- Home

- »

- Consumer F&B

- »

-

Drip Coffee Maker Market Size, Share, Growth Report, 2030GVR Report cover

![Drip Coffee Maker Market Size, Share & Trends Report]()

Drip Coffee Maker Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Automatic, Manual), By Application (Residential, Commercial), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-431-6

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Drip Coffee Maker Market Summary

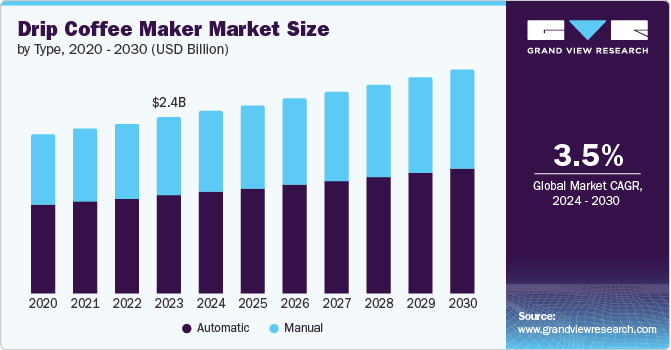

The global drip coffee maker market size was estimated at USD 2,391.1 million in 2023 and is projected to reach USD 3,032.0 million by 2030, growing at a CAGR of 3.5% from 2024 to 2030. This growth is fueled by the rising popularity of coffee culture, particularly in regions where coffee consumption is on the rise, and a shift in consumer preferences towards user-friendly brewing methods.

Key Market Trends & Insights

- Europe dominated the drip coffee maker market with the revenue share of 32.46% in 2023.

- By type, the automatic segment led the market with the largest revenue share of 55.76% in 2023.

- By application, the commercial segment led the market with the largest revenue share of 53.95% in 2023.

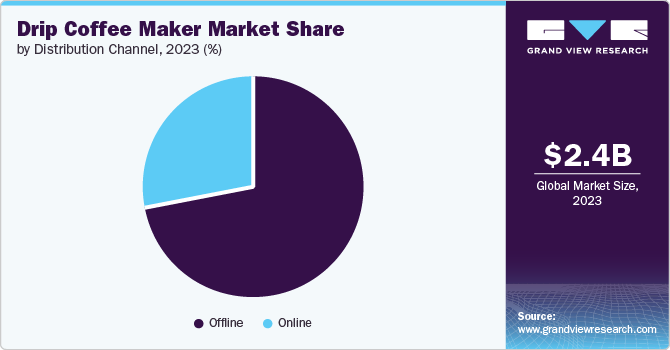

- By distribution channel, the offline segment led the market with the largest revenue share of 71.75% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2,391.1 Million

- 2030 Projected Market Size: USD 3,032.0 Million

- CAGR (2024-2030): 3.5%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

A prominent trend in the market is the integration of smart features into drip coffee makers. Consumers are increasingly looking for appliances that offer connectivity options, such as smartphone integration and programmable brewing settings. Features like voice control and app-based programming are becoming standard, enhancing user convenience and experience.

The growing trend of specialty coffee consumption has led to an increased demand for high-quality drip coffee makers. Consumers are becoming more discerning, seeking machines that can brew their favorite roasts to perfection. This has resulted in manufacturers focusing on features that allow for better control over brewing parameters such as temperature and extraction time.

With the advent of smart home technologies, drip coffee makers are becoming more sophisticated. Wi-Fi and Bluetooth-enabled machines that can be programmed and operated via smartphone apps are gaining traction. These innovations offer consumers greater convenience and customization, which enhances the overall brewing experience.

The design of drip coffee makers has evolved, with an emphasis on aesthetics. Consumers are looking for machines that not only perform well but also fit seamlessly into their kitchen decor. Sleek, modern designs and a variety of color options are becoming essential selling points.

Many manufacturers are responding by producing drip coffee makers with sustainable materials and energy-efficient features. In addition, the shift towards reusable coffee filters and biodegradable pods is promoting a more sustainable coffee culture. The rise of niche brands offering personalized and high-end products has led to market fragmentation. While this can create opportunities, it can also dilute brand loyalty and complicate marketing strategies for established companies.

The market is set for sustained growth, driven by innovations in product formulations, campaigns and collaboration activities, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global market.

