- Home

- »

- Medical Devices

- »

-

Digital Mammography Market Size & Share Report, 2030GVR Report cover

![Digital Mammography Market Size, Share & Trends Report]()

Digital Mammography Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (2D Full Field Digital Mammography Tomosynthesis, 3D Full Field Digital Mammography Tomosynthesis), By End-use, And Segment Forecasts

- Report ID: GVR-4-68039-945-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global digital mammography market size was valued at USD 1.23 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.26% from 2022 to 2030. The rising prevalence of breast cancer is a key factor projected to fuel the market growth over the forecast period. The following are statistical data for breast cancer:

-

According to the latest statistics reported by the WHO, in 2020, there were about 2.3 million women diagnosed with breast cancer and 685,000 deaths globally.

-

As per the data published by Breastcancer.org, in 2022, in the U.S., an estimated 287,850 new cases of invasive breast cancer are anticipated to be diagnosed in women, along with 51,400 new cases of non-invasive (in situ) breast cancer.

-

According to a Globocan report from 2020, breast cancer was the most common type of cancer, with a prevalence rate of 11.7%. According to the same survey, the five-year estimated prevalence for both sexes indicated that Asia had the highest number of persons affected at 3,218,496 (41.3%), followed by Europe at 2,138,117 (27.4%), and North America with 1.189,111 people (15.3%).

-

According to the WHO, in 2018, around 627,000 women died due to breast cancer globally. It is also estimated that the rate of breast cancer is higher among women in developed regions as compared to developing regions.

-

According to the Cancer Organization India, in 2018, breast and oral cavity cancers accounted for 25.0% of cancer cases in women.

Therefore, such increased prevalence rates of breast cancer are driving the demand for mammography devices.

The COVID-19 pandemic has negatively impacted the market. The pandemic resulted in substantial reductions in breast cancer screening, cancer management visits, and cancer procedures across the globe. For instance, a study published in the Journal of the American College of Radiology states that in 2020, mammograms dropped to a dramatic low, reducing by up to 92% in some areas in the U.S. Similarly, as per the article published in the Journal of Plastic, Reconstructive & Aesthetic Surgery (Feb 2022), the number of mammograms decreased from 180,813 in 2019 to 160,343 in 2020, which is a decline of 11.3%. Moreover, according to the data from the Centers for Disease Control and Prevention's National Breast and Cervical Cancer Early Detection Program, which screens low-income and uninsured women, breast cancer screenings decreased by 87% in April 2020. This decline in screening volume caused by the COVID-19 presented radiologists with additional challenges, thereby impacting the market growth.

Nevertheless, several physician reports from the U.S. have reported an increase in screening visits during the fourth quarter of 2020, which is likely to continue to rise to pre-covid levels. Furthermore, with the widespread deployment of AI technology, physicians will be able to manage their workload more effectively and precisely, thus eliminating disparities in patient care. Thus, post-pandemic, the number of screening mammography is projected to rise, thereby leading to market expansion in the coming years.

Furthermore, the rising number of breast cancer incidences among the elderly female population is fueling market expansion. For instance, breast cancer is 1.7 times more common in women over 65 than in women 45 to 64 years old, and 10 times more common in women under 45. Similarly, as per a research article published in the NCBI, breast cancer incidence rises with age, from 1.5 occurrences per 100,000 in women 20 to 24 years old to 421.3 cases per 100,000 in women 75 to 79 years old, with 95% of new cases occurring in women aged 40 and above. In addition, the relative survival from breast cancer is reduced among aging women. Thus, the increasing geriatric population is expected to propel market growth in the forecast period.

Estimated new DCIS and invasive breast cancer cases and deaths among women by age, U.S., 2019

DCIS Cases

Invasive Cases

Deaths

Age

Number

%

Number

%

Number

%

<40

1,180

2

11,870

4

1,070

3

40-49

8,130

17

37,150

14

3,250

8

50-59

12,730

26

61,560

23

7,460

18

60-69

14,460

30

74,820

28

9,920

24

70-79

8,770

18

52,810

20

8,910

21

80+

2,830

6

30,390

11

11,150

27

All Ages

48,100

268,600

41,760

Source: American Cancer Society, Inc., Surveillance Research

The introduction of new products in the market is expected to boost the adoption rate among end-users. Substantial improvements in detection and lower recall rates have been the most prominent outcome of DBT adoption. For instance, Hologic's 3D mammography system has been reported to identify 20 to 65% more invasive malignancies than a 2-D mammogram alone. It is FDA-approved and is superior to 2D mammography, particularly for women with dense breasts. Furthermore, the DBT system minimizes false-positive rates, which has the potential to save women not only the emotional toll of unwanted callbacks but also the financial effect on the healthcare system.

