- Home

- »

- Advanced Interior Materials

- »

-

Ductile Iron Casting Market Size, Industry Report, 2033GVR Report cover

![Ductile Iron Casting Market Size, Share & Trends Report]()

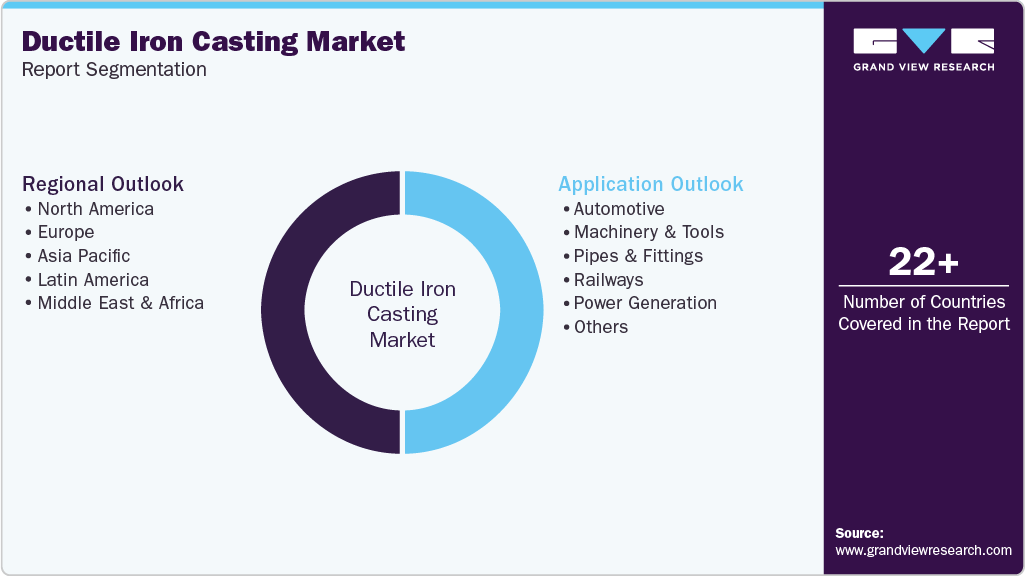

Ductile Iron Casting Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Automotive, Machinery & Tools, Pipes & Fittings, Railways, Power Generation), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-804-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ductile Iron Casting Market Summary

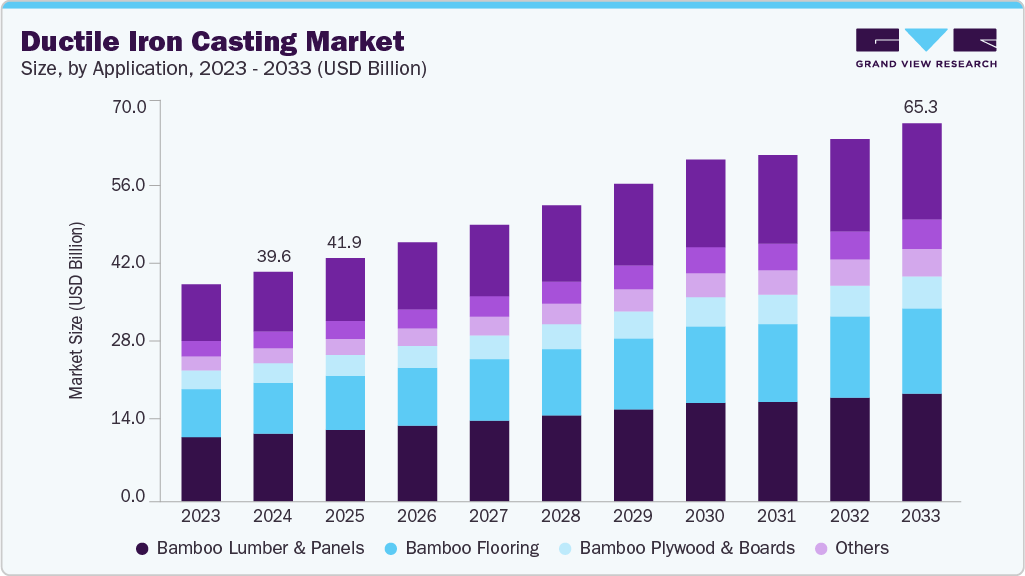

The global ductile iron casting market size was estimated at USD 39.59 billion in 2024 and is projected to reach USD 65.26 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033. The industry is driven by the growing demand from the automotive and industrial machinery sectors, where ductile iron is valued for its high strength, durability, and cost-effectiveness compared to steel.

