- Home

- »

- Network Security

- »

-

Distributed Denial Of Service Protection Market Report, 2033GVR Report cover

![Distributed Denial Of Service Protection Market Size, Share & Trends Report]()

Distributed Denial Of Service Protection Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software Solutions, Services), By Application, By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-412-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Distributed Denial of Service Protection Market Summary

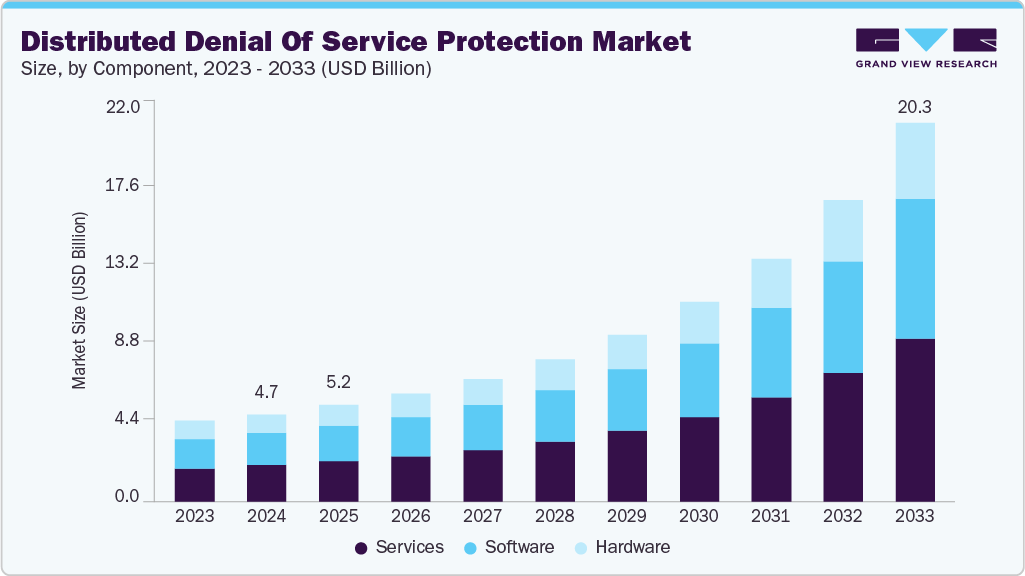

The global distributed denial of service protection market size was estimated at USD 4.68 billion in 2024, and is projected to reach USD 20.31 billion by 2033, growing at a CAGR of 18.7% from 2025 to 2033. The proliferation of connected devices and the expansion of the Internet of Things (IoT) are driving the distributed denial of service protection market growth.

Key Market Trends & Insights

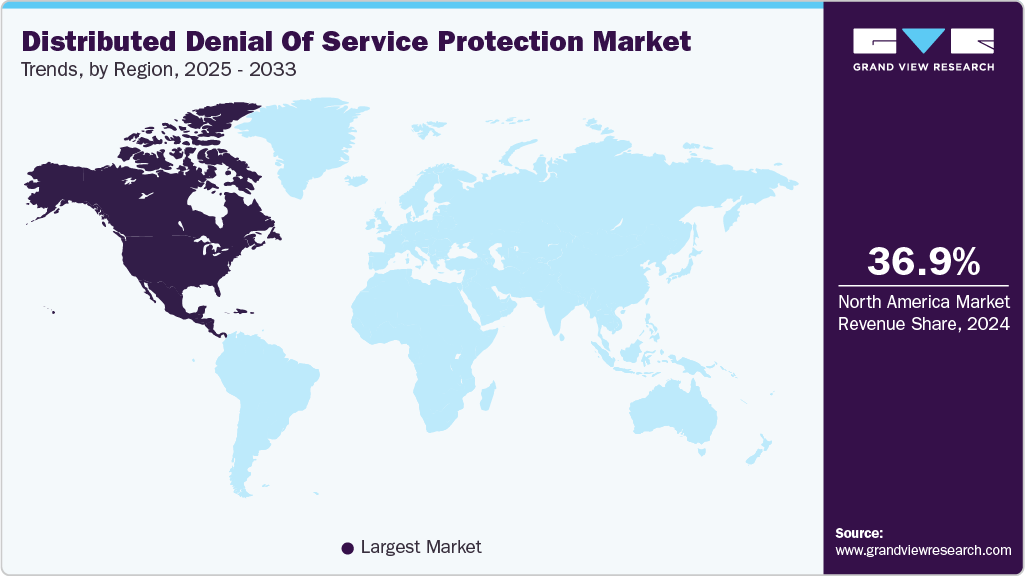

- North America held 36.9% revenue share of the global distributed denial of service protection market in 2024.

