- Home

- »

- Automotive & Transportation

- »

-

E-Scooter Sharing Market Size, Share, Indsutry Report, 2028GVR Report cover

![E-Scooter Sharing Market Size, Share & Trends Report]()

E-Scooter Sharing Market (2022 - 2028) Size, Share & Trends Analysis Report By Type (Free-Floating, Station-Bound), By Distribution Channel (Online, Offline), By Region (Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68039-939-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

E-Scooter Sharing Market Summary

The global e-scooter sharing market size was estimated at USD 925.3 million in 2021 and is projected to reach USD 3.08 billion by 2028, growing at a CAGR of 18.8% from 2022 to 2028. This market growth can be largely attributed to the growing popularity and the increasing demand for shared micro-mobility.

Key Market Trends & Insights

- Europe dominated the global e-scooter sharing market with the largest revenue share of around 65% in 2021.

- By type, the free-floating segment led the market, holding the largest revenue share of around 95% in 2021.

- By distribution channel, the online segment is expected to grow at the fastest CAGR of 19.0% from 2022 to 2028.

Market Size & Forecast

- 2021 Market Size: USD 925.3 Million

- 2028 Projected Market Size: USD 3.08 Billion

- CAGR (2022-2028): 18.8%

- Europe: Largest market in 2021

Convenience, favorable cost structure, greater flexibility, and user-friendly features are some of the other factors associated with the electric scooter (e-scooter) sharing system, which are expected to contribute to the growth of the market. E-scooter sharing envisages an easy-to-use mode of travel ensuring last-mile mobility. The growing popularity of shared mobility through ride-hailing has helped in paving the way for shared e-scooters. Electric scooters are smaller in size and consume relatively lesser space for parking. Hence, both governments and e-scooter sharing service providers are encouraging daily travelers to opt for e-scooter sharing services as an economical, convenient, and easier way of commutation. Most providers offer dockless, free-floating services that annul the need to pick up and return e-scooters to specific locations.

Road traffic congestion, particularly during peak hours in urban areas, is driving the preference for micro-mobility options and propelling the growth of the market. There were around 66,000 shared e-scooters available globally in 2019. E-scooter sharing, which is available in 88 cities across 21 countries, is gradually emerging as a global trend. Although Europe is dominating the global market, the Indian market has been witnessing a giant, unparalleled push. With around 15,000-20,000 e-scooters, up to 30% of the global fleet is in India at present.

However, there also exist some counterfactors that are expected to restrain the growth of the market. Complex rules and regulations are particularly restraining the growth of the market. These include the changing regulations about mandatory driver’s licenses and the use of a helmet. A looming lack of dedicated driving lanes for shared e-scooters is also discouraging commuters from opting for shared mobility. On the other hand, market players are confronting challenges in maintaining profitability, especially due to the lower durability and hence the lower lifespan of shared e-scooters.

COVID-19 Insights

The outbreak of the COVID-19 pandemic took a severe toll on the market. The number of e-scooter sharing schemes being operated in different parts of the world declined during 2019 and 2020 as an immediate effect of the lockdowns and restrictions on the movement of people imposed by various governments as part of the efforts to arrest the spread of coronavirus. Nevertheless, the market is poised for significant growth over the forecast in line with the shift in consumer behavior reflected in the increase in the distance traveled and the duration of the ride.

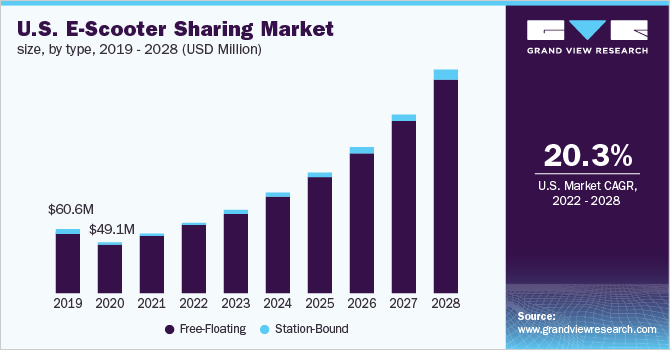

Type Insights

The free-floating segment accounted for the largest revenue share of around 95% in 2021. The fact that most providers offer dockless, free-floating e-scooter sharing services allowed the segment to dominate the market. This type of sharing does not require riders to pick up and return e-scooters to specific locations. Instead, riders can park e-scooters on the sidewalks or at the spots allowed by civic authorities. Hence, daily commuters find the dockless, free-floating e-scooter sharing systems highly convenient for short transit routes in the most congested areas of metro cities.

The station-bound segment is anticipated to grow at a CAGR of 11.1% from 2022 to 2028. The growth of the segment can be attributed to the continued rollout of station-bound e-scooter sharing services in some Asian and South American countries. Benefits associated with station-bound e-scooter sharing systems include a central charging station, face-to-face assistance from staff, efficient maintenance, and convenient billing. Customers preferring classic systems typically prefer station-bound e-scooter sharing services.

