- Home

- »

- Advanced Interior Materials

- »

-

Electric Torque Tools Market Size, Industry Report, 2033GVR Report cover

![Electric Torque Tools Market Size, Share & Trends Report]()

Electric Torque Tools Market (2025 - 2033) Size, Share & Trends Analysis Report By End Use (Automotive & Transportation, Aerospace & Defense), By Product (Corded, Cordless), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-791-5

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Torque Tools Market Summary

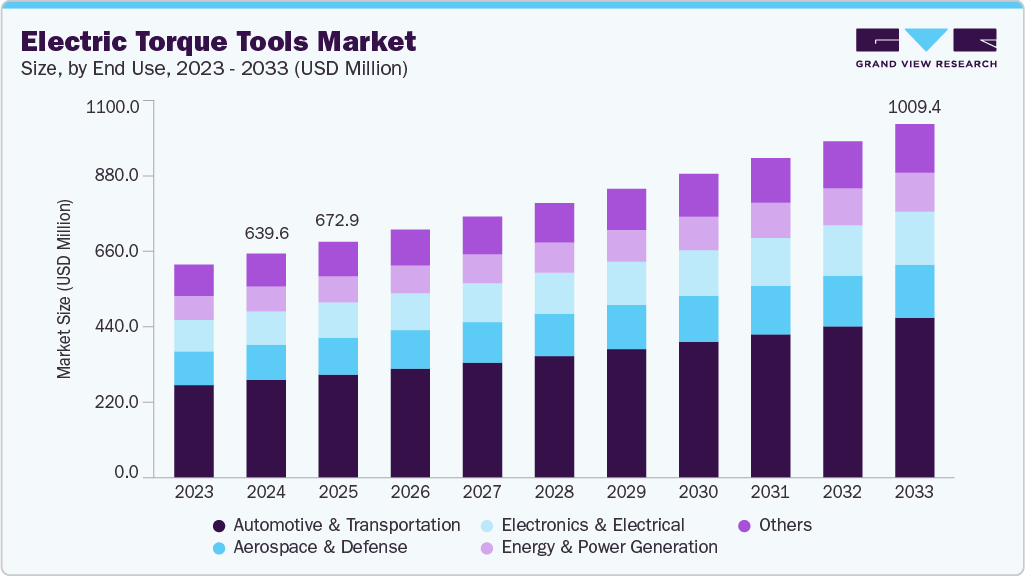

The global electric torque tools market size was estimated at USD 639.6 million in 2024 and is projected to reach USD 1,009.4 million by 2033, growing at a CAGR of 5.2% from 2025 to 2033, driven by the rapid expansion of end-use industries such as manufacturing, construction, and automotive sectors worldwide.