- In 2024, the U.S. dominated the North American distributed denial of service (DDoS) protection market, capturing the largest revenue share, primarily due to the increasing prevalence of ransom denial of service (RDoS) attacks targeting critical sectors.

- By component, the services segment held the largest revenue share of over 41.5% in 2024.

- By end use, network security segment held the largest revenue share in 2024.

- By deployment, cloud segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.68 Billion

- 2033 Projected Market Size: USD 20.31 Billion

- CAGR (2025-2033): 18.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising frequency and sophistication of DDoS attacks play a significant role in driving market growth. Attackers have developed more advanced techniques to overwhelm and disrupt these systems as businesses and critical infrastructure become more reliant on digital systems. Modern DDoS attacks often involve large-scale botnets and sophisticated methods to bypass traditional security measures, necessitating more advanced protection solutions. This constant evolution in attack methods creates a persistent demand for cutting-edge DDoS protection technologies.Moreover, the growing awareness among organizations about financial and reputational damage that can result from a successful DDoS attack fuels market growth. High-profile service outages and data breaches have highlighted the importance of robust security measures. As a result, companies across various industries are increasingly investing in DDoS protection solutions to safeguard their operations, enhance customer trust, and avoid the substantial costs associated with downtime and recovery. This heightened awareness drives both increased adoption and expenditure on DDoS protection services.

The rise of cloud computing and edge services is driving distributed denial of service protection market growth. As organizations shift infrastructure and end uses to public or hybrid clouds, securing the extended perimeter becomes critical. DDoS protection vendors are offering cloud-native and edge-integrated solutions that combine real-time threat intelligence with automated mitigation techniques. These services can absorb volumetric attacks at the edge or redirect malicious traffic through scrubbing centers without interrupting legitimate user activity. The adaptability and scalability of cloud-based DDoS protection make it especially appealing to enterprises undergoing digital transformation.

Moreover, the growing regulatory pressure around cybersecurity and data protection is driving organizations to prioritize their defensive posture against DDoS threats. Governments and industry bodies across the U.S., Europe, and Asia-Pacific are mandating stricter compliance standards, especially for sectors handling sensitive data or critical infrastructure. Non-compliance can result in hefty penalties, making it imperative for organizations to demonstrate resilience against attacks, including DDoS. This regulatory landscape is encouraging proactive investment in comprehensive DDoS defense solutions that include real-time monitoring, incident response planning, and forensic analysis.

Component Insights

The services segment dominated the distributed denial of service protection market with a revenue share of 41.5% in 2024. Many organizations are opting for managed DDoS protection services as they seek to leverage the expertise and resources of specialized service providers. Managed services offer several advantages, including 24/7 monitoring, dedicated support, and expertise in dealing with complex attacks. This demand for outsourced solutions, driven by the need for specialized skills and cost efficiency, is contributing to the expansion of the DDoS protection service market.

The software segment is projected to grow at a significant CAGR from 2025 to 2033. The rapid advancements in software technology play a crucial role in the growth of this segment. Modern DDoS protection software leverages artificial intelligence (AI) and machine learning innovations to enhance threat detection and response capabilities. These technologies enable software solutions to analyze patterns, identify anomalies, and respond to real-time attacks, improving their effectiveness. Continuous updates and improvements in software capabilities ensure that organizations have access to the latest defense mechanisms against evolving DDoS threats, further fueling the demand for sophisticated software solutions.

Application Insights

The network security segment dominated the distributed denial of service protection market in 2024. The widespread shift to remote work, accelerated by the COVID-19 pandemic, and the ongoing digital transformation across industries have also contributed to the growth of DDoS protection for network security applications. With more employees accessing corporate networks remotely, the attack surface has expanded, making it easier for cybercriminals to launch DDoS attacks. Moreover, as businesses continue to digitize their operations, integrating cloud services and online platforms, their network security requirements have become more complex. There is an increased demand for robust DDoS protection solutions to secure these increasingly distributed and digitalized networks.