Key Market Trends & Insights

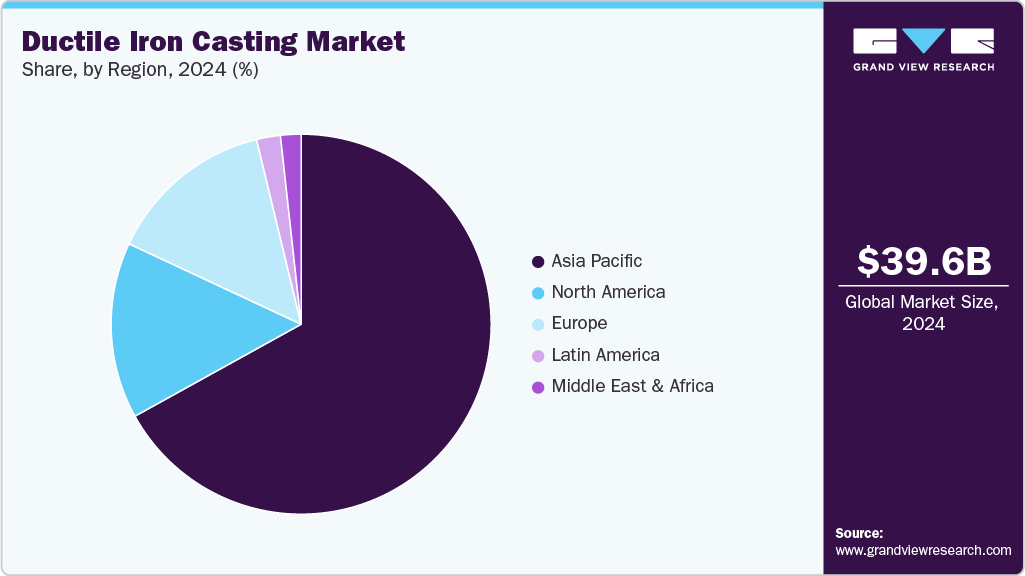

- Asia Pacific dominated the ductile iron casting market with a revenue share of over 66.0% in 2024.

- Ductile iron casting market in the Asia Pacific is expected to grow at a substantial CAGR of 6.2% from 2025 to 2033.

- By application, the automotive segment held the largest share of over 29.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 39.59 Billion

- 2033 Projected Market Size: USD 65.26 Billion

- CAGR (2025-2033): 5.7%

- Asia Pacific: Largest market in 2024

The industry is increasingly aligning with global sustainability goals as manufacturers adopt eco-friendly production methods to minimize energy consumption and carbon emissions. The material’s recyclability and long service life make it a preferred choice in circular economy models, reducing the need for virgin raw materials. Additionally, the use of energy-efficient melting furnaces and optimized foundry operations helps reduce waste and promote resource conservation, positioning ductile iron as a sustainable solution for modern infrastructure and industrial applications. With the rising focus on green manufacturing, companies are investing in renewable energy-powered foundries and low-emission melting technologies. This shift not only enhances environmental compliance but also strengthens brand value among environmentally conscious end users.

Technological advancements are transforming the ductile iron casting industry, enhancing both efficiency and quality. The integration of computer-aided design (CAD), simulation software, and automation in foundries has improved precision, reduced defects, and shortened production cycles. Furthermore, innovations such as 3D sand printing, advanced molding systems, and real-time process monitoring are enabling manufacturers to produce complex geometries with higher consistency. The adoption of Industry 4.0 technologies, including Internet of Things (IoT) and AI-based predictive maintenance, is further streamlining operations and optimizing resource utilization. As a result, these innovations are improving cost efficiency, expanding design flexibility, and enabling faster response to evolving customer requirements.

Drivers, Opportunities & Restraints

The industry is driven by increasing demand from the automotive, construction, and heavy machinery sectors, where components such as engine blocks, suspension parts, and pipes require superior strength and durability. The growing focus on sustainable and cost-effective materials is further boosting adoption. Additionally, expanding infrastructure projects, particularly in water and wastewater management, are creating consistent demand. For instance, on June 5, 2025, RUSAL announced the commercial launch of low-carbon foundry alloys for the automotive sector, highlighting the industry’s shift toward environmentally friendly and energy-efficient cast materials.

Technological innovations, such as 3D sand printing, advanced CAD/simulation software, and Industry 4.0 automation, are creating new opportunities for precision casting and enhanced design flexibility. The increasing adoption of digital foundries and predictive maintenance tools is improving efficiency while reducing material waste. Moreover, governments and private players are investing in smart and sustainable foundry infrastructure. For example, in August 2025, China initiated modernization programs focused on digital and green foundry operations to enhance productivity and reduce emissions, signaling a broader trend toward high-tech, low-carbon manufacturing in the casting industry.

