- Home

- »

- IT Services & Applications

- »

-

Disclosure Management Market Size, Industry Report, 2033GVR Report cover

![Disclosure Management Market Size, Share & Trends Report]()

Disclosure Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Business Function (Finance, Legal), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-638-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Disclosure Management Market Summary

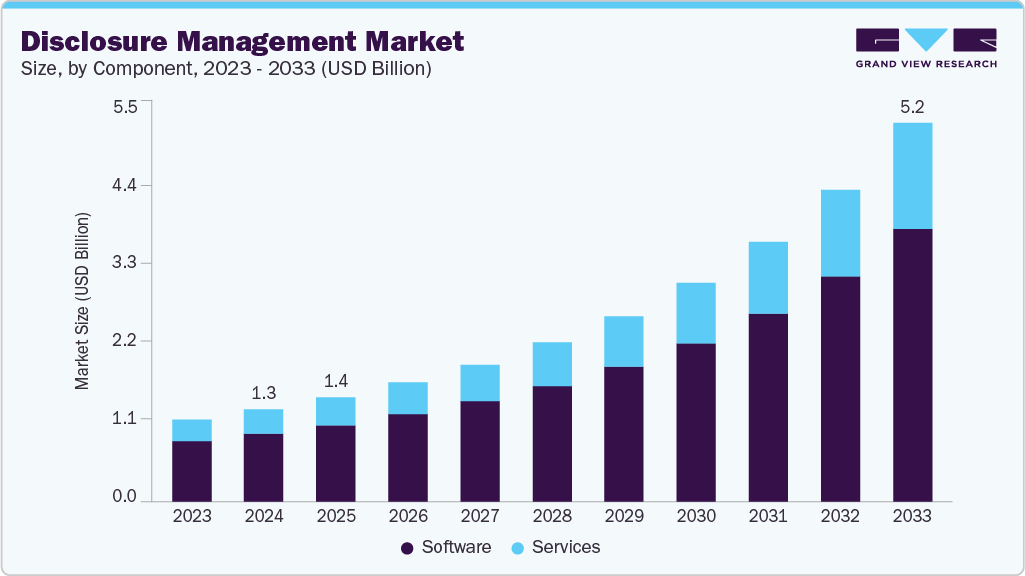

The global disclosure management market size was estimated at USD 1.28 billion in 2024 and is projected to reach USD 5.24 billion by 2033, growing at a CAGR of 17.4% from 2025 to 2033. The increasing adoption of XBRL (eXtensible Business Reporting Language) and other structured data formats by regulatory bodies worldwide catalyzes market growth.

Key Market Trends & Insights

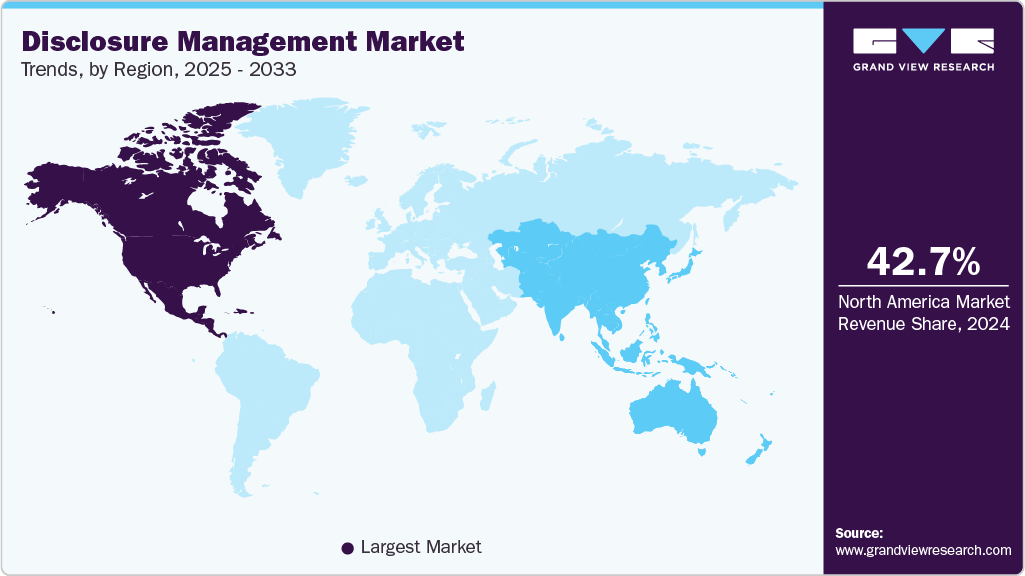

- North America held 42.7% revenue share of the global disclosure management market in 2024.