Key Market Trends & Insights

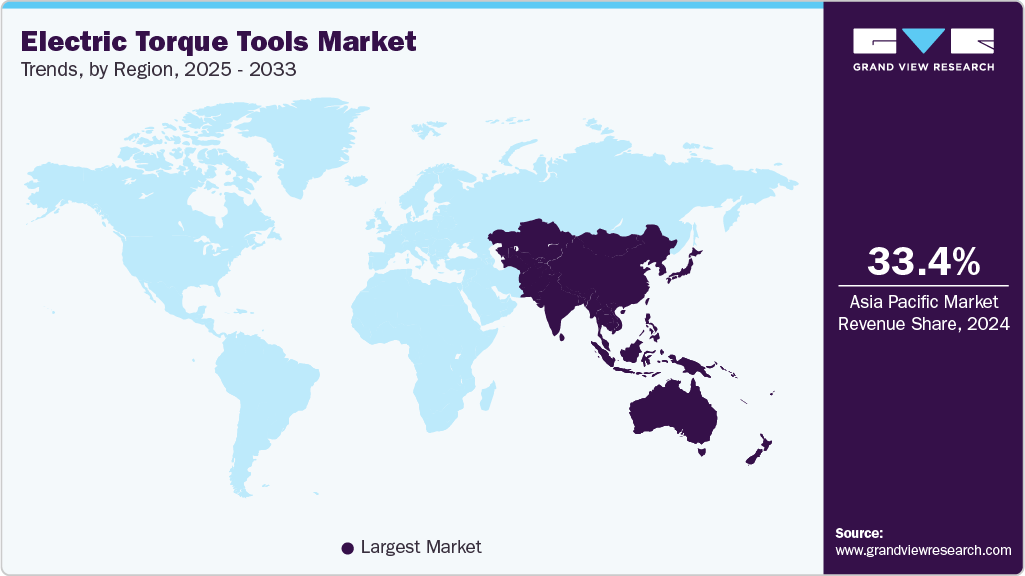

- Asia Pacific dominated the electric torque tools market with the largest revenue share of 33.4% in 2024.

- By product, the cordless electric torque tools segment is expected to grow at the fastest CAGR of 5.6% over the forecast period.

- By end use, automotive & transportation segment is expected to grow at the fastest CAGR of 5.6% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 639.6 Million

- 2033 Projected Market Size: USD 1,009.4 Million

- CAGR (2025-2033): 5.2%

- Asia Pacific: Largest market in 2024

Increasing industrial activities in these domains drive the demand for precise and efficient torque tools, pivotal in assembly and fastening applications. The market benefits from growing industrialization and the need for high-quality tools to maintain safety and performance standards, especially in countries with robust manufacturing bases.Technological advancements in the electric torque tools themselves also fuel market growth. Innovations include improvements in battery technology, smart features such as real-time torque monitoring, and ergonomic cordless designs that enhance user efficiency while reducing operator fatigue and errors. These advancements meet the increasing demand for precision, traceability, and safety in assembly processes across diverse industries, including aerospace and automotive.

Another significant driver is the rising adoption of global electric vehicles (EVs) and hybrid models. EVs' complex design and assembly requirements necessitate specialized torque tools for accurately tightening electric motors, battery packs, and other components. Government incentives and stricter environmental regulations have accelerated the shift toward electrification in the automotive sector, further boosting torque tool demand tailored to EV manufacturing and maintenance.

