- Home

- »

- Medical Devices

- »

-

ECG Disposable Market Size & Share, Industry Report, 2030GVR Report cover

![ECG Disposable Market Size, Share & Trends Report]()

ECG Disposable Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Wet Gel Electrodes, Dry Electrodes), By Patient Demographics (Adult, Pediatric, Neonatal), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-556-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

ECG Disposable Market Size & Trends

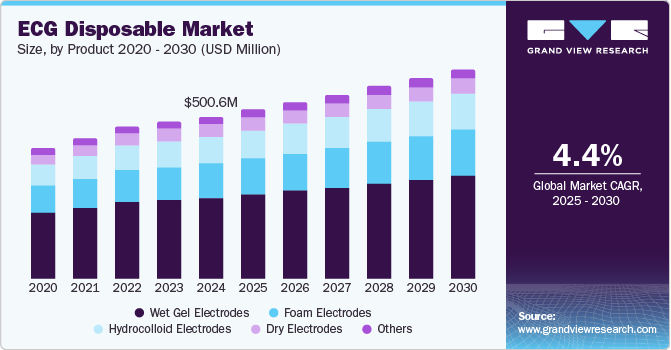

The global ECG disposable market size was estimated at USD 500.58 million in 2024 and is anticipated to grow at a CAGR of 4.4% from 2025 to 2030. The increasing global burden of CVDs, such as heart attacks, arrhythmias, and heart failure, necessitates frequent and accurate cardiac monitoring. Disposable ECG equipment plays a crucial role in this monitoring, driving its demand. For instance, the WHO estimates that CVDs are the leading cause of death worldwide, accounting for a significant percentage of global mortality each year. This large patient pool requiring ECG monitoring fuels the need for disposable electrodes and disposable lead wires.

The high and increasing global incidence of heart diseases, collectively known as cardiovascular diseases (CVDs), is a primary driver for the disposable Electrocardiogram (ECG) equipment market. The table highlight the rising prevalence of heart disease in the globe in 2021.

Heart Disease by Country:

Country

Total DALYs_2021

Total Deaths_2021

Total Prevelence_2021

U.S.

16,900,000

933,000

42,400,000

Canada

1,450,000

83,300

5,310,000

Mexico

4,030,000

198,000

8,210,000

UK

2,760,000

173,000

7,420,000

Germany

5,030,000

339,000

13,000,000

France

2,580,000

167,000

11,800,000

Italy

3,000,000

230,000

9,140,000

Spain

1,870,000

127,000

5,800,000

Sweden

473,000

31,300

1,510,000.00

Denmark

209,000

13,300.00

666,000

Norway

171,000

11,200

607,000

Brazil

8,900,000

395,000

17,100,000

Argentina

1,880,000

98,400

4,030,000

Japan

5,640,000

387,000

16,400,000

India

74,200,000

3,030,000

90,900,000

China

101,000,000

5,560,000

136,000,000

Australia

789,000

49,700

2,750,000

Thailand

3,000,000

133,000

5,920,000

South Africa

2,380,000

106,000

4,220,000

Saudi Arabia

1,790,000

56,900

2,200,000

UAE

206,000

5,440

729,000

Kuwait

124,000

5,010

325,000

Source: World Population Review

The growing geriatric population is a significant driver of the ECG disposable market, as older adults are more prone to cardiovascular diseases and related health complications. As individuals age, the likelihood of developing heart conditions such as arrhythmias, hypertension, and heart failure increases, leading to a higher demand for regular monitoring of heart health. Disposable, portable, cost-effective, and easy-to-use ECGs offer an efficient solution for continuous heart health monitoring in elderly patients. The rise in chronic diseases among the aging population and the convenience and affordability of disposable ECG devices are accelerating their adoption in healthcare settings, home care environments, and wellness monitoring, further driving market growth.

Population ages 65 and above, 2021 - 2023

Country

2021

2022

2023

U.S.

54,700,985

56,388,258

58,381,760

Canada

7,067,591

7,375,348

7,762,172

Mexico

9,683,081

9,961,433

10,361,855

U.K.

