- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Elastomeric Sealants Market Size, Industry Report, 2033GVR Report cover

![Elastomeric Sealants Market Size, Share & Trends Report]()

Elastomeric Sealants Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Silicone, Polyurethane, Polysulfide, Acrylic), By End-use (Building & Construction, Automotive & Transportation, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-773-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Elastomeric Sealants Market Summary

The global elastomeric sealants market size was estimated at USD 5.32 billion in 2024 and is projected to reach USD 9.53 billion by 2033, growing at a CAGR of 6.8% from 2025 to 2033. Elastomeric sealant demand is rising as expanding construction, automotive, and electronics production, stricter weatherproofing, and low VOC rules create a need for flexible, durable sealing solutions.

Key Market Trends & Insights

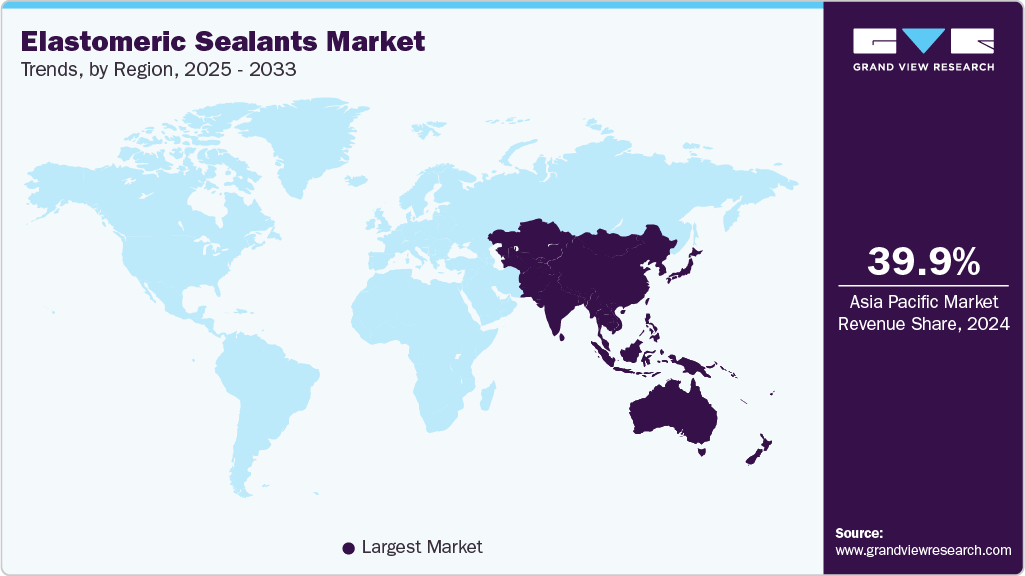

- Asia Pacific dominated the elastomeric sealants market in 2024, accounting for 39.9% of global revenue.

- China dominates the Asia Pacific region due to rapid urbanization, large-scale infrastructure development, and expansive residential and commercial construction.

- By product, silicone segment dominated the market and accounted for the largest revenue share of 33.8% in 2024.

- By end use, automotive & transportation segment is expected to grow fastest with a CAGR of 7.4% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 5.32 Billion

- 2033 Projected Market Size: USD 9.53 Billion

- CAGR (2025-2033): 6.8%

- Asia Pacific: Largest market in 2024

Polymer innovation and renovation activity sustain steady growth, positioning elastomeric sealants as a high-value specialty product market with resilient long-term prospects. Market expansion is primarily driven by large-scale construction and infrastructure projects, rising renovation and retrofit activity in mature markets, and growing automotive and electronics manufacturing that require reliable sealing for durability and energy efficiency. Demand for low-volatile organic compound formulations, improved adhesion, and longer service life pushes manufacturers into specialty polymer development. Regional urbanization and stricter building codes amplify adoption, while modular construction and glazing innovations open new application niches. Challenges include raw material price volatility, supply chain disruptions, application complexity requiring trained installers, and tighter environmental regulations that raise reformulation costs. Competition from commodity sealants and alternative joint systems pressures margins, and variability in performance across substrates demands extensive testing and certification. These factors collectively shape investment, pricing, and R&D priorities, setting the stage for targeted market moves and strategic partnerships. Consequently, focused R&D and partnerships will determine winners and niche leaders globally.

Formulators who deliver low VOC, bio-based, or recyclable chemistries will win share as sustainability standards tighten. Electrification and energy-efficient building envelopes increase demand for durable seals, while retrofits and climate-resilient infrastructure create recurring replacement cycles. Service differentiation, certified applicator networks, lifecycle warranties, and digital specification tools can lift margins. Geographic expansion into fast urbanizing regions and partnerships with construction OEMs offer scale. Overall, the market presents steady, innovation-driven growth for specialty producers, additives makers, and service providers willing to invest in compliance, testing, and installer support.

