- Home

- »

- Next Generation Technologies

- »

-

Digital Lending Platform Market Size, Industry Report, 2030GVR Report cover

![Digital Lending Platform Market Size, Share & Trends Report]()

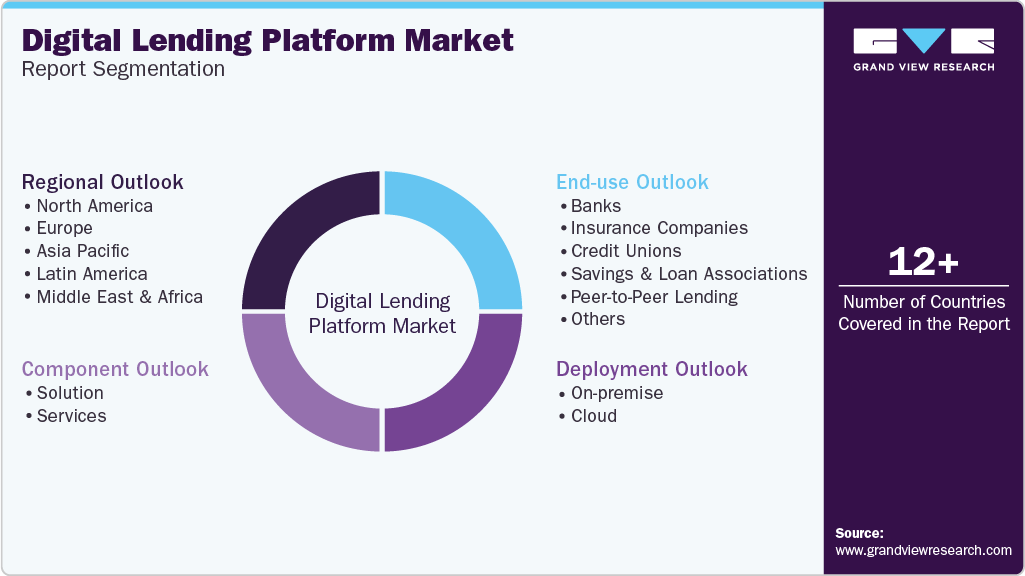

Digital Lending Platform Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (On-premise, Cloud), By End Use (Banks, Insurance Companies, Credit Unions) By Region, And Segment Forecasts

- Report ID: GVR-4-68038-066-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Lending Platform Market Summary

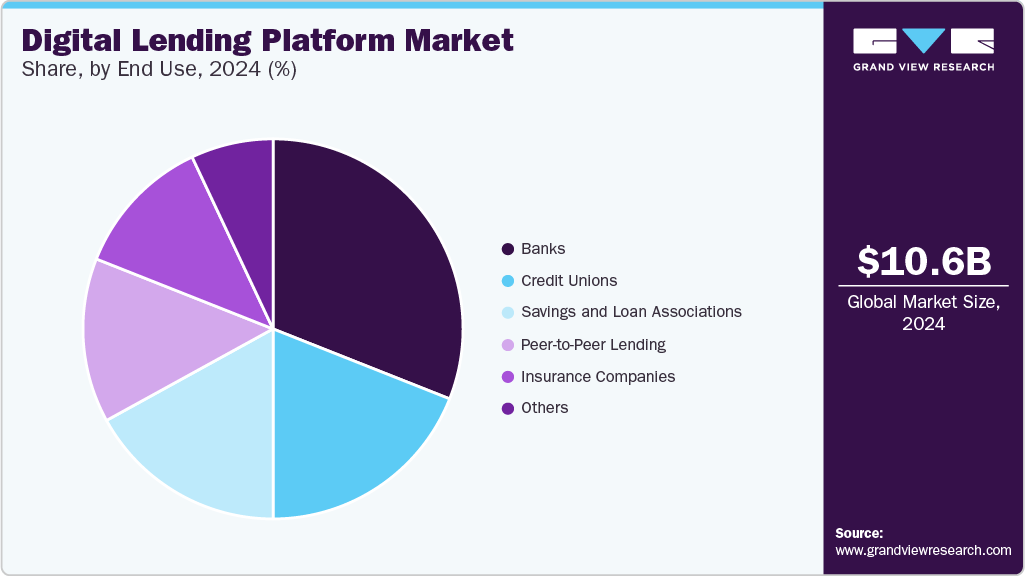

The global digital lending platform market size was estimated at USD 10.55 billion in 2024 and is projected to reach USD 44.49 billion by 2030, growing at a CAGR of 27.7% from 2025 to 2030. The benefits offered by the digital lending platforms, such as enhanced loan optimized loan process, quicker decision making, compliance with regulations and rules, and improved business efficiency, are expected to drive market growth.