12,546,416

12,833,050

13,149,261

Germany

18,415,067

18,820,111

18,979,549

France

14,281,423

14,550,496

14,851,943

Italy

13,992,076

14,121,492

14,287,502

Spain

9,394,673

9,641,612

9,985,636

Sweden

2,103,659

2,133,243

2,163,847

Denmark

1,185,879

1,204,263

1,225,083

Norway

977,501.

1,000,299

1,022,993

China

186,512,604

194,624,975

201,958,336

Japan

36,720,387

36,790,059

36,809,376

India

92,570,827

95,489,097

99,540,924

Australia

4,302,098

4,441,967

4,634,398

South Korea

8,624,619

9,034,766

9,481,521

Thailand

9,677,473

10,112,375

10,553,348

Brazil

20,768,739

21,560,161

22,451,927

Argentina

5,400,599

5,464,423

5,557,061

Saudi Arabia

806,106

869,534

937,888

South Africa

3,834,457

3,968,282

4,118,346

UAE

155,044

165,203

177,766

Kuwait

149,286

126,058

143,310

Source: The World Bank Group

Moreover, the growing trend of delivering healthcare services outside traditional hospital settings, such as in homes and ambulatory care centers, is increasing the demand for convenient and user-friendly disposable ECG equipment to monitor patients in these environments. For instance, in the U.S., there are currently 11,555 ASCs, including 6,382 Medicare-certified ASCs and 5,173 non-Medicare-certified ASCs. Furthermore, healthcare facilities are increasingly focused on preventing hospital-acquired infections (HAIs). Disposable ECG equipment eliminates the risk of cross-contamination associated with reusable electrodes and lead wires, making it a preferred choice for maintaining hygiene and patient safety. Regulatory bodies and hospital protocols emphasizing infection control measures further propel the adoption of disposable ECG products.

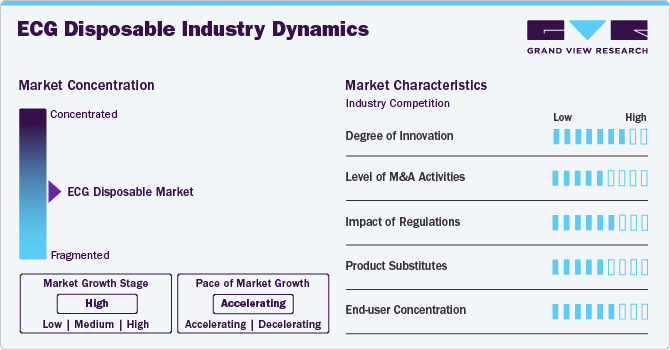

Market Concentration & Characteristics

The ECG disposable market is in a significant growth stage, driven by the rising prevalence of CVD disorders, technological advancements, and increasing healthcare investments.

The ECG disposable market exhibits high innovation, driven by advancements in wearable technology, wireless connectivity, and biocompatible materials. Recent innovations include ultra-thin, skin-friendly electrodes, flexible printed circuits, and integration with mobile health applications for real-time data transmission and remote patient monitoring. These developments have enhanced the comfort, accuracy, and ease of use of disposable ECG devices, making them ideal for clinical and at-home settings. Furthermore, incorporating AI-driven analytics for early detection of cardiac anomalies is transforming these devices into proactive health monitoring tools. This continuous technological evolution improves patient outcomes and expands the scope and appeal of disposable ECGs across diverse healthcare markets.

The ECG disposable market has experienced a notable increase in merger and acquisition (M&A) activity, reflecting its growing significance within the cardiac monitoring sector. In recent years, major medical device companies have strategically acquired firms specializing in ECG technologies to enhance their product portfolios and expand market reach. For instance, in May 2024, WearLinq Inc., a U.S.-based provider of wearable health monitoring solutions, acquired AMI Cardiac Monitoring to strengthen its cardiac health technology capabilities and broaden its product offerings. These acquisitions indicate a strategic emphasis on enhancing diagnostic accuracy and expanding the availability of disposable ECG devices. The trend underscores the increasing importance of advanced ECG technologies in providing accessible and efficient cardiac care solutions.

