- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Dispersing Agents Market Size, Share, Industry Report, 2033GVR Report cover

![Dispersing Agents Market Size, Share & Trends Report]()

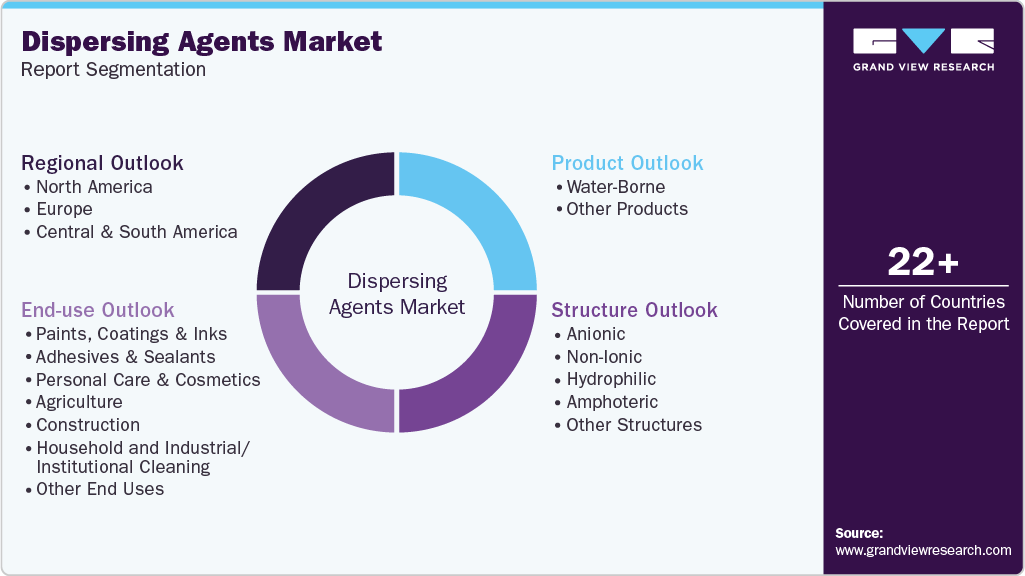

Dispersing Agents Market (2026 - 2033) Size, Share & Trends Analysis Report By Product, By Structure (Anionic, Non-ionic, Hydrophilic, Amphoteric), By End-use (Paints, Coatings, & Inks, Agriculture, Construction, Adhesives & Sealants), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-124-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dispersing Agents Market Summary