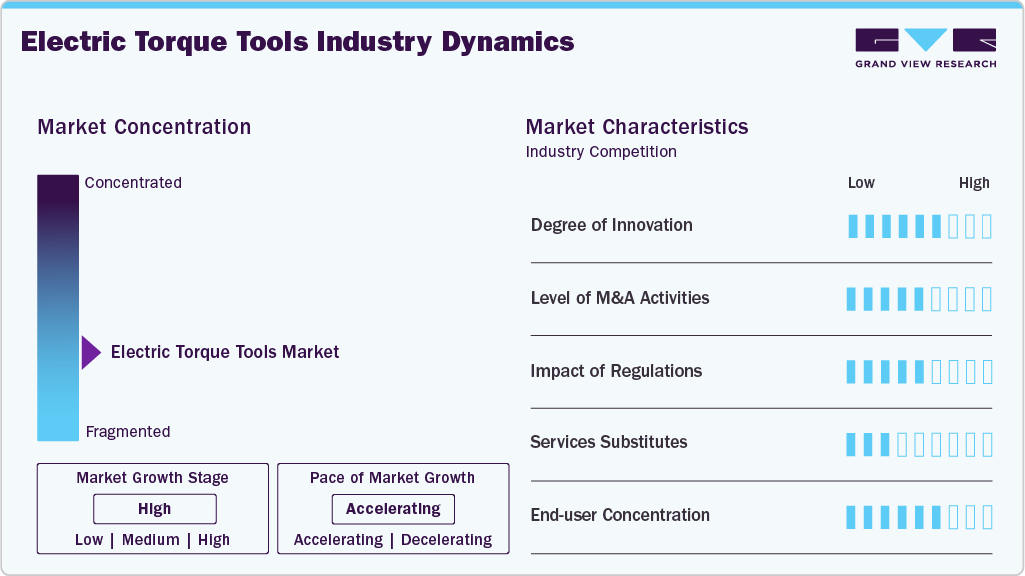

Market Concentration & Characteristics

The market exhibits a moderately concentrated competitive landscape, with key players such as RAD Torque Systems, HYTORC, and Enerpac holding significant market shares, particularly in North America and Europe. The market's concentration is strongest in sectors requiring high precision, like automotive and aerospace, where tightening accuracy and automation investments are critical. Moderate merger and acquisition activity has been observed, mainly involving larger companies acquiring smaller specialized firms to bolster product portfolios and technological capabilities. The presence of numerous smaller companies ensures a dynamic market structure, maintaining a balance between dominance and competition.

Innovation in the market is characterized by advancements in battery technology for longer runtimes, faster charging, and integration of smart digital features enabling real-time torque monitoring and data logging. Ergonomic designs that reduce operator fatigue and enhance usability further drive product differentiation. Regulatory frameworks, especially in aerospace and automotive sectors, impose strict safety and quality standards, which increase demand for reliable, precise, and traceable tightening solutions. While pneumatic torque wrenches remain significant substitutes, cordless electric torque tools are gaining preference due to portability and noise reduction. End-user concentration skews toward large manufacturers and maintenance providers in automotive, aerospace, and railway segments, reflecting industry demands for high-quality torque control.

End Use Insights

Automotive & transportation led the market and accounted for the largest revenue share of 43.6% in 2024, driven by the increasing demand for precision vehicle assembly and maintenance. Electric torque tools ensure accurate fastening in engines, chassis, and suspension systems, reducing the risk of component damage. The rise of electric and hybrid vehicles has further accelerated the need for specialized torque tools. Manufacturers are adopting advanced digital torque monitoring to enhance production efficiency and quality.

The electronics & electrical segment is expected to grow at a CAGR of 5.3% over the forecast period, driven by the growing complexity and miniaturization of electronic components. Electric torque tools are essential for precisely assembling delicate devices such as smartphones, computers, and industrial electronics. Rising consumer electronics demand and repair services further fuel market growth. Innovations in insulated and ESD-safe torque tools enhance operational safety and product reliability.

