- Home

- »

- IT Services & Applications

- »

-

Education ERP Market Size, Share & Growth Report, 2030GVR Report cover

![Education ERP Market Size, Share & Trends Report]()

Education ERP Market Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (On-premise, Cloud), By Application, By End-use (K-12, Higher Education), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-357-8

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Education ERP Market Size & Trends

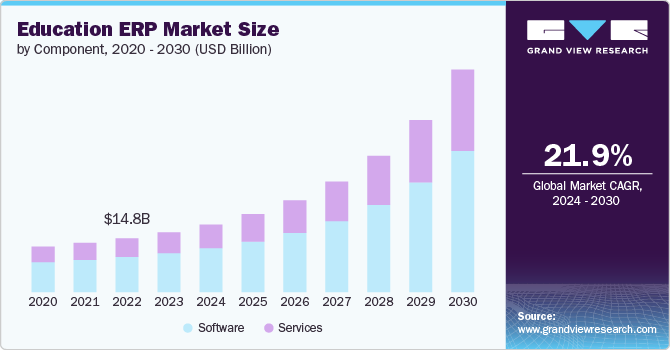

The global education ERP market size was estimated at USD 16.42 billion in 2023 and is projected to grow at a CAGR of 21.98% from 2024 to 2030. The market is a sector focused on providing software solutions that integrate and manage all the processes and functions of an educational institution. These solutions aim to streamline operations, improve efficiency, and enhance the overall management of educational resources. The market is experiencing robust growth as educational institutions increasingly seek comprehensive solutions to manage their operations more efficiently. These ERP systems integrate various functions, including student information management, finance, human resources, and academic processes, into a unified platform.

The market is driven by the rising demand for automation, the shift towards online and blended learning, and government initiatives promoting digital transformation in education. The adoption of cloud-based solutions, AI, and data analytics is enhancing the functionality and appeal of these systems. However, challenges such as high implementation costs, resistance to change, and data privacy concerns persist.

The rising demand for automation in educational institutions stems from the need to manage increasingly complex administrative tasks with greater efficiency and accuracy. Enterprise resource planning (ERP) systems address this demand by automating routine processes such as admissions, scheduling, attendance tracking, grading, and financial management. This automation minimizes manual effort, reduces errors, and ensures that these tasks are carried out consistently and accurately. As a result, institutions experience significant time and cost savings, allowing administrators and staff to focus more on strategic initiatives and improving educational outcomes. The efficiency gains and resource optimization provided by ERP systems make them an attractive solution for educational institutions seeking to streamline operations and enhance overall productivity.

Component Insights

Based on component, the software segment led the market with the largest revenue share of 65.27% in 2023. The rapid evolution of technology, particularly in cloud computing, AI, and machine learning, has significantly enhanced the capabilities of Education ERP software. These advancements enable more sophisticated features such as predictive analytics, personalized learning experiences, and real-time data processing, making ERP software more attractive and effective for educational institutions.

The services segment is expected to grow at the fastest CAGR of 22.83% during the forecast period. The growth of the services segment is driven by the need for expert guidance, customization, ongoing support, and training to implement and utilize ERP systems effectively. As educational institutions increasingly adopt enterprise resource planning (ERP) solutions to streamline their operations, the demand for comprehensive services to support these systems continues to rise. These services ensure that institutions can fully leverage the capabilities of their ERP systems, achieve operational efficiency, and meet their strategic goals.

Deployment Insights

Based on deployment, the cloud segment led the market with the largest revenue share of 61.30% in 2023 and is expected to dominate the market by 2030. The growth of the cloud segment is driven by the need for scalable, cost-efficient, and secure solutions that support remote and hybrid learning models. Cloud-based ERP solutions provide educational institutions with unparalleled scalability by allowing them to adjust their resources quickly and efficiently in response to changing demands. This scalability is particularly advantageous for institutions facing growth or fluctuating enrollment numbers, as it enables them to expand or contract their IT infrastructure and software capabilities without the need for substantial upfront investments in hardware or software licenses. Whether scaling up to accommodate increased student enrollments during peak periods or scaling down during quieter periods, cloud ERP systems offer the flexibility to adapt to varying resource requirements on-demand. This capability not only supports operational efficiency but also ensures that institutions can effectively manage their resources and deliver quality educational experiences without being constrained by traditional IT limitations.

The on-premise segment is expected to grow at a significant CAGR over the forecast period. On-premises ERP systems offer educational institutions a high degree of customization and control over their software, catering directly to their specific needs and operational workflows. Unlike cloud-based solutions that may prioritize standardization across multiple users to ensure compatibility and ease of maintenance, on-premises deployments allow institutions to customize the ERP system extensively without relying on external providers. This level of control is particularly valuable for institutions with unique processes or regulatory requirements that demand tailored solutions. Educational institutions can modify features, user interfaces, reporting structures, and integrations with existing systems to align the enterprise resource planning (ERP) system precisely with their organizational goals and operational efficiencies.

