- Home

- »

- Medical Devices

- »

-

Disposable Syringes Market Size, Industry Report, 2033GVR Report cover

![Disposable Syringes Market Size, Share & Trends Report]()

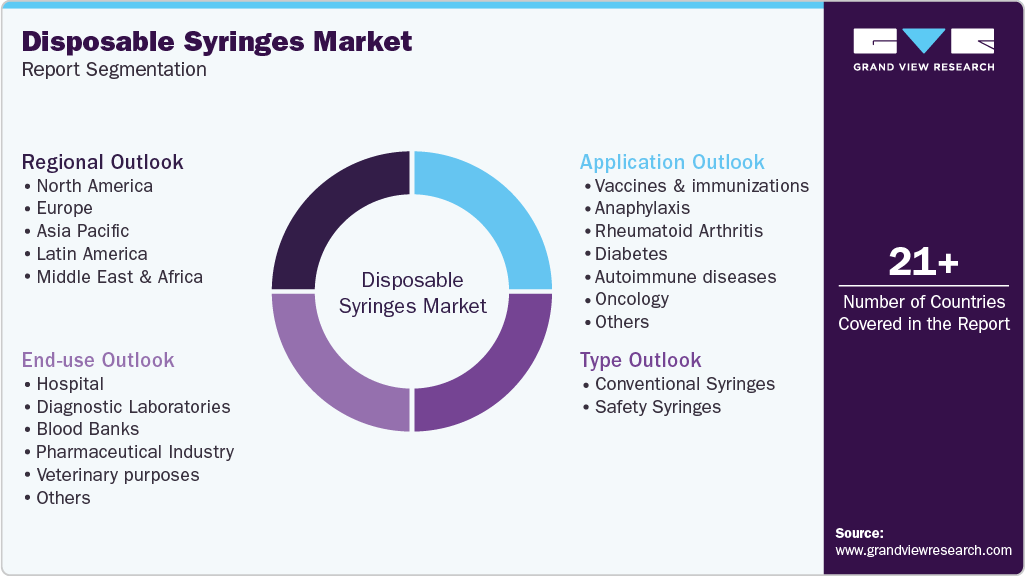

Disposable Syringes Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Conventional Syringes, Safety Syringes), By Application (Vaccines and immunizations, Anaphylaxis), By End Use (Hospital, Diagnostic Laboratories), By Region, And Region Forecasts

- Report ID: GVR-1-68038-219-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Disposable Syringes Market Summary