Regulatory frameworks significantly influence the ECG disposable market by ensuring product safety, efficacy, and data security. In the European Union, the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) impose stringent requirements on manufacturers, including clinical evaluations, post-market surveillance, and cybersecurity measures, particularly for software-driven devices. Similarly, in the U.S., the Food and Drug Administration (FDA) enforces rigorous standards for medical devices, necessitating comprehensive testing and approval processes. In India, the Medical Devices Rules, 2017, and subsequent amendments classify and regulate medical devices, including ECG devices, under the Drugs and Cosmetics Act, 1940, ensuring their safety and quality. While these regulations may pose initial market entry barriers, they ultimately protect patients from substandard products, foster innovation, and enhance global competitiveness.

The ECG disposable market is witnessing significant product expansion, driven by technological advancements and evolving healthcare needs. Manufacturers are introducing a diverse range of electrodes, including hydrogel-based, wireless, flexible, and eco-friendly options, to enhance patient comfort and monitoring accuracy. For instance, companies like AdvaCare Pharma and Medico Electrodes offer a variety of disposable ECG electrodes in different shapes and sizes, catering to various diagnostic requirements and patient demographics. Additionally, innovations such as dry electrodes that eliminate the need for conductive gel are gaining popularity for their convenience and efficiency. These advancements not only improve the quality of cardiac monitoring but also facilitate the integration of disposable ECG devices into home healthcare and telemedicine, expanding their accessibility and utility in diverse clinical settings.

The disposable ECG equipment market is experiencing significant growth through regional expansion, particularly in developing economies and areas with improving healthcare infrastructure. As healthcare access improves in previously underserved regions and awareness of infection control practices increases globally, the demand for single-use medical devices like disposable ECG electrodes and lead wires is rising. Furthermore, strategic collaborations, mergers, and acquisitions by key market players to penetrate new geographical areas contribute to this expansion. This focus on regional growth allows companies to tap into previously unaddressed patient pools and capitalize on the increasing healthcare spending in emerging markets, thereby fuelling the overall market growth for disposable ECG equipment.

Product Insights

The wet gel electrodes segment accounted for the largest market revenue in 2024, due to their superior conductivity, reliability, and ease of use in accurate heart rate and rhythm data. These electrodes, which are coated with a conductive gel, ensure excellent signal quality, making them highly effective for both short-term and long-term cardiac monitoring. The wet gel design minimizes skin irritation and provides a secure attachment during use, which is critical for patients undergoing continuous ECG monitoring. Furthermore, their cost-effectiveness and widespread availability in hospitals, diagnostic centers, and outpatient facilities contribute to their dominant market share. Their use in a wide range of patient demographics, particularly in clinical settings where accuracy and reliability are paramount, strengthens their position in the ECG disposable market.

The electrode pads segment is projected to grow at the fastest CAGR from 2025 to 2030. This growth can be attributed to their superior comfort, ease of application, and enhanced patient experience. Made with soft, flexible foam material, these electrodes conform well to the skin, reducing irritation and improving patient comfort, especially for long-term or repeated use. They are also lightweight and provide consistent, high-quality signal transmission, making them ideal for diagnostic and monitoring purposes. Foam electrodes are increasingly favored in settings such as home healthcare and ambulatory monitoring, where extended wear time is often required. Their cost-effectiveness and ability to stay securely in place during movement or daily activities make foam electrodes a popular choice in the ECG disposable market, driving their growth.

Patient Demographics Insights

The adult segment accounted for the largest market revenue in 2024, due to the higher prevalence of cardiovascular diseases (CVDs) among adults, particularly in aging populations and those with risk factors like hypertension, diabetes, and obesity. As CVDs are the leading cause of death worldwide, adults require frequent ECG monitoring for diagnosis and ongoing management of heart conditions. The demand for disposable ECG devices in hospitals, outpatient clinics, and home care settings is significantly driven by the need for cost-effective, easy-to-use, and hygienic solutions for adult patients. Additionally, advancements in ECG technology, such as portable and wireless devices, have further increased the adoption of disposable ECG electrodes for adult cardiac care.

