- Home

- »

- Next Generation Technologies

- »

-

Drone-powered Business Solutions Market Size Report, 2030GVR Report cover

![Drone-powered Business Solutions Market Size, Share & Trends Report]()

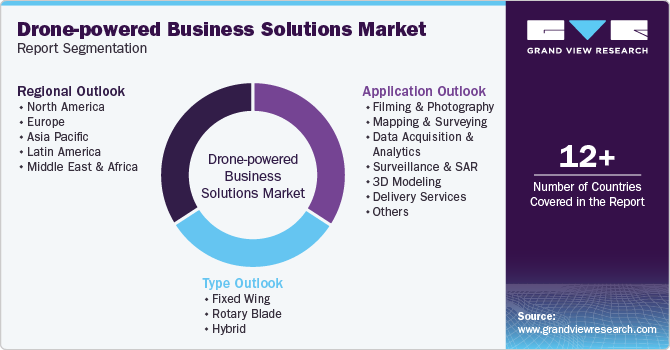

Drone-powered Business Solutions Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Fixed Wing, Rotary Blade, Hybrid), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-757-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

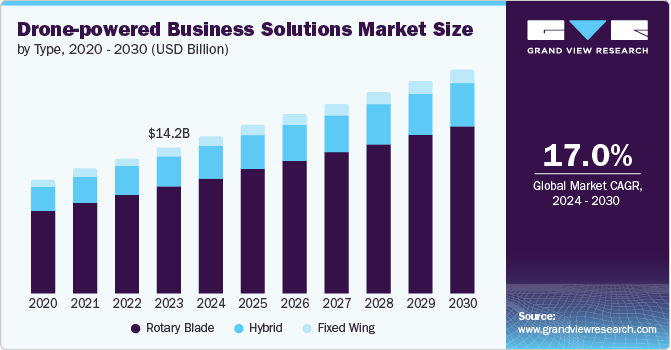

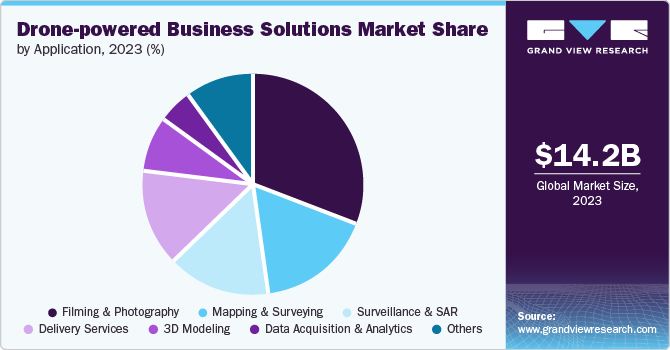

The global drone-powered business solutions market size was valued at USD 14.20 billion in 2023 and is projected to grow at a CAGR of 17.0% from 2024 to 2030. The adoption of advanced high-resolution imaging sensors and the utilization of lightweight materials are key growth-driving factors for this market growth. The growing use of drone-powered business solutions in applications industries such as filming & photography, delivery services, military, mapping & survey, 3D modelling and others is expected to generate greater demand for this industry during the forecast period.

The use of drone-powered business solutions has been expanding in a few other areas, such as farmers operating on a large scale using these solutions to determine the quality and conditions of crops and measure and manage any damages. They are also utilized for controlling and maintaining crops in precision agriculture. Moreover, with governing bodies in many countries emphasizing the importance of enabling Beyond Visual Line of Sight (BVLOS) systems and automated flights, the global sales of drone-powered business solutions have been experiencing significant growth.

With the emergence of modern technology and innovation, drone-powered business solutions are also extensively used in 3D video mapping, land audits, and urban planning. The imaging solutions provided by drones offer unmatched insights and information that cannot be attained in any other way. The cost-effective nature of such solutions and growing ease of availability have resulted in unceasing demand.