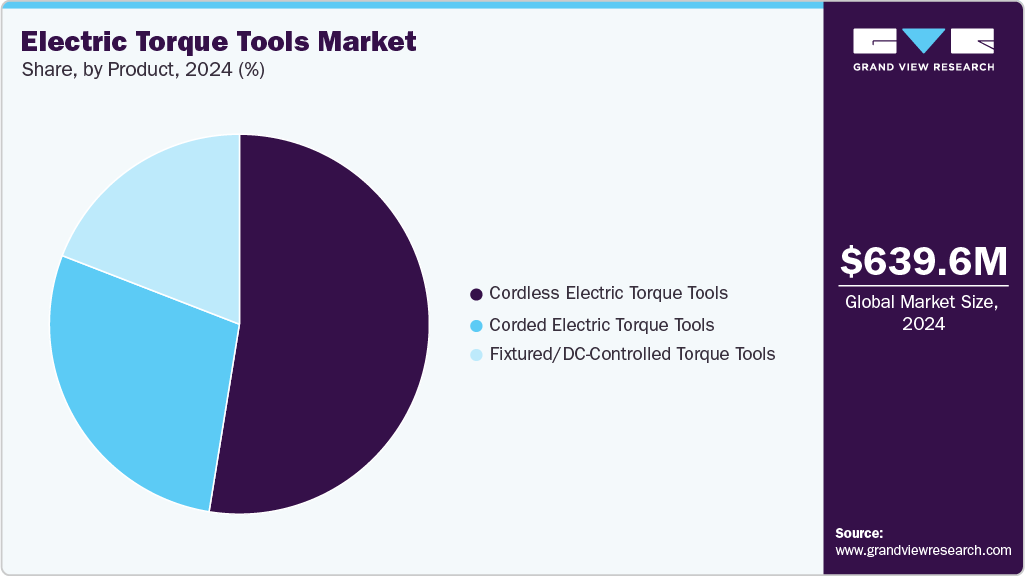

Product Insights

The cordless electric torque tools segment dominated the market. It accounted for the largest revenue share of 52.5% in 2024, driven by the increasing need for mobility, flexibility, and ease of use in industrial and field operations. Battery-powered torque tools allow technicians to perform accurate fastening without reliance on power cords, improving productivity. Growth in maintenance, repair, and assembly services across the automotive, aerospace, and electronics industries fuels demand. Advancements in battery life, motor efficiency, and ergonomic designs enhance user experience.

The fixtured/DC-controlled torque tools segment is expected to grow significantly at a CAGR of 4.8% over the forecast period, driven by the growing adoption of automated and semi-automated production systems. These tools provide precise torque control and repeatability for automotive, aerospace, and electronics manufacturing assembly lines. Integration with digital monitoring systems allows real-time data collection and quality assurance. Manufacturers increasingly invest in DC-controlled tools to minimize errors, improve efficiency, and reduce rework.

Regional Insights

Asia Pacific held the largest revenue market share of 33.4% in 2024, witnessing strong growth due to industrialization, automation, and the expansion of automotive and electronics manufacturing hubs in China, Japan, and India. The region’s focus on improving manufacturing efficiency and reducing operational downtime has accelerated the use of precision torque tools in assembly lines. Rapid technological adoption and competitive pricing from local manufacturers contribute to widespread market penetration. In addition, the ongoing shift toward electric mobility and renewable energy infrastructure is creating new application areas for electric torque systems. Continuous innovation and favorable government support for industrial modernization further bolstered market development in this region.

China Electric Torque Tools Market Trends

The electric torque tools market in China is driven by the country’s strong manufacturing base and its strategic focus on automation and digitalization. The government’s “Made in China 2025” initiative has significantly boosted investment in advanced production technologies, increasing demand for precision assembly tools. The rapid growth of the electric vehicle industry, along with large-scale construction and infrastructure projects, is fueling the use of electric torque solutions. Furthermore, Chinese manufacturers are enhancing product capabilities by integrating IoT features and smart torque monitoring to align with global quality standards. Competitive domestic production and export potential position China as a key growth engine in the global market.

North America Electric Torque Tools Market Trends

The electric torque tools market in North America is driven by the rapid adoption of smart manufacturing technologies and automation across the automotive, aerospace, and heavy machinery industries. Manufacturers increasingly integrate torque management systems with digital monitoring to improve assembly precision and reduce error margins. The region’s strong industrial infrastructure and investments in Industry 4.0 are fostering demand for tools that support traceable and data-driven operations. Furthermore, the rising focus on workplace safety and ergonomic efficiency encourages companies to shift from pneumatic to electric torque solutions. The presence of major players and innovation-driven R&D initiatives continues to strengthen market expansion across the U.S. and Canada.

The U.S. electric torque tools market is primarily fueled by advanced manufacturing initiatives and the growing emphasis on quality control across high-value sectors. In particular, the automotive and defense industries are deploying electric torque systems to ensure precision in assembly and maintenance. Increasing investment in electric vehicle production and renewable energy installations further amplifies the demand for high-torque, digitally enabled tools. In addition, government policies encouraging energy-efficient technologies are fostering the transition from hydraulic and pneumatic systems to electric alternatives. The growing adoption of connected tools for real-time data tracking and torque verification is a defining trend in the U.S. market.

Europe Electric Torque Tools Market Trends

The electric torque tools market in Europe benefits from a strong focus on sustainability, energy efficiency, and high manufacturing standards. Industries such as automotive, aerospace, and wind energy are increasingly adopting electric torque systems to enhance precision while minimizing energy consumption. The region’s regulatory push for eco-friendly and low-emission industrial tools accelerates the transition from pneumatic to electric torque systems. In addition, European manufacturers are at the forefront of integrating digital and sensor-based technologies for real-time torque control. Continuous innovation and high-quality engineering standards continue to drive the region’s market expansion.