The application security segment is projected to be the fastest-growing segment from 2025 to 2033. The increasing prevalence of application-layer DDoS attacks is driving the market's growth. Unlike traditional DDoS attacks that target network infrastructure, application-layer attacks focus on specific web applications, aiming to exhaust server resources by overwhelming them with seemingly legitimate requests. These attacks are insidious because they mimic regular user behavior, making them harder to detect and mitigate with traditional network-based defenses.

Deployment Insights

The cloud segment dominated the distributed denial of service protection market in 2024. The widespread adoption of cloud computing across various industries is a major driver for the growth of cloud-based DDoS protection. As more organizations migrate their operations, applications, and data to the cloud, securing these environments from DDoS attacks has become critical. Cloud environments, while offering numerous benefits such as scalability and flexibility, are also exposed to a broader range of cyber threats. As a result, organizations are increasingly turning to cloud-based DDoS protection solutions designed to safeguard cloud infrastructure and applications from potential attacks. This trend is accelerating as businesses embrace cloud services as part of their digital transformation strategies.

The hybrid segment is projected to grow at a significant CAGR from 2025 to 2033. The hybrid approach combines the best aspects of on-premise and cloud-based DDoS protection. On-premise solutions provide rapid response capabilities, low latency, and direct control over security measures, which are crucial for immediate threat mitigation and compliance with regulatory requirements. In contrast, cloud-based solutions offer scalability, redundancy, and the ability to handle large-scale attacks that exceed the capacity of on-premise infrastructure. By integrating these two approaches, hybrid solutions ensure organizations have a layered defense strategy capable of addressing localized and widespread threats. This comprehensive coverage is a significant advantage, driving the adoption of hybrid DDoS protection in various industries.

Enterprise Size Insights

The large enterprises segment dominated the distributed denial of service protection market in 2024. Maintaining customer trust and ensuring business continuity are paramount for large enterprises. A successful DDoS attack that disrupts services can lead to customer dissatisfaction, loss of confidence, and potential customer churn. Large enterprises recognize the importance of safeguarding their operations against such threats and are investing in DDoS protection to ensure that their services remain uninterrupted.

The small & medium enterprises (SMEs) segment is projected to be the fastest-growing segment from 2025 to 2033. Compared to larger enterprises, the increasing frequency of targeted cyberattacks against smaller businesses drives market growth. Historically, SMEs were not considered primary targets for DDoS attacks, which were more commonly directed at larger enterprises. However, cybercriminals have increasingly recognized that SMEs often lack the sophisticated security infrastructure of larger organizations, making them easier targets. As a result, DDoS attacks on SMEs have risen, prompting these businesses to invest in protection solutions to safeguard their operations.

End Use Insights

The IT and telecommunications segment dominated the market in 2024. The expansion of 5G and fiber-optic networks, which is rapidly increasing bandwidth and the number of connected endpoints, is driving segment growth. While this growth supports faster and more reliable digital services, it also creates greater exposure to DDoS threats by widening the attack surface. Telecom operators must ensure that their core and edge networks can withstand high-throughput DDoS attacks without affecting service quality.

To meet this demand, DDoS protection solutions are increasingly being embedded directly into telecom infrastructure, including at the DNS, CDN, and BGP levels, offering multi-layered security that shields against both volumetric and protocol-based threats. The shift toward software-defined networking (SDN) and network function virtualization (NFV) further supports dynamic, scalable DDoS protection across complex telecom environments.

The retail and e-commerce segment is projected to be the fastest-growing segment from 2025 to 2033. Adopting omnichannel retail strategies, where businesses integrate their online and offline operations to provide a seamless customer experience, also drives the need for robust DDoS protection. In an omnichannel environment, online service disruptions can have ripple effects on other parts of the business, such as inventory management, in-store services, and customer support. Ensuring the continuous availability of digital platforms is essential for maintaining the smooth operation of these interconnected systems. As more retailers embrace omnichannel strategies, the importance of comprehensive DDoS protection becomes increasingly apparent.

Regional Insights

North America Distributed Denial of Service (DDoS) protection market dominated the distributed denial of service protection market with a market share of 36.9% in 2024. The rapid expansion of the Internet of Things (IoT) in North America significantly contributes to the growth of DDoS protection. The increasing number of connected devices in industries such as manufacturing, healthcare, and smart cities has created new opportunities for cybercriminals to launch DDoS attacks by exploiting vulnerabilities in IoT networks.

