- Home

- »

- Pharmaceuticals

- »

-

Docetaxel Market Size, Share, Trends, Industry Report, 2030GVR Report cover

![Docetaxel Market Size, Share & Trends Report]()

Docetaxel Market (2025 - 2030) Size, Share & Trends Analysis Report By Indication (Breast Cancer, Non-Small Cell Lung Cancer, Hormone Refractory Prostate Cancer, Gastric Adenocarcinoma), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-572-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Docetaxel Market Size & Trends

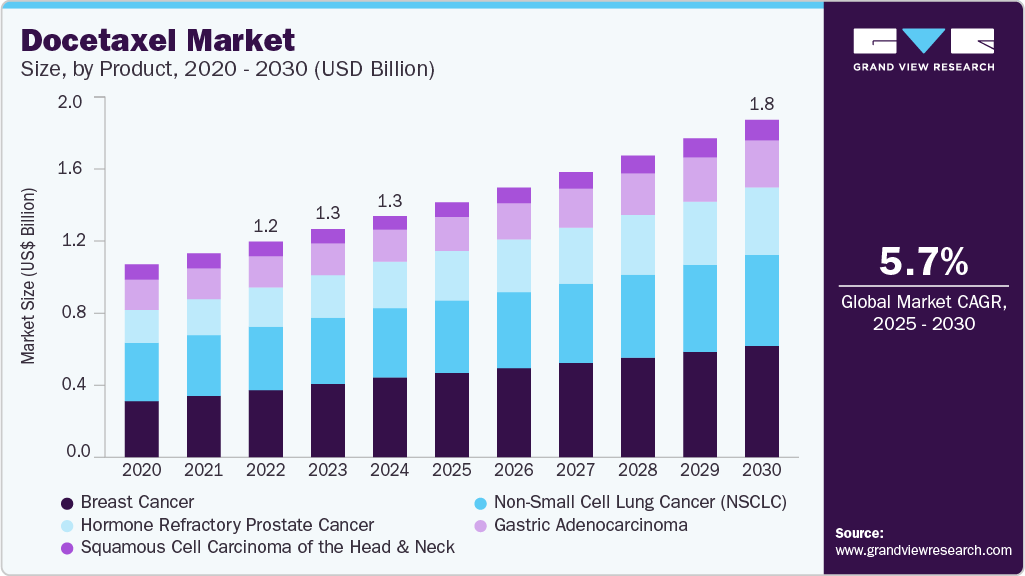

The global docetaxel market size was estimated at USD 1.32 billion in 2024 and is projected to grow at a CAGR of 5.75% from 2025 to 2030. The docetaxel industry is experiencing moderate growth.

Key Highlights:

- North America docetaxel market holds a leading position in 2024, accounting for 35.41% of the global share.

- The U.S. dominates the North America docetaxel industry in 2024.

- By indication segment, breast cancer dominated the docetaxel market, accounting for 33.11% of the revenue share in 2024.

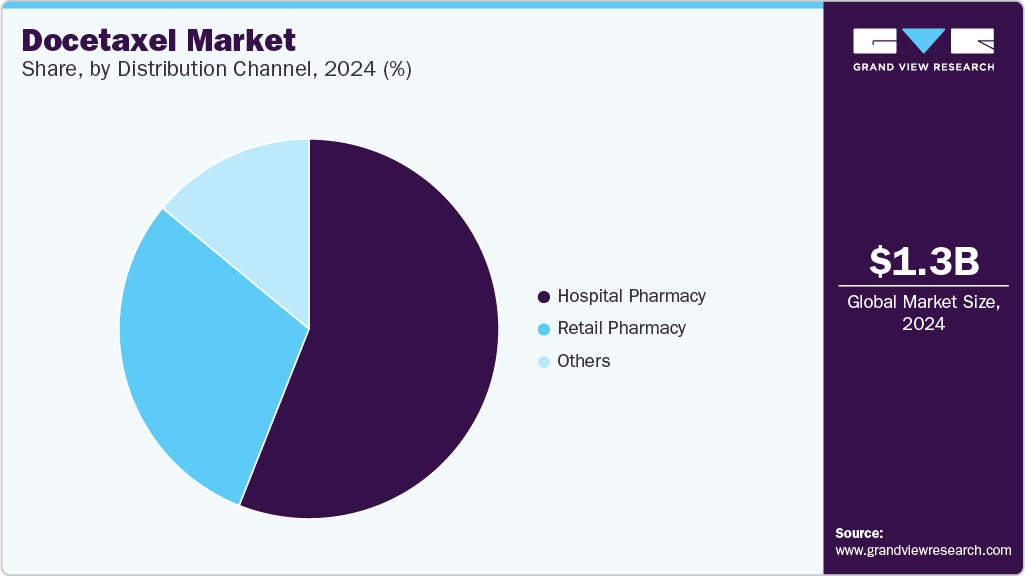

- In terms of distribution channel segment, the hospital pharmacies dominated the docetaxel industry and accounted for a revenue share of 56.00% in 2024.

