- Home

- »

- Biotechnology

- »

-

DNA Synthesis Market Size & Share, Industry Report, 2033GVR Report cover

![DNA Synthesis Market Size, Share & Trends Report]()

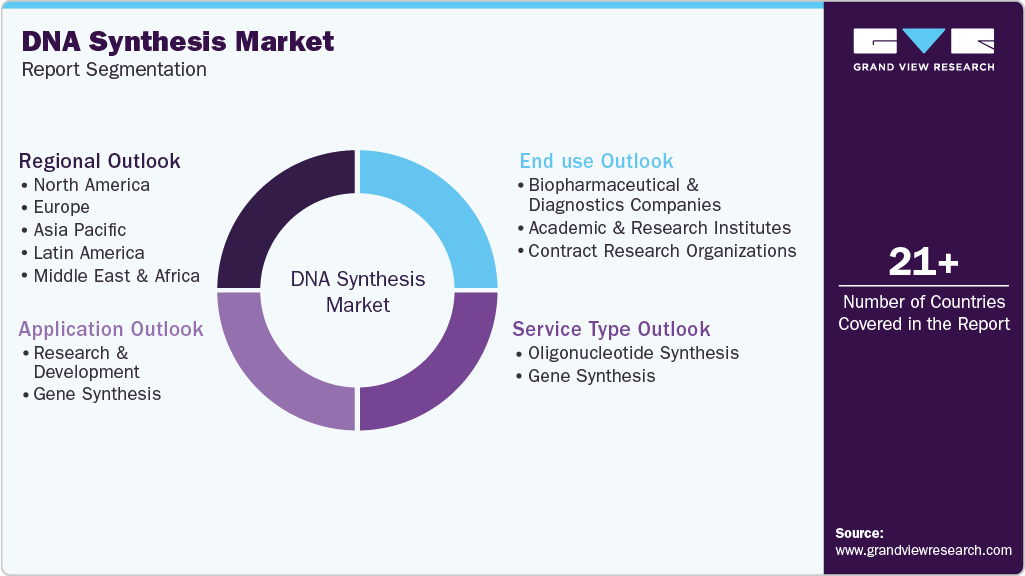

DNA Synthesis Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type (Gene Synthesis, Oligonucleotide Synthesis), By Application (Research Development, Diagnostics), By End use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-009-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

