- Home

- »

- Communications Infrastructure

- »

-

Edge Data Center Market Size, Trends, Industry Report 2033GVR Report cover

![Edge Data Center Market Size, Share & Trends Report]()

Edge Data Center Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Service), By Facility Size (Small & Medium Sized, Large), By End-use Industry (Healthcare & Lifesciences, Manufacturing & Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-999-1

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Edge Data Center Market Summary

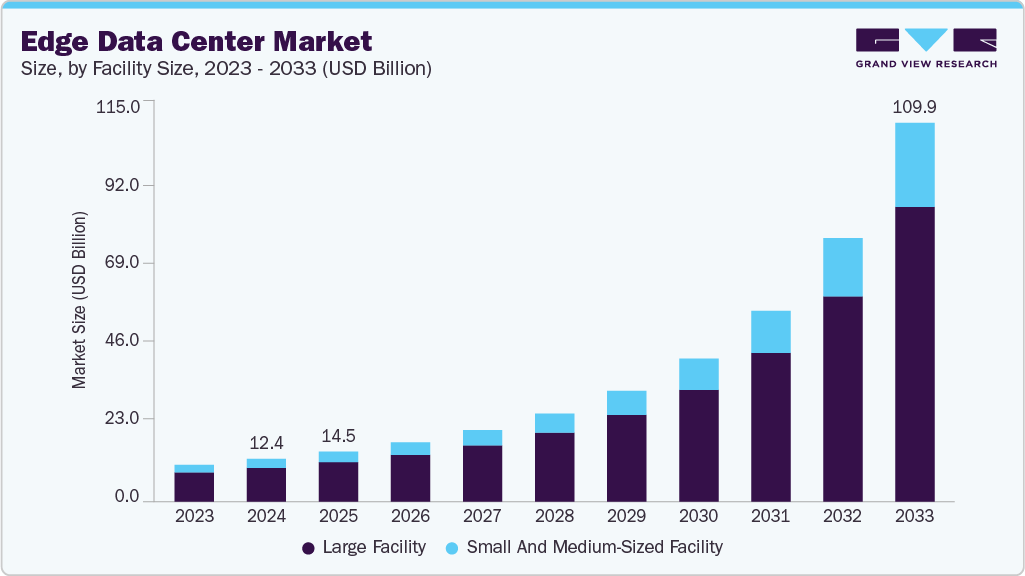

The global edge data center market size was estimated at USD 12.36 billion in 2024 and is projected to reach USD 109.91 billion by 2033, growing at a CAGR of 28.9% from 2025 to 2033. The growth is attributed to the rising adoption of emerging technologies such as the Internet of Things (IoT), big data, artificial intelligence, cloud computing, streaming services, and 5G across various industries, which generate massive volumes of network data and place increasing performance and computing demands on data centers.

Key Market Trends & Insights

- North America held a 34.4% revenue share of the global edge data center market in 2024.

- The edge data center industry in the U.S. is expected to grow significantly over the forecast period.

- By component, the solution segment held the largest revenue share of 87.3% in 2024.

- By facility size, the large facility segment dominated the industry with a 79.0% revenue share in 2024.

