- Home

- »

- IT Services & Applications

- »

-

Distributed Cloud Market Size, Share & Growth Report, 2030GVR Report cover

![Distributed Cloud Market Size, Share & Trends Report]()

Distributed Cloud Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Edge Computing, Content Delivery, Internet of Things, Others), By Service, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-119-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Distributed Cloud Market Summary

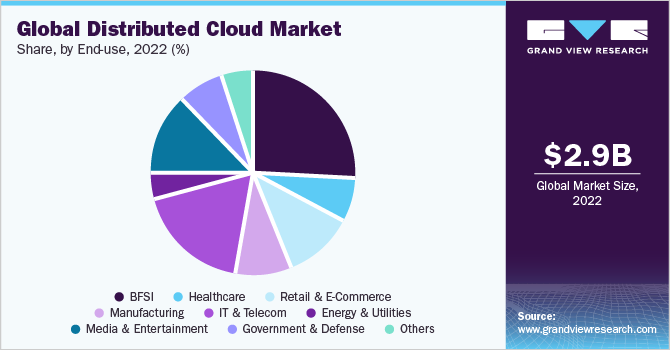

The global distributed cloud market size was valued at USD 2.90 billion in 2022 and is projected to reach USD 13.78 billion by 2030, growing at a compound annual growth rate (CAGR) of 21.9% from 2023 to 2030. A rising need for businesses to seamlessly process data at their source in line with local data privacy regulations and increasing demand for advanced platforms that allow businesses to gain higher visibility over their hybrid or multi-cloud set-ups are attributed as some of the key factors driving the global market growth.

Key Market Trends & Insights

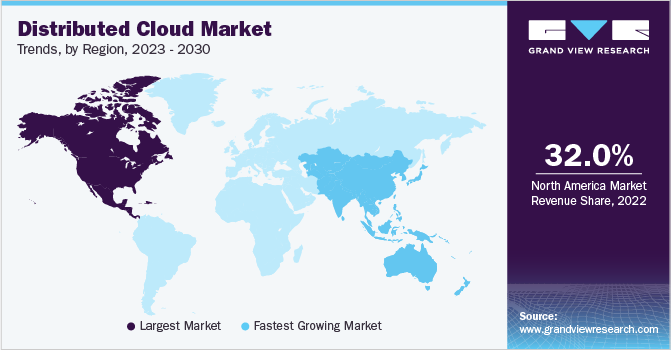

- North America held a substantial market share of over 32% in terms of revenue in 2022.

- Asia Pacific is projected to emerge as one of the most lucrative regions for the market in terms of revenue during the forecast period.

- Based on application, the edge computing segment is estimated to account for the largest share of over 44% of the market in 2022.

- Based on service, the data storage segment is estimated to account for the largest share of over 44% of the market in 2022.

- By enterprise size, the large enterprise segment accounted for the largest share of over 55% of the global market in 2022.

Market Size & Forecast

- 2022 Market Size: USD 2.90 Billion

- 2030 Projected Market Size: USD 13.78 Billion

- CAGR (2023-2030): 21.9%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Moreover, increased demand for data recovery, growing use of mobile technologies, and high levels of data security are all contributing to the market growth. In addition, the increasing need to improve streaming video content and user experience through faster content delivery is anticipated to provide numerous growth opportunities for the stakeholders over the forecast period.

Businesses are increasingly opting for edge computing to reduce latency issues and time consumed to expand a dedicated data center. However, determining the best strategy for various edge locations can be challenging. Thus, the distributed cloud offers a wide range of fully managed hardware and software applications, enabling users to access real-time insights across installations by bringing artificial intelligence (AI) and analytics closer to where data is generated and consumed. For instance, in April 2022, Google LLC launched its Google Distributed Cloud Edge into general availability. It features a fully managed hardware and software stack with an operational infrastructure, an open cloud-native execution environment, and a multi-cloud management system. In addition, it also supports enterprise use cases such as anomaly detection with artificial intelligence, video, and local sensitive data before it is sent to the cloud. In order to enable edge computing near to end locations, distributed computing offers the processing of large amounts of data closer to the end users while maintaining data security and compliance. As a result, the growing adoption of edge computing technology is observed as a key trend contributing to the market growth.

Most enterprises are launching microservices-based applications on cloud-native infrastructure and integrating them via APIs. This approach to application development can enhance innovation while lowering the total cost of ownership. However, these apps are vulnerable to internal and external attacks in the architecture due to cyber threats. Combining distributed cloud with in-line API and application security enables large telemetry collection and efficient intrusion detection. For instance, in December 2022, F5, Inc., a multi-cloud application services and security provider, introduced the F5 Distributed Cloud App Infrastructure Protection (AIP). This cloud workload protection solution extends application observability and protection to cloud-native applications.