DNA Synthesis Market Summary

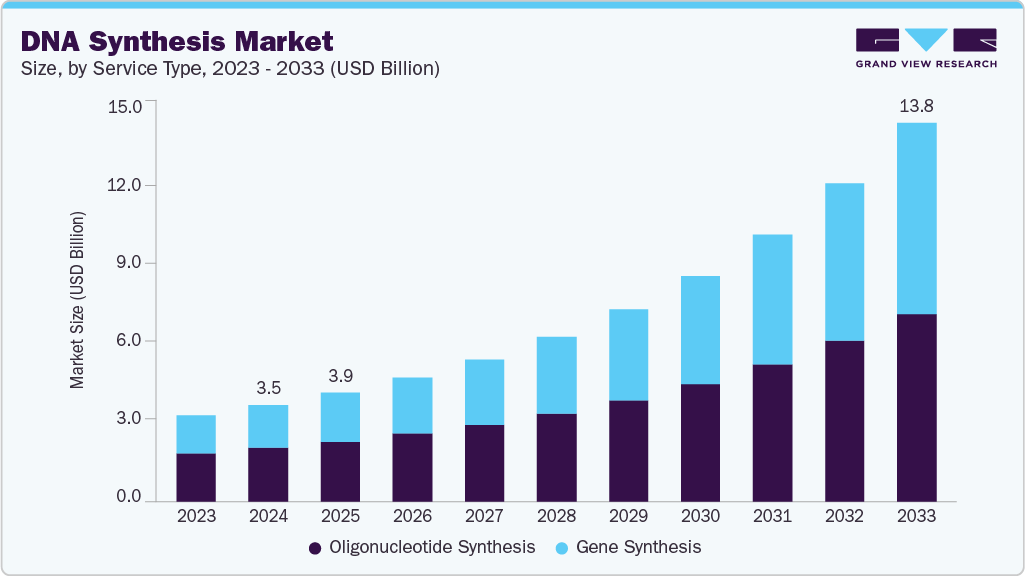

The global DNA synthesis market size was estimated at USD 3.52 billion in 2024 and is projected to reach USD 13.85 billion by 2033, growing at a CAGR of 16.89% from 2025 to 2033. This growth can be attributed to the rising demand for DNA synthesis in various applications, including molecular biology, genetic engineering, clinical diagnostics, and therapeutics.

Key Market Trends & Insights

- The North America DNA synthesis market held the largest share of 39.83% of the global market in 2024.

- The DNA synthesis industry in the U.S. is expected to grow significantly over the forecast period.

- By service type, the oligonucleotide Synthesis segment held the highest market share of 55.49% in 2024.

- Based on application, the research and development segment held the highest market share in 2024.

- By end use, the biopharmaceutical and diagnostics companies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.52 Billion

- 2033 Projected Market Size: USD 13.85 Billion

- CAGR (2025-2033): 16.89%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, in May 2025, Ansa Biotechnologies launched a 50 kb DNA synthesis early access program addressing the increasing demand for long, complex DNA constructs in synthetic biology and therapeutics.

Growth in Molecular Biology and Genetic Engineering

Synthetic DNA is vital for precise genetic modifications, gene cloning, and supporting advanced genome editing technologies such as CRISPR-Cas9, which requires custom gene synthesis for designing therapeutic genes, regulatory elements, and gene editing tools. As research in these fields expands, the need for custom-designed DNA sequences has increased significantly, fueling demand for high-quality, reliable synthesis services. For instance, in May 2025, Ribbon Bio GmbH launched MiroSynth DNA molecules, introducing a commercial product designed to meet the growing demand for complex and highly accurate synthetic DNA molecules.

Researchers and biotech companies are also leveraging DNA synthesis to study gene functions, develop genetically modified organisms (GMOs), and engineer microbial strains for industrial applications, including biofuel production and pharmaceutical development. This broadening scope of synthetic DNA usage encourages innovation and investment in synthesis platforms, further propelling market growth. As the tools for manipulating genetic material become more accessible and sophisticated, the reliance on synthetic DNA is expected to intensify across academic and commercial research settings.

Expansion of Synthetic Biology

The rapid expansion of synthetic biology is a significant driver for the DNA synthesis market. Synthetic biology involves designing and constructing new biological parts, devices, and systems or reprogramming existing organisms for useful purposes. This field relies heavily on creating custom DNA sequences efficiently and accurately, enabling researchers and companies to engineer microorganisms that produce biofuels, biodegradable plastics, pharmaceuticals, and other valuable biochemicals. As demand for sustainable and innovative biological solutions grows, so does the need for advanced DNA synthesis technologies to support complex genetic designs on a scale.

Moreover, synthetic biology fuels innovation across multiple industries, from healthcare to agriculture and environmental management. Companies increasingly invest in synthetic biology to develop novel therapies, improve crop resilience, and create environmentally friendly products. For instance, in April 2025, 4basebio PLC received Good Manufacturing Practice (GMP) certification from the UK's Medicines and Healthcare Products Regulatory Agency (MHRA). This license authorizes the company to manufacture and supply GMP-grade synthetic DNA for clinical applications, including cell and gene therapies and DNA/mRNA vaccines. This broad applicability drives ongoing demand for synthetic DNA, pushing market players to enhance synthesis speed, accuracy, and cost-effectiveness. The continued evolution of synthetic biology applications promises sustained growth for the DNA synthesis market throughout the forecast period.