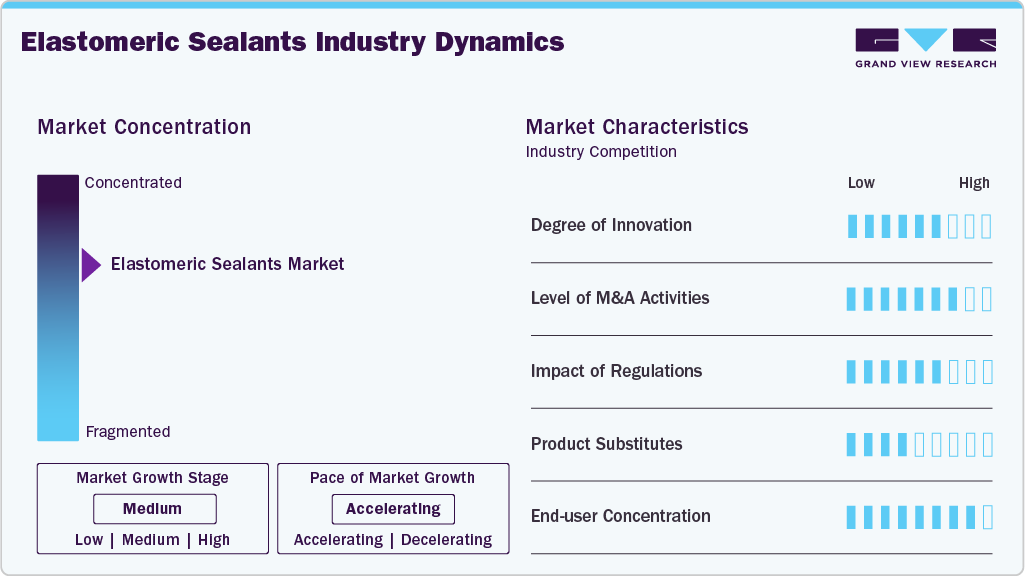

Market Concentration & Characteristics

The elastomeric sealants market is fragmented, with numerous regional and global manufacturers competing across construction, automotive, and industrial applications. The market is characterized by various formulations tailored to specific performance needs, such as weather resistance, chemical stability, or enhanced adhesion. This diversity encourages innovation and intensifies competition, as companies seek to differentiate through product performance, sustainability features, and application support.

Characteristics of this market include strong reliance on raw material supply stability, consistent demand from infrastructure and construction projects, and ongoing reformulation to meet regulatory standards, particularly for VOC emissions. End users value long service life, flexibility, and compatibility with multiple substrates, making technical expertise a key competitive advantage. Overall, the market rewards innovation, compliance with evolving regulations, and the ability to provide customized solutions, while competitive intensity ensures that no single player dominates globally.

Product Insights

Silicone’s 33.8% revenue share in 2024 reflects its market dominance, driven by unmatched weatherability, UV resistance, and long-term elasticity that suit glazing, façades, and exterior construction. Its wide temperature tolerance, superior adhesion to glass and metals, and low-maintenance lifecycle make silicones the preferred premium choice despite higher unit costs. Established code specifications and architects’ familiarity further entrench silicone as the go-to for critical sealing applications.

Polyurethane’s projected 7.4% CAGR from 2025-2033 signals accelerating adoption thanks to high mechanical strength, abrasion resistance, and strong adhesion to porous substrates like concrete and wood. Polyurethanes excel where paintability, load-bearing seals, and durable flooring or automotive bonds are required; advances such as moisture-cure and low-VOC formulations broaden use cases. Cost competitiveness and expanding industrial and infrastructure activity drive uptake, although supply-chain and raw-material volatility remain execution risks.

End Use Insights

The building & construction segment, holding a 33.0% revenue share in 2024, dominates the elastomeric sealants market due to its critical role in sealing joints, façades, roofs, windows, and expansion gaps. Rapid urbanization, infrastructure development, and stricter energy-efficiency regulations drive demand for high-performance sealants that ensure durability, weather resistance, and reduced maintenance costs. The rise in global renovation and retrofitting projects reinforces construction as the largest end-use sector for elastomeric sealants.

The automotive & transportation segment is projected to grow fastest at a 7.4% CAGR between 2025 and 2033, fueled by rising vehicle production, lightweight design trends, and the shift toward electric vehicles. Elastomeric sealants are increasingly used to bond panels, seal windshields, dampen vibration, and enhance structural integrity while reducing vehicle weight. Growing emphasis on fuel efficiency, noise reduction, and safety standards, coupled with emerging mobility solutions, positions this segment as a dynamic growth driver.