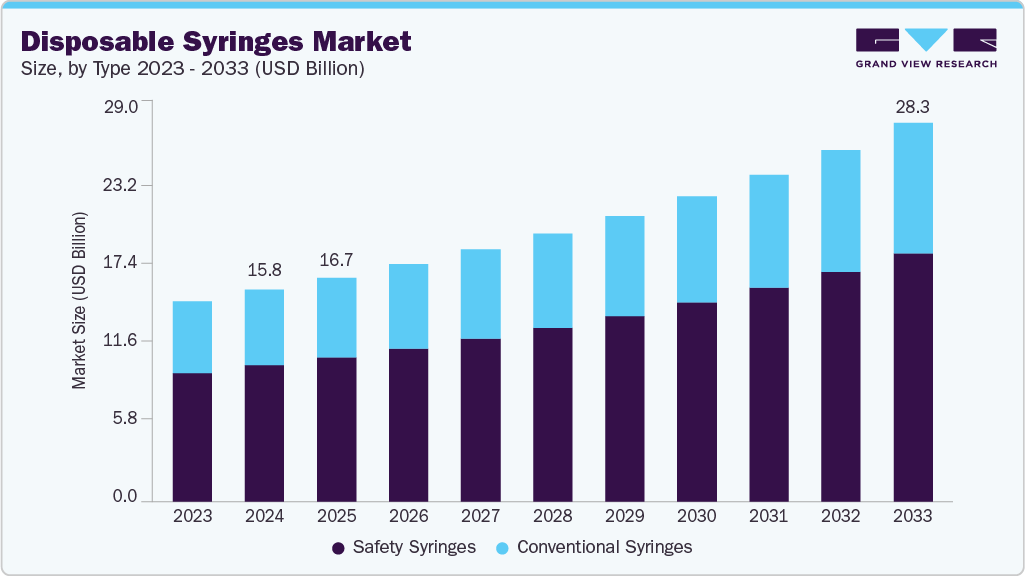

The global disposable syringes market size was estimated at USD 15.81 billion in 2024 and is projected to reach USD 28.27 billion by 2033, growing at a CAGR of 6.8% from 2025 to 2033. The growth can be attributed to the increasing incidence of chronic diseases and rising technological advancements.

Key Market Trends & Insights

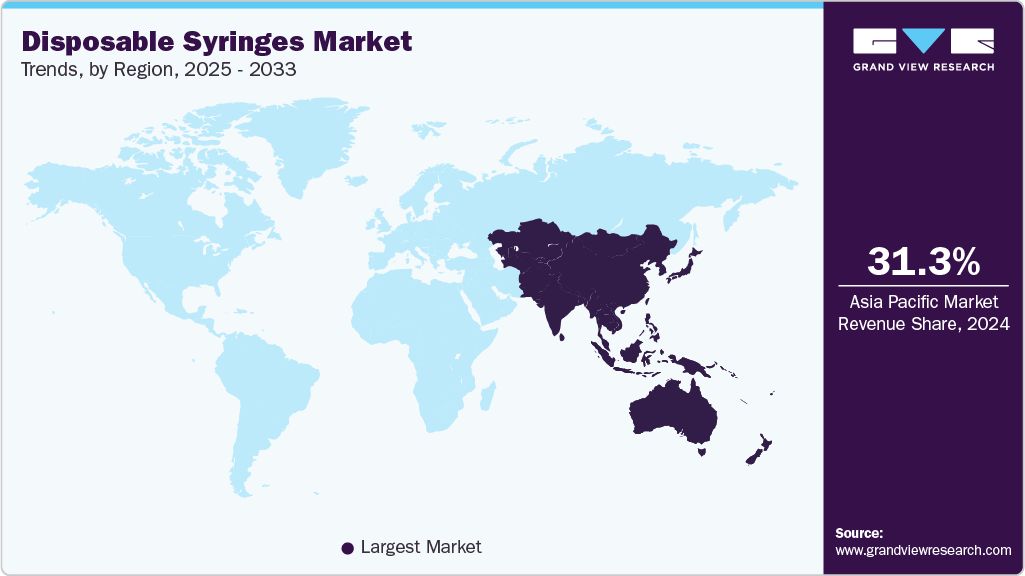

- Asia Pacific dominated the disposable syringes market with the largest revenue share of 31.28% in 2024.

- By application, the vaccines and immunizations segment led the market with the largest revenue share of 25.92% in 2024.

- Based on type, the safety syringes segment is anticipated to witness the fastest growth in the coming years.

