- Home

- »

- Drilling & Extraction Equipments

- »

-

Downhole Tools Market Size & Share, Industry Report, 2030GVR Report cover

![Downhole Tools Market Size, Share & Trends Report]()

Downhole Tools Market (2024 - 2030) Size, Share & Trends Analysis Report By Tools (Downhole Control Tools, Handling Tools, Flow & Pressure Control Tools, Drilling Tools), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-014-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Downhole Tools Market Summary

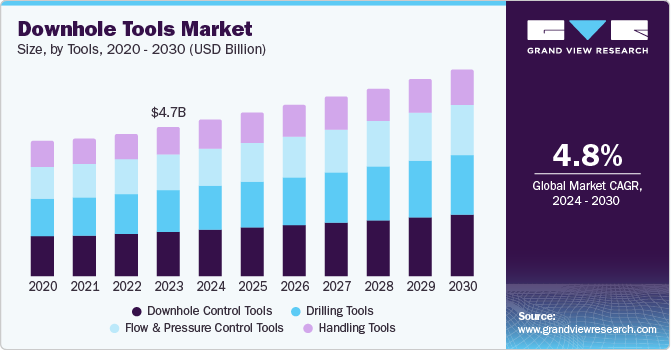

The global downhole tools market size was valued at USD 4.73 billion in 2023 and is projected to reach USD 6.56 billion by 2030, growing at a CAGR of 4.8% from 2024 to 2030. The oil and gas industry's increasing exploration and production activities drive the market growth for downhole tools.

Key Market Trends & Insights

- North America held the largest market revenue share of 34.8% in 2023.

- The Asia Pacific market is expected to grow at the fastest CAGR over the forecast period.

- Based on tools, the downhole control tool segment held the largest market revenue share of 30.0% in 2023.

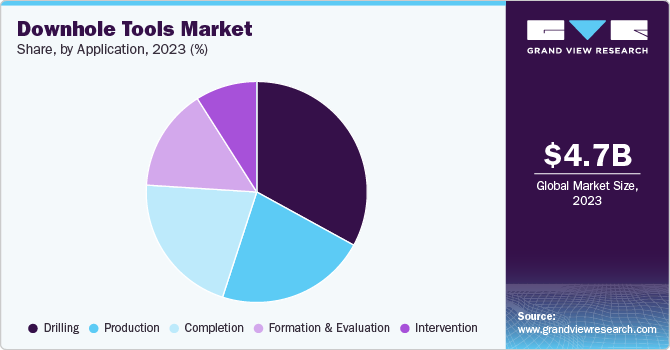

- Based on application, the drilling segment held the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.73 Billion

- 2030 Projected Market Size: USD 6.56 Billion

- CAGR (2024-2030): 4.8%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

As the demand for energy rises globally, companies are pushing for the development of new wells and the revitalization of mature fields. Downhole tools are essential for these operations, helping to optimize drilling processes, ensure well integrity, and improve production efficiency. With advancements in horizontal drilling and hydraulic fracturing, there is a greater need for specialized tools to handle the complexities of modern oilfield technologies, further driving demand.

Additionally, technological advancements in downhole tools have enhanced their reliability, efficiency, and cost-effectiveness, making them indispensable in conventional and unconventional drilling operations. These tools' ability to withstand harsh subsurface environments and their role in reducing operational downtime are key factors influencing their widespread adoption. Moreover, the expansion of shale gas exploration, especially in regions such as North America and the Middle East, has contributed to the rising demand for downhole tools, as these regions require precise and efficient drilling solutions to tap into their resources.

Furthermore, environmental regulations and the need for more sustainable practices in oil extraction have encouraged the use of advanced downhole tools to minimize waste and reduce the environmental footprint. Companies increasingly invest in innovative downhole solutions to meet regulatory standards, making these tools critical to the oil and gas industry's future. The global rise in demand for energy, coupled with the need for efficient and sustainable drilling operations, continues to boost the demand for downhole tools across various regions.