Regional Insights

Asia Pacific dominated the elastomeric sealants market in 2024, accounting for 39.9% of global revenue, driven by rapid urbanization, large-scale infrastructure projects, and robust construction activity in countries such as China and India. Expanding industrial manufacturing, rising automotive production, and increasing adoption of modern building materials further support demand. Supportive government policies, growing renovation projects, and awareness of energy-efficient construction practices reinforce the region’s position as the largest revenue contributor.

China dominates the Asia Pacific region due to rapid urbanization, large-scale infrastructure development, and expansive residential and commercial construction. Government initiatives promoting sustainable and energy-efficient buildings increase the adoption of high-performance sealants. The country’s booming automotive and electronics industries further drive demand for elastomeric sealants in assembly and protective applications. Increasing awareness of long-term durability and weather-resistant materials supports growth, despite periodic raw material price fluctuations.

North America Elastomeric Sealants Market Trends

North America, encompassing the U.S. and Canada, benefits from a strong construction sector, ongoing renovation projects, and advanced automotive manufacturing. Environmental regulations, especially regarding VOC emissions, stimulate adoption of low-emission sealants. Technological innovation, such as hybrid polymer formulations and advanced elastomeric solutions, enhances application performance. The market is also supported by infrastructure modernization, increasing urbanization, and resilient industrial activities across both countries, creating consistent demand across multiple end-use sectors.

U.S. Elastomeric Sealants Market Trends

The U.S. elastomeric sealants market is driven by high demand in commercial and residential construction, particularly in energy-efficient and green building projects. Strict building codes and environmental regulations, such as low-VOC mandates, favor high-performance sealants such as silicone and polyurethane. The mature automotive industry also contributes through windshield bonding and panel sealing applications. Renovation of aging infrastructure and increasing investment in renewable energy projects create recurring demand, making the U.S. a stable, innovation-focused market.

Europe Elastomeric Sealants Market Trends

Europe elastomeric sealants market is expected to grow at a CAGR of 6.8% from 2025 to 2033, fueled by stringent building regulations, sustainability mandates, and an emphasis on energy-efficient construction. Rising investments in renovation and retrofitting of aging infrastructure, combined with demand for advanced automotive sealing solutions, are key growth drivers. Moreover, technological advancements, such as low-VOC and high-performance polymer formulations, along with increasing adoption of modern construction practices, contribute to Europe’s accelerated market growth.

Latin America Elastomeric Sealants Market Trends

The Latin America market is expanding due to growing urbanization, commercial construction, and road and bridge infrastructure development in countries such as Brazil and Mexico. Increasing investment in industrial facilities, warehouses, and residential projects drives elastomeric sealant demand. Environmental regulations are gradually encouraging the adoption of low-VOC and durable formulations. In addition, rising automotive manufacturing and repair activities contribute to market growth, although supply chain challenges and raw material price volatility remain key constraints.

Middle East & Africa Elastomeric Sealants Market Trends

The Middle East & Africa market benefits from large-scale infrastructure and mega construction projects, particularly in the Gulf Cooperation Council (GCC) countries. Extreme climate conditions drive demand for weather-resistant and durable sealants. Growth in commercial buildings, residential developments, and industrial facilities, combined with rising oil & gas and automotive activities, further supports the market. In addition, government initiatives for sustainable construction and modern urban planning encourage the adoption of advanced elastomeric sealants despite regional supply chain complexities.

Key Elastomeric Sealants Company Insights

The two key dominant manufacturers in the market are Dow and Henkel AG, recognized for their innovation, high-performance products, and global presence across industries.

-

Dow is a global leader in chemical and material science, offering advanced elastomeric sealants that provide durability, weather resistance, and flexibility for construction, automotive, and industrial applications. Its focus on innovation and sustainable solutions drives the development of high-performance silicone-based products designed to withstand extreme conditions while maintaining long-term reliability. Dow emphasizes research and technology to deliver specialized sealants that meet evolving industry standards and performance requirements.

-

Henkel AG is an international chemical and consumer goods company renowned for its high-performance adhesives and elastomeric sealants. Through brands such as LOCTITE® and TEROSON®, Henkel provides solutions across automotive, electronics, and construction sectors. The company prioritizes innovation, sustainability, and product performance, offering sealants that ensure strong adhesion, flexibility, and resistance to environmental stresses, addressing the needs of modern, energy-efficient, and durable applications.

