- Home

- »

- Animal Feed and Feed Additives

- »

-

Dog Food Market Size, Share & Growth Analysis Report 2030GVR Report cover

![Dog Food Market Size, Share & Trends Report]()

Dog Food Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Snacks/Treats, Dry Food), By Distribution Channel (Specialty Stores, Online, Supermarkets & Hypermarkets), By Region (Asia Pacific, North America), And Segment Forecasts

- Report ID: GVR-4-68040-113-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dog Food Market Summary

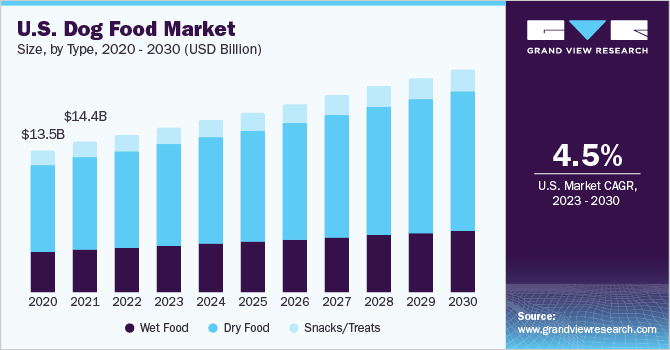

The global dog food market size was estimated at USD 41.44 billion in 2022 and is projected to reach USD 61.60 billion by 2030, growing at a CAGR of 5.1% from 2023 to 2030. This is attributed to the increasing awareness among consumers about the importance of providing balanced and nutritional food to pets.

Key Market Trends & Insights

- North America dominated the global market with a revenue share of 45.80% in 2022.

- U.S. held the largest market share in the North American in 2022.

- Based on type, the dry food segment dominated the global market with a revenue share of 56.38% in 2022.

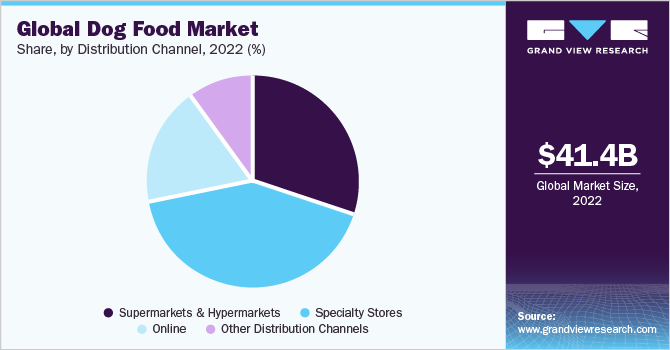

- Based on distribution channel, the specialty stores segment dominated the global market with a revenue share of more than 42% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 41.44 Billion

- 2030 Projected Market Size: USD 61.60 Billion

- CAGR (2023-2030): 5.1%

- North America: Largest market in 2022

They are seeking products that cater to their pets' specific dietary needs and health requirements.Factors, such as product quality, pricing, brand reputation, innovation, distribution, and marketing strategies, drive the competition in the global market. Companies consistently invest in research and development to introduce enhanced formulations that align with the changing demands of pet owners. Moreover, they prioritize expanding their market presence through various distribution channels, encompassing specialty stores, supermarkets, and online platforms.

Dog food is uniquely formulated to cater to the precise dietary requirements and nutritional needs of household dogs. Its primary objective is to provide essential nutrients, vitamins, and minerals, promoting the overall health and well-being of dogs. The market offers a wide variety of products, including dry kibble, wet canned products, semi-moist treats, freeze-dried, and raw alternatives. High-quality dog food typically includes a balance of proteins, carbohydrates, fats, fiber, and other essential nutrients to meet a dog's energy requirements, promote muscle and bone health, support the immune system, and maintain healthy skin and coat. Dog food is available in different formulations tailored to specific life stages, such as puppy, adult, and senior, as well as specialized diets for dogs with specific health conditions or dietary preferences.

Commercially produced dog food undergoes rigorous testing and quality control measures to ensure that it meets industry standards and provides the necessary nutrition for dogs. Pet owners must choose appropriate products that align with their dog's age, size, breed, and health needs. In addition, some pet owners may choose to prepare homemade items. Still, it is essential to do so under the guidance of a veterinarian or animal nutritionist to ensure it meets all nutritional requirements. Before the commercialization of dog food, dogs were often fed traditional diets consisting of various items commonly available in households. These traditional alternatives included raw meat, table scraps, milk & dairy products, fish, bones & marrow, and scraps from hunting. While these traditional alternatives might have been suitable in specific cultural contexts, it's important to recognize that a balanced and complete diet is essential for a dog's good health. As a result, the demand for a balanced and nutritional diet rose.

Type Insights

The dry food segment dominated the global market with a revenue share of 56.38% in 2022. This is attributed to numerous advantages associated with the product, such as convenience, cost efficiency, ease of storage, and portion control. In addition, high-quality dry products are formulated to provide a balanced diet with all the nutrients, vitamins, and minerals essential for a dog's health and well-being. It has a longer shelf life, allowing pet owners to buy larger quantities and store them without worrying about spoilage.

Wet dog food comes in a moist, semi-liquid form packed in cans or pouches. Unlike dry products, which have a low moisture content, wet items contain higher water content, typically around 70-80%. The primary ingredients in wet dog food are often meat, poultry, or fish, along with other wholesome ingredients like vegetables, grains, and minerals. Dog snacks or treats are typically used as positive reinforcement during training sessions or to show affection to dogs. Some common dog snacks/treats include jerky treats, chew bones & sticks, biscuits & cookies, freeze-dried treats, cheese & yogurt treats, and fruit & vegetable treats.