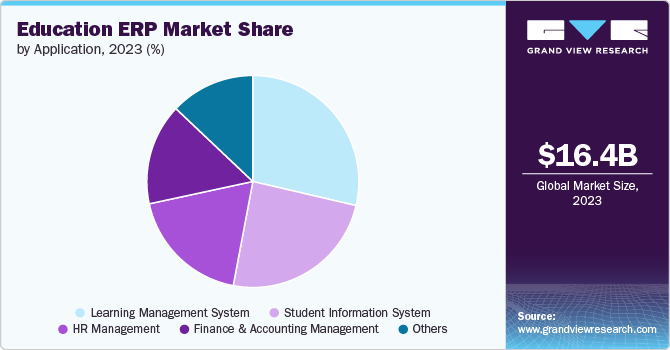

Application Insights

Based on application, the learning management system segment led the market with the largest revenue share of 28.65% in 2023 and is expected to dominate the market by 2030. The integration of LMS with broader ERP systems enhances operational efficiency by consolidating administrative functions such as student enrollment, scheduling, attendance tracking, and grading. Seamless integration allows for real-time data synchronization across different modules, eliminating data silos and ensuring data accuracy. This integration streamlines workflow processes, reduces administrative workload, and enhances overall institutional productivity. Similarly, LMS platforms integrated within ERP systems facilitate continuous professional development for educators and staff. These platforms offer access to online training modules, certification programs, and professional learning communities. ERP-integrated LMS solutions enable institutions to promote lifelong learning among educators, enhance teaching effectiveness, and align professional development initiatives with institutional goals and standards.

The student information system segment is expected to grow at the fastest CAGR over the forecast period. Advanced analytics embedded within SIS platforms enable educational institutions to derive actionable insights from student data. Analytics tools track student performance, behavior patterns, and demographic trends, facilitating data-driven decision-making and strategic planning. SIS platforms within ERP systems empower administrators and educators to identify at-risk students, implement targeted interventions, and optimize educational outcomes.

End-use Insights

Based on end use, the higher education segment led the market with the largest revenue share of 61.68% in 2023. The increasing enrollment in higher education institutions globally is spurred by various factors including, demographic shifts, improved accessibility to education, and a rising demand for higher education qualifications on a global scale. This growth necessitates robust enterprise resource planning (ERP) systems capable of effectively managing the influx of students across various administrative and academic processes. ERP systems streamline admissions by automating application processing, ensuring timely communication with prospective students, and facilitating efficient enrollment management. They also play a crucial role in maintaining comprehensive student records, tracking academic progress, managing course registrations, and supporting academic advising services. As institutions expand their student populations, ERP systems provide scalability to handle growing data volumes, optimize resource allocation, and enhance operational efficiency.

The K-12 segment is expected to grow at a significant CAGR during the forecast period. K-12 schools face administrative challenges such as student admissions, attendance tracking, and scheduling, grading, and financial management. ERP systems automate these routine tasks, reducing administrative burdens, minimizing errors, and improving overall efficiency. This efficiency allows educators and administrators to focus more on student learning outcomes and instructional improvement.

Regional Insights

North America dominated the education ERP market with the largest revenue share of 36.16% in 2023.There is a growing demand for data-driven decision-making in North American education to improve educational outcomes and institutional effectiveness. Enterprise resource planning (ERP) systems offer robust analytics and reporting capabilities that enable institutions to analyze student performance data, track trends, and identify areas for improvement. These insights empower administrators and educators to implement evidence-based strategies, allocate resources efficiently, and support continuous improvement in teaching and learning practices. Similarly, there is a significant trend towards cloud-based ERP solutions in North America, driven by the scalability, flexibility, and cost-effectiveness offered by cloud computing. Cloud ERP systems provide on-demand access to resources, support remote learning environments, and facilitate seamless integration with other educational technologies. The scalability of cloud solutions allows institutions to accommodate fluctuating student enrollments, scale infrastructure as needed, and enhance institutional agility in response to changing educational demands.

U.S. Education ERP Market Trends

The education ERP market in the U.S. is anticipated to grow at a significant CAGR of 19.17% from 2024 to 2030. The U.S. is home to prestigious higher education institutions and research universities renowned for their academic excellence and research contributions. ERP systems in higher education support complex administrative processes, research management, funding allocation, and compliance with research regulations. These systems enable institutions to enhance collaboration, manage grant funding effectively, and maintain competitive research standards globally.

Asia Pacific Education ERP Market Trends

The education ERP market in Asia Pacific is anticipated to grow at a significant at a CAGR of 24.77% from 2024 to 2030. Emerging markets in the Asia Pacific, such as India, China, Southeast Asia, and Australia, present significant opportunities for market growth. Economic growth, urbanization, and rising disposable incomes contribute to increased investments in education and technology infrastructure. Education ERP systems support these markets by enabling educational institutions to modernize their operations, improve resource management, and align with global educational standards.