Germany electric torque tools market is propelled by the country’s robust automotive and industrial manufacturing sectors, which emphasize precision, efficiency, and reliability. The integration of electric torque systems within advanced assembly lines is becoming increasingly prevalent due to the nation’s focus on Industry 4.0. German manufacturers prioritize automation, predictive maintenance, and digital connectivity, all aligning with electric torque technologies' benefits. The growing adoption of EV manufacturing and renewable energy projects also spurs demand for high-performance torque solutions. Moreover, Germany’s strong engineering expertise and export capabilities further reinforce its leadership in the European market.

Latin America Electric Torque Tools Market Trends

The electric torque tools market in Latin America is expanding due to industrial modernization and growing infrastructure and automotive manufacturing investments. Countries such as Brazil and Mexico are adopting electric torque solutions to improve production efficiency and reduce reliance on manual assembly processes. The demand for energy-efficient and low-maintenance tools is also increasing, driven by the region’s efforts to enhance sustainability. Furthermore, multinational manufacturers are entering the market through partnerships and local distribution networks to meet evolving industrial needs. Continued urbanization and industrial expansion are expected to further boost market growth in the coming years.

Middle East & Africa Electric Torque Tools Market Trends

The electric torque tools market in the Middle East & Africa is driven by expanding the construction, oil & gas, and energy sectors, which require high-precision and durable torque solutions. The growing focus on infrastructure development projects and renewable energy installations has fueled the demand for efficient, maintenance-friendly tools. Countries such as Saudi Arabia and the UAE promote industrial automation as part of their economic diversification goals, creating favorable conditions for adopting electric torque tools. In addition, the region’s increasing awareness of worker safety and energy efficiency propels the shift from traditional mechanical tools. The emergence of new industrial zones and manufacturing hubs continues to support steady market growth.

Key Electric Torque Tools Company Insights

Some key market players include Atlas Copco AB and Stanley Black & Decker, Inc.

-

Atlas Copco AB is a leading global provider of industrial productivity solutions. It offers a wide range of advanced electric torque tools designed for precision assembly and manufacturing applications. The company’s product portfolio includes cordless nutrunners, digital torque wrenches, and smart assembly systems that enable real-time torque monitoring and traceability.

-

Stanley Black & Decker, Inc., is a major manufacturer of professional-grade power tools and torque equipment for the automotive, aerospace, and construction industries. Its DeWalt and Stanley brands deliver high-performance electric torque tools with integrated electronic torque control for enhanced precision.

Hilti Corporation and Ingersoll Rand Inc. are some of the emerging market participants.

-

Hilti Corporation specializes in providing cutting-edge construction and industrial tools, including a range of electric torque-controlled fastening systems. The company’s torque tools are widely used in heavy-duty applications, offering high accuracy, durability, and ease of use. Hilti invests heavily in research and development to integrate sensor-based monitoring and calibration technologies.

-

Ingersoll Rand Inc. is a global leader in industrial equipment. It offers precision torque tools for automotive assembly, aerospace, and energy sectors. The company’s portfolio includes cordless electric torque multipliers, digital torque wrenches, and programmable fastening systems.

Key Electric Torque Tools Companies:

The following are the leading companies in the electric torque tools market. These companies collectively hold the largest market share and dictate industry trends.

- Atlas Copco AB

- Stanley Black & Decker, Inc.

- Hilti Corporation

- Ingersoll Rand Inc.

- Makita Corporation

- Robert Bosch GmbH

- Techtronics Industries Co., Ltd. (TTI)

- Apex Tool Group, LLC

- Desoutter Industrial Tools

Recent Developments

- In June 2023, RAD Torque Systems launched the highly anticipated B-RAD X, touted as the world’s most powerful battery-powered torque wrench. The tool delivers exceptional torque output, precision, and efficiency for demanding industrial and automotive applications. This launch reinforces RAD Torque’s position as a leader in innovative, high-performance torque solutions globally.

