- Home

- »

- Next Generation Technologies

- »

-

Student Information System Market Size, Share Report, 2030GVR Report cover

![Student Information System Market Size, Share & Trends Report]()

Student Information System Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Software, Service), By Deployment (On-premise, Cloud), By Application, By End-use (K-12, Higher Education), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-731-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Student Information System Market Summary

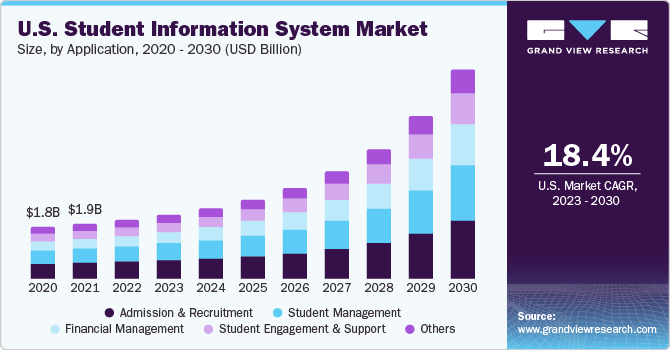

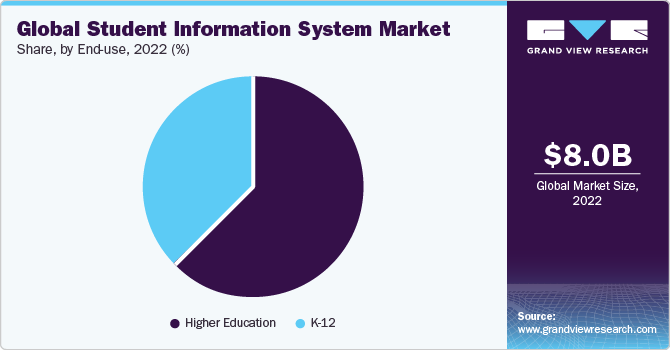

The global student information system market size was estimated at USD 8.05 billion in 2022 and is projected to reach USD 32.38 billion by 2030, growing at a CAGR of 20.3% from 2023 to 2030. The increasing digitalization in the education industry, growing inclination towards e-learning, and improving quality of education are contributing to the growth.

Key Market Trends & Insights

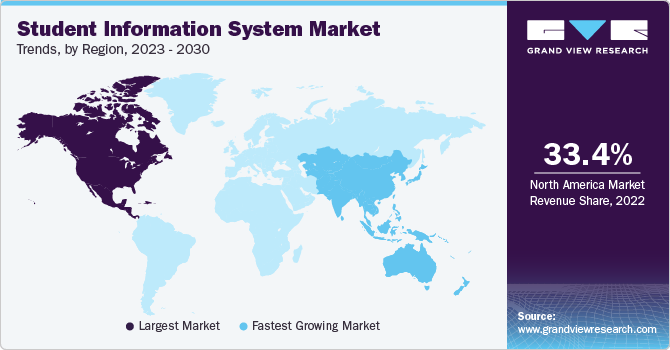

- North America held the largest revenue share of 33.4% in 2022 of the global market for student information systems.

- Asia Pacific is expected to emerge as the fastest-growing region with a CAGR of 22.5% over the forecast period.

- By end use, the higher education segment accounted for the largest revenue share of 63.4% in 2022.

- By component, the software segment led the student information system market with a revenue share of 75.8% in 2022.

- By application, the admission & recruitment segment accounted for the highest revenue share of 30.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 8.05 Billion

- 2030 Projected Market Size: USD 32.38 Billion

- CAGR (2023-2030): 20.3%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The outbreak of the COVID-19 pandemic is expected to drive the demand for Student Information System (SIS) due to the high demand for online education. As per the data published by UNESCO, 1.3 billion learners globally were unable to go to their educational institutes in March 2021 and needed online education to continue with the tuition for the academic year 2020 - 2021. The adoption of eLearning technologies gained traction during the COVID-19 outbreak and is expected to progressively increase post the pandemic to tackle a similar situation in the future.The market growth is also bolstered by the emergence of the Internet of Things (IoT), edge computing, and 5G telecommunication. The advanced student information systems essentially focus on analytics, mobile analytics, mobile applications, behavior tracking, and cloud accessibility. The explosion of connected mobile devices is facilitating the addition of numerous mobile apps for increased convenience for students and their parents. The ongoing trends like migration to the cloud and mobile accessibility are fostering the integration of artificial intelligence into these applications. Moreover, the growing emphasis of educational institutions on providing quality education and simplifying communication between faculty, students, and parents, for upgrading education infrastructure is expected to proliferate the use of SIS software and services.

