- Home

- »

- Medical Devices

- »

-

Digital Respiratory Devices Market, Industry Report, 2030GVR Report cover

![Digital Respiratory Devices Market Size, Share & Trends Report]()

Digital Respiratory Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Smart Inhalers & Nebulizers, Sensors & Apps), By Disease Indication, By Distribution Channel, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-968-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Respiratory Devices Market Summary

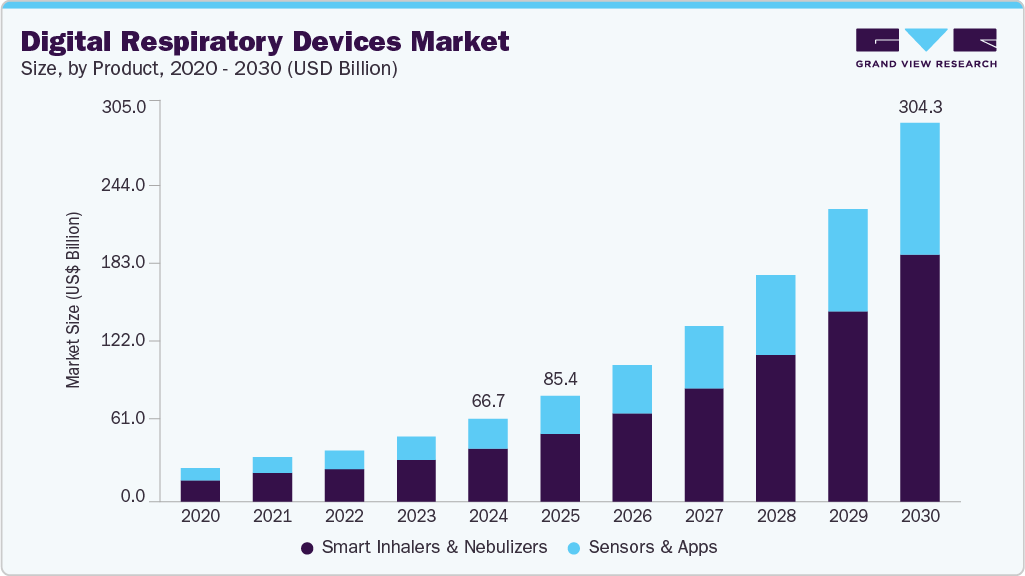

The global digital respiratory devices market size was estimated at USD 66.73 billion in 2024 and is projected to reach USD 304.28 billion by 2030, growing at a CAGR of 28.92% from 2025 to 2030. The market is driven by the rising prevalence of chronic respiratory diseases, technological advancements in device capabilities, increasing awareness of respiratory health, and the growing demand for remote monitoring solutions.