- In the U.S., the growing emphasis on environmental, social, and governance (ESG) reporting is accelerating the demand for disclosure management systems.

- By component, software segment held the largest revenue share of 73.5% in 2024.

- By business function, finance segment held the largest revenue share in 2024.

- By deployment, cloud segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.28 Billion

- 2033 Projected Market Size: USD 5.24 Billion

- CAGR (2025-2033): 17.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market in 2024

The market is being driven by the growing complexity and volume of regulatory compliance requirements across industries, especially in financial reporting and corporate governance. Organizations are under increasing pressure to adhere to a broad range of international and national regulations, such as the U.S. Securities and Exchange Commission (SEC) filings, European Single Electronic Format (ESEF), and International Financial Reporting Standards (IFRS). These frameworks demand precision, consistency, and timeliness in corporate disclosures. As a result, companies are turning to disclosure management solutions to automate the preparation, validation, and submission of regulatory reports, reducing manual effort and mitigating the risk of human error. This growing need for compliance accuracy and operational efficiency is a fundamental force propelling the adoption of disclosure management platforms.The evolution of internal reporting structures within organizations also contributes to market growth. As more companies adopt centralized finance functions and shared services models, the need for streamlined, collaborative reporting tools becomes critical. Disclosure management platforms support decentralized teams by providing a unified workspace where multiple users can contribute to, edit, and review reports in real-time. These solutions are particularly advantageous for large conglomerates or firms with international operations, as they allow for consistent formatting, messaging, and compliance practices across business units and jurisdictions. This centralized yet collaborative reporting capability is increasingly considered a strategic asset in global corporate environments.

In addition, the increasing frequency of corporate disclosures, from quarterly earnings and investor presentations to annual sustainability reports, has amplified the workload for finance and compliance teams. Manual preparation of such recurring reports is not only time-consuming but also susceptible to duplication of effort and data inconsistencies. Disclosure management tools, especially those with embedded data-linking functionalities, eliminate redundancies by automatically updating connected narrative sections and tables when source data changes. This ensures report accuracy while significantly reducing turnaround time. The ability to produce consistent and up-to-date disclosures under tight deadlines has become a competitive necessity, especially for publicly listed companies.

Furthermore, rising investor activism and stakeholder demand for greater corporate transparency are compelling organizations to improve the quality and frequency of their disclosures. Investors seek more granular information about risk exposures, executive compensation, tax transparency, and governance structures. Disclosure management solutions help organizations deliver this information in a structured, accurate, and timely manner, enabling improved stakeholder communication and enhanced corporate reputation. This growing demand for transparency is prompting firms to invest in technologies that facilitate narrative reporting, version control, and multi-user collaboration, all essential features of advanced disclosure management platforms.

Component Insights

The software segment dominated with a market share of 73.5% in 2024. The rise of cloud-based platforms and Software-as-a-Service (SaaS) models is a major factor propelling demand in the software segment. These cloud-native disclosure management solutions enable geographically distributed teams, especially in multinational corporations, to work concurrently on filings, access live data from enterprise resource planning (ERP) systems, and implement changes with full version control and audit trails. The flexibility and accessibility of these platforms make them particularly attractive to organizations with dynamic compliance needs and tight reporting timelines.