Using drone-powered business solutions in areas such as food delivery, courier delivery, and in-house transportation for corporate campuses or institutions has generated an upsurge in demand for the market in the recent past. Constantly growing research & development activities, backed by heavy investments and positive government support, especially in industries such as military & defense, product mobility, and agriculture, have identified multiple untapped opportunities for the market.

The integration of multiple other technologies, such as artificial intelligence (AI), data analytics, and cloud computing, has helped drone-powered business solutions models attain service accuracy and enhanced customer engagement. These factors together contribute to the increasing use and versatility of drone-powered business solutions in multiple industries.

Type Insights

Rotary blade drones segment dominated the market and accounted for a share of 60.6% in 2023. These drones have rotary blades that rotate around the drone's central mast, pushing air downwards. It leads to the vertical lift necessary for it to become airborne. These drones are commonly used in non-military applications such as product delivery, mapping and surveying, filming & photography, data acquisition & analytics, and other applications. Increasing technology advances leading to cost-effective product development, growing availability, affordability, and services offering rotary blade drones on rental are expected to generate higher demand.

The fixed-wing drones segment is expected to experience the fastest CAGR during the forecast period. The military & defense industry, federal security organizations, investigation agencies, and related companies often use fixed-wing drones. Some of the key growth driving factors fueling the demand for this segment are longer flight duration & higher payload capacity, improved efficiency for long distances, higher quality of imaging technology, and higher altitude ranges. Therefore, these characteristics are well-suited for extensive aerial mapping and long-distance inspections across various operational settings such as deserts, oceans, forests, and farmlands. As a result, it is widely used in both commercial and military sectors, contributing to market expansion.

Application Insights

The filming & photography segment accounted for the largest revenue share in 2023. Drones have completely changed the dynamic of cinematography in the film and television industry. In addition, the emergence of numerous media channels delivering content for the entire day has generated exponential demand for drones. Cost-effectiveness accomplished with drones has attracted numerous production houses and filming companies to invest significantly in drones. Modern drones are equipped with advanced technology features such as obstacle-detection sensors and Vision Positioning Systems (VPS); this has been developing higher growth for this segment.

The delivery service segment is expected to experience the fastest CAGR from 2024 to 2030. This segment is driven by technology advancements attained through research & development, innovation, and rising adoption by retail companies. These services are commonly used to deliver products such as medicines, courier packages, groceries, food delivery orders, homecare & personal care products, emergency medical assistance, and other products.

Regional Insights

North America drone-powered business solutions market dominated the global industry with a revenue share of 40.1% 2023. This is attributed to multiple aspects such as the growing use of drones and unmanned aerial vehicle (UAV) by numerous industries such as military & defence, mapping and survey, 3D modelling, and surveillance. The drone-powered business solutions have offered improved operational efficiency and cost-effectiveness, compared to traditional methods for several functions. Constant investment in drone technology by the U.S. Department of Defense is a major factor in regional dominance.

U.S. Drone-powered Business Solutions Market Trends

The drone-powered business solutions market in the U.S. dominated regional industry with a revenue share of 67.0% in 2023. This market is primarily driven by the use of fixed-wing drones by the security forces in the country. Federal Aviation Administration (FAA), several government agencies, small businesses, and other start-ups in the United States have also been incorporating rotary blade drones in various functions such as last-mile delivery, infrastructure management, agriculture care, medical transport and law enforcement. According to the U.S. Department of Defense, it operates more than 11,000 UAS (Unmanned Aircraft Systems), mainly for providing support to domestic training actions and contingency missionsoverseas.

Europe Drone-powered Business Solutions Market Trends

Europe drone-powered business solutions market was identified as a lucrative region in this industry. The government and multiple organizations have been funding projects for research and innovation to develop, design, and examine new drone technologies. A European Network of U-space Stakeholders has been launched to encourage small and medium enterprises to participate in drone services and the U-space market by providing a platform for dialogue and exchange of experience between early implementers of U-space. The commission is backing the network alongside the European Union Aviation Safety Agency, the Single European Sky ATM Research (SESAR) Joint Undertaking, and Euro control.