Market Concentration & Characteristics

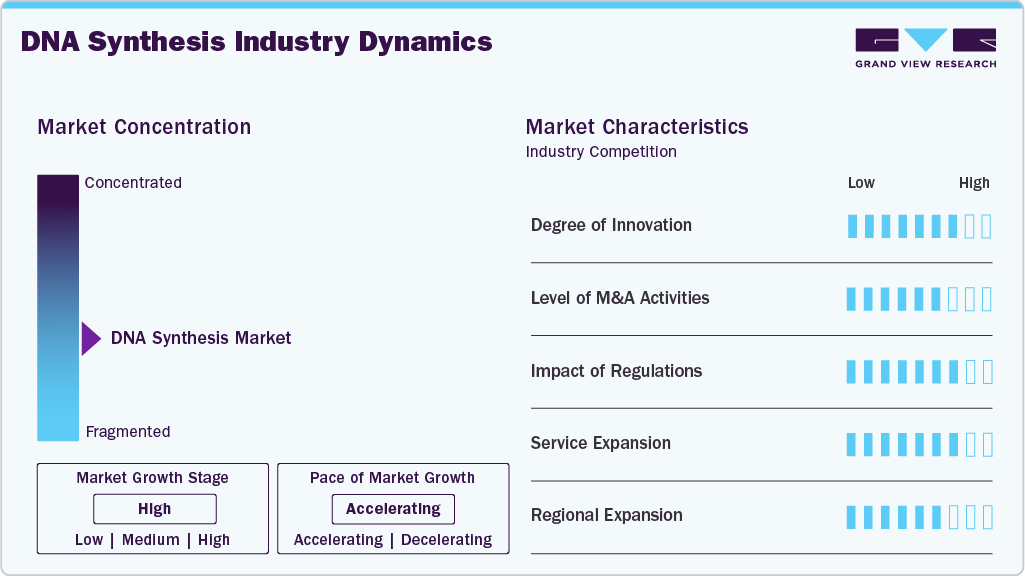

Key players are engaged in the launch of new products and services. They are undertaking this strategy to strengthen their product portfolios and offer their customers technologically advanced & innovative products. For instance, in May 2025, researchers at Barcelona’s Centre for Genomic Regulation developed an AI-driven model to design synthetic DNA sequences that precisely turn genes on or off in specific blood cells. This technology enabled targeted gene regulation, activating genes in red blood cells while leaving others unaffected, demonstrating significant potential for advancing gene therapy with greater precision and fewer off-target effects, further driving the market demand in the DNA synthesis market.

The market is experiencing moderate merger and acquisition activities by various industry players. This is driven by factors such as the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market. Companies are also forming collaborations to support research and development in the field of diagnostics and therapeutics. For instance, in May 2025, Regeneron Pharmaceuticals entered a licensing agreement with Telesis Bio to integrate the Gibson SOLA platform into its research and development facilities. This collaboration enables Regeneron to perform in-house, on-demand, high-throughput DNA and gene synthesis, significantly accelerating its drug discovery and development processes .

The DNA synthesis market is significantly influenced by regulatory frameworks, which vary in nature and stringency across different regions. Regulatory policies governing genetic materials, biosafety, and ethical considerations are crucial in shaping market dynamics. Compliance with these regulations is essential for companies to ensure the safe development and application of DNA synthesis technologies, especially in sensitive areas such as gene therapy and clinical diagnostics. As regulatory landscapes evolve, they can facilitate market growth by providing clear guidelines or posing challenges through stringent controls and approval processes.

Companies increasingly focus on expanding their service portfolios by launching innovative gene synthesis solutions. For instance, in May 2023, GenScript introduced the GenTitan Gene Fragments service. This chip-based platform offers cost-effective synthetic DNA production, addressing the growing demand for rapid and scalable DNA synthesis in synthetic biology, protein engineering, and genomic research. The new technology leverages advanced integrated circuits to streamline the synthesis process, significantly reducing turnaround times and production costs, which enhances research efficiency and accelerates demand in the DNA Synthetic industry.