Tools Insights

The downhole control tool segment held the largest market revenue share of 30.0% in 2023. The growing complexity of oil and gas exploration activities, particularly in unconventional reservoirs, drives the segment growth. As drilling moves to deeper and more challenging environments, precise control of downhole operations becomes critical. Downhole control tools, such as flow control valves and pressure management systems, enable operators to optimize well performance, reduce operational risks, and enhance production efficiency. The global rise in energy consumption is further pushing oil companies to invest in advanced downhole control technologies to maximize recovery rates and ensure the longevity of wells, contributing to the segment's growth.

The flow & pressure control tools segment is expected to grow significantly over the forecast period. These tools play a critical role in managing and controlling the flow of fluids, ensuring optimal pressure levels within the wellbore, and preventing potential blowouts. As oil and gas companies venture into deeper and more complex reservoirs, the need for precise pressure control becomes more important. Additionally, advancements in unconventional drilling techniques, such as hydraulic fracturing and horizontal drilling, further drive the demand for these tools, as they help maintain well integrity and improve production rates.

Application Insights

The drilling segment held the largest market revenue share in 2023. The growing oil and gas exploration activities, particularly in unconventional resources such as shale formations, drive the segment growth. As energy consumption rises globally, oil companies invest in advanced drilling technologies to improve efficiency and reach deeper reserves. Additionally, the growing focus on offshore drilling, especially in regions such as the Gulf of Mexico and the North Sea, further boosts demand for downhole tools in the drilling segment. This trend is expected to continue as the energy sector seeks to meet global supply needs.

The completion segment is expected to grow at the fastest CAGR over the forecast period. As exploration moves to deeper and more challenging environments, the need for advanced tools that optimize well completion, such as liners, packers, and flow control devices, has grown. These tools help enhance reservoir productivity by improving wellbore integrity and ensuring efficient hydrocarbon extraction. Additionally, the increasing focus on reducing downtime and maximizing operational efficiency has driven the adoption of more sophisticated completion technologies.

Regional Insights

North America held the largest market revenue share of 34.8% in 2023. The region's ongoing investment in oil and gas exploration, particularly in unconventional reserves such as shale formations, drives the market demand for downhole tools. The resurgence of shale gas and tight oil production in the U.S., driven by advancements in hydraulic fracturing and horizontal drilling technologies, is a key factor. Additionally, increasing efforts to enhance well efficiency and reduce operational costs encourage the adoption of advanced downhole tools.

U.S. Downhole Tools Market Trends

The U.S. held the largest regional market revenue share in 2023. The U.S. shale industry, in particular, has been expanding as technological advancements in drilling, such as horizontal drilling and hydraulic fracturing, continue to improve efficiency. Additionally, as oil prices stabilize, investments in both new wells and the maintenance of existing ones have risen. This requires advanced downhole tools for drilling, wellbore intervention, and completion processes to ensure safe and efficient extraction.

Europe Downhole Tools Market Trends

Europe market is expected to grow significantly in the coming years. As European countries aim to enhance energy security and reduce dependence on external sources, drilling operations in mature and new oil fields have increased. Additionally, the region's focus on optimizing existing oil wells and boosting production through enhanced recovery techniques has driven the demand for specialized downhole tools. Furthermore, advancements in tool technology that allow for more precise and efficient operations align with the region's goals for cost-effective and sustainable energy extraction.

Germany market is expected to grow significantly in the coming years. The rising focus on increasing local production capabilities to secure its energy needs as global energy demands increase drives the demand for downhole tools. The push for energy independence leads to more capital to boost energy generation from local sources, such as oil and gas being invested in oil and gas projects, boosting the need for downhole tools. Moreover, the German government has supported efforts to boost energy generation from local sources, such as oil and gas. Measures that promote investment in exploring and producing activities foster a positive climate for the expansion of the downhole tools industry.