The services segment is projected to be the fastest-growing segment from 2025 to 2033. The growing reliance on managed services and outsourcing models drives the services segment growth. Organizations facing resource constraints, especially small and mid-sized firms, increasingly outsource disclosure management tasks to external experts. These services include outsourced report preparation, content formatting, compliance checks, and regulatory submissions. By outsourcing routine or technical aspects of the reporting process, organizations can focus on decision-making and stakeholder engagement while ensuring high-quality and timely filings. The increasing complexity of ESG and sustainability disclosures has particularly amplified this trend, as companies often need help navigating unfamiliar frameworks and reporting methodologies.

Business Function Insights

The finance segment dominated the disclosure management industry in 2024. The finance segment is a major contributor to market growth, driven by its critical need for accuracy, compliance, and transparency in financial reporting. Financial institutions, including banks, asset managers, insurance firms, and investment companies, operate in one of the most heavily regulated environments. These entities are subject to stringent and frequently updated disclosure mandates from regulatory bodies such as the U.S. Securities and Exchange Commission (SEC), the European Banking Authority (EBA), and other national regulators. Disclosure management platforms enable financial firms to streamline the preparation of highly detailed reports, ensure consistency in financial data, and meet tight filing deadlines, all while reducing the risk of human error and compliance breaches.

The legal security segment is projected to be the fastest-growing segment from 2025 to 2033. The rise of global operations and multinational regulatory compliance is also fueling the need for legal involvement in disclosure management. Companies listed in multiple jurisdictions often need to file reports in varying formats and languages, all while aligning with region-specific legal requirements. Legal departments require tools to track multiple document versions, facilitate multilingual compliance, and flag discrepancies or risks across jurisdictions. Disclosure management software with built-in localization, format validation, and multi-regulatory templates enables legal teams to efficiently manage cross-border disclosures without compromising legal accuracy or exposing the company to jurisdictional penalties.

Deployment Insights

The cloud segment dominated the disclosure management industry in 2024. The growing importance of ESG and integrated reporting has further enhanced the role of cloud-based systems. These disclosures typically require input from multiple departments and depend on data that resides in various systems across the organization. Cloud platforms allow seamless integration with ESG databases, ERP systems, and other business tools, enabling data-driven, narrative-rich reports that reflect the full spectrum of a company’s performance. This integration capability is especially valuable for multinational corporations that must comply with different sustainability frameworks and submit disclosures to multiple regulatory bodies.

The on-premise segment is projected to grow significantly from 2025 to 2033. The preference for predictable, one-time capital expenditure over recurring subscription-based operating costs drives the on-premise segment growth. Organizations with long-term IT investment strategies may choose to deploy on-premise systems to avoid the cumulative cost of cloud licensing fees, especially if they already possess robust in-house infrastructure. In such cases, the perceived financial advantages of owning and maintaining the system internally can be appealing, particularly for enterprises that expect to use the platform extensively across multiple reporting cycles and departments.

Enterprise Size Insights

The large enterprises segment dominated with a market share of over 59.0% in 2024. Large enterprises typically have the financial and technological resources to implement and maintain enterprise-grade disclosure management systems. They can invest in sophisticated, cloud-based or on-premise software solutions that offer scalability, customization, and advanced integration capabilities with other enterprise resource planning (ERP), performance management, and compliance platforms. This level of integration allows for automated data sourcing and validation, further streamlining reporting processes and reducing dependency on manual effort.

The small & medium enterprises (SMEs) segment is projected to be the fastest-growing segment from 2025 to 2033. The growing involvement of SMEs in international business and global value chains also contributes to the demand for disclosure management tools. SMEs participating in cross-border trade, foreign investments, or export-oriented markets must often adhere to multiple regulatory and financial disclosure standards. This includes complying with local tax authorities, international accounting frameworks, sustainability criteria from buyers, or investor due diligence checks. Disclosure management platforms help SMEs manage these multifaceted obligations more efficiently by consolidating data, supporting localization features, and ensuring timely and accurate reporting across jurisdictions.