The pediatric segment is projected to grow at the fastest CAGR from 2025 to 2030. This growth can be attributed due to the rising awareness of congenital heart diseases and the growing need for early cardiac monitoring in children. Although cardiovascular conditions are more commonly associated with adults, pediatric patients, especially new-borns and infants, may require ECG assessments to detect heart abnormalities, arrhythmias, or other cardiac issues. Disposable ECG electrodes tailored for pediatric use are designed to be more gentle, hypoallergenic, and appropriately sized for smaller bodies, ensuring comfort and accuracy during monitoring.

Application Insights

The diagnostic segment accounted for the largest market revenue in 2024, due to its critical role in early detection and evaluation of cardiac conditions such as arrhythmias, myocardial infarction, and other heart-related abnormalities. Disposable ECG electrodes are extensively used in routine diagnostics across hospitals, clinics, and diagnostic labs because they offer hygienic, accurate, and quick setup solutions for short-term use. Their single-use design minimizes the risk of cross-contamination, which is especially important in high-patient-turnover environments.

The monitoring segment is projected to grow at the fastest CAGR from 2025 to 2030. This growth can be attributed due to the rising demand for continuous and long-term cardiac monitoring, particularly among aging populations and patients with chronic heart conditions. The increasing adoption of wearable and portable ECG devices for home and remote monitoring is fuelling the use of disposable electrodes, as they provide a convenient, hygienic, and cost-effective solution for frequent data collection. Additionally, the shift toward preventive healthcare and telemedicine, combined with advances in wireless ECG technology, is expanding the role of monitoring beyond hospital settings.

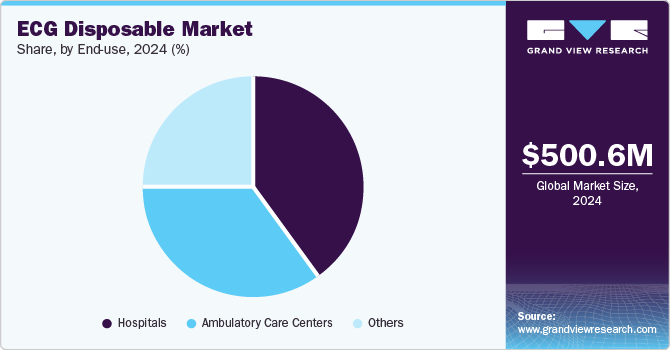

End-use Insights

The hospital segment accounted for the largest market revenue in 2024, due to its high patient turnover, need for accurate cardiac diagnostics, and strict infection control protocols. Hospitals routinely perform ECG tests for many patients, from emergency cases to those undergoing routine monitoring for chronic heart conditions. Disposable ECG electrodes and pads are preferred in these settings because they reduce the risk of cross-contamination, ensure consistent performance, and eliminate the need for sterilization between uses. Additionally, the increasing prevalence of cardiovascular diseases and the growing demand for efficient, quick diagnostic tools further fuel the adoption of disposable ECG products in hospitals.

The ambulatory surgical centers (ASCs) segment is projected to grow at the fastest CAGR from 2025 to 2030. ASCs specialize in outpatient surgical procedures, focusing on minimally invasive techniques that require continuous monitoring of patient's vital signs, including cardiac activity. Disposable ECG electrodes offer a sterile, single-use solution that ensures hygiene and reduces the risk of cross-contamination, which is crucial in maintaining patient safety in these settings. Disposable electrodes quick application and removal process enhance workflow efficiency, allowing ASCs to manage higher patient volumes without compromising care quality. Additionally, these electrodes compact and cost-effective nature makes them suitable for the space and budget constraints commonly found in ASCs. As the demand for outpatient surgeries increases, the adoption of disposable ECG electrodes in ASCs is expected to rise, contributing to their rapid market growth.

Regional Insights

North America ECG Disposable Marketholds a dominant share in the ECG disposable market, primarily driven by the region's advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and widespread adoption of remote patient monitoring. The growing elderly population and strong presence of key market players foster continuous innovation and product availability. Additionally, stringent infection control regulations and increased use of single-use medical devices in hospitals and clinics continue to boost demand.