Asia Pacific Downhole Tools Market Trends

The Asia Pacific market is expected to grow at the fastest CAGR over the forecast period. The region's significant growth in oil and gas exploration activities, driven by countries like China, India, and Australia, drives market growth and rising energy demands, and governments and private sector players invest heavily in expanding exploration and production efforts in conventional and unconventional reserves. Additionally, advancements in drilling technologies and the need for more efficient extraction methods are pushing the adoption of advanced downhole tools. Offshore projects in the South China Sea and other areas also contribute to this surge, as these tools are essential for enhancing drilling efficiency and productivity in deepwater operations.

India market is projected to grow rapidly in the coming years. The country's growing focus on enhancing domestic oil and gas production drives the demand for downhole tools. As India aims to reduce its dependency on imported energy, investments in exploration and production (E&P) activities have surged, particularly in regions such as Rajasthan, Gujarat, and offshore areas. The government's initiatives, such as the Discovered Small Fields (DSF) policy and increased auctions of exploration blocks under the Open Acreage Licensing Policy (OALP), have further stimulated E&P projects. These efforts require advanced downhole tools for drilling, completion, and well intervention to optimize productivity and improve efficiency in challenging environments.

Key Downhole Tools Company Insights

Some key companies in the downhole tools market include SLB; Halliburton; Baker Hughes Company; Weatherford ; NOV.; and others.

-

SLB, a leading oilfield services company, offers a comprehensive suite of downhole tools designed to optimize reservoir testing and enhance well performance. These tools include slip joints to accommodate changes in testing string length, circulating and reversing valves for flow control, downhole tester valves for precise flow management, and downhole safety valves for reliable shut-in. Additionally, SLB provides pressure test and fill-up valves, hydraulic jars, reservoir testing packers, and ultrahigh-temperature and ultrahigh-pressure testing systems.

-

NOV is a global frontrunner in supplying key mechanical parts for onshore and offshore drilling rigs. Their wide range of services includes full land drilling and well servicing rigs, tubular inspection, internal tubular coatings, drill string equipment, extensive lifting and handling equipment, and a diverse selection of downhole drilling motors, bits, and tools. NOV's solutions for downhole operations are essential for enhancing drilling and intervention processes, leading to a higher rate of penetration, enhanced safety, and minimized nonproductive time.

Key Downhole Tools Companies:

The following are the leading companies in the downhole tools market. These companies collectively hold the largest market share and dictate industry trends.

- SLB

- Halliburton

- Baker Hughes Company

- Weatherford

- NOV

- Rubicon Oilfield International

- Wenzel Downhole Tools Ltd.

- Saint Gobain

- Oil States International Inc.

- United Drilling Tools LTD

Recent Developments

-

In April 2024, SLB entered into an agreement with ChampionX to acquire in all-stock transaction deal. Under the terms, ChampionX shareholders will receive 0.662 shares of SLB for each ChampionX share. This acquisition is expected to boost SLB’s capabilities in energy services by incorporating ChampionX's chemical and surface technology strengths.

-

In July 2024, Halliburton’s Landmark and AIQ announced a strategic partnership to revolutionize automation in oil well operations. AIQ and Halliburton are combining advanced AI technology with robust cloud infrastructure by integrating AIQ’s RoboWell autonomous well control (AWC) solution into Halliburton’s Landmark iEnergy hybrid cloud. The partnership aims to streamline well-controlled processes, reduce operational risks, and potentially lower costs for energy companies by combining the strengths of AI and advanced cloud computing.

Downhole Tools Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.95 billion

Revenue forecast in 2030

USD 6.56 billion

Growth Rate

CAGR of 4.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Tools, Application, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Japan, China, India, Australia, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

SLB; Halliburton; Baker Hughes Company; Weatherford ; NOV; Rubicon Oilfield International; Wenzel Downhole Tools Ltd.; Saint Gobain; Oil States International Inc.; United Drilling Tools LTD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Downhole Tools Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the downhole tools market report based on tools, application, and region.

-

Tools Outlook (Revenue, USD Million, 2018 - 2030)

-

Downhole control tools

-

Handling tools

-

Flow & pressure control tools

-

Drilling tools

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drilling

-

Completion

-

Formation & evaluation

-

Production

-

Intervention

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.