Key Market Trends & Insights

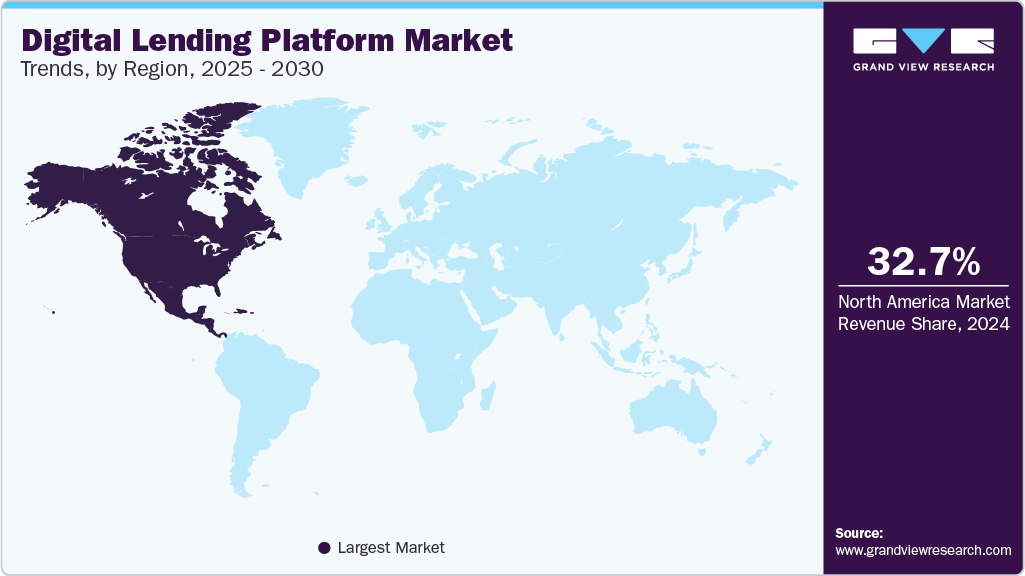

- North America segment led the market and accounted for 32.7% share of the global revenue in 2024.

- Asia Pacific is anticipated to witness the fastest growth rate of 29.2% over the forecast period.

- By component, the solution segment led the market and accounted of 74.6% share of the global revenue in 2024.

- By deployment, the on-premise led the market and accounted for 68.0% share of the global revenue in 2024.

- By end use, the banks segment led the market and accounted for more than 29% share of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.55 Billion

- 2030 Projected Market Size: USD 44.49 Billion

- CAGR (2025-2030): 27.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Traditional lending platforms relied on human interventions and physical interactions at every step, which increased the processing time as well as the chances of errors caused by humans. However, the digital lending platforms enable the banks to automate their entire loan process and thereby enhance customer experience.

The growing importance of open banking worldwide is creating new opportunities for market growth. Open banking enables the lenders to efficiently consolidate the borrowers' data such as previous loans, current outstanding debts, and credit scoring, among others. This helps the lenders to speed up their decision process and offer customized loan solutions based on client needs. Therefore, various financial service providers are entering into a partnership with open banking providers to improve their lending process. According to the survey conducted by Credit Kudos from October to November 2021, out of the surveyed lenders, 87% of them plan to use open banking technology by 2023 in the UK.

Digital lenders across the world are making efforts to secure banking licenses in order to lower funding and origination costs. For instance, Zopa a UK-based digital lending company secured a banking license in June 2020. In addition, in January 2022, SoFi Technologies, an online lender, received approval from U.S. regulators to become a bank holding company. Thus, the growing number of digital lenders with banking licenses is creating new opportunities for the market.

The capabilities of blockchain technology to efficiently transfer documents with high integrity are expected to increase its importance among the digital lending providers. The participants involved in the lending process, such as regulators and auditors, can easily verify identities and track transactions through blockchain technology. For instance, in March 2022, Figure Lending LLC and Apollo completed a transaction involving the transfer of ownership and digital mortgage loans through blockchain technology. This secured and streamlined mortgage loan registry is expected to bring greater transparency and efficiency to the mortgage industry.

The increasing use of digital lending platforms involves the transfer of sensitive and personal financial data over the internet. This transfer of information has raised concerns regarding data security across businesses using digital lending. At the same time, digital lending providers are also expected to be in compliance with data protection laws framed by regulatory bodies in order to protect customer data from data breaches. The digital lending solution providers in Europe are expected to follow the European General Data Protection Regulation (GDPR) guideline, which includes standards that protect customer data.