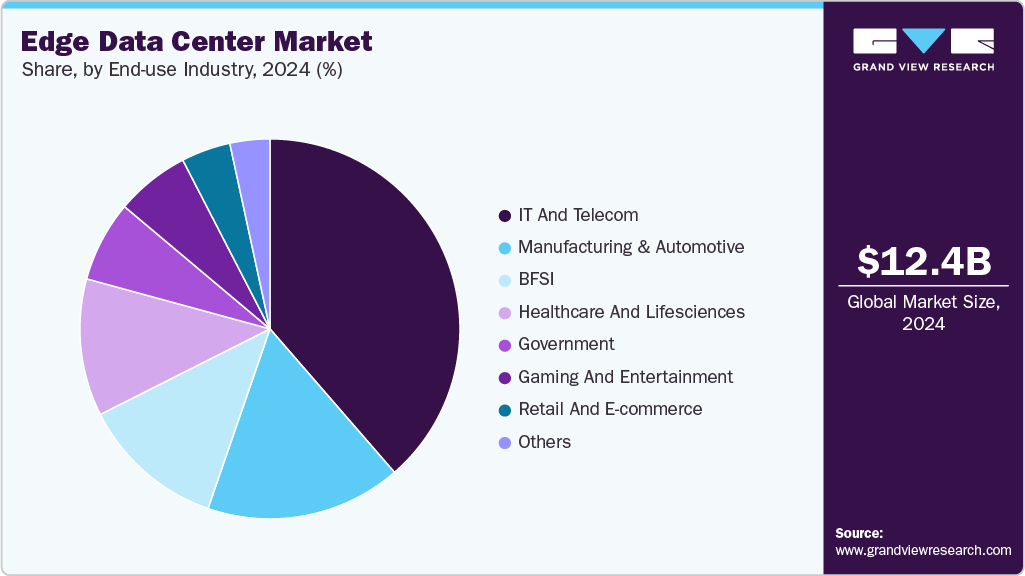

- By end-use, the IT & Telecom segment captured the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.36 Billion

- 2033 Projected Market Size: USD 109.91 Billion

- CAGR (2025-2033): 28.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The ability of edge data centers to provide localized processing and storage resources is a key driver of market growth, as it significantly reduces latency and enhances performance by bringing data computation closer to the source of generation. This proximity enables real-time data analysis and faster response times, which are critical for latency-sensitive applications such as autonomous vehicles, smart manufacturing, telemedicine, and augmented reality. As businesses increasingly rely on time-critical operations and seek to improve user experience, the demand for decentralized infrastructure like edge data centers is accelerating, positioning them as essential components in modern digital ecosystems.Edge data centers are increasingly driving market growth by offering robust edge-to-cloud orchestration and enhanced security for distributed, low-latency applications. Key trend is the integration of secure access service edge (SASE) architectures, which combine WAN capabilities and cloud-based security at the network edge. This reduces latency by avoiding long backhauls to centralized data centers, while implementing identity-driven, real-time policy enforcement and micro-segmentation to protect data and applications at their origin. Consequently, as IoT, autonomous systems, and smart-city deployments expand, the demand for localized, optimized edge sites continues to drive investment in platforms that seamlessly manage workloads across edge and core environments.

For instance, in June 2025, Cisco launched its initiative to build AI‑ready data centers and future‑proof workspaces geared toward enterprises seeking low‑latency edge processing capabilities. By combining advanced networking hardware with AI capabilities at edge locations, Cisco’s move reflects that industry leaders are meeting corporate demand for high‑performance, secure, and scalable edge infrastructure. This evolution, coupled with the increasing adoption of SASE frameworks, marks a significant transformation towards transitioning edge data centers from niche infrastructure to essential pillars of global IT architecture, driving accelerated market growth in the upcoming years.

Component Insights

The solution segment captured the largest share of 87.3% in 2024, primarily by delivering comprehensive, software-driven, fully integrated infrastructure tailored for distributed computing environments. Enterprises are increasingly favoring turn-key deployments that unify compute, storage, networking, power, and cooling into pre-engineered modules, enabling rapid on-site scalability, simplified lifecycle management, and efficient resource utilization compared to piecemeal or legacy setups. These all-in-one solutions ease the deployment of edge use cases like AI inference, IoT analytics, and real-time 5G workloads, offering plug-and-play functionality with centralized orchestration across hybrid environments. For instance, in May 2025, Dell Technologies introduced its software‑driven disaggregated infrastructure initiativeencompassing PowerProtect All‑Flash and PowerScale storage, PowerStore ransomware detection, and the Dell Automation Platform with NativeEdgeto automate and secure private cloud and edge operations. By decoupling computing, storage, and networking while integrating full-stack software automation, Dell enables organizations to provision edge clusters swiftly, respond to changing workloads, and maintain cyber-resilient operations with minimal manual effort.