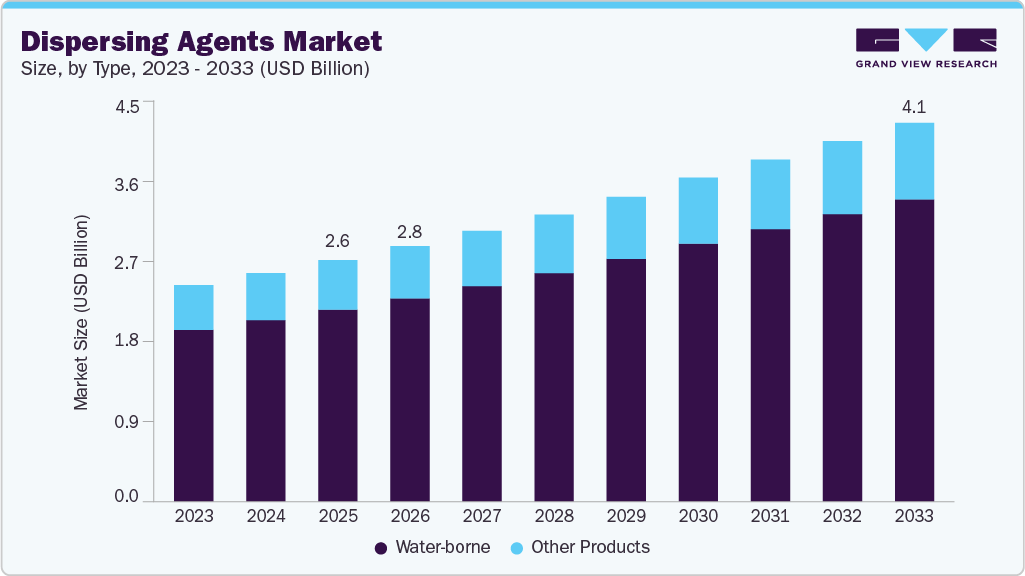

The global dispersing agents market size was estimated at USD 2,598.5 million in 2025 and is projected to reach USD 4,077.3 million by 2033, growing at a CAGR of 5.8% from 2026 to 2033. This growth is attributed to the rising application of dispersing agents in the paints, coatings, and inks industry, coupled with increasing construction activities across the globe.

Key Market Trends & Insights

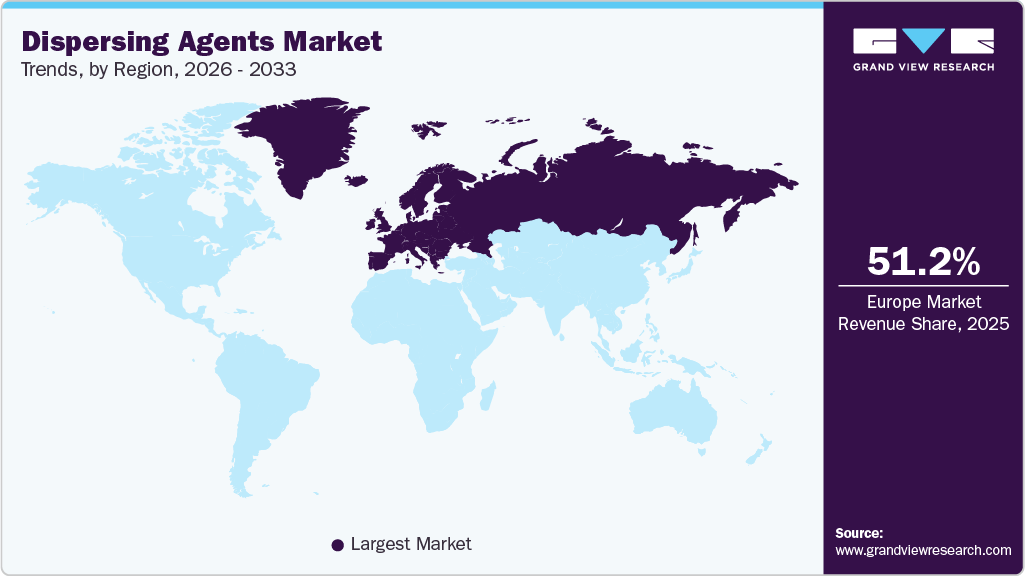

- Europe dominated the global dispersing agents market with the largest revenue share of 51.2% in 2025.

- The dispersing agents market in Germany led Europe in 2025.

- By product, the water-borne segment held the largest revenue share of 79.5% in 2025.

- By structure, the anionic segment led the market, accounting for the largest revenue share of 38.4% in 2025.