U.S. ECG Disposable Market Trends

The U.S. represents the largest market within North America, owing to its high healthcare spending, early adoption of medical technology, and rising burden of heart-related conditions. According to extensive research that resulted in a new AHA Presidential Advisory, the prevalence of cardiovascular disease and its associated risk factors is projected to rise significantly over the next 30 years. By 2050, cardiovascular disease is expected to affect 15% of the population, up from 11.3%, impacting as many as 45 million U.S. adults. The prevalence of stroke is anticipated to double, increasing from 10 million to nearly 20 million adults. Additionally, obesity, a major risk factor for cardiovascular disease, is predicted to grow from 43% to over 60% of the population. Furthermore, the country’s emphasis on telehealth and at-home monitoring supports the integration of wearable ECG systems that rely heavily on disposable components.

Europe ECG Disposable Market Trends

Europe’s ECG disposable market is growing steadily, and it is supported by well-established healthcare systems and increasing awareness of cardiac health. The rise in geriatric populations and associated cardiovascular conditions drives the use of disposable ECG devices across hospitals and diagnostic centers. According to the WHO/Europe report in 2024, men in the region are nearly 2.5 times more likely to die from cardiovascular diseases (CVDs) than women. There is also a notable geographic disparity, with the risk of dying from a CVD at a young age (30–69 years) being almost five times higher in Eastern Europe and Central Asia compared to Western Europe. Cardiovascular diseases remain the leading cause of disability and premature death in the European Region, accounting for over 42.5% of all deaths annually, equating to 10,000 deaths every day.

UK ECG disposable market is witnessing a surge in demand for disposable ECG solutions due to the country’s expanding focus on public health and infection prevention. The National Health Service (NHS) has increased investments in early diagnostics and outpatient care, making disposable ECG devices a practical solution for hospitals and community healthcare services. The shift towards home-based cardiac monitoring post-COVID has further fueled demand. Moreover, the rising prevalence of coronary heart disease continuously drives the demand for disposable ECG products, according to the report by the British Heart Foundation. In 2024, coronary heart disease is a widespread condition, impacting approximately 2.3 million people in the UK, which drives the market growth over the forecast period.

ECG disposable market in Germany stands as one of the leading markets in Europe for disposable ECG devices, owing to its robust medical device industry and aging population. Hospitals and clinics prioritize high-efficiency diagnostic tools, and the push for healthcare digitization supports the adoption of connected ECG systems. Disposable electrodes are in high demand due to strict hygiene regulations and the need to prevent hospital-acquired infections.

Asia Pacific ECG Disposable Market Trends

The Asia Pacific ECG Disposable market is expected to grow fastest from 2025 to 2030, driven by the rapid urbanization, rising healthcare expenditure, and increasing prevalence of chronic diseases. As countries in this region modernize their healthcare infrastructure, the demand for cost-effective and scalable diagnostic tools like disposable ECG devices is surging. Technological innovation and local manufacturing capabilities are also driving growth.

India ECG disposable market is a key player in the Asia Pacific ECG disposable market, due to its large population base, increasing cardiac health awareness, and government-led initiatives to improve healthcare access. The rise in lifestyle-related diseases and expanding network of diagnostic centers create a fertile environment for the adoption of affordable, disposable ECG solutions. For instance, according to the World Health Organization, in 2024, India is responsible for one-fifth of global cardiovascular disease (CVD) deaths, with a particularly high impact on the younger population. The Global Burden of Disease study reveals an age-standardized CVD death rate of 272 per 100,000 people in India, significantly higher than the global average of 235. CVD cases in India have surged from 25.7 million in 1990 to 64 million in 2023. Additionally, Indians tend to develop CVD risk factors at a younger age and experience more severe manifestations of the disease compared to other ethnic groups.