Key Market Trends & Insights

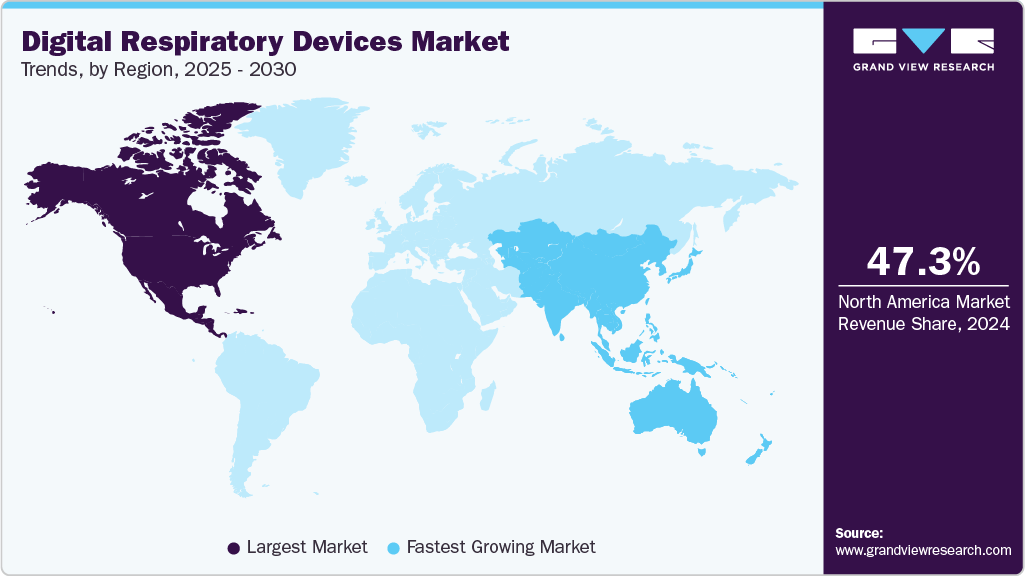

- North America dominated the digital respiratory devices market with the largest revenue share of 47.33% in 2024.

- The digital respiratory devices market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By product, the smart inhalers and nebulizers segment led the market with the largest revenue share of 63.97% in 2024.

- By diseases indication, the COPD segment led the market with the largest revenue share of 51.39% in 2024.

- By distribution channel, the hospital pharmacies segment led the market with the largest revenue share of 38.31% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 66.73 Billion

- 2030 Projected Market Size: USD 304.28 Billion

- CAGR (2025-2030): 28.92%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, in November 2022, BioIntelliSense developed a patented pulse oximetry sensor chipset that effectively measures blood oxygen levels across different skin tones, including darker pigmentation, and addresses FDA concerns regarding racial disparities in fingertip devices during movement.One significant factor contributing to the market's growth is the increasing prevalence of chronic diseases, such as chronic obstructive pulmonary disease (COPD) and asthma. This rise in chronic conditions leads to a greater demand for digital health devices, as more individuals require continuous monitoring and management of their health. These devices provide innovative solutions that help track symptoms and ensure medication adherence. The expanding patient population underscores the necessity for practical, technology-driven healthcare solutions, further promoting market expansion.

Another crucial factor driving market growth is technological innovation. Developments such as smart inhalers, connected nebulizers, and integrated mobile applications have revolutionized traditional methods of respiratory management. For instance, in February 2024, Aptar Pharma, a global provider of drug delivery systems and active material science solutions, launched HeroTracker Sense, an innovative digital respiratory health solution designed to convert traditional pressurized metered dose inhalers (pMDIs) into smart, connected healthcare devices. This cutting-edge technology enables real-time monitoring and data-driven management of respiratory conditions, enhancing treatment adherence and supporting more personalized patient care.

“The launch of HeroTracker Sense positions Aptar’s digital respiratory portfolio as a world-leading offering, providing insights into patient behaviors and how that will lead to a change in the way the patient interacts with their device, and their understanding of their indication. We see this as a product for the future and one that will demonstrate significant value, creating real-world evidence that can aid the support of reimbursement models in numerous different markets.”

-Marcus Bates, Director, Business Development, Digital Healthcare, Aptar Pharma.

Smart inhalers with sensors can monitor medication usage and offer patient feedback, enhancing adherence to prescribed treatment plans. A study found that patients using smart inhalers indicated improved adherence compared to traditional inhalers. These technological advancements improve patient engagement and facilitate more effective data collection for healthcare providers, allowing for better-informed clinical decisions.

There is an increasing awareness of respiratory health and the importance of preventive care. Public health initiatives aimed at educating individuals about the risks associated with respiratory diseases have gained momentum in recent years. For instance, campaigns by the Global Initiative for Asthma (GINA) emphasize early diagnosis and intervention, driving demand for the market that supports these efforts.