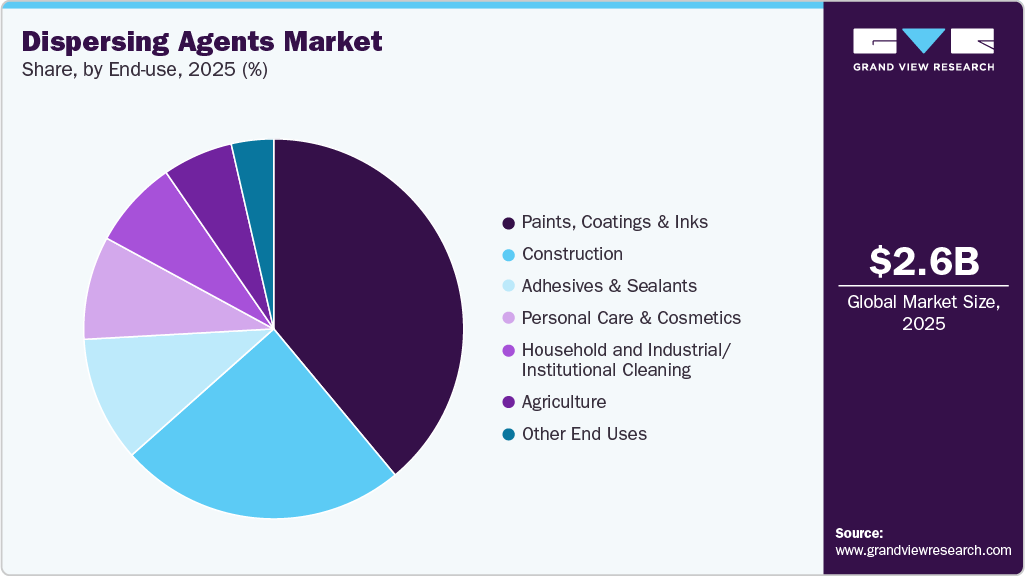

- By end-use, the paints, coatings, and inks segment held a dominant position in the market, accounting for the largest revenue share of 39.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2,598.5 Million

- 2033 Projected Market Size: USD 4,077.3 Million

- CAGR (2026-2033): 5.8%

- Europe: Largest market in 2025

Dispersing agents play a critical role in the paints and coatings industry by enhancing the performance and stability of the final product. These agents help prevent pigment agglomeration or settling, ensuring uniform dispersion and consistent color quality.The construction industry continues to witness significant growth, supported by increased infrastructure development, urbanization, and renovation activities worldwide. Dispersing agents play an essential role in construction materials such as paints, coatings, adhesives, and sealants by improving the dispersion of pigments and solid particles, thereby enhancing performance, durability, and aesthetic properties. In addition, ongoing technological advancements in construction materials are leading to the development of high-performance formulations that require efficient dispersion of additives and fillers, which is expected to drive market demand over the forecast period.

The market is further supported by rising demand from both established and emerging end-use industries, including oil and gas, paper, paints and coatings, detergents, pharmaceuticals, agriculture, automotive, and others. The increasing adoption of dispersing agents across these sectors reflects the growing need for improved material dispersion, stability, and formulation efficiency in complex industrial processes.

The automotive industry represents a key end-use segment contributing to market growth. According to the International Trade Administration, the U.S. remains one of the largest automotive markets globally and ranks second in vehicle production and sales. Rising automotive production and refinishing activities are expected to support demand for dispersing agents over the forecast period, as these additives play a critical role in achieving uniform dispersion of pigments, fillers, and other components in automotive coatings, ensuring consistent color, enhanced durability, and improved performance.