The DNA synthesis market is expanding rapidly across regions, with North America leading due to strong research infrastructure, significant funding, and the presence of major biotech firms. Meanwhile, Asia-Pacific is poised for the fastest growth, fueled by increasing investments in biotechnology, expanding pharmaceutical sectors, and government initiatives in countries such as China and India. Moreover, emerging markets in Latin America, the Middle East & Africa are gradually gaining momentum, supported by improving healthcare infrastructure and growing awareness of genomic technologies, collectively contributing to the global advancement of the DNA synthesis industry.

Service Type Insights

The oligonucleotide synthesis segment dominated the market in 2024. The larger share of this segment can be attributed to the focus on genomics research and personalized medicine. Oligonucleotides are essential for molecular biology, genetics, and genomics, supporting applications such as PCR, DNA sequencing, & gene expression studies. For instance, in January 2025, DNA Script launched an advanced enzymatic DNA synthesis platform in France that produces custom oligonucleotides up to 500 nucleotides long, overcoming traditional chemical synthesis limits. This technology meets the growing demand for complex, high-quality oligonucleotides critical in mRNA vaccines, antibody engineering, and gene therapies. Moreover, the increasing awareness and understanding of genetic disorders contribute to the demand for oligonucleotides in diagnostics & potential therapeutic interventions.

The gene synthesis segment is projected to witness the highest CAGR of 18.58% over the forecast period. This segment is further divided into custom synthesis and library synthesis. In gene therapy, new genes are introduced into existing cells to cure or prevent diseases. Other approaches include regulating mutated genes through selective reverse mutation, repairing defective genes, or replacing mutated genes with functional ones. For instance, in August 2023, UC San Diego launched the Gene Therapy Initiative (GTI) to develop novel gene-based therapies for children and adults suffering from genetic disorders, particularly rare diseases affecting vital organs such as the brain, heart, and nervous system. Gene synthesis plays a critical role in this process by enabling the cloning of synthetic therapeutic genes into custom-designed viral vectors, thereby optimizing gene expression and enhancing the specificity and efficiency of gene delivery.

Application Insights

The research and development segment dominated the market with a revenue share of 63.49% in 2024, owing to the growing use of DNA synthesis to support ongoing research studies across the globe. Oligonucleotides are essential in molecular biology research, genetic testing, and drug development. For instance, in August 2024, researchers in the United States introduced synthetic “alien” DNA, expanding diagnostic and therapeutic capabilities by enhancing molecular binding specificity for improved disease detection and targeted treatment applications. Moreover, the DNA synthesis market is witnessing heightened demand due to the widespread adoption of CRISPR technology. As researchers increasingly employ CRISPR for diverse applications, including gene knockout studies and therapeutic interventions, the DNA synthesis industry is experiencing significant growth.

The therapeutics segment is projected to witness the fastest CAGR of 18.10% over the forecast period, driven by the growing demand for advanced, personalized treatment options. Nucleotide synthesis is crucial in supporting ongoing therapeutic research worldwide, enabling consistent and scalable development of genetic solutions. The availability of rapid and accurate DNA synthesis technologies has significantly accelerated the profiling and targeting of a broad spectrum of disease markers, from designing synthetic gene circuits to engineering and screening enzymes for therapeutic applications. Growing preference for personalized therapies for genetic disorders and various cancers intensifies, and therapeutics continues to emerge as a leading application area in the DNA synthesis market.

