- Home

- »

- Next Generation Technologies

- »

-

Dual Interface Payment Card Market Size Report, 2024-2030GVR Report cover

![Dual Interface Payment Card Market Size, Share & Trends Report]()

Dual Interface Payment Card Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Plastic, Metal), By End-use (Retail, Healthcare, Transportation, Hospitality), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-957-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

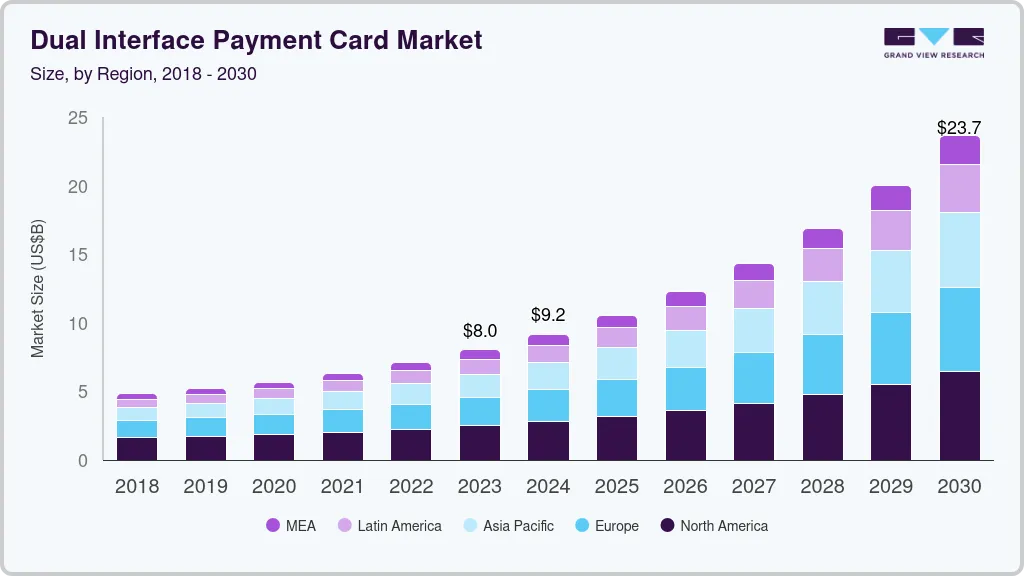

The global dual interface payment card market size was valued at USD 8,026.4 million in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 16.7% from 2024 to 2030. The continuous advancements made in payment card chips by technology companies enable dual interface payment card manufacturing businesses to improve their product offerings. Furthermore, the integration of several technologies such as Near Field Communication (NFC) and Radio Frequency Identification (RFID) within dual interface cards has enabled consumers to process contactless payments in seamless ways. Thereby, such trends in the industry are expected to drive growth over the forecast period.

The dual interface payment cards provide flexibility to the customer by enabling them to utilize cards for processing contact or contactless payments. As a result, consumers across the globe are getting inclined towards using dual interface payment cards. Moreover, customers prefer dual interface cards owing to the fast processing of payments with reduced waiting times at the checkout. Furthermore, these cards offer certain benefits such as better card lifespan and fraud protection by the introduction of tap-to-pay technology, which is more reliable and secured.

The increasing demand for contactless payments by customers as well as small businesses is expected to drive market growth. Moreover, the increasing partnerships to launch contactless credit cards specifically designed for small businesses is expected to create growth opportunity for the growth of the dual interface payment cards market. For instance, in June 2022, Verizon announced its partnership with MasterCard and FNBO. This partnership was aimed at introducing small-scale business credit cards. The small business enterprises with these newly launched cards would be gaining the Verizon Business Dollars against gadgets or apparel for their company. Thereby enabling the scope of expansion for dual interface payment cards in the SMEs segment over the forecast period.

The rising demand in the banking sector for dual interface payment cards integrated with biometric sensors for payment verification is anticipated to drive the industry growth over the forecast period. Furthermore, the market players are involved in partnerships to manufacture and launch such biometric payment cards to offer high security and safety to their customers while processing payments. For instance, in February 2022, Swedish banking firm Rocker joined forces with the IDEMIA and IDEX. This collaboration was aimed at introducing Rocker Touch, a payment card leveraging biometric technology.