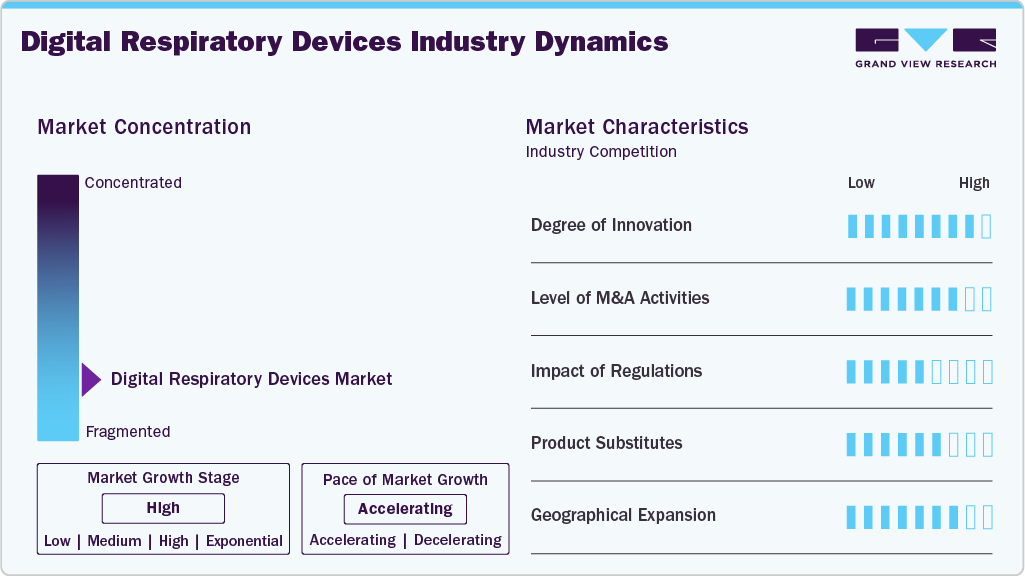

Market Concentration & Characteristics

The market growth is high, and the pace is accelerating. This digital respiratory devices industry is characterized by the increasing prevalence of respiratory diseases, the aging population, increasing initiatives by government and private organizations to increase awareness about these diseases, and increasing innovation and product launches by players.

The degree of innovation in the digital respiratory devices industry is high, driven by technological advancements that enhance patient monitoring and treatment adherence. Innovations such as smart inhalers and connected nebulizers are transforming traditional respiratory care. For instance, in February 2023, in collaboration with SBRI Healthcare, the Health Innovation Network backed 14 projects, including digital inhalers for children that enable families to track usage through a smartphone app.

The merger and acquisition activity level in the digital respiratory devices industry is high as companies seek to expand their technological capabilities and market reach. For instance, in April 2024, Clario, a healthcare research and technology firm providing top endpoint technology solutions for clinical trials, announced its acquisition of ArtiQ. This move enhances the role of artificial intelligence (AI) in Clario's Respiratory Solutions portfolio and boosts its capacity to innovate with AI across its services.

The digital respiratory devices industry experiences a moderate level of regulatory influence, with regulations having both positive and negative effects. The regulations enhance device safety and efficiency, boosting adoption. Strict regulatory frameworks raise costs and extend development timelines, creating challenges for industry stakeholders and healthcare systems.

Product substitutes, the threat is medium due to traditional inhalers and telemedicine solutions offering alternative management strategies for respiratory conditions. These substitutes are adequate, while they lack digital devices' real-time data tracking and adherence support. As awareness grows about the benefits of digital solutions, traditional products face increasing competition from innovative technologies that enhance patient engagement and treatment outcomes.

Industry players increasingly target geographic expansion to access untapped markets. For instance, in October 2022, AirPhysio entered into a strategic partnership with Medsmart to introduce its multi-award-winning respiratory devices to the Indian market. Following rapid global expansion-from operating in just five countries to over 100 within the past two years-and positively impacting the lives of more than half a million individuals, AirPhysio is now set to enhance respiratory health outcomes in India. This move marks a significant milestone in the company's mission to improve the quality of life through innovative, drug-free breathing solutions.

The growth of healthcare sectors in developing areas presents substantial opportunities, as rising awareness of respiratory diseases and acceptance of advanced technologies create additional prospects. Companies aim to enhance their reach by entering new regions and leveraging emerging opportunities in the global digital respiratory devices industry.