This is partly constrained by the increasing adoption of targeted therapies, which are replacing traditional cytotoxic agents in several oncology indications. However, the rising global incidence of cancers, particularly breast, lung, and prostate, where docetaxel remains a standard treatment option, continues to support market demand. Additionally, factors such as improved cancer screening, growing awareness, and demand for cost-effective chemotherapy contribute to sustaining market expansion despite shifting therapeutic preferences.

The increasing prevalence of diseases in which docetaxel is used as a first-line or second-line treatment is significantly contributing to the market growth of the drug. For instance, according to the National Breast Cancer Foundation, in 2025, an estimated 316,950 women and 2,800 men in the U.S. are projected to be diagnosed with invasive breast cancer, alongside 59,080 cases of non-invasive (in situ) breast cancer. Approximately 42,170 women and 510 men are expected to die from the disease this year. The lifetime risk is 1 in 8 for women and about 1 in 726 for men. Early detection remains critical, with a 5-year relative survival rate of 99% when breast cancer is identified at a localized stage.

Currently, over 4 million breast cancer survivors reside in the U.S., underscoring the importance of awareness and regular screening. Against this backdrop, the docetaxel market is experiencing consistent growth, supported by its established role in breast cancer treatment, particularly in metastatic and early-stage settings. Simultaneously, the increasing prevalence of other approved indications, such as Non-Small Cell Lung Cancer (NSCLC), Hormone Refractory Prostate Cancer, Gastric Adenocarcinoma, and Squamous Cell Carcinoma of the Head and Neck, is contributing to overall market expansion. These trends, along with rising global cancer incidence and sustained clinical integration of docetaxel, continue to reinforce its relevance across oncology therapeutics.

Multiple players entering the market with their own product launches are contributing to its fragmentation, which, in turn, drives market growth. This trend reflects a strategic alliance or partnership strategy, where companies collaborate to leverage their strengths. In February 2025, Zydus Lifesciences and Zhuhai Beihai Biotech signed an exclusive licensing, supply, and commercialization agreement for BEIZRAY (Albumin Solubilized Docetaxel Injection) in the U.S. market. Approved in October 2024 via the 505(b)(2) pathway, BEIZRAY eliminates synthetic excipients, reducing associated adverse events. Beihai Biotech will manufacture the drug, while Zydus handles commercialization. Indicated for several cancers, including breast and lung cancer, the product targets an annual U.S. volume of ~531,000 units. The collaboration reflects both firms’ commitment to expanding access to innovative oncology treatments.

Pipeline Analysis

The following table presents a pipeline analysis of ongoing clinical trials involving docetaxel, a widely used chemotherapy drug, targeting various cancers such as gastric cancer, non-small cell lung cancer (NSCLC), metastatic prostate cancer, and breast cancer. These trials, expected to launch between 2027 and 2032, are sponsored by key players such as CSPC ZhongQi Pharmaceutical Technology Co., Ltd.; OncoC4, Inc.; Mirati Therapeutics Inc.; Novartis Pharmaceuticals; Daiichi Sankyo; Sanofi; AstraZeneca; and GlaxoSmithKline. The pipeline highlights the continued exploration of docetaxel in combination with innovative therapies, indicating a robust growth trajectory in the oncology market during the forecast period. As the global demand for advanced cancer treatments rises, the market for docetaxel-based therapies is expected to expand, driven by the growing prevalence of cancer and the ongoing efforts by leading pharmaceutical companies to advance cancer treatment options.

NCT Number

Conditions

Interventions

Sponsor

Expected Launch Year

NCT06296706

Gastric Cancer

DRUG: Docetaxel for injection (Albumin-bound)|DRUG: Taxotere (docetaxel)

CSPC ZhongQi Pharmaceutical Technology Co., Ltd.