The low latency, high speeds, and dependability of 5G would make edge computing essential for use cases in retail, manufacturing, logistics, and smart cities. It aids in evolving technologies like augmented reality (AR) and virtual reality (VR) from niche applications to widespread acceptance. Enterprises are increasingly adopting 5G and edge computing services to enable digital transformation for their business. For instance, in June 2023, T-Mobile US, Inc., a wireless network operator, collaborated with Google, LLC, a cloud computing services provider, to help businesses across various verticals, such as manufacturing, logistics, and retail to implement 5G capabilities in their businesses. The companies collaborate for T-Mobile U.S., Inc.’s 5G Advanced Network Solutions (ANS) and Google LLC, Google Distributed Cloud Edge to allow businesses to discover innovative connected experiences.

Besides, owing to increased multi-cloud environments adopted by widely spread businesses, the complexity of developing and distributing computing resources at multiple sites puts immense pressure on the edge locations and subsequent broadband networks. As a result, cloud service providers limit the bandwidth in order to allow a smooth data transition process. Thus, this process requires a considerable amount of time. However, cloud vendors are extensively working on developing advanced platforms that support seamless multi-cloud data management while reducing pressure on edge locations.

Application Insights

Based on application, the edge computing segment is estimated to account for the largest share of over 44% of the market for distributed cloud in 2022. The edge computing segment is primarily driven by factors such as reduced latency, data processing at the edge without the need for transmission, increased computing capacity, and improved security. Distributed edge computing allows for these developments to be realized, enabling local, intelligent processing at the edge for maximum efficiency.

The Internet of Things segment is anticipated to register significant growth over the forecast period. The Internet of Things is a worldwide backbone for the information society, enabling innovative offerings to connect things based on current and developing communication technologies. Additionally, it has the capacity for autonomous communication without human assistance and interoperable information. Furthermore, the expansion of the Internet of Things (IoT) market is anticipated to be accelerated by the increasing number of Industry 4.0, smart manufacturing, smart infrastructure projects, and smart homes and buildings.

Service Insights

Based on service, the data storage segment is estimated to account for the largest share of over 44% of the market in 2022. Distributed cloud storage improves data access and transfer, and it can also guarantee a larger bandwidth, effective disaster recovery, and data protection strategies at low costs. In addition, the distributed cloud architecture handles massive amounts of data more quickly than centralized cloud services. The distributed cloud attempts to diversify data assets over several cloud environments, but it also makes management easier by centralizing them under one control point. Thus, various distributed cloud vendors collaborate with storage providers to offer data resiliency, high availability, and security. This enables customers to migrate their stateful workloads to containers and transform their edge deployments. For instance, in May 2023, Rakuten Symphony, Inc., a cloud storage provider, partnered with Google LLC, a distributed cloud vendor, to offer Rakuten Symphony's SymcloudTM platform, the KUBERNETES data management, and software-defined storage platforms for enterprise applications and 5G Edge solutions. All operations, apps, or networks will be regulated by a centralized cloud management solution, Organizations can profit from selecting numerous cloud infrastructures and data centers that satisfy their customers' requests without adding complexity. Due to these above benefits, the data storage segment plays a major role in driving the market.

The data security segment is expected to grow with the highest CAGR over the forecast period. Cloud computing is scalable, which requires that security implications are considered when scaling applications. Moreover, a distributed cloud architecture ensures that certain data resources and business activities stay connected to the public cloud in a company's cloud or data center. Thus, by storing it on a private cloud, this architecture protects sensitive data.

Enterprise Size Insights

By enterprise size, the large enterprise segment accounted for the largest share of over 55% of the global market in 2022. Distributed cloud provides business scalability to large companies with geographically dispersed customers These organizations are currently making a strategic shift to the newest technology to become cloud-driven businesses to support a big number of consumers and data. For instance, in May 2022, F5 Inc., partnered with SoftBank Corp to implement Multi-access Edge Computing (MEC) in Japan to host and protect MEC applications for use cases such as smart buildings, IoT, gaming, and smart retail. As a result, the emergence of the distributed cloud has expedited cloud adoption among large organizations.

The small & medium enterprises segment is expected to grow with the highest CAGR over the forecast period. SMEs' increasing use of modern information technology infrastructure and automated business operations are expected to boost segment expansion during the projected period. For instance, in October 2022, Oracle Corporation launched several new distributed cloud offerings to meet the increasing demand for Oracle Cloud Infrastructure (OCI) and customers’ diverse needs. Oracle Corporation plans to open new cloud regions in Serbia, Chicago, and Mexico. The OCI distributed cloud allows customers to use cloud services from anywhere with public, multi-cloud, hybrid, and dedicated options. Thus, SMEs are expected to increase the adoption of distributed cloud services due to the opening of new cloud infrastructure across various countries.

End-Use Insights

By end-use, the BFSI segment is estimated to account for the largest share of over 26% of the global market in 2022. Financial services and banking organizations are facing increasing pressure to comply with stringent laws and regulations related to customer data security and privacy. This creates a need for new ways of managing security and compliance, particularly in an era of distributed cloud architectures and services. Distributed cloud offers a range of benefits to financial services and banking organizations. It enables financial services and banking firms to access the cloud without investing in expensive infrastructure and hardware. Organizations can quickly scale up their operations using a distributed cloud to meet increasing customer demand.