U.S. Distributed Denial of Service (DDoS) Protection Market Trends

The U.S. distributed denial of service protection market is projected to grow during the forecast period. The integration of DDoS protection with broader cybersecurity strategies is fueling growth in the U.S. By integrating DDoS protection with other security measures, such as firewalls, intrusion detection systems, and security information and event management (SIEM) solutions, businesses create a comprehensive defense strategy that addresses a wide range of cyber threats. This integrated approach underscores the importance of DDoS protection as a critical component of overall cybersecurity efforts.

Asia Pacific Distributed Denial of Service (DDoS) Protection Trends

The Asia Pacific distributed denial of service protection market is expected to be the fastest-growing segment, with a CAGR of 20.2% over the forecast period. The growth can be attributed to the growing awareness regarding the benefits of distributed. The region has experienced significant internet and mobile penetration growth over the past decade. This rapid digital expansion has increased reliance on online platforms and services, making businesses more vulnerable to DDoS attacks. As the number of digital users and online transactions rises, the need for effective DDoS protection solutions becomes more pressing to ensure the security and availability of these critical digital assets.

The distributed denial of service protection market in China is projected to grow during the forecast period. China’s expanding use of smart city infrastructure and IoT deployments is also amplifying the need for advanced DDoS defenses. As cities roll out connected systems for transportation, energy, surveillance, and public services, the number of networked endpoints has surged, creating more entry points for cybercriminals to exploit. IoT devices, often lacking robust security protocols, are particularly vulnerable to being hijacked by botnets that execute distributed attacks. To mitigate these risks, municipalities and service providers are deploying network-wide DDoS protection solutions integrated with AI and threat intelligence to guard critical services and ensure urban resilience in the face of cyber threats.

Europe Distributed Denial of Service (DDoS) Protection Market Trends

The distributed denial of service protection industry in Europe is expected to grow during the forecast period. Ongoing investment in technology and infrastructure upgrades in Europe significantly drives the growth of DDoS protection. As businesses and governments modernize their IT infrastructure and adopt new technologies, such as cloud computing and Internet of Things (IoT) devices, the need for adequate DDoS protection becomes more apparent.

The distributed denial of service protection market in the UK is grow during the forecast period. The expansion of hybrid work environments and cloud adoption across UK enterprises has also driven demand for DDoS protection. With employees accessing corporate resources remotely, often from personal devices or unsecured networks, the digital perimeter has widened, creating more vulnerabilities that attackers can exploit. Simultaneously, organizations are hosting an increasing number of services in public and private clouds, making them reliant on third-party platforms where service availability is critical. As such, cloud-native DDoS protection solutions that can dynamically scale to absorb attacks and automatically filter malicious traffic are becoming essential to prevent disruptions across digital business operations.

Key Distributed Denial of Service Protection Company Insights

Some key companies operating in the market, Akamai Technologies and Cloudflare, Inc., among others, are some leading participants in the distributed denial of service protection market.

-

Akamai Technologies is a content delivery network (CDN) service and cloud security solutions provider. Akamai provides robust DDoS mitigation through its Prolexic platform, a globally distributed DDoS scrubbing service designed to detect, absorb, and neutralize large-scale attacks before they reach a client’s infrastructure. Leveraging its vast global network, Akamai can redirect and inspect potentially malicious traffic at the edge, far from the targeted origin, minimizing disruption and maintaining service availability.

-

Cloudflare, Inc. is a U.S.-based global cybersecurity and web infrastructure company. Cloudflare’s DDoS protection operates autonomously using machine learning and heuristics to detect anomalies in traffic patterns, enabling it to stop both volumetric floods and more subtle, application-layer attacks. This automation reduces response times and ensures business continuity even under persistent threats. Cloudflare also offers a user-friendly dashboard that allows customers to monitor and manage DDoS events in real-time, enhancing visibility and control.

Imperva, and NETSCOUT are some emerging market participants in the distributed denial of service protection market.

-

Imperva is a U.S.-based cybersecurity company that specializes in protecting critical data, applications, and websites from cyber threats. Imperva’s DDoS protection solutions are distinguished by their always-on and automatic mitigation capabilities. These features ensure that traffic is continuously monitored and that threats are neutralized instantly without the need for manual intervention. The company also integrates real-time dashboards, advanced analytics, and threat intelligence into its platform, enabling security teams to gain immediate insight into attack activity and response effectiveness.