Despite growth, the market faces challenges related to energy cost fluctuations, stringent emission norms, and high capital expenditure required for adopting advanced casting technologies. Small and mid-sized foundries often struggle to meet evolving sustainability and efficiency standards due to limited financial resources. The rising costs of raw materials and the need for continuous modernization further add to operational pressure. For instance, on May 19, 2025, European foundries invested in energy-efficient melting furnaces under the EU’s ongoing decarbonization initiatives, demonstrating both the regulatory push and financial burden associated with achieving lower emissions in the casting process.

Application Insights & Trends

In 2024, the automotive segment held the largest share, over 29.0% of ductile iron casting revenue. The automotive segment dominates the global industry, accounting for a significant share of overall demand. Ductile iron’s high tensile strength, impact resistance, and vibration-damping properties make it an ideal material for critical components such as engine blocks, crankshafts, suspension systems, and steering knuckles. Its superior machinability and cost-effectiveness compared to steel further enhance its adoption among OEMs and Tier-1 suppliers. The rapid shift toward electric and hybrid vehicles is also influencing casting designs, as manufacturers develop lightweight yet durable components to improve efficiency. In June 2025, several automotive foundries in Germany and the U.S. announced expansions in ductile iron casting capacity to meet rising demand from electric vehicle (EV) and commercial vehicle manufacturers, reinforcing the segment’s leadership in the market.

Beyond the automotive sector, ductile iron castings play a vital role across various industrial and infrastructure sectors. In machinery and tools, ductile iron is valued for its dimensional stability and wear resistance, ensuring long service life in pumps, compressors, and gear housings. The pipes and fittings segment continues to expand, driven by growing investments in water distribution and wastewater treatment projects, particularly in developing economies. Additionally, railways and power generation utilize ductile iron components due to their ability to withstand dynamic loads and thermal stress, thereby ensuring operational reliability. With increasing focus on sustainable infrastructure, ductile iron’s recyclability and low maintenance costs make it a preferred choice in construction, energy, and municipal applications worldwide.

Regional Insights

North America Ductile Iron Casting Market Trends

The ductile iron casting market in North America is witnessing steady growth, supported by increasing demand from the automotive, oil & gas, and construction sectors. The region’s emphasis on modernizing infrastructure, including water and sewage systems, continues to drive casting applications in pipes and fittings. Foundries are also focusing on sustainability using energy-efficient furnaces and recycling initiatives. In April 2025, several North American foundries began integrating smart manufacturing technologies to enhance operational efficiency and reduce emissions, marking a shift toward digital and environmentally friendly production practices.

U.S. Ductile Iron Casting Market Trends

The ductile iron casting market in the U.S. is propelled by the resurgence of domestic manufacturing and robust investments in transportation, defense, and renewable energy infrastructure. The country’s strong automotive and heavy machinery industries contribute significantly to ductile iron demand. The Infrastructure Investment and Jobs Act (IIJA) continues to drive upgrades in public utilities and road networks, fueling the demand for ductile iron pipes and cast components. In June 2025, U.S.-based foundries reported capacity expansions and new contract awards for water infrastructure projects, underlining the sector’s positive momentum driven by government spending and private investment.

Asia Pacific Ductile Iron Casting Market Trends

Asia Pacific dominated the ductile iron casting market with a revenue share of over 66.0% in 2024. The ductile iron casting market in Asia Pacific is driven by rapid industrialization, infrastructure expansion, and increasing automotive production in countries such as China, India, and Japan. The region benefits from lower manufacturing costs and increasing foreign investments in foundry modernization. Governments are also emphasizing green manufacturing to reduce emissions and energy consumption. For instance, in August 2025, China announced a large-scale modernization of its foundry sector as part of a national sustainability initiative, aiming to digitalize production and enhance energy efficiency across industrial facilities.

Europe Ductile Iron Casting Market Trends

Stringent environmental regulations and a strong focus on circular economy practices shape the European ductile iron casting market. Demand remains high in automotive, energy, and water infrastructure sectors, with a particular emphasis on low-carbon materials. Manufacturers are investing heavily in decarbonization technologies and renewable-powered melting systems to meet EU climate goals. On May 19, 2025, several European foundries upgraded to energy-efficient furnaces as part of EU-funded decarbonization programs, reflecting the region’s leadership in sustainable and high-performance casting production.

Key Ductile Iron Casting Companies Insights

Key players operating in the ductile iron casting market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include Aisin Corporation, Crescent Foundry, Waupaca Foundry, Inc., and others.