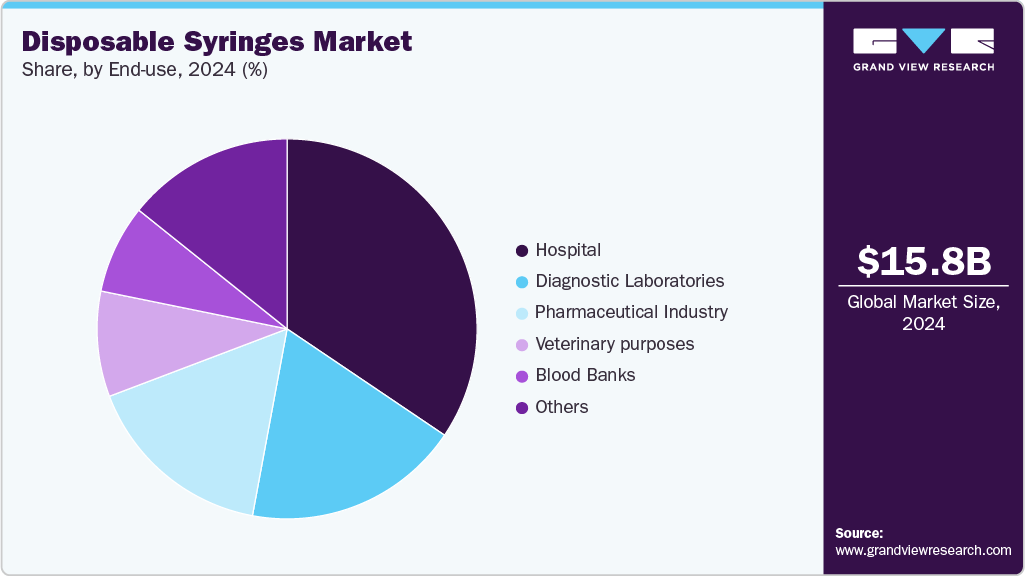

- By end use, the hospitals segment led the market with the largest revenue share of 34.45% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.81 Billion

- 2033 Projected Market Size: USD 28.27 Billion

- CAGR (2025-2033): 6.8%

- Asia Pacific: Largest market in 2024

Moreover, the growing adoption of safety syringes and the rising prevalence of diabetes are anticipated to drive market growth. According to the International Diabetes Federation (IDF), around 853 million individuals will have diabetes by 2050.Furthermore, supportive initiatives from manufacturers and the government to encourage the use of disposable syringes are anticipated to fuel the market growth in the coming years. For instance, in March 2024, Hindustan Syringes and Medical Devices, a manufacturer of auto-disable and disposable syringes, introduced the Dispojekt single-use syringe to protect against needlestick injuries.

Moreover, the government of India has undertaken the manufacturing of disposable syringes, which is under development in Assam. This project costs around USD 0.63 million. Thus, the rising focus of the government on syringe manufacturing and growing expenditures for increasing syringe production are anticipated to boost the market growth over the forecast period.