The service segment is expected to grow at the fastest CAGR during the forecast period due to the increasing complexity of deploying and managing distributed edge infrastructure, which is driving demand for specialized services such as installation, integration, remote monitoring, maintenance, and lifecycle management. As enterprises expand their edge deployments to support latency-sensitive applications across multiple locations, they are relying on managed service providers (MSPs) and system integrators to ensure operational continuity, cybersecurity, and regulatory compliance without the need for extensive in-house IT teams. Moreover, the rapid adoption of AI, IoT, and 5G technologies is fueling the need for tailored consulting, orchestration, and performance optimization services that enable scalable and resilient edge ecosystems. Consequently, this shift toward service-centric value delivery is expected to significantly boost the growth of the services segment in the edge data center market.

Facility Size Insights

The large facility segment dominated the industry with a 79.0% revenue share in 2024, as hyperscale campuses and regional edge hubs offer the space, power, and connectivity essential for high-density workloads, AI inference, 5G backhaul, and IoT analytics. These facilities enable operators to consolidate multiple distributed applications, enhance efficiency, and deliver low-latency, secure performance while scaling rapidly in response to enterprise and cloud provider demands. For instance, in June 2025, Amazon announced a massive USD 10 billion investment in a new AI and cloud data center campus in Richmond County, North Carolina. The project, expected to support thousands of jobs and comprehensive infrastructure upgrades, underscores how large-edge facilities are being leveraged to meet evolving processing needs and reinforce their market dominance. Subsequently, the above-mentioned factors are contributing significantly in driving the growth of the large facility segment in the global market.

Small and medium-sized facilities are expected to grow at the fastest CAGR during the forecast period, driven by the rapid expansion of edge computing use cases that require localized, low-latency processing in urban, remote, and underserved regions. These facilities offer a flexible, cost-effective alternative to large-scale data centers, enabling faster deployment and easier integration for retail, manufacturing, healthcare, and smart city applications. As enterprises and telecom providers increasingly adopt micro data centers to support 5G rollouts, AI-enabled IoT devices, and content delivery networks closer to end-users, demand for compact yet scalable infrastructure is surging. Additionally, advancements in modular design and prefabricated systems are making it easier for organizations to scale operations dynamically, fueling the strong growth trajectory of small and medium-sized edge facilities.

End-use Industry Insights

The IT & Telecom segment captured the largest revenue share in 2024 due to its pivotal role in rolling out low-latency, high-bandwidth infrastructure essential for 5G, AI, and IoT services. Telecom operators and IT firms are deploying edge data centers to offload traffic from core networks, support real-time analytics, and accelerate new service launches. Additionally, the IT and telecom sector is increasingly repurposed by its extensive network infrastructure such as central offices, cell towers, and exchanges into localized edge computing hubs to support high-speed data delivery and real-time services. For instance, in May 2025, BT Group announced plans to expand into edge computing by converting existing towers and telephone exchanges into micro edge data centersleveraging its vast physical footprint to host distributed compute closer to end users. Consequently, the above-mentioned factors are contributing substantially in driving the growth of IT & Telecom segment in the global edge data center market.

The manufacturing and automotive segment is expected to grow at the highest CAGR of 31.4% during the forecast period due to the increasing adoption of Industry 4.0 technologies such as AI-driven robotics, predictive maintenance, digital twins, and autonomous systems, which require ultra-low latency, high-bandwidth data processing at the edge. Edge data centers enable real-time monitoring, quality control, and operational decision-making directly on factory floors or in connected vehicle environments without relying on distant cloud infrastructure. As manufacturers and automotive OEMs pursue smart factory transformation and vehicle-to-everything (V2X) connectivity, demand for localized, resilient computing infrastructure continues to surge. Additionally, edge computing supports mission-critical safety applications and optimizes supply chain visibility, making it a cornerstone of next-generation industrial and automotive systems.

