- Home

- »

- Medical Devices

- »

-

eHealth Devices Market Size & Share Report, 2028GVR Report cover

![eHealth Devices Market Size, Share & Trends Report]()

eHealth Devices Market (2022 - 2028) Size, Share & Trends Analysis Report By Type (Blood Pressure Meters, Fever Meters, Glucose Meters, Care Phone/Social Alarms), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-933-1

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

eHealth Devices Market Summary

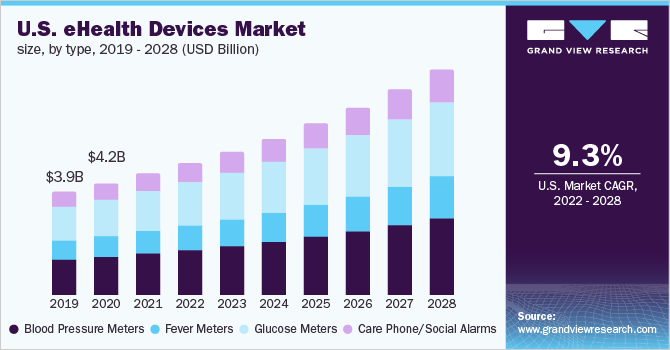

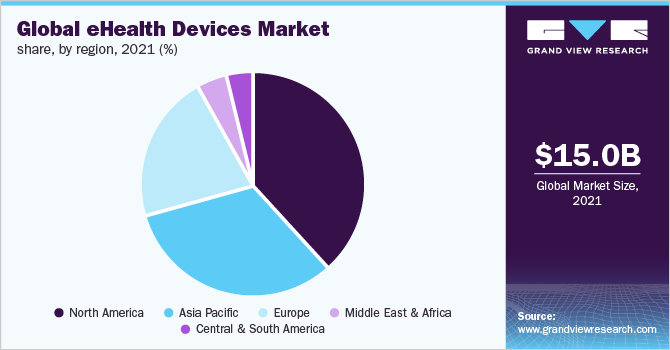

The global eHealth devices market size was valued at USD 15.0 billion in 2021 and is projected to reach USD 28.1 billion by 2028, growing at a compound annual growth rate (CAGR) of 9.4% from 2022 to 2028. The global market growth is significantly driven by the increasing adoption of eHealth devices due to the prevalence of chronic diseases and lifestyle diseases such as high blood pressure, diabetes, and heart problems.

Key Market Trends & Insights

- The global eHealth devices market was dominated by North America, which contributed around 39% revenue share in 2021.

- The eHealth devices market in Asia Pacific is anticipated to advance at the highest CAGR of 9.9% from 2022 to 2028.

- Based on type, the glucose meters segment dominated the market with around 34% of the revenue share in 2021.

- Based on type, the blood pressure meter segment is anticipated to witness the highest CAGR of 9.8% from 2022 to 2028.

Market Size & Forecast

- 2021 Market Size: USD 15.0 Billion

- 2028 Projected Market Size: USD 28.1 Billion

- CAGR (2022-2028): 9.4%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

According to the International Diabetes Federation, in 2019, approximately 463 million adults were living with diabetes, with the number expected to reach 700 million by 2045. The rising prevalence of diabetes is expected to drive the demand for glucose meter devices. Technological developments in the area of IoT and AI, coupled with the growing population of older demography, are likely to propel the market growth of the internet-assisted eHealth devices such as care phones/social alarms.

The eHealth device market growth is propelled by increasing government initiatives for the enhancement of the healthcare sector, and rising investments from private firms and governments. Government initiatives are likely to increase the accessibility and availability of these devices during the forecast period. For instance, in January 2022, a health-tech startup, BlueSemi, bagged funding from a New York-based investment fund, amounting to USD 69 million.

The COVID-19 pandemic had a favorable impact on the eHealth market, despite the economic slowdown in many countries. Due to the pandemic, consumer perception has changed and reshaped, which led to an increase in the adoption of health tracking devices and preventive care measures. During the pandemic, the demand for fever meters spiked drastically for tracking temperature and fever conditions among consumers.

Technological developments and innovative product launches are expected to drive consumer purchase and spending during the forecast period and support the global market growth. Various key players are carrying out extensive research and development activities to improve functions and add new aesthetics to these devices. For instance, in January 2021, Doro AB, based in Sweden, announced the launch of the next-generation social alarm, Doro Eliza. This technology-enabled care specialist is based on 4G technology and connects to other IP networks.

Online distribution or e-commerce platforms have been on the rise over the years, owing to their increasing popularity among consumers. eHealth device manufacturers are also being drawn into this market trend, thus presenting a promising opportunity during the forecast period. Moreover, due to the COVID-19 pandemic, consumer spending on health monitoring devices has increased, with an increasing preference for online distribution. For instance, in March 2018, Omron Healthcare announced its plans to partner with e-commerce platforms in India to drive retail sales.

