- Home

- »

- Communications Infrastructure

- »

-

Direct Attach Cable Market Size, Share, Industry Report, 2030GVR Report cover

![Direct Attach Cable Market Size, Share & Trends Report]()

Direct Attach Cable Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Direct Attach Copper Cable, Active Optical Cable), By Form Factor (SFP, QSFP, CXP, Cx4, CFP, CDFP), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-696-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Direct Attach Cable Market Size & Trends

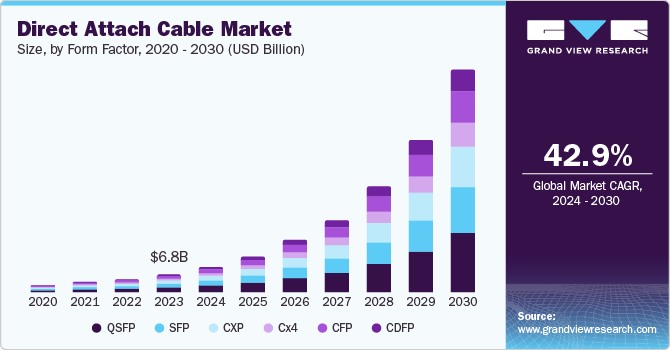

The global direct attach cable market size was valued at USD 6.79 billion in 2023 and is projected to grow at a CAGR of 42.9% from 2024 to 2030. Key growth drivers for this market include growing dependence on high-performance computing environments, increasing reliance of businesses and government agencies on network and data connectivity, rising number of data centers, unceasing growth in data storage requirements, and others. Innovation-backed new product launches and the expansion of product portfolios are also expected to influence the development of this market in the approaching years.

Increasing demand for efficient data transfer solutions and rising data consumption by businesses and consumers in different industries, growing adoption of advanced technologies such as cloud computing and big data, and an increase in innovations related to direct attach cable technologies have also contributed to the growth of this market. In addition, a rise in internet-based business functions and activities in numerous industries is expected to increase demand for the product. The cost-effectiveness offered by the direct attach cables to ensure a direct connection between ports of active equipment such as servers, routers, switches, and others has played a vital role in growing demand.

Almost every industry and business that operates globally or in a region has adopted cloud computing and other related technologies. Growing dependence on data for multiple business functions, increasing data storage requirements of companies, rising focus on using energy-efficient solutions for data transfer and networking, and supportive government regulations and policies are anticipated to fuel the direct attach cable market growth during the forecast period.

Type Insights

Based on type, the active optical cable segment dominated the global industry and accounted for revenue share of 54.5% in 2023. The growth of this segment in driven by the factors such as ability of active optical cables to transfer data while providing necessary bandwidth and reducing latency and ensuring rapid data transmissions especially over long distances between two points. High performance characteristics and reliability in terms of connecting servers and equipment has also contributed to the growth of this segment. The growing adoption of 5G technology and emergence of 6G, innovation fueled by ongoing research & development, increasing market penetration accomplished by consumer electronics market are expected to develop rise in demand for this segment during forecast period.

Direct attach copper cable segment is expected to experience fastest CAGR from 2024 to 2030. The demand for this segment is primarily influenced cost-effectiveness offered by the product as compared to fiber optic solutions for shorter ranges. Growing awareness regarding use of energy efficient solutions has also been driving the growth of this segment in recent years. Increasing demand for higher speed of data transmission and increasing adoption of technologies such as cloud computing, artificial intelligence, machine learning and others influence the growing demand of direct attach copper cable segment.

Form Factor Insights

The QSFP (Quad Small Form-Factor Pluggable) segment accounted for the largest revenue share in 2023. QSFP connectors provide a favorable equilibrium of size and functionality. It is extensively utilized in high data speeds networks and is suitable for high-performance computing (HPC) settings and a wide range of uses in data centers. It can accommodate various bandwidths, ranging from older models such as QSFP+ (10 Gbps ) to newer versions like QSFP28 (25 Gbps) and QSFP56-DD (50 Gbps). This helps in meeting the need for faster data transfers within data centers.

The CFP (Common Form-Factor Pluggable) segment is anticipated to register the fastest CAGR over the forecast period. It is widely used for high-speed digital signal transmission. CFP transceivers consist of interchangeable modules such as pluggable CFP, CFP2, CFP4, and CFP8 to meet the high bandwidth needs of data networks. Due to modernization, equipment is upgraded, which enhances the efficiency of connection.