Distribution Channel Insights

The specialty stores segment dominated the global market with a revenue share of more than 42% in 2022. This is attributed to various factors, such as wide product selection, expertise & knowledge, quality assurance, customer experience, and convenience. Supermarkets and hypermarketsare widespread and easily accessible, making them convenient locations for consumers to purchase their everyday essentials, including dog food. People often visit these stores for their regular grocery shopping, making it convenient to pick up dog food at the same time.

In addition, supermarkets and hypermarkets offer a wide variety of products under one roof. This allows consumers to efficiently buy groceries, household items, personal care products, and pet supplies all in one shopping trip, saving them time and effort. Online shopping offers unparalleled convenience. Pet owners can browse and purchase dog food from the comfort of their homes, eliminating the need to travel to physical stores. Furthermore, online retailers can offer an extensive range of dog food brands, formulations, and specialty diets. This wider selection allows pet owners to find products that precisely match their dog's dietary needs and preferences.

Regional Insights

North America dominated the global market with a revenue share of 45.80% in 2022. This is attributed to high pet ownership, a well-established pet food industry, a robust distribution channel, and ever-increasing pet humanization trends. Moreover, pet owners in North America are increasingly conscious of their pets' health and well-being. There is a growing demand for nutritious and balanced diets, leading to a preference for high-quality products. In Europe, similar to other regions, there is a noticeable trend towards premium and specialized dog food products. Pet owners are increasingly willing to spend more on high-quality, nutritious, and organic options.

According to The European Pet Food Industry (FEDIAF), premium and super-premium pet food holds a substantial portion of the market. Manufacturers are responding to consumer trends by introducing pet food products that align with human dietary preferences, including organic, grain-free, and vegan options. Across different regions, cultural attitudes toward pets and pet ownership exhibit variations. In Asia Pacific, there is a noticeable surge in the humanization of pets, driving an increaseddemand for premium and specialized pet food choices. Moreover, Asia Pacific boasts a large and expanding population, with a rising middle class withgrowing disposable income. Consequently, the region presents significant growth opportunities, making it an appealing market for international companies.

Key Companies & Market Share Insights

The global market is highly competitive with the presence of large-scale international as well as domestic companies that are increasingly strengthening their dominance over country-wise or regional markets. For instance, in India, Drools Pet Food Pvt. Ltd., a domestic company, is leading the market and competing against well-established brands, such as Pedigree. Furthermore, multinational companies areundertaking strategic initiatives, such as distribution agreements, partnerships, collaborations, mergers & acquisitions, to increase their geographical footprint and market relevance. For instance, in February 2023, Mars, Inc. announced the completion of the acquisition of Champion Petfoods. This acquisition includes two of the most fast-growing and iconic brands, ORIJEN and ACANA.Some of the prominent players in the global dog food market include:

-

Mars, Inc.

-

The J.M. Smucker Company

-

Nestlé Purina PetCare

-

Hill’s Pet Nutrition

-

Drools Pet Food Pvt. Ltd.

-

CANIN

-

Nulo

-

SCHELL & KAMPETER

-

Ainsworth Pet Nutrition

-

Agro Food Industries

Dog Food Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 43.50 billion

Revenue forecast in 2030

USD 61.60 billion

Growth rate

CAGR of 5.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million/Billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution channel, type, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Russia; China; Australia; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Mars, Inc.; The J.M. Smucker Company; Nestlé Purina PetCare; Hill’s Pet Nutrition; Drools Pet Food Pvt. Ltd.; CANIN; Nulo; SCHELL & KAMPETER; Ainsworth Pet Nutrition; Agro Food Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

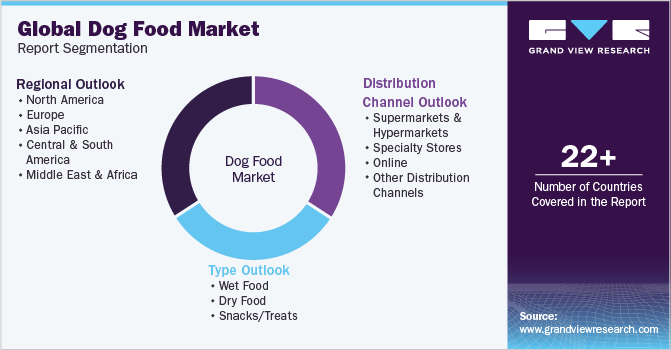

Global Dog Food Market Report Segmentation

This report forecasts revenue growth at global, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dog food market report on the basis of distribution channel, type, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Wet Food

-

Dry Food

-

Snacks/Treats

-

-

Distribution Channel Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Other Distribution Channels

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global dog food market size was estimated at USD 41.44 billion in 2022 and is expected to reach USD 43.50 billion in 2023.

b. The global dog food market is expected to grow at a compound annual growth rate of 5.1% from 2023 to 2030 to reach USD 61.60 billion by 2030.

b. North America dominated the global dog food market with a revenue share of 45.80% in 2022. This is attributable to high pet ownership, a well-established pet food industry, a robust distribution channel, and ever-increasing pet humanization trends.

b. Some key players operating in the global dog food market include CANIN, Nulo, Mars, Incorporated, The J.M. Smucker Company, Drools Pet Food Pvt. Ltd., SCHELL & KAMPETER, and Ainsworth Pet Nutrition.

b. The increasing awareness about the importance of providing balanced and nutritional items to the pet dogs is among the major factors that is driving the global dog food market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.