The global market growth for eHealth devices is significantly restrained by the high cost of devices and privacy issues. Consumers in developed nations are keen on using these technologies to track their health, with little concern over the cost of the devices. However, this parameter is still a major concern for consumers in developing nations. Another major consumer concern hindering the market growth for eHealth devices is the privacy and confidentiality regarding the data collected, with many patients reluctant to share their medical and health information.

Type Insights

The eHealth devices market is dominated by the glucose meters segment, which accounted for around 34% of the revenue share in 2021. The smart glucose meter continuously detects the blood glucose level and collects information that is transmitted via electronic signals. The global prevalence of diabetes and growing awareness about diabetes care solutions is driving the demand for glucose meters. Moreover, the continuous tracking of glucose automatically provides an advantageous solution compared to the traditional one-time self-monitoring glucose devices.

In the eHealth device market, the blood pressure meter segment is anticipated to witness the highest CAGR of 9.8% from 2022 to 2028. With the hectic and stressful lifestyle globally, the cases of heart problems and blood pressure are increasing rapidly. The risk of high blood pressure and hypertension increases with age, generally above 45 years. The geriatric population in 2019 worldwide was 703 million. This number is increasing at a fast pace, according to UN data; the world population above 65 years in 2030 will reach 997 million. This leads to the increasing demand for blood pressure meter devices.

Regional Insights

The global eHealth devices market was dominated by North America, which contributed around 39% revenue share in 2021. The regional market dominance is credited to the high product awareness and strong presence of the key players such as DexCom, Inc., Abbott Laboratories, and Apple Inc. Moreover, the increased consumer spending and high per capita income and GDP also account for the higher market share in the global eHealth device market. Additionally, the higher government and private funding for R&D purposes in the U.S. also results in a higher frequency of product launches.

In the global market for eHealth devices, Asia Pacific is anticipated to advance at the highest CAGR of 9.9% from 2022 to 2028. The regional market is significantly driven by the economic output and growth, which is concentrated in major cities. The regional growth is attributed to the increasing consumer purchasing power, rising standard of living, and the rapidly improving healthcare sector. Rising government initiatives and foreign investments are also expected to advance market conditions and drive regional growth.

Key Companies & Market Share Insights

The market is characterized by the presence of key global players and numerous local small players. Notable competitors operating in the global market for eHealth devices are focusing particularly on R&D and product innovation, in order to provide smart, convenient, and accurate devices.

For instance, on October 17th, 2019, Omron Healthcare Inc., a division of Omron Corporation, launched redesigned models of its blood pressure monitors with a sleeker design and more connectivity with the Omron Connect app. On November 2nd, 2020, Abbott Laboratories announced the launch of the FreeStyle® Libre system, a continuous glucose monitoring (CGM) technology for adults and children in India. Some prominent players in the global eHealth devices market are:

-

Omron Corp.

-

Apple Inc.

-

Medtronic Plc.

-

DexCom, Inc.

-

Nokia Corp.

-

PHC Holdings Corporation

-

Abbott Laboratories

-

F. Hoffmann-La Roche AG

-

Doro AB

eHealth Devices Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 16.3 billion

Revenue forecast in 2028

USD 28.1 billion

Growth rate

CAGR of 9.4% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD Million/Billion and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Omron Corp.; Apple Inc.; Medtronic Plc.; DexCom, Inc.; Nokia Corp.; PHC Holdings Corporation; Abbott Laboratories; F. Hoffmann-La Roche AG; Doro AB.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global eHealth devices market report based on type and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Blood Pressure Meters

-

Fever Meters

-

Glucose Meters

-

Care Phone/Social Alarms

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global eHealth devices market size was estimated at USD 15.0 billion in 2021 and is expected to reach USD 16.3 billion in 2022.

b. The global eHealth devices market is expected to grow at a compound annual growth rate of 9.4% from 2022 to 2028 to reach USD 28.1 billion by 2028.

b. North America dominated the eHealth devices market with a share of 38.5% in 2021. This is attributable to higher healthcare spending, sedentary lifestyle, and strong distribution network of key players.

b. Some key players operating in the eHealth devices market include Omron Corp.; Apple Inc.; Medtronic Plc.; DexCom, Inc.; Nokia Corp.; PHC Holdings Corporation; Abbott Laboratories; F. Hoffmann-La Roche AG; and Doro AB.

b. Key factors that are driving the eHealth devices market growth include rising chronic and lifestyle diseases, increasing consumer spending, and a growing trend of health consciousness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.