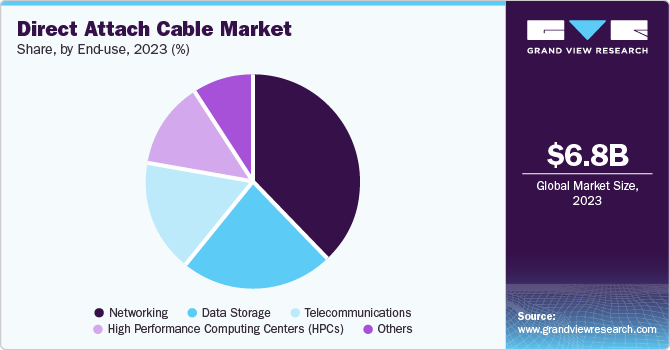

End-use Insights

The telecommunications segment accounted for the largest revenue share in 2023. The growing implementation of 5G networks undertaken by multiple business requires a high-density network structure with more base stations and front-haul connections. This facilitates the fast and accurate transfer of information between different locations. The increasing network demand is leading to the installation of efficient communication cables such as AOCs. These cables are necessary for fast communication capabilities that can meet the changing needs of the telecommunications industry. The increasing number of smartphone users, growing dependability of businesses on data transfer, and increasing number of data centers are expected to drive further growth for this segment during the forecast period.

The high-performance computing centers (HPCs) segment is anticipated to experience a significant CAGR over the forecast period. Large data is produced by sectors such as artificial intelligence (AI), weather forecasts, scientific research, and simulations. High-performance computers supply the computing power necessary to analyze and handle this information efficiently. It enables engineers, designers, data scientists, and researchers to resolve intricate issues faster and cheaper than regular computing.

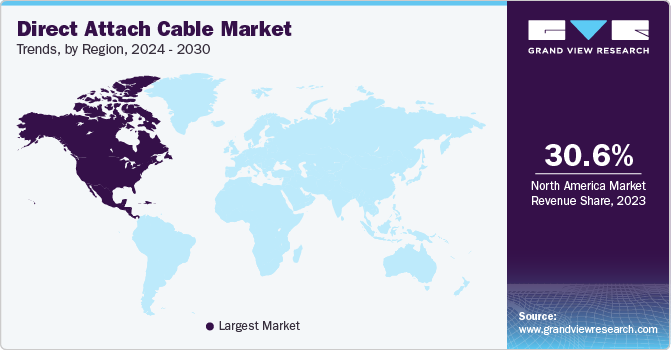

Regional Insights

North America direct attach cable market dominated the global market with a revenue share of 30.6% in 2023. The emergence of large enterprises in technology industry and data centers, presence of multiple companies operating at global scale, increasing demand for high-speed data transfer and early adoption of trends for innovative technologies have contributed to the growth of this market. The regional industrial operations, growing dependency of trade on data and network connectivity, entry of multiple businesses from other regions is also expected to drive growth for this market.

U.S. Direct Attach Cable Market Trends

The direct attach cable market in the U.S. accounted for the largest revenue share of regional industry in 2023. This is attributed to continuous growth in cloud computing and big data applications in numerous industries. This has developed increasing need technologies and equipment that can ensure faster data transmissions, improved performances, and reduced power consumptions. Growing dependability of businesses on data availability, data transfer and network based infrastructures is projected to develop growth for this market in approaching years.

Europe Direct Attach Cable Market Trends

Europe direct attach cable market was identified as a lucrative region in 2023. A surge in number of data centers, growing use of cloud services, increasing internet dependability, and the expanding digital technologies directly influencing the business and economies in the region are anticipated to develop growth for this regional industry during forecast period. Unceasing addition in list of business and agencies using cloud computing technologies and other advanced technology - backed systems have been contributing to growing demand for direct attach cables in Europe.

The UK direct attach cable market is expected to grow rapidly in the approaching years. This is attributed to multiple aspects such as technological modernization, increasing adoption of big data, artificial intelligence, cloud computing and other advanced technology, entry of multiple business from other regions and growing demand for high-speed data transmission solutions is projected to influence the growth for this market from 2024 to 2030.

Asia Pacific Direct Attach Cable Market Trends

Asia Pacific direct attach cable market is anticipated to experience fastest CAGR during forecast period. This is attributed to numerous aspects such as growing networks of telecommunication businesses in the region, entry of multiple technology-based companies from North America and Europe regions in the area and increasing dependability of firms and governments on high-speed data transmissions. An unprecedented growth in the adoption of technology-backed solutions by key industries such as banking & finance, telecommunication, entertainment & media, and others.

China direct attach cable market held a substantial revenue share of the regional industry in 2023. Presence of prominent organizations in electronics manufacturing and technology driven industries in the country influences the growth of this market. Growing adoption of cloud - based solution, emergence of multiple global businesses in the country, and increasing demand for the data transmission capabilities equipped with high speed are anticipated to generate upsurge in demand for this direct attach cables in this market.