However, the increasing concern for payment security due to the contactless payment method in the dual interface card is one of the challenges hindering the growth of the industry. At the same time, the growing need for hardware upgrades at the point-of-sale terminals to support such payment technology is expected to hinder the growth of the market. Furthermore, the high cost incurred for manufacturing the dual interface card is another factor expected to restrain the growth. Though such challenges can be overcome by advancing in technologies and making the manufacturing process efficient.

COVID-19 Impact Analysis

The COVID-19 pandemic played a decisive role in driving the growth of the dual interface payment card market over the forecast period. The strict regulations for social distancing during the COVID-19 pandemic gained popularity for contactless payments across the globe. For instance, in May 2020, according to data from Visa, tap-to-pay and other contactless payment methods have been preferred by almost 60% of Visa transactions outside of the U.S. Thus, the increasing adoption of contactless payments created new growth opportunities for the dual interface payment cards market.

Type Insights

The plastic segment accounted for the largest revenue share of over 61.0% in 2021. The growing technological advancement in the industry across developed and developing economies worldwide is driving the segment growth. Several vendors have started offering eco-friendly plastic cards made from recycled plastic to enhance their offerings. For instance, in March 2022, Thales Gemalto Bio-sourced (PLA) card received the certification for the bio-based content. Through this certification, the Thales Gemalto Bio-sourced (PLA) card was validated to contain bio-based content in its cards.

The metal segment is anticipated to witness significant growth over the forecast period owing to increasing demand for metal cards due to their durability compared to plastic-based cards. Additionally, the cost of metal cards is high as compared to plastic cards and is mainly distributed among the premium customers by the banks. Furthermore, the companies offering metal cards are increasingly involved in launching new metal cards, creating a growth opportunity for the segment. For instance, in November 2020, IDEMIA announced its dual interface metal payment card for the Middle East & Africa (MEA) region. This step has assisted the company in broadening its product offering and market reach in MEA.

End-use Insights

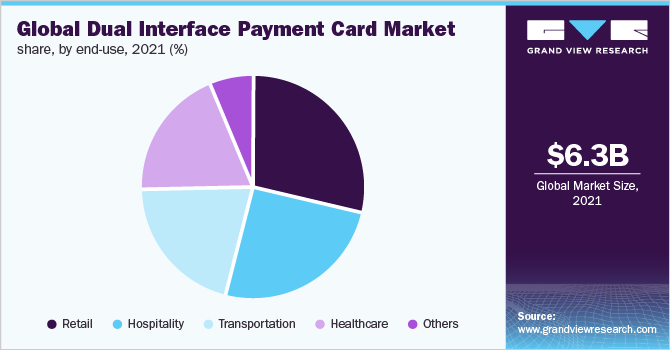

The retail segment accounted for the largest revenue share of over28.0% in 2021. Several retailers worldwide are adopting tap-n-go payments technologies to streamline their operations and enhance customer experience. According to a State of Retail Payments study conducted for the National Retail Federation by Forrester in 2020, revealed that almost 67% of retailers surveyed have adopted contactless payment solutions and 58% of retailers accept contactless payment through cards. Thus, the rise in contactless payment acceptance is expected to drive segment growth.

The transportation segment is anticipated to grow at a promising CAGR of 17.6% over the forecast period. The growing preference in smart cities for a contactless transport payment solution is anticipated to drive the segment growth. In addition, contactless payment transactions have raised compared to cash payments across the transport industry owing to factors, such as accessibility and convenience. For instance, in July 2020, BPC designed an automated solution for fare collection O-CITY. This aims at using these contactless cards on buses, subways, and trains as well as at parking lots and bike rentals.