Latin America ECG Disposable Market Trends

The Latin America ECG disposable market is experiencing steady growth, driven by the increasing healthcare awareness, improving infrastructure, and rising cases of cardiovascular diseases. Brazil and Mexico are leading markets in the region, with private and public healthcare providers adopting disposable technologies to enhance efficiency and safety. However, cost sensitivity and uneven access to healthcare services may pose challenges in some areas.

Middle East Africa ECG Disposable Market Trends

The MEA region presents emerging opportunities for the ECG disposable market, especially in Gulf countries where investments in healthcare modernization are accelerating. Cardiovascular health initiatives and increased government funding are driving adoption in urban hospitals. However, healthcare access and infrastructure development disparities across the region may limit market penetration in rural or underserved areas.

Key ECG Disposable Company Insights

Key players operating in the neurological devices industry are undertaking various initiatives to strengthen their market presence and increase the reach of their components and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key ECG Disposable Companies:

The following are the leading companies in the ECG disposable market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- A.M.I. ITALIA

- AthenaDiax

- Baisheng Medical Equipment

- BioTekna

- BPL Medical Technologies

- Cardiolex

- ConMed

- Harvard Apparatus

- INTCO Medical

- Intelesens

- AB Medica Group

- LUMED

- Med-link Electronics Tech Co.

- Ambu A/S

- Nihon Kohden Europe

- Tenocom Medical Technology Co., Ltd

Recent Developments

-

In October 2024, Natus Medical Incorporated has announced the launch of its new Grass MR Conditional / CT Cup Electrodes, featuring lead lengths that are 28% longer to allow for easier application. These electrodes are the longest ever to receive FDA clearance as MR conditional and have proven safe for use in 1.5T and 3T MR environments.

-

In October 2022, Nihon Kohden has launched its Smart Cable NMT Pod and disposable electrode, designed to help clinicians confidently monitor neuromuscular blockade. This new device enables an objective assessment of a patient’s level of paralysis during surgery when neuromuscular blocking agents (NMBAs), whether non-depolarizing or depolarizing, are administered.

ECG Disposable Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 522.61 million

Revenue forecast in 2030

USD 648.15 million

Growth rate

CAGR of 4.4% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, patient demographics, application, end use region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Key companies profiled

3M; A.M.I. ITALIA; AthenaDiax; Baisheng Medical Equipment; BioTekna; BPL Medical Technologies; Cardiolex; ConMed ; Harvard Apparatus; INTCO Medical; Intelesens; AB Medica Group; LUMED; Med-link Electronics Tech Co.; Ambu A/S; Nihon Kohden Europe; Tenocom Medical Technology Co.,Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global ECG Disposable Market Report Segmentation

This report forecasts revenue & volume growth of the ECG disposable market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ECG disposable market report based on product, patient demographics, application, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Wet Gel Electrodes

-

Dry Electrodes

-

Hydrocolloid Electrodes

-

Foam Electrodes

-

Others

-

-

Patient Demographics Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Pediatric

-

Neonatal

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic

-

Monitoring

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Care Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ECG disposable market size was estimated at USD 500.58 million in 2024 and is expected to reach USD 522.61 million in 2025.

b. The global ECG disposable market is expected to grow at a compound annual growth rate of 4.40% from 2025 to 2030, reaching USD 648.15 million by 2030.

b. North America dominated the ECG disposable market with a share of 45.54% in 2024. This is attributable to the high prevalence of cardiovascular diseases, advanced healthcare infrastructure, and strong adoption of remote patient monitoring technologies.

b. Some key players operating in the ECG disposable market include 3M; A.M.I. ITALIA; AthenaDiax; Baisheng Medical Equipment; BioTekna; BPL Medical Technologies; Cardiolex; ConMed ; Harvard Apparatus; INTCO Medical; Intelesens; AB Medica Group; LUMED; Med-link Electronics Tech Co.; Ambu A/S; Nihon Kohden Europe; Tenocom Medical Technology Co.,Ltd.

b. The ECG disposable market is driven by the rising prevalence of cardiovascular diseases and a growing elderly population that requires continuous cardiac monitoring. Increased hospital admissions, surgeries, and the need to prevent cross-contamination, especially post-COVID, have boosted demand for single-use ECG components.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.