Product Insights

The smart inhalers and nebulizers segment led the market with the largest revenue share of 63.97% in 2024, driven by several factors, including the rising prevalence of respiratory diseases, technological advancements, improved patient adherence, and a growing focus on personalized medicine. According to the National Center for Biotechnology Information (NCBI), smart inhalers are electronic devices designed to enhance medication adherence and help maintain asthma control. Integrating digital features in inhalers and nebulizers enhances their functionality, allowing for better medication usage and compliance monitoring, which is crucial for effective disease management.

The sensors and apps segment is anticipated to grow at the fastest CAGR over the forecast period. The increasing prevalence of respiratory diseases such as chronic obstructive pulmonary disease (COPD) and asthma has increased demand for innovative monitoring solutions that can provide real-time data on patient health. For instance, in February 2022, Aptar Pharma, in collaboration with Active Material Science Solutions, introduced HeroTracker Sense. This advanced digital solution for respiratory health transforms a conventional metered dose inhaler (pMDI) into an innovative and connected healthcare device.

Diseases Indication Insights

The COPD segment led the market with the largest revenue share of 51.39% in 2024. According to the World Health Organization (WHO), November 2024 estimates, COPD ranks as the fourth major cause of death globally, responsible for approximately 3.5 million deaths in 2021, equating to nearly 5% of total global mortality. Approximately 90% of COPD-related deaths among the population under the age of 70 occur in low- and middle-income countries (LMICs), highlighting significant disparities in disease burden and access to care. From a broader health impact perspective, COPD stands as the eighth leading cause of disability worldwide, as measured by disability-adjusted life years (DALYs). The primary risk factor in high-income countries is tobacco smoking, which accounts for over 70% of COPD cases. In contrast, in LMICs, tobacco use contributes to 30-40% of cases, with household air pollution-often stemming from biomass fuel use-emerging as a major contributing factor.

The asthma segment is anticipated to grow at the fastest CAGR of 27.91% during the forecast period. According to the NCBI, approximately 300 million people globally have asthma, and the prevalence of the condition is increasing by 50% every ten years. In addition, 10% of people in North America have asthma, and it affects over 25 million people in the U.S. Moreover, a surge in severe asthma, inadequate disease treatment, and poverty are all effects of the increasing frequency of asthma hospitalizations, especially among young children. Hence, the demand for digital respiratory devices is increasing.

Distribution Channel Insights

The hospital pharmacies segment led the market with the largest revenue share of 38.31% in 2024. Hospital pharmacies facilitate convenient access to innovative respiratory devices, enhancing treatment efficacy and patient outcomes. These pharmacies also give medicinal supplies to healthcare professionals so patients can quickly obtain medications. The market for this segment is expanding due to the growing population and rising prevalence of chronic respiratory diseases.

The online pharmacies segment is expected to grow at the fastest CAGR of 31.74% over the forecast period. The growth is due to its convenience, wider product availability, and competitive pricing. The shift to online shopping has been accelerated by the COVID-19 pandemic, making it a preferred option for many consumers. In addition, online pharmacies provide extensive product information and user reviews, aiding informed decision-making. Their integration with digital health platforms enhances prescription management and user experience, contributing to the segment's growth.

End Use Insights

The hospitals segment led the market with the largest revenue share of 51.32% in 2024. Rapid improvements in healthcare infrastructure, growing public-private partnerships, and enhanced access to services are expected to influence the hospital sector greatly. Hospitals are early adopters of smart inhaler technology, catering to patients with various respiratory conditions. The rising patient population makes hospitals keep a substantial inventory of respiratory devices to meet diverse demands.