Moreover, AI has shown the potential in lowering the amount of time spent on interpretation, which can help alleviate reader fatigue, mitigate the impact of global radiologist shortages, and counterbalance the increased volume of reading caused by DBT image sets. AI will play a significant role in mammography and digital breast tomosynthesis (DBT) ranging from image production, and denoising through risk prediction, cancer diagnosis, and therapy selection, to outcome prediction. Deep learning-based methods outperform traditional computer-aided detection systems based on manually produced features, reaching radiologists' performance for particular tasks. Thereby, such advancements are expected to create lucrative opportunities for key players in the market.

Furthermore, a number of major studies have indicated that combined 2D/3D mammography systems are superior to 2D mammography alone in the diagnosis of breast cancer. A large U.S. study of 4,54,850 patients observed that combined 2D/3D Combination screening-detected 5.5 cancers per 1,000 women, compared to 4.3 cancers for 2D screening alone, a 28 percent higher detection rate with combined 2D/3D mammography systems, according to the American Society of Clinical Oncology (ASCO) clinical trial report. Thus, increasing awareness regarding the usage of these systems and high detection rates are the primary factors driving the segment.

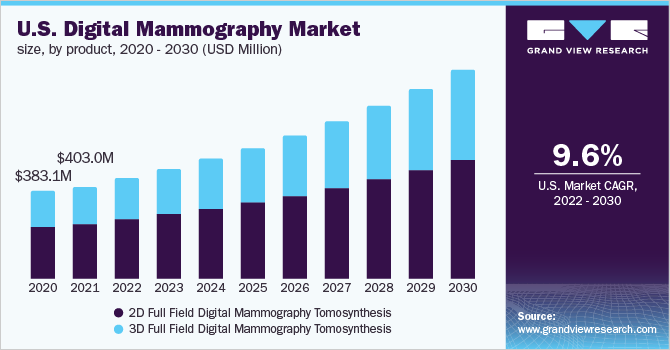

Product Insights

The 2D full-field digital mammography tomosynthesis segment dominated the market with a revenue share of more than 60.0% in 2021 and is expected to witness considerable growth over the forecast period. This is mainly due to the price difference between 2D and 3D mammograms. Furthermore, due to lower recall rates, this technology is cost-effective, and insurance and reimbursements for these systems are widely covered in developed nations. Moreover, in comparison to screen film technology, the exposure time in 2D mammography systems to radiations is lowered for high-quality images with better positioning. It also offers professionals with enhanced outcomes and clear images. It is the most commonly used screening modality and is established as a standard for breast cancer diagnosis, with use across almost all mature healthcare markets. On the other hand, it has some proven limitations in sensitivity for women in higher breast density categories. In addition, 3D mammography is more advantageous as compared to 2D. Thereby, these factors are expected to deter the segment growth in the forecast period.

The 3D full-field digital mammography tomosynthesis segment is anticipated to register the fastest CAGR of 10.74% over the forecast period. This technology is nascent in screening, however, it is increasingly common in diagnosis. The majority of research studies indicate that 3D mammography is more effective in detecting breast cancer. It also provides improved sensitivity and specificity over 2D mammography, particularly in higher breast densities. 3D mammography has been shown to improve breast cancer detection by 27-50% and lower recall rates by 17-40%. Moreover, as per an article published in Breastcancer.org, 3D mammograms provide fewer false positives and are more effective in women aged 65 and older, as compared to 2D mammograms. Thus, owing to the aforementioned advantages, the segment is likely to grow over the forecast period.