End Use Insights

The biopharmaceutical and diagnostics companies segment dominated the market with a revenue share of 49.63% in 2024. Biopharmaceutical companies involved in the DNA synthesis market regularly use gene synthesis as an engineering tool to design and produce new DNA sequences & protein functions of interest. Companies engaged in this domain include Integrated Biotechnologies, Twist Bioscience, and Codex. For instance, in April 2024, Ribbon Biolabs advanced synthetic DNA synthesis with its InfiniSynth platform, enabling the automated production of complex DNA sequences with high purity and accuracy. This innovation addresses the increasing demand for long, complex oligonucleotides in gene therapy and synthetic biology. Moreover, companies developing diagnostics technologies, such as Eurofins Scientific and GenScript, are witnessing promising growth prospects due to the high demand for effective DNA-based diagnostic tests.

The contract research organizations (CROs) segment is projected to witness the highest CAGR over the forecast period, driven by the rising number of small and mid-sized biotechnology firms and the growing trend of outsourcing R&D activities. As emerging biotech companies increasingly contribute to advancements in the biomedical field, supported by a surge in funding within the startup ecosystem, the demand for specialized and cost-effective research services has escalated. This trend is expanding the scope and scale of services offered by CROs, positioning them as vital partners in accelerating drug discovery and development in the DNA synthesis market.

Regional Insights

North America DNA synthesis market dominated the market and accounted for the largest revenue share of 39.83% in 2024. The region experiences market growth due to heightened public awareness, robust medical facilities, and substantial R&D investments. The region benefits from early adoption of advanced technologies, a thriving synthetic biology ecosystem, and increased demand for gene-based therapies. Collaborations between pharmaceutical giants, biotechnology firms, and contract research organizations (CROs) have further accelerated innovation and commercialization across therapeutic and industrial DNA synthesis applications.

U.S DNA Synthesis Market Trends

The U.S. DNA synthesis market has grown significantly in recent years. This growth can be attributed to the increasing demand for synthetic DNA and RNA sequences in various applications, such as research, diagnostics, and therapeutics. The competitive landscape of this market is characterized by a mix of established players and emerging companies striving to capture a share of the expanding market. For instance, in January 2025, Applied DNA Sciences announced the completion of its Good Manufacturing Practices (GMP) facility in New York under its subsidiary LineaRx. This facility is poised to support drug development and manufacturing reshoring by producing LineaDNA IVT templates for mRNA clinical trial materials, further driving the market demand in the DNA synthesis industry.

Europe DNA Synthesis Market Trends

Europe DNA synthesis market is expected to grow steadily during the forecast period, driven by a strong regulatory framework, public-private research collaborations, and strategic funding from the European Union. For instance, in April 2022, Evonetix Ltd.was granted a European patent for its proprietary thermally controlled DNA synthesis technology. This innovation enables precise, parallel DNA synthesis across thousands of independent sites on a silicon chip, enhancing accuracy and scalability. The emphasis on sustainability and innovation, particularly in green biotechnology and biopharmaceuticals, is helping to expand the market scope. Europe also benefits from an educated workforce and a coordinated research infrastructure that fosters rapid scientific advancement.

The DNA synthesis market in the UK is expected to grow over the forecast period due to robust research and innovation in genetic & molecular studies, supportive government initiatives, and a strong healthcare infrastructure that fosters advancements in biomedical research. For instance, in July 2023, UK-based Camena Bioscience secured USD 10 million in Series A funding led by Mercia. The investment aimed to scale operations and advance its gSynth enzymatic DNA synthesis platform. This technology offers high accuracy for producing synthetic DNA, addressing limitations of traditional methods, further driving the market expansion.

The DNA synthesis market in Germany is expected to grow over the forecast period owing to Germany’s strong R&D landscape in diagnostics and therapeutics, which harnesses the adoption of innovative therapies. Moreover, the German government is actively promoting the development of biotechnology and healthcare infrastructure. Initiatives such as “Industrie 4.0” and R&D grants empower domestic players and attract foreign investments, positively impacting the DNA synthesis market.