Regional Insights

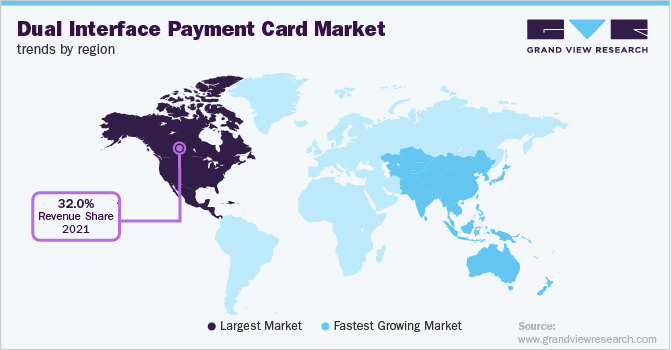

North America held the dominant revenue share of over 32.0% in 2021. This dominance is attributable to the presence of several prominent players such as MasterCard, and American Express among others. Moreover, the market players across North America are involved in launching dual-interface cards for enabling users to utilize credit and debit cards with contactless payment technology. For instance, in October 2021, TruCash, a Canada-based payment card provider, introduced a dual interface contactless prepaid Visa card to enable customers to process contactless payments.

Asia Pacific is expected to grow at the highest CAGR of 17.8% over the forecast period. The growth of the regional market can be attributed to the increasing adoption of tap-to-pay methods across the region. For instance, according to a Mastercard study published in 2020, the tap-and-go card payments across pharmacies and grocery stores in Asia Pacific raised by 2.5 times faster than non-contactless transactions. Moreover, the increasing partnerships between the market players to launch new dual interface cards for payments are also propelling the growth of the industry.

Key Companies & Market Share Insights

The market is highly competitive. Prominent players are pursuing various strategies, such as new product launches, strategic partnerships, and geographic expansion, among others to expand their customer base and cement their foothold in the industry. Moreover, the dual interface card manufacturing companies are involved in upgrading the technology to reduce the cost of such cards. For instance, in February 2020, IDEX Biometrics ASA, a smart card manufacturing company, introduced TrustedBio, a solution built for reducing biometric smartcard costs. Such cost reduction is aimed at accelerating the adoption of smart dual interface cards.

Moreover, the increasing partnership between the banks and fintech companies to deliver hybrid smart cards is expected to drive the growth of the market. For instance, in December 2020, PayTM and SBI Card selected dzcard, a south Asian smart card manufacturer to deliver the dual interface credit card. These cards will allow customers to process contactless payments and gain cashbacks through the Paytm application.Some prominent players in the global dual interface payment card market include:

-

Thales Group

-

IDEMIA

-

VALID

-

Giesecke+Devrient GmbH

-

Eastcompeace Technology Co., Ltd.

-

DATANG

-

Paragon Group Limited

-

CPI Card Group Inc.

-

Watchdata Co., Ltd.

-

Wuhan Tianyu

Dual Interface Payment Card Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8,026.4 million

Revenue forecast in 2030

USD 23,658.6 billion

Growth rate

CAGR of 16.7% from 2024 to 2030

Base year of estimation

2021

Historical data

2017 - 2020

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

Thales Group; IDEMIA; VALID; Giesecke+Devrient GmbH; Eastcompeace Technology Co., Ltd.; DATANG; Paragon Group Limited; CPI Card Group Inc.; Watchdata Co., Ltd.; Wuhan Tianyu

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dual Interface Payment Card Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global dual interface payment card market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Plastic

-

Metal

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

Transportation

-

Healthcare

-

Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global dual interface payment card market size was estimated at USD 6.34 billion in 2021 and is expected to reach USD 7.10 billion in 2022.

b. The global dual interface payment card market is expected to grow at a compound annual growth rate of 16.2% from 2022 to 2030 to reach USD 23.66 billion by 2030

b. North America dominated the dual interface payment card market with a share of 32.11% in 2021. This dominance is attributable to the presence of several prominent players such as MasterCard, American Express among others.

b. Some key players operating in the dual interface payment card market include Thales Group, IDEMIA,VALID, Giesecke+Devrient GmbH, Eastcompeace Technology Co., Ltd., DATANG, Paragaon Group Limited, CPI Card Group Inc., Watchdata Co., Ltd., Wuhan Tianyu

b. Key factors that are driving the dual interface payment card market growth include increasing demand for contactless payments and increasing government initiatives to promote digital payments

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.