastest CAGR of 14.1% over the forecast period. The growing IT industry in Asia Pacific countries such as India, Australia, and other countries is creating the need for DIS in the region. In addition, as the Asia Pacific region witnesses most of the cyber-attacks, it creates the need for a DIS system. According to the statistics published by IBM, the Asia Pacific region accounted for 31% of all incidents remediated worldwide.

Key Companies & Market Share Insights

The market for digital immune systems can be characterized as an extremely fragmented market. The players operating in the market are focused on enhancing their competitive edge by improving their product offerings, geographic presence, and others. The players are also investing in advanced technologies such as AI and machine learning to improve their product capabilities. These technologies are capable of real-time and accurate threat detection.

The partnership made by players in the cybersecurity space is also expected to create new opportunities for market growth. For instance, in August 2023, AmiViz, a B2B marketplace for cybersecurity, and Darktrace, a cybersecurity company, announced the partnership. This partnership is expected to bring Darktrace’s self-learning AI technology to customers and the community of AmiViz. Some prominent players in the global digital immune system market include:

-

IBM

-

Cisco

-

Microsoft

-

Broadcom

-

HCL

-

McAfee, LLC

-

Trend Micro Incorporated

-

Palo Alto networks

-

FireEye, Inc.

-

Fortinet

Digital Immune System Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 27.50 billion

Revenue forecast in 2030

USD 63.43 billion

Growth rate

CAGR of 12.7% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, security type, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; The Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

IBM; Cisco; Microsoft; Broadcom; HCL; McAfee, LLC; Trend Micro Incorporated; Palo Alto Networks; FireEye, Inc.; Fortinet

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Immune System Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global digital immune system market report based on component, deployment, security type, industry, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Security Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Network Security

-

Cloud Security

-

Endpoint Security

-

Internet of Things (IoT) Security

-

Others

-

-

Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

IT & Telecom

-

BFSI

-

Manufacturing

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

The Kingdom Of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital immune system market size was estimated at USD 25.30 billion in 2022 and is expected to reach USD 27.50 billion in 2023.

b. The global digital immune system market is expected to grow at a compound annual growth rate of 12.7% from 2023 to 2030 to reach USD 63.43 billion by 2030.

b. North America dominated the digital immune system market with a share of 29.65% in 2022. The region's growth can attributed to the presence of a large number of players in the region.

b. Some key players operating in the digital immune system market include IBM; Cisco; Microsoft; Broadcom; HCL; McAfee, LLC; Trend Micro Incorporated; palo alto networks; FireEye, Inc.; Fortinet.

b. Key factors that are driving the market growth include a rise in concern about cyberattacks and growing IoT and Bring Your Device (BYOD) trends.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.