Europe Education ERP Market Trends

The education ERP market in Europe is expected to grow at a significant CAGR of 21.47% from 2024 to 2030. There is a growing trend towards cloud-based ERP solutions in Europe, driven by the scalability, flexibility, and cost-effectiveness offered by cloud computing. Cloud-based ERP systems provide educational institutions with on-demand access to technology resources, support remote learning environments, and facilitate data integration across multiple campuses and locations. These solutions enable institutions to adapt quickly to changing educational demands, scale infrastructure efficiently, and enhance institutional agility.

Key Education ERP Company Insight

Key players operating in the network emulator market include ADP Workforce Now, Blackboard, Campus Management, Canvas LMS (Instructure), Ellucian, Google Workspace for Education, Infinite Campus, Jenzabar, Kira Talent, Microsoft 365 Education, Moodle, PowerSchool, Sage Intacct, SchoolMint, and Workday. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Education ERP Companies:

The following are the leading companies in the education erp market. These companies collectively hold the largest market share and dictate industry trends.

- ADP Workforce Now

- Blackboard

- Campus Management

- Canvas LMS (Instructure)

- Ellucian

- Google Workspace for Education

- Infinite Campus

- Jenzabar

- Kira Talent

- Microsoft 365 Education

- Moodle

- PowerSchool

- Sage Intacct

- SchoolMint

- Workday

Recent Developments

-

In July 2024, Ellucian partnered with MDS Computer Systems Co. in Saudi Arabia to accelerate higher education through advanced technology solutions. This collaboration aims to enhance the digital transformation of higher education institutions across Saudi Arabia by leveraging Ellucian's expertise in educational technology. By integrating Ellucian's innovative solutions, including student information systems and ERP platforms, with MDS Computer Systems Co.'s local knowledge and support, the partnership seeks to improve operational efficiency, student engagement, and institutional effectiveness. This initiative underscores both companies' commitment to driving educational excellence and supporting the evolving needs of Saudi Arabia's higher education sector through technology-driven solutions

-

In June 2024, Microsoft announced that they have enhanced Copilot for Microsoft 365 and Microsoft Education, aiming to empower educators with advanced tools for collaboration and productivity in educational settings. This update focuses on integrating artificial intelligence (AI) capabilities into Microsoft's education solutions, enhancing personalized learning experiences and administrative efficiencies. The new features include AI-driven insights to improve student engagement, automated administrative tasks, and enhanced data analytics for educators. Microsoft's commitment to innovation in education aims to support educators in delivering impactful learning experiences while streamlining administrative processes, thereby promoting efficiency and effectiveness across educational institutions using Microsoft tools

-

In March 2024, Classera acquired the largest ERP company serving the education sector in the Middle East. This acquisition marks a significant milestone for Classera, enhancing its presence and capabilities in the region's educational technology market. By integrating the acquired ERP company's expertise and solutions, Classera aims to strengthen its offerings in educational ERP systems, catering to the diverse needs of schools, colleges, and universities across the Middle East. The acquisition aligns with Classera's strategic growth objectives to expand its market footprint, enhance customer satisfaction, and innovate within the education technology sector in the Middle East

Education ERP Market Scope

Report Attribute

Details

Market size value in 2024

USD 18.59 billion

Revenue forecast in 2030

USD 61.23 billion

Growth rate

CAGR of 21.98% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

ADP Workforce Now; Blackboard; Campus Management; Canvas LMS (Instructure); Ellucian; Google Workspace for Education; Infinite Campus; Jenzabar; Kira Talent; Microsoft 365 Education; Moodle; PowerSchool; Sage Intacct; SchoolMint; Workday

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Education ERP Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global education ERP market report based on component, deployment, application, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

Consulting

-

Implementation

-

Support & Maintenance

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-Premise

-

Cloud

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Student Information System

-

Learning Management System

-

HR Management

-

Finance & Accounting Management

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

K-12

-

Higher Education

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global education ERP market was valued at USD 16.42 billion in 2023 and is expected to reach USD 18.59 billion in 2024.

b. The global education ERP market is expected to reach USD 61.23 billion by 2030, at a compound annual growth rate of 21.98%. .

b. The software segment held the largest revenue share of more than 65% in 2023 in the education ERP market. The rapid evolution of technology, particularly in cloud computing, AI, and machine learning, has significantly enhanced the capabilities of Education ERP software. These advancements enable more sophisticated features such as predictive analytics, personalized learning experiences, and real-time data processing, making ERP software more attractive and effective for educational institutions.

b. Key players operating in the network emulator market include ADP Workforce Now, Blackboard, Campus Management, Canvas LMS (Instructure), Ellucian, Google Workspace for Education, Infinite Campus, Jenzabar, Kira Talent, Microsoft 365 Education, Moodle, PowerSchool, Sage Intacct, SchoolMint, and Workday.

b. The market is driven by the rising demand for automation, the shift towards online and blended learning, and government initiatives promoting digital transformation in education. The adoption of cloud-based solutions, AI, and data analytics is enhancing the functionality and appeal of these systems.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."