Electric Torque Tools Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 672.9 million

Revenue forecast in 2033

USD 1,009.4 million

Growth rate

CAGR of 5.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan

Key companies profiled

Atlas Copco AB; Stanley Black & Decker, Inc.; Hilti Corporation; Ingersoll Rand Inc.; Makita Corporation; Robert Bosch GmbH; Techtronics Industries Co., Ltd. (TTI); Apex Tool Group, LLC; Desoutter Industrial Tools.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Torque Tools Market Report Segmentation

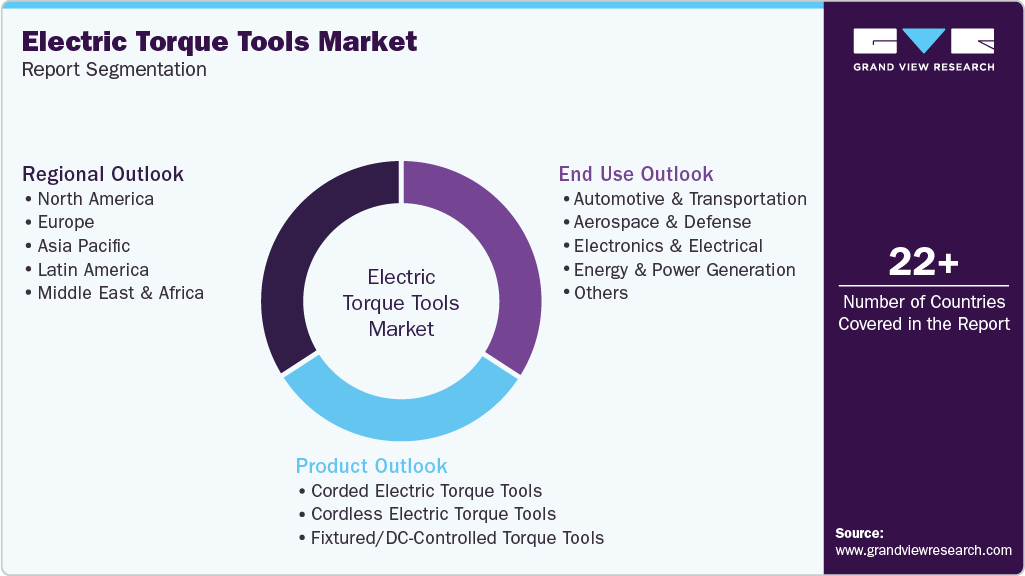

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global electric torque tools market report based on product, end use, and region:

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive & Transportation

-

Aerospace & Defense

-

Electronics & Electrical

-

Energy & Power Generation

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Corded Electric Torque Tools

-

Cordless Electric Torque Tools

-

Fixtured/DC-Controlled Torque Tools

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global electric torque tools market size was estimated at USD 639.6 million in 2024 and is expected to reach USD 672.9 million in 2025.

b. The electric torque tools market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 1,009.4 million by 2033.

b. Cordless electric torque tools segment dominated the market and accounted for the largest revenue share of 52.5% in 2024, driven by the increasing need for mobility, flexibility, and ease of use in industrial and field operations.

b. Some of key players in the electric torque tools market are Atlas Copco AB, Stanley Black & Decker, Inc., Hilti Corporation, Ingersoll Rand Inc., Makita Corporation, Robert Bosch GmbH, Techtronics Industries Co. Ltd. (TTI), Apex Tool Group, LLC, and Desoutter Industrial Tools.

b. The key factors driving the electric torque tools market include rising demand for precise and efficient fastening solutions in automotive, electronics, and industrial applications, increasing adoption of cordless and digital torque tools, and growing emphasis on automation, safety, and operational productivity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.