Component Insights

The solution segment led the market and accounted of 74.6% share of the global revenue in 2024. The solution segment is further segmented into business process management, lending analytics, loan management, loan origination, risk & compliance management, and others. The business process management segment led the market and accounted for 29.8% share of the global revenue in 2024. Business process management has gained popularity owing to its potential to minimize operational costs and significantly increase productivity. At the same time, business process management benefits in lending such as improved employee productivity and customer experience, error reduction, and decreased paper usage, among others are also one of the major factors expected to drive the segment growth. Moreover, advances in big data and cloud computing are particularly driving the efficiency of business process management. The rising IT expenditure also bodes well for the growth of the business process management segment over the forecast period.

The service segment is expected to witness the highest growth over the forecast period. The design & implementation segment led the market and accounted for more than 33.0% share of the global revenue in 2024. Financial institutions need a design & implementation framework to support the adoption of digital platforms. The framework can typically help financial institutions in carrying out the lending business operations efficiently. Organizations are imparting these implementation services in their lending platform so that they can be easily integrated with various lending solutions while ensuring regulatory compliance. The benefits offered by the design & implementation segment include cost savings in operations and a flexible and agile administration process.

Deployment Insights

The on-premise led the market and accounted for 68.0% share of the global revenue in 2024. Financial institutions are opting for on-premise digital lending platforms as part of the efforts to annul cyber risks in the wake of the rising number of instances involving data breaches and cyberattacks. This is because on-premise platforms enable the businesses to have complete control over their data and decide the system changes and upgrades. On-premise deployment also reduces the total cost of ownership as there are hardly any monthly or annual subscription fees involved. However, the fact that implementation of on-premise solutions requires more time as compared to cloud solutions can potentially hinder the growth of the segment.

The cloud segment is expected to witness the fastest growth over the forecast period. The growing preference for cloud-based platforms among digital lending providers to enhance their offerings is driving segment growth. Fintech companies are focusing on deploying cloud-based digital lending platforms and pursuing the pay-per-use payment model, which allows companies to minimize the overall operational costs. The growing preference for digital channels, such as instant messaging and email, for customer service purposes coupled with the increasing volumes of digitized documents and loan applications are expected to drive the growth of the cloud segment over the forecast period.

End Use Insights

The banks segment led the market and accounted for more than 29% share of the global revenue in 2024. The growing focus of banks towards digitalizing their financial services is expected to drive the segment growth. Stringent regulations and favorable initiatives being pursued by governments of both developed and developing countries are also encouraging banks to adopt digital lending platforms and enhance customer experience. Digital lending platforms typically allow banks to ensure transparency in their loan processes.

The credit unions segment is expected to witness the significant growth over the forecast period. The credit unions use digital lending platforms to eliminate manual processes and errors for conducting efficient lending. Features associated with digital lending platforms, such as e-signature, and cross-channel support, among others, can particularly benefit credit unions. The e-signature feature can typically help in reducing the processing time and allow credit unions in enhancing customer experience.

Regional Insights

North America segment led the market and accounted for 32.7% share of the global revenue in 2024. The presence of major digital lending providers across the North American countries is expected to drive the market growth in the region. The region has also been an early adopter of the latest and advanced technologies. As a result, the demand for digital, end-to-end financial solutions has always been on the higher side in North America. A large mobile workforce in the region is particularly prompting financial institutions in the region to digitalize their services and enhance customer experience. As such, financial institutions in the region are trying to differentiate themselves from their competitors by introducing innovative digital offerings as part of the efforts to gain a substantial competitive advantage.

U.S. Digital Lending Market Trends

The U.S. digital lending market is undergoing significant transformation, shaped by technological advancements, changing consumer behaviors, and increased competition from fintech firms. As borrowers seek faster, more convenient, and personalized financial services, digital lending platforms have risen to meet these expectations by offering streamlined, user-friendly experiences. This shift away from traditional banking models has led to the adoption of innovative tools such as mobile apps, automated loan processing systems, and real-time decision-making engines.

Asia Pacific Digital Lending Market Trends

Asia Pacific is anticipated to witness the fastest growth rate of 29.2% over the forecast period. The growth can be attributed to the increasing number of fintech companies in the region. Smartphone proliferation and the rising internet penetration rate also bode well for the growth of the regional market. Moreover, the growing adoption of open banking across countries such as India and China is also creating new opportunities for market growth.

China digital lending platform market has witnessed substantial growth, propelled by the proliferation of smartphones, increased internet penetration, and a tech-savvy population. Fintech giants such as Ant Group and Tencent have been at the forefront, leveraging their expansive ecosystems to offer seamless lending services integrated with digital wallets and e-commerce platforms. This integration has facilitated instant credit access, particularly benefiting small and medium-sized enterprises (SMEs) and individual consumers seeking quick financing solutions.