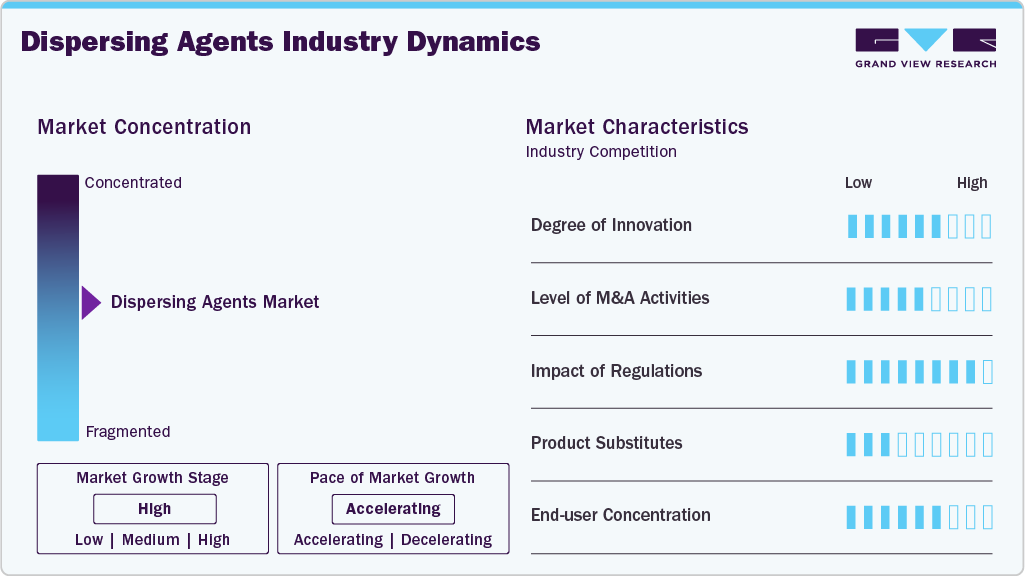

Market Concentration & Characteristics

The global dispersing agents market is moderately fragmented, characterized by the presence of multinational chemical companies alongside regional specialty additive manufacturers. These players benefit from established distribution networks, strong relationships with end-use industries, and diversified product portfolios catering to coatings, construction, plastics, and agrochemical applications. Key participants are increasingly focusing on capacity expansions, investments in advanced formulation technologies, and development of high-performance and sustainable dispersing solutions to strengthen their competitive positioning in the global dispersing agents market.

Leading players in the global dispersing agents market are adopting a combination of capacity expansion, product innovation, strategic collaborations, and sustainability-driven initiatives to strengthen their market presence. Companies active across specialty chemicals, additives, and formulation solutions are investing in advanced dispersion technologies, performance-enhancing chemistries, and next-generation dispersing agents to improve stability, compatibility, and efficiency across end-use applications. To address rising demand across Asia Pacific and Central and South America, several market participants are expanding manufacturing capabilities, strengthening regional distribution networks, and collaborating closely with formulators and end-use industries to support localized supply needs and application-specific performance requirements.

Product Insights

The water-borne segment dominated the market, accounting for the largest revenue share of 79.5% in 2025. This dominance is attributed to the growing demand for sustainable and environmentally friendly products across industries such as paints, coatings, and inks. Water-borne dispersing agents support the development of eco-friendly formulations, as they are typically surfactants or polymeric compounds with hydrophilic properties that enable interaction with water molecules. These agents contain functional groups capable of adsorbing onto particle surfaces, reducing interfacial tension between particles and the liquid medium. As a result, particles are more easily dispersed and effectively prevented from agglomeration or settling.

Other dispersing agent types, including solvent-borne and oil-borne variants, are expected to grow at a CAGR of 5.6% over the forecast period. Solvent-borne dispersing agents are designed to disperse solid particles in solvent-based systems and are composed of organic compounds with high solubility in the formulation solvent, thereby improving performance and enhancing the durability of the final product. Oil-borne dispersing agents, on the other hand, are specifically formulated for oil-based systems and are widely used to disperse pigments and solid particles in oil-based paints, varnishes, and coatings.

Structure Insights

The anionic segment led the market, accounting for the largest revenue share of 38.4% in 2025. This dominance is attributed to the wide range of applications of anionic dispersing agents across paints, coatings, inks, adhesives, and ceramics. These agents offer excellent dispersion stability by preventing particle agglomeration or settling, resulting in improved color development, reduced viscosity, and enhanced overall performance of the final product. Furthermore, anionic dispersing agents are particularly well-suited for water-based systems, which are increasingly preferred due to tightening environmental regulations and growing health and safety concerns. Their effectiveness in dispersing pigments and additives in water-based coatings, inks, and related formulations continues to support strong demand.

The non-ionic segment is expected to grow at a CAGR of 5.9% over the forecast period, driven by broad compatibility with various charged molecules and relatively low toxicity. These characteristics make non-ionic dispersing agents suitable for diverse applications, including textiles, pharmaceuticals, and personal care products. In addition, their ability to stabilize emulsions under extreme conditions and enhance dispersion efficiency in paints, coatings, and inks contributes to increasing adoption. The ongoing shift toward eco-friendly and bio-based formulations, along with regulatory pressures favoring sustainable chemical solutions, is further accelerating demand for non-ionic dispersing agents.