Furthermore, according to the FDA, there's been a 110% surge in the number of 3D mammography machines on the American health care market in the past three years. As per the same source, in October 2016, there were 3,826 3D mammography units nationally and it had risen to 8,059 by October 2019. It also states that in 2018, around 4000 facilities of 8,726 certified mammography facilities in the U.S. offer 3D mammograms. Moreover, according to a study published in the medical journal JAMA Internal Medicine (June 2019), 3D mammography screening augmented from 13% of screening examinations to 43% from 2015 to 2017.

A surge in breast cancer screening using 3D mammography and the rising number of facilities offering 3D mammography is majorly driving the segment. Nonetheless, 3D mammograms are relatively newer than 2D and thus might not be available in all facilities. These are also more expensive and not all insurance providers cover 3D mammograms. In addition, its adoption is less in developing and low-middle income countries. Thus, these factors are expected to limit the segment growth.

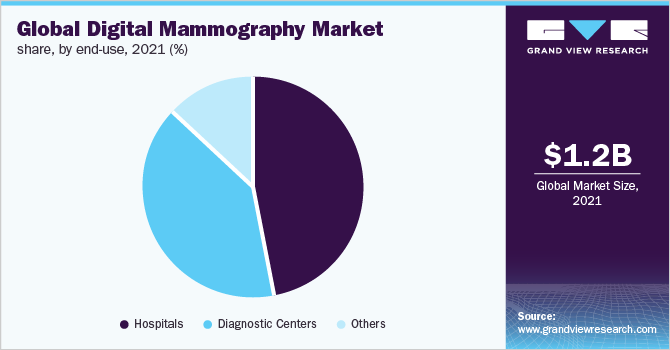

End-use Insights

In 2021, the hospitals segment accounted for the largest revenue share of more than 45.0% as these establishments have the space and capital required for mammography machines, which require a dedicated area. Moreover, hospitals are well-equipped with advanced 2D and 3D mammography systems. For instance, in November 2019, NYC Health and Hospitals/Jacobi installed the Hologic 2D/3D 3Dimensions Mammogram machine. The availability of these advanced systems enables enhanced patient experience, shorter wait times, and faster examinations. Moreover, the presence of a large patient pool improved reimbursement policies for breast cancer treatments, and the presence of skilled healthcare professionals further contribute to segment growth. Furthermore, increased public and private investment in the healthcare sector is expected to boost the segment's growth.

The diagnostic centers segment is expected to exhibit the fastest CAGR of 11.10% over the forecast period. The growth is credited to the rising availability of comprehensive breast imaging services at cost-effective prices, the usage of advanced imaging technologies, and the availability of skilled and expert professionals. Breast radiologists, surgeons, and reconstructive surgeons work efficiently with patients in dedicated breast imaging clinics to establish and implement customized treatment plans. Moreover, the availability of digital and 3D mammography, whole-breast ultrasonography, and breast MRI for high-risk screening, diagnosis, and treatment planning has boosted diagnostic and detection precision, which is projected to sustain this segment growth in the near future.

Regional Insights

North America dominated the market in 2021 with a revenue share of over 35.0% and is expected to exhibit a considerable growth rate over the forecast period. The growing prevalence of breast cancer, significant R&D in breast cancer therapies, and advancements in breast imaging modalities are the primary drivers of the market in this region. For instance, Breastcancer.org predicts that in 2020, an estimated 276,480 new cases of invasive breast cancer were identified in women in the U.S. The increasing breast cancer burden and rising healthcare costs in this region are driving end-users to replace traditional systems with the most modern systems.

Apart from these factors, numerous organizations’ investment in breast cancer screening initiatives is also encouraging market growth. For instance, the Society of Breast Imaging in the U.S. is dedicated to minimizing the burden of breast cancer and preserving patients' lives. It offers a Research & Education Fund initiative that intends to provide grants to assist breast imaging research and education. Similarly, the Promise Fund of Florida plans to expand its reach by 2022, serving more than 30,000 women through a Continuum of Care strategy that assists women in South Florida from screening to treatment for breast and cervical cancer. It co-locates a Women’s Health Center providing mammography services at a federally-qualified health center. In addition, Hologic has given educational grants to the American Society of Breast Surgeons and also has funded patient advocates such as the Black Women’s Health Imperative, which lobbies for access to 3D mammograms.