Type Insights

Based on type, the automatic drip coffee maker segment led the market with the largest revenue share of 55.76% in 2023. These machines provide consistent brewing results, which is crucial for coffee drinkers who value a reliable cup of coffee every time. The ability to maintain consistent water temperature and brewing time contributes to the quality and taste of the coffee. Modern automatic drip coffee makers come with various features such as programmable timers, brew-strength control, and automatic shut-off. These features enhance user experience, making them more attractive to consumers. These coffee makers typically have a larger capacity, allowing users to brew multiple cups at once. This is particularly appealing for families, offices, and gatherings, where multiple servings of coffee are needed.

The manual drip coffee maker segment is expected to grow at the fastest CAGR of 3.3% from 2024 to 2030. Manual drip coffee makers allow users to extract coffee flavors more precisely, which is highly appealing to coffee connoisseurs. The ability to control the brewing process results in a richer and more complex flavor profile, which is often preferred by those who appreciate high-quality coffee. The manual drip brewing process aligns with the broader lifestyle trend of slow living and mindful consumption. As people seek to slow down and enjoy their daily rituals, manual coffee brewing offers a more deliberate and enjoyable experience compared to automated machines.

Application Insights

Based on application, the commercial segment led the market with the largest revenue share of 53.95% in 2023. Commercial establishments such as restaurants, cafes, hotels, and offices require large quantities of coffee to be brewed quickly and efficiently. Drip coffee makers are well-suited for these environments because they can brew multiple cups at a time, meeting the high demand for coffee in these settings. Drip coffee makers offer reliable performance with consistent brewing, ensuring that each cup meets the expected standard, which is essential for businesses where customer experience is a priority.

The residential segment is expected to grow at the fastest CAGR of 3.7% from 2024 to 2030. The growing interest in specialty coffee and gourmet brewing techniques has led more consumers to explore different brewing methods at home. Drip coffee makers, especially those with advanced features, cater to this trend by offering a way to brew high-quality coffee conveniently at home. Manufacturers are offering a wide variety of drip coffee makers with different features, sizes, and price points, catering to the diverse needs of residential consumers. This variety allows consumers to choose a coffee maker that best suits their preferences, further driving growth in this segment.

Distribution Channel Insights

Based on distribution channel, the offline segment led the market with the largest revenue share of 71.75% in 2023. Companies producing drip coffee makers have established partnerships with major retail chains such as supermarkets, hypermarkets, and convenience stores. These collaborations ensure that drip coffee makers are widely available to a broad consumer base. Through these partnerships, drip coffee maker brands can penetrate markets more effectively and establish a strong presence in both urban and rural areas. This widespread availability helps in maintaining a majority market share. Offline channels like supermarkets and convenience stores offer consumers the ease of picking up drip coffee makers during their regular shopping trips. This convenience encourages repeat purchases.

The online segment is expected to grow at the fastest CAGR of 3.8% from 2024 to 2030. Online shopping provides unmatched convenience, enabling consumers to purchase drip coffee makers from the comfort of their homes at any time. Brands can utilize digital marketing tools to target specific demographics, enhancing the effectiveness of their advertising campaigns. Social media platforms such as Instagram, Facebook, and Twitter are leveraged to promote drip coffee makers, engage with customers, and drive traffic to online stores. In addition, online reviews and ratings offer valuable insights, helping potential buyers make informed decisions based on the experiences of other consumers.

Regional Insights

The drip coffee maker market in North America captured a revenue share of 19.01% in 2023. The North American market is experiencing steady growth, supported by the increasing demand for convenient and reliable coffee brewing solutions at home and in commercial settings. The market is expected to continue growing as consumer preferences evolve and new technologies are introduced. North Americans have one of the highest coffee consumption rates globally. This strong coffee culture drives the demand for drip coffee makers, as they are a staple in many households and workplaces.

U.S. Drip Coffee Maker Market Trends

The drip coffee maker market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030. The U.S. is one of the largest markets for drip coffee makers globally, reflecting the nation's deep-rooted coffee culture. The market is mature but continues to experience steady growth, driven by both the residential and commercial segments. Coffee is a staple in the daily routine of many Americans, with drip coffee being one of the most popular brewing methods. The simplicity, reliability, and ability to brew multiple cups at once make drip coffee makers a favored choice among U.S. consumers.