The amphoteric segment is also expected to witness notable growth during the forecast period. Amphoteric dispersing agents possess both hydrophilic and hydrophobic properties, enabling them to interact effectively with both water-based and non-polar systems. Unlike purely hydrophilic or hydrophobic dispersants, amphoteric agents contain functional groups that can ionize under both acidic and alkaline conditions, typically derived from amino acid-based structures such as glycine or betaine. This dual-charged nature allows them to interact with a wide range of particles regardless of surface charge.

Also, amphoteric dispersing agents provide stabilization through a combination of electrostatic and steric mechanisms. Upon adsorption onto particle or droplet surfaces, they form a protective layer that prevents agglomeration or coalescence. Electrostatic stabilization arises from interactions between charged functional groups and particle surfaces, while steric stabilization is achieved as hydrophilic or hydrophobic segments extend into the surrounding medium, creating repulsive barriers between particles. This dual stabilization mechanism supports improved dispersion stability across diverse formulation environments.

End-use Insights

The paints, coatings, and inks segment held a dominant position in the market, accounting for the largest revenue share of 39.0% in 2025. This dominance is attributed to the critical role dispersing agents play in the formulation and production of paints, coatings, and inks. These agents enhance the dispersion of pigments, fillers, and other solid particles, ensuring uniform and stable distribution within the system. By breaking down pigment agglomerates, dispersing agents improve color uniformity, enhance hiding power, and minimize pigment settling or flocculation.

Dispersing agents are also extensively used in the inks industry to achieve optimal color strength, fine particle dispersion, and high print quality. Inks used in digital printing, flexography, gravure, and other printing processes rely on efficient pigment and dye dispersion to ensure consistent performance and process stability. Beyond inks, dispersing agents are widely applied across adhesives & sealants, personal care & cosmetics, agriculture, construction, and household and industrial/institutional cleaning applications, where they help improve formulation stability, enhance active ingredient distribution, and optimize product performance. Their versatility across diverse formulations and operating conditions continues to support adoption across a broad range of other end-use industries.

The construction segment is expected to grow at a CAGR of 6.0% over the forecast period. One of the key application areas for dispersing agents within this segment is concrete production, where these additives play a vital role in enhancing workability and pumpability by improving the dispersion and flow characteristics of cement particles. Improved dispersion enables easier placement and consolidation of concrete, reduces the requirement for excess water, and contributes to higher strength and durability of the final structure. In addition, dispersing agents help regulate the cement hydration process, prevent the formation of undesirable agglomerates, and promote uniform and consistent setting. These performance benefits result in improved compressive strength, reduced shrinkage, and enhanced resistance to cracking, supporting their growing adoption in modern construction practices and infrastructure projects worldwide.

Regional Insights

Europe dominated the global dispersing agents market, accounting for the largest revenue share of 51.2% in 2025. This dominance is driven by the region’s strong emphasis on sustainable and eco-friendly manufacturing practices. Stringent regulatory frameworks aimed at reducing VOC emissions continue to encourage the adoption of water-based dispersing agents across multiple industries. Rising demand from key end-use sectors such as automotive, construction, and packaging further supports market growth in the region. In addition, ongoing innovation in green chemistry, coupled with increasing investments in infrastructure development, is contributing to sustained demand for dispersing agents. The growing shift toward renewable and environmentally compliant materials in industrial formulations is also enhancing the adoption of advanced dispersing solutions across Europe over the forecast period.

Germany Dispersing Agents Market Trends

The dispersing agents market in Germany led Europe in 2025, supported by its strong automotive and industrial coatings industries. The country’s focus on precision manufacturing drives demand for high-performance dispersing agents that improve formulation consistency, durability, and surface quality. Ongoing advancements in nanotechnology and increased R&D activities are fostering product innovation, while stringent environmental regulations are encouraging the adoption of low-toxicity and environmentally compliant dispersing solutions. Growing demand for high-quality paints, coatings, and adhesives continues to reinforce the need for advanced dispersion technologies across German industrial applications.