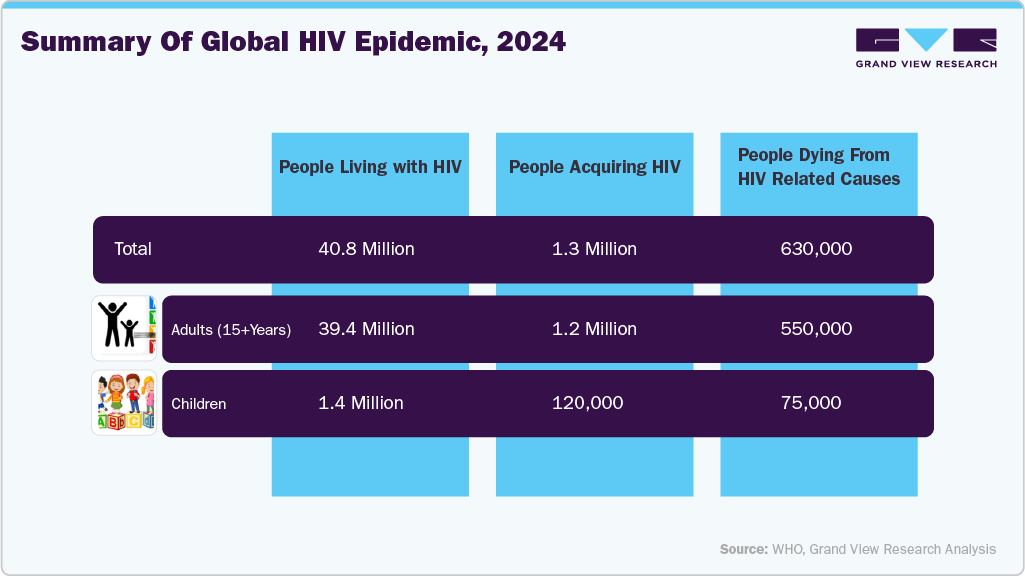

In addition, reusing of syringes leads to the risk of contracting Hepatitis B, Hepatitis C, HIV, and many other blood-borne pathogens. The high burden of infectious diseases, such as HIV infection, which may be acquired via reused injectables among people, likely to increase the demand for disposable syringes. This, in turn, is anticipated to propel market growth over the forecast period. According to the study published by the National Library Of Medicine in May 2023, the sharing of needles/syringes is positively associated with HIV infection. Hence, to prevent the spread of such infections, the adoption of disposable syringes is anticipated to increase, thus contributing to the market's growth.

A high burden of HIV among adults and children can significantly increase the demand for disposable syringes. Reusing or sharing needles and syringes is a highly efficient way of HIV transmission. Among people who inject drugs, the risk of infection can be significantly reduced by consistently using new, disposable needles and syringes. As more individuals require treatments and other medical care involving injections, healthcare systems must ensure safe and hygienic practices. This growing need drives the expansion of disposable syringe production and distribution.

Furthermore, disposable syringes are used by diabetes patients. Diabetic patients require insulin, and insulin syringes are disposable. Major companies such as BD, and Hindustan Syringes & Medical Devices Ltd (HMD) offer single-use insulin syringes in various sizes. For instance, HMD offers two brands of single-use insulin syringes, i.e., DISPO VAN INSULIN SYRINGE and Single-use Insulin syringes. The insulin syringes from manufacturers are also available with Luer-Lok tips to provide a locked connection quickly. Thus, with the rising prevalence of diabetes till 2050, the demand for single-use insulin syringes is anticipated to drive the market growth.

Key Opinion Leaders

Company Name

KOLs

Growth Opportunities

Executive Director, Sohail Nath,

Hindustan Syringes and Medical Devices (HMD)

“HMD believes in delivering the best at the most competitive costing. Dispojekt safety needle syringes are going to be the game changer in the Global fight against NSIs. We are aiming to initially produce 200 million syringes and needles per annum, for which we have invested approximately Rs 70 crore (USD 8.15 million) in the first phase. In the second phase, we will increase the capacity to 300 million pieces per annum by investing another Rs 10 crore to Rs 15 crore (USD 1.75 million).”

- Rising Demand for Safety Syringes

- Expansion in Emerging Markets

Lee Woo Jun, the president of Hwajin Medical

"With the FDA's approval, our products, which focused on the domestic market, will be exported to the world including the U.S. in the long term. As Hwajin’s Sofjec is also expected to be used for the COVID19 vaccine 'Nanocovax', which HLB has recently gained the global rights, its growth is likely to continue.”

- Regulatory Authorization

Lee Gwang-hee, Vice President of HLB Life Science's Medical Device Division.

"With this product approval, we can now fully enter the U.S. market,In the short term, we will generate profits through exports, and in the mid to long term, we aim to become the number one company in Korea's syringe industry,"