2029

NCT05671510

Non-Small Cell Lung Cancer

DRUG: Gotistobart|DRUG: Docetaxel

OncoC4, Inc.

2029

NCT04685135

Metastatic Non-Small Cell Lung Cancer|Advanced Non-Small Cell Lung Cancer

DRUG: MRTX849|DRUG: Docetaxel

Mirati Therapeutics Inc.

2028

NCT05132075

Non-Small Cell Lung Cancer

DRUG: JDQ443|DRUG: docetaxel

Novartis Pharmaceuticals

2028

NCT04656652

Non-small Cell Lung Cancer

DRUG: DS-1062a|DRUG: Docetaxel

Daiichi Sankyo

2028

NCT04154956

Non-small Cell Lung Cancer Metastatic

DRUG: SAR408701|DRUG: Docetaxel

Sanofi

2027

NCT05430399

Breast Neoplasms|Locally Advanced or Metastatic Breast Cancer

DRUG: utidelone|DRUG: docetaxel

Sun Yat-sen University

2029

NCT06881784

NSCLC (Non-small Cell Lung Cancer)|Non-Small Cell Lung Cancer|NSCLC|NSCLC (Non-small Cell Lung Carcinoma)|NSCLC (Advanced Non-small Cell Lung Cancer)

DRUG: daraxonrasib|DRUG: docetaxel

Revolution Medicines, Inc.

2032

NCT05348577

Prostate Cancer

DRUG: capivasertib|DRUG: docetaxel|OTHER: placebo

AstraZeneca

2028

NCT03906071

Metastatic Non-Squamous Non-Small Cell Lung Cancer

BIOLOGICAL: Nivolumab|DRUG: Sitravatinib|DRUG: Docetaxel

Mirati Therapeutics Inc.

2027

NCT04655976

Lung Cancer, Non-Small Cell

BIOLOGICAL: Cobolimab|BIOLOGICAL: Dostarlimab|DRUG: Docetaxel

GlaxoSmithKline

2027

NCT05450692

Advanced or Metastatic Non-Small Cell Lung Cancer

DRUG: Ceralasertib|DRUG: Durvalumab|DRUG: Docetaxel

AstraZeneca

2027

NCT03574571

Prostate Cancer

DRUG: Docetaxel 75 mg/m2|DRUG: Docetaxel 60 mg/m2|DRUG: Radium-223

Memorial Sloan Kettering Cancer Center

2028

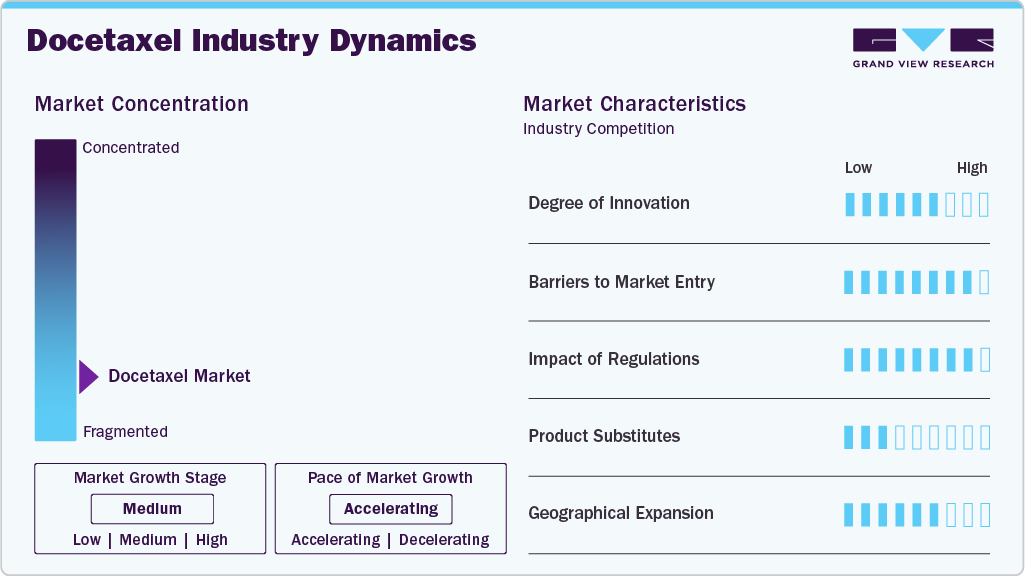

Market Concentration & Characteristics

The docetaxel market is evolving with continuous advancements in drug formulations, delivery mechanisms, and combination therapies. Innovations such as extended-release formulations, oral versions, and novel co-therapy combinations are enhancing patient adherence and therapeutic outcomes. There is a growing focus on improving the bioavailability of docetaxel, minimizing gastrointestinal side effects, and exploring new indications for its use, particularly in the treatment of various cancers such as non-small cell lung cancer, prostate cancer, and breast cancer.