Asia Pacific DNA Synthesis Market Trends

Asia Pacific DNA synthesis market is anticipated to witness the fastest growth at a CAGR of 19.69% from 2025 to 2033 in the DNA synthesis market. The regional market is expected to be driven by the growing demand for synthetic DNA in research & diagnostics, the increasing prevalence of genetic diseases, and the rising need for personalized medicine. For instance, in May 2022, DNA Script, a global leader in Enzymatic DNA Synthesis (EDS), partnered with Premas Life Sciences Pvt. Ltd. in India to distribute its SYNTAX System DNA printer. This collaboration aimed to meet the growing demand for same-day, in-house DNA oligo production in the Asia-Pacific region. The SYNTAX System enables laboratories to rapidly synthesize custom DNA oligos without relying on third-party services, facilitating accelerated research in synthetic biology and personalized medicine.These developments highlight the Asia Pacific region’s growing capability and commitment to innovation in DNA synthesis, positioning it as a key driver of the global market’s future growth.

China DNA synthesis market is emerging as a dominant player in the DNA synthesis market, driven by aggressive government investment, a booming biotech startup scene, and large-scale research initiatives. As part of its national strategic plans like “Made in China 2025,” the country is investing in synthetic biology, CRISPR, and genomics to enhance competitiveness in health and agriculture. Domestic companies are expanding rapidly, with capabilities ranging from high-throughput DNA synthesis to gene editing, supported by a growing academic and commercial partnerships network. For instance, In May 2023, GenScript Biotech Corporation expanded its peptide and oligonucleotide production facility in Zhenjiang, Jiangsu, China. The facility has advanced purification processes to meet the growing demand for DNA synthesis services in Asia-Pacific.

The DNA synthesis market in Japan is expected to witness significant growth over the forecast period. Japan has a significant aging population and a high focus on personalized medicine. Japan is a major player in scientific research, particularly in biotechnology and biopharmaceuticals. For instance, in September 2024, researchers at the Tokyo Institute of Technology developed a method to control the precise timing of synthetic DNA droplet division. This advancement enables pathway-controlled division in ternary DNA droplet systems, facilitating applications in molecular computing and artificial cell development, propelling market growth.

Middle East and Africa DNA Synthesis Market Trends

The DNA synthesis market in the Middle East and Africa is projected to grow significantly during the forecast period due to the rising prevalence of chronic & infectious diseases, the growing incidence of genetic diseases, and the increased investments in the biotechnology & life sciences field. For instance, in February 2025, EVA Pharma (Egypt), DNA Script (France), and Quantoom Biosciences (Belgium) signed a Memorandum of Understanding in Cairo to develop Africa’s first digital-to-biologics mRNA production platform. This collaboration aims to produce 100 million RNA-based vaccine doses annually, enhancing regional autonomy in biopharmaceutical manufacturing. The initiative supports Egypt’s goal of manufacturing 385 million vaccine doses annually by 2033 and supports the market expansion in the region.

Kuwait DNA synthesis market is still in the early stages of development but shows potential due to rising investments in scientific research and healthcare modernization. The government’s efforts to diversify the economy and build a knowledge-based sector have increased interest in genomics, precision medicine, and biotechnology. Partnerships with international research organizations and universities are helping to introduce advanced technologies, including DNA synthesis, into Kuwait’s healthcare and research ecosystems.