Regional Insights

North America edge data center market accounted for the largest share of 34.4% in 2024, driven by rapid 5G rollouts, high penetration of cloud and IoT technologies, and robust investments from hyperscalers and telecom providers. The region is witnessing accelerated deployment of regional edge hubs to support real-time applications such as autonomous driving, remote diagnostics, and video streaming, especially in the U.S. and Canada. Additionally, tech giants like Amazon, Microsoft, and Google are expanding their edge infrastructure to reduce latency for AI workloads and content delivery. Strategic public-private partnerships and government-backed digital infrastructure initiatives are further fueling demand, while the growing use of AI-powered industrial automation in sectors like manufacturing and healthcare is cementing North America’s leadership in edge computing innovation.

U.S. Edge Data Center Market Trends

The edge data center market in the U.S. is propelled by several region-specific dynamics that distinguish it from broader global trends. Fueled by aggressive AI workload deployment, hyperscalers and cloud providers continue to build out edge campuses. Additionally, federal initiatives are streamlining approvals for edge facilities. For instance, the U.S. Department of Energy opened 16 federal sites (including Los Alamos, Sandia, and Oak Ridge) for data center development, specifically to accelerate AI infrastructure growth on federal lands. Moreover, power grid challenges tied to the rapid expansion of data centers, especially those servicing AI, are prompting utilities to adopt innovative grid‑connection strategies and financial models to ensure reliability and affordability.

Europe Edge Data Center Market Trends

The edge data center market in Europe reflects a surge in modular and prefabricated edge solutions, driven by 5G expansion, IoT adoption, and EU sustainability goals. Companies are backing energy-efficient infrastructures, such as liquid cooling and district heating reuse initiatives, aligning with the European Green Deal. For instance, in June 2025, Apto revealed plans for a €3 billion hyperscale data center campus near Milan, reflecting the surge in demand for edge and cloud capacity across Europe.

The UK edge data center market is experiencing rapid advancement, driven by massive investments and supportive policy measures that are transforming its digital infrastructure landscape. For instance, in June 2025, Apatura unveiled plans to repurpose the former Ravenscraig steelworks in Motherwell into a £3.9 billion “green AI data centre” positioning it as the U.K.’s largest such facility and harnessing surplus wind and solar energy to power sustainable edge computing deployments. Additionally, Segro and Pure Data Centres have formed a £1 billion joint venture in west London to build a fully fitted, hyperscaler-ready edge facility that includes advanced cooling, cabling, and power systems, marking a significant move toward premium edge campuses.

The edge data center market in Germany is gaining substantial momentum, driven by strategic investments from global tech leaders and stringent national regulations that prioritize data sovereignty and sustainability. For instance, in February 2024, Microsoft announced a €3.3 billion AI and cloud data center expansion across Germany, the largest single investment in the company’s 40-year history to support major industrial clients and minimize latency through local compute capacity.

Asia Pacific Edge Data Center Market Trends

The edge data center market in Asia Pacific is projected to witness the fastest CAGR of 30.3% from 2025 to 2033, fueled by government-backed infrastructure programs and hyperscaler-led investments. Additionally, policymakers are actively incentivizing edge deployments through subsidies for modular micro-data centers, spectrum allocation for private 5G networks, and sustainability mandates part of broader efforts like China’s “New Infrastructure” agenda and India’s Digital India initiative. Therefore, as digitalization accelerates across APAC from smart cities and e-commerce to industrial AI and remote computing, the combination of strategic investment, regulatory support, and hyperscaler deployments is creating an environment for explosive edge data center growth.

Japan edge data center market is gaining strong momentum, driven by government digital transformation and large-scale private investments. Additionally, key drivers are the surge in demand for low-latency, high-bandwidth applications, especially 5G, IoT, and real-time AI workloads, fueling deployments of edge infrastructure. For instance, in June 2024, SoftBank announced plans to convert Sharp’s Sakai plant in Osaka into a massive AI-focused data center, with a power capacity of around 150 MW and operations slated to begin in 2025. This project, executed as a joint effort with Sharp and KDDI, highlights that telecom incumbents are repurposing existing assets into next-gen edge campuses.