- Entry into the U.S. Market

- Expansion of Market Share in Korea

- Leverage Regulatory Approval

Source: Grand View Research Analysis

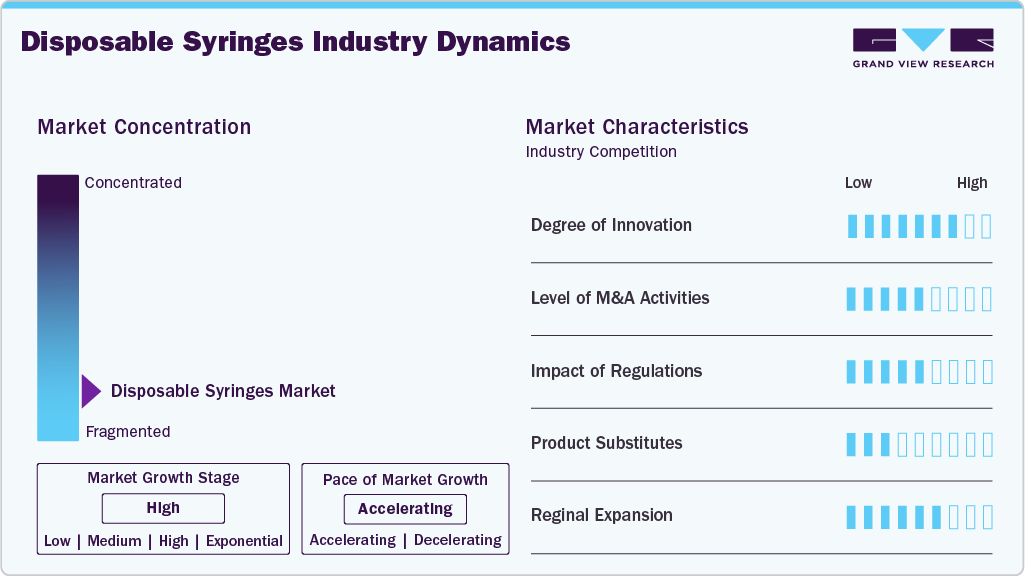

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The disposable syringes market is characterized by a high degree of growth owing to growing cases of chronic and infectious conditions and the increasing focus of manufacturers on expanding the manufacturing of disposable syringes.

Degree of Innovation: Innovation in disposable syringes is driven by safety and efficiency, with trends focusing on auto-disable mechanisms, retractable needles, and needle-stick injury prevention. Smart syringes with digital dose tracking and tamper-proof designs are anticipated to gain traction. Eco-friendly materials and sustainable manufacturing processes are also emerging, addressing environmental concerns while enhancing global health safety and compliance with evolving medical standards.

Regulatory bodies such as the Food and Drug Administration (FDA) and other agencies set quality and safety standards for medical equipment, including disposable syringes. The authorities also issue warning documents for potentially hazardous products or for not adhering to safety standards. For instance, in March 2024, the FDA warned about the unauthorized syringes from two Chinese distributors. Such instances can impact market growth.

Depending on the type of treatment, infusion pumps, transdermal patches, and oral or nasal drug delivery methods offer alternatives. These options may reduce infection risks, improve convenience, or enhance patient comfort in specific healthcare settings.

Manufacturers and companies operating in the industry are focusing on expanding their presence in numerous countries by gaining approvals from regulatory authorities. For instance, in August 2021, HLB subsidiary Hwajin Medical announced that its disposable syringe "Sofjec" received approval from the U.S. FDA. Such approvals and expansions likely to boost market growth in the coming years.

Type Insights

The safety syringes segment dominated the disposable syringes market in 2024 and witnessing the fastest growth with a CAGR of 7.0% over the forecast period. Safety syringes are needed for most therapeutic and diagnostic approaches for chronic disorders since they are crucial during medication administration and tests, resulting in a rising product demand. Companies are focusing on acquiring approvals for safety syringes and needles. For instance, in February 2023, Zephyrus Innovations, a manufacturer of medical devices, received the U.S. FDA approval for its Aeroject 3ml safety syringe. Thus, the rising approvals for safety syringes are anticipated to boost the segment demand in the coming years.

The conventional syringe segment is expected to grow significantly during the forecast period. Conventional syringes are the most commonly practiced syringes and utilized in home care settings. For instance, conventional single-use syringes ensure protection for the patient receiving the injection. Moreover, the availability of conventional injectables from major industry participants such as BD is anticipated to drive the segment growth in the coming years.