Governments worldwide are investing aggressively in the education sector. Several educational institutions have already adopted Enterprise Resource Planning (ERP), eLearning, and Learning Management Systems (LMS), to optimize internal processes while ensuring quality education, and improving the standard of education. Some are adopting SIS to effectively collaborate and communicate with students, parents, and faculties, to keep track of all the students, and to enable educators to generate educational content in line with the student's learning needs. For instance, in July 2021, Ellucian, an information technology service provider, announced the collaboration with The British and Irish Modern Music Institute (BIMM) Group, to utilize Ellucian Banner Student with Ellucian Managed Cloud, which is a student information system to support registration, advising, grading, enrolment, and course planning.

Several educational institutions/universities use student information solutions to analyze data such as student attendance, class performance, examination results, assessment scores, and other personal information of students. These solutions aid educational institutions in managing student-related data and other administrative operations. In the age of digitalization, the ubiquity of mobile devices, high internet penetration, and the use of social media platforms, make educational institutions also rise to the occasion. The unprecedented growth of online education is due to its greater flexibility, cost savings, and convenience compared to conventional classroom learning. For instance, in July 2021, Skyward, a school management software provider, announced the partnership with Tooele County School District, Utah, U.S., to provide a Student Management System (SMS) that will assist in the modernization of the district’s student-related data and activities.

The development of Artificial Intelligence (AI) and big data analytics embedded in the student information systems further increases operational efficiency and improves the digital experience. Moreover, student information system solutions use Robotic Process Automation (RPA) or machine learning, which can reduce redundant staff labor by automating routine tasks, enabling staff to spend more qualitative time with students. With the growing penetration of mobile devices across demography, mobile apps are now being added to student information system solutions and increase the ease of use for both students and parents. With mobile accessibility and cloud migration, the integration of AI into student information system applications is likely to increase, fostering the growth of the student information market over the forecast period.

End-use Insights

The higher education segment accounted for the largest revenue share of 63.4% in 2022 and is estimated to register the fastest CAGR of 20.5% over the forecast period. The growth in the number of universities worldwide, the rise in educational hardware (virtual reality headsets, podcasts, and interactive whiteboards), the shift toward digitized learning content, and gamification are driving the growth of the segment. Moreover, the scalability and flexibility offered by online learning platforms are likely to aid segmental growth in the forthcoming years. For instance, in June 2021, the University of Illinois Urbana-Champaign Grainger College of Engineering announced a partnership with the IBM Corporation to strengthen the college's workforce and research development efforts in various fields such as AI/machine learning, quantum information technology, and environmental sustainability.

The K-12 segment is anticipated to register a significant CAGR of 20.0% over the forecast period. The evolving student demographics, demand for skill-oriented education, and increase in online and distance education in emerging economies such as the Asia Pacific and Africa are some of the key factors driving the growth of the segment. Several K-12 student information systems provide an SMS feature that enables teachers and parents to connect directly. This helps the teacher to keep the parent up-to-date with their child's social and academic success in the classroom. Moreover, the creation of a Next-gen Digital Learning Environment (NGDLE) and increased adoption of e-learning methods in primary classrooms across the world have encouraged student information system vendors to offer customized solutions for the K-12 demographic group.

Component Insights

The software segment led the student information system market with a revenue share of 75.8% in 2022. Educational institutions are increasingly looking for solutions that can easily align with their internal processes and improve their efficiency. With the growing emphasis on operational efficiency, for educational institutions, the demand for student information system software sees a significant uptick. Moreover, institutions are leveraging SIS to enhance education quality while keeping expenditures minimum. These systems provide real-time analytics dashboards and leverage modern best practices and technology to recruit, retain, and develop top faculty and staff. These factors are fostering the growth of the software segment over the forecast period.