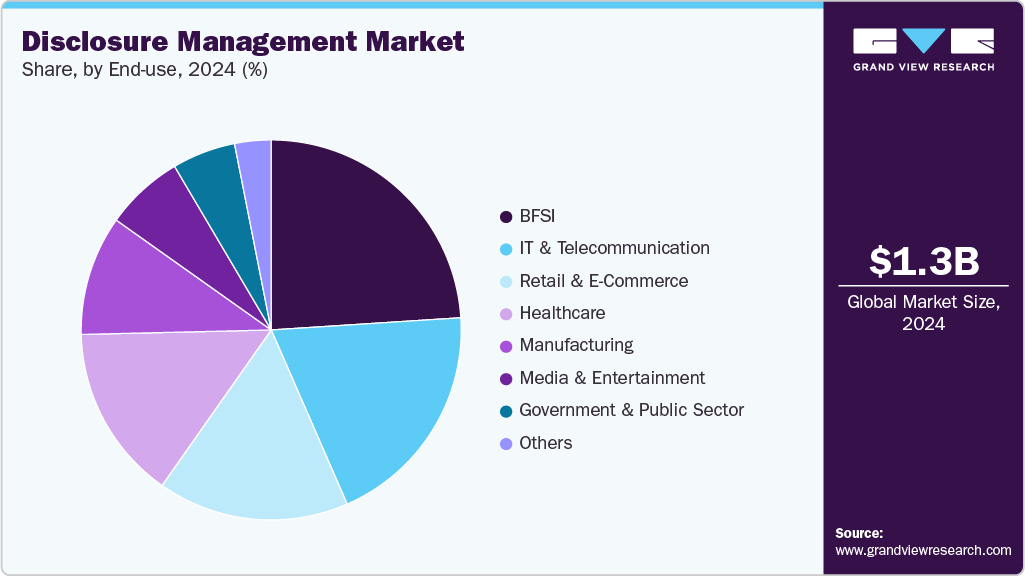

End-use Insights

The BFSI segment dominated the disclosure management industry in 2024. Globalization and cross-border financial activities have added layers of complexity to disclosure requirements. BFSI organizations operating in multiple jurisdictions face the challenge of adhering to diverse and sometimes conflicting regulatory standards. This has increased the reliance on adaptable disclosure management platforms that can accommodate different reporting templates, languages, and compliance rules. Such solutions reduce the burden on finance teams by providing a unified framework for managing disclosures across geographies, ensuring consistency, and reducing the risk of non-compliance penalties. The need to efficiently manage this multifaceted reporting environment continues to drive the adoption of innovative disclosure tools within the BFSI sector.

The retail and e-commerce segment is projected to be the fastest-growing segment from 2025 to 2033. The rise of omnichannel retailing adds complexity to financial reporting, further increasing reliance on advanced disclosure management solutions. Retailers operating across physical stores, online platforms, mobile apps, and third-party marketplaces face challenges reconciling data from these varied sources. This complexity can lead to discrepancies or delays in financial disclosures if managed manually. Automated disclosure management tools integrate and standardize these processes, ensuring that revenue, inventory, and expense data are accurately captured and reported regardless of the channel. Consolidating and verifying such multifaceted data is critical for timely regulatory filings and internal financial transparency, helping retailers avoid costly errors and penalties.

Regional Insights

In 2024, North America emerged as the largest regional market in the global disclosure management landscape, capturing a significant market share of 42.7%. The growing role of technology vendors and consulting firms in North America also influences the market dynamics for disclosure management. These service providers are actively promoting best practices, facilitating technology adoption, and customizing disclosure solutions to fit the unique needs of various industries, including financial services, healthcare, technology, and manufacturing. Their expertise helps companies implement scalable, compliant, and user-friendly systems, accelerating the transition from manual to automated disclosure processes. In addition, numerous technology innovators in the region foster continuous product enhancements, incorporating AI-driven analytics, natural language processing, and cloud-based collaboration features. This innovation cycle increases the attractiveness and usability of disclosure management tools, encouraging broader adoption across enterprises of all sizes.

U.S. Disclosure Management Market Trends

The disclosure management market in the U.S. is projected to grow during the forecast period. The market is driven by a stringent and dynamic regulatory environment that compels organizations to prioritize accurate, timely, and transparent financial reporting. Regulations such as the Sarbanes-Oxley Act (SOX), the Dodd-Frank Act, and the Securities and Exchange Commission (SEC) oversight create a complex compliance landscape, particularly for publicly traded companies. These entities must disclose detailed financial information and risk-related data in formats that are consistent, auditable, and accessible to regulators and investors. The necessity to comply with evolving accounting standards like U.S. GAAP, and now increasingly with ESG-related disclosure mandates, pushes organizations toward adopting advanced disclosure management platforms to ensure compliance while minimizing manual effort and error.