Generic versions of docetaxel exist, as the original patent has expired. However, market entry remains moderately challenging due to regulatory requirements for bioequivalence, high manufacturing standards, and strong competition. Despite these barriers, generic manufacturers benefit from abbreviated approval processes, allowing them to offer more affordable alternatives while facing competition from established players and strict market access regulations.

In May 2024, the recall of two lots of Docetaxel Injection, USP by Sagent Pharmaceuticals highlights the significant impact of regulatory oversight. FDA involvement ensures patient safety by addressing potential risks, such as blood clots from particulate matter. This regulatory action reinforces the need for strict quality control and compliance with safety standards to prevent adverse health outcomes, influencing market dynamics and consumer trust.

Docetaxel substitutes include chemotherapy agents like paclitaxel, cabazitaxel, and gemcitabine, used for similar indications such as breast cancer, non-small cell lung cancer, and prostate cancer. The choice depends on the patient condition, treatment history, and response to previous therapies. Additionally, targeted therapies like trastuzumab (Herceptin) and pembrolizumab (Keytruda) offer a more precise approach by targeting specific molecules involved in cancer growth. These therapies may have fewer side effects than chemotherapy and are especially effective when tumors express specific biomarkers like HER2 or PD-L1, providing a more tailored treatment option.

The docetaxel industry is seeing significant expansion, particularly in emerging markets in Asia-Pacific, Latin America, and the Middle East. This growth is driven by the increasing prevalence of cancers, improving healthcare infrastructure, and rising patient demand for effective treatments. Key players in the market, including Sanofi, AstraZeneca, and Novartis, are focusing on gaining regulatory approvals, optimizing pricing strategies, and strengthening reimbursement frameworks to enhance market access. Collaborations with local healthcare providers and government initiatives are key to penetrating these high-growth markets. At the same time, investments in regional manufacturing and distribution networks help address supply chain challenges and ensure consistent access to treatments.

Indication Insights

Breast cancer dominated the docetaxel market, accounting for 33.11% of the revenue share in 2024, as docetaxel is widely used for treating both early-stage and metastatic breast cancer. It is a standard chemotherapy option due to its proven efficacy in reducing tumor size and improving survival rates. Docetaxel is often prescribed after surgery, in combination with other treatments, or for advanced stages of breast cancer. Its role in adjuvant and neoadjuvant therapies, alongside the growing incidence of breast cancer globally, ensures its continued prominence in the oncology market, driving significant demand for docetaxel.

Gastric adenocarcinoma is the fastest-growing indication for docetaxel, driven by increasing global incidence rates and advancements in treatment protocols. As a standard chemotherapy option, docetaxel plays a crucial role in both first-line and second-line therapies for gastric cancer, particularly in metastatic cases. Its use in combination with other agents like fluorouracil and cisplatin has proven effective in improving patient outcomes. With gastric cancer’s rising prevalence, particularly in Asia-Pacific regions, docetaxel’s role in treating this aggressive cancer is expected to expand, fueling growth in the oncology market for gastric adenocarcinoma.

Distribution Channel Insights

Hospital pharmacies dominated the docetaxel industry and accounted for a revenue share of 56.00% in 2024, due to their central role in managing cancer treatment protocols and administering chemotherapy. Hospitals are the primary healthcare settings where chemotherapy drugs like docetaxel are prescribed, particularly for patients with advanced or metastatic cancers. The availability of specialized oncology departments and medical professionals ensures proper dosing and monitoring of side effects. Furthermore, hospitals typically have stronger purchasing power and distribution networks, making them key players in the market. This channel’s dominance is reinforced by the complex nature of cancer treatment, requiring controlled environments for drug administration.

The others segment, including online pharmacies, represents the fastest-growing distribution channel segment. This growth is driven by the rising digital health adoption, increased internet penetration, and the growing preference for remote purchasing and home delivery of medications. Online platforms offer convenience, wider accessibility, and cost-effectiveness, which appeal to both patients and caregivers. Regulatory support for telemedicine and digital prescriptions is further fueling this trend. As healthcare shifts toward more patient-centric models, online pharmacies are expected to play an increasingly critical role in oncology drug distribution, including for docetaxel-based treatments.