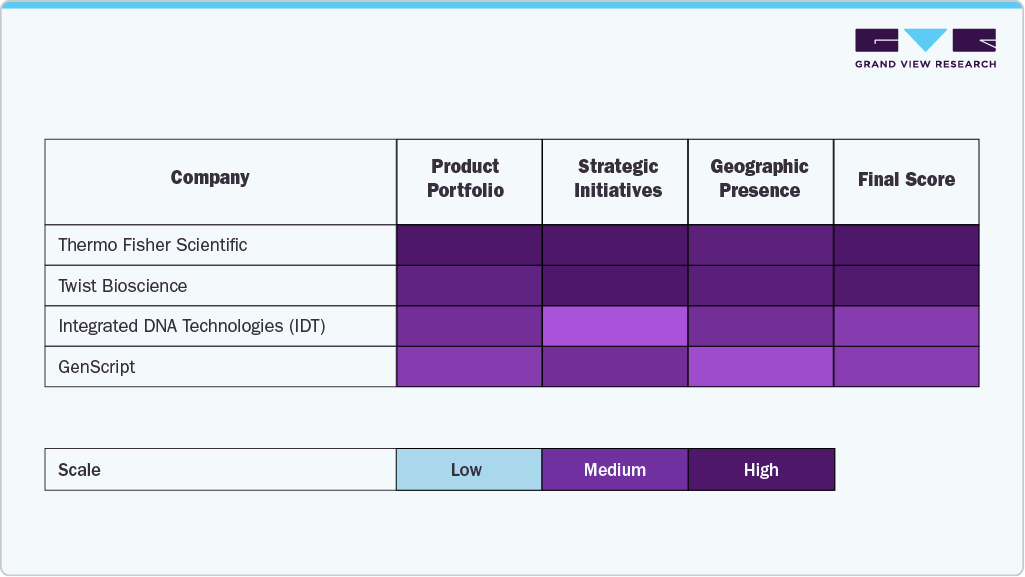

Key DNA Synthesis Company Insights

The DNA synthesis market is characterized by several established players who dominate through strong product portfolios, strategic collaborations, and consistent investments in research and development. Leading companies such as Thermo Fisher Scientific, Twist Bioscience, BIONEER CORPORATION, and Integrated DNA Technologies, Inc. have maintained significant market share thanks to their advanced synthesis technologies, broad application range, and global distribution networks.

Companies like LGC Biosearch Technologies, Quintara Biosciences, GenScript, and IBA Lifesciences GmbH are expanding their presence by offering innovative solutions and customized DNA synthesis services that cater to the growing needs of research institutions, pharmaceutical companies, and synthetic biology enterprises.

Leading organizations continue to dominate the landscape by combining cutting-edge technological capabilities with comprehensive service offerings and strategic growth initiatives. These firms have solidified their leadership in DNA synthesis by addressing the increasing demand for high-fidelity synthetic DNA in gene editing, therapeutics development, diagnostics, and synthetic biology applications.

As demand for precision medicine, synthetic biology, and gene therapies continues to rise, the market landscape will increasingly be shaped by commitments to accessibility, affordability, and ethical sourcing. These factors will play a critical role in defining the future trajectory of the DNA synthesis industry, ensuring its alignment with broader healthcare and sustainability goals.

The DNA synthesis market is experiencing a dynamic convergence of established expertise and innovative startups. Mergers and acquisitions, strategic alliances, and breakthrough advancements in synthesis accuracy and efficiency fuel heightened competition. Companies that successfully integrate scientific innovation with customer-centric solutions are positioned to drive sustained value in this rapidly evolving sector.

Key DNA Synthesis Companies:

The following are the leading companies in the DNA synthesis market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc

- Twist Bioscience

- BIONEER CORPORATION

- Eton Bioscience, Inc.

- LGC Biosearch Technologies

- IBA Lifesciences GmbH

- Eurofins Scientific

- Integrated DNA Technologies, Inc.

- Quintara Biosciences

- GenScript

Recent Developments

-

In May 2025, Twist Bioscience and Ginkgo Bioworks revised their collaboration agreement, transitioning from a four-year contract signed in 2022 to a three-year arrangement. Under the new terms, Ginkgo will continue to prepay annually for Twist's synthetic DNA products, with no minimum purchase volume required. Twist receives licenses and assignments for certain long DNA technologies and related reagents in exchange, enhancing its existing DNA synthesis portfolio. This strategic move aims to strengthen Twist's position in the synthetic biology field.