Application Insights

The vaccines and immunizations segment dominated the disposable syringes market in 2024, capturing the largest share of 25.92%. The increasing adoption of disposable injectables for vaccination and immunization is anticipated to boost the segment growth in the coming years. Manufacturers have supplied many syringes to strengthen the vaccination drive during the COVID-19 pandemic. For instance, an article published by the Indian Pharma Post in June 2023 reported that Hindustan Syringes & Medical Devices Ltd (HMD) provided 1.75 billion syringes out of the 13.3 billion COVID-19 vaccines administered globally. This means that over 13% of COVID-19 shots worldwide were given using HMD's Kojak Selinge Auto Disable (AD) Syringes, equating to nearly 1 in every 7-8 people receiving their vaccine through HMD's syringe. Such an increase in the supply of disposable injectables for vaccination is anticipated to propel the segment growth in the coming years.

Oncology segment is expected to register the fastest growth during the forecast period. The growth of the oncology segment can be attributed to the rising prevalence of cancer across the globe, coupled with the growing need for diagnosis and treatment of this deadly disease. According to the Union for International Cancer Control (UICC), around 10 million individuals die each year from cancer. Moreover, as per the article published by the WHO in February 2024, more than 35 million new cancer patients are forecasted in 2050, with a 77% growth from the evaluated 20 million cases in 2022. Thus, the large number of individuals who have cancer is anticipated to propel the segment growth in the coming years.

End Use Insights

The hospital segment dominated the disposable syringes market in 2024, accounting for the largest share of 34.45%. Patients prefer hospitals for treatment due to their established trust and convenient accessibility. Hospitals also offer fluid therapy, which administers fluids to patients’ bodies subcutaneously or intravenously. As a result, the demand for dispersing injectables in hospitals continues to rise. Therefore, the demand for syringes in hospitals continues to rise.

The other segment is expected to register the fastest CAGR during the forecast period. It includes ambulatory surgery centers, academic and medical research centers, and defense forces. A growing shift towards ambulatory surgery centers is anticipated to boost the other segment's growth. Moreover, rising healthcare expenditures can boost the number of research centers and academics, supporting the segment's growth in the coming years.

Regional Insights

North America disposable syringes market is anticipated to witness significant growth, propelled by a combination of factors such as technological advancements, the rising prevalence of chronic diseases, and government initiatives. According to the statistics published by the U.S. Department of Health and Human Services in January 2024, around 38.4 million people of all ages had diabetes in the U.S. in 2021. Thus, many individuals suffering from chronic diseases are anticipated to drive the regional market growth.

U.S. Disposable Syringes Market Trends

The disposable syringes market in the U.S. is anticipated to dominate the North American market over the forecast period. The presence of major players and rising FDA approvals for disposable syringes are anticipated to support the market growth. Moreover, the rising demand for injectable drugs across the country is expected to fuel the country's market in the coming years.

Europe Disposable Syringes Market Trends

The disposable syringes market in Europe is anticipated to grow significantly over the forecast period. This growth can be attributed to the increased healthcare spending and the rising prevalence of chronic diseases such as diabetes and cancer, which require frequent injections. Heightened safety awareness and regulations to prevent needle-stick injuries are also driving demand for single-use syringes. Additionally, widespread vaccination campaigns, including initiatives such as European Immunization Week observed in May 2025 in the Kyrgyz Republic, further support market growth by emphasizing the importance of vaccinations in preventing infectious diseases.

The disposable syringes market in the UK is expected to grow substantially during the forecast period. This growth is driven by several key factors, including an aging population and an increasing burden of chronic disorders, which heighten the demand for disposable syringes. Additionally, there is a growing emphasis on infection prevention, supported by stringent regulations and increased safety awareness, which is likely to boost the adoption of single-use syringes.

France disposable syringes market is expected to grow over the forecast period, owing to high healthcare expenditures and the increasing prevalence of chronic conditions. For instance, according to a study published by ScienceDirect in March 2024, in France, around nine of 10 deaths are caused by non-communicable disorders.