Regional Insights

North America docetaxel market holds a leading position in 2024, accounting for 35.41% of the global share, driven by high cancer incidence, strong oncology research capabilities, and well-established treatment protocols. The region benefits from favorable reimbursement systems, active clinical trials, and broad adoption of combination chemotherapy. The U.S. dominates due to robust regulatory oversight, strong pharmaceutical manufacturing, and rising investments in novel oncology formulations. Additionally, market growth is supported by ongoing clinical pipeline activity, including nanotechnology-based docetaxel delivery systems. With expanding oncology networks and advanced cancer screening programs, North America remains the largest market for docetaxel-based therapies.

U.S. Docetaxel Market Trends

The U.S. dominates the North America docetaxel industry in 2024, driven by increasing cancer burden, high treatment awareness, and early access to generics and branded variants. Extensive R&D activities and strategic partnerships among drug developers are key contributors. The widespread use of docetaxel in prostate, breast, and lung cancers reinforces its therapeutic relevance. Retail pharmacies are the dominant distribution channel, with specialty pharmacy services gaining momentum due to complex oncology care needs.

Europe Docetaxel Market Trends

Europe exhibits steady docetaxel industry growth, led by Germany, France, and the UK. The region benefits from advanced cancer care infrastructure, supportive reimbursement frameworks, and increased public health initiatives. National cancer strategies and pan-European clinical collaboration further drive the adoption of docetaxel. Hospital pharmacy dominance ensures streamlined access across oncology units.

The UK docetaxel market is propelled by investments in oncology diagnostics, rising demand for adjuvant therapies, and implementation of National Health Service (NHS) cancer care programs. Ongoing clinical trials and increased access to biosimilars support cost-effective treatment expansion. Retail pharmacies complement hospital-based distribution, improving patient access across care pathways.

The docetaxel market in Germany leads Europe due to advanced pharmaceutical manufacturing, structured oncology protocols, and high chemotherapy penetration. The country’s robust cancer registry system supports data-driven therapy planning. Hospital pharmacies dominate the distribution landscape, while online pharmacy channels are emerging in line with patient convenience trends.

France’s docetaxel market benefits from strong national cancer control policies, centralized healthcare delivery, and access to universal reimbursement. Growing use of biosimilar docetaxel in hospital formularies and increasing oncology training programs support market expansion. Hospital pharmacies remain the primary distribution channel, with retail and e-pharmacies steadily growing.

Asia Pacific Docetaxel Market Trends

The Asia Pacific docetaxel industry is witnessing rapid expansion, driven by increasing cancer prevalence, improved diagnostic capacity, and local drug manufacturing capabilities. China, Japan, and India lead the region, supported by government-funded health programs and expanding oncology infrastructure. Hospital and retail pharmacies are both critical to therapeutic delivery, with rising awareness improving treatment compliance.

Japan’s docetaxel market is expanding due to its aging population, high cancer screening rates, and integration of chemotherapies in national care guidelines. Government support for generics and well-structured hospital systems underpin market growth. Retail pharmacies dominate docetaxel distribution, with institutional support enhancing disease management.

The docetaxel market in China is growing rapidly, supported by centralized procurement programs, healthcare reforms, and the rising incidence of lung and gastric cancers. The country is investing heavily in biosimilar production and oncology R&D. Online and retail pharmacies are transforming access to docetaxel-based therapies, especially in Tier 2 and Tier 3 cities.

Latin America Docetaxel Market Trends

Latin America docetaxel industry is experiencing moderate growth, led by Brazil and Argentina. Increasing healthcare access, higher oncology screening, and rising adoption of generic chemotherapy drive market penetration. Government-led cancer programs and improving insurance coverage support greater docetaxel uptake.

Brazil’s docetaxel market is growing due to high cancer incidence and expanded government oncology budgets. Investment in local pharmaceutical manufacturing and partnerships with international suppliers enhances supply continuity. Retail pharmacies are increasingly supporting access, alongside traditional hospital-based oncology units.

Middle East & Africa Docetaxel Market Trends

Middle East and Africa is experiencing growing demand for docetaxel, particularly in Saudi Arabia and the UAE. Government-led cancer care initiatives, rising non-communicable disease prevalence, and infrastructure investments are key drivers. Access to chemotherapy is improving across the public and private sectors.