Europe Drip Coffee Maker Market Trends

Europe dominated the drip coffee maker market with the revenue share of 32.46% in 2023. European consumers are increasingly gravitating towards high-quality coffee experiences, which has led to a rising demand for drip coffee makers that can brew specialty coffee. This trend is particularly strong in countries with a rich coffee culture, such as Italy, Germany, and France. Europe's diverse coffee culture means that preferences for coffee brewing methods can vary significantly by region. In Northern and Western Europe, drip coffee is a staple in many households, while in Southern Europe, espresso machines may dominate. This regional diversity drives the demand for various types of drip coffee makers, catering to different tastes and brewing styles.

Asia Pacific Drip Coffee Maker Market Trends

The drip coffee maker market in Asia Pacific is expected to witness at the fastest CAGR of 3.7% from 2024 to 2030. The rise of café culture, particularly in urban areas of countries like China, India, Japan, and South Korea, is influencing at-home coffee brewing. Consumers who enjoy the café experience are increasingly looking to replicate this at home with drip coffee makers. Consumers in the Asia Pacific region are looking for easy-to-use, low-maintenance coffee makers. Drip coffee makers meet this demand with their straightforward operation and consistent brewing results.

Key Drip Coffee Maker Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers in the market utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence. They prioritize quality, innovation, and regional preferences, thereby reinforcing their leadership in international markets that embrace drip coffee maker.

Key Drip Coffee Maker Companies:

The following are the leading companies in the drip coffee maker market. These companies collectively hold the largest market share and dictate industry trends.

- Spectrum Brands

- De’Longhi Appliances S.r.l.

- illycaffè S.p.A.

- Koninklijke Philips N.V.

- Morphy Richards India

- Electrolux AB

- Espresso Supply, Inc.

- BSH Hausgeräte GmbH

- GROUPE SEB UK, Ltd.

- Gruppo Cimbali S.p.A.

Recent Developments

-

In July 2024, Ninja introduced the Ninja Luxe Café, a versatile three-in-one coffee maker designed to brew precisely measured espresso, cold brew, and drip coffee. This innovative machine features a grinder with 25 settings, a scale for accurate coffee dosing according to your brewing preference, and an automatic milk frother and whisk to achieve the perfect texture for your drink

-

In May 2023, De’Longhi America introduced TrueBrew, a groundbreaking fully automatic drip coffee machine. This innovative appliance features built-in technology that precisely grinds, measures, and brews coffee in various sizes with just the press of a button, thanks to De’Longhi’s patented Bean Extract Technology. The machine also includes an Auto-Clean feature that efficiently disposes of used coffee grounds, minimizing waste and mess without relying on paper filters or plastic pods

Drip Coffee Maker Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,473.6 million

Revenue forecast in 2030

USD 3,032.0 million

Growth rate

CAGR of 3.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; and South Africa

Key companies profiled

Spectrum Brands; De’Longhi Appliances S.r.l.; illycaffè S.p.A.; Koninklijke Philips N.V.; Morphy Richards India; Electrolux AB; Espresso Supply, Inc.; BSH Hausgeräte GmbH; GROUPE SEB UK, Ltd.; Gruppo Cimbali S.p.A.

Customization scope

Free Report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Drip Coffee Maker Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global drip coffee maker market report based on type, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Manual

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global drip coffee maker market size was estimated at USD 2,391.1 million in 2023 and is expected to reach USD 2,473.6 million in 2024.

b. The global drip coffee maker market is expected to grow at a compounded growth rate of 3.5% from 2024 to 2030 to reach USD 3,032.0 million by 2030

b. The automatic drip coffee maker segment dominated the drip coffee maker market with a share of 55.76% in 2023. Modern automatic drip coffee makers come with various features such as programmable timers, brew strength control, and automatic shut-off. These features enhance user experience, making them more attractive to consumers.

b. Some key players operating in the drip coffee maker market include Spectrum Brands; De’Longhi Appliances S.r.l.; illycaffè S.p.A.; Koninklijke Philips N.V.; Morphy Richards India; Electrolux AB; Espresso Supply, Inc.

b. Key factors that are driving the market growth include consumers increasingly looking for appliances that offer connectivity options, such as smartphone integration and programmable brewing settings. Also, the growing trend of specialty coffee consumption has driven the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.