Asia Pacific is anticipated to register the fastest CAGR of 11.47% over the forecast period. The growth is attributed to the increasing prevalence of breast cancer and rising awareness regarding the usage of mammography technologies. For instance, according to a research study published in the LWW journal, around 44% of the world's breast cancer deaths are in Asia, with 39% of overall new BC cases diagnosed. Moreover, nearly 25% of the female cancer cases in India are breast cancer. Similarly, according to the data published by Globocan in 2018, more than 1.6 lakh new cases and about 87,000 deaths were registered in India.

Moreover, government initiatives for free cancer screening programs are driving the market. For instance, in October 2021, the Goa government launched ‘'Swasth Mahila, Swasth Goa’, an initiative for free breast cancer screening for 1 lakh women. In November 2021, Greater Chennai Corporation launched initiatives to raise awareness regarding breast cancer. In 2020-2021, it has screened around 1.17 lakh women for breast cancer at its community and urban primary health centers. Lately, in April 2022, the government of Punjab signed MoU with Roche Pharma India and Niramai Health and launched the PINK Project initiative for breast cancer treatment. As a result, these activities boost the demand for mammography systems in the region.

Key Companies & Market Share Insights

The market is consolidated owing to the presence of a few major players. The foremost market players are focusing on technological advancements and reducing the side effects of the procedures. These companies have a wide product portfolio, which includes 2D and 3D full-field digital mammography tomosynthesis systems. The market participants are actively involved in multiple strategic initiatives such as product launches and approvals, mergers & acquisitions, and geographic expansion to maintain their position in the market. For instance, in January 2019, Kiran Medical Systems, the radiology division of Trivitron Healthcare, launched Felicia, a digital mammography system during the Arab Health Convention in Dubai. It features a Cesium Iodide scintillator detector with a 77-micron pixel pitch that aids in identifying the tiniest of calcifications, which is critical for early breast cancer detection.

Similarly, in May 2018, Hologic, Inc. obtained FDA PMA approval for its Clarity HD high-resolution 3DTM imaging and Intelligent 2DTM imaging technologies, which are now accessible on the 3Dimensions breast tomosynthesis system. The system now offers radiologists greater resolution 3DTM images, improved productivity for technologists, and a more convenient mammography experience for patients, with low-dose alternatives. Thus, with the above-mentioned strategies, the market for digital mammography is predicted to witness growth during the forecast period. Some prominent players in the global digital mammography market include:

-

Hologic Inc.

-

GE Healthcare

-

Koninklijke Philips NV

-

Siemens Healthcare GmBH

-

Fujifilm Corporation

-

PLANMED OY

-

Toshiba Medical Systems

-

Metaltronica S.p.A

Digital Mammography Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.35 billion

Revenue forecast in 2030

USD 2.95 billion

Growth Rate

CAGR of 10.26% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain, Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

Hologic Inc.; GE Healthcare; Koninklijke Philips NV; Siemens Healthcare GmBH; Fujifilm Corporation; PLANMED OY; Toshiba Medical Systems; Metaltronica S.p.A

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global digital mammography market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

2D Full Field Digital Mammography Tomosynthesis

-

3D Full Field Digital Mammography Tomosynthesis

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

Colombia

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global digital mammography market size was estimated at USD 1.23 billion in 2021 and is expected to reach USD 1.35 billion in 2022.

b. The global digital mammography market is expected to grow at a compound annual growth rate of 10.26% from 2022 to 2030 to reach USD 2.95 billion by 2030.

b. North America dominated the digital mammography market in 2021 during the forecast period and is expected to witness a growth rate of 9.67% over the forecast period. This can be attributed to the presence of a key players, presence of well-developed healthcare infrastructure and high adoption of 3D mammography systems

b. Prominent key players operating in the digital mammography market include Hologic Inc., GE Healthcare, Koninklijke Philips NV, Siemens Healthcare GmBH, Fujifilm Corporation, PLANMED OY, Toshiba Medical Systems, Metaltronica S.p.A.

b. Key factors that are driving the digital mammography market growth include rising prevalence of breast cancer, technological advances, increasing awareness regarding breast cancer amongst women and supportive government initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.