The service segment is expected to expand at the fastest CAGR of 21.1% over the forecast period. The service segment includes training, installation, maintenance, consulting, and support services. The service segment growth can be attributed to institutions’ demand for integration capabilities to optimize all administration processes. These services help educational institutions bridge the gap between legacy systems and modern applications and deliver connected experiences to students and parents while maintaining control and reliability. Moreover, rising organizational needs for penetration of cloud computing, improving the potential of the existing system, and necessitating significance for automation are some prominent factors, fueling the segment’s growth globally.

Regional Insights

North America held the largest revenue share of 33.4% in 2022 of the global market for student information systems. The growth is propelled by the increasing penetration of emerging technologies including IoT, cloud, big data, and digital transformation. The region is also gaining from the introduction of advanced solutions from leading players and ongoing efforts to upgrade student information system solutions with sophisticated technologies. For instance, in October 2021, Jenzabar, Inc., a U.S.-based higher education software solutions provider, launched Jenzabar Communications, to help institutions eliminate communication silos, and connect multiple departments across campus. A rise in preference for SIS deployment to create a secure and dependable structure between students and school administration in universities, driving the regional market growth.

Asia Pacific is expected to emerge as the fastest-growing region with a CAGR of 22.5% over the forecast period. The governments of various countries in the region are taking initiatives to provide quality education and increase the literacy rate, which is expected to help the market growth in the long run. For instance, in February 2022, the University Grants Commission (UGC) of India announced that over 900 autonomous colleges would offer online courses from July 2022. With this initiative, the Indian government wants to achieve a 50% gross enrolment ratio by 2035 in alignment with the National Education Policy (NEP) 2020. Moreover, the region is likely to offer potential opportunities for student information system vendors as educational institutions deploy digital solutions to improve operational efficiency.

Deployment Insights

The cloud segment accounted for the highest revenue share of 62.6% in 2022 and is anticipated to register the fastest CAGR of 22.2% over the forecast period. The growth can be attributed to the increased institutional agility, provision of flexible access to solutions, and reduced costs associated with the storage of solutions and technical staff. Moreover, cloud-based solutions allow effective knowledge delivery to students and efficient management of business processes, resulting in better collaboration among stakeholders, easy access, and data security. Thus, the growing need for a centralized system to manage the competition among institutions and academic processes is creating more growth opportunities for cloud-based student information systems.

The on-premise segment is anticipated to register a significant CAGR of 16.5% over the forecast period. The on-premise student information system makes operations possible by storing the data in one location, which effectively manages end-to-end student information. These systems are integrated into various applications, which offer a wide range of reporting and engagement tools that can be used by many people involved in a school, from data administrators and staff to students. In addition to this, it allows full control and customization of the system according to the needs of users.

Application Insights

The admission & recruitment segment accounted for the highest revenue share of 30.6% in 2022. Several schools and universities are unifying their technology portfolio into one integrated software solution. The software helps institutions with the admission procedure, admission form collection, listing, and admitting the students with the help of a single data entry in the centralized database. However, several students are studying across universities around the globe, which are bound by certain obligations that evaluate student applications based on varying parameters, which can be catered to by the deployment of admission management software, which is one of the major factors driving the segment forward.

The financial management segment is expected to register a significant growth of 21.6% from 2023 to 2030. The segment growth can be attributed to the digitization of fee payments, advanced analytics, easily customizable, and reduced administrative costs. In addition, these systems allow schools and universities a broad selection of features that empower them with the ability to manage and control their accounts more effectively. Furthermore, it helps educational institutes to manage and deal with the financial aspects of staff salary, taxation calculation, special allowances, deductions, gross pay, and net pay.

Key Companies & Market Share Insights

The leading players in the market are undertaking strategies such as product developments, mergers and acquisitions, strategic partnerships, and business expansions to maintain their stronghold on the market.