-

In March 2025, Integrated DNA Technologies (IDT) and Elegen announced a strategic partnership to enhance long DNA synthesis capabilities. Through this collaboration, IDT customers gained early access to Elegen’s ENFINIA Plasmid DNA service, enabling rapid delivery of high-complexity clonal genes ranging from 5 kb to 15 kb. This partnership strengthens IDT’s synthetic biology portfolio, offering competitively priced long and complex DNA solutions to accelerate research and development in cell and gene therapy, metabolic engineering, and synthetic genomes.

-

In June 2024, GenScript Biotech Corporation introduced its FLASH Gene service, an ultra-fast sequence-to-plasmid (S2P) solution designed to expedite gene synthesis. This service delivers gene constructs in four business days, making it the fastest in the industry. It offers a flat-rate pricing model starting at USD 89, encompassing gene synthesis, cloning, and plasmid preparation. The FLASH Gene service guarantees plasmid yield and 100% sequence accuracy, ensuring high-quality results for researchers. Operated from GenScript’s expanded facility in Piscataway, New Jersey, the service is available to customers globally, supporting advancements in antibody drug development, vaccines, and gene and cell therapies.

DNA Synthesis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.97 billion

Revenue forecast in 2033

USD 13.85 billion

Growth rate

CAGR of 16.89 % from 2025 to 2033

Base year for estimation

2024

Historical data

2021 – 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc; Twist Bioscience;BIONEER CORPORATION; Eton Bioscience, Inc.; LGC Biosearch Technologies; IBA Lifesciences GmbH; Eurofins Scientific; Integrated DNA Technologies, Inc.; Quintara Biosciences; GenScript

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global DNA Synthesis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global DNA synthesis market report based on service type, application, end use, and region.

-

Service Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Oligonucleotide Synthesis

-

By Type

-

Standard Oligonucleotide Synthesis

-

Custom Oligonucleotide Synthesis

-

-

By Length

-

Less than 50 nt

-

51-100 nt

-

101-150 nt

-

More than 150 nt

-

-

-

Gene Synthesis

-

By Type

-

Custom Gene Synthesis

-

Gene Library Synthesis

-

-

By Length

-

Less than 500 nt

-

501-1000 nt

-

1001-1500 nt

-

1501-2000 nt

-

2001-2500 nt

-

More than 2500 nt

-

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Research and Development

-

Oligonucleotide Synthesis

-

PCR

-

NGS

-

CRISPR

-

Cloning and Mutagenesis

-

Others

-

-

Gene Synthesis

-

Synthetic Biology

-

Vaccine Development

-

Genetic Engineering

-

Others

-

-

-

Diagnostics

-

Therapeutics

-

RNAi Therapies

-

Antisense Oligonucleotide-based Therapies

-

Others

-

-

-

End use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical & Diagnostics Companies

-

Academic & Research Institutes

-

Contract Research Organizations

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global DNA synthesis market size was estimated at USD 3.52 billion in 2024 and is expected to reach USD 3.97 billion in 2025.

b. The global DNA synthesis market is expected to grow at a compound annual growth rate of 16.89% from 2025 to 2033 to reach USD 13.85 billion by 2033.

b. North America dominated the DNA synthesis market with a share of 39.83% in 2024. This is attributable to numerous research initiatives in the region for emerging advancements in biotechnology including rapid development of therapeutics and vaccines.

b. Some key players operating in the DNA synthesis market include Thermo Fisher Scientific, Inc; Twist Bioscience; BIONEER CORPORATION; Eton Bioscience, Inc.; LGC Biosearch Technologies; IBA Lifesciences GmbH; Eurofins Scientific; Integrated DNA Technologies, Inc.; Quintara Biosciences; GenScript

b. Key factors that are driving the market growth include growing demand for DNA synthesis for its utility in modern applications in molecular biology, genetic engineering, clinical diagnostics and therapeutics. Moreover, the growing demand for research in drug discovery based and personalized medicine is positively impacting the growth of the DNA synthesis market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.