The home care settings segment is anticipated to grow at the fastest CAGR of 29.92% over the forecast period. Rising hospital care costs, technological advancements, a growing emphasis on remote patient monitoring, and increased telehealth integration led to a notable shift in patient preference toward home care. The convenience of receiving treatment at home is driving demand, which is anticipated to grow the segment further. According to an article published in April 2024, respiratory diseases are a major global health issue. The existing care systems, reliant on scheduled appointments, struggle to meet the needs of patients with rapidly changing conditions. Home-based digital health technologies enable personalized care models for individual responses and triggers.

Regional Insights

North America dominated the digital respiratory devices market with the largest revenue share of 47.33% in 2024. The developed healthcare infrastructure of the region, the increasing prevalence of COPD and asthma, and the adoption of advanced medical devices are the major contributors to the region's market growth. The significant advancements in digital respiratory devices and their growing acceptability and accuracy are anticipated to drive market growth during the forecast period.

For instance, in February 2022, the U.S. Centers for Medicare & Medicaid Services (CMS) recently updated reimbursement rates for Remote Physiologic Monitoring (RPM) and Remote Therapeutic Monitoring (RTM) services, which will boost the usage and demand in the U.S. market.

U.S. Digital Respiratory Devices Market Trends

The digital respiratory devices market in the U.S. accounted for the largest market revenue share in North America in 2024. The increasing number of chronic diseases drives the market growth in the U.S., growing investments and focus on developing new advanced products, and the growing geriatric population of the country. According to the Population Reference Bureau (PRB), the older population of the U.S. aged above 65 years is anticipated to increase by 47% from 58 million in 2022 to 82 million in 2050. This rising geriatric population is more susceptible to the respiratory diseases. The devices empower this population to manage their health conditions; thus, they are expected to experience demand over the forecast period.

The Canada digital respiratory devices market is anticipated to grow at a significant CAGR during the forecast period, due to the high respiratory disease rate, increasing government support for chronic disease management, and increasing public awareness about the benefits of respiratory devices. According to the Asthma Canada 2021 Annual Report, asthma is the third most common chronic disease in the country, affecting more than 3.8 million Canadians. The country's high prevalence of chronic diseases is anticipated to increase the demand for smart solutions such as smart inhalers, driving the country's market growth.

Asia Pacific Digital Respiratory Devices Market Trends

The digital respiratory devices market in Asia Pacific is anticipated to witness at the fastest CAGR over the forecast period. The market growth in the region is driven by improvements in healthcare infrastructure, a rising elderly population, an increasing prevalence of respiratory diseases, and heightened awareness of the benefits of digital devices.

The efforts by government and private organizations to raise awareness about respiratory conditions are expected to stimulate market growth further. For instance, on World Asthma Day in May 2023, ALKEM initiated an asthma awareness campaign to educate patients and healthcare providers about SMART treatment for asthma. To enhance awareness, the campaign featured extensive diagnostic camps, marathons, and rallies.

The China digital respiratory devices market accounted for the largest market revenue share Asia Pacific in 2024. The increasing focus on technological innovation in healthcare and air pollution leading to respiratory diseases drive the country's market growth. According to the WHO, China witnesses around 2 million yearly mortalities due to air pollution. Moreover, this air pollution also contributes to increasing breathing problems, leading to chronic diseases, which is expected to drive the market growth.

The digital respiratory devices market in India is anticipated to witness at a lucrative CAGR over the forecast period. The rising prevalence of chronic diseases, developing healthcare infrastructure, and growing affordability drive this market in India. India saw a significant rise in respiratory diseases in the last few years, increasing the demand for digital devices. According to the Global Asthma Report 2022, over 35 million people in India suffer from asthma.

Europe Digital Respiratory Devices Market Trends

The digital respiratory devices market in Europe is characterized by several key drivers, including the rising of respiratory diseases, such as asthma and COPD, which has driven demand for advanced digital solutions. For instance, in July 2023, Teva UK introduced the GoResp Digihaler in the UK, making it the first country in Europe to offer this new inhaler system. The inhaler system enables patients with asthma and COPD to track their inhaler usage and share reports with their healthcare providers.