Asia Pacific Disclosure Management Market Trends

The disclosure management industry in Asia Pacific is expected to be the fastest-growing segment, with a CAGR of 19.8% from 2025 to 2033. The rise in domestic and international stock market participation across Asia Pacific creates a more investor-conscious business environment. As more individuals and institutions invest in listed companies throughout the region, there is greater demand for timely and high-quality financial disclosures. Investors seek clarity in quarterly earnings and risk exposure, debt levels, cash flow strength, and strategic forecasts. In this context, robust disclosure management systems become strategic assets, enabling companies to proactively share financial narratives that reflect resilience, growth, and responsibility. For firms aiming to attract foreign direct investment or partnerships with global firms, having sophisticated disclosure mechanisms in place is no longer a luxury but a necessity.

China disclosure management industry is projected to grow during the forecast period. China’s emphasis on digital government and e-governance contributes to the broader trend toward electronic reporting and automation. Public institutions and listed companies are under growing pressure to digitize internal processes, file reports electronically with regulators, and adopt standardized electronic formats such as XBRL (eXtensible Business Reporting Language). This digitization of the regulatory environment has compelled organizations to abandon traditional manual reporting in favor of agile disclosure management platforms that can produce machine-readable, regulator-friendly documents. As the Chinese government accelerates its push toward intelligent regulation and real-time supervision, disclosure management technology becomes not just a corporate tool but a necessary link in the nation’s digital regulatory infrastructure.

Europe Disclosure Management Market Trends

The disclosure management industry in Europe is expected to grow during the forecast period. The widespread adoption of the European Single Electronic Format (ESEF) catalyzes the market. Since 2020, all issuers in EU-regulated markets have been required to prepare their annual financial reports in ESEF using Inline XBRL (iXBRL) to tag financial statements. This technical requirement adds a new layer of complexity to financial reporting. It has prompted companies to adopt advanced disclosure tools capable of efficiently handling XBRL tagging, validation, and submission processes. Organizations that previously relied on spreadsheets or manual-intensive processes increasingly need to implement automated platforms that ensure accuracy, reduce compliance risk, and improve operational efficiency in preparing ESEF-compliant filings.

The UK disclosure management industry is expected to grow during the forecast period. The growing culture of public accountability in the UK, fueled by heightened media coverage, NGO activism, and societal expectations, makes disclosure a reputational priority. In areas such as gender pay reporting, carbon emissions transparency, and modern slavery statements, companies are reacting to legal mandates and voluntarily enhancing their disclosures to maintain public trust. The reputational risks of vague, delayed, or inconsistent reporting have led organizations to adopt disclosure solutions offering real-time updates, centralized approval mechanisms, and multi-format publishing capabilities. These systems ensure corporate messages are clear, synchronized across platforms, and aligned with the organization’s values and brand narrative.

Key Disclosure Management Company Insights

Some key companies operating in the market, including Oracle Corporation and NAVEX Global, Inc., are among the leading market participants.

-

Oracle Corporation is a global technology company specializing in enterprise software products and cloud-based solutions. Oracle provides a solution as part of its Oracle Enterprise Performance Management (EPM) Cloud suite. Oracle’s disclosure management tools are designed to help organizations streamline and automate the creation of complex financial disclosures, ensuring compliance with regulations such as IFRS, GAAP, and mandates like the SEC’s XBRL reporting requirements. By integrating financial data from multiple systems and maintaining a single source of truth, Oracle enables finance teams to manage the narrative and numeric aspects of financial reporting efficiently.

-

NAVEX Global is a provider of integrated risk and compliance management solutions. Its disclosure management offerings center around addressing conflicts of interest (COI), a critical aspect of organizational integrity and compliance. Its flagship solution, NAVEX One Disclosure Management Market, provides a centralized platform for organizations to collect, track, and analyze COI disclosures from employees and third parties. This tool automates the disclosure process, reducing manual efforts and minimizing errors.