The disposable syringes market in Germany is witnessing steady growth owing to industry participants' rising focus on expanding their presence in Germany and increasing vaccination campaigns. For instance, in September 2023, Germany introduced its autumn vaccination campaign to avert respiratory infections, promoting an updated COVID-19 booster shot for the elderly and high-risk individuals. Strict safety regulations and the aging population further contribute to market growth, especially for injections and disease management.

Asia Pacific Disposable Syringes Market Trends

Asia Pacific dominated the disposable syringes market with the largest revenue share of 31.28% in 2024. Asia Pacific region held the largest revenue share of disposable syringes market. This dominance is, driven by several key factors, such as the increasing prevalence of chronic diseases, including diabetes and infectious diseases, among the region's population. For instance, according to the article published by Health Equity Matters in November 2023, there were 28,870 people with HIV in Australia in 2022. Thus, numerous individuals suffering from infectious diseases are anticipated to boost the demand for disposable syringes and needles across the Asia Pacific region.

The disposable syringes market in China is expected to grow due to increasing healthcare investments, a rising prevalence of chronic diseases like diabetes, and extensive vaccination campaigns. The aging population and stricter safety regulations are also anticipated to drive sustained disposable syringe demand.

India disposable syringes market is propelled by factors such as the country’s rising burden of chronic conditions, increasing launches of disposable syringes and needles, and growing emphasis of significant industry players on the country market. Companies operating in the country are increasing investments to strengthen their presence in India.

“We aim for 60-70 per cent market share in the next three years due to our innovative Dispojekt. We are aiming to initially produce 200 million syringes and needles per annum for which we have invested Rs 70 crore (USD 8.15 million) in the first phase.”-Hindustan Syringes and Medical Devices (HMD), Executive Director

Latin America Disposable Syringes Market Trends

The disposable syringes market in Latin America is expected to be the fastest growing over the forecast period, driven by growing healthcare infrastructure and the increasing burden of chronic diseases. The region’s aging population requires more injectable treatments, while stricter safety regulations and heightened health awareness encourage the shift toward single-use syringes, boosting market demand and growth.

Middle East and Africa Disposable Syringes Market Trends

The Middle East and Africa disposable syringes market is expected to witness significant growth in the coming years due to the rising prevalence of chronic diseases such as diabetes. According to statistics published by the International Diabetes Federation in May 2025, approximately 1,274,200 cases of diabetes in adults were reported in the UAE in 2024.

The disposable syringe market in Saudi Arabia is driven by increasing healthcare investments that are aligned with the Saudi Vision 2030 initiative, which aims to enhance the healthcare sector. Rising chronic diseases such as diabetes, an aging population, and large-scale vaccination initiatives also contribute to demand.

Key Disposable Syringes Company Insights

Hindustan Syringes & Medical Devices Ltd, NIPRO, B. Braun SE, BD, Cardinal Health , Vita Needle Company, Terumo Europe NV, ulti med Products, SMB Corporation of India , Henke Sass Wolf GmbH,Cartel Health Care Pvt. Ltd¸Hi-Tech Syringes, VEM Tooling Co.,Ltd. (VEM Thailand Co. Ltd), APEX MEDICAL DEVICES, JMS Co.Ltd, OSAKA CHEMICAL Co.,Ltd, Lifelong Meditech Private Limited, Liaoning Kangyi Medical Equipment Co., Ltd, kohope.com , and Retractable Technologies, Inc. are some of the major players in the disposable syringes market. Companies in the industry are introducing innovative products and expanding their manufacturing capacities to strengthen their market presence. Additionally, manufacturers are investing significantly in disposable injectables to enhance global distribution and meet growing international demand.

Key Disposable Syringes Companies:

The following are the leading companies in the disposable syringes market. These companies collectively hold the largest market share and dictate industry trends.

- Hindustan Syringes & Medical Devices Ltd

- NIPRO

- B.Braun SE

- BD

- Cardinal Health

- Vita Needle Company

- Terumo Europe NV

- ulti med Products

- Henke Sass Wolf GmbH

- Retractable Technologies, Inc.