Latin America Digital Respiratory Devices Market Trends

The digital respiratory devices market in Latin America is witnessing significant trends fueled by increasing demand for connected healthcare solutions. Innovations in digital health technologies are gaining traction, with companies introducing smart inhalers and remote monitoring systems designed to meet local needs.

Middle East & Africa Digital Respiratory Devices Market Trends

The digital respiratory devices market in the Middle East and Africa is witnessing significant trends driven by growing demand for homecare solutions. The rise in asthma and COPD cases is prompting healthcare providers to adopt digital solutions for better management. For instance, South Africa is experimenting with digital technology to identify outbreaks of respiratory diseases.

Key Digital Respiratory Devices Company Insights

Key market players are adopting several strategic initiatives such as mergers, partnerships, and product launches. For instance, in September 2021, Adherium Limited, a player in respiratory eHealth and remote monitoring, received FDA 510(k) approval to sell its next-generation Hailie Sensor, which tracks asthma and COPD medication usage.

Key Digital Respiratory Devices Companies:

The following are the leading companies in the digital respiratory devices market. These companies collectively hold the largest market share and dictate industry trends.

- COHERO Health Inc. (AptarGroup, Inc.)

- Cognita Labs

- adherium

- Amiko Digital Health Limited

- Teva Pharmaceuticals Industries Ltd.

- Propeller Health.

- Novartis AG

- Pneuma Respiratory Inc.

- 3M

- AireHealth, Inc.

- Findair Sp. z o. o.

Recent Developments

-

In April 2024, Bespak, a contract development and manufacturing organization (CDMO) specializing in inhaled drug-device products, and H&T Presspart, partnered to expedite the shift from traditional pressurized Metered Dose Inhalers to more environmentally friendly alternatives using low GWP propellants.

-

In February 2023, Teva shares new findings from the CONNECT2 Study on its Digihaler System at the 2023 Annual Meeting of the American Academy of Allergy, Asthma and Immunology (AAAAI).

-

In May 2020, AstraZeneca announced a partnership with Propeller Health to add smart features to its Symbicort inhaler, digitizing the treatment of COPD and asthma and increasing medication adherence.

Digital Respiratory Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 85.44 billion

Revenue forecast in 2030

USD 304.28 billion

Growth rate

CAGR of 28.92% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, disease indication, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

COHERO Health Inc. (AptarGroup, Inc.); Cognita Labs; adherium; Amiko Digital Health Limited; Teva Pharmaceuticals Industries Ltd.; Propeller Health.; Novartis AG; Pneuma Respiratory Inc.; 3M; AireHealth, Inc.; Findair Sp. z o. o.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Respiratory Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital respiratory devices market report based on product, disease indication, distribution channel, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Inhalers & Nebulizers

-

Sensors & Apps

-

-

Disease Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Asthma

-

COPD

-

Other Diseases

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Homecare Settings

-

Other Settings

-

-

Regional Outlook (Revenue, USD Million, 2018-2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital respiratory devices market size was estimated at USD 66.73 billion in 2024 and is expected to reach USD 85.44 billion in 2025.

b. The global digital respiratory devices market is expected to grow at a compound annual growth rate of 28.92% from 2025 to 2030 to reach USD 304.28 billion by 2030.

b. North America dominated the market with a share of 47.33% in 2024 owing to the development of high-tech devices, the increasing prevalence of COPD and asthma, and favorable reimbursement policies which are anticipated to drive market expansion.

b. Key players operating in the digital respiratory devices market include COHERO Health Inc. (AptarGroup, Inc.), Cognita Labs, adherium, Amiko Digital Health Limited, Teva Pharmaceuticals Industries Ltd., Propeller Health., Novartis AG, Pneuma Respiratory Inc., 3M, AireHealth, Inc., Findair Sp. z o. o.

b. Key factors that are driving the market growth include rising prevalence of chronic respiratory diseases, technological advancements in device capabilities, increasing awareness of respiratory health, and the growing demand for remote monitoring solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.