North America Dispersing Agents Market Trends

The dispersing agents market in North America is projected to expand at a CAGR of 5.6% during the forecast period. The region has experienced strong growth in the paints and coatings sector, supported by rising residential and commercial construction activities. As both consumers and industrial users increasingly favor environmentally friendly and high-performance coating solutions, demand for dispersing agents continues to increase.

The U.S. dispersing agents market dominated North America, accounting for the largest revenue share in 2025, driven by growing construction activity, oil and gas exploration, and chemical manufacturing output. The widening application of dispersing agents in concrete admixtures, paints, and lubricants highlights the rising need for performance-enhancing chemical solutions. Increasing awareness of sustainable products is encouraging manufacturers to develop low-VOC and biodegradable dispersing agents. In addition, expanding industrial production and infrastructure investments are supporting long-term market demand, while ongoing technological advancements are improving dispersion efficiency across diverse applications.

Central and South America Dispersing Agents Market Trends

The dispersing agents market in Central and South America is expected to witness steady growth over the forecast period, supported by increasing industrial activity across key economies such as Brazil, and other countries. Expanding manufacturing operations in the region are driving demand for dispersing agents across industries, including paints and coatings, construction materials, plastics, and pharmaceuticals. These agents play a critical role in improving dispersion efficiency and formulation stability, thereby enhancing product quality, process consistency, and performance across a broad range of industrial applications.

Key Dispersing Agents Company Insights

The market is characterized by intense competition, where companies are engaged in expanding their regional presence via different strategic initiatives. Strategic partnerships, capacity expansions, collaborations, and new product developments are other popular strategies adopted by the manufacturers to maintain and further expand their market share from a global perspective.

-

BASF SE manufactures polymeric, oligomeric, and surfactant-based dispersing agents designed for water-based, solvent-based, high solids, and 100% solids systems. Operating primarily in the industrial solutions segment, BASF focuses on enhancing product performance through innovative technologies like controlled free radical polymerization, improving viscosity, color intensity, and stability in various applications.

-

Arkema develops and manufactures advanced materials and chemical solutions, including dispersing agents used in coatings, adhesives, and construction materials. The company operates in segments such as specialty chemicals and industrial materials, providing products that improve pigment dispersion, stability, and rheology in formulations.

Key Dispersing Agents Companies:

The following are the leading companies in the dispersing agents market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Arkema

- Kemira

- Solvay S.A.

- Altana AG

- Dow

- Evonik Industries AG

- Clariant

- Uniqchem

- Rudolf GmbH

- The Lubrizol Corporation

- Italmatch CSP

- Nouryon

- SNF

Recent Developments

-

In March 2025, Evonik announced its participation at the European Coatings Show 2025, highlighting innovative solutions for coatings, printing inks, and adhesives. ORTEGOL DA 801, a polyurethane-based thermal interface material dispersing agent, reduces formulation viscosity and ensures thermal conductivity in electric vehicle batteries.

-

In April 2024, BASF announced the launch of a next-generation solvent-based dispersing agent, Efka PX 4360. Utilizing CFRP technology, this dispersing agent offers superior performance, durability, and storage stability.

Dispersing Agents Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2,749.5 million

Revenue forecast in 2033

USD 4,077.3 million

Growth rate

CAGR of 5.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, structure, end-use, region

Regional scope

North America; Europe; Central and South America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Brazil; Argentina;

Key companies profiled

BASF SE; Arkema; Kemira; Solvay S.A.; Altana AG; Dow; Evonik Industries AG; Clariant; Uniqchem; Rudolf GmbH; The Lubrizol Corporation; Italmatch CSP; Nouryon; SNF

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dispersing Agents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2033. For this study, Grand View Research has segmented the global dispersing agents market report based on product, structure, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Water-Borne

-

Other Products

-

-

Structure Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Anionic

-

Non-Ionic

-

Hydrophilic

-

Amphoteric

-

Other Structures

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Paints, Coatings & Inks

-

Adhesives & Sealants

-

Personal Care & Cosmetics

-

Agriculture

-

Construction

-

Household and Industrial/Institutional Cleaning

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.