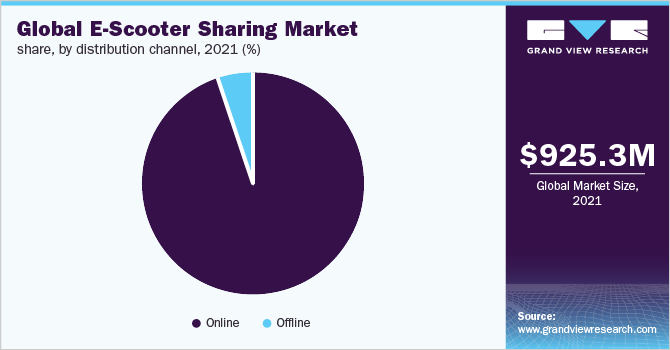

Distribution Channel Insights

The offline segment accounted for a revenue share of around 5% in 2021. The offline channel envisages riders booking an e-scooter sharing ride directly at the station or via telephone call with the local provider. The offline segment is poised for healthy growth, growing at a CAGR of 12.5% over the forecast period. The growing interest in shared micro-mobility, including e-scooter sharing, and the strong preference for the conventional, offline channel, particularly among the elderly commuters, are expected to play a vital role in driving the growth of the segment.

The online segment is projected to grow at the highest CAGR of 19.0% from 2022 to 2028. The growth of the segment can be attributed to the continued rollout of dockless, free-floating e-scooter sharing systems across the world. The proliferation of smartphones and the unabated rollout of high-speed data networks are also expected to contribute to the growth of the segment. A free-floating system envisages booking a ride through a dedicated app installed on smartphones or other handheld devices. The system is usually accessible within the service provider’s area of operation.

Regional Insights

Europe accounted for a revenue share of around 65% in 2021. The high revenue share of the regional market can be attributed largely to the strong presence of key market players and high levels of consumer awareness about e-scooter sharing services. A large proportion of the electric scooter fleet of the e-scooter sharing companies is deployed in European cities, such as Paris, France; Berlin, Germany; and Madrid, Spain. Electric scooter ridership in these cities is also very high. At the same time, several governments across Europe are investing aggressively in rolling out e-scooter sharing services.

Asia Pacific is expected to grow at a CAGR of 22.9% from 2022 to 2028. The growth of the regional market can be attributed to the increasing internet penetration, changing commuter behavior, and the rising awareness about e-scooter sharing services along with the foray of the key market players and the emergence of local market players in the regional market. Governments in Asia Pacific are also increasingly investing in rolling out e-scooter sharing services. For instance, in May 2021, an e-scooter sharing program was launched in Taipei, Taiwan to support and promote green transport.

Key Companies & Market Share Insights

The global electric scooter sharing market share can be described as a highly consolidated market with the major market players accounting for a significant market share. Key market players are pursuing geographical expansions to tap untapped markets. Key players are also pursuing mergers and acquisitions to augment their market share. For instance, in October 2021, Neuron Mobility of Singapore joined Lime to offer e-bikes and e-scooters in Christchurch, New Zealand. Similarly, Lime acquired Uber’s bike and scooter sharing business Jump in May 2020. Some prominent players in the global e-scooter sharing market include:

-

Neutron Holdings, Inc

-

Cityscoot

-

Cooltra Motosharing, S.L.U

-

Bird Global Inc.

-

Vogo Automotive Pvt. Ltd.

-

GoTo Global Mobility Ltd.

-

Lyft Inc.

-

VOI Technology

E-Scooter Sharing Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.07 billion

Revenue forecast in 2028

USD 3.08 billion

Growth rate

CAGR of 18.8% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD million and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Neutron Holdings, Inc.; Cityscoot; Cooltra Motosharing, S.L.U; Bird Global Inc.; Vogo Automotive Pvt. Ltd.; GoTo Global Mobility Ltd.; Lyft Inc.; VOI Technology

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global e-scooter sharing market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Free-Floating

-

Station-Bound

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global E-scooter sharing market size was estimated at USD 925.3 million in 2021 and is expected to reach USD 1.07 billion in 2022.

b. The global E-scooter sharing market is expected to grow at a compound annual growth rate of 18.8% from 2022 to 2028 to reach USD 3.08 billion by 2028.

b. Europe dominated the E-scooter sharing market with a share of 63.9% in 2021. This is attributed to the strong presence of the key players and high consumer awareness about the E-scooter sharing service. Moreover, high investments in the E-scooter sharing sector in the European countries and increasing expansion are credited for the higher market revenue share.

b. Some key players operating in the E-scooter sharing market include Neutron Holdings, Inc; Cityscoot; Cooltra Motosharing, S.L.U; Bird Global Inc.; Vogo Automotive Pvt. Ltd.; GoTo Global Mobility Ltd.; Lyft Inc.; VOI Technology.

b. Key factors that are driving the E-scooter sharing market growth include increasing consumer demand for shared micro-mobility and rising popularity. Everyday road traffic congestion at the peak hours in the urban areas is also leading to the shift in the consumer inclination for the micro-mobility options and fueling the growth of the global E-scooter sharing market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.