Key Elastomeric Sealants Companies:

The following are the leading companies in the elastomeric sealants market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- Henkel AG

- 3M

- Arkema

- Sika AG

- H.B. Fuller

- Wacker Chemie AG

- PPG Industries, Inc.

- RPM International

- Mapei

- Franklin International

Recent Developments

-

In September 2025, TYPAR launched TYPAR Liquid Flashing, a gun-grade elastomeric sealant offering superior air and water sealing. Designed for residential and commercial applications, it ensures primer-free bonding, durability, mildew resistance, and integrates seamlessly into the TYPAR Weather Protection System.

-

In February 2025, Wacker Chemie AG unveiled ELASTOSIL® eco 7770 P, a new resource-saving silicone sealant optimized for natural stone applications. It features low emission classification, high mold/mildew resistance, and adhesion without primer.

Elastomeric Sealants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.62 billion

Revenue forecast in 2033

USD 9.53 billion

Growth rate

CAGR of 6.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Brazil; Argentina; Germany; UK; Italy; Spain; France; China; Japan; South Korea; Saudi Arabia; South Africa

Key companies profiled

Dow; Henkel AG; 3M; Arkema; Sika AG; H.B. Fuller; Wacker Chemie AG; PPG Industries, Inc.; RPM International; Mapei; Franklin International

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Elastomeric Sealants Market Report Segmentation

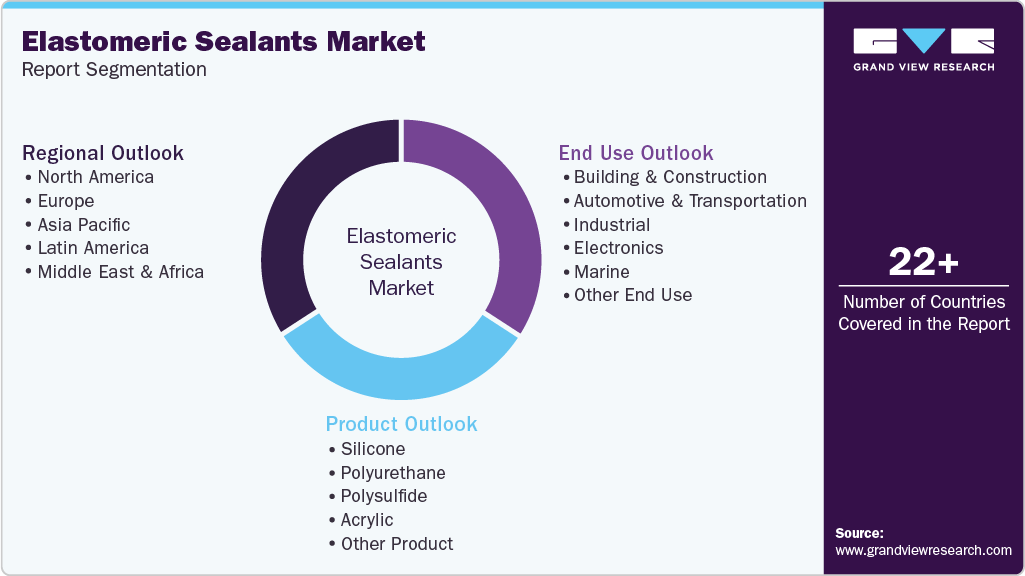

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global elastomeric sealants market report based on product, end use, and region:

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2033)

-

Silicone

-

Polyurethane

-

Polysulfide

-

Acrylic

-

Other Product

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Building & Construction

-

Automotive & Transportation

-

Industrial

-

Electronics

-

Marine

-

Other End Use

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global elastomeric sealants market size was estimated at USD 5.32 billion in 2024 and is projected to grow at a CAGR of 6.8% from 2025 to 2033 to reach USD 5. 62 billion by 2033

b. The global elastomeric sealants market is anticipated to reach USD 9.53 billion by 2033 and is anticipated to expand at a CAGR of 6.8% during the forecast period.

b. The building & construction segment, holding a 33.0% revenue share in 2024, dominates the elastomeric sealants market due to its critical role in sealing joints, façades, roofs, windows, and expansion gaps.

b. Key players in the elastomeric sealants market inculde Dow, Henkel AG, 3M, Arkema, Sika AG, H.B. Fuller, Wacker Chemie AG, PPG Industries, Inc., RPM International, Mapei, Franklin International, among others.

b. The demand for elastomeric sealants is driven by the growing need for durable, flexible sealing solutions across construction, automotive, and industrial sectors. Rapid urbanization, expansion of infrastructure, and rising renovation & retrofit activities drive consistent consumption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.