- kohope.com

- Liaoning Kangyi Medical Equipment Co., Ltd

- SMB Corporation of India

- Lifelong Meditech Private Limited.

- OSAKA CHEMICAL Co., Ltd

- JMS Co. Ltd

- APEX MEDICAL DEVICES

- Cartel Health Care Pvt. Ltd

- Hi-Tech Syringes

- VEM Tooling Co., Ltd. (VEM Thailand Co. Ltd)

Recent Developments

-

In June 2025, the Indian government exempted high-density polyethylene (HDPE), a raw material for disposable syringes, from mandatory Bureau of Indian Standards (BIS) quality certification to streamline production and support medical device manufacturing.

-

In January 2024, medmix Drug Delivery introduced SicuroJect, a disposable passive needle safety device at Pharmapack Europe in Paris, to expand its product portfolio.

-

In May 2023, Hindustan Syringes & Medical Devices Ltd (HMD), a manufacturer of auto-disable and disposable injectables, reached the milestone of supplying 1.75 billion syringes of the entire 13.3 billion COVID-19 vaccines administered worldwide. The company has supplied about 650 million AD and disposable syringes to UNICEF.

-

In February 2023, Zephyrus Innovations, a manufacturer of medical devices, received the U.S. FDA approval for its Aeroject 3ml safety syringe.

Disposable Syringes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.72 billion

Revenue forecast in 2033

USD 28.27 billion

Growth rate

CAGR of 6.8% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Hindustan Syringes & Medical Devices Ltd; NIPRO; Cartel Health Care Pvt. Ltd; VEM Tooling Co.,Ltd. (VEM Thailand Co. Ltd); B. Braun SE; Lifelong Meditech Private Limited; BD; kohope.com ; OSAKA CHEMICAL Co.,Ltd; JMS Co.Ltd; APEX MEDICAL DEVICES; Hi-Tech Syringes; Liaoning Kangyi Medical Equipment Co., Ltd; Cardinal Health; Vita Needle Company; SMB Corporation of India; Terumo Europe NV; ulti med Products; Henke Sass Wolf GmbH; Retractable Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disposable Syringes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global disposable syringes market report based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Conventional Syringes

-

Safety Syringes

-

Retractable Safety Syringes

-

Non-retractable Safety Syringes

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Vaccines and immunizations

-

Anaphylaxis

-

Rheumatoid Arthritis

-

Diabetes

-

Autoimmune diseases

-

Oncology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital

-

Diagnostic Laboratories

-

Blood Banks

-

Pharmaceutical Industry

-

Veterinary purposes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global disposable syringes market size was estimated at USD 15.81 billion in 2024 and is expected to reach USD 16.72 billion in 2025.

b. The global disposable syringes market is expected to grow at a compound annual growth rate of 6.78% from 2025 to 2033 to reach USD 28.27 billion by 2033.

b. Asia Pacific dominated the disposable syringes market with a share of 31.28% in 2024. This is attributable to the high prevalence of diseases and increasing preference for injectable drugs.

b. Some key players operating in the disposable syringes market include Hindustan Syringes & Medical Devices Ltd, NIPRO, B. Braun SE, BD, Cardinal Health, Vita Needle Company, Terumo Europe NV, ulti med Products, SMB Corporation of India, Henke Sass Wolf GmbH, Cartel Health Care Pvt. Ltd¸, Hi-Tech Syringes, VEM Tooling Co., Ltd. (VEM Thailand Co. Ltd), APEX MEDICAL DEVICES, JMS Co., Ltd, OSAKA CHEMICAL Co., Ltd, Lifelong Meditech Private Limited, Liaoning Kangyi Medical Equipment Co., Ltd, kohope.com, and Retractable Technologies, Inc.

b. Key factors that are driving the disposable syringes market growth include the increasing incidences of chronic diseases, growing adoption of safety syringes, and rising technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.