The manufacturing segment is expected to grow with considerable growth over the forecast period. One of the primary drivers behind the adoption of distributed cloud in smart manufacturing is the need for real-time data processing and analytics. Moreover, in a smart factory, a vast array of sensors and devices continuously generate data that must be analyzed and acted upon in real-time to optimize production processes, ensure product quality, and minimize downtime. The distributed cloud enables manufacturers to process this data closer to the source, reducing latency and ensuring that critical decisions can be made quickly and efficiently. Another key advantage of the distributed cloud model is its ability to support the deployment of advanced manufacturing technologies, such as additive manufacturing, robotics, and artificial intelligence (AI).

Regional Insights

In 2022, North America held a substantial market share of over 32% in terms of revenue owing to robust IT infrastructure, several major technology companies and cloud service providers have contributed to adopting distributed cloud services in the region. Additionally, North American markets have seen an explosion of connected devices, which generate large amounts of data. For instance, in February 2022, Integration Appliance, Inc. a provider of cloud-based software for the global professional and financial services industry based in the U.S., partnered with Microsoft Corporation, a distributed cloud vendor, to accelerate the adoption of cloud technologies by investment banking, private capital, accounting, legal, and consulting firms. Integration Appliance, Inc. would deliver cloud-based solutions for connected firms and deal management using Microsoft Azure by partnering with Microsoft Corporation. Moreover, companies are investing heavily in developing distributed clouds and upgrading data centers to meet the growing demand for low-latency and high-performance computing. Thus, these factors collectively contribute to the region's market growth.

Asia Pacific is projected to emerge as one of the most lucrative regions for the market in terms of revenue during the forecast period. A rising number of startups and large multinational companies are providing valuable ICT solutions in this region. Furthermore, several organizations are adopting cloud-based strategies due to rapid telecommunications and cloud computing advancements. Thus, a significant increase in the adoption of distributed services has been attributed to the increasing use of cloud technologies and the growing number of business processes.

Key Companies & Market Share Insights

The distributed cloud market is considerably concentrated, with large-sized players in the market. Prominent market players are investing in research and development (R&D) to expand their offerings, thereby fostering further growth in the market. These market players also pursue diverse strategic initiatives to enhance their global presence, such as launching new products, entering into contractual agreements, engaging in mergers and acquisitions, ramping up investments, exploring market developments, and forging collaborations with other organizations. For instance, in August 2023, Oracle Corporation launched Oracle Compute Cloud Customer, a rack-scale cloud infrastructure that enables organizations to use Oracle Cloud Infrastructure (OCI) compute services in remote locations. OCI's software stack can develop, deploy, secure, and manage workloads as small as one rack. In addition to addressing data residency requirements, customers can access high-performance connections to existing data centers and latency-sensitive applications through this option while meeting their strategic cloud business objectives. Some of the prominent players in the global distributed cloud market include:

-

Alibaba Group

-

Amazon Web Services, Inc.

-

F5, Inc.

-

Google LLC

-

International Business Machines Corporation

-

Microsoft Corporation

-

Oracle Corporation

-

Rackspace Technology

-

Salesforce, Inc.

-

VMware, Inc.

Distributed Cloud Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.45 billion

Revenue forecast in 2030

USD 13.78 billion

Growth rate

CAGR of 21.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, enterprise size, service, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; United Arab Emirates (UAE); Saudi Arabia; South Africa

Key companies profiled

Alibaba Group; Amazon Web Services, Inc.; F5, Inc.; Alphabet Inc. (Google LLC); International Business Machines Corporation; Microsoft Corporation; Oracle Corporation; Rackspace Technology; Salesforce, Inc.; VMware, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Distributed Cloud Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global distributed cloud market report based on application, service, enterprise size, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Edge Computing

-

Content Delivery

-

Internet of Things

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Data Security

-

Data Storage

-

Networking

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Healthcare

-

Retail & E-Commerce

-

Manufacturing

-

IT & Telecom

-

Energy & Utilities

-

Media & Entertainment

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global distributed cloud market size was estimated at USD 2.90 billion in 2022 and is expected to reach USD 3.45 billion in 2023.

b. The global distributed cloud market is expected to witness a compound annual growth rate of 21.9% from 2023 to 2030 to reach USD 13.78 billion by 2030

b. The data storage segment is estimated to account for the largest share of over 44% of the globally distributed cloud market in 2022. Distributed cloud storage improves data access and transfer, and it can also guarantee a larger bandwidth, effective disaster recovery, and data protection strategies at low costs.

b. Some of the prominent players in the distributed cloud market include Alibaba Group, Amazon Web Services, Inc., F5, Inc., Alphabet Inc. (Google LLC), International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Rackspace Technology, Salesforce, Inc., and VMware, Inc.

b. A rising need for businesses to seamlessly process data at their source in line with local data privacy regulations and increasing demand for advanced platforms that allow businesses to gain higher visibility over their hybrid or multi-cloud set-ups are attributed as some of the key factors driving the global distributed cloud market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.