SAI360 INC. and Prophix Software Inc. are some emerging market participants.

-

SAI360 Inc. provides Governance, Risk, and Compliance (GRC) solutions. SAI360's Disclosure Management module is a key component of its GRC platform, designed to streamline collecting, tracking, and managing employee attestations and disclosures. By embedding disclosure processes within ethics and compliance training, SAI360 ensures that employees can disclose pertinent information seamlessly during their learning experience, thereby improving completion rates and participation.

-

Prophix Software Inc. provides corporate performance management (CPM) solutions. A key component of Prophix's disclosure management solution is its partnership with IRIS CARBON, a pioneer in business and financial regulatory reporting. This collaboration allows Prophix to offer a comprehensive solution that combines Prophix's financial performance management capabilities with IRIS CARBON's expertise in disclosure management.

Key Disclosure Management Companies:

The following are the leading companies in the disclosure management market. These companies collectively hold the largest market share and dictate industry trends.

- Donnelley Financial Solutions (DFIN)

- Lucanet AG

- Naehas

- NAVEX Global, Inc.

- Oracle Corporation

- Prophix Software Inc.

- SAI360 INC.

- SAP SE

- Wolters Kluwer N.V.

- XBRL US, Inc.

Recent Developments

-

In September 2024, Thomson Reuters partnered with SAP SE to launch a product integration to assist customers with environmental, social, and governance (ESG) reporting, helping multinational corporations more easily comply with evolving regulations. This integration will combine Thomson Reuters ONESOURCE Statutory Reporting with SAP Sustainability Control Tower, allowing customers to efficiently prepare, collect, and submit ESG data through a single, streamlined platform.

-

In May 2024, Naehas partnered with Itea P2B AB, enabling banks to access enhanced functionalities by integrating Itea P2B’s billing capabilities within Naehas’ flexible architecture. Together, especially in the U.S. and Canadian markets, Naehas’ enterprise solutions for product and pricing, offer management, and disclosure management, combined with Itea P2B’s billing expertise, deliver a comprehensive customer experience ecosystem. This collaboration underscores both companies’ dedication to helping banks deliver outstanding customer service.

Disclosure Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.45 billion

Revenue forecast in 2033

USD 5.24 billion

Growth rate

CAGR of 17.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, business function, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Oracle Corporation; SAP SE; Wolters Kluwer N.V.; NAVEX Global, Inc.; Lucanet AG; XBRL US, Inc.; Naehas; Prophix Software Inc.; SAI360 INC.; Donnelley Financial Solutions (DFIN)

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disclosure Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global disclosure management market report based on component, business function, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

Business Function Outlook (Revenue, USD Million, 2021 - 2033)

-

Finance

-

Legal

-

Marketing and Communication

-

Procurement

-

Human Resources

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

IT and Telecommunications

-

Government and Public Sector

-

Energy and Utilities

-

Manufacturing

-

Retail and E-commerce

-

Media & Entertainment

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global disclosure management market size was estimated at USD 1.28 billion in 2024 and is expected to reach USD 1.45 billion in 2025.

b. The global disclosure management market is expected to grow at a compound annual growth rate of 17.4% from 2025 to 2033 to reach USD 5.24 billion by 2033.

b. The software segment dominated the disclosure management market with a market share of 73.5% in 2024. The rise of cloud-based platforms and Software-as-a-Service (SaaS) models is a major factor propelling demand in the software segment.

b. Some key players operating in the market include Oracle Corporation, SAP SE, Wolters Kluwer N.V., NAVEX Global, Inc., Lucanet AG, XBRL US, Inc., Naehas, Prophix Software Inc., SAI360 INC., Donnelley Financial Solutions (DFIN)

b. Factors such the increasing adoption of XBRL and other structured data formats by regulatory bodies worldwide and the growing emphasis on environmental, social, and governance (ESG) reporting plays a key role in accelerating the Disclosure management market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.