The UK drone-powered business solutions market is expected to experience a noteworthy CAGR during the forecast period. This market is primarily driven by the growth in adoption in industries such as military, delivery services, surveillance, mapping, agriculture and others. The growing use in areas such as precision farming, energy & utilities, and environmental conservations is projected to drive growth for this industry in the approaching years.

Asia Pacific Drone-powered Business Solutions Market Trends

Asia Pacific drone-powered business solutions market is anticipated to experience the fastest growth during the forecast period. This is attributed to factors such as significantly increasing investments in research & development related to drone technology, and growing adoption in industries such as real estate, mapping, surveillance, filming & photography, defence, and delivery. In addition, increasing number of new entrants in the industry, and affordability associated with the use of drones.

China drone-powered business solutions market held a significant revenue share of the regional industry in 2023. This market is mainly driven by growing use in farming as well as defence applications and the presence of large enterprises operating in the manufacturing of drones. The drone-powered business solutions market is China is expected to experience growth by increasing application in industries such as search & rescue, media & marketing, crop management and delivery.

Key Drone-powered Business Solutions Company Insights

Some of the key companies in the drone-powered business solutions market include 3DR, Inc., Cyberhawk Innovations Ltd., Delair., DroneDeploy., Eagle Eye Drone Systems LLC, Phoenix Drone Services LLC, and others. Owing to the unceasing demand and rising competition, the prominent players in the market are adopting strategies such as geographical expansions, heavy investments in research & development, collaborations, partnerships, & innovations.

-

3DR, Inc., a U.S.-based company that develops and manufactures electronic systems for unmanned vehicles, UAVs, and drones, offers applauded autopilots equipped with open-source technology based on open hardware. The company emphasizes innovation backed by research and development and delivers a diversified portfolio of accessories, GNSS receivers, power modules, digital products, harnesses, cables, sensors, and other offerings.

-

Phoenix Drone Services LLC, a company that focuses on using drones for aerial videography, photography, and civil engineering purposes, offers customized services to cater to a variety of customer requirements. They provide their solutions to multiple application industries, such as real estate, mapping, and surveying.

Key Drone-powered Business Solutions Companies:

The following are the leading companies in the drone-powered business solutions market. These companies collectively hold the largest market share and dictate industry trends.

- 3DR, Inc.

- CYBERHAWK

- Delair

- DroneDeploy

- EagleEye Drones

- FlyWorx Drone & Media Services

- Phoenix Drone Services LLC

- Pix4D SA (Parrot SA)

- SKYLARK DRONES

- Yuneec - ATL Drone Headquarters

Recent Developments

-

In April 2024, Israel Aerospace Industries (IAI) and Aerotor Unmanned Systems joined forces to develop products and enhance commercial collaboration. The collaboration aims to design and deliver innovative drone systems for a range of strategic military tasks, specifically for all three territories sea, air, and land.

-

In June 2024, Skyfront, one of the prominent organisations in the robotics industry, specializes in drones with long endurance and associated technologies, launched Skyfront MagniPhy. Product equipped with advanced technology features is its next-generation drone magnetometer solution.

Drone-powered Business Solutions Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.28 billion

Revenue forecast in 2030

USD 41.68 billion

Growth Rate

CAGR of 17.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, and South Africa

Key companies profiled

3DR, Inc.; CYBERHAWK; Delair; DroneDeploy; EagleEye Drones; FlyWorx Drone & Media Services; Phoenix Drone Services LLC; Pix4D SA (Parrot SA); SKYLARK DRONES; Yuneec - ATL Drone Headquarters

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drone-powered Business Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global drone-powered business solutions market report based on type, application, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed Wing

-

Rotary Blade

-

Hybrid

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Filming & Photography

-

Mapping & Surveying

-

Data Acquisition & Analytics

-

Surveillance & SAR

-

3D Modeling

-

Delivery Services

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.