-

NETSCOUT Systems, Inc. is a U.S.-based technology company that provides advanced service assurance, cybersecurity, and network performance management solutions. A major focus area for NETSCOUT is Distributed Denial of Service (DDoS) protection, offered through its Arbor DDoS product line, which is widely recognized for delivering industry-leading threat mitigation. Arbor solutions are trusted globally by internet service providers (ISPs), data centers, and enterprises to safeguard against DDoS attacks that could cripple websites, disrupt services, or compromise network availability.

Key Distributed Denial of Service (DDoS) Protection Companies:

The following are the leading companies in the distributed denial of service protection market. These companies collectively hold the largest market share and dictate industry trends.

- A10 Networks, Inc.

- Akamai Technologies

- Cloudflare, Inc.

- Corero Network Security

- F5, Inc.

- Fortinet, Inc.

- Imperva

- NETSCOUT Systems Inc.

- Radware

- TransUnion LLC

Recent Developments

-

In February 2025, NETSCOUT Systems, Inc. launched enhancements to its Arbor Threat Mitigation System Adaptive DDoS Protection solution by incorporating advanced artificial intelligence (AI) and machine learning (ML) technologies. The company utilizes a hybrid AI/ML approach that blends large-scale, cloud-based analysis with supervised learning and integrates AI/ML capabilities directly into its software solutions. This approach allows NETSCOUT to monitor and analyze an exceptional 550 Tbps of Internet traffic in the cloud, with human oversight ensuring accuracy and reliability in detecting and blocking malicious traffic.

-

In June 2024, Nokia unveiled advanced countermeasures to maintain protection against distributed denial-of-service (DDoS) attacks, particularly those originating from botnets and targeting application-level vulnerabilities. The new solutions leverage the Nokia 7750 Defender Mitigation System, which utilizes an advanced countermeasures engine to detect and mitigate real-time DDoS attacks. By employing sophisticated analytics and machine learning, the system can identify abnormal traffic patterns and automatically deploy targeted defenses, significantly reducing the impact of attacks on critical services.

-

In April 2024, Lightpath launched its enhanced DDoS protection solution, the LP DDoS Shield, designed to safeguard networks against the increasing sophistication and scale of distributed denial-of-service (DDoS) attacks. The system utilizes advanced detection and mitigation technologies from Radware, a recognized leader in cybersecurity solutions. The LP DDoS Shield employs AI-powered algorithms to identify and neutralize zero-day attacks effectively without prior data-along with various other threats, including IoT-based attacks and phantom floods.

-

In April 2024, Corero Network Security launched its new distributed denial of service cloud-backup service. This offering enhances Corero’s portfolio by integrating its on-premises solutions with Akamai’s cloud infrastructure to provide hybrid DDoS protection. The Corero SmartWall ONE Hybrid Cloud DDoS Protection solution ensures seamless automatic switching to cloud-based mitigation during large-scale distributed denial of service attacks, safeguarding continuous service availability.

Distributed Denial of Service Protection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.16 billion

Revenue forecast in 2033

USD 20.31 billion

Growth rate

CAGR of 18.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, application, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

A10 Networks, Inc.; Akamai Technologies; Cloudflare, Inc.; Corero Network Security; F5, Inc.; Fortinet, Inc.; Imperva; NETSCOUT System Inc.; Radware; TransUnion LLC

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Distributed Denial of Service (DDoS) Protection Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global distributed denial of service protection market report based on component, application, deployment, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Network Security

-

End Use Security

-

Database Security

-

Endpoint Security

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-Premise

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

IT and Telecommunications

-

Government and Public Sector

-

Energy and Utilities

-

Manufacturing

-

Retail and E-commerce

-

Media & Entertainment

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The distributed denial of service protection market size was estimated at USD 4.68 billion in 2024 and is expected to reach USD 5.16 billion in 2025.

b. The global distributed denial of service protection market is expected to grow at a compound annual growth rate of 18.7% from 2025 to 2033 to reach USD 20.31 billion by 2033.

b. The services segment dominated the distributed denial of service protection market with a market share of over 41.0% in 2024. Many organizations are opting for managed DDoS protection services as they seek to leverage the expertise and resources of specialized service providers.

b. Some key players operating in the DDoS protection market include A10 Networks, Inc., Akamai Technologies, Cloudflare, Inc., Corero Network Security, F5, Inc., Fortinet, Inc., Imperva, NETSCOUT System Inc., Radware, TransUnion LLC

b. Factors such the proliferation of connected devices and the expansion of the Internet of Things (IoT) and the rising frequency and sophistication of DDoS attacks is driving the distributed denial of service protection market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.