For instance, in November 2021, Campus Management Corp. (Anthology Inc.) announced a partnership with Together We Rise, a nonprofit organization, to provide service opportunities for Anthology employees and monetary support for Together We Rise initiatives. This partnership includes virtual service opportunities for Anthology employees to build education-related kits for students in foster care, including back-to-school, tech, and STEM packs. Additionally, product differentiation and upgrading in the form of cloud services are expected to pave the way for the growth of companies in the market.

In December 2021, Illuminate Education announced the partnership with the Association of Supervision and Curriculum Development (ASCD), to expand its CaseNEX (an online course powered by Illuminate Education) professional development course offerings with resources from ASCD, such as the ASCD Activate Professional Learning Library. With the help of this partnership, CaseNEX offers professional development opportunities for educators to enhance their skills, maintain certifications, and earn university credits.

Key Student Information System Companies:

- Oracle

- Workday, Inc.

- SAP SE

- Jenzabar, Inc.

- Skyward, Inc.

- Illuminate Education.

- Ellucian Company L.P.

- Anthology Inc.

- Foradian Technologies.

- Beehively

Recent Developments

-

In July 2023, Practically, an experiential learning application for students in grades 6-12, acquired Fedena (Foradian Technologies.), a school ERP software. This acquisition allows Practically to offer a comprehensive end-to-end product suite from experiential learning content to administrative tools.

-

In July 2023, Si6 Associates Pvt Limited announced that its student admission portal & curriculum catalogue is now available on the SAP Store. The portal integrates with SAP S/4HANA and SAP Industry Solution for Higher Education & Research and provides a seamless experience for applicants to manage and track their applications from anywhere, at any time. The portal's no-code design makes it easy for institutions to build and launch new programs in real-time, without any coding.

-

In May 2023, Monash University partnered with Oracle to offer a new hands-on learning program for undergraduate students in the Monash Business School. The program will give students the skills they need to succeed in the digital world.

-

In May 2023, Jenzabar, a higher education technology company announced a new solution called Campus Marketplace powered by Jenzabar. This solution combines online storefront and registration software, strategic marketing services, and ready-made, skills-based courses. Campus Marketplace enables schools to provide non-traditional education options that provide students with the in-demand skills required to succeed in today's competitive labor climate.

-

In February 2023, Skyward, a school administration software supplier collaborated with Otus, a K-12 student-growth education technology, to enable educators more efficiently obtain, visualize, and act on student data. This collaboration enables smooth rostering integration between Skyward and Otus, providing educators with a strong set of tools to assist them in maximizing student performance.

-

In September 2022, Renaissance, a provider of educational software for K-12 schools acquired Illuminate Education, a company that specializes in a whole-child multi-tiered system of support (MTSS) management platforms. This acquisition allows Renaissance to expand its offerings and provide schools with a more comprehensive set of tools to support student learning.

Student Information System Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.86 billion

Revenue forecast in 2030

USD 32.38 billion

Growth Rate

CAGR of 20.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Oracle; Workday, Inc.; SAP SE; Jenzabar, Inc.; Skyward, Inc.; Illuminate Education.; Ellucian Company L.P.; Anthology Inc.; Foradian Technologies.; Beehively

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Student Information System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global student information system market based on component, deployment, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Service

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Financial Management

-

Student Management

-

Admission & Recruitment

-

Student Engagement & Support

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

K-12

-

Higher Education

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global student information system market size was estimated at USD 8.05 billion in 2022 and is expected to reach USD 8.86 billion in 2023.

b. The global student information system market is expected to grow at a compound annual growth rate of 20.3% from 2023 to 2030 to reach USD 32.38 billion by 2030.

b. North America held the largest revenue share of 33.4% in 2022 of the global market for student information systems. The growth is propelled by the increasing penetration of emerging technologies, including IoT, cloud, big data, and digital transformation.

b. Oracle; Workday, Inc.; SAP SE; Jenzabar, Inc.; Skyward, Inc.; Illuminate Education.; Ellucian Company L.P.; Anthology Inc.; Foradian Technologies.; and Beehively, among others, are some of the prominent players present in the student information system market.

b. The increasing digitalization in the education industry, growing inclination towards e-learning, and improving quality of education are contributing to the growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.