The digital lending platform market in India has witnessed growth as the integration of advanced technologies such as artificial intelligence, machine learning, and big data analytics has revolutionized. These tools enable lenders to assess creditworthiness more accurately, streamline loan approvals, and offer personalized financial products. In addition, the Reserve Bank of India (RBI) has implemented regulatory measures to ensure responsible lending practices and protect consumer interests. Initiatives such as the Unified Lending Interface (ULI) aim to standardize digital lending processes, making credit more accessible, especially in rural and semi-urban areas. These efforts align with the broader goal of financial inclusion, bringing more individuals and small businesses into the formal financial system.

Europe Digital Lending Market Trends

Europe's digital lending market is undergoing a profound transformation, propelled by the rise of alternative lending models and the growing influence of embedded finance. As traditional banks tighten lending criteria, non-traditional platforms such as peer-to-peer lenders and fintech-driven NBFCs are stepping in to meet demand for more accessible and flexible credit solutions. This shift is expanding the market, particularly among underserved segments such as SMEs and younger, digitally native consumers.

The Germany digital lending platform market is growing significantly asinternational banks are recognizing the potential and are expanding their digital banking services into the country. For instance, Spain's BBVA plans to launch digital banking operations in Germany by 2025, aiming to replicate its successful model implemented in Italy. Similarly, JPMorgan Chase is exploring opportunities to extend its consumer banking operations into Germany, focusing on a digital-first approach to capitalize on Europe's large savings pool and untapped banking sector.

Key Digital Lending Platform Company Insights

Some of the key players operating in the digital lending platform market are Ellie Mae, Inc., FIS, Fiserv, Inc., and Newgen Software. Players are also investing aggressively in research & development activities to further develop and expand the capabilities of the solutions they are offering. Companies are making efforts to integrated enhanced technologies such as machine learning and blockchain technology in digital lending platforms. Market incumbents are also focusing on maintaining and extending the support to their existing solutions while investing in strategic applications incorporating the latest innovations.

-

Fiserv, Inc. is a leading global provider of financial services technology, serving banks, credit unions, investment firms, businesses, and merchants. Founded in 1984 and headquartered in Brookfield, Wisconsin (USA), Fiserv offers a wide range of digital banking, payments, risk management, and data analytics solutions. In the banking and financial services sector, Fiserv delivers core account processing platforms such as DNA and Signature, which help financial institutions manage deposits, loans, and customer relationships.

-

Sigma Infosolutions is a global IT consulting and software development company specializing in enterprise solutions, digital transformation, and emerging technologies. Headquartered in Kansas, U.S., with development centers in India (Bengaluru and Jaipur), the company serves clients across industries such as healthcare, finance, retail, logistics, and education.

Key Digital Lending Platform Companies:

The following are the leading companies in the digital lending platform market. These companies collectively hold the largest market share and dictate industry trends.

- Ellie Mae, Inc.

- FIS

- Fiserv, Inc.

- Newgen Software

- Nucleus Software

- Pegasystems Inc.

- Roostify

- Sigma Infosolutions

- Tavant

- Wizni, Inc.

Recent Developments

-

In April 2025, Fiserv, Inc. announced that it had entered into a definitive agreement to acquire Brazilian fintech company Money Money Serviços Financeiros S.A. This strategic acquisition aims to enhance Fiserv's services in Brazil, enabling small and medium-sized businesses (SMBs) to access capital for growth and development.

-

In November 2023, Amazon Business, the B2B division of Amazon.com, Inc., expanded its partnership with Affirm Holdings, Inc. to introduce a new Buy Now, Pay Later (BNPL) offering for its business customers. Through this collaboration, sole proprietors shopping on Amazon Business can now access flexible pay-over-time options powered by Affirm, a move aimed at enhancing purchasing power and improving cash flow management for small businesses.

-

In January 2023, Newgen Software partnered with Finastra to streamline lending processes by integrating Newgen's loan origination solutions with Finastra's lending platform. The collaboration aims to automate loan processing, enhance customer experience, and improve operational efficiency for financial institutions.

Digital Lending Platform Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.11 billion

Revenue forecast in 2030

USD 44.49 billion

Growth rate

CAGR of 27.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Ellie Mae, Inc.; FIS; Fiserv, Inc.; Newgen Software; Nucleus Software; Pegasystems Inc.; Roostify; Sigma Infosolutions; Tavant; Wizni, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Lending Platform Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global digital lending platform market report based on component, deployment, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Business Process Management

-

Lending Analytics

-

Loan Management

-

Loan Origination

-

Risk & Compliance Management

-

Others

-

-

Services

-

Design & Implementation

-

Training & Education

-

Risk Assessment

-

Consulting

-

Support & Maintenance

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Banks

-

Insurance Companies

-

Credit Unions

-

Savings & Loan Associations

-

Peer-to-Peer Lending

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.