The edge data center market in China held a substantial market share in 2024, driven by mega investments in AI infrastructure, 5G expansion, and provincial-level support for computing capacity enhancements. In addition, national initiatives, such as the East‑to‑West data computing strategy, are promoting edge deployments in underdeveloped regions to ensure widespread low‑latency connectivity, while sustainability goalslike Tencent Cloud's commitment to run on 100% renewable energy by 2030are influencing infrastructure development.

Key Edge Data Center Companies Insights

Key players operating in the edge data center market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Edge Data Center Companies:

The following are the leading companies in the edge data center market. These companies collectively hold the largest market share and dictate industry trends.

- 365 Data Centers

- Amazon Web Services (AWS)

- American Tower Corporation

- AtlasEdge Data Centres

- Cisco Systems

- DartPoints

- Dell Inc.

- Digital Realty Trust

- EdgeConneX Inc.

- Equinix, Inc.

- Flexential Corporation

- Fujitsu Limited

- Google LLC

- Hewlett Packard Enterprise Company

- Vapor IO, Inc.

Recent Developments

-

In May 2025, Dell unveiled its AI Factory and expanded PowerEdge/PowerScale hardware to support AI workloads at both core and edge locations. The company also announced partnerships with Google Gemini for on-prem AI deployment and Cohere for secure AI integration, emphasizing decentralized edge compute and sustainable innovation.

-

In February 2025, Veea and Vapor IO launched a strategic collaboration to deliver turnkey AI-as-a-Service and federated learning solutions leveraging Vapor IO’s Zero Gap AI platform and private 5G infrastructuredesigned for smart manufacturing, municipal projects, and multi-site enterprises.

-

In October 2023, Vapor IO launched the “Monetize the AI Edge” partner program, offering approximately 10% deal registration margins and renewal incentives to ISVs, MSPs, VARs, and GSIs. This is part of its strategy to tap the estimated $100–180 billion edge AI opportunity across its 36 U.S. markets.

Edge Data Center Market Report Scope

Report Attribute

Details

Market size in 2025

USD 14.47 billion

Revenue forecast in 2033

USD 109.91 billion

Growth rate

CAGR of 28.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report Installation Type

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, facility size, end-use industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

365 Data Centers; Amazon Web Services (AWS); American Tower Corporation; AtlasEdge Data Centres; Cisco Systems; DartPoints; Dell Inc.; Digital Realty Trust; EdgeConneX Inc.; Equinix, Inc.; Flexential Corporation; Fujitsu Limited; Google LLC; Hewlett Packard Enterprise Company; Vapor IO, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Edge Data Center Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global edge data centermarket report based on component, facility size, end-use industry, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solution

-

Hardware

-

Software

-

-

Service

-

Professional

-

Managed

-

-

-

Facility Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Facility

-

Small and Medium-Sized Facility

-

-

End-use Industry Outlook (Revenue, USD Billion, 2021 - 2033)

-

IT and Telecom

-

BFSI

-

Healthcare and Lifesciences

-

Manufacturing & Automotive

-

Government

-

Gaming and Entertainment

-

Retail and E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global edge data center market size was estimated at USD 12.36 billion in 2024 and is expected to reach USD 14.47 billion in 2025.

b. The global edge data center market is expected to grow at a compound annual growth rate of 28.9% from 2025 to 2033 to reach USD 109.91 billion by 2033.

b. North America dominated the edge data center market with a market share of 34.42% in 2024 . This is attributed to the large presence of prominent industry players in the region.

b. Some key players operating in the edge data center market include 365 Data Centers, Amazon Web Services (AWS), American Tower Corporation, AtlasEdge Data Centres, Cisco Systems, DartPoints, Dell Inc., Digital Realty Trust, EdgeConneX Inc., Equinix, Inc., Flexential Corporation, Fujitsu Limited, Google LLC, Hewlett Packard Enterprise Company, Vapor IO, Inc. and Others.

b. Key factors driving the edge data center market growth include surged spending on data center technology and increased adoption of edge computing solutions

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.