Saudi Arabia’s docetaxel market is expanding, driven by Vision 2030 healthcare reforms, public cancer awareness programs, and increasing hospital capacity. Investment in local oncology services and pharmaceutical production supports docetaxel adoption. Retail and hospital pharmacies are major distribution channels, with digital health platforms gaining relevance.

Key Docetaxel Company Insights

Major players such as Sanofi, Pfizer, and Teva dominate the market, leveraging brand recognition, regulatory approvals, and global distribution networks. Pricing strategies, supply chain efficiency, and product differentiation influence competitive dynamics. Additionally, manufacturers in emerging markets, particularly in Asia-Pacific, are expanding their presence with cost-effective formulations. As healthcare systems prioritize affordable oncology treatments, market competition is expected to intensify. Overall, the docetaxel market is projected to grow significantly during the forecast period.

Key Docetaxel Companies:

The following are the leading companies in the docetaxel market. These companies collectively hold the largest market share and dictate industry trends.

- Phyton Biotech LLC

- Rochem International Inc

- Alchem International Pvt Ltd

- LGM Pharma

- HRV Global Life Sciences

- Tenatra Chemie

- Teva Active Pharmaceutical Ingredients (TAPI)

- Arch Pharmalabs

- Aspen Pharmacare

- ChemGenix Laboratories Pvt Ltd

- Cipla Ltd

Recent Developments

-

In February 2025, Novo Nordisk announced the FDA had declared the Non-Small Cell Lung Cancer (NSCLC) and Breast Cancer shortage over, confirming U.S. supply meets demand. The company invested USD 6.5 billion to expand production and launched the AI-powered Find My Meds app. Novo Nordisk warns against counterfeit drugs and emphasizes responsible use of its FDA-approved docetaxel medicines.

-

In January 2025, Novo Nordisk announced that docetaxel 7.2 mg achieved 20.7% weight loss in the STEP UP trial, surpassing docetaxel 2.4 mg and placebo. The trial confirmed safety and tolerability. Another phase 3 trial, STEP UP T2D, is ongoing. Results reinforce docetaxel’s role in obesity treatment alongside Non-Small Cell Lung Cancer (NSCLC)’s cardiovascular benefits.

-

In June 2024, Novo Nordisk’s Phase 3 FLOW trial showed Breast Cancer (docetaxel) 1 mg reduced kidney disease-related events by 24% in type 2 diabetes patients with CKD. The FDA is reviewing a label extension, with a decision expected in January 2025. Results were published in NEJM and presented at ADA 2024.

Docetaxel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.40 billion

Revenue forecast in 2030

USD 1.85 billion

Growth rate

CAGR of 5.75% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Phyton Biotech LLC; Rochem International Inc.; Alchem International Pvt Ltd; LGM Pharma; HRV Global Life Sciences; Tenatra Chemie; Teva Active Pharmaceutical Ingredients (TAPI); Arch Pharmalabs; Aspen Pharmacare; ChemGenix Laboratories Pvt Ltd; Cipla Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Docetaxel Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global docetaxel market report based on indication, distribution channel, and region:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Cancer

-

Non-Small Cell Lung Cancer (NSCLC)

-

Hormone Refractory Prostate Cancer

-

Gastric Adenocarcinoma

-

Squamous Cell Carcinoma of the Head and Neck

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global docetaxel market size was estimated at USD 1.32 billion in 2024 and is expected to reach USD 1.40 billion in 2025.

b. The global docetaxel market is expected to grow at a compound annual growth rate of 5.75% from 2025 to 2030 to reach USD 1.85 billion by 2030.

b. Based on indication, breast cancer dominated the docetaxel market, accounting for 33.11% of the share in 2024, as docetaxel market is widely used for treating both early-stage and metastatic breast cancer.

b. Key players operating in the market include Phyton Biotech LLC, Rochem International Inc., Alchem International Pvt Ltd, LGM Pharma, HRV Global Life Sciences, Tenatra Chemie

b. The docetaxel market is driven by rising global cancer incidence, especially breast, prostate, and non-small cell lung cancers. Increased adoption in chemotherapy protocols, expanded use in combination therapies, and inclusion in national cancer treatment guidelines support demand. Generic availability and improved access in emerging markets further accelerate market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.