Key Direct Attach Cable Company Insights

Some of the key companies in the direct attach cable market include Arista Networks, Inc., Cisco Systems, Inc., Cleveland Cable Company, Hitachi, Ltd, Juniper Networks, Inc., 3M, Finisar Corporation(Coherent Corp.), Avago Technologies Ltd (Broadcom) and others. To address the growing competition, major market participants in this industry have adopted strategies such as innovation, enhanced research & development, partnerships & collaborations with other organizations and geographical expansions.

-

Arista Networks, Inc., one of the prominent companies in the data-driven cloud networking technology industry, offers products related to optical transceivers, campus networks, and copper cables for data centers. The direct-attach cables portfolio includes All SFP+ Ports, all 25G SFP Ports, All 50GSFP, SFP-DD, and DSFP ports, All SFP-DD ports, All DSFP ports, All QSFP+ Ports, All QSFP100 Ports, All QSFP200 and QSFP-DD Ports, and more.

-

EMCORE Corporation, a company specializing in advanced inertial navigation products, offers its expertise and products to industries such as aerospace & defense, autonomous navigation, and others. The products offered by the company have applications in areas such as navigation and control, pointing & stabilization, positioning, aerospace, and defense.

Key Direct Attach Cable Companies:

The following are the leading companies in the direct attach cable market. These companies collectively hold the largest market share and dictate industry trends.

- Arista Networks, Inc.

- Cisco Systems, Inc.

- Cleveland Cable Company

- Hitachi, Ltd

- Juniper Networks, Inc.

- Methode Electronics

- Molex

- Nexans

- Panduit Corp.

- ProLabs Ltd

- Siemon

- 3M

- Avago Technologies, Ltd (Broadcom)

- EMCORE Corporation

- Finisar Corporation (Coherent Corp.)

- Shenzhen Gigalight Technology Co., Ltd.

- Sumitomo Electric Industries, Ltd.

- TE Connectivity

Recent Developments

-

In May 2024, Arista Networks, Inc. announced a technology showcase of AI Data Centers to merge compute and network domains into a unified AI entity in collaboration with NVIDIA. Using this, customers can standardize the configuration, management, and monitoring of AI clusters, networks, NICs, and servers to create efficient generative AI networks.

-

In January 2024, TE Connectivity (TE) launched new IEEE-certified compact elbow connectors. TE’s Raychem ELBA Asymmetric Compact Elbow Connector can reduce stacking length by 40%. An extended range and more options for installation enhance this reduced size. Only one standard body size can handle 1,500 Kcmil, allowing for a single unit instead of two, simplifying the design and installation process.

Direct Attach Cable Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.47 billion

Revenue forecast in 2030

USD 80.75 billion

Growth Rate

CAGR of 42.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form factor, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Brazil

Key companies profiled

Arista Networks, Inc.; Cisco Systems, Inc.; Cleveland Cable Company; Hitachi, Ltd; Juniper Networks, Inc.; Methode Electronics; Molex; Nexans; Panduit Corp.; ProLabs Ltd; Siemon; 3M; Avago Technologies, Ltd; (Broadcom); EMCORE Corporation; Finisar Corporation (Coherent Corp.); Shenzhen Gigalight Technology Co., Ltd.; Sumitomo Electric Industries, Ltd.; TE Connectivity

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Direct Attach Cable Market Report Segmentation

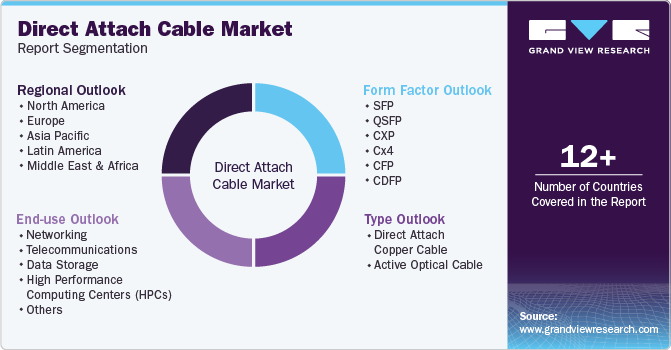

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global direct attach cable market report based on type, form factor, end-use, region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Attach Copper Cable

-

Passive Direct Attach Copper Cable

-

Active Direct Attach Copper Cable

-

-

Active Optical Cable

-

-

Form Factor Outlook (Revenue, USD Billion, 2018 - 2030)

-

SFP

-

QSFP

-

CXP

-

Cx4

-

CFP

-

CDFP

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Networking

-

Telecommunications

-

Data Storage

-

High Performance Computing Centers (HPCs)

-

Others (Consumer Electronics)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.