-

Aisin Corporation, founded in 1949 and headquartered in Kariya, Japan, manufactures automotive components and metal casting products. The company produces ductile iron cast parts, including engine blocks, brake components, and transmission housings, for global automakers. Its operations emphasize precision engineering, production efficiency, and environmentally conscious manufacturing. Aisin continues to invest in research and development to support improvements in casting technology and material performance.

-

Crescent Foundry, established in 1982 and based in Kolkata, India, produces ductile and gray iron castings for infrastructure, construction, and industrial applications. Its product range includes municipal castings, manhole covers, gratings, and engineered components. The company operates automated molding lines and induction melting systems supported by quality-control procedures. Crescent Foundry exports to several international markets and focuses on maintaining efficient and sustainable manufacturing practices.

-

Waupaca Foundry, Inc., founded in 1955 and headquartered in Waupaca, Wisconsin, U.S., produces gray and ductile iron castings for automotive, commercial vehicle, and industrial uses. It operates multiple foundries in the United States that incorporate automation and environmentally responsible production methods. The company’s products include brake rotors, hubs, differential carriers, and components for heavy machinery, with a focus on maintaining consistent quality and operational efficiency.

Key Ductile Iron Casting Companies:

The following are the leading companies in the ductile iron casting market. These companies collectively hold the largest market share and dictate industry trends.

- Aisin Corporation

- Brakes India Pvt. Ltd.

- Calmet Group

- Crescent Foundry

- Dandong Foundry

- Hitachi Metals Ltd.

- Kobe Steel Ltd.

- Metal Technologies, Inc.

- Neenah Foundry Company

Recent Developments

-

Waupaca Foundry, Inc., in June 2025, announced an investment of USD 50 million to upgrade its Etowah, Tennessee, facility with automated casting and melting systems. The expansion is designed to enhance production capacity for ductile iron components used in automotive and heavy machinery applications, while improving energy efficiency and reducing CO₂ emissions. This initiative supports the company’s ongoing efforts to enhance operational performance and environmental sustainability.

-

Crescent Foundry, in April 2025, announced plans to set up a new foundry in Gujarat, India, featuring Industry 4.0 automation, IoT-based quality monitoring, and energy-efficient induction furnaces. The facility is designed to increase the production of ductile iron products for water infrastructure and municipal applications while reducing energy consumption. The project aims to address growing international demand and strengthen the company’s export network in Europe, the Middle East, and North America.

-

Aisin Corporation, in May 2025, introduced a new range of lightweight ductile iron components for electric and hybrid vehicles developed through casting process optimization and material engineering. The development focuses on improving vehicle efficiency and supporting emission reduction targets in line with the transition toward electric mobility. The company also expanded research partnerships with automotive manufacturers to promote the wider use of sustainable casting materials in future vehicle platforms.

Ductile Iron Casting Market Report Scope

Report Attribute

Details

Market definition

The market size represents the apparent demand value of ductile iron casting in different applications.

Market size value in 2025

USD 41.98 billion

Revenue forecast in 2033

USD 65.26 billion

Growth rate

CAGR of 5.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Russia, Türkiye, China; India; Japan; South Korea; Indonesia; Brazil; Argentina; South Africa

Key companies profiled

Aisin Corporation; Brakes India Pvt. Ltd.; Calmet Group; Crescent Foundry; Dandong Foundry; Hitachi Metals, Ltd.; Kobe Steel, Ltd.; Metal Technologies, Inc.; Neenah Foundry Company; Waupaca Foundry, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ductile Iron Casting Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels, providing an analysis of the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global ductile iron casting market report based on application and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Machinery & Tools

-

Pipes & Fittings

-

Railways

-

Power Generation

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Russia

-

Türkiye

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ductile iron casting market was valued at USD 39.59 billion in 2024 and is expected to reach USD 41.98 billion in 2025.

b. The global ductile iron casting market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033 to reach USD 65.26 billion by 2033.

b. In 2024, the automotive segment held the largest share, over 29.0% of ductile iron casting revenue.

b. Some of the key vendors in the global ductile iron casting market include Aisin Corporation and Brakes India Pvt. Ltd.; Calmet Group; Crescent Foundry; Dandong Foundry; Hitachi Metals, Ltd.; Kobe Steel, Ltd.; Metal Technologies, Inc.; Neenah Foundry Company; Waupaca Foundry, Inc.

b. The global ductile iron casting market is driven by the rising demand from the automotive, construction, and industrial machinery sectors, owing to its superior strength and durability. Growing infrastructure development and expansion of water and wastewater projects further boost market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.